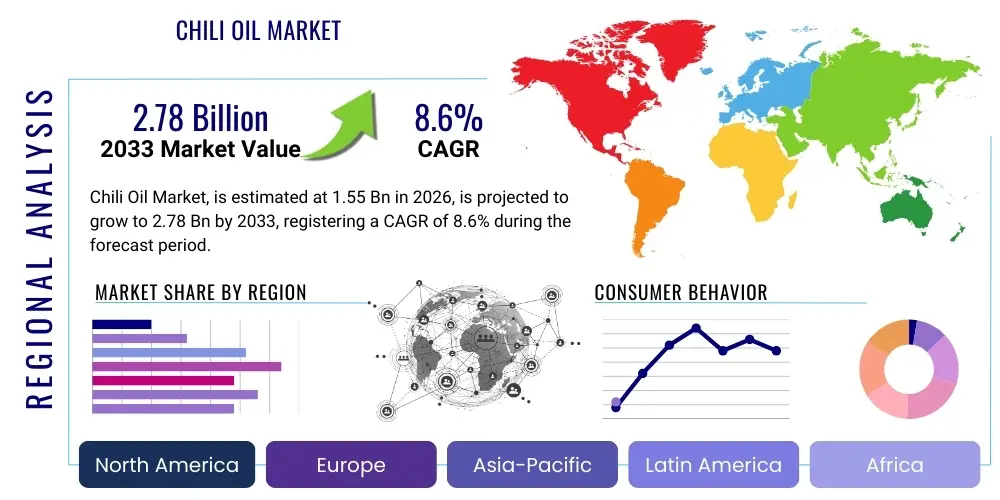

Chili Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443646 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Chili Oil Market Size

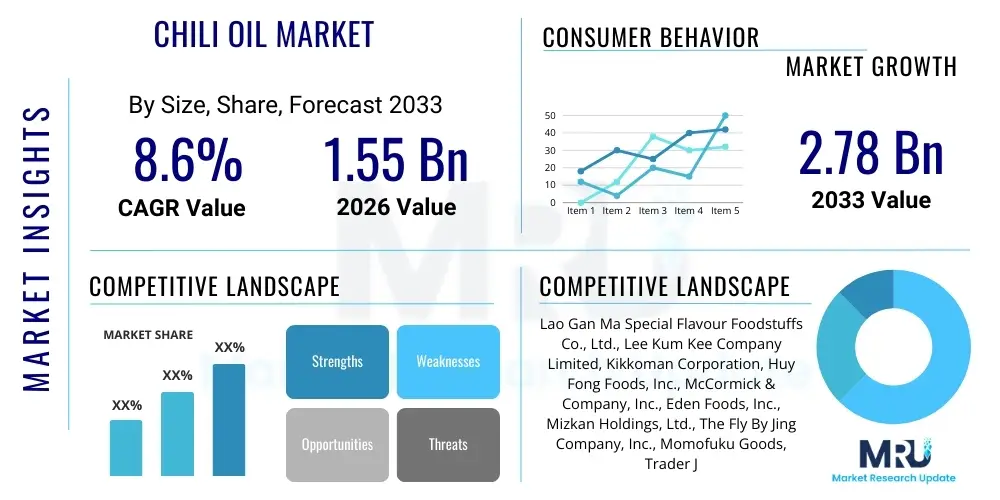

The Chili Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.6% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.78 Billion by the end of the forecast period in 2033.

Chili Oil Market introduction

The Chili Oil Market encompasses the production, distribution, and sale of oil-based condiments infused with chili peppers and various aromatics. Originating predominantly from Asian culinary traditions, particularly Chinese, Japanese, and Korean cuisine, chili oil has rapidly transitioned from a niche specialty ingredient to a mainstream global condiment. Its core appeal lies in its dual function: providing intense flavor depth—often savory, umami, and nutty—alongside customizable levels of heat, which caters effectively to the rising global consumer demand for bold and experiential food products. The versatility of chili oil allows it to be used as a dipping sauce, a finishing oil, a marinade ingredient, or a flavor enhancer in dishes ranging from noodles and dumplings to pizzas and roasted vegetables, significantly broadening its application scope across household and commercial food service segments.

Market expansion is fundamentally driven by the accelerating globalization of ethnic cuisines and a shift in consumer preferences toward premium, artisan, and health-conscious food products. Modern consumers are increasingly seeking ingredients that offer transparency regarding sourcing and processing methods, prompting manufacturers to innovate with high-quality oils (such as sesame, peanut, or high-oleic sunflower oil) and natural ingredients free from artificial preservatives. Furthermore, the convenience factor associated with ready-to-use chili oil, which delivers complex flavors without extensive preparation, positions it favorably in busy modern lifestyles, ensuring robust adoption across diverse demographic groups globally.

Key driving factors supporting the market's trajectory include the robust growth of e-commerce platforms, which facilitates global access to traditionally regional specialty products, and technological advancements in processing that help preserve the essential flavors and shelf stability of the oil. The growing popularity of plant-based diets and gourmet cooking trends also contributes substantially, as chili oil serves as an essential flavor base in many vegetarian and vegan preparations. This combination of cultural integration, product innovation, and efficient distribution channels establishes a strong foundation for sustained market growth throughout the forecast period.

Chili Oil Market Executive Summary

The Chili Oil Market is characterized by vigorous competition and significant expansion, underpinned by evolving consumer palates that increasingly favor spicy, complex flavor profiles. Business trends indicate a strong move toward product premiumization, where artisanal and small-batch brands emphasizing high-quality ingredients, unique regional spice blends (e.g., Sichuan peppercorns, Gochugaru), and clean label certifications are gaining considerable market share over conventional offerings. Strategic acquisitions and partnerships between regional specialty manufacturers and large global food conglomerates are defining the competitive landscape, aimed at streamlining supply chains and accelerating international market entry for specialized chili oil varieties.

Regionally, Asia Pacific (APAC) remains the dominant market, driven by deep-rooted culinary usage in countries like China, Japan, and South Korea, which are also leading innovators in product variety and flavor experimentation. However, North America and Europe are exhibiting the fastest growth rates, propelled by the widespread adoption of Asian street food culture and increased exposure through social media and food delivery services. This rapid Westernization of Asian culinary condiments requires manufacturers to adapt formulations to meet local regulatory standards and distinct consumer heat tolerance levels, fueling demand for milder, yet equally flavorful, variations.

Analysis by market segment highlights the Commercial/Food Service sector as a critical growth engine, as restaurants and ready-to-eat meal producers integrate chili oil to elevate flavor complexity and differentiate their menus. Concurrently, the Distribution Channel segment sees e-commerce flourishing, offering consumers unparalleled access to exotic and international brands that may not be available in traditional retail settings. Ingredient segmentation shows a rising preference for crispy chili oil variants containing crunchy inclusions (such as fried garlic, shallots, or soybeans), valued for their textural contribution, indicating that sensory experience is becoming a major purchase determinant for modern chili oil consumers.

AI Impact Analysis on Chili Oil Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Chili Oil Market primarily revolve around operational efficiency, flavor consistency, and predictive market adaptation. Users are frequently asking: "How can AI ensure consistent heat and flavor profiles across large production batches?" and "Can AI predict the next viral spice blend or regional flavor trend?" There is also considerable interest regarding AI’s role in optimizing the chili supply chain, given the high volatility in chili pepper harvests and pricing, querying: "What tools are available for mitigating supply chain risks using AI in chili sourcing?" The collective expectation is that AI will move chili oil production away from traditional, subjective methods toward data-driven precision manufacturing, ensuring brand consistency and accelerating new product development (NPD) cycles.

AI's primary influence centers on predictive analytics applied to flavor mapping and consumer demand forecasting. By analyzing vast datasets—including social media trends, food blog reviews, search queries related to spice preferences, and retail sales patterns—AI algorithms can precisely determine optimal flavor combinations, ingredient ratios, and heat levels that resonate with specific regional consumer demographics. This data-driven approach allows manufacturers to rapidly prototype and launch highly targeted products, minimizing the risk associated with traditional, lengthy flavor R&D. Furthermore, AI tools are employed in sensory analysis during quality control, utilizing advanced imaging and chemical analysis to ensure that color, viscosity, and particle distribution in chili oil batches meet stringent criteria, far surpassing human capabilities in detecting minute inconsistencies.

The secondary but equally crucial application of AI is optimizing the intricate supply chain for core ingredients, specifically chili peppers, garlic, and specialty oils. AI models forecast yield variations based on satellite imagery, weather patterns, and historical price volatility in key growing regions, enabling companies to execute proactive procurement strategies and secure favorable contracts, thereby stabilizing raw material costs and ensuring supply continuity. Within the manufacturing plants, machine learning algorithms optimize equipment scheduling, predictive maintenance, and energy consumption during the oil infusion and processing stages, leading to significant cost reductions and enhanced operational throughput necessary to meet the escalating global demand for chili oil products.

- Precision Flavor Mapping: AI algorithms analyze consumer data and social trends to predict and formulate optimal spice blends and heat levels for targeted demographics.

- Supply Chain Risk Mitigation: Utilization of predictive analytics to forecast chili pepper harvest yields, manage price volatility, and ensure stable sourcing of high-quality raw materials.

- Automated Quality Control (QC): Implementation of machine learning and computer vision systems for real-time monitoring of chili oil consistency, color, particle size, and viscosity during production.

- Personalized Marketing and Recommendation Engines: AI-driven platforms suggest specific chili oil products or pairings to individual consumers based on their past purchase behavior and cooking habits.

- Optimized Manufacturing Processes: Use of machine learning for predictive maintenance on infusion equipment, optimizing energy consumption and minimizing downtime in production facilities.

DRO & Impact Forces Of Chili Oil Market

The Chili Oil Market dynamics are shaped by a complex interplay of growth Drivers, market Restraints, strategic Opportunities, and overarching Impact Forces that influence investment decisions and competitive positioning. Key drivers revolve around cultural integration and changing dietary preferences, specifically the widespread global adoption of Asian cuisine and the increasing consumer appetite for intense, layered flavors. Opportunities are abundant in product diversification, including the introduction of functional benefits (e.g., incorporating superfoods or CBD), sustainable sourcing narratives, and rapid expansion into emerging economies where culinary exploration is rapidly gaining momentum. However, the market faces constraints related to volatile raw material costs and challenges in maintaining batch-to-batch flavor consistency across large, international supply chains, requiring sophisticated operational strategies to mitigate these risks.

Primary drivers fueling the market include the significant exposure provided by international travel, culinary media, and social platforms, which have popularized gourmet and specialty chili oil as a lifestyle product rather than merely a traditional condiment. This normalization of high heat and complex spice profiles among general consumers accelerates adoption across North American and European households. Furthermore, the growing trend of home cooking, amplified globally, encourages experimentation with unique ingredients. Chili oil, offering an easy way to achieve gourmet flavor depth, is highly valued by consumers seeking convenient solutions for elevating standard meals. This demand for premium, yet accessible, flavor innovation ensures sustained market dynamism, especially as manufacturers explore unique chili varieties like ghost peppers or specific heritage chilies.

Conversely, the market growth is moderately restrained by the inherent volatility in the cost and quality of chili peppers, which constitute the primary raw material. Environmental factors such as unpredictable weather patterns severely impact global harvests, leading to fluctuating prices and inconsistency in pungency levels (Scoville units), posing a significant challenge for standardized global production. Furthermore, intense competition from localized artisan producers, particularly in Asian markets, necessitates constant innovation and robust intellectual property protection for proprietary recipes. Regulatory hurdles in international trade related to food labeling, additive restrictions, and import standards also impose compliance costs, slowing down the pace of global expansion for smaller specialized brands.

The overarching impact forces driving strategic direction include the shift toward sustainable and ethical sourcing practices (social impact force), compelling manufacturers to invest in transparent supply chains and fair-trade sourcing for specialty chilies and oils. Technological forces (such as AI in quality control) push for greater consistency and production efficiency. Economically, the rise of the middle class in emerging Asian markets and Latin America expands the consumer base capable of affording premium gourmet condiments. Successful companies are capitalizing on the opportunity presented by health and wellness trends by developing chili oils with reduced sodium, lower saturated fat content, or incorporating functional ingredients known for anti-inflammatory properties, thus capturing the niche market of health-conscious food enthusiasts.

Segmentation Analysis

The Chili Oil Market is comprehensively segmented based on Type, Application, and Distribution Channel, reflecting the diverse product landscape and varied consumer usage patterns globally. Segmentation by Type identifies distinct variations, such as traditional Sichuan-style (known for the inclusion of numbing Sichuan peppercorns), crispy chili oil (characterized by textural elements like fried garlic and shallots), and pure infused hot oil. This segmentation is crucial as flavor profile and texture are the primary determinants for consumer purchase decisions, driving manufacturers to specialize in specific regional styles or ingredient combinations to create differentiation. Understanding these sub-segments allows for targeted product development and marketing efforts aligned with regional culinary preferences.

The segmentation by Application distinguishes between Household consumption and Commercial (Food Service) use, where the Commercial sector, encompassing restaurants, quick-service eateries, and industrial food processing, accounts for a substantial and rapidly growing share. Food service providers often purchase chili oil in bulk institutional formats, prioritizing cost-effectiveness, consistency, and stability for large-scale operations. Conversely, the Household segment prioritizes convenience, premium ingredients, and unique flavor profiles packaged in attractive, smaller retail formats. This duality in demand requires distinct product development and pricing strategies tailored to the specific needs of these end-user groups.

Distribution Channel analysis reveals the structural evolution of product accessibility, with Supermarkets/Hypermarkets dominating traditional retail sales, offering high visibility and immediate consumer access. However, the rapid expansion of the Online/E-commerce channel is transforming the market, providing a platform for niche, international, and small-batch artisan brands to bypass traditional gatekeepers and reach global consumers efficiently. This channel is particularly vital for premium and specialty products, allowing consumers to explore a wider range of exotic chili oil variations, thereby accelerating market fragmentation and specialization across the value chain.

- Type:

- Sichuan-Style Chili Oil

- Crispy Chili Oil (Chili Crisp)

- Hot Infused Oil (Pure Oil Base)

- Lao Gan Ma Style (Fermented Soybean/Nut Inclusion)

- Application:

- Household/Retail

- Commercial/Food Service

- Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Specialty Food Stores

Value Chain Analysis For Chili Oil Market

The value chain of the Chili Oil Market begins with the upstream procurement of essential raw materials, primarily specialized chili peppers (e.g., facing heaven peppers, cayenne, gochugaru), high-quality cooking oils (soybean, rapeseed, sesame, or peanut oil), and aromatic ingredients such as garlic, ginger, and various spices. Upstream activities are critical for determining the final product's quality, flavor profile, and cost structure. Due to the reliance on agricultural commodities, supplier selection focuses heavily on geographical sourcing, seasonality, and establishing long-term contracts to mitigate price fluctuations and ensure consistent supply volume. Effective quality checks at this stage are paramount, particularly assessing the Scoville heat units and cleanliness of the chili peppers.

Midstream activities involve processing and manufacturing, where the raw materials undergo rigorous preparation, including drying, grinding, frying, and oil infusion. This stage utilizes specialized equipment for precise temperature control during the slow infusion process, which is essential for extracting and preserving the aromatic compounds and heat of the chilies without burning the oil. Key technological processes include controlled roasting of chili flakes and the infusion of various additives to enhance shelf life and stability. The midstream value addition is significant, transforming basic commodities into a finished gourmet product with a distinct brand identity and proprietary recipe formulation.

The downstream component involves distribution and sales, covering both direct and indirect channels. Indirect distribution, leveraging Supermarkets, Hypermarkets, and established Food Service distributors, allows for high volume throughput and broad market penetration. Direct channels, primarily through e-commerce platforms and brand-owned online stores, facilitate greater control over pricing, branding, and direct consumer engagement, particularly for premium or niche artisan brands. Final sales are driven by targeted marketing campaigns that emphasize the product's versatility and unique flavor profile, targeting both cooking enthusiasts and consumers seeking convenient, high-quality flavor boosters.

Chili Oil Market Potential Customers

Potential customers for the Chili Oil Market are broadly categorized into two major segments: the End-User/Household segment and the Commercial/Food Service sector. The household consumer base is highly diversified, encompassing young, adventurous millennials and Gen Z consumers who actively seek out global food trends and spicy condiments, often using chili oil as a finishing touch or dipping sauce. This segment values premiumization, authentic regional flavors, and convenient packaging. These consumers are frequently influenced by social media food content and tend to experiment with different varieties, such as Sichuan crispy oil, over traditional pure hot sauce alternatives, positioning them as key drivers for new flavor adoption.

A second significant demographic within the household segment includes culinary enthusiasts and dedicated home cooks who utilize chili oil as a foundational ingredient in complex dishes, requiring bulkier, economical packaging and emphasizing natural ingredients and minimal preservatives. Furthermore, consumers adhering to plant-based or flexitarian diets represent a growing subset of potential customers, as chili oil serves as an ideal savory, umami-rich component to enhance vegetable and grain dishes where meat flavors are absent. Marketing efforts targeted toward this group often highlight the oil's natural ingredient profile and versatility in vegetarian cooking.

The Commercial sector represents institutional demand, including Asian restaurants (especially those specializing in noodles, dumplings, and street food), fast-casual dining chains, and large industrial food processors (e.g., manufacturers of frozen meals, instant noodles, and ready-to-eat salads). For the Commercial buyer, reliability, consistent heat level, bulk pricing, and compliance with high food safety standards are the primary purchasing criteria. These businesses view chili oil as a crucial ingredient for menu differentiation and cost-effective flavor enhancement, making them consistent, high-volume purchasers. Successful penetration into this sector requires robust B2B logistics and stringent quality assurance protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.78 Billion |

| Growth Rate | 8.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lao Gan Ma Special Flavour Foodstuffs Co., Ltd., Lee Kum Kee Company Limited, Kikkoman Corporation, Huy Fong Foods, Inc., McCormick & Company, Inc., Eden Foods, Inc., Mizkan Holdings, Ltd., The Fly By Jing Company, Inc., Momofuku Goods, Trader Joe's Company, B&G Foods, Inc. (Through specialty brands), Tabasco (McIlhenny Company, specialized varieties), S&B Foods Inc., Gochujang brands (CJ CheilJedang, for related products), Tofco International (Japan), Shaanxi Weiyuan Food Co., Ltd., Taiwan Excellence (select brands), KPOP Foods, and various artisanal regional producers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chili Oil Market Key Technology Landscape

The technology landscape governing the production of chili oil has evolved significantly, focusing primarily on achieving flavor stability, batch consistency, and extended shelf life, essential requirements for globalized distribution. A core technology involves precision temperature control systems utilized during the infusion process. This ensures that the chili flakes and aromatic ingredients are heated in the oil at an optimal, low temperature for an extended period—often ranging from 120°C to 150°C—to slowly extract flavor compounds and color without burning the solids, which would introduce bitter notes. Advanced manufacturing facilities now employ automated stirring and mixing apparatus integrated with digital sensors to maintain exact thermal profiles, drastically reducing human error and guaranteeing uniformity in flavor complexity and heat level across mass production batches.

Furthermore, packaging and preservation technologies play a crucial role in maintaining the quality of chili oil, which is susceptible to oxidative rancidity due to its high fat content. Modified Atmosphere Packaging (MAP) techniques, coupled with nitrogen flushing prior to sealing, are increasingly adopted to displace oxygen and significantly slow down the oxidation process, thereby extending the product’s freshness and flavor integrity on the shelf. The use of natural antioxidants, such as rosemary extract or tocopherols, integrated early in the formulation process, is another key technological approach, addressing consumer demand for clean-label products by replacing traditional synthetic preservatives while enhancing product stability.

In the preparation phase, advanced particle size reduction and separation technologies are employed to achieve the desired texture, particularly for the highly popular crispy chili oil variants. Sophisticated vacuum frying technology is used to prepare the crunchy inclusions (garlic, shallots, sesame seeds) at lower temperatures, minimizing oil absorption and preserving the crisp texture, which is critical for consumer sensory appeal. Quality control leverages spectroscopic analysis and high-performance liquid chromatography (HPLC) to accurately measure capsaicinoid content, ensuring that the finished product adheres strictly to the stated Scoville unit claim or established internal heat standards, a vital aspect for maintaining consumer trust and brand consistency in a market driven by spice intensity.

Regional Highlights

The global Chili Oil Market exhibits pronounced regional variations in consumption patterns, local production methods, and growth trajectory. Asia Pacific (APAC) stands as the undisputed market leader, not only in terms of volume consumption but also in manufacturing innovation and tradition. Countries such as China, South Korea, and Japan boast long-standing culinary traditions centered around chili oil, resulting in a mature yet highly dynamic market. Chinese consumers, in particular, drive the demand for Sichuan-style and chili crisp (like the iconic Lao Gan Ma brand), viewing the product as a daily staple. The region benefits from robust local supply chains for specialized chili peppers and efficient processing infrastructure, sustaining its dominant market share and acting as the global benchmark for flavor authenticity.

North America is recognized as the fastest-growing region, displaying substantial year-over-year market expansion. This growth is predominantly fueled by rapid cultural integration, high consumer spending power, and strong influence from social media and culinary globalization, which has propelled previously niche Asian condiments into mainstream grocery stores. American consumers are increasingly seeking complex, umami-rich flavors, driving demand for premium, artisan, and internationally sourced chili oils. The market in this region is characterized by high levels of product diversification, including fusion flavors and innovative packaging tailored to the fast-paced Western lifestyle, with strong performance noted particularly in the e-commerce segment.

Europe represents a burgeoning market, characterized by sophisticated and ingredient-conscious consumers. While the adoption rate historically lagged behind North America, the increasing popularity of Korean and Japanese cuisine, coupled with a growing preference for specialty gourmet items, is accelerating consumption. Western European countries, including the UK, Germany, and France, show strong potential, especially for products marketed with clear provenance, organic certifications, and sustainable sourcing narratives. Manufacturers entering the European market must navigate complex EU food regulations, focusing heavily on clear allergen labeling and compliance with strict additive policies, which influence both formulation and distribution strategies within the continent.

- Asia Pacific (APAC): Market leader and primary consumption hub; deep traditional usage; high growth driven by China, South Korea, and Southeast Asia; focus on authentic, regional varieties.

- North America: Fastest-growing market; high adoption rate due to globalization and food trends; strong demand for premium and artisanal crispy chili oil variants; e-commerce is a critical distribution channel.

- Europe: Emerging high-potential market; demand driven by gourmet segment and cultural integration of Asian cuisine; preference for clean-label and sustainably sourced products.

- Latin America and MEA (Middle East & Africa): Nascent markets showing gradual growth, often influenced by population demographics and growing accessibility through international retail chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chili Oil Market.- Lao Gan Ma Special Flavour Foodstuffs Co., Ltd.

- Lee Kum Kee Company Limited

- Kikkoman Corporation

- Huy Fong Foods, Inc.

- McCormick & Company, Inc.

- The Fly By Jing Company, Inc.

- Momofuku Goods

- S&B Foods Inc.

- Eden Foods, Inc.

- Mizkan Holdings, Ltd.

- Trader Joe's Company (Private Label Influence)

- CJ CheilJedang (Through associated specialty condiments)

- B&G Foods, Inc.

- Tofco International

- Shaanxi Weiyuan Food Co., Ltd.

- KPOP Foods

- McIlhenny Company (Tabasco Brand Extension)

- Thai Taste

- House Foods Group Inc.

- Wing Yip

Frequently Asked Questions

Analyze common user questions about the Chili Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Chili Oil Market?

The Chili Oil Market is projected to experience robust growth, anticipating a Compound Annual Growth Rate (CAGR) of 8.6% between the forecast years of 2026 and 2033, driven by global consumption of Asian condiments.

Which geographical region dominates the global Chili Oil Market?

Asia Pacific (APAC), particularly China, South Korea, and Japan, dominates the global market share due to the deep-rooted culinary traditions and high volume of production and consumption in these regions.

What is Crispy Chili Oil and why is it a key market trend?

Crispy Chili Oil (Chili Crisp) is a popular product type valued for its textural components, typically containing crunchy inclusions like fried garlic, shallots, or soybeans, enhancing the overall sensory experience and driving premium market growth.

How is Artificial Intelligence (AI) impacting the Chili Oil industry?

AI is primarily used for precision flavor mapping based on consumer trends, optimizing complex ingredient supply chains, and implementing automated quality control systems to ensure consistent heat and flavor profiles across batches.

What are the main segments driving commercial consumption of chili oil?

The Commercial/Food Service application segment is a key growth driver, where restaurants, quick-service eateries, and food processors utilize bulk chili oil for menu differentiation, flavor enhancement, and efficient preparation of global cuisine items.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager