Children Smartwatch Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442838 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Children Smartwatch Market Size

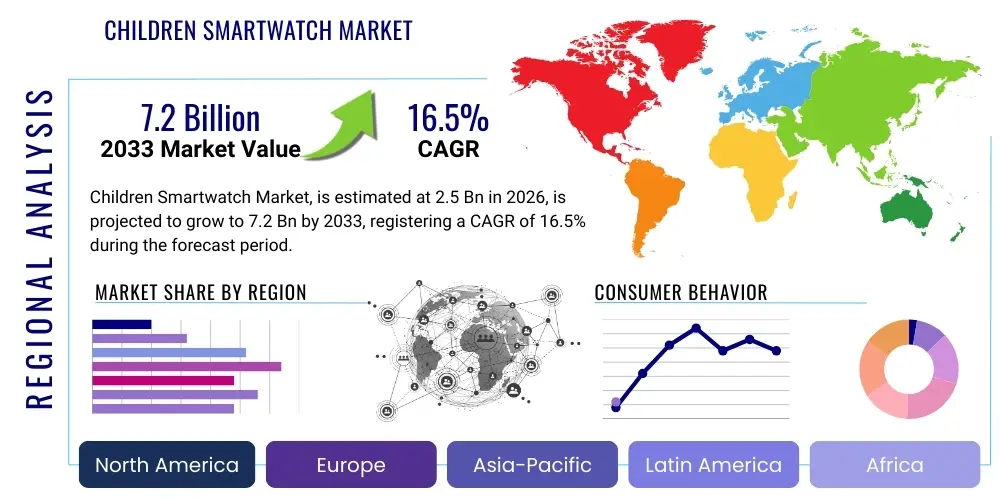

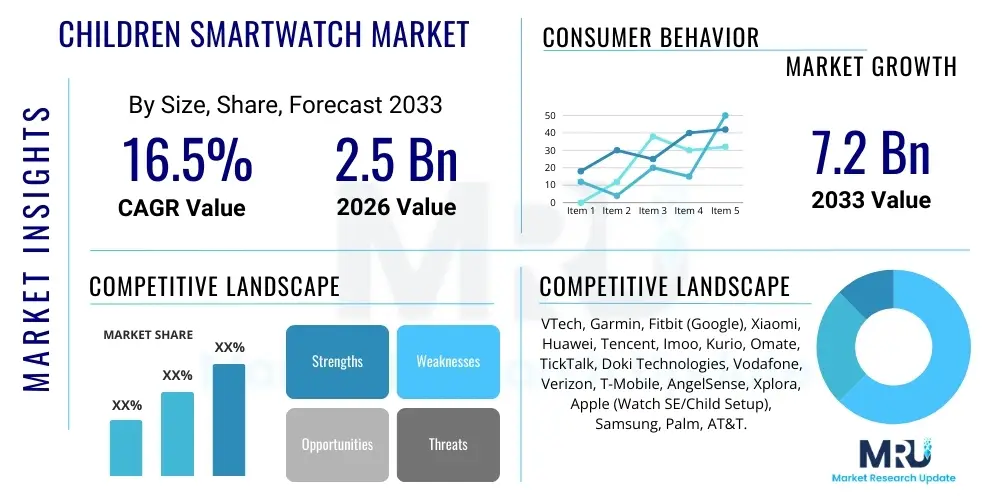

The Children Smartwatch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Children Smartwatch Market introduction

The Children Smartwatch Market encompasses a rapidly evolving category of wearable technology designed specifically for younger users, typically aged 4 to 12. These devices serve a dual purpose: providing parents with critical safety and monitoring capabilities, such as GPS tracking and geofencing, while offering children engaging and age-appropriate features like educational games, communication tools, and activity tracking. The market is fundamentally driven by increasing parental concern regarding child safety in a modern, often digitally interconnected environment, coupled with the rising adoption rates of smart devices globally. These products bridge the gap between basic trackers and sophisticated adult smartwatches, focusing heavily on robust communication features (voice calls, messaging) and emergency functions (SOS buttons).

Product descriptions vary significantly across the market, ranging from basic models focused solely on location tracking and calling functionality (often catering to younger demographics) to more advanced, feature-rich smartwatches equipped with 4G/LTE connectivity, integrated cameras, higher-resolution displays, and enhanced battery life. Major applications include parental monitoring for security, facilitating direct communication between child and caregiver, and promoting physical fitness and healthy habits through integrated step counters and activity challenges. Furthermore, educational applications are increasingly integrated, offering controlled access to learning materials, thus positioning the smartwatch as a beneficial, rather than merely recreational, tool.

The core benefits driving market growth include enhanced peace of mind for parents, providing real-time location data and two-way voice communication, which is often preferred over providing a full smartphone to a young child. Key driving factors include the declining cost of component technology (such as GPS modules and cellular chips), sustained high smartphone penetration leading to increased tech literacy among families, and regulatory push towards implementing location-based safety features in children's devices across various geographies. Additionally, the continuous innovation in battery technology and development of more kid-friendly, durable, and aesthetically appealing designs further stimulates consumer uptake globally.

Children Smartwatch Market Executive Summary

The Children Smartwatch Market is characterized by robust business trends centered on technological diversification and strategic partnerships between hardware manufacturers and mobile network operators (MNOs). A significant trend involves the migration from 2G/3G connectivity, which dominated earlier models, towards 4G and 5G enabled devices, allowing for quicker data transfer, reliable voice over IP (VoIP), and support for enhanced safety features like real-time video calling and improved cloud-based services. Market incumbents are intensely focused on differentiating through enhanced software ecosystems, offering proprietary platforms with robust parental control dashboards, strict data privacy compliance (such as COPPA and GDPR adherence), and curated app stores designed specifically for pediatric use, thereby addressing major consumer hesitations regarding data security and screen time management.

Regionally, the market exhibits highly asymmetrical growth patterns. Asia Pacific (APAC) dominates the volume demand, primarily driven by China and South Korea, where parental monitoring technologies are heavily embraced, and local manufacturers benefit from established supply chains and cost efficiencies. North America and Europe, while representing smaller volumes, contribute significantly to revenue due to higher average selling prices (ASPs) for premium models offering superior connectivity, advanced medical monitoring integrations, and sophisticated software platforms. Growth in emerging economies, particularly in Latin America and the Middle East, is accelerating, propelled by increasing disposable incomes and urbanization, which heightens the need for dependable child safety solutions during commuting and school hours.

Segmentation trends indicate a strong consumer preference shift toward smartwatches offering superior connectivity and comprehensive safety features. The 4G/LTE segment is rapidly overshadowing basic GPS-only watches, reflecting the consumer willingness to pay a premium for reliability and speed. Furthermore, distribution through specialized online retailers and telco channels (in-store and online) is gaining prominence over general retail, as consumers seek bundled services, including subsidized device costs coupled with dedicated low-cost cellular data plans. Applications focusing on educational content and supervised social connection (e.g., pre-approved contact lists) are poised for substantial expansion, moving the device beyond a purely safety tool into an integrated component of a child’s digital life.

AI Impact Analysis on Children Smartwatch Market

Common user questions regarding AI's impact on children's smartwatches frequently revolve around enhanced safety, personalized learning experiences, and data privacy implications. Parents are keen to understand how AI can improve the accuracy of location tracking (e.g., predictive location algorithms), extend battery life through smart power management, and identify abnormal behavior patterns that signal potential distress or deviation from routine. Furthermore, there is significant interest in AI-driven educational content, such as adaptive learning modules that tailor difficulty based on the child's real-time performance, transforming the watch into an active educational accessory rather than a passive communication device. However, these benefits are balanced by concerns regarding the collection and algorithmic processing of highly sensitive child behavior data, demanding stringent ethical AI development and transparent privacy policies.

The integration of Artificial Intelligence and Machine Learning (ML) algorithms is transforming the Children Smartwatch Market from simple tracking devices into sophisticated monitoring and interaction hubs. AI enables advanced analytics on accelerometer and gyroscope data to accurately determine activity types (e.g., playing, running, sleeping), providing parents with meaningful insights into a child's health and wellness rather than just raw step counts. ML models are crucial for developing highly effective anomaly detection systems; for instance, identifying unusually high heart rates or significant, unexpected deviations from established travel routes, triggering proactive alerts faster and more accurately than traditional rule-based systems. This shift elevates the protective capabilities of the device, offering a new level of proactive child safety management.

Beyond safety, AI is playing a critical role in optimizing device performance and enhancing user experience. AI-powered voice assistants, specifically tailored for child users with controlled vocabularies and strict content filters, are improving the accessibility and utility of the device for younger children who may struggle with small touchscreens. Furthermore, AI algorithms are instrumental in optimizing energy consumption. By learning usage patterns, the system can intelligently power down non-essential modules during predictable low-activity periods, significantly extending the time between charges—a key pain point for current wearable technology. The convergence of AI with pediatric wearables mandates rigorous adherence to regulatory standards to ensure that data utility does not compromise child safety or privacy.

- AI-enhanced Location Accuracy: Utilizing ML to filter GPS noise and predict child location in areas of low satellite visibility (e.g., urban canyons).

- Predictive Anomaly Detection: Algorithms identifying deviations in behavior, movement, or physiological metrics indicative of potential distress or emergency situations.

- Adaptive Learning Modules: AI customizing educational games and challenges based on the child’s engagement and learning pace.

- Smart Power Management: ML optimizing battery life by dynamically managing hardware resources according to learned usage patterns.

- Child-Specific Voice Assistants: AI-powered assistants offering safe, curated, and interactive experiences suitable for pediatric users.

- Enhanced Biometric Monitoring: ML interpreting sensor data to provide accurate insights into sleep quality, activity levels, and cardiac health relevant to children.

DRO & Impact Forces Of Children Smartwatch Market

The market dynamics are governed by a complex interplay of facilitating drivers, critical restraints, emerging opportunities, and significant impact forces that shape investment decisions and consumer adoption. The primary driver is the accelerating concern for child safety, globally exacerbated by increased instances of child abduction and parental need for constant connectivity in fast-paced urban environments. This demand is met by continuous technological advancements, particularly the shrinking size and increasing efficiency of components, allowing manufacturers to integrate more features (like 4G connectivity and advanced health sensors) into a durable, child-friendly form factor. However, the market faces significant restraints, notably the high initial cost of advanced 4G-enabled devices and the necessity of ongoing subscription fees for cellular service, which presents a barrier to entry for lower-income segments. Additionally, widespread parental concerns regarding data privacy, regulatory scrutiny (e.g., GDPR and COPPA enforcement), and potential negative health impacts of constant exposure to radio frequencies restrain broader market penetration.

Opportunities in the Children Smartwatch Market are largely centered on diversification into niche applications and geographical expansion. There is a substantial untapped opportunity in integrating medical-grade sensors for chronic condition management, such as continuous glucose monitoring or asthma tracking, transforming the watch into a health management tool supervised by both parents and healthcare providers. Expanding into specialized educational markets, offering robust platforms that integrate seamlessly with school curriculums and remote learning environments, represents another lucrative avenue. Geographically, significant opportunities exist in developing regions—such as Southeast Asia and Africa—where mobile connectivity is high, but access to full smartphones for children is limited, positioning the smartwatch as the primary entry point into digital communication and safety services.

The impact forces currently restructuring the market include intensifying regulatory pressure demanding verifiable child data protection mechanisms, which forces manufacturers to prioritize privacy by design. Secondly, the rapid obsolescence cycle of wearable technology compels companies to invest heavily in R&D to maintain competitive advantage, often through proprietary software platforms that lock in consumers. Finally, the growing dominance of telecom operators in the distribution chain significantly impacts consumer purchasing patterns, as MNOs often bundle devices with attractive data plans, making them primary gatekeepers for connectivity-reliant smartwatches. These forces collectively dictate pricing strategies, feature roadmaps, and international market entry dynamics, requiring market players to possess both technological agility and strong regulatory compliance frameworks.

Segmentation Analysis

The Children Smartwatch Market is meticulously segmented based on product type, connectivity, distribution channel, application, and geography, enabling manufacturers to target specific demographic and functional requirements. Segmentation by product type distinguishes between basic models focused primarily on location tracking and voice calling, and advanced models incorporating enhanced features such as high-speed data connectivity (4G/LTE), video calling capabilities, and more complex interactive applications. Connectivity remains a pivotal segmentation axis, classifying devices based on their reliance on cellular networks (2G, 3G, 4G, 5G), or non-cellular dependence (GPS-only models relying on Wi-Fi for supplemental data transfer), directly impacting real-time functionality and geographical coverage.

Distribution channel segmentation highlights the evolving landscape of retail and service provisioning, distinguishing between online sales (e-commerce platforms and brand websites) and offline sales (traditional retail stores, specialized tech outlets, and crucially, Mobile Network Operator (MNO) stores). The application segmentation is crucial for understanding user motivation, grouping devices based on whether they are primarily purchased for safety and tracking (the dominant segment), entertainment and social interaction, health and fitness monitoring, or educational purposes. Understanding these segments allows strategic market players to tailor marketing efforts and product development, ensuring alignment with diverse parental expectations regarding functionality and pricing tiers across various regional markets.

- By Product Type:

- Basic Smartwatches (Focus on GPS tracking and limited voice calling)

- Advanced Smartwatches (Integrated 4G/5G, Video Calling, Comprehensive Apps)

- By Connectivity:

- Cellular Connectivity (2G, 3G, 4G/LTE, 5G)

- Non-Cellular Connectivity (GPS and Wi-Fi only)

- By Distribution Channel:

- Online Channels (E-commerce sites, brand portals)

- Offline Channels (Retail stores, MNO outlets, specialized electronics chains)

- By Application:

- Safety and Tracking (Geofencing, SOS functions, Real-time location)

- Communication (Two-way calling, messaging)

- Entertainment and Education (Games, learning apps, curated content)

- Health and Fitness Monitoring (Step counts, sleep tracking, activity goals)

- By Region:

- North America (U.S., Canada)

- Europe (U.K., Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Southeast Asia)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Children Smartwatch Market

The value chain for the Children Smartwatch Market begins with upstream activities, which are dominated by component suppliers specializing in miniature electronics. These suppliers provide essential materials and technology, including highly efficient Microcontroller Units (MCUs), specialized GPS modules, low-power cellular chipsets, battery cells optimized for small form factors, and durable display panels (often reinforced to withstand rough handling). Critical upstream activities involve R&D collaboration between chipset manufacturers and smartwatch Original Design Manufacturers (ODMs) to ensure optimal integration of connectivity and power management features, significantly impacting the device's final cost and functionality. Component sourcing and assembly efficiency in East Asia remain central to maintaining competitive pricing, characterizing the early stages of the value chain.

Midstream processes involve manufacturing, brand assembly, and crucially, software development and quality assurance (QA). Unlike standard consumer electronics, children’s smartwatches require rigorous QA testing for durability, ingress protection (water and dust resistance), and most importantly, compliance with child safety and data privacy regulations. Brand owners invest heavily in proprietary operating systems and parental control platforms that differentiate their offerings, focusing on intuitive user interfaces for children and sophisticated data analytics dashboards for caregivers. This stage also includes regulatory certification (FCC, CE, etc.) which is mandatory before market launch, adding complexity and time to the product cycle.

Downstream activities are focused on market access and customer support, encompassing distribution channels, retail, and post-sale service provision. Distribution channels are increasingly polarized between direct-to-consumer online sales (providing higher margin control) and strategic partnerships with Mobile Network Operators (MNOs). MNOs act as powerful downstream partners, offering bundled service contracts that simplify the process for parents, integrating the watch seamlessly into existing family mobile plans. After-sales support is vital, given the young target demographic and high probability of device damage; effective warranty claims processing and software update deployment contribute significantly to customer satisfaction and brand loyalty, closing the feedback loop for future product development.

Children Smartwatch Market Potential Customers

The primary customer base for Children Smartwatches consists of parents and legal guardians, specifically those within the middle to high-income bracket, residing predominantly in urban and suburban areas, who are generally tech-savvy and highly proactive regarding their child's safety and connectivity. These end-users are not merely seeking a gadget but a comprehensive safety solution that offers peace of mind through real-time location monitoring, controlled communication capabilities, and rapid emergency response functions (SOS alerts). The decision-making process is heavily influenced by factors such as device battery life, GPS accuracy, data security certifications, and the cost of the combined device and recurring cellular subscription service, emphasizing reliability over pure entertainment features.

A significant secondary customer segment includes schools and educational institutions, particularly in geographies where student safety during commuting and field trips is a mandated concern. These organizational buyers are interested in fleet management capabilities, where multiple devices can be managed centrally, offering features like silent classroom mode operation and restricted communication hours. Furthermore, healthcare providers represent an emerging niche, advocating for smartwatches equipped with specialized health monitoring features for children managing conditions like Type 1 Diabetes or asthma, leveraging the device for passive data collection that aids in condition management under pediatric supervision, expanding the traditional end-user definition beyond the nuclear family unit.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VTech, Garmin, Fitbit (Google), Xiaomi, Huawei, Tencent, Imoo, Kurio, Omate, TickTalk, Doki Technologies, Vodafone, Verizon, T-Mobile, AngelSense, Xplora, Apple (Watch SE/Child Setup), Samsung, Palm, AT&T. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Children Smartwatch Market Key Technology Landscape

The technological foundation of the Children Smartwatch Market is rapidly advancing, shifting from reliance on outdated 2G/3G networks towards modern, high-speed 4G LTE and emerging 5G connectivity. This shift is critical as it enables richer feature sets, including real-time video calling, faster data transfer for accurate mapping services, and support for complex cloud-based AI analytics. Miniaturization of System-on-Chips (SoCs) and dedicated cellular modules designed for low power consumption are vital, balancing feature density with the requirement for all-day battery performance. Manufacturers are increasingly utilizing hybrid positioning technologies that combine traditional GPS, GLONASS, Galileo, and Beidou satellite systems with Wi-Fi triangulation and LBS (Location Based Services) using cellular towers, significantly improving location accuracy, especially indoors or in dense urban areas where satellite signals are often blocked.

A key focus in the technology landscape is the development of robust, kid-proof hardware and highly secure, specialized software platforms. Hardware design emphasizes durability, using reinforced screens and IP-rated water resistance, reflecting the active nature of young users. On the software side, the landscape is defined by proprietary, closed ecosystems tailored for child use. These operating systems, distinct from adult smartwatches (like WatchOS or Wear OS), are intentionally restrictive, offering curated app environments and granular parental control dashboards to manage screen time, permitted contacts, and operational modes (e.g., school mode). Furthermore, the integration of certified encryption protocols (end-to-end encryption for voice calls and stored location data) is mandatory, addressing the escalating regulatory requirements concerning child data protection.

Emerging technologies, particularly in sensor integration and battery science, are poised to redefine the market over the forecast period. Advances in non-invasive biometric sensors, such as sophisticated photoplethysmography (PPG) sensors for heart rate variability and blood oxygen level (SpO2) monitoring, are transforming basic activity trackers into health monitoring devices. Coupled with this, innovation in solid-state batteries or advanced lithium polymer technologies, focusing on higher energy density in smaller packages, aims to overcome the perennial challenge of daily charging, enhancing overall user convenience. The successful deployment of these technologies requires careful tuning to ensure sensor data is accurate for pediatric physiology and that the charging mechanisms remain safe and durable for young children.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market in terms of volume consumption, driven primarily by China, South Korea, and Japan. High population density, robust mobile infrastructure, and intense parental competition regarding academic and extracurricular success fuel the demand for both safety and educational features. China is a technological powerhouse in this sector, housing major manufacturers and enjoying high domestic adoption of brands like Imoo and Huawei. The shift to 4G/5G is rapid, supported by governmental infrastructure initiatives.

- North America: This region is characterized by high Average Selling Prices (ASPs) and a strong focus on premium features, sophisticated software ecosystems, and high-level data privacy compliance (COPPA). The market is heavily influenced by telecom operators (Verizon, AT&T, T-Mobile) who strategically partner with device manufacturers to offer subsidized devices and bundled service plans, positioning the watch as a safe, intermediate communication device before a smartphone.

- Europe: Growth in Europe is substantial, though constrained by stringent data privacy laws (GDPR), which necessitates high transparency and secure data handling, particularly in Germany and the UK. Safety features are paramount, often mandated by local regulations for tracking features. The market sees strong uptake through specialized child tech retailers and established MNO channels, with increasing demand for devices supporting multiple European languages and localized educational content.

- Latin America (LATAM): LATAM represents a rapidly growing opportunity market, driven by increasing urbanization and corresponding parental safety concerns, particularly in large economies like Brazil and Mexico. The market is highly price-sensitive, initially favoring basic models, but quickly transitioning to 4G connectivity as network coverage improves and disposable incomes rise, focusing heavily on robust GPS and SOS functionalities.

- Middle East & Africa (MEA): While currently a smaller contributor, MEA is poised for accelerated growth, especially in the GCC countries and South Africa, fueled by high mobile penetration rates and increasing affluence. Demand is concentrated in safety and communication applications, reflecting the region's focus on securing children's movements within rapidly expanding urban centers. Deployment often involves leveraging existing mobile operator infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Children Smartwatch Market.- Imoo (BBK Electronics)

- Xplora Technologies AS

- VTech Holdings Limited

- Garmin Ltd.

- Huawei Technologies Co., Ltd.

- Xiaomi Corporation

- Doki Technologies (HK) Limited

- TickTalk Tech LLC

- Kurio (KD Interactive)

- AngelSense

- Omate Ltd.

- Vodafone Group Plc

- Verizon Communications Inc.

- T-Mobile US, Inc.

- Fitbit (Google LLC)

- Samsung Electronics Co., Ltd.

- Palm Ventures Group Inc.

- Tencent Holdings Ltd.

- Gabb Wireless

- MiaoMiao (RongSheng Technology)

Frequently Asked Questions

Analyze common user questions about the Children Smartwatch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a children's smartwatch and an adult smartwatch?

Children's smartwatches prioritize safety features like accurate GPS tracking, geofencing, and SOS buttons, operating on closed, heavily curated operating systems to restrict internet access and manage communication, contrasting sharply with adult watches that focus on productivity, comprehensive health data, and open third-party application ecosystems.

Are children's smartwatches safe regarding data privacy and security?

Leading manufacturers are increasingly prioritizing data privacy by implementing end-to-end encryption for sensitive data (location, communication) and ensuring compliance with international regulations such as COPPA (U.S.) and GDPR (Europe). Consumers must verify the manufacturer’s privacy policy and server location before purchase, as security robustness varies significantly across brands.

What connectivity type is currently dominant and recommended for children’s smartwatches?

While basic 2G/3G models still exist, 4G LTE connectivity is rapidly becoming the standard and most recommended type. 4G offers superior speed, reliability for real-time tracking, supports enhanced features like video calling, and provides more stable voice quality, which is crucial for emergency communication functions.

How does AI technology benefit the children’s smartwatch market?

AI integration improves safety through predictive location algorithms and anomaly detection, helping identify unusual movement or physiological patterns. It also enhances user experience by optimizing battery life through smart power management and personalizing educational content for adaptive learning.

What are the typical recurring costs associated with owning a children’s smartwatch?

Beyond the initial device purchase price, the primary recurring cost is the cellular data plan. Since most safety and communication features rely on continuous connectivity (4G/GPS), a dedicated SIM card and a monthly subscription plan from a mobile network operator are typically required, ranging in cost based on data volume and feature inclusion.

At what age is a children's smartwatch most suitable?

Children's smartwatches are generally designed for ages 4 to 12. Devices for younger children (4-7) focus mainly on basic GPS tracking and one-touch calling, while models for older children (8-12) often include more advanced communication features, light entertainment, and greater fitness tracking capabilities, serving as a transition device before full smartphone adoption.

How does geofencing functionality work and why is it important?

Geofencing allows parents to define virtual safe zones (e.g., home, school perimeter) using GPS technology. If the child enters or exits this predefined area, the parent receives an immediate notification. This feature is crucial for monitoring commutes and ensuring the child remains within expected boundaries without requiring continuous manual tracking.

What role do Mobile Network Operators (MNOs) play in the distribution channel?

MNOs are critical distribution partners, especially in North America and Europe. They bundle the smartwatch device with affordable, dedicated cellular plans, making the purchase and setup process seamless for parents. This strategic bundling often drives market penetration and dictates subscription pricing models for connectivity-reliant devices.

Are educational applications on smartwatches effective?

The effectiveness relies on the quality and curation of the content. Many manufacturers are developing proprietary, AI-driven educational modules that offer adaptive challenges (e.g., math quizzes, vocabulary builders) appropriate for the child's grade level, providing short, engaging learning sessions without the distractions of an open internet, positioning the watch as a positive reinforcement tool.

What is the impact of product durability on market trends?

Durability is a major factor influencing parental purchasing decisions. Given the active nature of children, parents seek devices with high ingress protection (IP ratings for water and dust resistance) and robust build quality. Market trends show a consumer willingness to pay a premium for certified durable products, reducing the frequency and cost of replacements.

How are battery limitations being addressed in this market?

Manufacturers are tackling battery limitations through technological advancements, including the use of high-density lithium polymer batteries and the implementation of AI-driven smart power management algorithms. These systems learn usage patterns to optimize power consumption dynamically, extending typical battery life to ensure the watch remains functional for a minimum of 24 hours between charges, vital for safety.

What role does the camera play in advanced children’s smartwatches?

Cameras, when included in advanced models, are used primarily for real-time video calling to parents and for taking simple, controlled photos. They are often subject to strict parental controls, limiting usage during specific hours (e.g., school time) to prevent misuse and comply with school policies and privacy regulations.

Is there a noticeable trend towards incorporating health and fitness monitoring features?

Yes, there is a strong trend integrating basic health metrics like step counting, sleep tracking, and calorie expenditure, moving the device beyond pure safety. Emerging premium models are incorporating more advanced, though non-medical, sensor technology (like heart rate monitoring) to help parents encourage healthy lifestyles and track wellness metrics.

What are the main concerns restricting market growth in developed regions?

In developed regions like North America and Europe, the primary restraints are the high associated costs (device plus subscription) and heightened consumer scrutiny regarding data collection and adherence to strict regulatory frameworks such as GDPR. These restraints necessitate extensive investment in compliance and privacy assurance, potentially slowing immediate market uptake.

How do manufacturers ensure the software ecosystem remains child-appropriate?

Manufacturers rely on proprietary, closed operating systems that strictly prohibit unrestricted access to the internet, social media, and third-party app stores. Communication is limited to pre-approved contacts set by the parent, and content delivery is carefully curated to eliminate exposure to inappropriate material, maintaining a controlled digital environment.

Which geographical region holds the highest potential for future growth?

While APAC currently leads in volume, emerging markets in Latin America and the Middle East & Africa show the highest potential for future growth acceleration. This growth is driven by rising disposable incomes, rapid urbanization intensifying safety needs, and high mobile connectivity penetration rates creating a strong foundation for cellular-dependent smartwatches.

Why are specialized devices preferred over giving a child an old smartphone?

Specialized children’s smartwatches offer simplified functionality focused solely on communication and safety, with robust parental controls and no risk of accessing harmful content or excessive gaming. They are also more durable, less expensive to replace than smartphones, and often designed to be easily worn and less distracting in educational settings.

How does the increasing adoption of 5G infrastructure impact the market?

5G infrastructure will eventually enable ultra-low latency communication and significantly higher data capacity, facilitating instantaneous real-time video calls and high-definition location streaming. While currently limited, 5G will unlock new applications requiring massive data throughput and minimal delay, enhancing critical safety features.

What is the role of upstream suppliers in driving innovation in the market?

Upstream suppliers, particularly those providing specialized chipsets (e.g., cellular, GPS), drive miniaturization and power efficiency. Their continuous innovation allows manufacturers to integrate more advanced features (like 4G/5G capability and advanced health sensors) into the compact and power-constrained form factor required for children's wearables.

How crucial is parental involvement in the daily use of the smartwatch?

Parental involvement is paramount. The device functions primarily as a monitoring and communication tool managed via a parental control application on the caregiver's smartphone. Parents set up safe zones, approve contacts, manage screen time, review activity logs, and maintain the device's subscription, making the technology deeply dependent on continuous parental oversight.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager