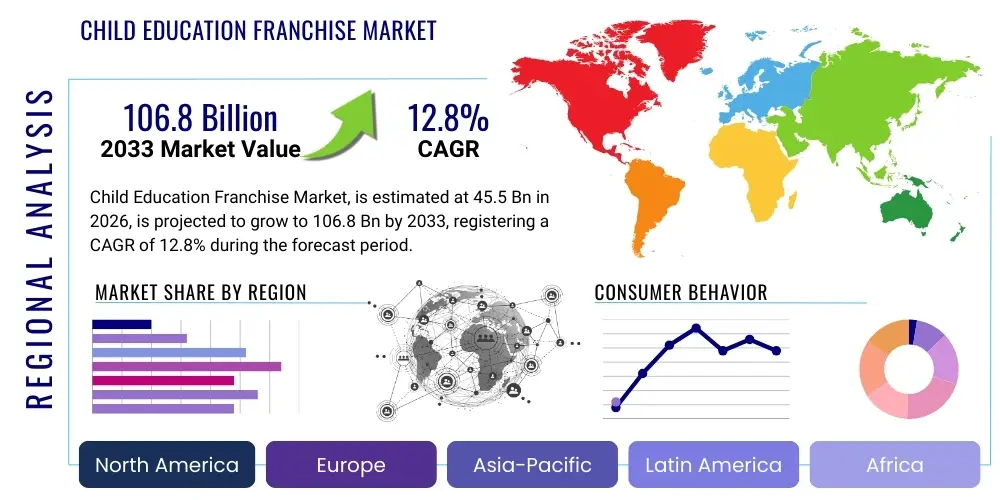

Child Education Franchise Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442076 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Child Education Franchise Market Size

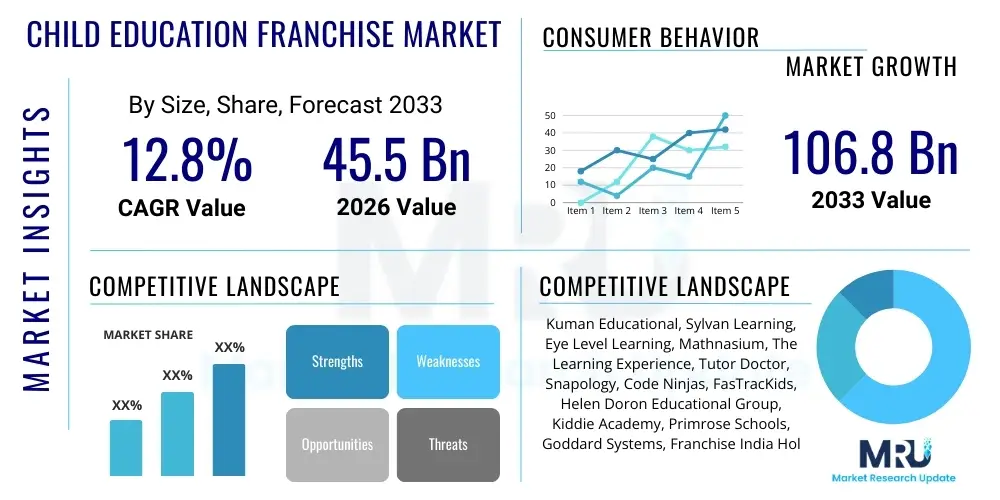

The Child Education Franchise Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 106.8 Billion by the end of the forecast period in 2033.

The substantial growth trajectory of the Child Education Franchise Market is fundamentally driven by increasing global parental awareness regarding the critical importance of early childhood development and specialized supplemental education. Families are increasingly willing to invest significant financial resources into programs that promise cognitive, emotional, and social advantages for their children, moving beyond traditional schooling models. This shift is particularly pronounced in emerging economies undergoing rapid urbanization and middle-class expansion, where competition for prestigious higher education institutions starts earlier than ever before. Franchised models offer a standardized curriculum, established brand recognition, and proven operational efficiency, making them attractive investment vehicles for entrepreneurs and trusted educational providers for parents seeking quality assurance in a fragmented market. Furthermore, the market benefits from demographic tailwinds, including stable birth rates in key developing regions and a heightened focus on STEM and coding education, which are typically offered through specialized franchise formats.

Market expansion is also fueled by significant advancements in educational technology (EdTech) integration within franchise systems. Modern child education franchises are leveraging hybrid learning models, incorporating adaptive AI-driven tutoring, virtual reality simulations, and gamified learning platforms to enhance student engagement and personalized learning outcomes. This technological adoption not only improves the educational offering but also streamlines operational overhead for franchisees, contributing to the scalability and profitability of the model. The fragmented nature of the independent tutoring and enrichment market provides a fertile ground for large, standardized franchise systems to consolidate market share, leveraging economies of scale in curriculum development, marketing, and teacher training. The shift towards outcome-based learning assessment further drives demand for franchises specializing in specific skills gaps, such as robotics, advanced mathematics, or foreign language proficiency, positioning these specialized segments for accelerated growth throughout the forecast period.

Child Education Franchise Market introduction

The Child Education Franchise Market encompasses a diverse range of business models providing supplementary and core educational services to children, typically aged 3 to 17, under a standardized, replicable franchise agreement. These services span academic tutoring (e.g., math, reading), enrichment programs (e.g., arts, music, sports), specialized skill development (e.g., coding, robotics, language immersion), and test preparation. The product description emphasizes proprietary curricula, formalized teaching methodologies, and strong brand equity, distinguishing these offerings from independent local operations. Major applications include filling educational gaps left by public schooling, providing advanced placement and gifted education, and offering specific skill development crucial for modern workforce readiness. The driving factors include escalating competition in educational attainment, rising disposable incomes globally, the proven success of franchisor support systems, and widespread recognition of early intervention programs.

The primary benefit of the franchise model in this sector lies in its capacity for rapid, quality-controlled expansion, allowing successful pedagogical methods developed centrally to be deployed consistently across diverse geographic locations. For parents, franchises represent a trustworthy alternative, offering transparency in curriculum and teacher qualifications, which mitigates the risk associated with unverified educational providers. Economically, the market is characterized by high operational margins once the initial infrastructure is established, driven by subscription-based or enrollment-based revenue models. The necessity for supplementary education is perpetually sustained by ongoing reforms and inconsistencies within global public education systems, ensuring a steady demand for external, specialized assistance that guarantees specific learning outcomes and adherence to global educational benchmarks, particularly in STEM fields.

Moreover, the resilience of the education sector, often proving counter-cyclical or recession-resistant, positions child education franchises as highly attractive investment opportunities. Societal factors, such as smaller family sizes and increased maternal workforce participation, lead to greater parental investment per child, prioritizing educational quality above other consumer goods. The proliferation of digital tools and hybrid learning environments has expanded the reach of these franchises, allowing them to serve remote or sparsely populated areas efficiently, further broadening the potential market size. Key industry stakeholders are constantly innovating curricula to address evolving academic standards and future workforce demands, ensuring the long-term relevance and sustained growth momentum of franchised child education services worldwide.

Child Education Franchise Market Executive Summary

The Child Education Franchise Market is witnessing significant transformation, primarily driven by robust business trends focusing on digitalization and hybrid service delivery, coupled with heightened regional demand, particularly across the Asia Pacific (APAC) and emerging markets in Latin America. Business trends highlight a strong movement toward specialized subject franchises, with coding, AI literacy, and advanced math tutoring exhibiting the fastest growth rates, signaling a parental prioritization of future-proof skills over generalized academic support. Franchisors are increasingly adopting advanced customer relationship management (CRM) systems and utilizing data analytics to optimize student performance tracking and curriculum personalization, enhancing the value proposition for both franchisees and end-users. Strategic mergers and acquisitions are consolidating the competitive landscape, as larger firms seek to integrate niche educational offerings and expand geographic footprints rapidly.

Regional trends indicate North America and Europe remain mature markets characterized by saturation in traditional tutoring but strong demand for high-end, premium enrichment services targeting gifted students and specific college entrance exams. Conversely, APAC represents the epicenter of growth, fueled by massive youth populations, high cultural value placed on academic achievement, and rising disposable incomes in countries like China, India, and Vietnam. These regions are primary targets for franchisors seeking international expansion, often requiring localized curriculum adjustments to align with national testing standards. The Middle East and Africa (MEA) are emerging, driven by governmental initiatives to improve national education standards and significant private sector investment in premium learning centers, although regulatory complexities pose unique market entry challenges.

Segment trends confirm that the largest market share belongs to supplemental tutoring and test preparation segments due to universal demand for grade improvement and entrance exam readiness. However, enrichment franchises focused on non-academic skills, such as entrepreneurial thinking, public speaking, and fine arts, are demonstrating superior long-term growth potential, appealing to parents seeking holistic child development. The segmentation by learning method shows a pivot toward blended learning formats, combining the structure of in-person instruction with the flexibility and personalization offered by online platforms. This hybrid approach ensures market resilience against unexpected disruptions and caters to varying parental preferences regarding scheduling and learning environments, maximizing accessibility and student retention across the franchise ecosystem.

AI Impact Analysis on Child Education Franchise Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) into the Child Education Franchise Market center around three key themes: efficacy, personalization, and job displacement. Users frequently ask if AI-driven tutoring can genuinely replace human instructors, whether personalized learning paths generated by machine learning algorithms yield significantly better academic outcomes, and how franchisors are ensuring data privacy and ethical AI usage, especially concerning minors. There is widespread expectation that AI will standardize quality and lower operational costs, making specialized education more affordable, but also underlying concern about the loss of human interaction and emotional support inherent in traditional learning settings. Consequently, key themes summarize AI's role as an enhancement tool for assessment and administration rather than a complete replacement for pedagogical expertise, with user expectation focusing on AI's ability to maximize efficiency and provide adaptive content tailored to individual learning speeds and styles.

The impact of AI is profound, moving beyond simple automation to fundamentally reshaping instructional delivery and operational management within franchise networks. AI algorithms are highly effective in identifying specific learning gaps by analyzing student performance data across thousands of data points, allowing instructors to intervene precisely where needed, transforming generalized teaching into targeted coaching. This capability significantly improves student mastery and reduces the time required to achieve learning benchmarks, thereby enhancing the overall value proposition of the franchise. Furthermore, AI tools are streamlining back-office functions such as scheduling, inventory management for educational materials, and franchisee support desk operations, freeing up human resources to focus predominantly on high-value interactions like personalized student mentorship and parental communication, optimizing franchise profitability and operational scalability.

However, the successful integration of AI requires significant upfront investment in technology infrastructure and specialized training for franchisees and educators. Ethical implementation remains a critical factor, necessitating robust governance frameworks to manage student data securely and transparently. Franchises that effectively leverage AI to augment, rather than replace, human educators—creating a "high-tech, high-touch" experience—are best positioned for sustained competitive advantage. This approach ensures the educational experience remains personalized, emotionally engaging, and compliant with evolving data protection regulations, addressing core user concerns about the impersonal nature of fully automated education models and reinforcing parental trust in the franchised brand.

- AI-driven adaptive assessments personalize curriculum paths instantly.

- Automated grading and performance tracking reduce teacher administrative load.

- Predictive analytics identify at-risk students for proactive human intervention.

- AI chatbots provide 24/7 basic homework support and FAQ resolution.

- Curriculum development is optimized based on real-time global learning trend analysis.

- Operational efficiency improved through AI-powered site selection and resource allocation for franchisees.

- Enhanced security and data privacy measures required for compliance with child protection laws.

DRO & Impact Forces Of Child Education Franchise Market

The dynamics of the Child Education Franchise Market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and inherent Impact Forces that influence investment decisions and strategic market positioning. The key drivers center on demographic trends, such as the increase in school-age populations in high-growth regions and escalating academic pressure requiring supplementary support. These market drivers are strongly supported by global cultural shifts prioritizing academic achievement and early exposure to specialized skills like coding and critical thinking. Conversely, market restraints include high initial franchising fees and recurring royalty structures, which can deter potential investors, alongside the inherent challenges of maintaining consistent quality control across geographically dispersed units, which risks diluting brand equity if not managed rigorously. Opportunity lies prominently in penetrating under-served rural markets using hybrid or fully digital franchise models and expanding specialized offerings in nascent fields like financial literacy and environmental science, aligning educational products with future societal needs.

Impact Forces are predominantly steered by technological disruption and regulatory volatility. The rise of sophisticated EdTech platforms, while an opportunity, simultaneously acts as an external competitive force, compelling traditional franchises to innovate or face obsolescence. Furthermore, national and regional educational policy changes, including curriculum mandates and changes to standardized testing requirements, directly impact the demand and structure of franchised offerings. Economic impact forces, such as fluctuations in global disposable income and localized currency instability, affect parents' ability to pay for non-essential supplementary education, necessitating flexible pricing models and diverse program tiers. The overarching social impact force relates to parental trust; a single high-profile failure in educational delivery or ethical misconduct within a major franchise network can severely damage industry-wide reputation, making quality assurance the most critical competitive differentiator.

The structural forces maintain high barriers to entry for new, unproven educational methodologies, due to the critical nature of child development and the parental preference for established, reputable brands with verified outcome metrics. This reinforces the market power of incumbent franchise systems. The threat of substitutes, largely independent tutors or bespoke local learning centers, remains moderate but is increasingly mitigated by the economies of scale and standardized professional training that franchise systems provide. Bargaining power of buyers (parents) is relatively high in competitive urban areas, necessitating perpetual innovation in curriculum and pricing flexibility, while the bargaining power of suppliers (e.g., textbook publishers, specialized software providers) is moderate, as franchisors typically develop most intellectual property internally to maintain proprietary competitive advantages. This complex force dynamic requires continuous strategic adaptation focused on brand strengthening and localized operational excellence.

Segmentation Analysis

The Child Education Franchise Market is highly segmented based on the age group of the children served, the type of educational service offered, and the modality of learning delivery. Understanding these segmentations is crucial for franchisors seeking to tailor their expansion strategies and product offerings to specific demographic demands. The segmentation by service type—ranging from foundational academic tutoring (math, language arts) to enrichment activities (art, music, sports) and advanced specialized skills (robotics, coding)—reflects the diverse needs of the modern family. The foundational academic segment typically commands the largest volume due to universal need, while the specialized skill segments often boast higher margins and faster growth due to their direct link to future employability and technological proficiency, especially in highly competitive developed markets.

Further segmentation by age group (e.g., pre-school/early childhood, primary school, middle school, and secondary/test preparation) dictates the required pedagogical approach and curriculum complexity, impacting resource allocation for franchisees. Early childhood education franchises require specialized infrastructure and play-based learning models, demanding stricter regulatory compliance regarding safety and staffing ratios. Conversely, secondary school franchises focus intensely on rigorous academic content and high-stakes test preparation (e.g., SAT, ACT, international baccalaureate exams), requiring highly credentialed instructors and sophisticated diagnostic tools. Successful franchisors leverage this segmentation by offering comprehensive, staggered programs that retain students across multiple age brackets, maximizing their lifetime customer value.

The learning modality segmentation differentiates between purely in-person centers, fully online models, and the increasingly dominant hybrid or blended learning formats. The shift towards hybrid models, accelerated by recent global health crises, offers franchisees superior flexibility, allowing them to optimize real estate footprint while reaching a broader geographical student base. This segmentation also directly influences the technology investment required by the franchisor and the operational training needs of the franchisee. Analyzing these segments rigorously provides key insights into consumer willingness to pay, optimal geographical placement, and the technological readiness required for effective market penetration and sustained educational quality delivery.

- By Service Type:

- Academic Tutoring (Math, Science, Language Arts)

- Test Preparation (Standardized Tests, College Entrance Exams)

- Specialized Skill Development (Coding, Robotics, STEM)

- Enrichment and Arts (Music, Visual Arts, Drama)

- Early Childhood Education (Pre-K, Kindergarten Readiness)

- By Learning Modality:

- In-Person/Center-Based Learning

- Online/Virtual Learning

- Hybrid/Blended Learning Models

- By Age Group:

- Ages 3-6 (Early Learners)

- Ages 7-12 (Primary & Middle School)

- Ages 13-17 (Secondary & High School)

Value Chain Analysis For Child Education Franchise Market

The value chain for the Child Education Franchise Market begins with upstream activities heavily focused on Intellectual Property (IP) creation, encompassing curriculum development, pedagogical research, and specialized content generation (e.g., proprietary software, workbooks). This stage is critical as it defines the unique competitive edge of the franchise. Upstream analysis involves rigorous quality control, expert subject matter recruitment, and continuous curriculum revision based on global educational standards and performance data. Effective upstream management ensures the franchise maintains a highly relevant and proprietary product line that cannot be easily replicated by competitors, justifying the premium pricing often associated with established brands. Strategic partnerships with educational publishers or EdTech developers often occur at this stage to accelerate technological integration and content enhancement.

Midstream activities revolve around the actual deployment and management of the franchise network. This includes robust franchisee recruitment, extensive initial and ongoing training, localized marketing support, and the provision of standardized operational manuals and technology platforms. This phase transforms the proprietary IP into a scalable business model. The distribution channel is primarily direct-to-consumer through the franchised center itself, ensuring a controlled brand experience. However, there is an increasing reliance on indirect distribution via digital platforms for online tutoring components, which demands seamless technological integration across the entire network. Operational support systems, including centralized billing, CRM, and performance monitoring dashboards, are essential midstream elements ensuring consistent service delivery and mitigating operational risks.

Downstream analysis focuses on customer acquisition, retention, and feedback loops. Effective local marketing campaigns, often subsidized or managed centrally by the franchisor, drive enrollment. Customer retention is highly dependent on demonstrated educational outcomes and personalized student support provided by the local franchisee. Feedback from parents and students is fed back upstream to inform curriculum updates and service improvements, closing the loop. Direct engagement involves personalized consultations and progress reporting, building parental confidence. Indirect downstream activities might include partnerships with local schools or community organizations to establish credibility and generate referrals. The successful execution across the value chain hinges on the ability of the franchisor to maintain strict brand standards while offering localized flexibility to franchisees operating in diverse regulatory and cultural environments.

Child Education Franchise Market Potential Customers

The primary customers (end-users/buyers) in the Child Education Franchise Market are affluent and middle-class parents globally, characterized by a high willingness to invest in supplementary education to secure competitive advantages for their children. These buyers exhibit specific psychographic traits, including intense academic aspirations, belief in structured learning environments, and a general aversion to educational risk. They seek specialized solutions that directly address perceived shortcomings in the standard public or private schooling system, often focusing on STEM skills, language fluency, or high-stakes test preparation necessary for university entry. Geographically, potential customers are concentrated in urban and peri-urban centers where educational competition is fierce, and access to disposable income is higher, demanding convenient, high-quality, and outcome-oriented educational services that fit into busy family schedules.

A secondary, yet rapidly growing, customer segment includes educational institutions (private schools, charter schools) that may contract with specialized franchises to offer proprietary enrichment programs on-site, thereby expanding their curriculum without the burden of developing internal expertise. In this scenario, the school acts as the direct buyer, prioritizing the franchise's brand reputation and proven track record. Additionally, corporate clients, particularly those focused on employee benefits or social responsibility, sometimes fund educational franchises for their employees' children, recognizing the link between family stability and workforce productivity. However, the majority of the revenue streams originate directly from individual family units, who are highly sensitive to perceived quality and return on investment (academic performance improvement).

Customer segmentation based on need is critical: 'Remedial' customers seek franchises to close existing learning gaps and boost grades; 'Enrichment' customers look for advanced skill development beyond the core curriculum; and 'Transitional' customers focus solely on specific milestones, such as college test scores or admission portfolio preparation. Targeting these distinct needs requires highly differentiated marketing messages and program structures. Given the high cost of customer acquisition in this sector, franchisors are increasingly focused on loyalty programs and offering tiered service packages to maximize retention across the child's academic lifecycle, ensuring continuous enrollment from early childhood through high school graduation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 106.8 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kuman Educational, Sylvan Learning, Eye Level Learning, Mathnasium, The Learning Experience, Tutor Doctor, Snapology, Code Ninjas, FasTracKids, Helen Doron Educational Group, Kiddie Academy, Primrose Schools, Goddard Systems, Franchise India Holdings Ltd., Best Brains, British Swim School, Amazing Athletes, Little Medical School, Lightbridge Academy, Huntington Learning Center |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Child Education Franchise Market Key Technology Landscape

The technology landscape underpinning the Child Education Franchise Market is rapidly evolving, driven by the need for personalized learning at scale and operational efficiency. Central to this landscape are Learning Management Systems (LMS) and proprietary digital platforms that serve as the backbone for curriculum delivery, student progress tracking, and communication between educators, students, and parents. These systems are increasingly integrated with sophisticated AI algorithms that analyze individual student responses to automatically adjust difficulty levels, recommend supplementary materials, and generate highly granular performance reports. The adoption of cloud-based infrastructure is pervasive, enabling franchisees to access centralized resources, standardized training modules, and real-time data analytics, ensuring consistency in educational delivery regardless of geographic location, which is paramount for maintaining brand integrity in a franchise model.

Virtual and Augmented Reality (VR/AR) technologies are emerging as key differentiators, particularly in specialized skill segments like science, technology, engineering, and mathematics (STEM). VR allows students to conduct complex, risk-free virtual experiments or explore historical sites, significantly enhancing engagement and contextual understanding beyond traditional classroom methods. Furthermore, gamification elements, often built into mobile applications and proprietary learning software, leverage behavioral science principles to motivate students and increase adherence to learning schedules. The development and continuous update of this proprietary EdTech stack represent a significant portion of the franchisor's ongoing investment, distinguishing advanced franchise offerings from basic tutoring services that rely primarily on traditional methods and generic educational software.

Crucially, the operational technology landscape includes advanced Customer Relationship Management (CRM) tools customized for the education sector, managing leads, enrollment cycles, scheduling, and billing. These systems ensure high levels of customer service and facilitate the communication necessary to sustain parental trust and minimize churn. Cybersecurity and data encryption protocols are also paramount components of the modern technology landscape, essential for protecting sensitive student data and complying with international regulations such as GDPR and COPPA. Successful franchisors are those who treat their technology platform not merely as an administrative tool but as an integral component of their pedagogical methodology, constantly iterating to maximize learning outcomes and franchisee operational profitability through automation and data-driven decision-making.

Regional Highlights

Regional dynamics significantly influence the growth trajectory and operational strategy of child education franchises, with varying levels of maturity, disposable income, and regulatory oversight defining market opportunities. North America (NA), driven primarily by the US and Canada, represents a highly mature market characterized by intense competition in test preparation and a growing demand for niche early childhood education franchises focusing on holistic development. NA consumers are sophisticated and often prioritize brand recognition and measurable outcomes, leading to a proliferation of specialized franchises focusing on STEM and college counseling. Europe, while culturally diverse, shows strong demand in supplementary language education and specialized tutoring to navigate varied national education systems, although regulatory hurdles concerning standardization and labor laws present challenges for large-scale cross-border franchising. The market here demands highly localized curriculum adaptation and sensitivity to national pedagogical norms.

The Asia Pacific (APAC) region is the undisputed engine of global growth, characterized by exponential demand fueled by demographic strength and a deeply ingrained cultural emphasis on academic success. Countries like China, India, South Korea, and Southeast Asian nations present vast untapped markets for all types of child education franchises, especially those offering international curriculum support (e.g., IB, AP) and future-focused skills like AI/coding. The high density of population and increasing middle-class disposable income facilitate rapid scalability. However, APAC is also subject to sudden, significant government regulatory shifts, particularly visible in China's recent stringent rules on after-school tutoring, which necessitates agile operational adjustments and diversified service offerings across the region to mitigate regulatory risk effectively.

Latin America (LATAM) and the Middle East and Africa (MEA) represent emerging high-potential markets. LATAM's growth is driven by the need to address educational inequalities and a desire for international language proficiency, with franchises focused on affordable, accessible models gaining traction. MEA, particularly the GCC countries, shows a strong propensity for high-end, premium international franchises, supported by government visions focusing on education quality improvement and significant private wealth investment. These regions require franchising models adapted to local infrastructure limitations, including payment systems and internet connectivity, often favoring blended learning approaches that combine digital content with mandatory physical interaction to build parental trust in nascent markets. Strategic regional penetration demands thorough cultural and regulatory due diligence to ensure long-term, sustainable expansion.

- North America (NA): High saturation in test prep; strong demand for STEM/coding and early childhood specialty programs; mature regulatory environment.

- Asia Pacific (APAC): Highest growth potential; driven by youth demographics and cultural emphasis on academics; vulnerable to dynamic regulatory changes (e.g., China's policy shifts).

- Europe: Fragmented demand across countries; focus on language proficiency and specialized subject tutoring; complexity due to varying national curricula and labor laws.

- Latin America (LATAM): Emerging market; increasing demand for foundational academic skills and affordable digital education; growth linked to middle-class expansion.

- Middle East and Africa (MEA): Premium segment growth in GCC nations; state-backed initiatives driving education sector investment; focus on international standard curricula franchises.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Child Education Franchise Market.- Kuman Educational

- Sylvan Learning

- Eye Level Learning

- Mathnasium

- The Learning Experience

- Tutor Doctor

- Snapology

- Code Ninjas

- FasTracKids

- Helen Doron Educational Group

- Kiddie Academy

- Primrose Schools

- Goddard Systems

- Huntington Learning Center

- British Swim School

- Amazing Athletes

- Little Medical School

- Lightbridge Academy

- Best Brains Learning Centers

- Franchise India Holdings Ltd. (Active in multiple brands)

Frequently Asked Questions

Analyze common user questions about the Child Education Franchise market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Child Education Franchise Market?

The primary growth driver is the increasing global parental investment in supplementary education, fueled by escalating academic competition and the pervasive need for specialized, future-focused skills such as coding and advanced mathematics, which traditional schooling often fails to adequately cover. This demand is further amplified by the trust associated with standardized, brand-recognized franchised curricula.

How is technology impacting the operational cost structure of education franchises?

Technology, specifically AI integration and robust Learning Management Systems (LMS), significantly improves operational efficiency by automating administrative tasks, personalizing curriculum delivery, and streamlining franchisee support. While initial investment is high, technology ultimately lowers variable costs per student and allows for greater scalability via hybrid learning models, optimizing the franchisee's profit margins.

Which geographical region offers the highest growth potential for new child education franchises?

The Asia Pacific (APAC) region offers the highest growth potential, characterized by vast youth populations, rising middle-class disposable incomes, and a strong cultural imperative for academic excellence. However, sustainable entry requires careful navigation of local regulatory landscapes and effective localization of educational content to meet national standards.

What are the key risks associated with investing in a child education franchise?

Key risks include high initial capital expenditure and royalty fees, intense local competition, challenges in maintaining consistent quality of instruction (brand dilution risk), and vulnerability to unexpected governmental regulatory changes that restrict after-school tutoring operations, particularly in international markets.

What types of educational services are experiencing the fastest segment growth?

Specialized skill development franchises, particularly those focused on STEM (Science, Technology, Engineering, and Mathematics), robotics, and computer coding, are experiencing the fastest growth. This trend reflects the modern parental focus on equipping children with skills directly relevant to the high-demand digital economy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager