CFRP Recycling Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441254 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

CFRP Recycling Market Size

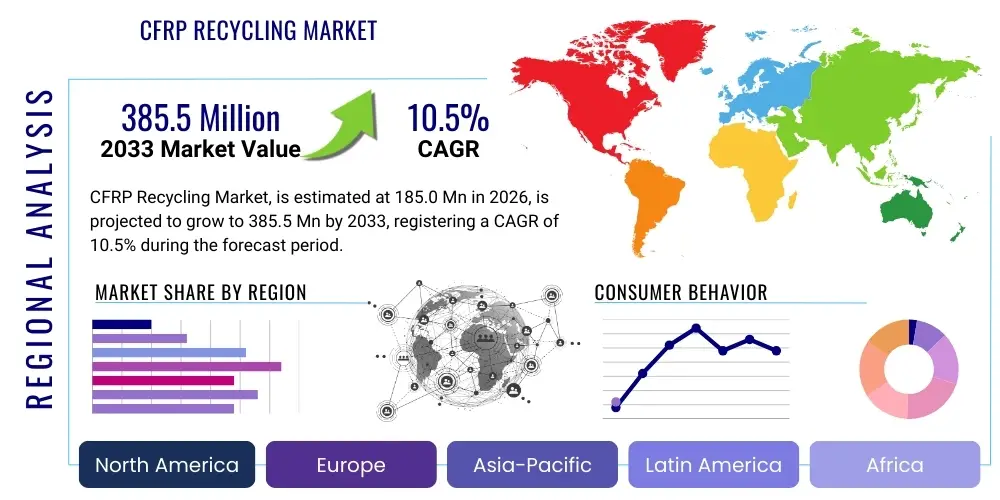

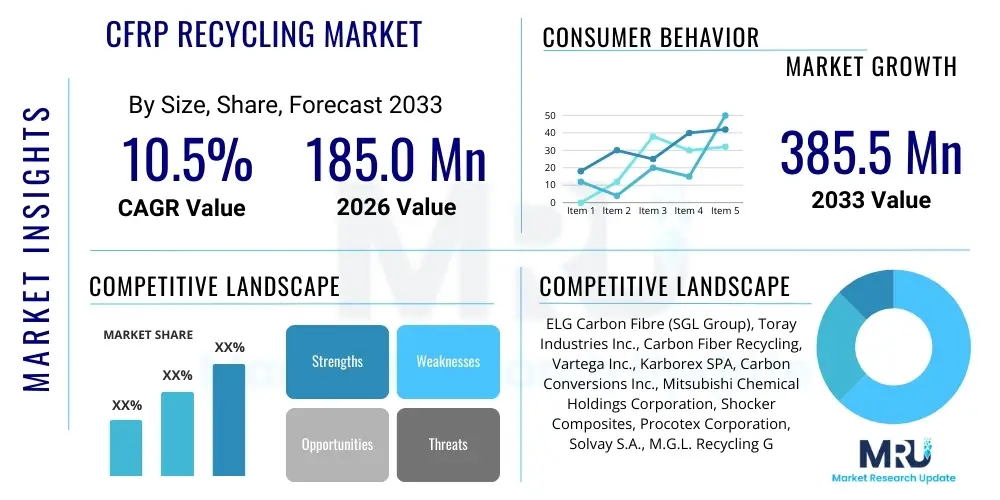

The CFRP Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $185.0 Million USD in 2026 and is projected to reach $385.5 Million USD by the end of the forecast period in 2033.

CFRP Recycling Market introduction

The Carbon Fiber Reinforced Polymer (CFRP) Recycling Market encompasses technologies and processes dedicated to recovering valuable carbon fibers and resins from end-of-life composite materials and manufacturing waste. Driven by the rapid adoption of lightweight CFRPs in aerospace, automotive, and wind energy sectors, the market addresses the critical environmental issue associated with landfill disposal of these durable, non-biodegradable materials, which pose a significant long-term ecological burden due to the inherent chemical stability of thermoset resin matrices, typically epoxies or polyurethanes. The recycling process focuses fundamentally on preserving the mechanical properties and structural integrity of the recovered fibers, ensuring they retain sufficient quality, often requiring the removal of residual sizing agents and matrix char, for reincorporation into secondary composites, thereby establishing vital circular economy pathways within the advanced materials supply chain.

Key recycling technologies involve rigorous material science applications, primarily thermal processes like optimized pyrolysis and chemical methods such as various forms of solvolysis. Pyrolysis, the most commercially established method globally, involves precision heating of the composite material in an inert atmosphere, typically nitrogen, to temperatures between 450°C and 700°C to induce thermal degradation of the polymer matrix. While highly scalable and relatively efficient for separating the fiber, this process often results in the oxidation or thermal decomposition of the fiber surface, potentially leading to a measurable reduction in tensile strength and modulus, necessitating downstream surface treatments to restore compatibility with new resin systems. Conversely, solvolysis utilizes specialized chemical solvents, often under elevated pressure and sub-critical or supercritical fluid conditions, to chemically dissolve the matrix, offering potentially higher-quality fiber recovery with minimal structural damage, though requiring sophisticated solvent regeneration systems and strict environmental control to manage chemical waste streams.

The proliferation of CFRP in highly regulated sectors defines the major applications driving the demand for recycling. This includes mitigating waste from large-scale manufacturing of critical aircraft components, addressing the substantial volume of end-of-life wind turbine blades which represent a unique disposal challenge due to their size, and managing high-volume automotive structural parts designed for mass lightweighting strategies. The strategic benefits derived from this market extend beyond waste reduction; they include achieving significant reductions in embodied energy compared to the immensely energy-intensive production of virgin carbon fiber (which can require up to 200 MJ/kg), offering competitive raw material cost advantages for composite manufacturers facing volatile raw material markets, and ensuring compliance with increasingly stringent global environmental regulations, particularly in Europe and North America, mandating sustainable material management and tracking. These compelling environmental and economic factors serve as fundamental, irreversible driving forces for pronounced market expansion across all industrialized regions adopting advanced composites.

CFRP Recycling Market Executive Summary

The CFRP Recycling Market is rapidly evolving from a technological bottleneck to a viable industrial segment, characterized by robust business trends emphasizing vertical integration and standardization efforts crucial for scaling operations. A significant business trend involves strategic partnerships, often transnational, between composite manufacturers (the waste generators) and technology providers (the recyclers), aiming to stabilize feedstock supply and guarantee quality control over the recovered carbon fibers (rCF). Furthermore, substantial private equity and corporate venture capital investments are channeling into the development of high-throughput solvolysis plants, signaling a shift towards higher-value fiber recovery methods. This market movement is intrinsically linked to corporate Environmental, Social, and Governance (ESG) performance targets, wherein securing a traceable, low-carbon rCF supply contributes directly to sustainability reporting and enhances brand reputation, moving recycled content from an optional extra to a core procurement requirement.

From a regional perspective, Europe maintains its leadership in technology deployment and regulatory influence, underpinned by the EU Green Deal and national initiatives like the UK's focus on composite waste, creating a strong pull market for rCF applications. North America is accelerating its infrastructure development, primarily focusing on managing scrap from the burgeoning aerospace and defense maintenance, repair, and overhaul (MRO) sector, where security of supply chains and domestic recycling capability are paramount strategic concerns. Crucially, the Asia Pacific region, driven by the sheer scale of manufacturing in automotive electrification and consumer goods production in markets like China and India, is experiencing explosive demand growth. While APAC currently favors cost-effective, high-volume pyrolysis, investment is mounting to deploy advanced solvolysis technologies to cater to domestic high-performance component manufacturers seeking high-quality rCF substitutes.

Segment trends highlight the technological differentiation driving market value. Pyrolysis currently accounts for the largest volume segment due to its established industrial footing, catering predominantly to the needs of the construction and standard automotive sectors with shorter rCF. However, the Solvolysis segment is projected to realize the highest Compound Annual Growth Rate (CAGR), reflecting the premium placed on rCF with minimal mechanical property loss, essential for semi-structural applications. By end-use, the Automotive sector is not only the largest consumer but also the primary catalyst for innovation in rCF compounding and molding, dictating specific quality parameters for bulk supply. The overall market narrative is defined by the necessity of bridging the cost-performance gap, demanding continuous process optimization and greater input stream homogenization to unlock the full economic potential of composite circularity.

AI Impact Analysis on CFRP Recycling Market

Common user questions regarding AI's impact on CFRP recycling center on how artificial intelligence can overcome traditional challenges associated with material heterogeneity, process optimization, and quality control. Users are keen to know if AI can reliably distinguish between various composite types and matrices during mixed waste streams, thereby enhancing sorting efficiency and input material preparation for recycling, which is crucial given the diverse range of resins (epoxy, BMI, thermoset) used in modern composites. Key concerns include the feasibility of using machine learning (ML) algorithms to predict optimal pyrolysis temperatures or solvolysis solvent mixtures in real-time based on fluctuating waste composition, ensuring maximum fiber recovery while minimizing energy consumption and preventing fiber oxidation. Expectations are high that AI will lead to the creation of 'smart recycling plants' capable of autonomous process adjustments, dramatically improving the economic viability and consistency of recycled carbon fiber quality, which is paramount for securing adoption in high-performance secondary applications.

- AI-Powered Non-Destructive Testing (NDT): Utilization of AI in analyzing sensor data (e.g., ultrasonic, thermal imaging, spectroscopy) to rapidly assess the degradation, resin type, and contamination levels of incoming CFRP waste streams, enhancing material quality segregation before processing, which is vital for selecting the appropriate recycling method.

- Optimized Process Control: Implementation of Machine Learning (ML) models to dynamically adjust parameters—such as furnace temperature profiles, residence time in pyrolysis, or solvent concentration and flow rate in solvolysis—minimizing thermal stress or chemical exposure and maximizing high-quality fiber yield based on real-time material analysis.

- Predictive Maintenance for Equipment: Deployment of advanced AI algorithms to monitor the operational health and performance characteristics of highly specialized, high-temperature/high-pressure recycling machinery, predicting component failure and scheduling proactive maintenance cycles to reduce costly downtime in capital-intensive recycling facilities and ensure continuous throughput.

- Automated Sorting and Separation: Use of sophisticated computer vision and robotic systems, integrated with deep learning networks trained on vast material libraries, for high-throughput identification and separation of mixed materials (e.g., separating carbon fiber composites from glass fiber composites or metallic inserts) in complex end-of-life product streams like shredded automotive chassis or wind turbine nacelles.

- Digital Material Passport Creation: Leveraging blockchain technology and AI to create secure, traceable, and verified digital records for recovered carbon fibers (rCF), detailing their precise origin, the specific recycling pathway utilized, and independently verified mechanical performance properties, thereby establishing essential trust and facilitating their commercial adoption in regulated supply chains.

DRO & Impact Forces Of CFRP Recycling Market

The dynamics of the CFRP Recycling Market are dictated by a sophisticated interplay of environmental, economic, and technical forces. Principal Drivers include the substantial and exponentially growing volume of end-of-life composite materials, particularly from the retirement of older aircraft fleets and the first generation of utility-scale wind turbine blades, which are too large and complex for traditional landfill disposal methods. Further accelerating growth are the global legislative mandates, specifically the tightening of landfill regulations and the introduction of mechanisms like carbon taxation, making the cost of disposing virgin composite waste prohibitively expensive. Moreover, the inherent energy savings—estimated at up to 95% compared to virgin fiber production—position rCF as a highly attractive material for companies committed to reducing their Scope 3 emissions in their supply chain procurement and adhering to strict corporate sustainability pledges.

However, significant Restraints hinder the market's rapid acceleration and commercial scale-up. The critical technical challenge is managing material heterogeneity; composite waste streams often contain a mixture of different resins (epoxy, polyester, vinyl ester), core materials (balsa, foam), and contaminants (paints, metals), making generalized recycling processes inefficient and jeopardizing the consistency of the final rCF product. Economically, the high initial capital costs associated with building and operating advanced thermal and chemical recycling plants, coupled with the long lead times for obtaining regulatory permits, present a substantial barrier to entry, particularly for smaller enterprises. Furthermore, the inherent risk of property degradation during recycling means that the resulting rCF often trades at a significant discount compared to virgin fiber, complicating investment recovery and necessitating market acceptance in lower-performance, high-volume applications to achieve sustained profitability.

The key Opportunities lie in the continued refinement and commercialization of advanced recycling techniques. Specifically, developing closed-loop solvolysis systems that can efficiently recover both the high-quality carbon fibers and reusable components of the polymer matrix (e.g., monomers, oligomers) offers dual revenue streams, significantly improving process economics and material utilization efficiency. Market expansion into non-traditional composite applications, such as large-scale civil engineering projects where rCF can replace steel rebar in specific contexts or be used in specialized concrete matrices to enhance structural integrity, also presents a massive avenue for volume growth. The long-term Impact Forces are concentrated on regulatory harmonization across major economies (EU, US, Japan), ensuring standardized measurement of rCF properties and mandated recycled content procurement thresholds, thereby creating reliable, long-term demand and significantly de-risking the substantial private investment necessary for industrial scale-up.

Segmentation Analysis

The CFRP Recycling Market is critically segmented based on the technology utilized for fiber recovery, the source of the waste material, and the specific application sector where the recycled fibers are ultimately deployed. Understanding these segments is vital as technological maturity dictates scalability, energy consumption, and final fiber quality, while waste source determines the consistency, contamination profile, and type of material input available (e.g., pre-preg vs. cured parts). The segmentation framework allows composite manufacturers, recyclers, and end-users to strategically target investments towards the most promising recovery methods and end-use applications, ensuring alignment with economic feasibility, circular economy objectives, and high-performance requirements.

Segmentation by technology clearly reveals the inherent trade-offs between yield, quality, and cost, with thermal methods currently dominating volume due to established infrastructure and processing speed, while advanced chemical methods (solvolysis) lead in potential for high-quality fiber return, albeit at a higher processing cost. Waste source segmentation highlights the necessary shift from easily managed internal manufacturing scrap (pre-consumer waste), which typically has a known matrix composition, to highly complex, contaminated end-of-life parts (post-consumer waste), necessitating robust and AI-assisted sorting, cleaning, and preparation processes to maintain feedstock integrity before the recovery stage.

Application segmentation clearly illustrates the market's current trajectory: the high-volume automotive industry represents the rising demand for cost-effective rCF composites, rapidly adopting short-fiber rCF for injection molding and sheet molding compound (SMC) formulations. Conversely, the conservative aerospace sector primarily sources rCF for non-critical interior and secondary structural parts, demanding much stricter quality assurance. This segmentation confirms that market growth will be heavily dependent on the development of mid-grade rCF that is sufficiently cost-effective for automotive use while retaining quality parameters suitable for semi-structural applications across multiple industries.

- By Technology

- Pyrolysis (Thermal Recycling)

- Solvolysis (Chemical Recycling)

- Mechanical Recycling (Shredding, Milling)

- Other (e.g., Microwave Pyrolysis, Supercritical Fluid Extraction)

- By End-Use Industry

- Aerospace and Defense

- Automotive (Passenger Vehicles, Electric Vehicles)

- Wind Energy (Turbine Blades, Nacelles)

- Construction and Infrastructure (Concrete Reinforcement)

- Marine and Sporting Goods

- By Source of Waste

- Manufacturing Waste (Pre-consumer Scrap, Trims, Off-cuts)

- End-of-Life Components (Post-consumer Decommissioning)

- By Fiber Type

- Continuous Carbon Fiber (Rarely recovered)

- Chopped Carbon Fiber (Most common recovered form)

- Milled Carbon Fiber (Powder form)

Value Chain Analysis For CFRP Recycling Market

The value chain for CFRP recycling is complex and multi-faceted, extending from the initial generation and collection of highly varied composite waste upstream to the sophisticated integration of recycled materials into new, certified products downstream. Upstream analysis focuses critically on the waste stream identification, collection logistics, and preparation phase. This involves waste generators (e.g., major aircraft manufacturers, wind farm operators managing decommissioning cycles, and high-volume automotive stampers) and specialized logistics providers who must navigate the logistical challenges posed by the large size and abrasive nature of composite scrap. Critical preparation activities at this stage include size reduction (shredding), detailed sorting to remove metallic and non-CFRP contaminants, and initial cleaning, as highly contaminated feedstock significantly impairs the efficiency and final quality yield of subsequent recycling processes.

Midstream activities are centered on the core technological conversion processes—optimized pyrolysis, advanced solvolysis, or high-speed mechanical grinding—operated by specialized material recycling firms. This phase is characteristically capital-intensive, requiring substantial investment in controlled atmosphere furnaces or high-pressure reactors, and is highly technology-dependent, where the mechanical properties and consistency of the recovered carbon fiber (rCF) are fundamentally determined. The efficiency of resin decomposition and the subsequent application of appropriate fiber sizing agents are pivotal midstream steps that define the commercial viability and target market segment (e.g., high-quality rCF for structural versus low-quality rCF for filler material).

Downstream analysis focuses explicitly on the material integration and end-market application phase. The recovered fibers, typically sold in chopped, non-woven mat, or milled forms, are acquired by resin compounders, material formulators, and secondary component manufacturers. These entities compound the rCF with new thermoplastic or thermoset resins to produce ready-to-use molding compounds (e.g., SMC, BMC) which are then sold directly or indirectly through technical distributors to end-use industries like automotive, consumer electronics, and construction. Distribution channels are often direct for high-volume transactions, involving long-term supply agreements between large-scale recyclers and major Original Equipment Manufacturers (OEMs), emphasizing the need for consistent supply and standardized product specifications. Indirect distribution, leveraging material brokers and specialized compounders, caters effectively to smaller firms needing customized rCF solutions and smaller batch quantities.

CFRP Recycling Market Potential Customers

The primary potential customers and end-users of recycled carbon fibers (rCF) are industries that necessitate lightweight, high-strength characteristics in their products but are constrained by significant cost pressures and escalating regulatory mandates concerning environmental sustainability and embodied carbon. The automotive sector, encompassing major global Original Equipment Manufacturers (OEMs) and their extensive network of Tier 1 and Tier 2 suppliers, represents the largest and most dynamic buyer base. These customers are leveraging rCF, frequently in the form of short fibers or non-woven veils, for a wide range of secondary structural and semi-structural components, internal body parts, battery enclosures in Electric Vehicles (EVs), and under-the-hood applications where they achieve vital weight reduction without the prohibitive cost associated with virgin carbon fiber.

The construction and infrastructure sector constitutes a rapidly growing and high-volume customer segment. Here, rCF is being effectively utilized, often in milled or powder form, as advanced reinforcement material for specialized concretes, enhancing durability, reducing susceptibility to corrosion, and minimizing material usage in large-scale civil engineering projects. Furthermore, manufacturers in the consumer electronics and portable device industries are increasingly exploring high-quality rCF pellets for lightweight, robust, and aesthetically pleasing casings for high-end laptops, smartphones, and medical equipment, driven by demands for reduced device weight and enhanced product ruggedness.

Although the aerospace industry remains a crucial source of high-quality pre-consumer manufacturing waste, its adoption as a customer for the end-product (rCF) is carefully managed, focusing on premium, high-integrity rCF for non-critical components such as cabin interiors, seat frames, and galley systems. The most compelling factor uniting all these potential customers is the intense pressure to demonstrate verifiable reductions in their environmental footprint. By substituting virgin carbon fiber, which has an extremely carbon-intensive production process, with traceable rCF, companies not only meet internal sustainability targets but also secure a strategic supply advantage, driving circularity throughout their product lifecycle management protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.0 Million USD |

| Market Forecast in 2033 | $385.5 Million USD |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ELG Carbon Fibre (SGL Group), Toray Industries Inc., Carbon Fiber Recycling, Vartega Inc., Karborex SPA, Carbon Conversions Inc., Mitsubishi Chemical Holdings Corporation, Shocker Composites, Procotex Corporation, Solvay S.A., M.G.L. Recycling GmbH, Composite Recycling GmbH, Gen 2 Carbon, Hadeg Recycling GmbH, Refiber Composites, Teijin Limited, Hexcel Corporation, Plasan Carbon Composites, Global Fibers Inc., A & P Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CFRP Recycling Market Key Technology Landscape

The technological landscape of CFRP recycling is defined by three primary commercially viable methods: Pyrolysis, Solvolysis, and Mechanical Recycling, each offering a distinct and optimized balance between recovered fiber quality, processing complexity, capital expenditure, and overall environmental footprint. Pyrolysis remains the most technologically mature and commercially prevalent method globally, relying on the precise thermal decomposition of the organic polymer matrix in an oxygen-deprived environment. While this method is highly advantageous for bulk processing and possesses high scalability, the necessity for high operating temperatures (up to 700°C) can induce significant thermal stress on the recovered carbon fibers (rCF), often leading to char residue deposition and measurable degradation of surface and mechanical integrity, consequently limiting the resulting rCF primarily to lower-performance, non-structural applications.

Solvolysis, conversely, represents the future trajectory for high-value recovery, employing highly selective superheated chemical solvents, frequently operating under elevated pressure (sub-critical or supercritical water or organic solvents), to chemically break down and dissolve the surrounding resin matrix. This chemical approach typically proceeds at significantly lower temperatures than pyrolysis, which is instrumental in yielding recovered fibers that retain superior mechanical properties, often exhibiting tensile strength retention approaching 90-95% of the virgin fiber specification. However, the widespread commercial adoption of solvolysis faces technological hurdles related to the inherent variability of polymer matrices, the need for costly solvent regeneration and recirculation systems, and the high energy input required for maintaining specific pressure and temperature regimes, demanding stringent process control and substantial initial investment.

Mechanical recycling, involving large-scale processes such as shredding, crushing, and subsequent grinding, is the least energy-intensive and simplest method to implement but inherently sacrifices fiber length and quality. This method yields short, low-grade fibers (milled product or bulk filler) suitable primarily as composite fillers, reinforcement in construction materials, or asphalt additives, providing limited structural utility. The current strategic research focus across the industry is intensely directed toward developing advanced hybrid systems, such as combining mechanical pre-treatment with microwave-assisted pyrolysis to reduce processing time and energy, or designing novel, environmentally benign bio-solvents for optimized solvolysis, aiming decisively to bridge the critical cost-quality gap that currently impedes the seamless, high-volume substitution of virgin carbon fiber with certified rCF.

Regional Highlights

The regional distribution of the CFRP Recycling Market displays strong heterogeneities, significantly influenced by local regulatory frameworks, the concentration of key end-use industries (aerospace, automotive, wind energy), and established national material science capabilities. Europe holds a commanding position in the global market share, primarily driven by the European Union’s pervasive commitment to the circular economy through legislation such as the Waste Framework Directive and specific mandates targeting the recycling of composite materials, notably the impending need to manage end-of-life wind turbine blades in volume. This regulatory environment has fostered the rapid establishment of advanced solvolysis and pyrolysis facilities across countries like Germany, the UK, and Spain, leading to a strong internal supply chain for rCF within the region.

North America, particularly the United States, represents a major market driven predominantly by the demands of the vast aerospace and defense maintenance, repair, and overhaul (MRO) sectors, generating significant volumes of high-quality pre-consumer scrap that is relatively easier to process. The region’s growth is further stimulated by rising corporate sustainability commitments and increasing federal procurement requirements that prioritize materials with verified low embodied carbon footprints. Key technological hubs in states like Washington and California are investing heavily in local infrastructure, often focusing on optimized pyrolysis to handle both aerospace and automotive manufacturing waste, with strategic emphasis on securing domestic supply chains for high-performance materials.

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR), propelled by the unparalleled scale of manufacturing output, especially in electric vehicle production and high-volume electronics in rapidly industrializing economies like China, South Korea, and Japan. While the region initially focused on basic mechanical and cost-effective, high-throughput pyrolysis to manage immense volumes of production scrap, increasing government emphasis on air quality standards and circular economy policy is accelerating investment in state-of-the-art chemical recycling technologies. Japan and South Korea, with their powerful base in material chemistry, are emerging as pioneers in customizing solvolysis processes specifically for high-volume automotive thermoset waste streams, aiming to secure high-quality rCF for domestic composite component production.

- Europe: The dominant market leader, mandated by rigorous EU regulations (e.g., Landfill Directives, REACH) which enforce composite waste diversion. Characterized by high investment in sophisticated, high-return solvolysis technology and strong industry-academic collaboration to standardize rCF quality measurement.

- North America: Crucial market anchored by the large aerospace and defense industries, focusing on pre-consumer waste management. Growth is facilitated by private-sector investment in large pyrolysis capacity and government incentives aimed at building localized, resilient supply chains for sustainable advanced materials.

- Asia Pacific (APAC): The fastest-growing region, driven by explosive demand from the automotive (EV) and electronics manufacturing sectors. Characterized by high-volume pyrolysis implementation and increasing strategic adoption of advanced solvolysis technologies, led by Japanese and South Korean chemical companies, to improve fiber quality.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging markets with nascent recycling infrastructure, typically reliant on basic mechanical processes or waste export. Future growth is anticipated, specifically in MEA, linked to new industrialization projects (e.g., in Saudi Arabia and UAE) prioritizing resource efficiency and waste minimization in large-scale infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CFRP Recycling Market.- ELG Carbon Fibre (SGL Group)

- Toray Industries Inc.

- Carbon Fiber Recycling

- Vartega Inc.

- Karborex SPA

- Carbon Conversions Inc.

- Mitsubishi Chemical Holdings Corporation

- Shocker Composites

- Procotex Corporation

- Solvay S.A.

- M.G.L. Recycling GmbH

- Composite Recycling GmbH

- Gen 2 Carbon

- Hadeg Recycling GmbH

- Refiber Composites

- Teijin Limited

- Hexcel Corporation

- Plasan Carbon Composites

- Global Fibers Inc.

- A & P Technology

Frequently Asked Questions

Analyze common user questions about the CFRP Recycling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary commercial challenge facing widespread CFRP recycling adoption?

The central challenge is achieving consistent economic viability and technical quality control. High capital costs for advanced facilities, coupled with the variable mechanical properties of recovered fibers (rCF), prevent widespread, cost-competitive substitution for virgin carbon fiber in highly demanding, performance-critical structural applications.

How does pyrolysis compare to solvolysis in terms of fiber quality recovery?

Pyrolysis, a thermal method, is scalable and cost-effective but typically causes fiber surface degradation, leading to 10% to 50% strength loss. Solvolysis, a chemical method, yields fibers with significantly higher mechanical property retention (near-virgin quality) but demands greater complexity and higher operating expenses due to solvent management.

Which end-use industry drives the highest volume demand for recycled carbon fiber (rCF)?

The Automotive Industry currently drives the highest volume demand for rCF. Focused on high-volume production, weight reduction, and cost containment in electric vehicle manufacturing, this sector is the largest consumer of cost-effective, short-fiber rCF for composite compounding and injection molding applications.

Are recycled carbon fibers suitable for use in primary aerospace structures?

No, rCF is generally not qualified for primary load-bearing aerospace structures due to strict regulatory requirements and performance variability. However, rCF is increasingly used in secondary applications, non-critical parts (e.g., interior panels, ducting), and tooling, where weight saving is desired but safety margins are less demanding.

What role do wind turbine blades play in the future feedstock supply for CFRP recycling?

Wind turbine blades are expected to be a critical, high-volume source of post-consumer CFRP waste over the next decade. Their decommissioning presents both a significant regulatory challenge and the primary opportunity to scale up bulk pyrolysis and specialized size reduction operations necessary for consistent, large-scale feedstock supply.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager