Cheek Pad Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442732 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Cheek Pad Market Size

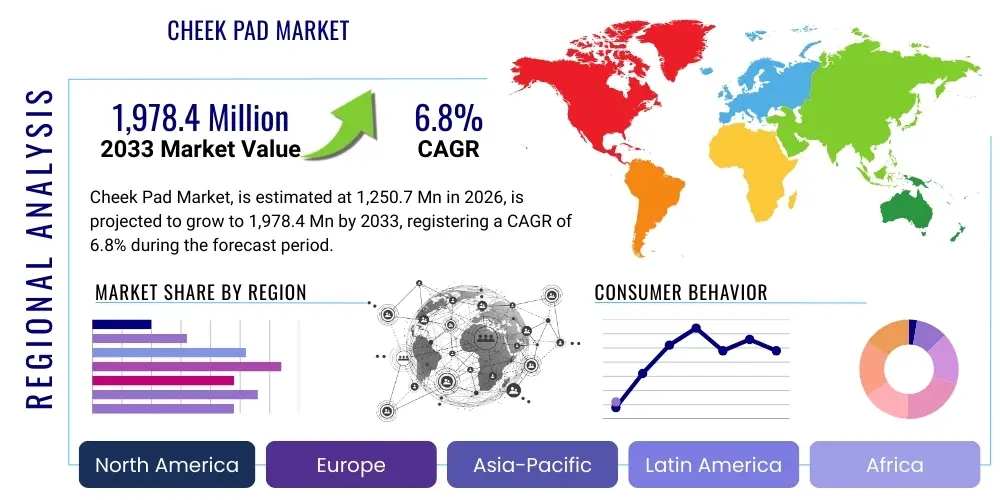

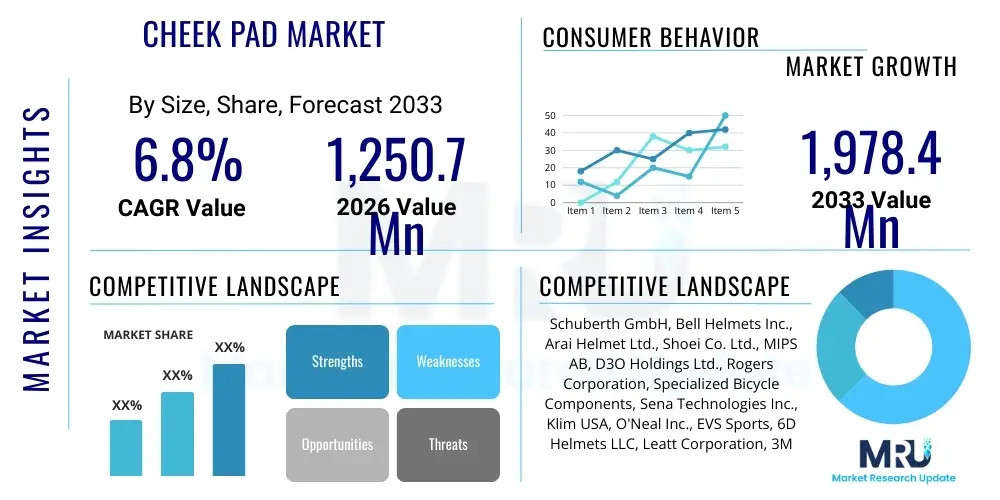

The Cheek Pad Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1,250.7 Million in 2026 and is projected to reach $1,978.4 Million by the end of the forecast period in 2033.

Cheek Pad Market introduction

The Cheek Pad Market encompasses the design, manufacturing, and distribution of cushioning components primarily used within protective headgear, medical devices, and ergonomic supports. These pads are crucial elements in enhancing wearer safety, comfort, and the overall fit of products such as motorcycle helmets, sports helmets (cycling, snow sports), military and tactical headgear, and certain prosthetic interfaces. The core function of a cheek pad is to ensure the helmet or device remains securely positioned on the head, minimizing rotational forces during impact while simultaneously providing customized pressure distribution to prevent hot spots or discomfort over prolonged use. Technological advancements are continuously focused on incorporating materials that offer superior energy absorption capabilities, breathability, and moisture-wicking properties, moving beyond traditional foam towards advanced viscoelastic polymers and air cell systems.

Major applications driving the market expansion include the rapidly growing global motorcycling and cycling communities, where adherence to stringent safety certifications (like ECE, DOT, Snell) necessitates high-quality internal padding systems. Furthermore, professional sports leagues and military applications are demanding lighter, more effective materials that can withstand extreme temperature variations and multiple impacts without degradation. The integration of advanced materials, such as non-Newtonian fluids (D3O technology) and proprietary memory foams, is elevating the performance standards of cheek pads, making them active safety features rather than mere comfort components. This technological push is vital for market growth, addressing consumer desire for premium protective gear.

Key driving factors fueling the market include increasing global awareness regarding head injury prevention, particularly in emerging economies seeing a rise in vehicle usage and participation in adventure sports. Regulatory mandates in major regions, compelling manufacturers to incorporate standardized safety features, significantly influence procurement decisions. Moreover, consumer demand for personalized and adjustable fit systems, often incorporating quick-release emergency removal mechanisms built into the cheek pads, pushes manufacturers towards sophisticated design iterations, thereby stimulating innovation and market volume growth across both OEM and aftermarket segments.

Cheek Pad Market Executive Summary

The Cheek Pad Market exhibits robust growth driven primarily by escalating safety concerns and mandatory regulatory compliance in the protective headgear sector. Business trends show a significant pivot towards premiumization, where consumers are willing to invest more in helmets featuring advanced, multi-density, and smart cushioning technologies that go beyond basic EPS liners. Key industry players are aggressively focusing on mergers, acquisitions, and strategic partnerships with material science companies to gain proprietary access to cutting-edge materials like advanced viscoelastic foams and aerated polymer structures, enabling products with better impact absorption and thermal regulation. Furthermore, the shift towards modular helmet designs and quick-change pad systems is influencing manufacturing processes, requiring greater precision and rapid prototyping capabilities.

Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market, propelled by expanding two-wheeler ownership, rising disposable incomes, and the introduction of stricter helmet safety laws in populous nations like India and China. North America and Europe, characterized by established regulatory frameworks and high levels of consumer spending on recreational and professional sports equipment, remain dominant in terms of technology adoption and value share. These regions prioritize features like moisture management, anti-bacterial treatments, and emergency quick-release systems integrated within the cheek pads. The competitive landscape in these developed markets is characterized by intensive R&D focused on achieving optimal balance between lightweight construction and maximum impact mitigation efficiency.

Segment trends underscore the dominance of the Foam segment, particularly high-density memory foam and polyurethane variants, due to their cost-effectiveness and proven performance in basic impact protection. However, the Gel and Air Bladder segments are anticipated to record the highest CAGR, reflecting increasing investment in high-end applications such as racing helmets and specialized military gear where pressure mapping and customized fitting are critical. The OEM segment currently holds the largest revenue share, intrinsically linked to new helmet production cycles, yet the Aftermarket segment is rapidly expanding due to consumer demand for replacement parts offering improved hygiene, customization, and upgraded comfort features for existing helmets, capitalizing on the longevity of high-quality helmet shells.

AI Impact Analysis on Cheek Pad Market

Common user questions regarding the impact of AI on the Cheek Pad Market primarily revolve around how artificial intelligence can personalize fit, optimize material composition for specific impact scenarios, and streamline manufacturing processes. Users frequently ask if AI can design a custom-molded cheek pad based solely on a 3D head scan, ensuring unprecedented comfort and safety unique to the individual. Concerns also touch upon the potential for AI-driven material simulations to replace expensive physical testing, reducing development costs and accelerating the introduction of safer products. The key themes summarized from user inquiries indicate high expectations for AI to deliver hyper-customization, predictive material failure analysis, and efficient supply chain management, thereby revolutionizing the transition from traditional, standardized padding to intelligent, adaptive cushioning systems.

AI's initial impact is focused on the design and simulation phase, where machine learning algorithms are trained on vast datasets of impact testing, material stress tolerance, and physiological data related to head geometry. This capability allows manufacturers to simulate millions of crash scenarios virtually, optimizing the thickness, density gradient, and geometric shape of the cheek pad before a single physical prototype is created. Such computational design optimization ensures that the pad provides maximum linear and rotational impact protection while maintaining comfort and minimizing bulk. This predictive analytics approach significantly reduces the time-to-market for high-performance helmet padding systems, directly enhancing product quality and safety compliance.

Further leveraging AI involves integrating it into advanced manufacturing techniques, such as additive manufacturing (3D printing). AI algorithms can govern the printing process of complex, lattice-structured foams, adjusting porosity and material deposition in real-time based on calculated stress zones for the intended end-user. In the consumer interface, basic AI tools are beginning to appear in digital sizing guides, recommending optimal pad thicknesses and shapes based on photographic head measurements provided by the user, leading to fewer returns and higher customer satisfaction. While full-scale AI integration remains nascent, its influence on materials selection, geometric complexity, and personalized fitting represents the future trajectory of the cheek pad industry, particularly in the high-performance and medical segments.

- AI-driven personalized geometry design based on anthropometric data.

- Machine learning optimization for material density and energy absorption properties.

- Predictive simulation of rotational impact forces to improve safety ratings.

- Automated quality control systems using computer vision in manufacturing.

- Enhanced supply chain forecasting and inventory management of raw materials.

- Development of smart, adaptive cheek pads that adjust firmness based on ambient conditions.

DRO & Impact Forces Of Cheek Pad Market

The Cheek Pad Market is primarily driven by escalating global safety regulations for protective headgear across various industries, coupled with rising consumer participation in high-risk recreational activities, notably motorsports and adventure cycling. These drivers are fundamentally supported by continuous material science innovation that enables lighter, more effective impact-absorbing components, satisfying the dual consumer demands for comfort and superior protection. Restraints include the relatively high cost associated with advanced materials like viscoelastic polymers and gel inserts, which limits their adoption in mass-market, budget-friendly helmets, alongside the challenge of balancing high energy absorption capacity with necessary airflow and heat dissipation to ensure wearer comfort in warm climates. The impact forces acting on the market are substantial, with regulatory bodies constantly updating standards, forcing rapid technological cycles, while competition from low-cost Asian manufacturers exerts downward pressure on pricing in the standard segment.

Significant opportunities for growth lie in the expansion of the tactical and military application sector, where demand for advanced, customized cheek pads that integrate communication systems and remain stable under extreme duress is increasing. Furthermore, the medical device segment, specifically in custom orthopedic supports and prosthetic socket liners, presents a high-value niche for specialized cushioning technology derived from helmet cheek pad R&D. Addressing emerging market needs through localized manufacturing and optimized supply chains also represents a pivotal growth opportunity. The market’s resilience is constantly tested by fluctuating raw material costs, particularly petrochemical derivatives used in foam production, necessitating strategic long-term sourcing contracts and hedging practices by major market participants.

The cumulative impact of these drivers, restraints, and opportunities is a dynamic and innovation-focused market environment. Mandatory certification requirements act as a powerful external force, pushing the entire industry toward continuous safety improvement. However, achieving market differentiation in a highly saturated headgear market requires substantial investment in patented technology, making entry difficult for new players lacking specialized material expertise. Success hinges on a company's ability to efficiently scale manufacturing of highly complex components while adhering to rigorous quality assurance protocols demanded by OEM partners and end-users, ensuring that the cheek pad functions perfectly as a critical life-saving component within the broader protective system.

Segmentation Analysis

The Cheek Pad Market is intricately segmented based on material type, application, and distribution channel, reflecting the diverse requirements of end-users ranging from recreational users to military personnel. Material segmentation—encompassing various foams, gels, and air bladder systems—is critical as it dictates the core performance metrics, including impact attenuation efficiency, weight, and thermal regulation capabilities. Application segmentation highlights the dominance of the protective helmet sector (motorcycle, sports, industrial safety), which demands specialized structural integrity and quick-release features, distinct from the requirements of medical or ergonomic cushioning applications. The structure of the distribution channel, split between Original Equipment Manufacturers (OEMs) and the Aftermarket, reveals crucial differences in volume, pricing strategy, and consumer interaction points.

The segmentation structure is fundamental for stakeholders in developing targeted marketing strategies and optimizing product portfolios. For instance, the high-performance sports application segment prioritizes lightweight design and superior rotational impact mitigation technologies, frequently incorporating hybrid material cheek pads (e.g., viscoelastic inserts combined with traditional foam backing). In contrast, the medical application demands hypoallergenic, highly durable, and easily cleanable materials. This granular differentiation ensures that product development aligns precisely with specific functional needs, driving higher customer satisfaction and justifying premium pricing in specialized sub-segments.

Analyzing these segments provides clear insights into investment priorities. The increasing adoption of advanced materials in entry-level helmets, previously reserved for premium models, signals a trend toward democratization of safety features. The growing aftermarket customization trend, where users upgrade standard pads for enhanced fit or hygiene, creates a stable revenue stream independent of new equipment sales. Successful market players are those who can navigate these segments efficiently, maintaining strong relationships with major helmet OEMs while simultaneously building robust branding and direct-to-consumer channels in the aftermarket.

- By Material Type:

- Foam (Polyurethane, Expanded Polystyrene, Memory Foam, Reticulated Foam)

- Gel-Based (Silicone, Viscoelastic Polymers)

- Air Bladders/Inflatable Systems

- Hybrid Materials

- By Application:

- Protective Helmets (Motorcycle, Cycling, Snow Sports, Equestrian, Tactical/Military)

- Medical & Healthcare (Prosthetics, Orthopedic Supports)

- Industrial Safety Gear

- Ergonomic Supports

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail Stores, Online Channels, Specialty Distributors)

Value Chain Analysis For Cheek Pad Market

The Cheek Pad Market value chain begins with upstream activities centered on material sourcing and specialized chemical processing. This segment is dominated by chemical and polymer manufacturers that supply high-grade raw materials, such as specific viscoelastic resins, polyurethane precursors, specialized fabrics for covers, and quick-release system components. Innovation at this stage is crucial, focusing on developing proprietary foam formulations that offer better energy dissipation, reduced weight, and enhanced breathability. Key players in the upstream sector often hold competitive advantages through patents on material composition, dictating costs and performance characteristics for the entire downstream chain. Efficiency in material procurement, particularly stabilizing supply amid volatile oil and chemical markets, is a primary challenge for this segment.

The midstream phase involves the core manufacturing and integration processes. Cheek pad manufacturers specialize in foaming, molding, cutting, assembly, and covering these intricate components. This phase includes high-precision processes like injection molding for complex geometries and advanced lamination techniques to bond comfort fabrics to the cushioning core. Quality assurance, ensuring compliance with strict dimensional tolerances and safety standards (e.g., impact tests), is paramount. Many large helmet manufacturers vertically integrate or operate exclusive partnerships with specialized pad producers to maintain stringent quality control over these mission-critical components. Manufacturing efficiencies through automation, particularly in complex stitching and covering operations, define profitability.

The downstream segment encompasses distribution, which is bifurcated into direct sales to OEMs and indirect sales through aftermarket channels. OEM distribution involves high-volume, B2B logistics, where pads are shipped directly to helmet assembly plants globally under strict just-in-time inventory management. Aftermarket distribution relies on a network of specialty retailers, authorized distributors, and rapidly growing e-commerce platforms. This channel focuses heavily on consumer education regarding replacement intervals, hygiene benefits, and upgrade options. The effective management of direct and indirect channels is essential; while OEM agreements ensure base revenue, the aftermarket offers higher margins and direct consumer feedback loops, driving iterative product improvement and faster responsiveness to trends like personalized fitting or new anti-bacterial treatments.

Cheek Pad Market Potential Customers

Potential customers for the Cheek Pad Market span across several highly regulated and safety-conscious sectors, primarily centered around protecting the human head during high-velocity activities or therapeutic applications. The largest consumer base comprises helmet manufacturers (OEMs) specializing in motorcycle, cycling, and automotive racing headgear, who require millions of units annually that meet exacting certification standards. These customers demand highly reliable, consistently manufactured pads that integrate seamlessly into their shell designs and often specify materials for rotational protection (like MIPS compatibility) and thermal management. Developing strong, long-term relationships with these OEMs is critical as they provide consistent, high-volume demand.

A secondary, rapidly growing customer segment consists of individual consumers seeking aftermarket upgrades or replacements. These end-users are driven by comfort, fit customization, hygiene concerns (seeking washable or anti-microbial pads), and the desire to upgrade older helmets with newer safety features like quick-release systems. This segment is characterized by higher price sensitivity for individual units but often seeks premium, specialized products. Furthermore, military and law enforcement organizations represent a key customer group, procuring tactical helmets that require cheek pads designed for extreme environmental durability, integration of communication devices, and prolonged wear comfort necessary for extended operational periods, prioritizing durability and stability over cost.

Finally, specialized medical and industrial sectors constitute niche but high-value customer bases. This includes prosthetic companies requiring specialized, pressure-reducing liners to prevent skin breakdown and industrial safety companies needing durable, flame-retardant cheek pads for hard hats used in demanding environments like mining or construction. These buyers prioritize function, certification compliance specific to their industry, and hypoallergenic properties. Understanding the unique regulatory and performance requirements of each customer segment is paramount for successful market penetration and specialized product development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250.7 Million |

| Market Forecast in 2033 | $1,978.4 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schuberth GmbH, Bell Helmets Inc., Arai Helmet Ltd., Shoei Co. Ltd., MIPS AB, D3O Holdings Ltd., Rogers Corporation, Specialized Bicycle Components, Sena Technologies Inc., Klim USA, O'Neal Inc., EVS Sports, 6D Helmets LLC, Leatt Corporation, 3M Company, Scott Sports SA, Uvex Sports, HJC Helmets, Lazer Sport NV, Kask SpA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cheek Pad Market Key Technology Landscape

The technology landscape of the Cheek Pad Market is rapidly evolving, moving beyond simple foam padding toward complex, engineered materials focused on maximizing impact absorption efficiency and rotational force mitigation. A pivotal advancement is the widespread adoption of multi-density foam layering, where different foam types (e.g., firm polyurethane backing and soft memory foam surface) are strategically layered to manage varying impact speeds and levels of kinetic energy transfer. This layering approach ensures comfort during normal wear while providing robust protection during catastrophic events. Additionally, there is significant integration of patented technologies such as D3O or other non-Newtonian polymers that instantly stiffen upon impact, offering superior protection while remaining flexible under normal conditions, thereby addressing the crucial balance between safety and ergonomic comfort.

Another major technological trend involves the development of specialized quick-release emergency systems integrated directly into the cheek pads. These systems, often activated via external pull tabs, allow emergency responders to safely remove the helmet without exerting potentially damaging forces on the wearer's neck or spine following an accident. This technological feature has become a critical marketing and safety requirement, particularly in high-performance motorcycle and racing helmets. Furthermore, advancements in textile technology have introduced anti-microbial, moisture-wicking, and temperature-regulating fabrics used for the pad covers, significantly enhancing hygiene and comfort for users in varied climates. These fabric innovations are essential for meeting the demands of long-duration wear in military and adventure applications.

The manufacturing process itself is undergoing a technological transformation with the increasing utilization of advanced digital modeling and 3D printing (additive manufacturing). These techniques allow manufacturers to create complex internal lattice structures within the foam or gel, offering geometric optimization not possible with traditional molding. This allows for precise control over energy dispersion pathways and breathability zones. The use of pressure mapping technology during the design phase helps validate these complex geometries, ensuring optimal fit and even pressure distribution across the face and jawline. This commitment to precision engineering and advanced material science is defining the next generation of protective cheek pads, emphasizing customized, performance-driven solutions over generic foam inserts.

Regional Highlights

The global Cheek Pad Market exhibits distinct characteristics and growth trajectories across its primary regional segments, influenced by local regulatory environments, consumer behavior, and economic development levels. North America and Europe currently represent the most mature markets, characterized by stringent safety standards (DOT, ECE, Snell), high average selling prices due to strong consumer demand for premium features like MIPS integration and emergency quick-release pads, and substantial market presence from established international helmet and safety gear brands. These regions also possess robust aftermarket segments driven by enthusiast customization and regular replacement cycles for hygiene and performance upgrades.

Asia Pacific (APAC) stands out as the highest potential growth region, driven by explosive growth in two-wheeler sales, increasing government enforcement of helmet mandates, and rising disposable incomes allowing consumers to transition from basic, uncertified headgear to safer, compliant products. Countries such as India, China, and Southeast Asian nations are central to this expansion. While the primary market entry is often cost-sensitive, the rapid urbanization and emergence of an affluent middle class are creating significant opportunities for premium and technologically advanced cheek pad solutions, particularly in urban commuting and recreational cycling sectors.

Latin America, the Middle East, and Africa (MEA) are emerging regions offering varied growth opportunities. Latin America, particularly Brazil and Mexico, demonstrates strong demand linked to high motorcycle reliance for daily transport, although often favoring budget-friendly options. The MEA region is developing, with growth concentrated in industrial safety applications and military sectors, where specialized, durable cheek pads are required for tactical and construction helmets. Overall regional success hinges on manufacturers' abilities to tailor product characteristics—such as focusing on extreme heat resistance and superior moisture management in tropical and desert climates—to meet specific geographical challenges.

- North America (NA): Dominant market share in value, driven by high consumer spending on recreational sports, motorsports culture, and strict adherence to safety standards like Snell and DOT. Key focus on MIPS technology adoption.

- Europe: Characterized by high regulatory compliance (ECE standards) and a strong emphasis on performance, ergonomics, and sustainable material sourcing; robust demand in both motorcycle and high-end cycling helmets.

- Asia Pacific (APAC): Highest CAGR projected, fueled by massive volume growth in two-wheeler ownership, improving regulatory enforcement, and increasing consumer awareness regarding helmet efficacy.

- Latin America: Growth driven by utility motorcycle usage; highly sensitive to pricing, with increasing movement toward mandatory certified helmets, creating opportunity for mid-range product segments.

- Middle East and Africa (MEA): Growth concentrated in military/tactical applications and industrial safety gear; demand for highly durable, specialized pads resistant to extreme temperatures and dust.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cheek Pad Market.- Schuberth GmbH

- Bell Helmets Inc.

- Arai Helmet Ltd.

- Shoei Co. Ltd.

- MIPS AB

- D3O Holdings Ltd.

- Rogers Corporation

- Specialized Bicycle Components

- Sena Technologies Inc.

- Klim USA

- O'Neal Inc.

- EVS Sports

- 6D Helmets LLC

- Leatt Corporation

- 3M Company

- Scott Sports SA

- Uvex Sports

- HJC Helmets

- Lazer Sport NV

- Kask SpA

Frequently Asked Questions

Analyze common user questions about the Cheek Pad market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a cheek pad in a helmet beyond comfort?

The primary function of a cheek pad is safety, specifically maintaining the correct fit and stability of the helmet on the wearer's head. By ensuring a snug fit around the jawline, the cheek pad minimizes helmet movement during impact, which significantly reduces the rotational forces transmitted to the brain, a key factor in concussion prevention.

How often should helmet cheek pads be replaced?

Cheek pads should typically be replaced every 1 to 3 years, depending on usage frequency and material type. Frequent use, exposure to sweat, cosmetics, and environmental factors degrade the foam's integrity and elasticity, compromising both comfort and the critical impact attenuation performance necessary for safety standards.

What is the difference between standard foam cheek pads and viscoelastic gel pads?

Standard foam pads (like EPS or polyurethane) offer basic cushioning and uniform structure. Viscoelastic gel pads, however, are engineered to deform slowly and distribute pressure more evenly upon impact, effectively absorbing and dissipating kinetic energy over a wider area. They provide superior comfort and higher-end impact protection, often utilized in premium racing and military applications.

Are quick-release cheek pads essential for modern helmet safety?

Yes, quick-release cheek pads are increasingly considered essential for modern safety protocols, particularly in emergency situations. This technology allows trained personnel (paramedics) to swiftly and safely remove the pads and then the helmet from an injured rider without manipulating the head or neck, greatly reducing the risk of further spinal injury.

How does the integration of smart technology impact cheek pad design?

Smart technology integration influences cheek pad design by necessitating channels or compartments for communication systems (like integrated Bluetooth speakers) and by facilitating personalized fit. Future designs, aided by AI analysis, will utilize 3D scanning data to create bespoke, pressure-mapped pads, optimizing individualized safety and fit while incorporating specialized wiring harnesses for electronics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager