Chenodeoxycholic Acid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441621 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Chenodeoxycholic Acid Market Size

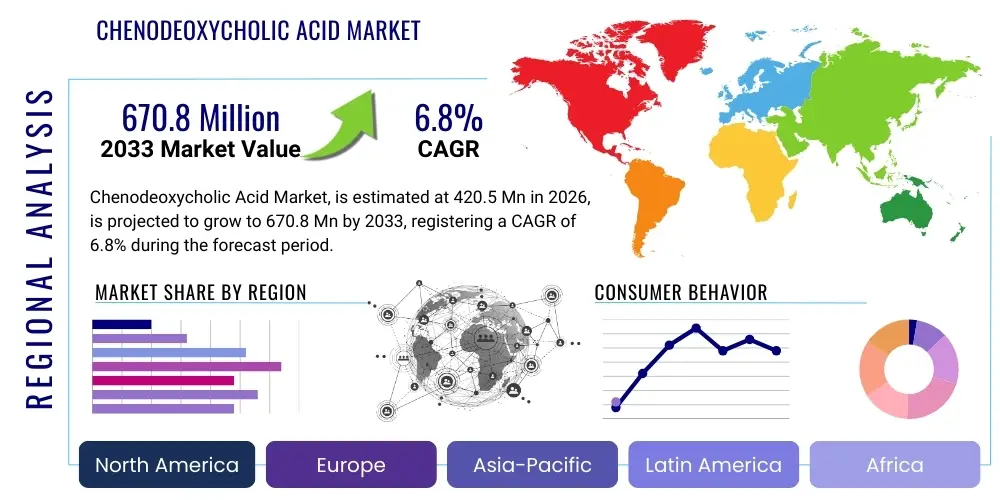

The Chenodeoxycholic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $420.5 Million in 2026 and is projected to reach $670.8 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing global prevalence of specific rare metabolic disorders, particularly Cerebrotendinous Xanthomatosis (CTX), where Chenodeoxycholic Acid (CDCA) serves as the primary and often sole effective therapeutic intervention, coupled with advancements in diagnostic capabilities that facilitate earlier identification of these conditions worldwide, thereby expanding the eligible patient pool requiring chronic treatment.

Chenodeoxycholic Acid Market introduction

Chenodeoxycholic Acid (CDCA) is a naturally occurring primary bile acid synthesized in the liver, playing a crucial physiological role in the digestion and absorption of fats and fat-soluble vitamins. Historically, its primary therapeutic application was in the non-surgical dissolution of cholesterol gallstones, utilizing its ability to reduce cholesterol saturation in bile. However, in contemporary pharmaceuticals, CDCA has gained significant prominence and high market value as an essential orphan drug for treating Cerebrotendinous Xanthomatosis (CTX), a rare, fatal, autosomal recessive lipid storage disorder characterized by the accumulation of cholestanol in multiple tissues, leading to neurological dysfunction, cataracts, and tendon xanthomas. The efficacy of CDCA in CTX stems from its regulatory role in suppressing the activity of cholesterol 7 alpha-hydroxylase (CYP7A1), the rate-limiting enzyme in bile acid synthesis, thereby correcting the underlying metabolic imbalance.

The market landscape for CDCA is defined by its dual sourcing methods: extraction from animal bile, primarily bovine or porcine sources, and complex multi-step synthetic chemical production. The synthetic route is increasingly favored due to concerns over supply consistency, disease transmission risks associated with animal products, and the need for high purity standards demanded by regulatory bodies like the FDA and EMA for human consumption, especially in chronic rare disease management. Major applications beyond CTX and gallstones include investigational use in other liver-related disorders and certain metabolic syndromes, though these remain nascent. Key benefits of CDCA include halting or slowing the neurological deterioration associated with CTX when administered early and offering a non-invasive alternative for specific gallstone patients. Driving factors for market expansion are the rising awareness and improved diagnostic tools for CTX, governmental incentives for orphan drug development, and the lack of alternative long-term treatments for this specific genetic disorder.

Chenodeoxycholic Acid Market Executive Summary

The Chenodeoxycholic Acid market is poised for robust expansion, predominantly fueled by the strong, inelastic demand generated by the designated orphan drug indication for Cerebrotendinous Xanthomatosis (CTX). Business trends indicate a strategic consolidation among manufacturers focusing on achieving strict Good Manufacturing Practices (GMP) and securing reliable, high-purity synthetic sourcing channels to mitigate supply chain volatility associated with animal-derived inputs. Furthermore, the market is characterized by premium pricing strategies, upheld by the drug's essential status for CTX patients and the regulatory exclusivity granted under orphan drug legislation in major pharmaceutical markets. Companies are investing heavily in process optimization and formulation stability to ensure long shelf life and consistent dosage delivery, critical for chronic therapy.

Regional trends highlight North America and Europe as the dominant revenue generators, primarily due to established healthcare infrastructure, high CTX diagnosis rates, and governmental support for rare disease treatments that facilitate rapid market access and reimbursement for high-cost therapies. Asia Pacific (APAC) is emerging as the fastest-growing region, driven by increasing healthcare expenditure, improving awareness among neurologists and metabolic specialists regarding rare genetic disorders, and the expansion of domestic pharmaceutical manufacturing capabilities aiming to capture regional demand. However, stringent regulatory requirements for active pharmaceutical ingredients (APIs) in markets like China and India present both opportunities for compliant manufacturers and barriers for non-compliant entities.

Segmentation trends show that the Application segment dominated by CTX treatment maintains its leading market share, significantly outpacing the historical gallstone dissolution segment in terms of revenue, owing to the massive price disparity between these applications. The Source segmentation is witnessing a structural shift, with the synthetic CDCA segment expected to overtake the natural extraction segment by the mid-forecast period, reflecting the industry's focus on quality, purity, and ethical sourcing standards. End-user trends confirm that specialty pharmaceutical companies involved in rare disease management are the largest purchasers of CDCA API, either for captive consumption in final dosage form manufacturing or for distribution through specialized hospital channels focused on metabolic medicine.

AI Impact Analysis on Chenodeoxycholic Acid Market

Common user questions regarding AI's impact on the Chenodeoxycholic Acid market frequently revolve around how artificial intelligence can accelerate the discovery of new therapeutic uses beyond CTX, whether AI can optimize the complex chemical synthesis pathways to reduce manufacturing costs, and how machine learning might personalize CDCA dosing for individual CTX patients to maximize efficacy while minimizing adverse effects. Users are keen on understanding if AI-driven diagnostics can significantly reduce the diagnosis time for CTX, which often suffers from long delays due to its rarity and non-specific early symptoms. The key themes summarized from user inquiries point towards AI's potential in lowering the high costs associated with orphan drugs through efficiency gains, improving diagnostic accuracy for rare diseases, and enhancing the patient-specific therapeutic management of CDCA, transitioning from standardized dosing to precision medicine protocols. Furthermore, there is interest in how predictive modeling can forecast supply chain disruptions for both synthetic precursors and natural bile sources.

- AI-driven optimization of multi-step synthetic chemical routes, reducing solvent use and enhancing yield purity.

- Machine learning algorithms aiding in the early and accurate diagnosis of Cerebrotendinous Xanthomatosis (CTX) by analyzing complex biomarker patterns and neurological imaging data.

- Development of predictive models for personalized dosing regimens of CDCA based on patient genetics, disease severity, and metabolic profiles, improving long-term outcomes.

- Accelerating R&D for novel CDCA derivatives or combination therapies by screening large compound libraries and predicting efficacy and toxicity profiles in silico.

- Enhancing pharmaceutical supply chain resilience by using AI for demand forecasting, inventory management, and raw material procurement optimization, particularly vital for an essential orphan drug.

DRO & Impact Forces Of Chenodeoxycholic Acid Market

The dynamics of the Chenodeoxycholic Acid market are significantly shaped by a powerful confluence of drivers related to high unmet medical need and restrictive factors concerning production complexity and cost, alongside considerable opportunities in therapeutic expansion. The primary driver is the designation of CDCA as a life-saving therapy for CTX, ensuring consistent, high-value demand regardless of macroeconomic volatility, supported by strong orphan drug regulatory frameworks providing market exclusivity and premium pricing power. This is counterbalanced by significant restraints, including the extremely high cost of synthesis, the stringent purification requirements needed to remove trace impurities, and the ethical/supply variability challenges associated with using animal bile for natural extraction, which limits scalability and necessitates high capital investment in synthetic infrastructure. The market's stability is further impacted by regulatory risks, particularly concerning compliance with API sourcing and stability requirements in diverse global markets.

Opportunities for growth are abundant in leveraging the existing safety profile of CDCA for new therapeutic indications, especially in areas of metabolic and liver disorders such as primary biliary cholangitis (PBC) or certain forms of non-alcoholic steatohepatitis (NASH), although competition is fierce in these spaces. Furthermore, developing advanced, patient-friendly drug delivery systems, such as micronized formulations or extended-release capsules, presents a path to product differentiation and enhanced patient adherence. The core impact force driving profitability in this market is the "unmet medical necessity" for CTX, which allows manufacturers to maintain substantial profit margins, overriding typical pharmaceutical pricing pressures. The regulatory environment acts as a strong barrier to entry for new competitors, making the market structure oligopolistic, dominated by a few players capable of meeting global quality standards for complex API manufacturing and securing intellectual property rights related to manufacturing processes or specialized formulations. The societal impact of diagnosing CTX earlier also drives institutional demand as health systems prioritize better neurological outcomes for these patients.

Segmentation Analysis

The Chenodeoxycholic Acid market is systematically segmented based on its application, the method of sourcing the active pharmaceutical ingredient (API), and the ultimate end-user utilizing the product. This segmentation framework allows for a granular understanding of the market's revenue streams, which are heavily skewed towards the high-value rare disease segment. Analyzing these segments reveals critical trends, such as the increasing commercial importance of synthetic manufacturing over traditional animal extraction and the concentrated purchasing power held by specialty pharmaceutical firms. The high disparity in volume and price between the two main applications—CTX treatment demanding premium prices and gallstone dissolution representing a lower-cost, volume-driven legacy market—is central to strategic planning within this domain, dictating production focus and distribution channel strategies for API manufacturers.

- By Application:

- Cerebrotendinous Xanthomatosis (CTX) Treatment

- Cholesterol Gallstone Dissolution

- Other Investigational Applications (e.g., Liver Disorders)

- By Source:

- Natural Extraction (Animal Bile)

- Synthetic Manufacturing (Chemical Synthesis)

- By End-User:

- Pharmaceutical & Biopharmaceutical Companies

- Research & Academic Institutions

- Compounding Pharmacies

Value Chain Analysis For Chenodeoxycholic Acid Market

The value chain for Chenodeoxycholic Acid is complex, characterized by highly specialized upstream processes and tightly regulated downstream distribution. Upstream analysis involves sourcing raw materials, which vary significantly depending on the method. For natural extraction, this involves sourcing high-quality bovine or porcine bile, necessitating secure supply contracts with slaughterhouses and rigorous quality control for animal health and disease surveillance. For synthetic manufacturing, the upstream complexity lies in securing consistent supplies of critical chemical precursors and intermediates, often involving specialized chiral chemistry suppliers, ensuring compliance with strict purity standards from the initial stages of synthesis. Both methods require intensive chemical processing, including purification, crystallization, and drying stages, which constitute the core manufacturing step where high cost and technical expertise are concentrated, defining the market's competitiveness and quality standards.

The midstream involves the transformation of raw materials into the final Active Pharmaceutical Ingredient (API), Chenodeoxycholic Acid. This stage requires adherence to cGMP (current Good Manufacturing Practices) and involves extensive quality assurance, testing, and regulatory documentation to ensure batch consistency and safety. Due to the drug's use in chronic, life-threatening conditions like CTX, quality control is paramount. Downstream operations primarily focus on formulation (converting API into tablets or capsules) and distribution. Distribution channels are highly specialized and often bifurcated. Direct distribution typically involves API suppliers selling large quantities directly to specialty pharmaceutical companies (End-Users) who manufacture the final dosage form. Indirect distribution involves finished drug products moving through specialized rare disease logistics providers, hospital pharmacies, and regulated distribution networks, ensuring cold chain or controlled environment integrity where necessary, particularly in markets with high reimbursement rates.

The direct channel, involving API sales to large pharmaceutical manufacturers, dominates the volume transactions. However, the high-margin finished product distribution relies on indirect channels, often involving exclusive distributors specialized in orphan drugs. The entire chain is heavily scrutinized by regulatory agencies, making compliance a continuous cost and operational necessity. Efficiency gains in this chain are crucial, as inventory holding costs are high due to the specialized nature of the product, and any disruption can severely impact the continuous treatment of CTX patients globally. Therefore, vertically integrated companies or those with strong, reliable partnerships across the value chain hold a significant competitive advantage in maintaining supply stability and cost control.

Chenodeoxycholic Acid Market Potential Customers

The primary customers and end-users of Chenodeoxycholic Acid are concentrated within the specialty healthcare and pharmaceutical sectors, reflecting its status as an essential, high-value API for niche therapeutic applications. The largest volume purchasers are global and regional pharmaceutical companies that hold the marketing authorization for the finished dosage forms of CDCA, particularly those specialized in orphan drugs and rare metabolic disorders. These companies purchase the API in bulk to formulate into proprietary drug products, such as the approved formulations for Cerebrotendinous Xanthomatosis (CTX). Their procurement strategy is driven by reliability, regulatory compliance of the API supplier (e.g., US FDA registration, CEP certification), and achieving the ultra-high purity required for chronic human use.

A secondary, yet important, customer segment includes compounding pharmacies, particularly in regions where specific commercial formulations are unavailable or where personalized dosage adjustments are needed for atypical patients, though regulatory oversight on compounded products is highly variable. These customers typically require smaller batch sizes but demand the same rigorous quality documentation. Research and academic institutions represent the third segment, purchasing CDCA for use in preclinical studies, clinical trials exploring new indications (e.g., gastrointestinal research, metabolic pathway investigation), or for use as a biochemical reference standard. While their purchase volume is low, their demand drives future market expansion potential through discovery and validation of novel applications, maintaining the innovation pipeline for CDCA and related bile acid therapies. The underlying constant is that all potential customers prioritize compliance and purity above price due to the critical nature of the drug's application.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $420.5 Million |

| Market Forecast in 2033 | $670.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Recordati S.p.A., CDCA Pharma, Sanofi S.A., Takeda Pharmaceutical Company Limited, Sigma-Aldrich (Merck KGaA), Zhejiang Shenghua Biok Biology Co., Ltd., Axcan Pharma Inc., Dipharma Francis S.r.l., Mitsubishi Tanabe Pharma Corporation, LGM Pharma, Glenmark Pharmaceuticals Ltd., Dr. Reddy's Laboratories Ltd., Century Pharmaceuticals, Mylan N.V. (Viatris), Solvay S.A., ICE S.p.A., H. Pylori Test System (HPS) Inc., Novasep, Hovione, Cambrex Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chenodeoxycholic Acid Market Key Technology Landscape

The technological landscape in the Chenodeoxycholic Acid market is dominated by advancements in chemical synthesis and purification techniques aimed at achieving pharmaceutical-grade purity and stability, essential for meeting global regulatory standards for APIs. The shift away from natural extraction—which involves complex, multi-stage processes to isolate CDCA from crude bile and subsequent meticulous purification to eliminate viral and prion contamination risks—is driving innovation in synthetic chemistry. Key technologies include stereoselective chemical synthesis methods, specifically designed to introduce the correct functional groups and stereochemistry at critical positions on the steroid nucleus, ensuring the final product is chemically identical to the naturally occurring isomer, thereby maintaining biological activity and minimizing impurity risk. Developing efficient, scalable, and environmentally friendly synthetic pathways, often involving highly specialized catalysts and reaction conditions, is the core technological challenge and differentiator among major manufacturers.

A critical technical focus is the implementation of advanced chiral separation techniques, such as chromatographic methods (e.g., High-Performance Liquid Chromatography - HPLC) and specific crystallization protocols. These technologies are crucial during the late stages of manufacturing to isolate high-purity CDCA and ensure that related bile acids or structural isomers are present at levels far below regulatory thresholds. The complexity of the steroid structure necessitates robust analytical methods, including Mass Spectrometry (MS) and Nuclear Magnetic Resonance (NMR) spectroscopy, to fully characterize the API and confirm batch consistency and stability over time. Furthermore, the pharmaceutical formulation process employs technologies for particle size reduction, such as micronization or nano-milling, which enhance the bioavailability and dissolution rate of the final drug product, a critical factor for oral medications targeting systemic metabolic correction in CTX patients.

Emerging technologies also involve bioconversion techniques, where genetically engineered microorganisms or enzyme systems are utilized to perform specific chemical transformations on inexpensive sterol starting materials, potentially offering a sustainable middle ground between chemical synthesis and traditional extraction. This enzymatic approach aims to improve reaction specificity, reduce the need for harsh chemical reagents, and potentially lower production costs in the long term, although its large-scale commercial viability is still under extensive investigation. Overall, the technological focus remains squarely on process intensification, minimizing impurities, and ensuring the high reproducibility necessary for a life-saving orphan drug that requires long-term, uninterrupted patient supply globally.

Regional Highlights

The global Chenodeoxycholic Acid market exhibits significant regional variations in terms of demand drivers, regulatory framework, and supply chain maturity. North America, particularly the United States, represents the largest revenue share due to the early adoption of CDCA therapy for CTX, robust healthcare spending, and favorable market access mechanisms for orphan drugs. High diagnosis rates achieved through widespread genetic screening and advanced specialist networks (neurologists, metabolic pediatricians) ensure a steady and increasing patient base. The presence of major pharmaceutical firms and stringent FDA regulations demand the highest quality APIs, favoring synthetic suppliers. Reimbursement policies, which often cover the high cost of orphan drugs like CDCA, further solidify the region's market leadership.

Europe holds the second-largest market position, driven by similar factors including well-developed healthcare systems and strong regulatory frameworks (EMA). The European Union’s commitment to rare disease initiatives, coupled with specific national reimbursement schemes, ensures high market penetration. However, pricing negotiations across different EU member states introduce complexity compared to the more unified North American market. Countries like Germany, France, and the UK are key consumers, supporting both domestic and international API suppliers who comply with their strict quality standards. Furthermore, Europe is often a hub for clinical research into new bile acid applications, contributing to the underlying knowledge base for CDCA derivatives.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This accelerated growth is primarily attributed to rapidly improving diagnostic capabilities, increasing healthcare awareness, and significant governmental investment in healthcare infrastructure in emerging economies like China, India, and South Korea. While the prevalence of CTX may be lower or underdiagnosed currently, the large population base ensures a substantial potential patient pool. Local API manufacturing capabilities are expanding rapidly, often focusing on competitive pricing, though these domestic players face challenges in meeting the high cGMP standards required for export to Western regulated markets. Regulatory streamlining in countries like Japan and Australia is also facilitating quicker patient access to authorized CDCA treatments.

- North America (US & Canada): Market leader driven by high orphan drug prices, advanced CTX diagnosis infrastructure, and robust governmental reimbursement policies for specialty pharmaceuticals.

- Europe (Germany, France, UK): Strong demand anchored by established rare disease treatment protocols, extensive clinical research activity, and mandatory EMA regulatory compliance for all marketed products.

- Asia Pacific (China, India, Japan): Fastest-growing market segment, fueled by increasing awareness of metabolic disorders, expansion of local API production capacity, and improving patient access through national health programs.

- Latin America (Brazil, Mexico): Emerging market where growth is constrained by uneven reimbursement policies and slower diagnosis rates, focusing on imported high-quality API and finished formulations.

- Middle East and Africa (MEA): Niche market with increasing potential, particularly in wealthy Gulf Cooperation Council (GCC) states, where high-end healthcare services are driving demand for essential orphan drugs, often sourced via direct imports from US or European manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chenodeoxycholic Acid Market, covering their strategic initiatives, product portfolios, manufacturing capabilities, and recent developments impacting global market dynamics.- Recordati S.p.A.

- CDCA Pharma

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Sigma-Aldrich (Merck KGaA)

- Zhejiang Shenghua Biok Biology Co., Ltd.

- Axcan Pharma Inc.

- Dipharma Francis S.r.l.

- Mitsubishi Tanabe Pharma Corporation

- LGM Pharma

- Glenmark Pharmaceuticals Ltd.

- Dr. Reddy's Laboratories Ltd.

- Century Pharmaceuticals

- Mylan N.V. (Viatris)

- Solvay S.A.

- ICE S.p.A.

- H. Pylori Test System (HPS) Inc.

- Novasep

- Hovione

- Cambrex Corporation

Frequently Asked Questions

Analyze common user questions about the Chenodeoxycholic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high market value of Chenodeoxycholic Acid?

The high market value is primarily driven by its essential and exclusive use as an orphan drug for treating Cerebrotendinous Xanthomatosis (CTX), a rare metabolic disorder. This designation allows for premium pricing due to high unmet medical need and regulatory market exclusivity.

Is Chenodeoxycholic Acid primarily sourced from natural bile or synthetic manufacturing?

While historically sourced from natural animal bile, the market is rapidly shifting toward synthetic manufacturing. The synthetic route offers higher purity, greater supply stability, better control over contaminants, and compliance with rigorous global pharmaceutical quality standards, particularly for chronic rare disease treatments.

How does the market segmentation by application affect revenue generation?

The market segmentation is heavily weighted toward the CTX treatment application, which generates the vast majority of revenue due to the high price point associated with orphan drugs. The gallstone dissolution application represents a much lower-value, volume-based segment in comparison.

Which geographical region holds the largest market share for CDCA and why?

North America (primarily the US) holds the largest market share, attributed to the presence of sophisticated diagnostic networks for rare diseases, established infrastructure for orphan drug commercialization, favorable regulatory pathways (FDA), and comprehensive reimbursement policies.

What is the most significant technological challenge facing CDCA manufacturers?

The most significant challenge is ensuring ultra-high purity and consistency of the Active Pharmaceutical Ingredient (API). This requires highly advanced and specialized chemical synthesis techniques, robust chiral separation processes, and rigorous analytical testing to eliminate trace impurities and related bile acids.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager