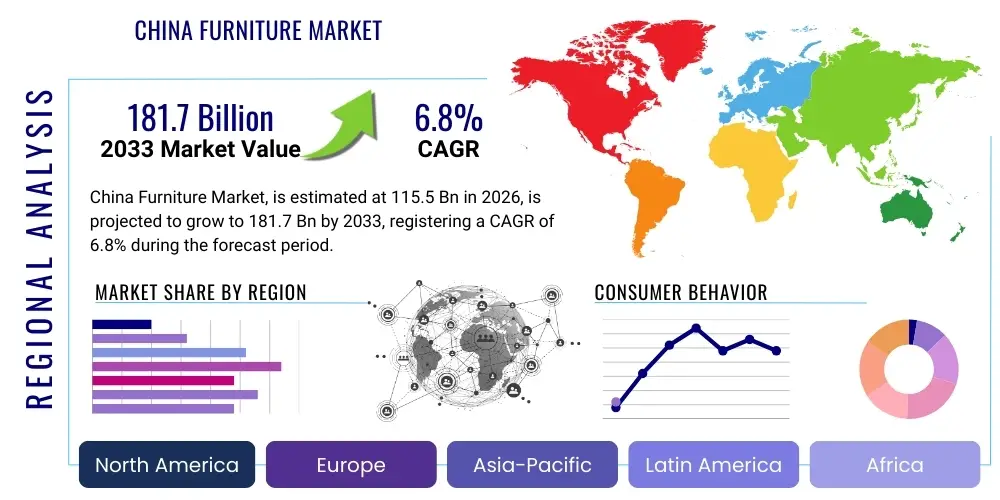

China Furniture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441202 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

China Furniture Market Size

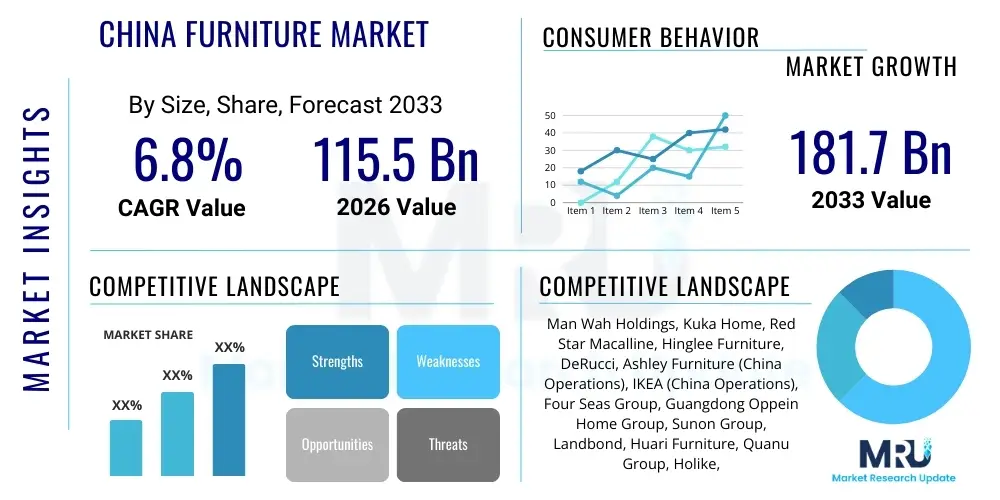

The China Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 115.5 Billion in 2026 and is projected to reach USD 181.7 Billion by the end of the forecast period in 2033.

China Furniture Market introduction

The China Furniture Market is one of the world's largest and most dynamic, fundamentally driven by rapid urbanization, significant growth in the middle-class population, and consistent governmental investment in real estate and infrastructure development. The primary product scope encompasses residential, commercial, and outdoor furniture, ranging from traditional solid wood pieces to highly advanced smart and modular solutions. Consumers are increasingly prioritizing quality, aesthetic design, and environmental sustainability, moving away from purely functional purchases toward lifestyle investments.

Major applications for furniture span across newly constructed residential complexes, renovations, commercial office spaces adapting to hybrid work models, and expansion within the hospitality and healthcare sectors. The shifting demographic profile, characterized by smaller family units and younger professionals, fuels demand for space-saving, multifunctional furniture designed specifically for compact urban living. This demand has catalyzed product innovation, particularly in ready-to-assemble (RTA) and customized furniture segments, offering unprecedented levels of personalization and efficient use of space, thereby boosting overall market valuation.

Key benefits derived from this market expansion include improved quality of living standards, enhanced productivity in commercial settings, and the development of a highly integrated digital supply chain that reduces delivery times and increases consumer choice. Driving factors prominently include supportive government policies focused on boosting domestic consumption, the seamless integration of online-to-offline (O2O) retail strategies, and technological advancements allowing for mass customization at competitive prices. Furthermore, the push for smart homes and interconnected living spaces has made intelligent furniture a significant growth vector.

China Furniture Market Executive Summary

The China Furniture Market is experiencing profound structural changes, driven by digital transformation and a strong emphasis on brand differentiation and sustainability. Business trends indicate a consolidation among top-tier manufacturers who are leveraging sophisticated digital tools for inventory management, design, and direct customer engagement, moving away from reliance solely on large, conventional retail chains. The increasing adoption of the direct-to-consumer (D2C) model, facilitated by powerful domestic e-commerce platforms like Tmall and JD.com, allows brands greater control over pricing and customer experience, while also intensifying competitive pressures on legacy retailers.

Regionally, while Tier 1 cities (Beijing, Shanghai, Shenzhen) remain core centers for high-value and luxury furniture consumption, the highest growth rates are now emanating from Tier 2 and Tier 3 cities. This expansion is supported by infrastructure improvements and rising disposable incomes in inland provinces, creating vast, untapped markets for mid-range and customized residential furnishings. Western and central China are becoming crucial logistical hubs, requiring furniture manufacturers to optimize their decentralized supply chains to meet localized demand efficiently. Government initiatives focusing on urban renewal and affordable housing continue to underpin regional growth stability.

Segmentation trends highlight a notable shift toward premiumization within the residential sector, with solid wood and upholstered furniture incorporating advanced materials showing significant uptake. The commercial furniture segment is witnessing a surge due to investments in flexible office solutions, co-working spaces, and smart meeting technology integration. In terms of materials, engineered wood (particleboard and MDF) continues to dominate due to cost-effectiveness, but sustainable and eco-friendly materials, certified under stringent national standards, are quickly gaining market share as consumer environmental consciousness rises. The service segment, particularly interior design consultation and installation services, is emerging as a critical value-added component in the overall purchasing journey.

AI Impact Analysis on China Furniture Market

Common user questions regarding AI’s influence in the China Furniture Market center primarily on how Artificial Intelligence facilitates personalized design, optimizes complex logistics for customized orders, and enhances the smart home experience. Users are keen to understand the efficiency gains achievable through AI-driven factory floor automation, predictive maintenance, and quality control systems that reduce waste and production costs. Furthermore, there is significant interest in AI-powered virtual staging and augmented reality (AR) applications that allow consumers to visualize furniture within their own living spaces before purchase, addressing concerns about fit and aesthetic compatibility in the highly competitive digital retail environment. The core theme is the expectation that AI will deliver faster, cheaper, and profoundly more personalized furniture solutions while simplifying the entire purchasing and manufacturing process.

The integration of AI technologies is fundamentally transforming the design and manufacturing lifecycle. In design, machine learning algorithms analyze vast datasets of consumer preferences, spatial dimensions, and successful historical designs to generate optimized, customized blueprints instantly. This drastically cuts down the traditional R&D cycle. On the manufacturing side, AI drives Industry 4.0 applications, utilizing sensors and data analytics to manage material consumption, schedule production lines dynamically, and ensure precise cutting and assembly, minimizing human error and maximizing material yield in high-volume production centers located in regions like Guangdong and Zhejiang. This predictive capability is crucial for managing the complex specifications inherent in the mass customization model prevalent in China.

In the consumer-facing domain, AI enhances e-commerce platforms through sophisticated recommendation engines and conversational AI chatbots that provide instantaneous customer support, guiding users through complex product catalogs and configuration options. For smart furniture, AI acts as the control layer, enabling connectivity, energy management, and personalized adjustments (e.g., automatically adjusting desk height or lighting intensity based on user presence and activity). This move towards intelligent furniture not only adds premium value but also deepens customer loyalty by offering a seamlessly integrated lifestyle experience, positioning Chinese manufacturers competitively against global peers who are also rapidly adopting smart technology standards.

- AI optimizes supply chain logistics and inventory management for customized furniture orders.

- Generative design AI accelerates product development by creating personalized furniture blueprints.

- AI-driven automation enhances precision manufacturing, reducing production errors and material waste.

- Machine learning algorithms power advanced e-commerce recommendation systems and virtual design consultation tools.

- AI forms the core operational intelligence for smart furniture, managing connectivity, energy, and user-specific configurations.

- Predictive maintenance using AI minimizes downtime on high-volume production lines.

- AI assists in trend forecasting, enabling manufacturers to rapidly adapt product portfolios to changing consumer aesthetics.

DRO & Impact Forces Of China Furniture Market

The China Furniture Market is currently shaped by a robust balance of driving forces (D), powerful restraints (R), and compelling opportunities (O), creating significant impact forces (I) on strategic decision-making. The primary driver remains the massive scale of ongoing urbanization and the continuous expansion of the Chinese middle class, which provides an ever-growing consumer base with increased purchasing power and a demand for higher quality, design-centric products. Opportunities are particularly pronounced in the digital sphere, including the expansion of cross-border e-commerce for export, the penetration of smart home systems, and the implementation of sustainable manufacturing practices that appeal to both domestic and international markets. Navigating these factors requires manufacturers to invest heavily in digitalization and supply chain resilience.

Restraints primarily revolve around escalating costs associated with raw materials, particularly timber, which is heavily reliant on international imports, making the supply chain vulnerable to geopolitical and trade fluctuations. Furthermore, stringent environmental regulations enforced by the central government necessitate high capital expenditure for compliance, especially concerning formaldehyde emissions and waste management, disproportionately affecting smaller, non-compliant manufacturers. The highly fragmented nature of the local market, despite recent consolidation, also maintains intense price competition, pressuring profit margins for established brands attempting to premiumize their offerings, creating complex market dynamics that require cautious strategic maneuvers.

The impact forces generated by these dynamics are shifting the market structure toward specialization and technological differentiation. Manufacturers that successfully integrate Industry 4.0 principles, such as mass customization enabled by advanced robotics and AI, are gaining substantial competitive advantage. The dual pressure of consumer demand for sustainability and governmental regulation is forcing a rapid transition to eco-friendly materials and circular economy models. These forces ensure that only companies capable of navigating high operational costs while simultaneously innovating their product portfolio and distribution channels (O2O integration) will achieve sustainable long-term growth and market dominance in the coming forecast period.

Segmentation Analysis

The China Furniture Market is extensively segmented across Product Type, Material, Application, and Distribution Channel, reflecting the diverse needs of the world’s largest consumer base. Segmentation by Product Type is essential, differentiating between Residential Furniture (which holds the majority share, including bedding, seating, and storage) and Commercial Furniture (focusing on office, hospitality, and institutional uses). Material segmentation highlights the dominance of wood (solid and engineered), alongside growing segments like metal, plastic, and increasingly, innovative composite materials used in outdoor and specialized applications, with sustainability metrics heavily influencing consumer choice across all material types.

Application segmentation delineates the end-users, distinguishing between New Construction projects and Renovation/Replacement demand, with the latter showing stable growth particularly in mature Tier 1 cities. The pivotal segmentation driving modern trends is the Distribution Channel, which has fundamentally transformed the market landscape. Traditional brick-and-mortar stores and franchised outlets still command substantial sales volume, especially for high-value items requiring physical inspection. However, the exponential rise of Online Channels, including proprietary e-commerce sites and third-party marketplaces, offers convenience, competitive pricing, and a vast array of niche products, increasingly making the O2O model the definitive standard for market success and expanded geographical reach across China.

- By Product Type:

- Residential Furniture (Seating, Tables, Storage Units, Beds, Accessories)

- Commercial Furniture (Office Furniture, Hospitality Furniture, Institutional Furniture, Healthcare Furniture)

- Outdoor Furniture

- By Material:

- Wood Furniture (Solid Wood, Engineered Wood/MDF/Plywood)

- Metal Furniture (Steel, Aluminum)

- Plastic/Polymer Furniture

- Glass/Ceramic Furniture

- Upholstered Furniture (Leather, Fabric)

- By Application:

- New Residential Construction

- Renovation and Replacement

- Commercial Real Estate Development

- By Distribution Channel:

- Offline (Specialty Stores, Department Stores, Direct Sales)

- Online (E-commerce Platforms, Brand Websites, Mobile Applications)

Value Chain Analysis For China Furniture Market

The value chain for the China Furniture Market is characterized by highly interconnected yet geographically concentrated phases, beginning with Raw Material Sourcing. China relies heavily on global imports for quality timber, impacting upstream cost volatility. The sourcing phase is followed by primary processing, often done near forestry reserves or ports, before materials are shipped to major manufacturing clusters. The inherent challenge at this stage is managing sustainable sourcing certifications and navigating complex international trade tariffs, which significantly influence final product pricing and supply stability.

The crucial Manufacturing and Assembly stage is geographically concentrated in industrial hubs like Guangdong (known for export-oriented production and sophisticated design) and Zhejiang (recognized for mass production efficiency). This stage involves complex operations, ranging from manual craftsmanship for solid wood to high-tech, automated assembly lines for engineered furniture and RTA products. Midstream focus is on maximizing production efficiency, implementing lean manufacturing techniques, and integrating AI and IoT solutions to handle the increasing volume of customized orders efficiently, thus bridging the gap between mass production and personalized consumer demand.

Downstream activities center on Distribution and Retail, which is transitioning rapidly. Traditional distribution relies on regional wholesalers and franchised retail stores, providing extensive geographical coverage. However, the rise of Direct and Indirect Channels through e-commerce has fundamentally reshaped retail dynamics. Direct channels involve brand-owned online stores and flagship showrooms, offering premium experience control. Indirect channels utilize powerful third-party marketplaces (Alibaba, JD.com), maximizing market reach and leveraging their logistical infrastructure. Successful market penetration necessitates a seamless omnichannel strategy, integrating online inventory with physical showroom experiences to cater to the discerning modern Chinese consumer.

China Furniture Market Potential Customers

The primary end-users and buyers in the China Furniture Market are segmented into residential consumers and commercial entities, each driven by distinct purchasing criteria and volume needs. Within the residential sector, the fastest-growing segment is the Urban Middle Class and Young Professionals (aged 25-40). These consumers, often first-time homeowners or renters in Tier 1 and Tier 2 cities, prioritize multifunctional, modern, and aesthetically pleasing furniture that reflects current design trends. They are highly active in online research, value competitive pricing, and demand efficient, personalized delivery and installation services, making them ideal targets for digitally native furniture brands specializing in customized or modular designs.

Another crucial customer group includes High-Net-Worth Individuals (HNWIs) and affluent families in Tier 1 cities, who constitute the core market for luxury, bespoke, and high-end imported furniture. This segment seeks premium materials (e.g., rare solid woods, high-grade leather), exclusive designs, and impeccable quality, often engaging specialized interior designers and custom workshops. Their purchasing decisions are less price-sensitive and heavily influenced by brand heritage, artisanal craftsmanship, and perceived long-term investment value, driving demand for specialized retail experiences and personalized consultation services focusing on unique, imported collections.

The commercial sector serves as a significant bulk purchaser, predominantly comprising Real Estate Developers (sourcing for new apartment complexes or office buildings), Hospitality Chains (hotels and resorts requiring durable, customized pieces), and Institutional Buyers (schools, hospitals, and government offices). The commercial segment requires compliance with stringent durability and fire safety standards, large-volume capabilities, and reliable long-term after-sales service. With the recent shift toward hybrid work models, commercial buyers are increasingly seeking flexible, ergonomic, and technology-integrated office furniture solutions to adapt to evolving workplace demands, offering a lucrative, high-volume segment for specialized B2B furniture manufacturers focusing on rapid deployment and modular solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Billion |

| Market Forecast in 2033 | USD 181.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Man Wah Holdings, Kuka Home, Red Star Macalline, Hinglee Furniture, DeRucci, Ashley Furniture (China Operations), IKEA (China Operations), Four Seas Group, Guangdong Oppein Home Group, Sunon Group, Landbond, Huari Furniture, Quanu Group, Holike, Suofeiya Home Collection, Zbom Home Collection, Haosen Furniture, TATA Woodwork, Loho Home Furnishing, Gelaimei Furniture. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

China Furniture Market Key Technology Landscape

The China Furniture Market is characterized by rapid technological adoption focused on enhancing manufacturing efficiency and revolutionizing the customer experience. A critical technology is the implementation of Industry 4.0 standards, which involves highly automated production lines utilizing advanced robotics and Computer Numerical Control (CNC) machinery for precision cutting and assembly. This technological shift is essential for handling the complexity inherent in customized furniture orders, allowing manufacturers to maintain high volume while significantly increasing product variety and reducing the time-to-market. Furthermore, integrated Manufacturing Execution Systems (MES) utilize data analytics to optimize workflow, minimize material waste, and ensure stringent quality control across large factory floors.

The rise of the smart home ecosystem has made Internet of Things (IoT) integration a key technological differentiator. Smart furniture incorporates sensors and embedded technology, allowing seamless interaction with centralized home automation systems. Examples include beds that monitor sleep patterns, desks that adjust ergonomically based on user input, and lighting fixtures integrated directly into shelving units. This technological layer transforms furniture from passive objects into active components of a connected lifestyle, driving a premium segment of the market and demanding expertise in both traditional carpentry and software engineering to maintain competitive edge in urban centers.

On the consumer engagement front, Augmented Reality (AR) and Virtual Reality (VR) tools are becoming standard for online and in-store visualization. AR applications allow potential buyers to digitally place furniture models within their own homes using smartphone cameras, addressing a major pain point in online furniture purchasing regarding scale and aesthetic compatibility. Coupled with sophisticated 3D modeling and rendering software, these tools enhance consumer confidence, reduce return rates, and offer an immersive shopping experience. The convergence of these advanced manufacturing technologies (Industry 4.0) and digital visualization tools (AR/VR) defines the cutting-edge technological landscape within the highly competitive and expansive Chinese furniture industry.

Regional Highlights

The China Furniture Market exhibits profound regional variations in terms of production capability, consumer preferences, and market maturity. The Eastern Coastal regions, including Guangdong, Zhejiang, and Jiangsu, represent the established core of both manufacturing and high-end consumption. Guangdong province, in particular, remains the world’s largest furniture manufacturing base, known for its concentration of skilled labor, advanced supply chain infrastructure, and export-oriented production focused on design and material quality. These regions are characterized by mature e-commerce penetration and a strong demand for luxury, modern, and imported furniture, reflecting higher average disposable incomes and sophisticated urban tastes.

The Central and Northern regions, such as Sichuan, Shandong, and Hebei, are rapidly emerging as significant growth areas driven by accelerated urbanization in Tier 2 and Tier 3 cities and substantial government investment in regional infrastructure. While historically focused on lower-cost or traditional furniture, these regions are now witnessing a surge in demand for mid-range, modular, and customized residential solutions. Logistical challenges are more pronounced here, necessitating investment in localized distribution centers and partnerships with regional retailers, but the expanding consumer base promises robust long-term growth opportunities for national brands seeking market diversification.

The Western and Inland provinces represent the frontier market, currently characterized by lower consumption per capita but possessing immense untapped potential. Government policies promoting the "Go West" strategy and initiatives like the Belt and Road Initiative are driving significant real estate development and infrastructure projects, which fuels demand for commercial and residential furniture. Key focuses in these regions are affordability and functionality, although quality awareness is quickly increasing. Companies entering this market must prioritize efficient logistics networks capable of traversing vast distances while maintaining cost efficiency to successfully capture market share in this developing regional segment.

- Guangdong Province: Dominant manufacturing hub; focus on export quality, design innovation, and high-end luxury furniture consumption.

- Yangtze River Delta (Zhejiang, Jiangsu): Strong production clusters for engineered wood and upholstered furniture; mature market for smart home integration.

- Tier 2 and Tier 3 Cities (Nationwide): Fastest growing consumer segment; high demand for customizable, mid-range, and multifunctional furniture solutions.

- Western China: Emerging market opportunity driven by infrastructure investment and urbanization policies; focus on establishing efficient logistical pathways.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the China Furniture Market.- Man Wah Holdings

- Kuka Home

- Red Star Macalline

- Hinglee Furniture

- DeRucci

- Ashley Furniture (China Operations)

- IKEA (China Operations)

- Four Seas Group

- Guangdong Oppein Home Group

- Sunon Group

- Landbond

- Huari Furniture

- Quanu Group

- Holike

- Suofeiya Home Collection

- Zbom Home Collection

- Haosen Furniture

- TATA Woodwork

- Loho Home Furnishing

- Gelaimei Furniture

Frequently Asked Questions

Analyze common user questions about the China Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the customized furniture segment in China?

The growth in customized furniture is primarily driven by smaller apartment sizes in urban centers, the rising purchasing power of young consumers who demand personalization, and technological advancements like AI and CNC machining that enable cost-effective mass customization, reducing production lead times significantly.

How significant is the shift towards online distribution channels for furniture in China?

The shift is highly significant; online channels, facilitated by major platforms like Alibaba and JD.com, now account for a substantial and rapidly increasing share of furniture sales. E-commerce success hinges on optimized logistics, augmented reality visualization tools, and robust O2O integration, providing convenience and price transparency across vast geographical areas.

What are the primary sustainability challenges facing Chinese furniture manufacturers?

Primary challenges include reliance on imported timber (requiring certified sustainable sourcing), compliance with increasingly strict national environmental regulations regarding volatile organic compound (VOC) emissions, and the management of waste and recycling programs, driving investment in eco-friendly engineered wood and non-toxic finishing materials.

Which material segment holds the largest market share in the Chinese furniture industry?

Wood furniture, specifically engineered wood products like Medium Density Fiberboard (MDF) and particleboard, holds the largest market share due to its versatility, cost-effectiveness, and suitability for mass production of customized and RTA furniture, though solid wood remains highly valued in the luxury residential segment.

How is the commercial furniture segment adapting to new Chinese workplace trends?

The commercial segment is rapidly adapting by investing in ergonomic, modular, and technology-integrated furniture solutions (smart desks, conferencing setups) to support the national transition toward hybrid and flexible work models. Demand is also high from expanding healthcare and institutional sectors requiring durable, high-specification fittings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager