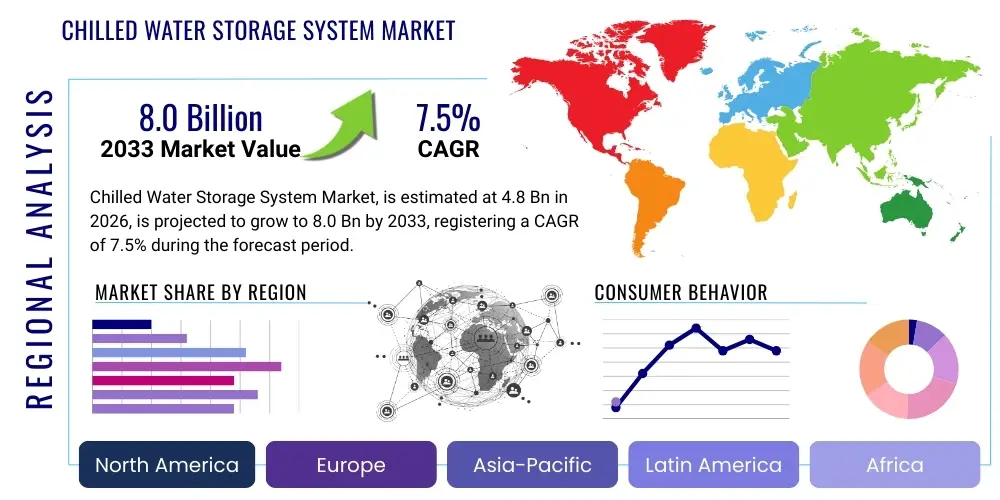

Chilled Water Storage System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441014 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Chilled Water Storage System Market Size

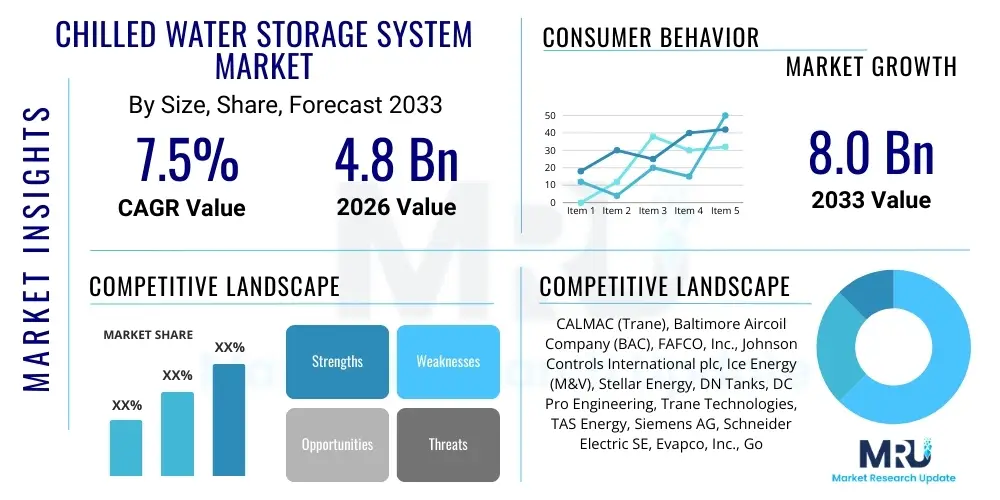

The Chilled Water Storage System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Chilled Water Storage System Market introduction

Chilled Water Storage (CWS) Systems, often referred to as Thermal Energy Storage (TES) systems utilizing sensible heat of water, are sophisticated HVAC solutions designed to shift the electrical demand required for cooling from peak daytime hours to off-peak periods, typically nighttime. This process involves using chillers during low-cost energy hours to produce chilled water, which is then stored in large, insulated tanks for subsequent use during high-demand cooling periods. The stored chilled water is circulated through the building’s cooling system when required, allowing the primary chillers to be shut down or run at reduced capacity during peak utility rate times. This load shifting capability significantly enhances operational efficiency, reduces energy expenditures, and minimizes the overall carbon footprint of large commercial, industrial, and institutional facilities.

The core product encompasses the entire installation, including high-capacity chillers optimized for off-peak operation, large thermal storage tanks (which can be concrete, steel, or fiberglass), advanced pumping and piping infrastructure, heat exchangers, and sophisticated controls that manage charging and discharging cycles based on building load and utility rates. These systems are predominantly utilized in environments requiring massive, continuous cooling capacity, where peak demand charges constitute a substantial portion of the facility’s operating budget. The implementation of CWS systems allows for the downsizing of chiller plants because the cooling load can be met by both the chiller (if running) and the stored energy, resulting in lower initial capital expenditure on cooling machinery.

Major applications of Chilled Water Storage Systems span diverse sectors. Key applications include large commercial office buildings, educational institutions, government facilities, hospitals and healthcare complexes, massive data centers, and specialized industrial processes such as pharmaceuticals and food processing. The primary benefits driving adoption are substantial energy cost savings realized through peak shaving, enhanced system reliability due to reserve cooling capacity, and flexibility in utility management. Furthermore, many regions offer financial incentives and regulatory mandates supporting the integration of thermal energy storage technologies, positioning them as critical components in modern, sustainable infrastructure development.

Chilled Water Storage System Market Executive Summary

The Chilled Water Storage System Market is experiencing robust growth driven primarily by escalating global energy costs and increasing mandates for sustainability and building efficiency across developed and emerging economies. Key business trends point toward greater integration of smart control systems utilizing predictive analytics and machine learning to optimize charge and discharge cycles, maximizing utility savings and system performance. There is a notable industry shift towards modular and prefabricated tank designs, which significantly reduce installation time and complexity, thereby making CWS solutions more accessible to a broader range of mid-sized commercial enterprises. Furthermore, partnerships between utility companies and CWS providers are becoming common, emphasizing demand response programs that financially reward facilities for utilizing stored energy during critical grid stress periods, thus solidifying the utility sector as a major market driver.

Regionally, the market dynamics show distinct variations. Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by rapid urbanization, massive infrastructure projects, particularly in the data center and commercial real estate sectors in nations like China, India, and Southeast Asian countries, coupled with severe energy shortages driving demand for load management solutions. North America and Europe, while mature markets, continue to grow steadily, largely driven by regulatory compliance regarding energy consumption, the modernization of aging district cooling infrastructure, and significant governmental incentives aimed at decarbonization. The Middle East and Africa (MEA) region remains a critical market due to extremely high air conditioning requirements and substantial investments in new smart cities and large-scale commercial developments.

Segment trends highlight the dominance of the commercial building sector, particularly office spaces and retail complexes, as the primary application area, although data centers are rapidly emerging as the fastest-growing segment due to their intensive, 24/7 cooling load requirements. By component, the sophisticated controls and automation segment is expected to see the highest technological advancements and growth, crucial for maximizing the economic return of the storage investment. In terms of storage type, concrete thermal energy storage (CTES) systems remain popular for large, new construction projects due to their longevity and low maintenance, while prefabricated steel tanks gain traction in retrofit and smaller installations requiring faster deployment.

AI Impact Analysis on Chilled Water Storage System Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Chilled Water Storage System market reveals a strong focus on predictive optimization, operational efficiency, and integration with wider smart building ecosystems. Users frequently inquire about how AI can move beyond simple time-of-use scheduling to incorporate real-time data from weather forecasts, building occupancy patterns, local utility pricing fluctuations, and dynamic grid conditions. A significant concern revolves around the accuracy and reliability of AI algorithms in forecasting cooling loads and ensuring the thermal energy storage capacity is optimally managed minute-by-minute, thereby maximizing savings while maintaining occupant comfort. Expectations are high that AI will automate complex decision-making processes, shifting system operation from reactive scheduling to highly precise, proactive energy management, fundamentally changing the role of facility managers in overseeing these complex thermal installations.

The core theme emerging from these inquiries is the desire for AI to unlock the full economic potential of CWS systems, which current conventional controls often fail to achieve due to reliance on static parameters. Users expect AI to seamlessly integrate CWS operations with renewable energy sources and grid-interactive efficient building (GEB) initiatives, making the stored thermal energy a dynamic asset for both the building owner and the utility grid. Furthermore, there is growing interest in using AI for predictive maintenance, identifying subtle performance degradation in chillers, pumps, or tank insulation before system failure occurs, thereby enhancing the reliability which is paramount in critical applications like data centers or hospitals.

Ultimately, the consensus suggests that AI is transforming CWS systems from passive energy-shifting tools into active, intelligent components of the smart grid infrastructure. The impact is anticipated to lead to the development of sophisticated software-as-a-service (SaaS) models that manage CWS assets across multiple geographically dispersed facilities, offering portfolio-level optimization and aggregated demand response capabilities, representing a major technological leap for the entire thermal storage ecosystem.

- AI enables real-time, dynamic charge/discharge scheduling based on predictive load forecasting and fluctuating electricity tariffs.

- Integration of CWS systems into Demand Response (DR) programs is enhanced via AI-driven grid optimization, maximizing utility incentives.

- AI algorithms continuously monitor system component performance, facilitating predictive maintenance and reducing unexpected downtime.

- Machine Learning (ML) improves energy efficiency by accurately balancing thermal capacity against actual cooling needs, minimizing over-chilling.

- AI assists in optimal sizing and design of new CWS installations by analyzing long-term historical and simulated load data.

DRO & Impact Forces Of Chilled Water Storage System Market

The Chilled Water Storage System Market is fundamentally shaped by compelling economic and environmental factors. Key drivers include the critical need for peak load reduction in regions with high time-of-use utility rates, allowing facility owners to arbitrage energy costs by shifting chiller operation to off-peak hours. Regulatory pushes and mandatory energy efficiency standards globally, coupled with corporate sustainability goals seeking to lower Scope 1 and Scope 2 emissions, further accelerate adoption. The rapid expansion of data center infrastructure, which requires high-reliability, 24/7 cooling, acts as a powerful driver, as CWS systems provide essential redundancy and energy savings. However, the market faces significant restraints, primarily the high initial capital expenditure associated with constructing and installing large, insulated storage tanks and the specialized balance of system components. Furthermore, the substantial physical space requirement for the storage tanks can be prohibitive, especially in dense urban environments or existing facilities seeking retrofitting solutions. The complexity of integrating CWS controls with legacy building management systems (BMS) also poses a technical hurdle for widespread adoption.

Opportunities within the sector are abundant, largely centered around technological innovation and geographic expansion. The development of advanced, smaller footprint storage materials and modular designs presents a major opportunity to overcome space constraints and reduce installation costs, appealing to the massive untapped potential in the retrofit market. The integration of CWS systems with renewable energy generation, particularly solar PV, allows buildings to store excess cooling generated during daytime power surplus for later use, maximizing self-consumption and grid independence. Furthermore, the evolution of sophisticated AI-driven control software transforms CWS systems into assets capable of providing ancillary services to the grid, opening up new revenue streams for facility operators through advanced demand response participation.

The impact forces within the market are predominantly driven by utility regulation and global infrastructure investment. Government incentives, tax credits, and favorable depreciation schedules for energy storage installations act as powerful accelerants. The growing criticality of data center reliability means that facilities prioritize solutions like CWS that offer inherent resilience. Conversely, fluctuations in raw material costs, particularly steel and insulation, exert downward pressure on the profitability of system providers, while the increasing need for highly specialized engineering expertise remains a key barrier to entry for new market players. These forces collectively propel the market toward solutions that are not only energy efficient but also highly customizable and seamlessly integrated into the smart building ecosystem.

Segmentation Analysis

The Chilled Water Storage System Market is comprehensively segmented based on the specific type of storage utilized, the components constituting the overall system, and the diverse applications across various end-user sectors. This granular segmentation is crucial for understanding specific technological preferences, investment patterns, and regional market maturity. The market is primarily divided by storage medium characteristics, system hardware requirements, and the functional cooling demands of different industries, allowing manufacturers and service providers to tailor offerings for maximum market penetration and return on investment.

- By Storage Type:

- Concrete Thermal Energy Storage (CTES)

- Steel Thermal Energy Storage (STES)

- Fiberglass Thermal Energy Storage

- Others (e.g., Plastic Tanks, Hybrid Systems)

- By Component:

- Chillers and Auxiliary Equipment

- Storage Tanks

- Pumps and Piping

- Heat Exchangers

- Control Systems and Automation

- Insulation and Accessories

- By Application:

- Commercial Buildings (Office, Retail, Hospitality)

- Industrial Facilities (Process Cooling, Manufacturing)

- District Cooling Systems

- Healthcare and Educational Institutions

- Data Centers and Telecommunication Facilities

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Chilled Water Storage System Market

The value chain for Chilled Water Storage Systems begins with the upstream suppliers responsible for providing essential raw materials and core components. This segment is dominated by manufacturers of specialized insulation materials (polyurethane, mineral wool), steel producers for tank fabrication, and component manufacturers specializing in high-efficiency chillers, pumps, and valves optimized for thermal storage applications. Procurement of high-quality, durable materials is critical, as the longevity and efficiency of the CWS system directly depend on the reliability of the storage tank structure and the operational performance of the chiller plant. Pricing and supply stability in the steel and chemical (insulation) markets significantly influence the overall system cost and the profit margins of system integrators. Long-term supplier relationships that ensure compliance with strict quality standards for thermal performance and structural integrity are paramount in this initial stage.

The midstream stage involves system design, engineering, integration, and installation. This is where specialized engineering firms and contractors play a pivotal role, translating client cooling requirements and space constraints into optimized CWS designs. The distribution channel typically involves direct sales models for large, bespoke projects (especially district cooling and major data centers) where Original Equipment Manufacturers (OEMs) work directly with end-users and engineering procurement construction (EPC) firms. For smaller, modular, or standardized commercial building retrofits, the channel often includes specialized HVAC distributors or certified mechanical contractors who handle sales, installation, and initial commissioning. The complexity of the integration, particularly the interface between the CWS controls and the existing Building Management System (BMS), necessitates highly skilled technical labor, creating a bottleneck in the rapid scaling of installation services.

The downstream analysis focuses on end-user operation, maintenance, and ongoing optimization. This stage includes long-term service agreements (LSAs) for periodic maintenance of chillers and pumps, thermal performance verification, and software updates for the control systems, often provided by the system integrator or specialized third-party service providers. Indirect channels gain prominence here, as utility companies increasingly partner with CWS operators to run demand response programs, effectively monetizing the stored thermal energy as a grid asset. Customer satisfaction is heavily reliant on the system’s ability to consistently deliver guaranteed energy cost savings and maintain comfort levels, driving demand for advanced monitoring and remote diagnostic services, ensuring the continuous economic viability of the initial investment.

Chilled Water Storage System Market Potential Customers

The primary purchasers of Chilled Water Storage Systems are entities characterized by high, consistent cooling loads, sensitivity to peak energy costs, and stringent requirements for cooling reliability. The most substantial segment of end-users includes owners and operators of large-scale commercial real estate, encompassing corporate headquarters, high-rise office towers, and expansive retail and hospitality complexes. These entities are heavily motivated by the opportunity to significantly reduce monthly operational expenditures associated with cooling, capitalizing on time-of-use utility rates which often make cooling during peak daytime hours extremely expensive. The long payback periods associated with these energy savings are typically justified by the scale of the facility and the long operational life of the thermal storage infrastructure.

Another crucial customer segment is the infrastructure sector, particularly district cooling providers and public utilities. District cooling schemes rely on large centralized plants serving multiple buildings, and the integration of CWS allows these plants to optimize capacity utilization, defer costly infrastructure upgrades, and enhance system resilience across the entire network. Furthermore, governments and municipalities procuring cooling solutions for large public facilities like airports, convention centers, and military bases are strong potential customers, often mandating CWS incorporation to meet public sustainability goals and demonstrate efficient taxpayer resource management. Reliability is a non-negotiable factor for these institutional clients, making the inherent redundancy provided by stored cooling energy highly attractive.

The fastest-growing and most technologically advanced customer base comprises data centers and healthcare facilities (hospitals and specialized laboratories). Data centers demand absolute cooling uptime (N+1 or greater redundancy) to prevent catastrophic financial loss from server overheating, making the CWS system's ability to act as a thermal buffer in case of mechanical or electrical failure invaluable. Similarly, hospitals require precise climate control for patient care and sensitive medical equipment, ensuring continuous operation regardless of electrical grid conditions. These mission-critical users prioritize system resilience and redundancy above all else, often justifying a higher initial capital outlay for specialized, high-performance CWS installations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CALMAC (Trane), Baltimore Aircoil Company (BAC), FAFCO, Inc., Johnson Controls International plc, Ice Energy (M&V), Stellar Energy, DN Tanks, DC Pro Engineering, Trane Technologies, TAS Energy, Siemens AG, Schneider Electric SE, Evapco, Inc., Goss Engineering, Inc., CIMCO Refrigeration, Arctic Coolings, Thermal Energy Storage Systems, Inc. (TES Systems), Cryogel, Burns & McDonnell, and Daikin Industries, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chilled Water Storage System Market Key Technology Landscape

The Chilled Water Storage System market relies on mature thermodynamic principles but its technological evolution is concentrated heavily on material science and digital control optimization. The primary technological focus remains on improving the efficiency of the thermal transfer process and minimizing standby losses. Advances in storage tank construction materials, particularly in high-density polyethylene (HDPE) liners and specialized fiberglass or pre-stressed concrete, aim to enhance structural longevity while improving the insulation’s R-value, thereby maximizing the amount of cooling energy retained over extended periods. Furthermore, the development of specialized nozzles and diffusers within the tanks is crucial for maintaining sharp thermal stratification—the separation of cold and warm water—which is essential for high operational efficiency. Poor stratification results in mixing and a lower effective storage capacity, thus technological improvements in diffuser design are central to maximizing the cost-effectiveness of CWS installations.

Beyond the physical structure, the most transformative technologies lie in the advanced control systems. Current systems are transitioning rapidly from basic time-clock scheduling to sophisticated optimization algorithms. These modern control platforms integrate real-time data feeds from utility grids (dynamic pricing signals), weather forecasts, and building occupancy sensors to predict future cooling loads and automatically adjust the charge/discharge cycles. The utilization of IoT sensors provides granular data on chiller performance and tank stratification levels, feeding into cloud-based analytics platforms. This technological shift enables CWS systems to participate actively in utility demand response programs, maximizing financial incentives while ensuring seamless integration with other building energy assets such as solar panels and battery storage systems, positioning the CWS as a component of a holistic, grid-interactive energy ecosystem.

Specific hardware innovations include the increased adoption of highly efficient variable refrigerant flow (VRF) and magnetic bearing centrifugal chillers, which can operate effectively over a wider range of load conditions, making them ideal for the cyclic nature of thermal storage charging. Furthermore, modular and prefabricated CWS units, often utilizing steel or factory-made concrete sections, are gaining significant traction. These modular solutions drastically reduce the complexity and duration of on-site construction, overcoming one of the major barriers to adoption, particularly in retrofit and constrained urban sites. Research is also continuing into advanced phase change materials (PCMs) that could theoretically reduce the tank volume required to store a given amount of energy, though chilled water (sensible heat) remains the dominant medium due to its cost-effectiveness and operational simplicity.

Regional Highlights

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by massive investment in data center infrastructure across China, Singapore, and India, coupled with rapid commercial building construction and significant government efforts to mitigate grid instability during peak summer months.

- North America: A mature but highly competitive market driven primarily by high time-of-use (TOU) utility rates in states like California and New York, making peak shaving economically essential. Strong growth is seen in district cooling modernization and robust regulatory incentives supporting energy storage deployment.

- Europe: Growth is primarily driven by stringent decarbonization targets and the expansion of efficient district heating and cooling networks across countries such as Germany, the UK, and Scandinavian nations. Emphasis is placed on integrating CWS with renewable energy systems to achieve near-zero energy building (NZEB) standards.

- Middle East and Africa (MEA): Critical market due to extreme cooling requirements. Major projects in the GCC nations (UAE, Saudi Arabia) related to smart cities (e.g., NEOM) and large-scale commercial developments mandate CWS systems to manage colossal energy consumption and ensure resilience during high-temperature events.

- Latin America (LATAM): An emerging market experiencing incremental growth driven by increased industrialization and urbanization. Adoption is slower due to varied utility structures but shows promise in highly industrialized areas like Brazil and Mexico seeking operational cost efficiencies in large manufacturing plants.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chilled Water Storage System Market.- CALMAC (Trane)

- Baltimore Aircoil Company (BAC)

- FAFCO, Inc.

- Johnson Controls International plc

- Ice Energy (M&V)

- Stellar Energy

- DN Tanks

- DC Pro Engineering

- Trane Technologies

- TAS Energy

- Siemens AG

- Schneider Electric SE

- Evapco, Inc.

- Goss Engineering, Inc.

- CIMCO Refrigeration

- Arctic Coolings

- Thermal Energy Storage Systems, Inc. (TES Systems)

- Cryogel

- Burns & McDonnell

- Daikin Industries, Ltd.

Frequently Asked Questions

Analyze common user questions about the Chilled Water Storage System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary financial benefit of installing a Chilled Water Storage System?

The primary financial benefit is achieved through energy cost reduction by shifting the operation of high-energy chillers from expensive peak daytime hours (peak shaving) to lower-cost off-peak or nighttime hours, capitalizing on time-of-use (TOU) utility tariffs.

How does AI technology enhance the performance of Chilled Water Storage Systems?

AI significantly enhances performance by utilizing predictive analytics to forecast cooling loads based on weather and occupancy, enabling dynamic, optimized control of charge and discharge cycles in real-time to maximize efficiency and participation in grid demand response programs.

What are the key differences between Concrete (CTES) and Steel (STES) Thermal Energy Storage?

Concrete (CTES) tanks offer greater durability and longevity, often preferred for new, large-scale district cooling projects due to lower maintenance. Steel (STES) tanks are typically used in smaller, modular, or retrofit applications where rapid installation and prefabricated design are prioritized over maximum system scale.

Is Chilled Water Storage suitable for data centers, and what is the main driver for adoption in this sector?

Yes, CWS is highly suitable for data centers. The main driver is cooling reliability and redundancy; the stored chilled water acts as a critical thermal buffer, ensuring continuous cooling and preventing catastrophic hardware failure during unexpected electrical or mechanical outages.

What is the typical lifespan and return on investment (ROI) period for a CWS installation?

Chilled water storage tanks often have an operational lifespan exceeding 40 years, while the chillers and auxiliary equipment typically last 15-20 years. The ROI period varies widely based on regional electricity costs and system scale but commonly ranges from 3 to 7 years due to substantial peak-demand savings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager