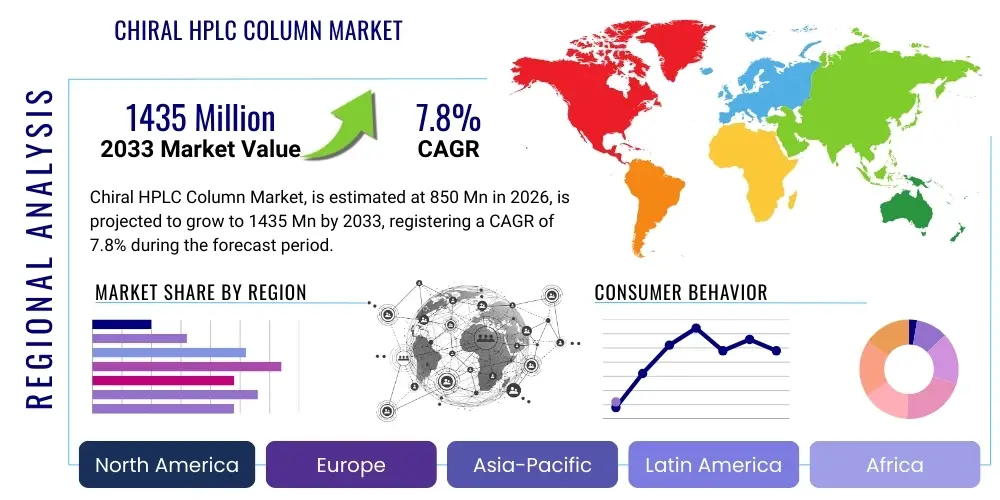

Chiral HPLC Column Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441165 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Chiral HPLC Column Market Size

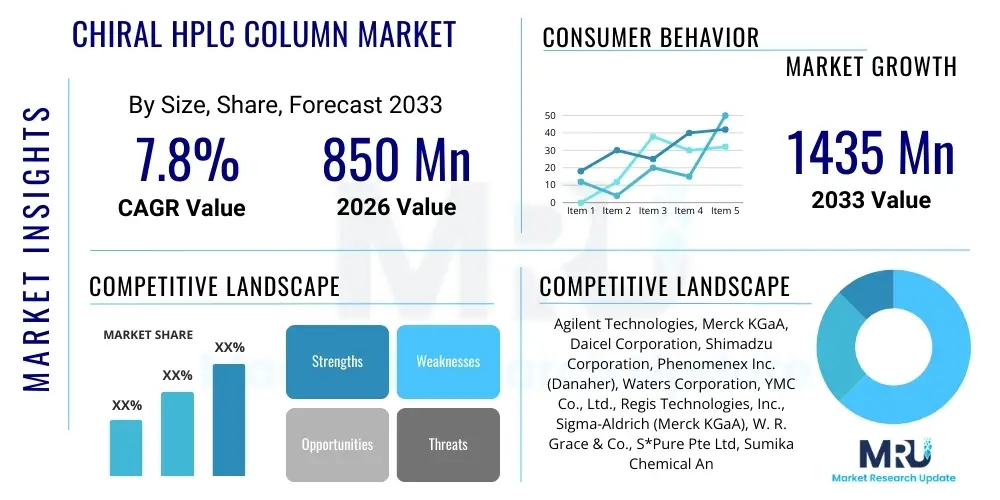

The Chiral HPLC Column Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1435 Million by the end of the forecast period in 2033.

Chiral HPLC Column Market introduction

The Chiral High-Performance Liquid Chromatography (HPLC) Column market is positioned at a crucial intersection of analytical chemistry, pharmaceutical science, and regulatory compliance, playing an indispensable role in ensuring the safety and efficacy of modern therapeutics. These specialized columns are engineered to address the inherent challenges associated with chirality—the property of molecules to exist as non-superimposable mirror images, or enantiomers. The separation is vital because, in biological systems, enantiomers often interact differently with receptors, enzymes, and proteins. For instance, while one enantiomer may be therapeutically active, its mirror image could be inert or, critically, highly toxic (a historical lesson cemented by the Thalidomide tragedy). Therefore, the ability to resolve, quantify, and isolate pure single enantiomers is not merely a technical necessity but a fundamental regulatory requirement for the development and quality control of stereoisomeric drugs. Chiral stationary phases (CSPs) utilize complex, asymmetric molecules, often based on polysaccharides (like cellulose or amylose derivatives), proteins, or macrocyclic antibiotics, which interact differently with the two enantiomers through stereospecific mechanisms, achieving baseline separation under optimized chromatographic conditions. The market's robust growth is intricately linked to the increasing sophistication of medicinal chemistry and the global shift towards producing single-isomer pharmaceuticals.

The product portfolio within the Chiral HPLC Column sector is highly differentiated, driven by the need to separate molecules across a vast chemical space, demanding tailored selectivity based on the analyte's functional groups and stereochemical features. Major applications span the entire spectrum of pharmaceutical development, beginning with early-stage drug discovery where rapid screening is required to determine the purity of synthesized reference standards, extending through complex process chemistry optimization where enantiomeric excess (ee) must be meticulously monitored, and culminating in final product quality assurance (QA) and quality control (QC) testing. Beyond pharmaceuticals, chiral columns are increasingly utilized in agrochemical synthesis to analyze stereoselective pesticides, in the flavor and fragrance industry to determine the authenticity and quality of natural products, and in environmental analysis to track the fate of chiral pollutants. The fundamental benefits of adopting advanced chiral HPLC technology include vastly superior analytical precision compared to older methods, the ability to achieve high-resolution separation even for highly similar compounds, adherence to global pharmacopeial standards (such as USP and EP), and improved operational throughput essential for large-scale manufacturing facilities that require rapid batch release testing. The core driving factors supporting sustained market expansion are the continuous pipeline of new stereoselective drugs entering clinical trials and the intensified global scrutiny over pharmaceutical impurities, compelling laboratories worldwide to upgrade their analytical infrastructure to meet evolving regulatory benchmarks.

Technological advancement within this sector is paramount, focusing primarily on two strategic areas: improving the versatility of the stationary phase and enhancing the efficiency of the chromatographic process. Modern chiral columns, particularly those featuring immobilized polysaccharide derivatives, represent a major technological leap, as they permit the use of strong organic solvents previously incompatible with coated phases, dramatically accelerating method development by allowing broader solvent screening without compromising column longevity. Simultaneously, the market is capitalizing on the trend towards miniaturization and high speed, driven by the demand for Ultra High-Performance Liquid Chromatography (UHPLC) systems. Manufacturers are introducing chiral columns with sub-3 µm and sub-2 µm particles, which deliver enhanced peak capacity, superior resolution, and significant time savings. This integration of high-performance particle technology with specialized chiral chemistry ensures that the analytical capabilities of these columns remain perfectly aligned with the fast-paced, high-resolution demands of cutting-edge research and industrial QC, further solidifying their indispensable status in the modern analytical laboratory landscape across North America, Europe, and rapidly expanding Asian markets.

Chiral HPLC Column Market Executive Summary

The Chiral HPLC Column Market is poised for dynamic expansion throughout the forecast period, underpinned by the confluence of rigorous regulatory oversight and accelerating pharmaceutical innovation globally. The primary business trend involves consolidation and specialization, where major analytical instrument providers often acquire or partner with niche chiral stationary phase developers to gain access to proprietary chemistries and specialized technical expertise, thereby offering integrated analytical solutions. Furthermore, there is a pronounced strategic focus among manufacturers to develop highly robust, versatile columns optimized for preparative chromatography, addressing the pharmaceutical industry's need to produce single-enantiomer bulk Active Pharmaceutical Ingredients (APIs) economically. This emphasis on scalability and robustness, coupled with the introduction of automated method development kits and AI-assisted screening software, is streamlining laboratory workflows and mitigating some of the traditional barriers associated with chiral separation complexity, fostering increased market adoption across various end-user sectors, including the burgeoning Contract Research Organization (CRO) ecosystem which relies heavily on flexible and high-throughput chiral methods.

Geographically, the market displays a clear trajectory of mature markets (North America and Europe) maintaining their foundational lead through high R&D budgets and early technology adoption, while the Asia Pacific (APAC) region acts as the principal engine of future growth. In North America and Western Europe, the demand is largely driven by replacement cycles of analytical instrumentation, the rigorous validation requirements for novel NCEs (New Chemical Entities), and the established trend towards personalized medicine which requires extremely precise impurity profiling. Conversely, APAC, particularly China and India, is witnessing explosive growth, driven by massive investments in domestic pharmaceutical manufacturing capabilities, the rapid rise of competitive generics production targeting global markets, and the localization of quality control standards, which mirror Western regulatory requirements. Companies are strategically establishing manufacturing and technical support hubs in APAC to capitalize on the lower operational costs and the rapidly expanding customer base seeking sophisticated analytical solutions for both domestic consumption and global export compliance.

Analysis of market segmentation reveals the continued dominance of Polysaccharide-Based CSPs, which remain the preferred choice due to their broad utility and robust performance across diverse chemical structures, especially in pharmaceutical development. The market is segmented not just by chemistry, but increasingly by operational scale: analytical columns for R&D/QC and preparative columns for bulk synthesis. While analytical usage drives volume, the preparative segment is experiencing higher revenue growth rates, reflecting the significant capital investment by CMOs and large pharmaceutical companies seeking efficient, large-scale separation processes. The enduring trend of outsourcing analytical and manufacturing services further bolsters the CRO/CMO end-user segment, which demands multi-mode chromatography solutions capable of handling diverse client requirements efficiently. The overall market narrative is one of technological sophistication enabling regulatory adherence and accelerating the drug development lifecycle, resulting in sustained, premium growth for high-performance chiral analytical instruments.

AI Impact Analysis on Chiral HPLC Column Market

The convergence of Artificial Intelligence and advanced chromatography is fundamentally reshaping user expectations and operational capabilities within the Chiral HPLC Column market. Common user inquiries frequently focus on the capacity of Machine Learning (ML) models to overcome the trial-and-error nature inherent in conventional chiral method development. Specifically, users are eager to understand how AI can analyze the steric and electronic properties of a target molecule and predict the optimal Chiral Stationary Phase (CSP) chemistry and the ideal mobile phase conditions (e.g., solvent type, concentration, flow rate) without requiring extensive, expensive, and time-consuming experimental screening. This ability to virtualize the method development process addresses a critical bottleneck in the pharmaceutical pipeline, accelerating the transition from synthetic chemistry to purified clinical candidates. Furthermore, concerns are often raised regarding data security, the need for standardized data input across diverse instruments, and the initial capital outlay required to integrate these sophisticated AI-driven platforms into existing laboratory infrastructure, necessitating clear ROI justification for analytical managers.

The application of deep learning algorithms is proving transformative in two key areas: enhanced predictive modeling and automated system diagnostics. AI systems, trained on proprietary and publicly accessible databases containing hundreds of thousands of separation results across various CSPs, are now capable of generating reliable starting conditions for novel compounds, significantly reducing the dependence on empirical knowledge and specialist chromatographers. This capability directly lowers operational costs by minimizing solvent consumption and reducing the required quantity of precious drug material used during screening. Moreover, AI integration extends to optimizing the physical performance of the columns themselves. By continuously monitoring subtle fluctuations in pressure, peak shape, and retention time stability across long sequences of runs, AI can provide predictive diagnostics, warning laboratory personnel of impending column degradation or fouling issues often before traditional metrics indicate a problem. This proactive maintenance capability maximizes the effective lifetime of expensive chiral columns and ensures regulatory compliance by maintaining consistent analytical validation parameters, thereby enhancing laboratory efficiency and data integrity throughout the column's operational cycle.

- AI-Driven Method Optimization: Predictive models utilizing molecular descriptors accelerate the selection of the most effective Chiral Stationary Phase (CSP) and mobile phase systems, potentially compressing method development time from weeks to days.

- Enhanced Resolution Prediction: Machine learning algorithms analyze complex peak profiles to suggest fine-tuning parameters, improving the enantiomeric resolution and purity assessment critical for regulatory submissions.

- Automated Data Processing: Integration of neural networks for rapid interpretation of chromatographic data, facilitating quicker decisions on batch quality and release by accurately identifying and quantifying minor enantiomeric impurities.

- Predictive Column Management: AI monitors system performance variables (back pressure, flow consistency) to anticipate column failure, enabling scheduled replacement and significantly extending the lifespan and reproducibility of high-cost CSPs.

- Robotic Integration Strategy: AI guides high-throughput screening robotic systems to test numerous chiral column chemistries and solvent combinations efficiently, maximizing experimental outcome per unit of time and material.

DRO & Impact Forces Of Chiral HPLC Column Market

The Chiral HPLC Column Market operates under a powerful dynamic equilibrium where substantial growth drivers and market opportunities contend with persistent technological and economic restraints, all influenced by critical regulatory impact forces. The dominant driver remains the increasing global emphasis on developing stereoselective drugs, recognizing the inherent pharmacological benefits of single-enantiomer therapeutics over racemic mixtures. This pharmaceutical trend is reinforced by stricter regulatory guidance globally, which often mandates baseline separation and precise quantification of both active and potentially harmful inactive enantiomers in drug formulations, creating a non-negotiable demand for high-resolution chiral separation tools. The continuous evolution and enhancement of Chiral Stationary Phase (CSP) technology, particularly the development of highly robust immobilized phases that tolerate aggressive solvents and offer extended operational stability, further fuel market expansion by broadening application scope and improving laboratory throughput, providing tangible operational returns on investment for end-users across industrial and academic research settings, especially in quality control environments that demand uncompromising reproducibility.

Despite the strong demand signals, the market faces significant structural restraints. Foremost among these is the exceptionally high cost associated with manufacturing and purchasing specialized chiral columns. The complexity of synthesizing high-purity chiral selectors and achieving uniform, stable bonding onto silica or polymeric supports requires proprietary, capital-intensive processes, translating directly into high unit costs compared to standard achiral columns. Furthermore, the steep learning curve and the requirement for highly trained analytical chemists to execute and validate complex chiral separations represent a significant barrier to entry, particularly for smaller laboratories or those in developing regions. Method transfer and validation between different laboratory sites remain complex, often requiring meticulous inter-laboratory comparisons due to the sensitivity of chiral selectivity to minor variations in mobile phase composition or temperature, adding time and cost to global quality assurance programs, thereby restraining broader, instantaneous adoption.

Opportunities for market growth are strongly concentrated in the preparative chromatography segment, where large-scale separation of enantiomers using techniques like Simulated Moving Bed (SMB) chromatography integrated with robust chiral stationary phases offers pharmaceutical manufacturers a cost-effective pathway to produce pure APIs in bulk. The rapidly expanding contract research and manufacturing organization (CRO/CMO) sector presents a critical sales channel, as these organizations require versatile chiral analytical capabilities to serve diverse clientele efficiently, driving demand for multi-mode and high-throughput column screening kits. The primary impact forces—global patent expiration leading to increased competition in stereoselective generics, the intensified need for personalized medicine requiring highly precise chiral diagnostics, and accelerating technological convergence (AI/ML integration)—all exert pressure on analytical laboratories towards investing in the latest, highest-performing chiral column technologies, reinforcing the market’s premium value proposition and ensuring continued differentiation from commodity analytical tools.

Segmentation Analysis

The detailed segmentation of the Chiral HPLC Column market provides crucial insights into product adoption patterns, technological preferences, and the commercial requirements of diverse end-user groups. Segmentation by Type (Stationary Phase Chemistry) highlights the fundamental technological choices available to chromatographers, reflecting the varying selectivity mechanisms required to resolve different classes of chiral molecules. Polysaccharide-based phases, due to their broad applicability and commercial availability, command the largest market share, but niche segments like protein-based and Pirkle-type columns remain essential for compounds that resist separation on conventional phases. Segmentation by Application emphasizes the pharmaceutical industry's overwhelming reliance on these tools, particularly for regulatory compliance and R&D activities, demonstrating where the majority of analytical expenditure is concentrated. Finally, End-User segmentation reveals the growing commercial significance of outsourcing, as CROs and CMOs increasingly centralize specialized analytical services globally.

- By Type:

- Polysaccharide-Based Columns:

- Amylose-based Columns: Known for robust performance and wide application range, particularly in normal phase chromatography; often utilized for high-throughput screening and scale-up.

- Cellulose-based Columns: Offer complementary selectivity profiles to amylose derivatives, crucial for separating specific drug enantiomers, and are increasingly available in immobilized formats for enhanced solvent compatibility.

- Protein-Based Columns: Used primarily for separating highly hydrophilic or biologically active compounds under aqueous conditions, essential for specific biochemical and clinical research applications.

- Pirkle-Type Columns: Characterized by brush-type selectors; historically important but often used now for specialized applications requiring high selectivity for specific functional groups, operating predominantly in the normal phase mode.

- Cyclodextrin-Based Columns: Macrocyclic selectors suitable for separating molecules where inclusion complex formation is the dominant chiral recognition mechanism, often employed in reversed-phase and polar organic modes.

- Ligand Exchange Columns: Primarily used for separating amino acids, peptides, and related chiral compounds, relying on metal coordination mechanisms for stereoselective retention.

- Others (e.g., Macroporous Resins, Antibiotic-Based Columns): Include specialized chemistries tailored for highly specific or challenging separation tasks outside the scope of mainstream polysaccharide columns.

- Polysaccharide-Based Columns:

- By Application:

- Pharmaceutical & Biotechnology Industry:

- Drug Discovery & Preclinical Testing: Rapid screening and purity assessment of newly synthesized chiral candidates.

- Drug Development & Clinical Trials: Method validation and stability testing of drug candidates; ensuring consistent enantiomeric purity throughout all trial phases.

- Quality Control (QC) & Batch Release: Routine analysis of finished APIs and drug products to ensure compliance with pharmacopeial standards prior to market release.

- Food & Beverage Industry (e.g., Flavor/Ingredient Analysis): Determination of natural vs. synthetic origins of chiral ingredients (e.g., amino acids, terpenes) for quality and authenticity control.

- Chemical Industry (e.g., Agrochemicals, Specialty Chemicals): Analysis of stereoselective pesticides and herbicides, where enantiomeric activity dictates efficacy and environmental impact.

- Academic & Research Institutions: Utilized in fundamental research, teaching laboratories, and novel method development for complex chiral molecules.

- Pharmaceutical & Biotechnology Industry:

- By End-User:

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs) & Contract Manufacturing Organizations (CMOs)

- Academic & Government Laboratories

Value Chain Analysis For Chiral HPLC Column Market

The complex value chain of the Chiral HPLC Column market commences with highly specialized upstream raw material procurement and proprietary chemical synthesis. This initial stage is crucial as the quality and purity of the chiral selector material—whether it be a modified polysaccharide, a synthesized cyclodextrin, or a proprietary small molecule Pirkle ligand—directly dictates the column's chromatographic performance, selectivity, and overall lifetime. Key upstream activities involve advanced organic synthesis, purification, and rigorous characterization of these often-expensive and sensitive materials. Suppliers in this phase are typically specialized fine chemical producers or the column manufacturers themselves who possess the intellectual property for the chiral selector. Maintaining secure supply lines and ensuring batch-to-batch consistency of these unique raw materials is a critical competitive necessity, as variations in the selector’s purity or structure can catastrophically impact the resulting column’s separation capability and reproducibility, which is unacceptable in regulated pharmaceutical QC environments.

The core manufacturing and midstream stage involves the meticulous process of bonding or coating the chiral selector onto the porous support (usually high-purity silica gel or polymer beads) and subsequently packing this material into the column hardware. The transition from coated to immobilized phases represents a significant technological shift in the midstream, requiring sophisticated chemical bonding protocols to ensure permanent attachment of the selector, enhancing stability against aggressive solvents. Column packing is a highly skilled operation utilizing specialized slurry packing techniques under extreme pressure to achieve a uniformly dense bed structure, which is vital for maximizing column efficiency (plate count) and minimizing peak tailing. Successful manufacturers invest heavily in automated packing processes and advanced quality control protocols—including rigorous efficiency, asymmetry, and retention time stability checks—to guarantee that every column meets stringent performance specifications before it moves to the distribution phase, thereby upholding brand reputation for reliability in high-stakes analytical environments.

Downstream activities center on distribution, sales, and comprehensive technical support, which are critical differentiators in this highly technical market segment. Distribution channels are typically dual: large manufacturers often employ a direct sales force to handle high-volume institutional accounts (major pharmaceutical companies) where direct technical consultation and customized bulk purchasing are necessary. This direct channel facilitates the complex process of method transfer and validation required for global drug development projects. Conversely, indirect channels, involving global and regional scientific equipment distributors, are utilized to efficiently reach smaller academic labs, regional CROs, and international markets where a direct presence is uneconomical. Effective technical support—providing expertise on solvent selection, temperature optimization, and troubleshooting difficult separations—is paramount, as the utility of a high-cost chiral column is severely diminished without expert guidance. Successful downstream strategy integrates specialized application support, ensuring customers can maximize the complex selectivity offered by these advanced chromatographic tools, thereby justifying the premium price point.

Chiral HPLC Column Market Potential Customers

The ecosystem of potential customers for Chiral HPLC Columns is defined by organizations engaged in chemical synthesis, quality assurance, and biological research where stereoisomeric control is mandated or scientifically advantageous. The foundational customer base is the Global Pharmaceutical Industry, spanning multi-national corporations and mid-sized drug developers. These entities utilize chiral columns across all phases: for analytical separation of novel drug candidates, for purity testing during clinical trials, and crucially, for large-scale preparative separation in API production. Their purchasing criteria prioritize column robustness (especially immobilized phases), regulatory documentation support, and verifiable batch-to-batch consistency to ensure adherence to global Good Manufacturing Practice (GMP) standards, making them highly receptive to premium, high-performance offerings that minimize validation risk.

A rapidly expanding customer segment comprises Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs). As pharmaceutical companies increasingly outsource non-core activities, CROs/CMOs have become central hubs for specialized analytical testing, including complex chiral separations. These organizations demand highly flexible, versatile column portfolios capable of resolving a wide array of chemical scaffolds belonging to different clients. Their investment focus is on high-throughput screening solutions (e.g., small-particle columns for UHPLC) and robust chemistries that facilitate rapid method development and reliable method transfer between client sites, driving significant volume demand and creating a dynamic opportunity for column manufacturers who can supply comprehensive screening kits and robust technical support services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1435 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agilent Technologies, Merck KGaA, Daicel Corporation, Shimadzu Corporation, Phenomenex Inc. (Danaher), Waters Corporation, YMC Co., Ltd., Regis Technologies, Inc., Sigma-Aldrich (Merck KGaA), W. R. Grace & Co., S*Pure Pte Ltd, Sumika Chemical Analysis Service, Guangzhou Research & Development Center of Chirality (GRDCC), FUJIFILM Wako Pure Chemical Corporation, Bio-Rad Laboratories, TOSOH Corporation, Restek Corporation, SunChrom GmbH, Mitsubishi Chemical Corporation, Orochem Technologies Inc., Avantor, Inc., Thermo Fisher Scientific Inc., GL Sciences Inc., Sepax Technologies, Inc., Chiral Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chiral HPLC Column Market Key Technology Landscape

The current technology landscape in the Chiral HPLC Column market is highly sophisticated, focusing primarily on maximizing efficiency, broadening chemical compatibility, and enabling high-throughput analysis, directly addressing the stringent demands of pharmaceutical R&D. The paramount innovation remains the transition from traditional coated chiral stationary phases (CSPs) to chemically immobilized phases, fundamentally altering column robustness. Immobilization techniques involve covalent bonding of the chiral selector, such as polysaccharide derivatives, onto the silica support surface. This structural modification eliminates the risk of the chiral selector dissolving or leaching into aggressive mobile phases, which previously restricted the use of common solvents like THF, DCM, or ethyl acetate in method development. The superior stability offered by immobilized phases translates into drastically extended column lifetimes, reduced cost per sample, and unparalleled freedom for chromatographers to screen a wider variety of solvents rapidly, accelerating the crucial process of finding the optimal separation conditions for novel stereoisomers, thereby enhancing both analytical flexibility and compliance integrity in global regulated environments.

A second major technological cornerstone is the integration of advanced particle engineering into chiral chromatography. The adoption of Ultra High-Performance Liquid Chromatography (UHPLC) systems has driven the need for chiral columns packed with smaller, highly uniform particles, typically 3 µm or less, compared to the conventional 5 µm or 10 µm size. Sub-2 µm particle technology significantly reduces longitudinal diffusion, leading to sharper peaks, higher theoretical plate counts, and superior resolving power, enabling faster analysis times—often reducing a complex separation from thirty minutes down to just five or ten. While these smaller particles necessitate instruments capable of withstanding very high back pressures, the gain in throughput and peak resolution is non-trivial for high-volume quality control and rapid screening applications, particularly in large CMOs. Furthermore, superficially porous particle (SPP) technology is emerging in the chiral domain, offering an optimal balance: core-shell structures deliver UHPLC-like efficiency at lower back pressures, allowing better integration with legacy or standard HPLC instrumentation, democratizing access to high-performance separations.

Beyond the stationary phase itself, hardware and systemic innovations are driving efficiency. Manufacturers are focusing on developing chiral columns specifically optimized for SFC (Supercritical Fluid Chromatography), a technique naturally suited for chiral separations due to faster mass transfer kinetics and the use of compressed CO2, which significantly reduces solvent consumption and disposal costs—a major driver for 'green chemistry' initiatives. The technology landscape also includes advancements in multi-mode chromatography, where novel CSPs exhibit different chiral recognition mechanisms depending on the mobile phase composition, allowing one column to be used for normal phase, reversed phase, or polar organic separations. This multi-functionality maximizes laboratory resource utilization. Continuous process improvement is also seen in column manufacturing, where sophisticated automation and robotic packing techniques ensure impeccable batch-to-batch reproducibility, a critical requirement for regulatory acceptance and successful multi-site analytical method transfer, reinforcing the technological barriers to entry for new market competitors and solidifying the positions of established leaders.

Regional Highlights

The geographical distribution of demand for Chiral HPLC Columns reflects varying levels of pharmaceutical maturity, R&D investment, and regulatory stringency across continents, necessitating tailored market penetration strategies by key vendors.

- North America: Maintains its leading position due to the highest concentration of global pharmaceutical and biotechnology companies, substantial private and public funding for drug discovery, and rigorous regulatory oversight by the FDA requiring mandatory chiral separation for most new drug candidates. The region is the primary early adopter of cutting-edge technology, including UHPLC chiral systems and AI-integrated method development platforms, characterized by a preference for premium, high-stability immobilized CSPs.

- Europe: Represents the second-largest market, driven by a strong, well-established pharmaceutical sector (e.g., Switzerland, Germany, UK) and centralized regulatory governance via the EMA. Demand is stable and highly concentrated on quality, reproducibility, and compliance, with a strong focus on utilizing preparative chiral chromatography for economic bulk API production, making the region a key driver for large-scale SMB technology adoption.

- Asia Pacific (APAC): The fastest-growing region globally, primarily fueled by the rapid expansion of generic and biosimilar manufacturing, especially in India and China. Government initiatives promoting domestic pharmaceutical capabilities, coupled with Western companies outsourcing R&D and manufacturing to the region, increase the urgent need for standardized analytical QC capabilities, driving robust demand for cost-effective, high-throughput chiral columns suitable for generic drug profiling and export compliance.

- Latin America (LATAM): An emerging market characterized by increasing investment in public health infrastructure and localized efforts to establish domestic pharmaceutical manufacturing bases, particularly in Brazil and Mexico. Market growth is dependent on global investment flows and the adoption of international pharmacopeial standards, with demand currently centered on foundational analytical capabilities for quality control and academic research.

- Middle East and Africa (MEA): Smallest but developing market, primarily focused on establishing regional pharmaceutical security and modernizing quality control laboratories in key hubs (e.g., UAE, Saudi Arabia, South Africa). Market penetration is tied to direct import channels and governmental efforts to align local drug standards with international regulatory benchmarks, leading to selective adoption of high-quality imported columns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chiral HPLC Column Market.- Agilent Technologies

- Merck KGaA (including Sigma-Aldrich)

- Daicel Corporation (Chiral Technologies Inc.)

- Shimadzu Corporation

- Phenomenex Inc. (Danaher Corporation)

- Waters Corporation

- YMC Co., Ltd.

- Regis Technologies, Inc.

- W. R. Grace & Co.

- S*Pure Pte Ltd

- Sumika Chemical Analysis Service

- Guangzhou Research & Development Center of Chirality (GRDCC)

- FUJIFILM Wako Pure Chemical Corporation

- Bio-Rad Laboratories

- TOSOH Corporation

- Restek Corporation

- SunChrom GmbH

- Mitsubishi Chemical Corporation

- Orochem Technologies Inc.

- Avantor, Inc.

- Thermo Fisher Scientific Inc.

- GL Sciences Inc.

- Sepax Technologies, Inc.

- GE Healthcare (Cytiva)

Frequently Asked Questions

Analyze common user questions about the Chiral HPLC Column market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why is the separation of enantiomers critical in the pharmaceutical industry?

Enantiomers often exhibit drastically different pharmacological activities; one isomer might be beneficial while the mirror image is inactive or toxic. Separation is mandated by global regulators to ensure that single-isomer drugs meet rigorous standards for efficacy, safety, and purity.

What is the primary technical advantage of immobilized Chiral Stationary Phases (CSPs)?

Immobilized CSPs offer enhanced chemical stability by covalently bonding the selector to the support. This allows chromatographers to utilize a broader range of strong organic solvents during method development and cleaning, increasing versatility and column longevity significantly.

How is AI influencing the complexity of chiral method development?

AI, specifically Machine Learning, is used to predict the optimal column chemistry and separation parameters based on the analyte's molecular structure and historical data, drastically reducing the traditional trial-and-error experimental time and solvent consumption.

Which application segment drives the highest volume demand in the market?

The Pharmaceutical and Biotechnology Industry, particularly the Quality Control (QC) and batch release segments, demands the highest volume of chiral columns globally due to the continuous and mandatory testing required for stereoisomeric drugs throughout their manufacturing lifecycle.

What is the market relevance of Supercritical Fluid Chromatography (SFC) in this sector?

Chiral SFC is gaining relevance because it offers significantly faster separations and uses environmentally friendlier, non-toxic mobile phases (mainly CO2), reducing operational costs and accelerating preparative-scale separations vital for bulk API manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager