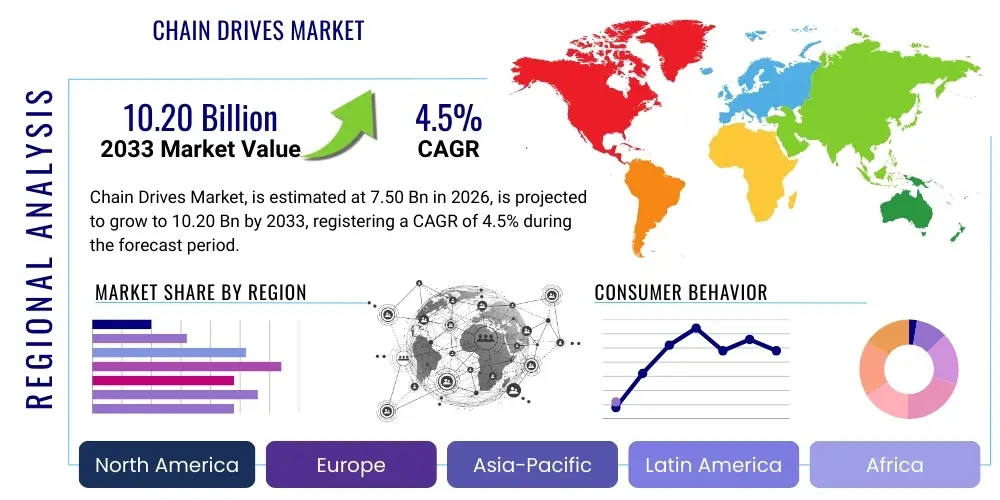

Chain Drives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441218 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Chain Drives Market Size

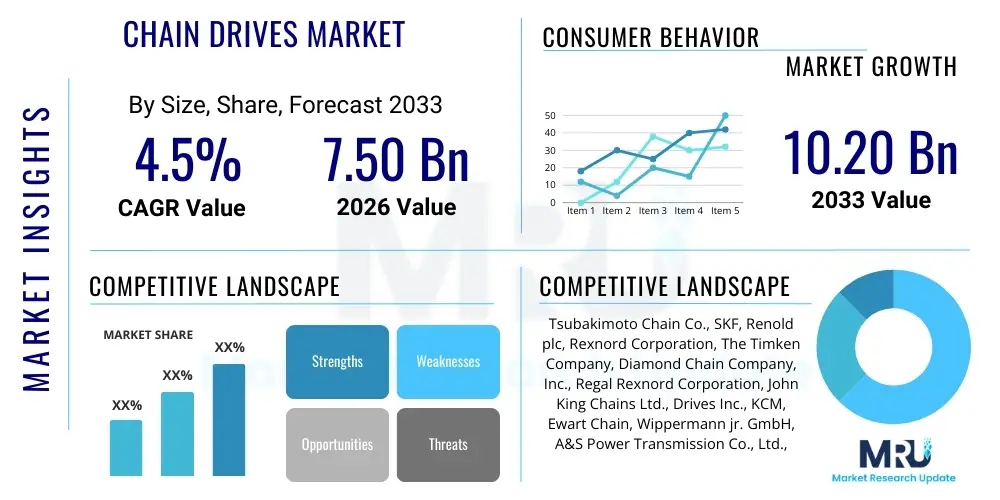

The Chain Drives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $7.50 Billion in 2026 and is projected to reach $10.20 Billion by the end of the forecast period in 2033.

Chain Drives Market introduction

The Chain Drives Market encompasses the manufacturing and distribution of mechanical power transmission systems utilizing chains, sprockets, and associated components. These systems are fundamental in transmitting mechanical power and motion across various industrial and commercial machinery, offering distinct advantages such as positive drive, high load-carrying capacity, and durability in challenging environments. Products range from standard roller chains used in light industrial applications to complex silent chains and heavy-duty engineered chains designed for high-power, high-speed, or specialized conveying operations in sectors like mining and construction. The core functionality of a chain drive ensures synchronous movement between input and output shafts, making them indispensable where precise timing and robust power delivery are essential, such as in automotive timing systems, packaging machinery, and large-scale material handling equipment.

Chain drives are preferred over belt drives in applications requiring high torque transmission over short to medium distances, especially where slippage must be avoided. Their robust construction, typically involving steel alloys, allows them to operate effectively under temperature extremes, shock loads, and abrasive conditions often encountered in heavy industry. Continuous innovation focuses on enhancing the wear resistance, fatigue life, and efficiency of these components, often through advanced heat treatments, specialized coatings, and optimized geometry of links and sprockets. The market is currently driven by the revitalization of industrial infrastructure globally, particularly in developing economies prioritizing manufacturing and automation expansion, alongside the rising demand for efficient material handling solutions in logistics and e-commerce.

Major applications of chain drive systems span across several critical industries, including the automotive sector where they are crucial for engine timing systems; industrial machinery where they power compressors, pumps, and machine tools; agriculture for machinery like harvesters and tractors; and the increasingly critical segment of material handling, powering conveyor belts and lifting equipment in automated warehouses. Key benefits include simplicity of installation, relatively low maintenance requirements compared to complex gearboxes, and the ability to operate effectively even when misalignment occurs. The ongoing development of lubricated-for-life chains and corrosion-resistant materials further solidifies their position as a versatile and reliable power transmission solution across diverse operational contexts.

- Product Description: Mechanical power transmission systems comprising articulated links (chains) and toothed wheels (sprockets) used to transfer rotary motion between shafts.

- Major Applications: Industrial equipment, Material handling, Automotive timing systems, Construction machinery, Agricultural machinery, and Mining operations.

- Benefits: High efficiency (low energy loss), Positive synchronization (no slip), High torque capacity, Durability in harsh conditions, and relatively long operational life.

- Driving factors: Rapid growth in industrial automation, increased capital expenditure on heavy machinery replacement, and expansion of the global logistics and warehouse sectors.

Chain Drives Market Executive Summary

The global Chain Drives Market is experiencing stable growth primarily fueled by robust investment in industrial modernization and the sustained expansion of global manufacturing capabilities, particularly in Asia Pacific. Business trends indicate a strong move toward high-performance, maintenance-free, and corrosion-resistant chains, reflecting end-user demand for minimizing downtime and total cost of ownership (TCO). Strategic mergers, acquisitions, and technological partnerships among key players are focusing on integrating smart monitoring capabilities (Condition Monitoring Systems) into drive systems, transitioning chain drives from purely mechanical components to integral parts of predictive maintenance regimes. The competitive landscape is characterized by established global manufacturers competing intensely on product quality, service life guarantees, and supply chain efficiency, particularly in offering specialized chains for niche applications like food processing or highly abrasive environments.

Regional trends highlight the Asia Pacific market as the dominant growth engine, attributed to massive investments in infrastructure development, automotive manufacturing, and the rapidly growing automated warehousing sector in countries like China, India, and Southeast Asia. North America and Europe, while mature markets, demonstrate steady demand driven by replacement cycles and the adoption of high-precision, specialized chains conforming to stringent safety and efficiency standards (e.g., ATEX requirements). Investment in local manufacturing hubs closer to end-users is a crucial strategy for managing complex logistical challenges and ensuring rapid delivery of heavy-duty or custom-engineered chain solutions, mitigating risks associated with volatile global shipping costs.

Segmentation trends reveal that the Roller Chain segment maintains the largest market share due to its versatility and cost-effectiveness across general industrial applications. However, the Engineered Chain and Silent Chain segments are registering higher growth rates, driven by their increasing adoption in heavy-duty conveyors and high-speed applications requiring reduced noise and vibration, respectively. Within applications, Material Handling remains the fastest-growing end-use sector, directly benefiting from the e-commerce boom and the associated need for complex, reliable intra-logistics systems in distribution centers. Furthermore, there is a clear segment shift towards solutions that require less or zero external lubrication, addressing environmental concerns and reducing operational maintenance complexity in sensitive industries.

AI Impact Analysis on Chain Drives Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Chain Drives Market predominantly focus on how predictive maintenance, smart sensing, and optimization algorithms can extend component life and reduce unforeseen failures. Key themes revolve around the potential for AI to transform reactive and preventive maintenance schedules into proactive, condition-based maintenance (CBM). Users are keen on understanding the financial feasibility of embedding sensors (IoT) into chain drive systems and utilizing machine learning models to analyze vibration, temperature, and lubrication characteristics in real-time. Concerns often relate to data security, the complexity of integrating AI platforms with existing legacy infrastructure, and the necessity of specialized expertise to interpret advanced diagnostic outputs. Expectations are high regarding significant reductions in total downtime and maximized operational efficiency through AI-driven insights into component degradation and remaining useful life (RUL).

AI’s influence is primarily manifested through the integration of Industrial IoT (IIoT) sensors applied to chain drive components and supporting machinery, feeding operational data into cloud-based analytical platforms. These platforms employ advanced machine learning algorithms to establish baseline performance metrics and detect subtle deviations indicative of potential failure modes, such as excessive chain stretch, misalignment of sprockets, or inadequate lubrication film thickness. This shift allows operators to schedule intervention precisely when needed, rather than following rigid time-based schedules, which often results in premature replacement of functional parts or sudden catastrophic failures. Consequently, the adoption of AI is leading to a premiumization of chain drive systems that are designed to be "smart-ready," featuring integrated connectivity or optimal points for sensor attachment, moving the industry toward a service-oriented model centered on uptime assurance.

The incorporation of AI into the market is also impacting the design and manufacturing processes. Generative design tools, powered by AI, are being utilized to optimize chain and sprocket geometries for maximum strength-to-weight ratios and reduced friction, tailored specifically to predefined application loads and environmental constraints. Furthermore, AI contributes to quality control during manufacturing by analyzing visual inspection data and material properties, ensuring stringent adherence to specifications and minimizing manufacturing defects that could lead to early field failure. While AI does not replace the fundamental mechanical function of the chain drive, it elevates the system's overall value proposition by drastically enhancing reliability, optimizing energy consumption through better operational management, and facilitating complex supply chain predictions regarding spare parts demand.

- Real-time Monitoring: AI analyzes sensor data (vibration, acoustics, temperature) from chain drives to identify incipient faults and operational anomalies.

- Predictive Maintenance (PdM): Machine learning models accurately predict the Remaining Useful Life (RUL) of chains and sprockets, minimizing unexpected shutdowns.

- Optimized Lubrication Schedules: Algorithms determine the precise timing and quantity of lubrication required based on usage patterns and environmental factors.

- Generative Design: AI tools optimize chain link profiles and sprocket teeth geometry for enhanced efficiency and reduced wear during the product development phase.

- Inventory Management: Predictive analytics forecast spare parts consumption patterns, leading to leaner, more efficient aftermarket supply chains for chain drive components.

DRO & Impact Forces Of Chain Drives Market

The Chain Drives Market dynamics are fundamentally shaped by a complex interplay of internal market demand, external technological substitution risks, and macroeconomic factors. The primary drivers are centered on the expansion of global manufacturing output and the necessity for robust, non-slip power transmission in heavy-duty industrial environments, particularly material handling, construction, and mining sectors. Restraints predominantly involve the competitive pressure from advanced belt drives and gear drives, which offer advantages in noise reduction, weight savings, and maintenance simplicity in specific lower-torque or high-speed applications. Opportunities are generated through the development of specialized, high-performance chains—such as self-lubricating or highly corrosive-resistant variants—and the integration of IIoT/AI technologies to offer superior predictive maintenance capabilities. These forces collectively dictate investment decisions, product development focus, and the overall trajectory of market growth.

Drivers: Significant impetus stems from the accelerating adoption of automation and robotics across manufacturing sectors, where reliable indexing and positive power transfer are non-negotiable requirements that chain drives inherently satisfy. The massive infrastructure and industrial expansion programs underway in emerging economies require substantial deployment of heavy machinery, including excavators, dozers, and complex conveying systems, all relying heavily on durable chain drive mechanisms. Furthermore, the stringent safety regulations in high-risk industries, such as oil and gas or nuclear power, favor chain drives due to their demonstrated reliability and ability to withstand extreme operational conditions better than many alternative flexible drives. The push for higher energy efficiency also drives demand for modern, precision-engineered chains that minimize frictional losses, contributing to lower overall operating costs for end-users.

Restraints: The market faces significant headwinds from the growing popularity of synchronous belt drives, especially in applications where cleanliness, low noise generation, and zero maintenance are critical, such as in food and beverage processing or sensitive laboratory equipment. Belts have improved substantially in terms of load-carrying capacity, challenging the traditional dominance of chains in medium-torque applications. Additionally, the inherent need for periodic lubrication and the susceptibility of standard chain drives to environmental contaminants, which necessitates protective casing and routine upkeep, represent a recurring operational cost and complexity that acts as a restraint. Market maturity in highly developed regions, where growth is primarily based on replacement demand rather than new installations, also limits the overall market expansion rate.

Opportunities: The greatest avenues for future growth lie in the development and proliferation of specialized chain products tailored for extreme environments. This includes highly corrosion-resistant chains made from specific stainless steel grades or polymers, ideal for chemical wash-down processes, and maintenance-free chains utilizing internal oil-impregnated bushings or unique sealing technologies, eliminating the need for external lubrication. Furthermore, the burgeoning market for Condition Monitoring Systems (CMS) and IoT integration presents a lucrative opportunity for manufacturers to transition towards providing value-added services based on predictive analytics, transforming the supply chain from component sales to comprehensive uptime solutions, thereby capturing higher profit margins and securing long-term customer loyalty.

- Drivers: Global industrial automation growth, Expansion of material handling and logistics infrastructure, High demand for positive non-slip power transmission, Increased capital expenditure on machinery replacement cycles in heavy industries.

- Restraints: Intense competition from advanced synchronous belt drives and gear systems, Requirement for periodic lubrication and maintenance, Susceptibility of standard chains to wear from abrasive contamination, Market maturity in Western industrialized nations limiting new installation growth.

- Opportunity: Development of maintenance-free and specialized corrosion-resistant chains, Integration of IIoT and predictive analytics (AI) for CBM, Growth in high-load, heavy-duty applications like mining and construction requiring engineered solutions, Focus on efficiency-optimized, light-weight designs.

- Impact forces: Technological advancements leading to product substitution risk; Economic stability influencing industrial investment levels; Raw material price volatility impacting manufacturing costs (steel alloys); Environmental regulations favoring cleaner, lubricated-for-life systems.

Segmentation Analysis

The Chain Drives Market is systematically segmented based on Type, Application, and End-Use Industry, providing a nuanced view of demand drivers and growth potential across various operational landscapes. Segmentation by Type, including Roller Chains, Silent Chains, Engineered Chains, and Leaf Chains, defines the technical performance profile and suitability for specific environments; for example, roller chains dominate general industry due to cost and flexibility, while silent chains are preferred where high speed and minimal noise are required. Segmentation by Application delineates the primary function served, such as power transmission for heavy machinery versus conveying for material movement, directly correlating to the required size, material strength, and pitch of the chain system.

The core of market activity is often driven by the End-Use Industry segmentation, which includes Automotive, Industrial Machinery, Material Handling, Construction, and Agriculture. Each sector imposes unique demands on chain drive characteristics; for instance, the Automotive industry requires high precision and fatigue resistance for engine timing, whereas the Material Handling sector emphasizes durability, longevity, and resistance to shock loading in continuous operation. Analyzing these segments helps manufacturers tailor their product offerings, focusing on compliance with industry-specific standards (e.g., cleanliness for Food & Beverage, or robust load capacity for Mining).

The ongoing trend towards customization and specialization is highly visible within the segmentation analysis. While standard chains remain essential for aftermarket and general use, high-growth opportunities are concentrated in custom-engineered solutions that integrate advanced materials, specialized coatings (like nickel plating or polymer components), and innovative sealing mechanisms to extend operational life in hostile environments (e.g., highly dusty cement plants or high-humidity bottling facilities). Understanding the interconnectedness of these segments is crucial for strategic market positioning and identifying underserved niche markets demanding application-specific drive solutions.

- By Type: Standard Roller Chains, Heavy-Duty Roller Chains, Silent Chains, Engineered Chains (Welded Steel, Drag Chains), Leaf Chains, Specialized & Stainless Steel Chains.

- By Application: Power Transmission (Engines, Gearboxes, Machine Tools), Conveying (Material Handling Systems, Assembly Lines), Indexing & Timing.

- By End-Use Industry: Automotive, Material Handling & Logistics, Industrial Machinery (Pumps, Compressors), Agriculture, Construction & Mining, Food & Beverage, Chemical & Petrochemical.

- By Sales Channel: OEM (Original Equipment Manufacturers), Aftermarket (Replacement and Maintenance).

Value Chain Analysis For Chain Drives Market

The Chain Drives Market value chain begins with the sourcing and processing of raw materials, predominantly high-grade steel alloys such as carbon steel, alloy steel, and various stainless steels necessary for manufacturing links, pins, bushings, and rollers. This upstream phase is highly capital intensive and sensitive to global commodity price volatility. Manufacturers rely heavily on specialized forging, stamping, and heat treatment processes to ensure the metallurgical integrity, tensile strength, and wear resistance of the components. Efficiency in raw material utilization and energy consumption during forging directly impacts the final product cost, making robust supply chain management crucial for profitability. The emphasis in the initial stages is on achieving superior quality and consistency of materials to guarantee product performance and durability under load.

The midstream phase involves the actual manufacturing, assembly, and quality control of the chains and sprockets. Leading manufacturers integrate advanced precision machining and automated assembly lines to produce high-tolerance components, crucial for achieving smooth operation and maximizing fatigue life. Product innovation occurs here, focusing on surface treatments (e.g., chrome plating, specialized coatings) and advanced sealing mechanisms (e.g., O-ring chains) to create maintenance-free or application-specific chains. Distribution channels form the critical link to the end-users, involving both direct sales to large Original Equipment Manufacturers (OEMs) who integrate the drives into their final products, and indirect sales through a vast network of industrial distributors, maintenance supply houses, and specialized power transmission retailers who service the highly fragmented aftermarket demand.

The downstream analysis centers on the utilization, maintenance, and replacement cycle. Direct sales to OEMs involve long-term contracts and technical collaboration, ensuring the chain drive system is optimized for the host machine. Indirect sales characterize the aftermarket, driven by routine maintenance and failure replacement, often requiring rapid delivery of standardized parts. Specialized consulting and engineering services, particularly around predictive maintenance integration (Condition Monitoring Systems), are increasingly being offered by manufacturers to enhance customer value. The efficiency of the distribution network—ensuring product availability and technical support—is a decisive competitive factor, especially for servicing the widespread demand from SMEs and remote industrial sites globally.

Chain Drives Market Potential Customers

Potential customers for the Chain Drives Market are widely distributed across key industrial and agricultural sectors, essentially encompassing any operation requiring robust, synchronized, and highly reliable power transmission or material conveyance. The largest segment of customers includes Original Equipment Manufacturers (OEMs) who integrate chain drive systems into their capital goods, such as vehicle manufacturers (for engine timing), heavy machinery producers (for construction and mining equipment), and manufacturers of specialized production machinery (e.g., paper mills, textile looms, bottling plants). These customers require high volumes of customized, quality-assured components backed by comprehensive technical support and long warranty periods, making purchasing decisions highly reliant on product reliability and engineering partnership capabilities.

Another major customer base comprises Maintenance, Repair, and Overhaul (MRO) professionals and industrial end-users across diverse sectors like logistics, food processing, agriculture, and power generation. These customers primarily procure through the aftermarket channel, purchasing replacement chains, sprockets, and accessories for routine upkeep or failure remediation. Their purchasing decisions are often driven by availability, cost-efficiency, and the ability of the supplier to provide components compatible with existing infrastructure. The rapidly expanding sector of automated warehousing and logistics is a burgeoning group of customers, demanding high-speed, long-life conveyor chains and precise indexing systems to support continuous, 24/7 operation.

Furthermore, specialized industries with unique operational constraints represent high-value potential customers. This includes the Chemical and Petrochemical sectors requiring specialized corrosion-resistant alloys for extreme temperature and chemically active environments, and the Food and Beverage industry demanding stainless steel chains compliant with stringent hygiene and wash-down protocols. Government and municipal bodies operating large utility infrastructure, such as water treatment plants and public transportation systems, also constitute critical buyers, prioritizing long service life and minimal environmental impact in their procurement of specialized power transmission components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.50 Billion |

| Market Forecast in 2033 | $10.20 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tsubakimoto Chain Co., SKF, Renold plc, Rexnord Corporation, The Timken Company, Diamond Chain Company, Inc., Regal Rexnord Corporation, John King Chains Ltd., Drives Inc., KCM, Ewart Chain, Wippermann jr. GmbH, A&S Power Transmission Co., Ltd., Ramsey Products Corporation, Kette-Dahmen GmbH, Hangzhou Donghua Chain Group Co., Ltd., IWIS drive systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chain Drives Market Key Technology Landscape

The technological evolution within the Chain Drives Market is focused on enhancing durability, minimizing maintenance requirements, improving energy efficiency, and integrating digital monitoring capabilities. A critical area of development involves the materials science used in manufacturing, specifically focusing on advanced heat treatment techniques (e.g., induction hardening, carburizing) to increase the surface hardness and core toughness of pins, bushings, and side plates, thereby extending the chain's fatigue life and resistance to abrasive wear. The refinement of steel alloys, including the greater use of specialized stainless steels and corrosion-resistant coatings (such as Dacromet or specialized polymer overlays), addresses the growing need for chain drives capable of functioning reliably in wet, corrosive, or high-temperature environments, particularly in offshore and food processing industries. These material innovations are foundational to achieving the promised "maintenance-free" operational life that customers increasingly demand.

Lubrication technology represents another significant technological frontier. The introduction and widespread adoption of self-lubricating chains, which feature oil-impregnated sintered metal bushings (like proprietary brands such as Lambda or Maintenance-Free technology), are revolutionizing maintenance protocols. These advancements eliminate the need for routine external lubrication, drastically reducing operational costs, environmental contamination risks, and maintenance induced downtime. Furthermore, sophisticated sealing mechanisms, particularly those utilized in heavy-duty or sealed (O-ring) chains, prevent the ingress of abrasive contaminants like dust, sand, or moisture into the bearing areas, preserving the internal lubrication and significantly extending the service interval. This focus on internal maintenance solutions is highly valued by industries operating in challenging conditions like mining or construction.

The most transformative technology impacting the chain drives sector is the integration of Industrial Internet of Things (IIoT) sensors and associated Condition Monitoring Systems (CMS). Modern systems often include proprietary sensors that monitor key operational parameters such as chain elongation (stretch), vibration patterns, load fluctuations, and temperature spikes. This data is processed locally or transmitted to cloud platforms, allowing for predictive analytics. These smart chain drive solutions leverage high-frequency data sampling and AI algorithms to accurately diagnose potential component degradation, enabling proactive interventions before critical failure occurs. This shift towards smart drive components moves the industry beyond traditional mechanical engineering and into the realm of digital industrial solutions, offering end-users unprecedented levels of operational control and asset management optimization.

Regional Highlights

The global Chain Drives Market exhibits distinct regional dynamics influenced by differing levels of industrialization, regulatory environments, and capital investment cycles. Asia Pacific (APAC) stands out as the primary growth region, driven by unparalleled expansion in manufacturing output, rapid urbanization, and massive infrastructure projects across China, India, and ASEAN nations. This region's demand is characterized by high volume procurement of both standard and heavy-duty chains for new installations in automotive assembly, logistics hubs, and heavy industries like steel production and cement manufacturing. Favorable government policies promoting domestic manufacturing and foreign direct investment further accelerate market activity, positioning APAC as the largest consumer and producer of chain drive systems globally.

North America and Europe represent mature markets characterized by stable replacement demand and a strong emphasis on high-performance, specialized, and efficient drive solutions. The demand in these regions is less focused on quantity for new builds and more on quality, service life, and adherence to rigorous environmental and safety standards. There is a high penetration of premium products, including silent chains for noise reduction and self-lubricating chains to minimize maintenance labor and environmental waste. The market growth here is strongly correlated with technological upgrades, such as the integration of Condition Monitoring Systems and the replacement of older equipment with energy-efficient, IIoT-enabled mechanical systems in key sectors like precision engineering, aerospace manufacturing, and advanced packaging.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets that display significant potential, primarily driven by investments in resource extraction (mining and oil & gas) and increasing domestic manufacturing capabilities. LATAM sees steady demand for heavy-duty engineered chains critical for mining operations and agricultural machinery. MEA is heavily reliant on oil and gas infrastructure, which requires robust, explosion-proof, and corrosion-resistant chain drives. While these regions often face supply chain challenges, increasing localized distribution partnerships and infrastructure spending are expected to provide robust growth opportunities throughout the forecast period, particularly for manufacturers offering reliable, rugged components suited for harsh climatic conditions.

- Asia Pacific (APAC): Dominant market, high growth, fueled by rapid industrialization, automotive sector expansion, massive infrastructure projects (e.g., Belt and Road Initiative), and booming e-commerce driving material handling demand. Key countries: China, India, Japan, South Korea.

- North America: Mature market, focus on replacement, technological upgrades (IIoT integration), demand for specialized chains in precision manufacturing and food processing, stringent safety standards. Key countries: USA, Canada.

- Europe: Stable growth, driven by manufacturing efficiency mandates, high adoption of silent and corrosion-resistant chains, emphasis on minimizing environmental impact, strong presence of high-end machinery builders (OEMs). Key countries: Germany, UK, Italy.

- Latin America (LATAM): Emerging growth, significant demand from mining, agriculture, and increasing investment in localized manufacturing facilities, focus on durable, cost-effective solutions. Key countries: Brazil, Mexico, Argentina.

- Middle East and Africa (MEA): Growth linked to oil & gas infrastructure projects, heavy construction, and developing logistics networks; strong requirement for components resistant to heat and harsh environmental conditions. Key countries: Saudi Arabia, UAE, South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chain Drives Market.- Tsubakimoto Chain Co.

- SKF

- Renold plc

- Rexnord Corporation

- The Timken Company

- Diamond Chain Company, Inc.

- Regal Rexnord Corporation

- John King Chains Ltd.

- Drives Inc.

- KCM

- Ewart Chain

- Wippermann jr. GmbH

- A&S Power Transmission Co., Ltd.

- Ramsey Products Corporation

- Kette-Dahmen GmbH

- Hangzhou Donghua Chain Group Co., Ltd.

- IWIS drive systems

- Hitachi Maxco, Ltd.

- Martin Sprocket & Gear, Inc.

- U.S. Tsubaki Power Transmission, LLC

Frequently Asked Questions

Analyze common user questions about the Chain Drives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Chain Drives Market?

Market growth is primarily driven by the global acceleration of industrial automation, substantial investments in material handling infrastructure due to the e-commerce boom, and the necessity for highly reliable, positive power transmission in heavy-duty sectors like mining, construction, and automotive manufacturing. The increasing demand for advanced, maintenance-free chain solutions also contributes significantly to market value.

How do Chain Drives compare to synchronous Belt Drives in industrial applications?

Chain drives excel in high-torque, positive synchronization applications where slip is unacceptable, offering superior robustness, higher efficiency, and better heat resistance. Belt drives are typically chosen for high-speed, light-to-medium-torque applications demanding low noise, less weight, and zero external lubrication, but they cannot transmit shock loads as effectively as chains.

What is the role of IIoT and AI in modern Chain Drives?

IIoT sensors and AI algorithms are transforming chain drives by enabling predictive maintenance (PdM). These technologies monitor operational variables like vibration and stretch in real-time to forecast component failure, optimizing maintenance schedules, reducing unplanned downtime, and extending the chain's operational life well beyond traditional replacement cycles.

Which chain segment is experiencing the fastest technological growth?

The Engineered Chain and Silent Chain segments are witnessing the highest technological advancement. Engineered chains incorporate advanced materials and coatings for severe environments, while silent chains are optimized for high-speed, high-power density applications requiring minimum noise and vibration, making them popular in precision machinery and high-throughput processes.

What are the key challenges facing chain drive manufacturers?

Key challenges include managing the intense competitive pressure from alternative transmission technologies, mitigating the volatility of raw material costs (especially steel alloys), and meeting increasing customer demand for complex, application-specific chains that offer long service life, corrosion resistance, and require minimal maintenance, driving up research and development costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Roller Chain Drives Market Statistics 2025 Analysis By Application (Food Processing, Manufacturing, Agricultural Machine), By Type (Single Strand, Double Strand, Multiple Strand), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Industrial Chain Drives Market Statistics 2025 Analysis By Application (Automotive, Industrial Machinery, Agriculture), By Type (Transmission Chain, Silent Chain, Leaf Chain, Roller Chain), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Chain Drives Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Transmission Chains, Conveyor Chains, Others), By Application (Automotive, Industrial Machinery, Agriculture, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager