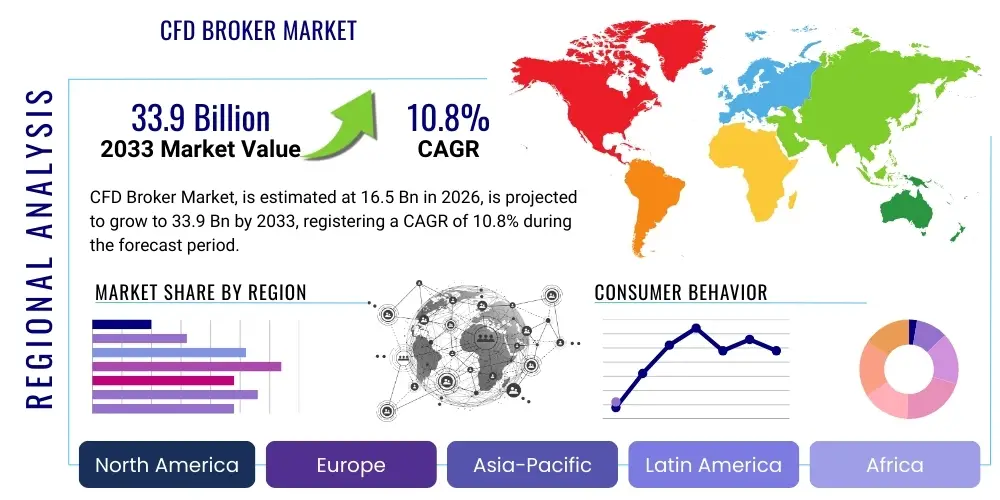

CFD Broker Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440694 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

CFD Broker Market Size

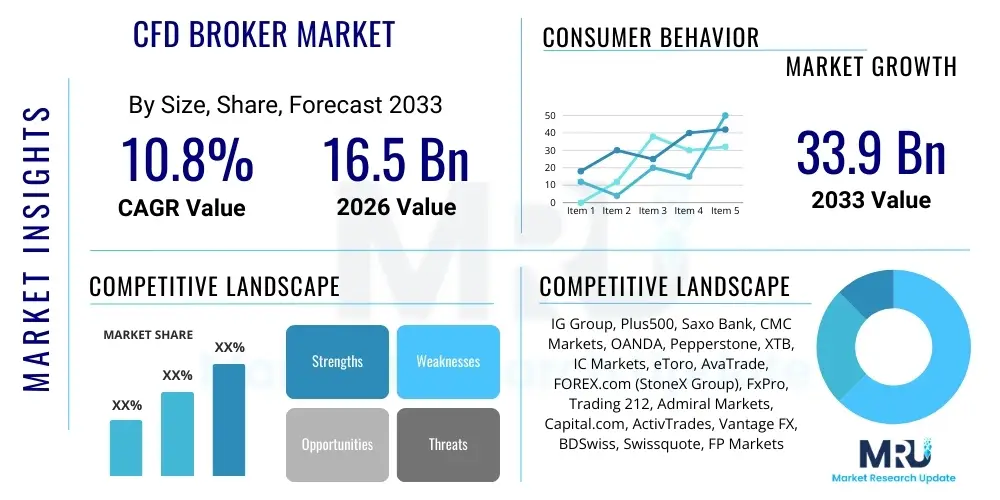

The CFD Broker Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at USD 16.5 Billion in 2026 and is projected to reach USD 33.9 Billion by the end of the forecast period in 2033.

CFD Broker Market introduction

The Contracts for Difference (CFD) broker market facilitates trading in financial instruments where individuals can speculate on the price movements of underlying assets without actually owning them. Products include CFDs on forex, indices, commodities, shares, and cryptocurrencies, offering traders leveraged exposure to global markets. Major applications encompass short-term speculation, hedging existing portfolios, and diversifying investment strategies across various asset classes. The primary benefits for traders include the ability to profit from both rising and falling markets, amplified returns through leverage, and access to a broad spectrum of markets from a single platform, often with competitive spreads and low commission structures, making it appealing for active participants seeking agility.

Key driving factors for the CFD broker market include the increasing digitization of financial services, which has lowered entry barriers for retail investors globally. Technological advancements in trading platforms, offering sophisticated tools, analytical capabilities, and mobile accessibility, continue to attract a new generation of traders. Furthermore, sustained volatility across global financial markets, driven by geopolitical events, economic shifts, and technological disruptions, creates an environment ripe for speculative trading, thereby boosting demand for CFD products. The continuous evolution of regulatory frameworks, aimed at investor protection and market transparency, also plays a crucial role in shaping market dynamics and fostering a more secure trading environment, contributing to its sustained growth and broader acceptance.

CFD Broker Market Executive Summary

The CFD Broker market is undergoing significant transformation, driven by a confluence of evolving business trends, distinct regional dynamics, and intricate segment-specific shifts. Business trends highlight a strong emphasis on technological innovation, with brokers heavily investing in advanced trading platforms, AI-driven analytics, and robust cybersecurity measures to enhance user experience and ensure platform integrity. The market is also witnessing a trend towards broader diversification of asset offerings, including cryptocurrencies and fractional shares, alongside a focus on educational resources to empower informed trading decisions. Regulatory scrutiny remains a pervasive trend, prompting brokers to adapt to stricter compliance requirements, particularly concerning leverage limits and client money protection, which reshapes operational models and competitive landscapes.

Regionally, the market presents a diverse growth landscape. Asia Pacific continues to emerge as a powerhouse, fueled by a burgeoning middle class, increasing internet penetration, and a growing appetite for online trading, albeit with varying regulatory landscapes across countries. Europe, while mature, remains a significant market, characterized by stringent regulatory oversight that influences leverage offerings and marketing practices, leading to consolidation among established players. North America, with its robust financial infrastructure, exhibits steady growth, particularly in technologically advanced trading solutions. Emerging markets in Latin America and the Middle East and Africa are demonstrating accelerating adoption, driven by digital transformation initiatives and increasing financial literacy, presenting substantial untapped potential for market expansion and new client acquisition for forward-thinking brokers.

Segment trends reveal dynamic shifts across different dimensions. By asset class, demand for cryptocurrency CFDs has surged, reflecting broader market interest, while traditional forex and indices CFDs maintain their foundational strength. Equity CFDs are also gaining traction as retail investors seek diversified exposure. From an end-user perspective, the retail investor segment continues to dominate, driven by accessibility and ease of entry, though institutional engagement is growing, seeking advanced tools for hedging and sophisticated strategies. Platform preferences are leaning towards highly customizable and intuitive proprietary solutions, alongside the enduring popularity of MetaTrader platforms, all supporting multi-device accessibility. These intricate segment evolutions necessitate tailored strategies for brokers to effectively capture and retain market share.

AI Impact Analysis on CFD Broker Market

Users frequently inquire about how Artificial Intelligence is revolutionizing trading decisions, enhancing risk management, and personalizing client experiences within the CFD Broker market. Common concerns revolve around the ethical implications of AI-driven automation, the potential for algorithmic bias, and the security of vast datasets processed by AI systems. There is a strong expectation that AI will offer advanced predictive analytics, enable more sophisticated automated trading strategies, improve customer service through intelligent chatbots, and provide hyper-personalized trading insights, ultimately leading to more efficient and potentially profitable trading outcomes while simultaneously necessitating robust regulatory oversight to ensure fair and transparent application.

- Enhanced predictive analytics for market movements and sentiment analysis.

- Automated execution of complex trading strategies with minimal human intervention.

- Personalized trading insights and recommendations based on individual behavior and risk profiles.

- Improved risk management through real-time monitoring and anomaly detection.

- Advanced fraud detection and prevention mechanisms to safeguard client funds.

- Intelligent customer support via AI-powered chatbots and virtual assistants.

- Optimization of marketing and client acquisition strategies through data-driven segmentation.

- Algorithmic trading opportunities that can adapt to changing market conditions.

- Development of sophisticated charting tools and technical indicators.

- Streamlined compliance and regulatory reporting processes.

DRO & Impact Forces Of CFD Broker Market

The CFD Broker market is profoundly shaped by a dynamic interplay of drivers, restraints, opportunities, and pervasive impact forces. Key drivers include heightened global financial market volatility, which stimulates speculative trading activities, alongside continuous advancements in trading technology offering more intuitive platforms and sophisticated analytical tools. The growing accessibility of online trading platforms and the increasing participation of retail investors seeking diversified investment avenues and leveraged exposure also act as significant catalysts for market expansion. Furthermore, robust marketing and educational initiatives by brokers have effectively lowered entry barriers and fostered greater understanding of CFD products among potential traders, contributing to sustained market growth.

Conversely, the market faces considerable restraints, primarily stemming from stringent regulatory frameworks imposed by authorities worldwide. These regulations often cap leverage limits, mandate negative balance protection, and impose stricter marketing rules, which can curb trading volumes and increase operational costs for brokers. The inherent high risk associated with CFD trading, especially due to leverage, acts as a deterrent for conservative investors, and necessitates extensive risk disclosures. Cybersecurity threats, including data breaches and platform vulnerabilities, pose ongoing challenges, as trust and security are paramount in financial services. Intense competition among brokers also leads to downward pressure on spreads and fees, impacting profitability margins across the industry.

Despite these challenges, substantial opportunities exist for growth and innovation. The proliferation of emerging markets, particularly in Asia Pacific and Latin America, represents a vast untapped client base with increasing disposable income and growing internet penetration. The integration of Artificial Intelligence and Machine Learning offers unprecedented opportunities for personalized trading experiences, enhanced risk management, and advanced analytics. Diversification of asset classes, including new cryptocurrencies, fractional shares, and thematic ETFs, attracts a broader spectrum of traders. Strategic partnerships, consolidation within the industry, and a focus on financial literacy through comprehensive educational programs are also critical avenues for expanding market reach and fostering sustainable development within the CFD broker landscape, navigating the intricate web of impact forces like technological disruption, economic cycles, and evolving geopolitical landscapes.

Segmentation Analysis

The CFD Broker market is meticulously segmented across various critical dimensions, providing a comprehensive view of its intricate structure and dynamic growth drivers. These segments allow for a nuanced understanding of market behavior, competitive dynamics, and specific client needs, enabling brokers and market participants to tailor their strategies effectively. The primary segmentation criteria include the type of CFD offered, the underlying asset class, the end-user profile, the technology platform utilized, and the geographical region of operation, each revealing distinct trends and opportunities.

- By Type:

- Fixed Spreads

- Variable Spreads

- By Asset Class:

- Forex

- Indices

- Commodities

- Equities/Shares

- Cryptocurrencies

- ETFs

- By End-User:

- Retail Investors

- Institutional Investors

- By Platform:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Proprietary Platforms

- Web-based Platforms

- Mobile Applications

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For CFD Broker Market

The value chain for the CFD Broker market is a complex ecosystem, beginning with upstream activities that provide the foundational infrastructure and liquidity necessary for trading operations. This includes technology providers developing trading platforms like MetaTrader, data feed providers delivering real-time market information, and prime brokers or liquidity providers offering deep liquidity pools to ensure efficient order execution and competitive pricing. The reliability and efficiency of these upstream partners are critical, as they directly impact a broker's ability to offer stable and high-performance trading environments to their clients, underscoring the importance of robust technological partnerships and strong financial backing to maintain competitive spreads and low latency.

Moving through the core operations, CFD brokers manage the client interface, providing customer support, educational resources, and risk management tools. They also handle regulatory compliance, client onboarding, and fund management. The distribution channel is predominantly direct, through the brokers' own online platforms accessible via web and mobile applications, allowing clients direct interaction with the market and services. However, indirect channels also exist through affiliate partnerships and introducing brokers (IBs) who refer clients to the CFD broker in exchange for commissions. These channels extend market reach and facilitate client acquisition in diverse geographical areas, serving as vital conduits for market penetration and brand visibility.

Downstream analysis focuses on the end-users and the benefits they derive. Retail traders, institutional investors, and hedge funds are the primary beneficiaries, utilizing CFD products for speculation, hedging, and portfolio diversification. The effectiveness of the entire value chain is ultimately measured by its ability to provide these users with a secure, efficient, and transparent trading environment, coupled with responsive customer service and comprehensive tools. The continuous feedback loop from downstream clients to brokers, and then upstream to technology and liquidity providers, drives innovation and service improvements across the entire value chain, ensuring the market evolves to meet changing client demands and technological advancements.

CFD Broker Market Potential Customers

Potential customers for the CFD Broker market primarily consist of a diverse group of individuals and entities seeking flexible and leveraged access to global financial markets without the complexities of direct asset ownership. The largest segment comprises retail investors, ranging from novice traders to experienced individuals, attracted by the ease of entry, the potential for magnified returns through leverage, and the ability to profit from both rising and falling markets. These individuals often seek platforms with user-friendly interfaces, comprehensive educational resources, and competitive trading conditions, reflecting a demand for both accessibility and sophistication in their trading tools.

Beyond the individual retail trader, institutional investors also represent a significant and growing customer base. This includes hedge funds, asset management firms, and proprietary trading desks that utilize CFDs for advanced hedging strategies, tactical asset allocation, and short-term speculation on various asset classes. These professional clients demand high-performance trading platforms, deep liquidity, prime brokerage services, and advanced analytical tools, often requiring bespoke solutions and dedicated support. Their participation underscores the versatility of CFD products as sophisticated financial instruments suitable for a broad spectrum of market participants.

Furthermore, businesses and corporations engaged in international trade or with exposure to commodity price fluctuations can act as potential customers, using CFDs to hedge against currency risks or commodity price volatility, thereby protecting their operational margins. The evolving landscape also sees an increase in demand from technology-savvy millennials and Generation Z, who are more inclined towards online trading and digital financial products, often seeking exposure to emerging asset classes like cryptocurrencies. This broad spectrum of end-users necessitates that CFD brokers offer a wide array of products, robust technological infrastructure, and tailored services to cater to the distinct needs and risk appetites of each customer segment effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 16.5 Billion |

| Market Forecast in 2033 | USD 33.9 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IG Group, Plus500, Saxo Bank, CMC Markets, OANDA, Pepperstone, XTB, IC Markets, eToro, AvaTrade, FOREX.com (StoneX Group), FxPro, Trading 212, Admiral Markets, Capital.com, ActivTrades, Vantage FX, BDSwiss, Swissquote, FP Markets |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CFD Broker Market Key Technology Landscape

The CFD Broker market is underpinned by a sophisticated and rapidly evolving technology landscape, crucial for delivering high-performance trading experiences, robust security, and seamless user interaction. At the core are advanced trading platforms, predominantly MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer extensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs). Alongside these industry standards, many brokers develop proprietary platforms that provide highly customized interfaces, unique features, and enhanced integration with their back-end systems, catering to specific client segments and differentiating their service offerings. These platforms are increasingly designed for multi-device accessibility, ensuring consistent functionality across desktop, web, and mobile applications.

Beyond the client-facing platforms, the technology stack includes critical components for backend operations and data management. Application Programming Interfaces (APIs) are fundamental, enabling connectivity with liquidity providers, third-party analytical tools, and CRM systems, facilitating efficient data exchange and streamlined workflows. Robust Customer Relationship Management (CRM) software is essential for managing client interactions, onboarding processes, and personalized support, enhancing the overall customer journey. Data analytics and business intelligence tools play a pivotal role in processing vast amounts of trading data, providing insights into market trends, client behavior, and operational efficiencies, thereby informing strategic decisions for brokers.

Emerging technologies are also making a significant impact. Artificial Intelligence (AI) and Machine Learning (ML) are being integrated for predictive analytics, personalized trading recommendations, enhanced risk management, and intelligent customer support, revolutionizing how brokers interact with and serve their clients. Blockchain technology is being explored for its potential to enhance transparency, security, and efficiency in transaction processing and record-keeping, particularly in the context of cryptocurrency CFDs. Cloud computing infrastructure provides scalability, reliability, and global accessibility for trading platforms and data storage, ensuring brokers can support a growing client base and manage increasing data volumes effectively, making technology innovation a continuous imperative for market leadership.

Regional Highlights

- North America: This region, particularly the United States and Canada, represents a mature CFD broker market characterized by stringent regulatory oversight from bodies like the CFTC and NFA. While direct CFD trading is restricted for retail clients in the U.S., brokers offering similar leveraged products thrive, and the region is a hub for institutional CFD activity. High technological adoption, sophisticated trading infrastructure, and a financially literate population drive demand for advanced trading tools and seamless platform experiences. Canada, with its more permissive regulatory environment for CFDs, sees steady growth fueled by a strong economy and increasing digital engagement among investors. Innovation in fintech and AI integration is a key regional trend.

- Europe: Europe is a dominant force in the CFD broker market, with significant activity across the UK, Germany, France, and Cyprus. The market is highly competitive and well-established, but it operates under the comprehensive regulatory framework of ESMA (European Securities and Markets Authority), which has introduced measures such as leverage restrictions and negative balance protection. These regulations have led to market consolidation and a focus on transparency and client protection. Despite regulatory pressures, Europe remains a robust market, driven by a large base of experienced traders, continuous product innovation, and a strong presence of global CFD brokerages, adapting effectively to evolving compliance standards.

- Asia Pacific (APAC): The APAC region is the fastest-growing market for CFD brokers, propelled by a burgeoning middle class, increasing internet penetration, and a growing appetite for online investments in countries like Australia, Japan, and Southeast Asian nations. Regulatory environments vary significantly across the region, from well-developed frameworks in Australia and Japan to emerging regulations in other parts of Asia, creating diverse operational landscapes. High economic growth, coupled with a tech-savvy population and a keen interest in speculative trading, especially in forex and cryptocurrency CFDs, positions APAC as a critical growth engine for the global market, attracting significant investment and expansion efforts from international brokers.

- Latin America: This region is an emerging market with substantial untapped potential for CFD brokers. Countries like Brazil, Mexico, and Chile are witnessing increasing financial literacy, digital transformation, and a rising interest in online trading platforms. While regulatory frameworks are still developing in many areas, the region offers opportunities for brokers capable of navigating varied local conditions and cultural preferences. Economic reforms and an expanding middle class are driving demand for accessible investment vehicles, positioning Latin America as a future growth frontier, particularly for mobile-first trading solutions and localized educational content.

- Middle East and Africa (MEA): The MEA region presents a promising growth trajectory, driven by increasing internet and mobile penetration, economic diversification efforts, and a young, digitally-native population. Key markets such as the UAE, Saudi Arabia, and South Africa are witnessing a surge in online trading activity, supported by government initiatives to foster financial technology and innovation. While regulatory frameworks are still evolving in many parts, established financial hubs are attracting international brokers. The demand for sharia-compliant trading options and localized customer support are important considerations for market entry and sustained growth, highlighting the region's unique market dynamics and opportunities for tailored service offerings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CFD Broker Market.- IG Group

- Plus500

- Saxo Bank

- CMC Markets

- OANDA

- Pepperstone

- XTB

- IC Markets

- eToro

- AvaTrade

- FOREX.com (StoneX Group)

- FxPro

- Trading 212

- Admiral Markets

- Capital.com

- ActivTrades

- Vantage FX

- BDSwiss

- Swissquote

- FP Markets

Frequently Asked Questions

Analyze common user questions about the CFD Broker market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a CFD (Contract for Difference)?

A Contract for Difference (CFD) is a financial derivative that allows traders to speculate on the price movements of underlying assets like stocks, indices, commodities, or currencies without actually owning the asset. Traders profit from the difference between the entry and exit prices of the contract, and can speculate on both rising (going long) and falling (going short) markets.

What are the main risks associated with CFD trading?

The primary risks in CFD trading include leverage risk, which can magnify both profits and losses, potentially leading to losses exceeding the initial deposit. Market volatility, where rapid price swings can impact trading positions quickly, and liquidity risk, where closing a position at a desired price might be difficult, are also significant concerns. Regulatory changes and counterparty risk with the broker also contribute to the overall risk profile.

How do I choose a reliable CFD broker?

Choosing a reliable CFD broker involves evaluating several key factors: ensuring the broker is regulated by a reputable financial authority (e.g., FCA, CySEC, ASIC), assessing their trading platform's features and user-friendliness, comparing spreads, commissions, and other fees, examining the range of assets available for trading, and reviewing customer support quality and available educational resources. Reading independent reviews and checking for negative balance protection are also crucial steps.

What role does leverage play in CFD trading?

Leverage in CFD trading allows traders to open larger positions with a relatively small amount of capital (margin). For example, with 1:30 leverage, a trader can control a position worth $30,000 with just $1,000 of their own funds. While leverage can significantly amplify potential profits, it also equally magnifies potential losses, making it a high-risk tool that requires careful management and understanding.

Is CFD trading legal and regulated globally?

CFD trading is legal and regulated in many parts of the world, including Europe, Australia, and most of Asia. However, the specific regulations vary significantly by jurisdiction, often dictating maximum leverage, client protection measures, and marketing practices. In some regions, like the United States, direct CFD trading for retail investors is restricted, though similar derivative products may be available. Always verify local regulations and ensure your chosen broker complies with relevant authorities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager