Chloroacetyl Chloride Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440947 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Chloroacetyl Chloride Market Size

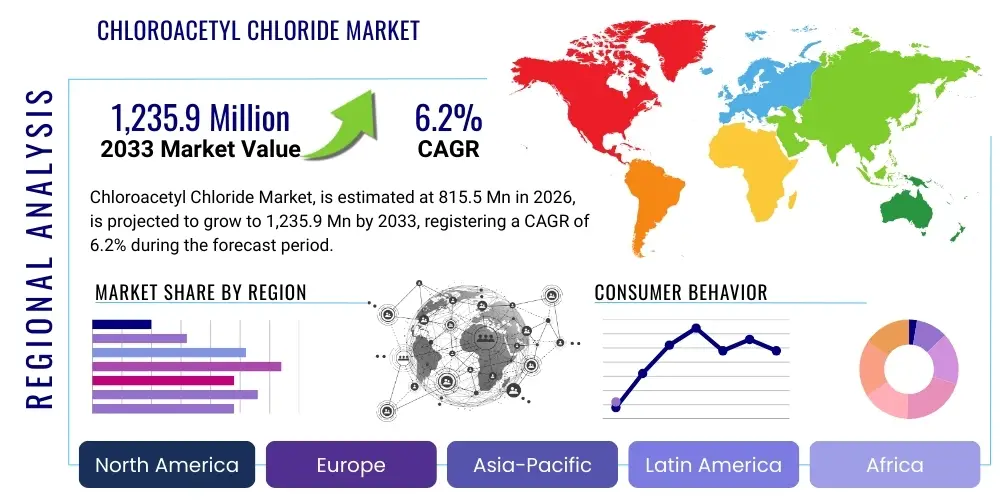

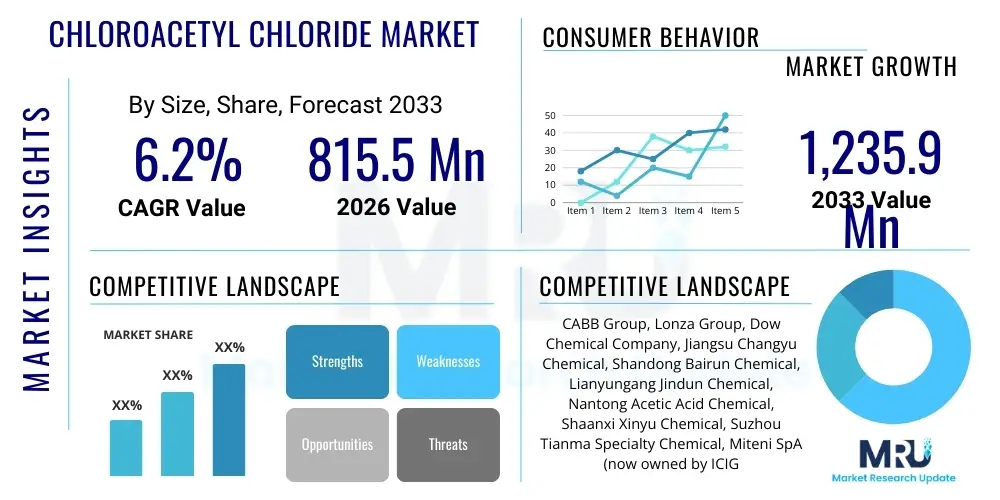

The Chloroacetyl Chloride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.15% between 2026 and 2033. The market is estimated at $815.5 Million in 2026 and is projected to reach $1,235.9 Million by the end of the forecast period in 2033.

Chloroacetyl Chloride Market introduction

Chloroacetyl Chloride (CAC) is a critical intermediate chemical widely utilized across various industrial sectors, primarily in the production of agrochemicals, pharmaceuticals, and dyestuffs. As a highly reactive acyl chloride, CAC serves as a foundational building block for synthesizing complex organic molecules, capitalizing on its reactive chlorine atom and carbonyl functionality. Its market growth is intrinsically linked to the demand dynamics of the global agricultural sector, particularly the necessity for advanced and effective herbicides to maximize crop yields in response to increasing global population and urbanization reducing arable land. The chemical's versatile reactivity makes it indispensable for creating acetanilide herbicides, a dominant class of weed control agents, ensuring its central role in the specialty chemicals supply chain.

The product description of Chloroacetyl Chloride highlights its clear, colorless, and highly corrosive liquid nature, possessing a pungent odor. It is generally synthesized through the chlorination of acetic acid or by reacting acetic anhydride with thionyl chloride, processes requiring stringent safety protocols due to its toxic and lachrymatory properties. Major applications include its use in synthesizing highly effective pre-emergence herbicides such as Alachlor, Butachlor, Metolachlor, and Pretilachlor, which are crucial for major staple crops like corn, soybeans, and rice. Furthermore, CAC is instrumental in the pharmaceutical industry for creating intermediates necessary for various drugs, including certain cephalosporin antibiotics and tranquilizers, signifying its dual importance across agricultural and healthcare sectors.

The primary driving factors for the Chloroacetyl Chloride market revolve around the robust expansion of the agrochemical industry, particularly in the Asia Pacific region where agricultural intensification is paramount. The increasing complexity and patent expiration of numerous high-value active pharmaceutical ingredients (APIs) also necessitate a steady supply of CAC for generic drug production. Benefits derived from the use of CAC include enabling the creation of high-efficacy pesticides that improve farm productivity and ensuring the cost-effective synthesis of essential pharmaceutical precursors. However, the market must constantly navigate the strict regulatory environment surrounding highly toxic chemicals and the associated logistical challenges in storage and transport, which demands continuous innovation in handling and processing technologies.

Chloroacetyl Chloride Market Executive Summary

The Chloroacetyl Chloride market exhibits dynamic business trends driven by capacity expansions in key manufacturing hubs, predominantly China and India, aiming to satisfy soaring demand from the agrochemicals sector. Strategic collaborations focused on backward integration, securing stable raw material supply (acetic acid and chlorine), and adopting closed-loop synthesis systems to minimize environmental discharge define the current competitive landscape. Regional trends show the Asia Pacific maintaining its dominance due to high agricultural activity and the presence of major global pesticide formulators, while North America and Europe focus more on regulatory compliance and the development of greener, less toxic derivatives, driving investment in process optimization technologies. This global shift towards sustainable manufacturing is influencing production methods and sourcing strategies.

Segment trends indicate that the agrochemical application segment holds the largest market share, driven specifically by the demand for acetanilide-based herbicides, which are critical for extensive commercial farming operations globally. However, the pharmaceutical application segment, although smaller in volume, is anticipated to exhibit a higher growth rate, fueled by expanding healthcare infrastructure in emerging economies and the continuous need for new drug intermediates. Analysis by purity suggests that high-purity grades of CAC, essential for pharmaceutical and high-end specialty chemical synthesis, are commanding premium pricing and experiencing accelerated demand. Manufacturers are increasingly differentiating their products based on purity and customized packaging to cater to these specialized, high-margin end-uses.

Overall, the market is characterized by moderate consolidation among key global suppliers who possess the necessary infrastructure and safety expertise to handle this corrosive chemical. The primary operational risks—raw material price volatility and rigorous environmental, health, and safety (EHS) regulations—necessitate continuous investment in advanced process control and waste minimization techniques. Successful players are those who can achieve scale efficiency, maintain impeccable safety records, and strategically position themselves near major agrochemical formulation centers, thereby minimizing logistics costs and regulatory hurdles associated with cross-border transport of highly hazardous materials.

AI Impact Analysis on Chloroacetyl Chloride Market

Common user questions regarding AI's impact on the Chloroacetyl Chloride market primarily revolve around safety improvements, optimization of batch processes, and supply chain resilience given the hazardous nature of the substance. Users are keenly interested in how AI can monitor complex chemical reactions (like chlorination), predict potential thermal runaways or equipment failures in highly corrosive environments, and optimize catalyst usage to improve yield and purity—critical factors in specialty chemical manufacturing. The key themes summarized from these inquiries center on using AI for predictive maintenance in corrosive plants, enhancing worker safety through real-time monitoring and alarm systems, and improving production efficiency to counteract rising operational costs and strict regulatory scrutiny inherent in handling Chloroacetyl Chloride. Expectations are high that AI will provide a crucial technological lever for maintaining operational excellence and regulatory compliance in this challenging chemical domain.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data from reactors, piping, and storage tanks to anticipate corrosion rates and equipment failure in highly acidic environments, minimizing downtime and catastrophic risks associated with CAC handling.

- Process Optimization and Yield Enhancement: Implementing AI models to fine-tune reaction parameters (temperature, pressure, feed rate) during the chlorination process, ensuring optimal conversion efficiency and maximizing the yield of high-purity Chloroacetyl Chloride required for pharmaceutical grades.

- Real-time Safety Monitoring and Hazard Prediction: Deploying AI and computer vision systems for continuous monitoring of plant environments, detecting leaks, abnormal volatile organic compound (VOC) levels, or deviations in process variables that could lead to safety incidents involving this toxic chemical.

- Supply Chain and Inventory Management: Using AI to forecast highly fluctuating demand from the agrochemical and pharmaceutical sectors, optimizing inventory levels of both raw materials (acetic acid, chlorine) and finished CAC, thus reducing storage risks and logistics costs.

- Quality Control Automation: Application of machine learning in analyzing spectroscopic data for automated, high-speed purity checks, ensuring that CAC meets stringent specifications before being delivered to end-user segments, particularly pharmaceuticals.

DRO & Impact Forces Of Chloroacetyl Chloride Market

The market for Chloroacetyl Chloride is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. Key drivers include the sustained global demand for high-efficacy herbicides, particularly in rapidly developing agricultural economies of Asia Pacific and Latin America, where crop protection remains a primary focus for food security. Opportunities arise from technological advancements leading to cleaner, more efficient manufacturing processes, reducing environmental impact and improving resource utilization. Conversely, the market faces substantial restraints due to the inherent toxicity and corrosiveness of CAC, leading to intense regulatory pressure from agencies like the EPA and REACH, which restrict its usage, transport, and disposal, demanding high capital investment in safety infrastructure.

Driving forces center on the economic necessity of effective farming, which places acetanilide herbicides—the largest consumers of CAC—at the core of modern agricultural practice. Expanding populations require enhanced food production capabilities, directly correlating with the need for better weed management tools. Furthermore, the pharmaceutical sector's rapid growth, particularly the production of essential off-patent drugs requiring CAC intermediates, provides a stable, high-value demand stream. These macroeconomic trends provide a solid foundation for market expansion, pushing manufacturers to increase capacity while maintaining strict quality control standards necessary for drug synthesis applications.

Restraining factors present the most significant hurdles. Regulatory mandates focusing on minimizing highly hazardous chemical use necessitate continuous innovation towards alternative, less toxic compounds or dramatically safer production methods, potentially displacing current CAC applications. The substantial costs associated with compliance, environmental remediation, specialized transportation, and high liability insurance act as barriers to entry for new market participants. Opportunities exist primarily in process innovation, such as continuous flow chemistry techniques that reduce the volume of hazardous material handled at any given time, thereby improving safety and operational efficiency, and exploring new, specialized applications in emerging fine chemical synthesis where CAC's reactivity remains unparalleled, provided safety can be guaranteed.

Segmentation Analysis

The Chloroacetyl Chloride market segmentation provides a granular understanding of the demand landscape based on application, grade type, and end-user vertical. The analysis reveals that the market structure is heavily skewed towards the agricultural sector due to the high volume requirement for herbicide synthesis, setting the pace for production capacity. However, segmentation by grade highlights the importance of purity, where pharmaceutical-grade CAC, while lower in volume, commands a significant price premium due to the stringent quality requirements and specialized handling protocols necessary for drug precursor manufacturing. Understanding these distinct segments is vital for producers aiming to optimize their product portfolio, manage supply chain risks associated with different purity levels, and allocate R&D efforts towards specialized applications.

- By Application:

- Agrochemicals (Herbicides: Alachlor, Butachlor, Metolachlor, Pretilachlor)

- Pharmaceuticals (Drug intermediates, Cephalosporins, Tranquilizers)

- Dyes and Pigments

- Specialty Chemicals and Fine Chemicals

- By Grade:

- Industrial Grade (Lower purity, high volume agrochemical use)

- Pharmaceutical Grade (High purity, specific regulatory standards)

- By End-User Industry:

- Agriculture

- Healthcare and Life Sciences

- Textile and Leather

- Others (Research and Development)

Value Chain Analysis For Chloroacetyl Chloride Market

The value chain for the Chloroacetyl Chloride market is highly integrated and sensitive, starting with the procurement of basic petrochemical derivatives. The upstream segment is dominated by the reliable sourcing of primary raw materials: acetic acid and chlorine gas, which are derived from large-scale chemical manufacturing operations. The stability and cost volatility of these feedstocks directly impact the final production cost of CAC. Manufacturers in the middle segment focus heavily on capital-intensive chlorination processes, demanding high technical expertise, significant investment in corrosion-resistant materials (e.g., specialized alloys, glass-lined reactors), and adherence to world-class safety and environmental standards due to the hazardous nature of both raw materials and the final product.

The downstream analysis reveals that the primary consumers are specialized chemical formulators and large multinational corporations (MNCs) that utilize CAC to synthesize active ingredients, particularly acetanilide herbicides and complex pharmaceutical intermediates. The relationship between CAC producers and downstream users is often long-term and contractual due to the necessary quality control and supply continuity required. Distribution channels are highly regulated; direct sales channels, where manufacturers supply end-users under specific transport and storage conditions, are predominant for large-volume industrial and pharmaceutical grades. Indirect distribution through specialized chemical distributors handles smaller orders or serves regional markets, but even these entities must possess high-level expertise in handling Class 8 Corrosive materials.

Effective value chain management is centered on risk mitigation—specifically, controlling the exposure associated with handling chlorine and CAC. Strategic location of production facilities near captive chlorine sources or major port facilities reduces logistics complexity and costs. Furthermore, the adoption of continuous flow reactors over traditional batch processes is a key innovation aimed at increasing safety and efficiency within the manufacturing segment. The stringent regulatory requirements across transport and storage necessitate specialized fleet management and certified personnel, adding a significant fixed cost component to the overall value chain operations, influencing pricing structures and competitive positioning within the market.

Chloroacetyl Chloride Market Potential Customers

The core customer base for the Chloroacetyl Chloride market comprises major players within the agrochemical and pharmaceutical industries, serving as crucial intermediaries in the production of finished products. In the agricultural sector, potential customers include large multinational crop protection companies that specialize in formulating and distributing high-volume herbicides globally, requiring industrial-grade CAC as a fundamental precursor. These customers purchase large quantities under long-term supply agreements, prioritizing consistency, regulatory compliance, and cost-effectiveness to maintain their competitive edge in the global pesticide market. Their demand cycles are often seasonal, tied closely to global planting schedules and regional climate patterns, necessitating agile inventory management from CAC suppliers.

In the pharmaceutical segment, end-users are typically API (Active Pharmaceutical Ingredient) manufacturers, both specialized contract manufacturing organizations (CMOs) and integrated pharmaceutical companies. These buyers require ultra-high-purity, often pharmaceutical-grade CAC for synthesizing intermediates necessary for producing life-saving drugs, particularly various generations of cephalosporin antibiotics and specialized tranquilizers. This customer segment places an absolute premium on quality, traceability, and robust quality management system (QMS) compliance, often demanding detailed documentation regarding the synthesis pathway and handling protocols, reflecting the strict regulatory oversight of drug production worldwide.

Additional potential customers reside within the fine chemicals sector, including specialized dye and pigment manufacturers, who use CAC to create colored compounds with enhanced fastness and stability for the textile and leather industries. Smaller volumes are purchased by dedicated research laboratories and academic institutions for complex organic synthesis R&D projects. Successfully serving these diverse customer profiles requires CAC suppliers to maintain flexible production capabilities, ranging from bulk industrial supply to smaller, highly certified, and packaged pharmaceutical quantities, along with robust technical support to navigate the application-specific challenges inherent in using this highly reactive chemical.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $815.5 Million |

| Market Forecast in 2033 | $1,235.9 Million |

| Growth Rate | 6.15% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CABB Group, Lonza Group, Dow Chemical Company, Jiangsu Changyu Chemical, Shandong Bairun Chemical, Lianyungang Jindun Chemical, Nantong Acetic Acid Chemical, Shaanxi Xinyu Chemical, Suzhou Tianma Specialty Chemical, Miteni SpA (now owned by ICIG), BASF SE, Lanxess AG, Sino-Japan Chemical, Hangzhou Qianyang Technology, Anhui Huaijing Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chloroacetyl Chloride Market Key Technology Landscape

The manufacturing technology for Chloroacetyl Chloride primarily revolves around the catalytic chlorination of acetic acid or the reaction of acetic anhydride with thionyl chloride. Historically, batch processing in glass-lined or specialized alloy reactors was the standard. However, the modern technology landscape is increasingly focused on enhancing process safety, maximizing yield purity, and minimizing the substantial environmental burden associated with handling chlorine and corrosive byproducts, driving innovation toward continuous processing methods. The high corrosivity of CAC necessitates sophisticated material science in plant design, utilizing expensive, chemically resistant materials and advanced seals and valves to prevent leaks and ensure long operational lifetimes, a major technological investment hurdle for new entrants.

A significant technological shift gaining traction is the adoption of continuous flow chemistry systems. Unlike traditional batch reactions, flow chemistry allows for the precise control of reaction conditions (temperature, mixing, pressure) in micro-reactors or specialized plug-flow reactors. This approach significantly reduces the inventory of hazardous materials handled at any given moment, mitigating the risk of large-scale thermal runaways and ensuring safer operating environments. For CAC production, continuous processing offers improved heat transfer, crucial for controlling the highly exothermic chlorination reaction, leading to better yield consistency and the ability to produce high-purity grades required by the pharmaceutical sector more reliably. This technological upgrade represents a capital-intensive but strategically advantageous investment for leading producers focused on long-term sustainability and enhanced safety records.

Furthermore, digital technologies are becoming integrated into the CAC production landscape. Advanced Distributed Control Systems (DCS) coupled with AI-powered analytics are employed for real-time monitoring and predictive control. These systems analyze parameters such as pH, chlorine residual levels, and thermal gradients to maintain optimal conversion rates and prevent side reactions that could generate unwanted impurities or dangerous byproducts. Additionally, enhanced purification technologies, including specialized fractional distillation columns and crystallization techniques, are vital, particularly for achieving the ultra-high purity (>99.5%) required for specialized pharmaceutical intermediates. The trend is clearly moving towards digitalization, automation, and closed-loop systems to meet escalating safety regulations and maintain global competitiveness.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Chloroacetyl Chloride market, primarily driven by China and India. This region benefits from the highest concentration of global agrochemical production capacity, supported by competitive manufacturing costs and massive domestic agricultural sectors. Rapid industrialization and expanding pharmaceutical manufacturing hubs further cement APAC’s leading position, with Chinese manufacturers controlling a substantial portion of global supply.

- North America: Characterized by stringent regulatory oversight (EPA) and a mature agricultural market focused on precision farming. Demand is stable, primarily serving established domestic agrochemical formulators and specialty chemical sectors. North American companies prioritize internal safety standards and focus on optimizing existing infrastructure rather than large-scale expansion.

- Europe: The European market is heavily influenced by REACH regulations, pushing manufacturers towards safer alternatives and closed-loop process technology. While the region is a significant consumer in the pharmaceutical and fine chemical sectors, large-scale CAC production is often scrutinized, leading to reliance on imports, particularly for industrial grades.

- Latin America: Exhibits robust growth, driven by the massive agricultural output, especially in Brazil and Argentina (soybeans, corn), which necessitates high volumes of acetanilide herbicides. This region represents a major end-market for CAC derivatives, fueling import growth and attracting investment in local formulation capabilities.

- Middle East and Africa (MEA): A smaller but emerging market, with increasing demand linked to local agricultural development initiatives and growth in infrastructure projects. Market penetration is often linked to the expansion strategies of global agrochemical majors establishing regional distribution and blending centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chloroacetyl Chloride Market.- CABB Group GmbH

- Lonza Group AG

- Dow Chemical Company

- Jiangsu Changyu Chemical Co., Ltd.

- Shandong Bairun Chemical Co., Ltd.

- Lianyungang Jindun Chemical Co., Ltd.

- Nantong Acetic Acid Chemical Co., Ltd.

- Shaanxi Xinyu Chemical Industry Co., Ltd.

- Suzhou Tianma Specialty Chemical Co., Ltd.

- Miteni SpA (now owned by International Chemical Investors Group - ICIG)

- BASF SE

- Lanxess AG

- Sino-Japan Chemical Co., Ltd.

- Hangzhou Qianyang Technology Co., Ltd.

- Anhui Huaijing Chemical Co., Ltd.

- Shandong Sinchem Chemical Co., Ltd.

- Chizhou Qingshan Chemical Co., Ltd.

- Sichuan Fine Chemical Co., Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Nantong Unisplendour Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Chloroacetyl Chloride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the Chloroacetyl Chloride market growth?

The primary growth driver is the agrochemical industry, specifically the synthesis of acetanilide herbicides such as Alachlor, Butachlor, and Metolachlor, which are essential for effective weed control in staple crops globally. The pharmaceutical sector, using CAC to produce drug intermediates, is the secondary growth engine.

Which geographical region exhibits the highest demand and production capacity for CAC?

The Asia Pacific (APAC) region, led by China and India, dominates both production and consumption. This dominance is attributed to large-scale agricultural operations, lower manufacturing costs, and the presence of numerous global and domestic agrochemical formulators.

What are the major regulatory challenges faced by Chloroacetyl Chloride producers?

Producers face significant regulatory challenges due to CAC’s high toxicity and corrosiveness. Regulations from bodies like REACH and the EPA impose strict limits on handling, storage, transport, emission control, and waste disposal, necessitating substantial investment in safety and environmental compliance technology.

How is technology influencing the manufacturing process of Chloroacetyl Chloride?

Technological advancements are shifting production from traditional batch processes to safer, more efficient continuous flow chemistry methods. This technology improves heat control during the exothermic reaction, enhances product purity, and significantly reduces the operational risk associated with handling large volumes of hazardous material.

What is the difference between industrial grade and pharmaceutical grade Chloroacetyl Chloride?

The difference lies in purity and associated standards. Industrial grade is high volume, typically used for agrochemicals, whereas pharmaceutical grade requires ultra-high purity (often >99.5%), demanding stricter quality control and traceability protocols for use in synthesizing active pharmaceutical ingredients (APIs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager