Chamomilla Recutita Extract Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440992 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Chamomilla Recutita Extract Market Size

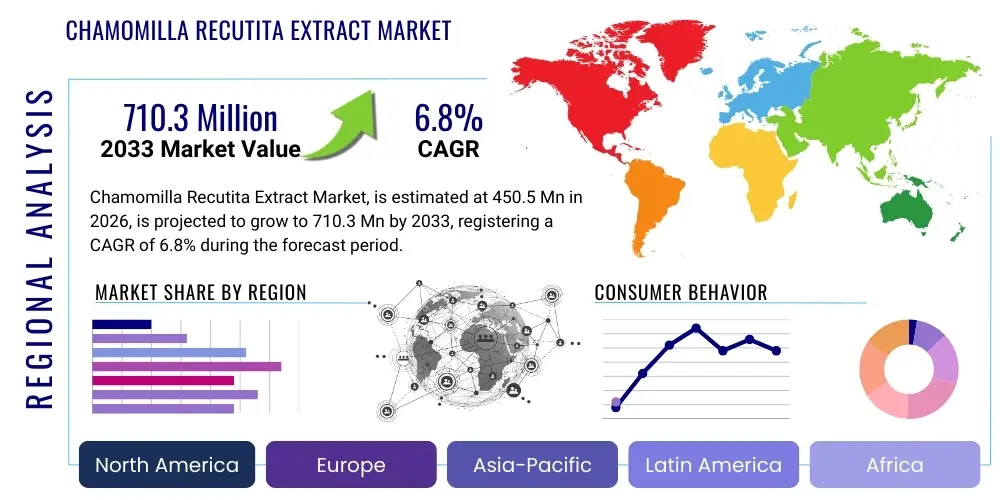

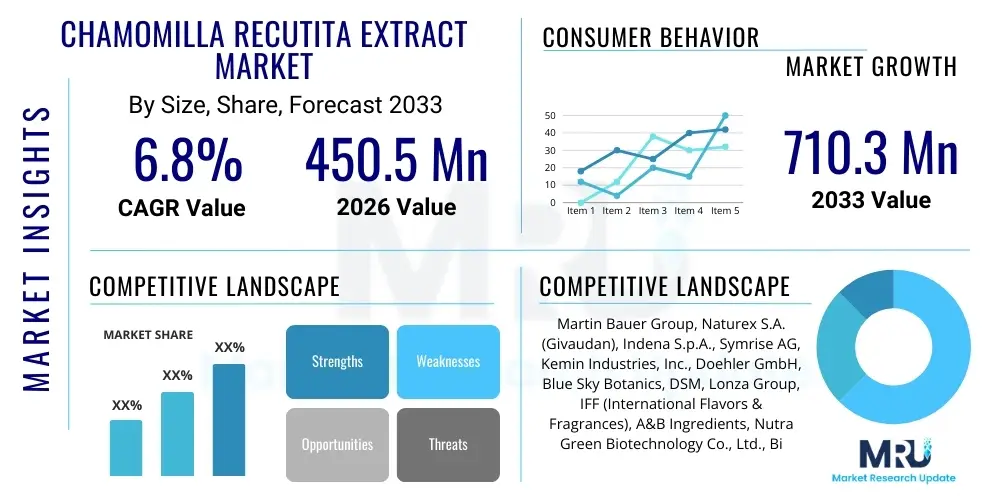

The Chamomilla Recutita Extract Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.3 Million by the end of the forecast period in 2033.

Chamomilla Recutita Extract Market introduction

The Chamomilla Recutita Extract Market, often referred to as the German Chamomile extract market, centers on products derived from the flowering plant Chamomilla recutita. This botanical extract is highly valued globally for its robust anti-inflammatory, antioxidant, and soothing properties, driven primarily by active constituents such as chamazulene, bisabolol, and various flavonoids. The market encompasses a range of product forms including oils, liquid extracts, and powders, which are synthesized using extraction methods like hydrodistillation, solvent extraction, or supercritical fluid extraction (SFE). This diversity in processing allows the extract to be tailored for specific applications, ensuring high purity and efficacy, especially in sensitive formulations.

Major applications for Chamomilla Recutita Extract span several high-growth industries, notably cosmetics, personal care, pharmaceuticals, and functional foods/beverages. In cosmetics, it is a key ingredient in skincare products designed for sensitive or irritated skin, capitalizing on its calming effects. The pharmaceutical sector utilizes it in topical formulations for treating minor skin conditions and in oral preparations for digestive relief and relaxation. The inherent benefits, such as dermal protection, therapeutic potential, and natural origin, position it favorably against synthetic alternatives, aligning with global consumer preference for natural ingredients.

Key driving factors propelling the market include the escalating demand for organic and natural ingredients across consumer packaged goods, heightened consumer awareness regarding skin health and wellness, and continuous research validating the efficacy of chamomile components in dermatological and internal health applications. Furthermore, the growing elderly population and rising instances of sensitive skin conditions worldwide contribute significantly to the consistent demand for gentle, natural soothing agents like Chamomilla Recutita Extract, reinforcing its essential role within the broader botanical supplements market landscape.

Chamomilla Recutita Extract Market Executive Summary

The Chamomilla Recutita Extract market is characterized by robust business trends focusing on sustainability, advanced extraction technologies, and clean label adherence. Manufacturers are increasingly investing in proprietary processes, such as Supercritical Fluid Extraction (SFE), to maximize the concentration of active compounds like bisabolol while minimizing environmental impact. Strategic partnerships between raw material suppliers and large cosmetic formulation houses are common, aiming to secure reliable, high-quality botanical sourcing. Furthermore, the shift towards personalized wellness and customized cosmetic formulations is opening specialized niche markets for high-ppurity, standardized extracts, dictating business strategies that prioritize traceability and transparency.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by rapidly expanding cosmetic and nutraceutical industries in countries like China, India, and South Korea, coupled with strong traditional use of herbal medicines. North America and Europe maintain dominance in terms of market value, fueled by stringent quality standards, high consumer spending on premium organic products, and established regulatory frameworks supporting botanical ingredients in pharmaceutical applications. Regulatory harmonization efforts across these major regions are simplifying market entry for standardized extract products, although local sourcing and ethical trade practices remain critical differentiators in competitive regional environments.

Segment-wise, the liquid extract form dominates the market due to ease of incorporation into beverages and liquid topical formulations, while the powder form exhibits the highest growth rate, primarily utilized in dietary supplements and dry cosmetic bases. Application segmentation shows that the Cosmetics and Personal Care sector is the principal consumer, followed closely by the Pharmaceutical sector, particularly for digestive health and anti-inflammatory drugs. Ingredient concentration trends indicate a rising demand for high-purity, standardized extracts (e.g., standardized to specific bisabolol content), reflecting a market maturity where efficacy assurance is paramount for both B2B buyers and end-consumers.

AI Impact Analysis on Chamomilla Recutita Extract Market

User inquiries regarding AI's influence on the Chamomilla Recutita Extract market primarily revolve around optimizing agricultural yields, enhancing extraction efficiency, and predicting consumer demand trends for specific product forms. Users frequently question how AI and machine learning (ML) algorithms can be employed to monitor the quality of chamomile crops in real-time, specifically focusing on optimal harvest times to maximize active ingredient concentration. There is significant interest in AI-driven formulation platforms that can rapidly test and predict the stability and efficacy of new cosmetic or pharmaceutical products incorporating chamomile extract, potentially accelerating R&D cycles and reducing costs. Furthermore, consumers and businesses are concerned with how AI can improve supply chain transparency and traceability, ensuring the ethical sourcing and purity of botanical raw materials amidst complex global supply networks. The consensus is that AI will transform research into efficacy claims and operational efficiency rather than significantly altering core product functionality.

AI's primary transformative role lies in optimizing complex biological and chemical processes inherent to botanical extraction and formulation. Machine learning models can analyze vast datasets concerning soil conditions, climate variables, and genetic markers to optimize the cultivation of Chamomilla recutita, ensuring higher yield consistency and greater active compound concentrations (e.g., increasing bisabolol content). In the post-harvest phase, AI is deployed in sophisticated quality control systems to analyze chromatograms and spectral data, automatically verifying the purity and standardization levels of the final extract, far surpassing traditional manual quality checks. This enhanced precision is vital for meeting stringent pharmaceutical grade requirements and boosting market confidence in standardized products.

Beyond technical optimization, AI tools are revolutionizing market strategy and product development. Natural Language Processing (NLP) is used to analyze millions of consumer reviews and social media trends instantaneously, providing manufacturers with highly detailed insights into unmet consumer needs—for example, specific preferences regarding texture, scent, or pairing with other botanicals. Predictive analytics driven by AI helps forecast demand fluctuations based on seasonal factors, advertising spend effectiveness, and competitor activities, allowing extract producers to manage inventory more efficiently and reduce waste, thereby strengthening supply chain resilience and profitability in this inherently volatile agricultural commodity market.

- AI-driven optimization of agricultural conditions (soil, climate, harvesting) to maximize bisabolol yield.

- Machine learning algorithms enhancing extraction process efficiency, reducing solvent usage and energy consumption.

- Predictive analytics for consumer trend forecasting, guiding new product development (e.g., novel infusion applications).

- Automated spectroscopic analysis for real-time quality control and standardization verification (purity and concentration).

- Blockchain integration, facilitated by AI oversight, ensuring end-to-end supply chain traceability and ethical sourcing verification.

- AI-powered formulation tools accelerating cosmetic and pharmaceutical R&D by simulating ingredient compatibility and stability.

DRO & Impact Forces Of Chamomilla Recutita Extract Market

The dynamics of the Chamomilla Recutita Extract Market are governed by powerful interconnected forces encompassing high consumer demand for natural ingredients, stringent regulatory hurdles, and technological advancements in extraction. Drivers (D) center on the proven efficacy in soothing skin conditions and digestive ailments, coupled with the rapid expansion of the organic beauty movement. Restraints (R) include price volatility of raw chamomile flowers due to dependency on weather patterns and agricultural constraints, alongside the challenge of maintaining standardization across diverse geographic sourcing areas. Opportunities (O) are significant in functional food applications, premium pet care products, and the development of highly concentrated, standardized extracts targeting specific therapeutic pathways. These factors exert considerable Impact Forces, compelling market participants to prioritize sourcing stability, investment in advanced quality control technologies, and diversification into high-margin segments like standardized nutraceutical supplements.

The primary driving force remains the increasing global awareness of the negative effects of synthetic chemicals, compelling consumers to seek gentler, plant-derived alternatives for daily use. Chamomilla Recutita Extract benefits from a long history of traditional use and substantial modern scientific validation, which significantly accelerates its adoption in premium formulations. Regulatory agencies generally recognize chamomile as safe, further simplifying its inclusion in Over-The-Counter (OTC) products. The expansion of the global middle class in emerging economies, coupled with increased disposable income allocated towards wellness and preventative healthcare, solidifies the sustained demand trajectory, particularly in the personal care and dietary supplement segments.

However, the market faces tangible limitations, primarily concerning agricultural yield variability. Chamomile cultivation is highly sensitive to climatic conditions; adverse weather events can lead to significant fluctuations in raw material supply and subsequent price spikes, impacting manufacturing margins. Furthermore, the technical challenge of ensuring consistent active ingredient profiles (standardization) across batches is a major restraint. Bisabolol and chamazulene content can vary dramatically depending on the cultivar, harvest timing, and extraction method, necessitating expensive, precise analytical testing (e.g., HPLC) which small manufacturers may struggle to afford, creating barriers to entry for standardized, pharmaceutical-grade product manufacturing.

Looking ahead, untapped potential resides in leveraging advanced encapsulation and delivery systems to improve the bioavailability and stability of the extract's components in complex formulations. Opportunities also exist in penetrating the specialized market for pediatric products, given chamomile's established reputation for mildness, and in the veterinary sector for soothing animal skin conditions. Furthermore, continuous innovation in Green Chemistry—specifically, the application of non-toxic, eco-friendly solvents and pressurized liquid extraction techniques—presents a crucial opportunity for manufacturers to improve purity, reduce processing waste, and meet growing environmental sustainability mandates, thereby strengthening market position and appealing to environmentally conscious consumers.

Segmentation Analysis

The Chamomilla Recutita Extract market is comprehensively segmented based on its form, concentration, and primary application, providing crucial insights into market dynamics and key areas of growth. Form segmentation delineates between liquid extracts, highly concentrated powders, and encapsulated oil forms, each catering to distinct formulation requirements across end-user industries. Concentration analysis focuses on the standardization levels of key active markers, such as Bisabolol and Apigenin, reflecting the rising industry trend towards verifiable efficacy. Application segmentation clearly highlights the dominance of the Cosmetics and Personal Care sector, juxtaposed against the steady, high-value demand originating from the Pharmaceutical and Nutraceutical industries, revealing diverse market needs from soothing cosmetic bases to potent therapeutic supplements.

The segmentation structure is fundamental for strategic market targeting. By analyzing the growth rates within each segment, manufacturers can optimize production schedules and R&D pipelines. For instance, the high growth observed in the powder segment indicates a strong shift towards dietary supplement manufacturing and convenience products, requiring investments in spray drying and micronization capabilities. Conversely, the continuous demand in the liquid extract segment underscores the need for optimized solvent systems and preservation techniques suitable for high-volume cosmetic and beverage production. Understanding these segment interactions allows companies to position their products effectively, addressing both high-volume consumer markets and specialized B2B demands requiring precise standardization.

Furthermore, segmentation by extraction method—including conventional solvent extraction, hydrodistillation, and advanced supercritical CO2 extraction—is increasingly important as it directly correlates with purity, yield, and sustainability claims. High-purity extracts obtained via SFE command premium pricing and are essential for pharmaceutical or high-end nutraceutical applications, emphasizing the need for technological differentiation. As regulatory scrutiny tightens regarding residual solvents and environmental impact, the segmentation by extraction technology offers a clear competitive advantage for firms adopting sustainable, technologically superior processing methods, thus shaping future investment patterns across the market value chain.

- By Form:

- Liquid Extracts (Oils, Tinctures)

- Powder Extracts (Spray-dried, Freeze-dried)

- Solid/Encapsulated Extracts

- By Concentration/Grade:

- Standardized Extracts (e.g., Min. 0.5% Bisabolol)

- Crude Extracts (Non-standardized)

- High-Purity Pharmaceutical Grade

- Cosmetic Grade

- By Application:

- Cosmetics and Personal Care (Skincare, Haircare, Baby Products)

- Pharmaceuticals (Topical Anti-inflammatories, Oral Digestive Aids)

- Nutraceuticals and Dietary Supplements (Sleep Aids, Calming Formulas)

- Food and Beverages (Teas, Functional Drinks, Flavorings)

- Pet Care and Veterinary Products

Value Chain Analysis For Chamomilla Recutita Extract Market

The value chain for Chamomilla Recutita Extract is relatively complex, starting with highly fragmented agricultural production and culminating in sophisticated consumer product manufacturing. Upstream analysis highlights raw material cultivation, primarily concentrated in regions such as Egypt, Hungary, and Argentina, requiring strict quality control over planting, harvesting (which must be precise to maximize essential oil content), and preliminary drying. The midstream involves specialized extraction and purification processes, where manufacturers leverage proprietary technology (e.g., SFE or specific solvent systems) to convert dried flowers into standardized extracts. High investment in analytical testing (HPLC, GC-MS) is necessary at this stage to ensure standardization and compliance, acting as a major bottleneck for smaller players.

Downstream analysis involves the incorporation of the finalized extract into end-user products across four major industries: cosmetics, pharmaceuticals, nutraceuticals, and food/beverages. This stage is characterized by high R&D intensity, as formulators develop complex formulations to maximize the extract's stability and bioavailability in the final consumer product. Distribution channels are varied: direct sales dominate the high-volume B2B sector (extract manufacturer to cosmetic conglomerate), while indirect distribution via specialized ingredient distributors and agents is prevalent for smaller, niche product developers seeking smaller quantities or specialized grades. The efficiency of the downstream chain heavily relies on marketing strategies that effectively communicate the natural and therapeutic benefits of chamomile to the end consumer.

The increasing focus on supply chain transparency and traceability significantly impacts the value chain structure. End-user brands are increasingly demanding certified organic and ethically sourced extracts, leading to tighter integration between the upstream agricultural phase and midstream processing. Direct sourcing relationships and vertical integration are becoming more common, allowing large-scale manufacturers to control quality from seed to finished extract. Digital tools and blockchain technology are beginning to play a vital role in documenting every transfer and transformation, ensuring authenticity and building consumer trust in a market where botanical adulteration is a persistent risk.

Chamomilla Recutita Extract Market Potential Customers

The potential customer base for Chamomilla Recutita Extract is exceptionally broad and spans multiple vertically integrated industries, driven by the extract's versatility as a functional, soothing, and natural ingredient. The largest segment of end-users consists of global Cosmetic and Personal Care manufacturers (B2B), particularly those specializing in sensitive skin care lines, anti-aging products, baby care formulations, and organic certified beauty brands. These customers require high-purity, standardized cosmetic-grade extracts suitable for topical application where anti-inflammatory and calming effects are paramount. They prioritize certificates of analysis demonstrating zero residual solvents and high levels of active marker compounds.

A second major customer group includes Pharmaceutical and Over-The-Counter (OTC) drug manufacturers. These buyers typically require the highest grade of extract (e.g., USP or EP grade) for use in formulations targeting gastrointestinal distress, mild anxiety, or dermatological conditions such as eczema or mild dermatitis. This segment is characterized by rigorous regulatory requirements, demanding extensive documentation, clinical validation support, and long-term supplier stability. Smaller but high-growth customers are found in the Nutraceutical and Dietary Supplement industry, focusing on formulations for stress relief, sleep support, and general wellness, often preferring powdered forms for capsules and tablets.

Finally, the Food and Beverage industry represents an increasingly important customer segment, utilizing the extract for its flavoring and functional properties in herbal teas, soothing beverages, and specialized functional foods. These customers are highly sensitive to price and sensory profiles (taste and aroma consistency) and often utilize standardized liquid extracts or high-quality crude powders. Emerging customer segments also include specialized Pet Care manufacturers who incorporate chamomile for its soothing properties in animal shampoos, calming chews, and specialized veterinary dermatological products, signaling diversification opportunities for extract suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.3 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Martin Bauer Group, Naturex S.A. (Givaudan), Indena S.p.A., Symrise AG, Kemin Industries, Inc., Doehler GmbH, Blue Sky Botanics, DSM, Lonza Group, IFF (International Flavors & Fragrances), A&B Ingredients, Nutra Green Biotechnology Co., Ltd., Bioprex Labs, Euromed S.A., Plant Extracts International, Inc., Sabinsa Corporation, B&B Botanicals, ALKEMIST LABS, Hunan NutraMax Inc., Xi'an HerbSpirit Bio-Tech Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chamomilla Recutita Extract Market Key Technology Landscape

The technological landscape of the Chamomilla Recutita Extract market is defined by advancements aimed at enhancing yield, purity, and active ingredient standardization, moving away from conventional methods that utilize large volumes of aggressive chemical solvents. Supercritical Fluid Extraction (SFE), particularly using CO2, represents a critical technology. SFE allows for the selective extraction of non-polar components like Bisabolol and volatile essential oils under moderate temperatures and pressures, yielding a high-purity, solvent-free product that meets stringent regulatory requirements for both pharmaceutical and clean-label cosmetic applications. The adoption of SFE is a key differentiator for premium extract manufacturers seeking high margins based on quality and environmental responsibility.

Furthermore, innovations in analytical chemistry are pivotal in driving the market forward. High-Performance Liquid Chromatography (HPLC) and Gas Chromatography-Mass Spectrometry (GC-MS) are indispensable technologies used not only for basic quality assurance but also for sophisticated chemometric profiling. These advanced analytical tools ensure accurate quantification of active markers (e.g., apigenin, chamazulene) and the detection of potential contaminants, such as heavy metals or residual pesticides, which is crucial for market entry into regulated zones like the EU and North America. The integration of spectroscopic methods (e.g., Near-Infrared Spectroscopy, NIRS) allows for rapid, non-destructive, and real-time quality assessment of raw materials and intermediate products during processing.

Another emerging technology involves encapsulated delivery systems, such as liposomes or nano-emulsions, designed to protect the sensitive active compounds of the chamomile extract from degradation (e.g., oxidation or light exposure) and enhance their bioavailability and targeted delivery within the human body. This microencapsulation technology is particularly crucial for nutraceutical and topical formulations, where stability and maximizing dermal absorption are primary concerns. The adoption of these sophisticated delivery methods allows formulators to create more potent and stable consumer products, justifying premium pricing and opening new product categories, especially in advanced dermatological therapies and precision wellness supplements.

Regional Highlights

The global Chamomilla Recutita Extract market exhibits distinct regional dynamics driven by local consumption patterns, regulatory environments, and indigenous cultivation capabilities. North America, specifically the United States and Canada, holds a substantial market share, primarily fueled by high consumer disposable income allocated towards premium nutraceuticals and organic personal care products. The stringent regulatory framework, especially from the FDA, mandates high quality and standardization, driving demand for technologically superior, verified extracts. Retail penetration of wellness brands and high rates of self-medication for stress and sleep issues further support the robust growth of the nutraceutical segment in this region.

Europe remains the largest revenue contributor, historically dominating both cultivation and consumption, particularly in Germany and France where chamomile has a long established pharmacological history. The European Pharmacopoeia sets high standards for Chamomilla recutita, ensuring market quality. Demand is strongly concentrated in the cosmetics sector due to the high regulatory adoption of natural and sustainable ingredients (e.g., COSMOS certification requirements), and in the pharmaceutical sector for herbal medicinal products. Regulatory clarity regarding health claims for botanical extracts in the EU provides a stable environment for both large-scale extraction manufacturers and specialized ingredient suppliers.

The Asia Pacific (APAC) region is projected to register the fastest CAGR during the forecast period. This rapid expansion is attributed to the surging demand for Western-style cosmetics and personal care products among the rapidly growing middle class in China and Southeast Asia. Furthermore, the strong integration of traditional herbal medicine (TCM and Ayurvedic practices) in healthcare systems contributes to high baseline consumption. Investment in modern extraction facilities in countries like India and South Korea, coupled with government initiatives promoting domestic cultivation of medicinal plants, are key factors accelerating regional market growth and shifting global supply chain dominance eastward.

Latin America and the Middle East & Africa (MEA) represent significant emerging markets. In Latin America, growth is driven by increasing local formulation capabilities, utilizing regionally sourced botanicals and catering to growing urban populations prioritizing wellness. In the MEA region, the rising popularity of high-end international cosmetic brands and modest but consistent growth in the localized nutraceutical market—especially linked to natural remedies—creates steady demand. However, these regions often face challenges related to logistical bottlenecks and fragmented regulatory structures, necessitating tailored market entry strategies focusing on specific high-growth urban centers.

- North America (USA, Canada): Dominant in high-value nutraceutical and organic personal care segments, driven by strong regulatory compliance standards and high consumer spending on wellness.

- Europe (Germany, France, UK): Largest market revenue due to established pharmaceutical usage, stringent quality control (EP standards), and robust organic/natural cosmetic sector growth.

- Asia Pacific (China, India, South Korea, Japan): Fastest-growing region, fueled by expanding cosmetic industries, integration of traditional medicine, and increasing disposable incomes.

- Latin America (Brazil, Mexico): Emerging market potential driven by local cultivation, expanding cosmetic formulation industry, and rising consumer awareness of natural alternatives.

- Middle East and Africa (South Africa, GCC): Developing market focused on imports of high-end cosmetic brands and localized growth in natural health supplements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chamomilla Recutita Extract Market.- Martin Bauer Group

- Naturex S.A. (Givaudan)

- Indena S.p.A.

- Symrise AG

- Kemin Industries, Inc.

- Doehler GmbH

- Blue Sky Botanics

- DSM

- Lonza Group

- IFF (International Flavors & Fragrances)

- A&B Ingredients

- Nutra Green Biotechnology Co., Ltd.

- Bioprex Labs

- Euromed S.A.

- Plant Extracts International, Inc.

- Sabinsa Corporation

- B&B Botanicals

- ALKEMIST LABS

- Hunan NutraMax Inc.

- Xi'an HerbSpirit Bio-Tech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Chamomilla Recutita Extract market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary active component responsible for Chamomilla Recutita Extract’s anti-inflammatory properties?

The primary anti-inflammatory activity of Chamomilla Recutita Extract is attributed to the sesquiterpene Bisabolol, alongside Chamazulene (found in the essential oil) and various flavonoids, such as Apigenin. These components work synergistically to inhibit inflammatory pathways, making the extract highly effective in soothing irritated skin and digestive tissues, and justifying its widespread use in medicinal and cosmetic applications targeting sensitivity.

Which extraction method yields the highest purity and standardized Bisabolol content?

Supercritical Fluid Extraction (SFE) using carbon dioxide (CO2) is generally recognized as the best method for obtaining high-purity, standardized extracts with minimal solvent residue. SFE allows for precise control over the extraction parameters, optimizing the selective removal of key lipophilic compounds like Bisabolol, resulting in a cleaner product preferred for pharmaceutical and high-end nutraceutical formulations.

In which application sector does Chamomilla Recutita Extract generate the highest market revenue?

The Cosmetics and Personal Care sector currently generates the highest market revenue for Chamomilla Recutita Extract globally. Its use is dominant in high-volume products such as baby care lines, sensitive skin creams, soothing lotions, and natural hair care formulations, capitalizing on the extract’s well-established calming and skin conditioning benefits and strong consumer preference for natural ingredients in daily personal hygiene.

What regulatory challenges impact the global supply chain for this extract?

The primary regulatory challenges involve ensuring standardization and preventing adulteration. Different regional pharmacopeias (e.g., USP, EP) require varying levels of active component verification, forcing manufacturers to employ costly advanced analytical testing. Furthermore, global regulators are increasingly focused on detecting pesticide residues and heavy metals stemming from cultivation, necessitating strict adherence to Good Agricultural and Collection Practices (GACP) across the entire supply chain to meet market access requirements.

How is climate change affecting the supply and pricing of Chamomilla Recutita raw materials?

Climate change introduces significant raw material price volatility. Chamomile cultivation is highly sensitive to extreme weather events, particularly drought or excessive rainfall, which can drastically reduce yields and compromise the concentration of active ingredients like Bisabolol. This instability necessitates diversification of sourcing regions and forward contracting by extract manufacturers to mitigate supply risks and stabilize prices for downstream customers.

The competitive landscape of the Chamomilla Recutita Extract Market is characterized by a mix of large multinational ingredient suppliers and specialized boutique extractors. Large players like Martin Bauer Group and Naturex leverage extensive global sourcing networks and sophisticated manufacturing capabilities, including SFE technology, allowing them to offer standardized, high-volume products to major cosmetic and pharmaceutical companies. These firms invest heavily in clinical research and sustainability certifications to secure premium market positioning. Their competitive advantage often stems from vertical integration, controlling the supply chain from seed cultivation to the final standardized extract, thereby ensuring consistent quality and mitigating price volatility risks associated with commodity markets. They focus on maintaining diverse product portfolios encompassing different grades (pharmaceutical, cosmetic, food grade) to serve all major application segments.

Conversely, smaller, specialized extractors often focus on niche markets, emphasizing unique selling propositions such as organic certification, fair-trade sourcing, or highly customized extraction processes tailored for specific client formulations. These companies thrive by catering to small-to-medium enterprises (SMEs) in the natural and organic beauty space, offering greater flexibility and potentially faster turnaround times. Strategic emphasis is placed on advanced analytical services, providing detailed testing reports that exceed basic regulatory requirements, thereby justifying higher pricing based on superior quality assurance and transparency. Mergers and acquisitions remain a constant feature, as larger entities seek to absorb smaller, innovative companies possessing specialized technology or strategic geographic sourcing locations, particularly in Eastern Europe and South America, key regions for high-quality chamomile cultivation.

Future growth strategies for market participants increasingly center on innovation in delivery and formulation. The development of water-soluble chamomile derivatives that retain therapeutic efficacy is a key area of research, expanding the extract's use in beverages and functional foods where solubility is critical. Furthermore, the market is seeing a trend toward 'cleaner' extraction methods, such as subcritical water extraction (SWE) or microwave-assisted extraction (MAE), which further reduce the environmental footprint and chemical residue compared to traditional solvent-based systems. Successful players will be those who can balance the demand for high-efficacy, standardized ingredients with robust, verifiable sustainability credentials throughout their entire operation, appealing to the environmentally and health-conscious consumer base that drives this market's expansion.

In-depth analysis of the application segments reveals subtle but important differentiators. Within Cosmetics and Personal Care, sub-segments such as baby care products and sensitive skin treatments are particularly lucrative, given the high consumer trust associated with chamomile’s gentle properties. Manufacturers are focused on developing hypoallergenic formulations, using certified organic Chamomilla Recutita Extract to command premium shelf space. For the Pharmaceutical segment, the focus is less on volume and more on high-value, patentable formulations. Research and development efforts are concentrated on isolating specific molecular fractions of the extract (e.g., highly pure Apigenin) that show potent activity against specific conditions, such as inflammatory bowel diseases or generalized anxiety disorders, positioning the extract as a complex drug precursor rather than merely a traditional remedy. This shift requires significant investment in clinical trials and sophisticated downstream processing capabilities.

The Nutraceutical segment is dynamic, driven by the global stress epidemic and the search for natural sleep aids and digestive support. Powdered Chamomilla Recutita Extract is often combined with other synergistic botanicals, like lavender or valerian, in capsule or gummy formats. Marketing in this segment relies heavily on substantiated health claims and celebrity endorsements, with growth being particularly strong in markets where regulatory pathways for dietary supplements are clearly defined, such as the US. Quality control in nutraceuticals remains critical due to market saturation and the risk of low-quality imports, making third-party testing and transparency essential tools for established brands to maintain consumer loyalty and market share against cost-cutting competitors.

Regional consumption patterns also influence product innovation. In Asia Pacific, for example, the demand for brightening and anti-pollution cosmetic formulations utilizing Chamomilla Recutita Extract alongside other anti-oxidants is high, reflecting urban consumer concerns. Conversely, in Europe, the emphasis remains on medicinal tea infusions and traditional topical remedies. The diversification of product offerings based on regional preferences—such as developing high-concentration liquid tinctures for the European market versus stable, dry powders for encapsulation in the US market—is a crucial element of successful geographic market penetration strategies. Supply chain management must adapt to these varied needs, requiring flexible production lines capable of switching between essential oil production (hydrodistillation) and standardized solvent extraction based on regional demand forecasts and seasonal raw material availability.

Technological advancement is not limited to extraction; it extends profoundly into cultivation practices, often termed 'Smart Farming' or 'AgriTech'. Advanced sensors and IoT devices are deployed in chamomile fields to monitor soil moisture, nutrient levels, and pest presence in real-time. This precision agriculture minimizes resource use (water, fertilizer) and ensures optimal growing conditions, directly contributing to higher yields of flowers with maximized active ingredient content. Furthermore, specialized optical sorting technology is utilized during the harvest and post-harvest phase to filter out non-target plant parts and impurities, enhancing the purity of the raw material before it even enters the extraction facility. This integration of technology at the cultivation stage is becoming indispensable for producers aiming for certified organic or pharmaceutical-grade raw materials.

The regulatory environment across different continents presents a patchwork of challenges. While the EU operates under cohesive regulations like EFSA guidelines for food supplements and the EMA for herbal medicinal products, North America relies on generally recognized as safe (GRAS) status and specific dietary supplement regulations (DSHEA). APAC is highly fragmented, with each major economy (China, India, Japan) maintaining unique approval processes for natural ingredients in food, drugs, and cosmetics. Successfully navigating this global regulatory complexity necessitates a dedicated regulatory affairs team and substantial documentation for each product variant, creating a considerable overhead cost that favors established global suppliers capable of amortizing these costs across high sales volumes and diverse geographical operations.

Investment trends highlight a strategic focus on clean-label verification and ethical sourcing. Consumer movements demanding transparent supply chains have pushed major buyers to audit their suppliers rigorously, focusing on labor practices and environmental impact. Certifications such as Fair Trade, Organic, and specialized certifications verifying the absence of GMOs are becoming mandatory criteria for entry into premium retail channels. This demand for ethical sourcing acts as a barrier to entry for smaller or less transparent suppliers, reinforcing the market positions of vertically integrated firms that can demonstrate complete control and ethical compliance throughout their operations, from the initial seed planting to the final extraction and packaging process.

Market segmentation based on the type of active marker—for example, extracts standardized to Bisabolol versus those focusing on Apigenin content—is a critical emerging trend. Bisabolol-rich extracts are predominantly targeted toward anti-inflammatory and soothing applications, whereas extracts standardized for Apigenin are increasingly utilized in formulations aimed at promoting relaxation, sleep, and anxiolytic effects, reflecting a deepening understanding of the differential biochemical effects of chamomile’s components. This scientific specialization allows extract suppliers to differentiate their offerings, moving away from generic chamomile extract sales toward high-value, functionality-specific ingredient sales, thus broadening the therapeutic and commercial scope of the market significantly.

The ongoing refinement of analytical methods, including the increasing use of advanced mass spectrometry techniques (e.g., LC-MS/MS), provides unparalleled precision in quality control. This precision is essential for verifying the authenticity of high-cost extracts and detecting subtle forms of adulteration, such as mixing with cheaper, less effective botanical oils. By providing highly detailed and verifiable certificates of analysis (CoAs), leading manufacturers are building a reputation for reliability, a non-negotiable factor when supplying the pharmaceutical industry. This technological superiority in quality assurance serves as a substantial moat, protecting established players from competitors who rely on less rigorous, potentially compromised sourcing or extraction methodologies, thereby stabilizing the premium pricing segment.

The utilization of Chamomilla Recutita Extract in the functional beverage space presents immense growth opportunities. As consumers move away from high-sugar, artificial drinks, soothing herbal infusions and fortified waters containing natural extracts are gaining traction. Formulators are challenged to stabilize the extract’s sensitive aroma and flavor profile within liquid matrices over extended shelf lives, often requiring microencapsulation techniques or specialized preservation systems. Successful product launches in this area, particularly those targeting relaxation or digestive wellness, demonstrate the market’s capability to bridge the gap between traditional herbal use and modern convenience-focused consumption, indicating strong future potential for this specific application segment.

Finally, the growing awareness of the gut-brain axis and the role of botanicals in modulating digestive health further bolsters demand from the nutraceutical sector. Chamomilla Recutita Extract is recognized for its spasmolytic properties and ability to soothe mucosal irritation. This is driving its incorporation into advanced formulations designed to support overall gut health, moving beyond simple indigestion relief to complex prophylactic and supportive therapies for chronic digestive issues. This evolution in understanding and application demonstrates the market’s pivot towards sophisticated health solutions, reinforcing its long-term sustainable growth trajectory within the global wellness economy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager