Chemical Filter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441842 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Chemical Filter Market Size

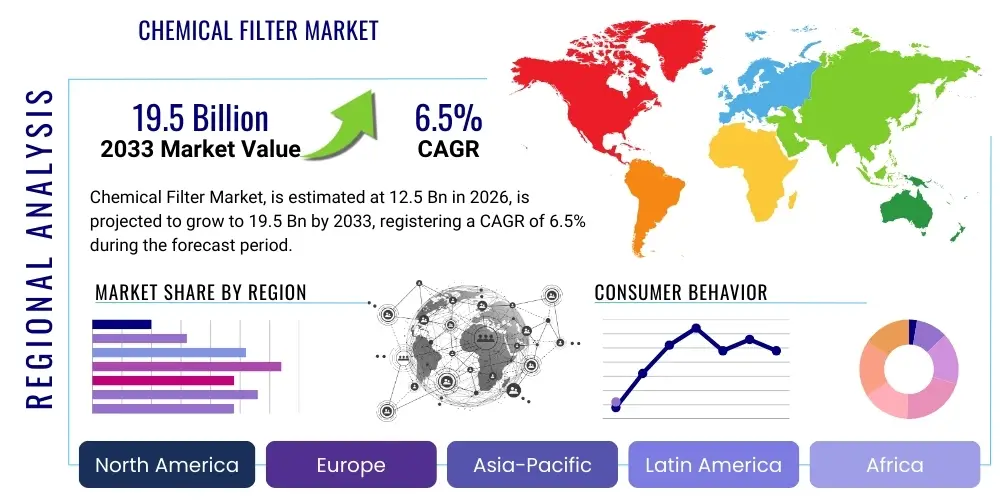

The Chemical Filter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 12.5 billion in 2026 and is projected to reach USD 19.5 billion by the end of the forecast period in 2033.

Chemical Filter Market introduction

Chemical filters represent a critical subset within the broader air and gas filtration industry, specifically designed to address gaseous and molecular contamination which standard particulate filters cannot capture. These highly specialized systems are engineered to prevent corrosion, eliminate odors, and safeguard personnel and process integrity by removing Volatile Organic Compounds (VOCs), acidic gases (such as hydrogen chloride and sulfur dioxide), basic gases (like ammonia), and other molecular contaminants from complex air streams. The operational necessity of chemical filters extends across numerous high-value sectors, including microelectronics fabrication where even parts-per-billion (ppb) levels of contamination can critically impair product yield, and petrochemical refining where corrosive gases pose a severe threat to expensive, critical instrumentation and control room electronics. The ability of these filters to selectively remove or neutralize harmful chemicals ensures compliance with increasingly strict environmental discharge regulations while maintaining controlled internal atmospheric conditions essential for modern manufacturing.

The core technology relies on physico-chemical processes, primarily adsorption, chemisorption, or catalysis. Adsorption utilizes high surface area materials, most commonly activated carbon derived from renewable sources like coconut shells, to physically bind molecules to the surface through Van der Waals forces. Chemisorption media, conversely, involve porous substrates chemically impregnated with reagents—such as potassium permanganate, caustic soda, or various metal oxides—to chemically react with and neutralize specific contaminants, rendering them inert and permanently locking them into the media structure. The choice between adsorption and chemisorption, or a sophisticated blend of both, is dictated by the specific chemical challenge, the required removal efficiency, the concentration of the contaminants, and the acceptable pressure drop within the air handling system. The effective deployment of these technologies ensures enhanced environmental compliance, improved occupational health standards, and crucial asset protection for industrial machinery, thereby driving substantial long-term value.

The market expansion is strongly underpinned by two main drivers: rapid industrial advancement in emerging economies and the escalating stringency of global regulatory frameworks regarding air quality and emissions. As complex manufacturing facilities proliferate globally, particularly in sectors requiring ultrapure environments (e.g., advanced batteries, gene therapy production, and nanotechnology), the demand for high-performance chemical filtration solutions intensifies. Furthermore, the increasing global awareness and legislation regarding indoor air quality (IAQ) and the health risks associated with VOC exposure in both industrial and commercial settings mandate the adoption of robust chemical filtration technologies. This regulatory momentum, combined with sustained investment in high-tech infrastructure that requires absolute contamination control, cements the market’s positive growth trajectory throughout the forecast period, positioning chemical filters as indispensable components of modern industrial operations.

Chemical Filter Market Executive Summary

The Chemical Filter Market is demonstrating significant dynamism, characterized by accelerated technological innovation focused on media efficiency, system intelligence, and sustainability. A pivotal business trend involves manufacturers shifting towards modular, easily replaceable chemical filter units and integrating advanced materials science to create media with higher capacity and lower pressure drop, thereby reducing system energy consumption and operational costs. The market is witnessing increased strategic consolidation among key players who are acquiring smaller, specialized media producers to gain control over proprietary chemisorption technologies and secure upstream material supply chains. This strategic vertical integration is crucial for maintaining competitive edge in sectors demanding tailored filtration solutions, such as preventing atmospheric corrosion in hypersensitive data centers, control rooms, and complex cleanroom environments where air purity is non-negotiable.

Geographically, Asia Pacific (APAC) holds the strategic growth accelerator position, primarily due to immense governmental and private sector investment in establishing advanced manufacturing capabilities, particularly in the semiconductor, electronics, and electric vehicle (EV) battery sectors. The density of semiconductor and flat-panel display manufacturing facilities in East Asia creates an insatiable demand for stringent molecular contamination control (AMC) filters, forcing rapid market growth. In contrast, mature markets in North America and Europe are focusing less on capacity expansion and more on infrastructure upgrades, adopting smart filtration systems that leverage IoT for real-time performance monitoring and predictive maintenance. This regional contrast highlights a market bifurcated between high-volume, aggressive growth demand in APAC and high-value, technology-driven demand in Western economies focused on operational efficiency, stringent OHS compliance, and reducing the total cost of ownership (TCO).

Analysis of market segments reveals that filters based on Mixed or Blended Media are projected to experience the highest growth rate. This segment caters effectively to complex contamination challenges involving the simultaneous presence of multiple, dissimilar gases (e.g., acidic, basic, and organic compounds), which single-type media cannot handle efficiently or economically. The Semiconductor and Electronics vertical remains the largest application segment by value, dictating specifications for media purity, system reliability, and filter performance across the entire industry. Successfully navigating the highly competitive Chemical Filter Market requires players to possess deep expertise in custom media formulation, robust quality assurance protocols, and strong integration capabilities with complex HVAC and air handling systems specific to highly regulated environments like pharmaceutical cleanrooms and microelectronics fabrication plants.

AI Impact Analysis on Chemical Filter Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Chemical Filter Market frequently concentrate on transitioning filter management from static, time-based replacement schedules to dynamic, data-driven optimization. A central concern for facility operators is achieving maximum filter media life while guaranteeing zero risk of contaminant breakthrough. Users want to understand how Machine Learning (ML) can process continuous streams of sensor data—monitoring differential pressure, ambient temperature, relative humidity, and real-time trace gas concentrations—to construct accurate, multivariate models of media depletion kinetics. This capability addresses the inherent inefficiencies of traditional maintenance, where filters are often discarded prematurely to avoid risk, or conversely, risk catastrophic process failure if pushed beyond safe capacity, a costly dilemma particularly in high-stakes environments like semiconductor manufacturing where unscheduled downtime is highly detrimental.

The practical application of AI involves the deployment of specialized algorithms trained on vast historical performance datasets combined with real-time operational parameters. These AI-driven systems provide facility engineers with highly accurate predictions of the remaining useful life (RUL) of the filter bed, moving significantly beyond simple time-based replacement models. Furthermore, advanced ML models can identify subtle correlations between external environmental factors (like seasonal shifts or localized pollution events) and internal filter stresses, allowing the filtration system to proactively adjust airflow rates, bypass ratios, or regeneration cycles if applicable. This enables a true predictive maintenance regime, drastically reducing media consumption by ensuring near-100% utilization of the filter capacity while guaranteeing continuous compliance with stringent emission and purity standards, thereby aligning with both AEO optimization objectives and environmental sustainability goals.

Looking forward, AI is deemed essential for managing the growing complexity inherent in blended media solutions. When a filtration system utilizes multiple chemical media types to effectively combat a multi-component contaminant challenge, accurately determining the saturation level of each individual component is nearly impossible manually. AI algorithms can analyze the breakdown rates of individual contaminants, correlating sensor outputs to specific media performance and recommending targeted, partial media refresh strategies, rather than replacing the entire blend. This intelligent chemical management, combined with automated remote diagnostic capabilities and integrated compliance reporting, transforms the chemical filtration system into an agile, highly responsive component of critical industrial infrastructure, positioning AI as a fundamental element in achieving next-generation purity standards and verifiable operational excellence.

- AI enables predictive maintenance, extending filter lifespan by dynamically scheduling replacement based on actual saturation modeling rather than fixed time intervals.

- Machine learning algorithms optimize media formulation and blending ratios for highly complex or fluctuating contaminant mixtures, maximizing neutralization efficiency and selectivity.

- Integration of AI with IoT sensors facilitates real-time monitoring and anomaly detection, ensuring immediate response to unexpected increases in hazardous gas concentrations and minimizing equipment corrosion risks.

- AI models correlate multivariate environmental data (temperature, humidity, process flow) with filter performance degradation, significantly enhancing the accuracy of Remaining Useful Life (RUL) forecasts.

- Automated compliance reporting and trend analysis are generated by AI systems, simplifying regulatory adherence for industrial operators by providing validated, continuous performance data logs.

- AI assists in optimizing energy consumption by regulating air handling unit fan speed based on calculated real-time filter pressure drop and required air purity levels, maximizing efficiency.

- Development of digital twins allows for simulation of various failure modes and complex contaminant scenarios, aiding in the proactive design and validation of robust filtration systems before physical deployment.

- AI-driven optimization reduces the overall consumption of specialized chemical media, contributing directly to lower operational expenses and enhanced ESG performance through waste reduction.

DRO & Impact Forces Of Chemical Filter Market

The Chemical Filter Market's expansion is fundamentally driven by the tightening grip of global environmental and occupational safety regulations. Regulators across major economic blocs are enforcing progressively stricter limits on industrial emissions of harmful substances, including VOCs, hazardous air pollutants (HAPs), and corrosive gases like NOx and SOx, compelling immediate and substantial investments in advanced scrubber and filtration technologies. The unparalleled growth of the high-tech sector, particularly in semiconductor, flat panel display, and advanced battery manufacturing (EV sector), acts as a powerful, non-cyclical driver. These industries necessitate absolute molecular contamination control (AMC) to protect complex, nano-scale processes, viewing high-performance chemical filtration not merely as a disposable cost, but as a critical enabling technology for achieving high product yield, avoiding financial loss from product defects, and maintaining competitive technological advantage.

Despite these strong drivers, the market faces structural constraints, most notably the high total cost of ownership (TCO). This includes the substantial initial capital investment required for specialized deep-bed scrubbers or high-flow chemical filter banks, coupled with the ongoing, significant expense of recurrently replacing the specialized, chemically-impregnated media. The constraint is compounded by the logistical hurdles and stringent regulatory complexities associated with disposing of spent media, which frequently qualify as hazardous waste requiring specialized handling, neutralization, and licensed disposal facilities, particularly in highly regulated jurisdictions. This inherently high operational expenditure (OPEX) can be a significant deterrent for smaller industrial operators or facilities in price-sensitive emerging markets, leading some to opt for less effective, cheaper alternatives or delay necessary upgrades until regulatory pressure forces mandatory compliance, thereby occasionally slowing market penetration outside of core high-tech sectors.

The most compelling market opportunities lie in strategically addressing these cost and sustainability challenges through continuous material innovation. Research and commercialization of regenerable chemical media, where adsorbed or reacted contaminants can be safely released or neutralized without discarding the substrate (e.g., through thermal or pressure swing regeneration), promises a significant reduction in TCO and environmental waste. Another crucial opportunity is the substantial untapped potential in the commercial and public infrastructure sector, including large transportation hubs, subway systems, hospitals, and major public venues, where high ambient pollution demands integrated, cost-effective chemical air treatment solutions to ensure public health and comfort. The combined impact of strong governmental regulatory drivers and non-negotiable process requirements in high-value industries (like electronics and pharma) strongly outweighs the inherent restraints of high operational costs, indicating a sustained and accelerating upward trajectory for market expansion, particularly focused on technology that offers verifiable efficiency gains and environmental accountability.

Segmentation Analysis

The Chemical Filter Market is segmented based on the core components used for contaminant removal and the application demands specific to various industrial verticals, providing a robust analytical framework for market sizing and competitive evaluation. Segmentation by Media Type is paramount as it defines the functional mechanism of contaminant removal, ranging from physical adsorption using standard activated carbon (best for VOCs and odors) to highly specific chemical reaction (chemisorption) using impregnated materials (best for corrosive inorganics). This distinction reflects the varying performance requirements across industries, where general odor removal might utilize basic carbon, but mission-critical corrosion protection in a control room demands complex, blended chemisorbent media capable of neutralizing multiple acidic gases simultaneously. The market’s technological trajectory is heavily influenced by the rapid development of mixed and catalytic media aimed at maximizing both lifespan and removal selectivity across challenging, multi-component contaminant profiles.

- By Media Type:

- Activated Carbon Filters: Utilized for general VOC and odor removal through physical adsorption; highly cost-effective and versatile for bulk air treatment.

- Chemisorbent Media: Includes Potassium Permanganate, Impregnated Alumina, and other proprietary metal oxides, employed for selective and permanent removal of specific corrosive gases (H2S, SO2, Cl2) through chemical reaction; essential for asset protection.

- Mixed/Blended Media: Combines multiple media types (e.g., carbon and permanganate) to address complex air streams containing both organic and inorganic pollutants efficiently and cost-effectively, catering to broad-spectrum industrial challenges.

- Catalytic Filters: Emerging technology that uses a specialized catalyst to convert gaseous pollutants into less harmful compounds (e.g., ozone decomposition), often allowing for media regeneration and significantly extended life, aligning with sustainability goals.

- By Application:

- Semiconductor and Electronics: Focused on ultra-high purity control (AMC) for wafer fabrication, microchip assembly, and hard drive manufacturing; requires the most stringent specifications and highest-grade filters.

- Pharmaceutical and Biotechnology: Used for solvent vapor control, cross-contamination prevention, and odor management in R&D, sterile compounding, and fermentation facilities, adhering strictly to GMP guidelines.

- Oil and Gas/Petrochemical: Critical for protecting sensitive control systems, instrumentation, and control rooms from corrosive atmospheric gases (H2S, SO2) in refineries, offshore platforms, and processing sites.

- Chemical Manufacturing: Employed in ventilation systems and process off-gas streams to capture and neutralize toxic or noxious byproducts, ensuring worker safety and regulatory compliance.

- Food and Beverage Processing: Primarily used for odor removal (e.g., ammonia, fermentation gases) and preventing cross-contamination that affects product flavor, shelf life, and safety standards.

- Water Treatment Facilities: Essential for large-scale odor control and removal of VOCs resulting from wastewater aeration, sewage treatment, and sludge handling processes in municipal facilities.

- By Form Factor:

- Filter Cartridges/Cylinders: Standardized, modular units used in HVAC systems and smaller filtration assemblies, offering ease of maintenance and rapid replacement.

- Deep Bed Scrubbers/Bulk Media: Large, high-capacity custom-engineered systems used in heavy industrial applications (refineries, large chemical plants) for treating high-volume or highly concentrated contaminant streams.

- Panel Filters/V-Bank Filters: Used primarily in commercial HVAC and smaller industrial settings where space efficiency, lower initial cost, and minimized pressure drop are key priorities.

Value Chain Analysis For Chemical Filter Market

The chemical filter value chain commences with the highly strategic sourcing and processing of foundational raw materials, which dictates both the ultimate performance envelope and the cost structure of the final filter solution. Upstream activities center on the refinement of raw carbonaceous precursors (such as coconut shells, peat, or coal) into highly porous activated carbon through thermal or chemical activation, and the precise synthesis of specialized chemical impregnants (metal salts, alkaline substances). Given that filter efficiency is fundamentally tied to the quality, surface area, and chemical loading uniformity of the adsorbent material, manufacturers must maintain extremely tight quality control over these raw inputs. Strategic vertical integration, where filter producers secure long-term supply agreements or acquire specialty chemical suppliers and carbon activation facilities, is increasingly vital to mitigate commodity price volatility and ensure a consistent supply of highly customized, high-purity media required by sensitive end-users like the electronics industry.

Mid-stream operations encompass the complex manufacturing, precision assembly, and rigorous quality assurance processes. This stage involves transforming raw media into engineered filter solutions, including the proprietary process of chemical impregnation, molding media into precise cartridge forms, assembling large scrubber vessels, and conducting extensive performance testing to validate removal efficiency and pressure drop specifications under simulated operating conditions. Manufacturing innovation focuses on leveraging automation and precision blending techniques to create stable mixed media packages that offer broad-spectrum chemical removal without compromising structural integrity or generating unwanted dust. Distribution follows two primary, distinct pathways: Direct sales are predominant for high-value, bespoke industrial projects—such as building large, custom molecular filtration systems for Giga-factories or petrochemical control rooms—where engineering consultation, specialized installation, and post-sale media analysis are critical components of the bundled service offering. This direct model facilitates high technical support and allows manufacturers to capture premium margins.

The indirect channel relies on established, specialized industrial distribution networks, HVAC wholesalers, and third-party maintenance contractors to supply standardized cartridge filters and panel units to smaller businesses, commercial buildings, and general industrial sites. Downstream activities are heavily concentrated on aftermarket services, which represent a significant source of recurring revenue. This includes active performance monitoring (often leveraging IoT connectivity and digital sensor integration), managing scheduled media replacement, and, critically, ensuring the compliant disposal or, ideally, the regeneration of spent, often hazardous media. The highest value is captured by companies that demonstrate technical expertise across the entire chain, combining proprietary media synthesis (upstream) with robust, technically proficient service contracts and environmentally responsible disposal/regeneration networks (downstream), thereby offering comprehensive contamination control solutions rather than just selling commodities.

Chemical Filter Market Potential Customers

The customer base for the Chemical Filter Market is highly specialized and predominantly clustered within industrial sectors defined by stringent process purity requirements and high economic sensitivity to atmospheric corrosion or contamination. The Semiconductor and Microelectronics industry represents the largest, most critical, and most demanding customer segment. Customers in this cohort include global wafer fabrication foundries, advanced display panel manufacturers, and specialized component producers. Their purchasing criteria are performance-driven and regulatory-intensive: filters must provide ultra-high removal efficiency (often requiring parts-per-trillion contaminant capture) and consistent long-term reliability to prevent massive yield loss on multi-million dollar production lines. These customers exclusively demand premium, advanced chemisorbent and catalytic media solutions coupled with integrated real-time monitoring and control systems to maintain ultra-clean operating environments.

A secondary, but rapidly expanding, major customer group includes companies in the Pharmaceutical, Biotechnology, and Healthcare sectors. Potential customers here range from large multinational drug manufacturers and specialized Contract Development and Manufacturing Organizations (CDMOs) to research laboratories and large hospital complexes. Their primary requirements are focused on removing solvent vapors, managing hazardous odors associated with synthesis or fermentation processes, and preventing crucial cross-contamination between different product lines as stringently mandated by global regulatory bodies (e.g., FDA, EMA) and Good Manufacturing Practices (GMP). These end-users prioritize validated, traceable filtration systems that ensure product integrity and maintain sterile or strictly controlled environmental conditions, frequently purchasing specialized V-bank or cartridge filters designed for seamless integration into complex, validated HVAC and air pressure control systems.

Furthermore, the heavy industry segments—specifically Oil & Gas, Petrochemicals, and Power Generation—constitute a massive customer segment dedicated primarily to asset protection and worker safety. Refineries, chemical processing plants, and power stations are often situated in environments with high concentrations of corrosive gases. They require high-capacity chemical filters to protect sensitive electronic control instrumentation, servers, and gas turbines from damage caused by hydrogen sulfide (H2S), sulfur dioxide (SO2), and chlorides. For these customers, the emphasis is on large, robust Deep Bed Scrubbers designed for high-volume air treatment and long-term durability in challenging, high-corrosion outdoor environments. The procurement decision in this sector is heavily weighted toward reliability, maintenance ease, and proven corrosive gas removal capacity, viewing the sophisticated filters as essential, non-discretionary insurance against catastrophic operational failures and the replacement of high-cost, critical instrumentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 19.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Donaldson Company, Inc., Camfil AB, Parker Hannifin Corporation, AAF Flanders (Daikin Industries), Pall Corporation (Danaher), Purafil, Inc., Filtronetics, Inc., SAAF Tech, Vokes Air (Mann+Hummel), Calgon Carbon Corporation, TreaTek, SFS Corporation, Freudenberg Filtration Technologies, Koch Filter Corporation, Nippon Air Filter Co., Ltd., Molecular Products Group, General Filter Company, Eaton Corporation plc, Ahlstrom-Munksjö Oyj, Rensa Filtration, Cobb Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Filter Market Key Technology Landscape

The chemical filtration technology landscape is undergoing continuous evolution, primarily driven by the imperative for higher contaminant removal efficiency, improved energy conservation, and greater overall sustainability in industrial operations. The foundational technology, activated carbon filtration, continues to be refined through innovative manufacturing processes that precisely control pore size distribution and surface chemistry at the molecular level, maximizing the specific surface area available for highly efficient adsorption of complex, low-concentration contaminants, such as fine VOCs. Furthermore, advancements in chemisorption rely heavily on highly proprietary chemical recipes for media impregnation, where filter manufacturers compete fiercely on the longevity, mechanical strength, and enhanced selectivity of their media, particularly when combating aggressive pollutants like hydrogen sulfide, hydrogen fluoride, and ammonia under varying humidity conditions. Integration of specialized binders and precision shaping techniques ensures that the filter media maintains exceptional structural integrity and uniform airflow distribution throughout its operational lifespan, effectively minimizing problematic particle shedding and destructive airflow channeling effects which compromise overall system performance.

A significant, technologically advanced shift is occurring towards catalytic filter technologies, particularly those leveraging specialized materials like high-efficiency manganese dioxide or engineered metal-loaded zeolites capable of catalyzing the decomposition or conversion of pollutants such as ozone, formaldehyde, and certain heavy VOCs at ambient or slightly elevated temperatures. Catalytic oxidation eliminates the dependency on media replacement by converting harmful gases into benign byproducts (e.g., CO2 and water), offering a game-changing solution for industries intensely focused on reducing operational waste, lowering disposal costs, and achieving strict circular economy objectives. Alongside catalytic innovation, there is increasing commercial interest in specialized polymer and ceramic membrane separation technologies, which utilize highly selective permeability principles to physically isolate specific gas molecules from a mixture. While currently applied to niche, high-purity gas processing streams, these membranes offer unparalleled precision that traditional bulk adsorption media cannot match, thereby significantly expanding the future applicability of chemical filtration into highly technical gas processing markets and microelectronics fabrication.

The most transformative technology trend remains the robust fusion of physical filtration components with digital intelligence, resulting in the rapid proliferation of smart filtration systems. These systems incorporate multi-sensor arrays (measuring pressure differential, humidity, temperature, and multiple trace gas levels) linked via robust IoT networks to cloud-based predictive analytics platforms. This powerful technological convergence, optimized by advanced AI and machine learning algorithms, allows facility managers to transition beyond conservative, time-based replacement schedules, maximizing the operational life of expensive media while guaranteeing continuous regulatory compliance. This digitalization extends beyond monitoring to the structural filter housing design itself, utilizing advanced computational fluid dynamics (CFD) modeling to precisely optimize air pathing, reduce internal turbulence, and minimize pressure drops, which directly contributes to significant energy savings and overall operational cost reduction, successfully addressing the modern industrial requirement for efficient, auditable, and environmentally responsible chemical contamination control solutions.

Regional Highlights

The global demand landscape for chemical filters exhibits distinct regional characteristics dictated profoundly by local industrial structure, prevailing climate conditions, and the varying intensity of regulatory enforcement. North America is characterized by robust, sophisticated demand, primarily driven by the stringent air quality and occupational safety regulations enforced by bodies like the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA). The region's extensive pharmaceutical, aerospace, and advanced manufacturing sectors, particularly across the United States, mandate the continuous use of high-efficiency chemisorbent and molecular filtration solutions for both external emission control and critical internal process protection. Furthermore, the high concentration of hypersensitive data centers and mission-critical infrastructure in North America drives substantial demand for specialized corrosion control filters to protect expensive server hardware from sulfur and chlorine compounds present in heavily industrialized or urban air, ensuring strong, stable market growth fueled by continuous technological adoption and compliance pressure.

- North America: Characterized by a highly mature market with leading-edge adoption of smart technologies. Key demand stems from the sophisticated pharmaceutical manufacturing base, significant petrochemical refining operations requiring advanced corrosion control, and the ongoing modernization of municipal water and wastewater treatment facilities requiring robust odor and VOC control systems. The region leads in the adoption of IoT and AI-enabled filtration systems, focused intensely on optimizing operational longevity and achieving reduced energy consumption through predictive maintenance strategies.

- Europe: Driven by the rigorous and comprehensive implementation of EU directives regarding industrial emissions (IED) and strict occupational exposure limits, which are among the world's tightest. Germany, France, and the UK are primary consumers, with a strong regional emphasis on sustainable filtration solutions, resulting in high uptake of regenerable and highly energy-efficient filter media and systems. The European market leads globally in the adoption of catalytic oxidation and low-waste technologies due to its deep commitment to circular economy principles and hazardous waste minimization goals.

- Asia Pacific (APAC): Recognized as the undisputed global growth engine, propelled by aggressive governmental policies supporting the rapid expansion of the electronics, semiconductor, and high-purity manufacturing bases across China, Taiwan, South Korea, and Southeast Asia. The region exhibits explosive, high-volume demand for ultra-high purity AMC (Airborne Molecular Contamination) filters. The immense industrial scale-up often creates complex, multi-contaminant atmospheric challenges, strongly favoring mixed-media and large-scale deep bed scrubbing installations to handle diverse pollutant profiles effectively.

- Latin America: Exhibits highly localized demand growth, principally tied to expanding mining operations and the significant maturation of the oil and gas extraction and processing sector (e.g., Brazil, Mexico). Demand focuses primarily on basic but robust chemisorbent solutions to protect critical instrumentation from harsh corrosive gases endemic to these industries, although market penetration of advanced smart systems and proprietary high-end media remains significantly lower compared to North American and European counterparts.

- Middle East & Africa (MEA): Growth is concentrated strategically in the Gulf Cooperation Council (GCC) states, driven by massive investments in mega-refinery projects, large-scale industrial infrastructure, and expanding petrochemical hubs. Demand is almost exclusively centered on heavy-duty, corrosion-resistant chemical filters essential for protecting power generation facilities, critical desalination plants, and sensitive petrochemical installations from the high concentrations of atmospheric H2S and severe saline corrosion agents prevalent in coastal industrial zones and hot climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Filter Market.- Donaldson Company, Inc.

- Camfil AB

- Parker Hannifin Corporation

- AAF Flanders (Daikin Industries)

- Pall Corporation (Danaher)

- Purafil, Inc.

- Filtronetics, Inc.

- SAAF Tech

- Vokes Air (Mann+Hummel)

- Calgon Carbon Corporation

- TreaTek

- SFS Corporation

- Freudenberg Filtration Technologies

- Koch Filter Corporation

- Nippon Air Filter Co., Ltd.

- Molecular Products Group

- General Filter Company

- Eaton Corporation plc

- Ahlstrom-Munksjö Oyj

- Rensa Filtration

- Cobb Technologies Inc.

Frequently Asked Questions

Analyze common user questions about the Chemical Filter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a chemical filter in semiconductor manufacturing?

The primary function is Molecular Contamination Control (AMC). Chemical filters remove ultra-trace levels of airborne molecular contaminants—such as acidic gases (HCl, HF), basic compounds (ammonia), and doping agents—that can severely damage photoresist materials and reduce the yield of high-precision microchips during fabrication processes, ensuring production integrity at the nanoscale level.

How do chemisorbent media differ from traditional activated carbon filters?

While traditional activated carbon uses physical adsorption to temporarily capture contaminants via surface attraction, chemisorbent media are chemically impregnated with active agents (e.g., potassium permanganate or metal oxides). These agents chemically react with the captured pollutant, converting it into a stable, harmless solid compound, offering superior and irreversible removal for specific, highly reactive or corrosive gases like H2S or SO2.

Which industrial application drives the highest demand for chemical filters globally?

The Semiconductor and Electronics industry is the primary driver of market value, commanding the highest demand for the most technologically advanced filtration solutions. The absolute necessity for zero-defect production in microchip fabrication mandates continuous, massive investment in high-efficiency chemical filters to protect sensitive process equipment and maintain high product yields globally, particularly in the rapidly growing APAC region.

What role does IoT and AI play in optimizing chemical filter lifespan and performance?

IoT sensors provide real-time data on media saturation, pressure drop, and environmental factors. AI/Machine Learning algorithms analyze this multivariate data to predict filter breakthrough points accurately, enabling dynamic, condition-based maintenance schedules. This predictive capability maximizes filter utilization, minimizes operational waste, and ensures continuous regulatory compliance, moving away from inefficient, fixed-time-based replacements.

What are the key restraints impacting the Chemical Filter Market growth?

The primary restraints include the high total cost of ownership (TCO), involving significant initial capital investment in specialized systems, the expensive and recurrent cost of replacing high-grade chemical media, and the complex logistical and environmental costs associated with the safe handling and disposal of spent, potentially hazardous filter materials under strict environmental regulations.

How are chemical filters contributing to corporate Environmental, Social, and Governance (ESG) goals?

Chemical filters contribute significantly to the 'E' and 'S' components of ESG by reducing toxic air emissions (improving environmental compliance), lowering energy consumption through optimized low-pressure drop designs, and enhancing worker safety and indoor air quality (improving the social environment) within industrial facilities and commercial buildings, thereby providing auditable sustainable benefits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager