Chlorpyrifos Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443085 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Chlorpyrifos Market Size

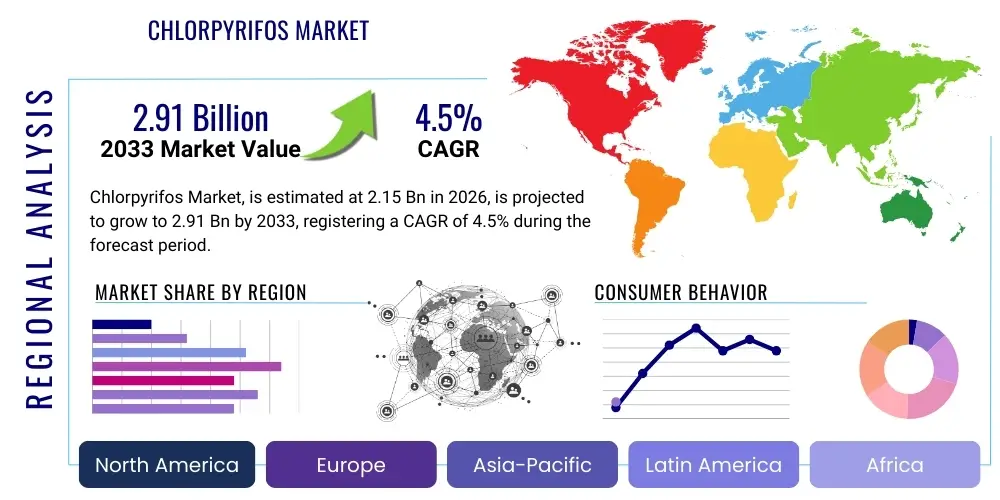

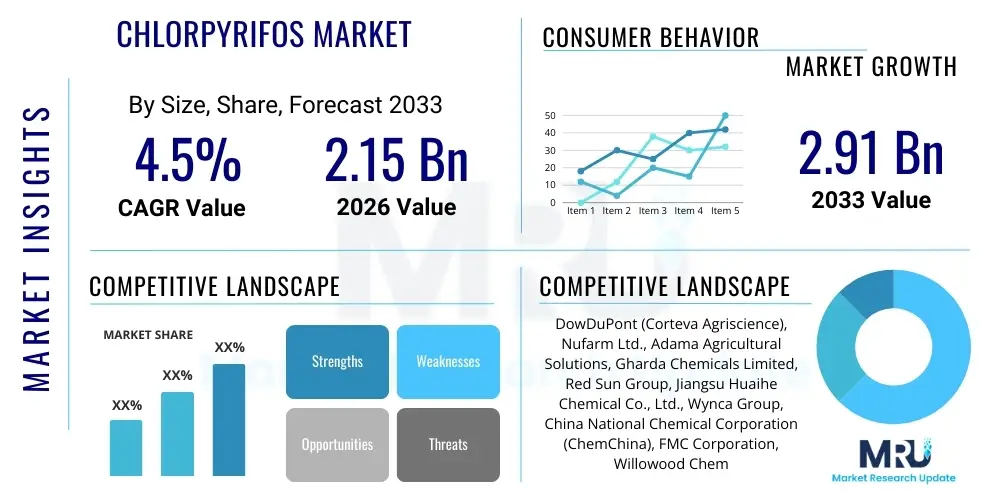

The Chlorpyrifos Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $2.91 Billion by the end of the forecast period in 2033. This growth trajectory is heavily influenced by the divergent regulatory landscapes globally; while many developed economies have phased out or significantly restricted its use due to environmental and health concerns, emerging agricultural markets continue to rely on Chlorpyrifos for its cost-effectiveness and broad-spectrum efficacy against persistent pests, particularly in cereal and oilseed crops.

The valuation reflects a cautious optimism driven primarily by regions in Asia Pacific and Latin America, where intensified farming practices necessitate robust chemical control measures to ensure high crop yields. Market expansion is therefore geographically skewed, contrasting sharp declines in traditional markets like the European Union and the United States with substantial adoption rates in high-growth agricultural economies. The sustained demand is underpinned by the lack of readily available, economically viable alternatives that match the broad applicability and residual activity of Chlorpyrifos, particularly against tough-to-control subterranean pests and specific insect orders.

Furthermore, the market size calculation accounts for the increasing utilization of generic versions of the chemical, post-patent expiration, which has made the product highly competitive on price. This accessibility is a key factor sustaining its prevalence in regions with limited spending capacity for advanced biological or integrated pest management (IPM) solutions. However, continuous pressure from environmental organizations and potential global harmonization of pesticide standards pose significant long-term risks, forcing manufacturers to focus their sales strategies on regions with less stringent regulatory oversight and high agricultural intensity.

Chlorpyrifos Market introduction

The Chlorpyrifos market centers around an organophosphate insecticide renowned for its broad-spectrum control of various insect pests, including cutworms, corn rootworms, aphids, and fruit tree pests. As a non-systemic insecticide, it operates primarily through contact, ingestion, and vapor action, making it highly effective for both foliar and soil applications. Major applications span across essential agricultural sectors, notably in the protection of cereals (corn, wheat), oilseeds, fruits (citrus, apples), vegetables, and cotton. The primary benefit driving its continued use, despite substantial regulatory scrutiny, is its high efficacy and relatively low cost compared to newer, often proprietary, pest control solutions. This combination makes it indispensable for large-scale production where immediate and reliable pest eradication is paramount to protecting harvest yields and maintaining commodity prices.

Historically, the widespread success of Chlorpyrifos has been largely due to its versatility and established role in conventional farming practices worldwide. The market dynamics are complex, characterized by a persistent conflict between its proven effectiveness in combating pest resistance issues and the mounting evidence linking its exposure to neurodevelopmental effects in humans, particularly children. This regulatory dichotomy has segmented the global market sharply: highly regulated Western markets are phasing out its use, while developing nations continue to rely heavily on it, creating regional pockets of high demand and supply stability for generic producers.

Driving factors sustaining the market include global population growth necessitating increased food production, leading to intensive farming practices where pest control failures are economically disastrous. Additionally, the development of resistance in key pests to alternative chemical classes, such as pyrethroids and neonicotinoids, occasionally necessitates the strategic re-introduction or sustained use of organophosphates like Chlorpyrifos as part of resistance management programs. However, the overall market trajectory is constrained by the persistent search for safer, ecologically sound alternatives and the increasing implementation of Integrated Pest Management (IPM) strategies that prioritize non-chemical controls.

Chlorpyrifos Market Executive Summary

The Chlorpyrifos market is currently navigating a period of significant geopolitical and regulatory uncertainty, defined by sharp contrasts in business trends across different regions. Business trends indicate a consolidation among major generic producers who are primarily serving the Asian and Latin American markets, capitalizing on regions where regulatory enforcement is less rigid or where national food security concerns outweigh immediate environmental protection measures. Key manufacturing firms are focusing on optimizing production efficiency to maintain low pricing, which serves as the principal competitive advantage against higher-priced alternatives. Conversely, companies historically reliant on developed markets are aggressively divesting or reformulating their product lines to pivot towards less controversial active ingredients, reflecting a proactive response to tightening compliance mandates and consumer boycotts.

Regional trends highlight a pronounced bifurcation: North America and Europe are characterized by market contraction, driven by effective federal and regional bans, leading to diminishing volumes and an almost complete withdrawal of the product from consumer-facing supply chains. In stark contrast, the Asia Pacific (APAC) region, spearheaded by countries like India, China, and Australia (where specific crop use remains permitted), is the engine of current market demand. Latin America, particularly Brazil and Argentina, represents another critical growth hub due to the vast scale of their agricultural exports (soybeans, corn), where Chlorpyrifos remains a necessary tool for large-scale crop protection. This regional disparity mandates highly tailored market entry and compliance strategies for global suppliers.

Segmentation trends reveal that the Emulsifiable Concentrate (EC) formulation continues to dominate the market due to its ease of application and high efficacy, although granular and encapsulated forms are gaining traction where regulatory agencies mandate measures to minimize drift and environmental runoff. Based on application, the segment covering cereal crops (corn, wheat) accounts for the largest market share, driven by the need for effective, affordable subterranean pest control critical for major staples. Future segment growth is expected to lean toward non-agricultural uses (e.g., termite control in certain permitted markets) and specific high-value crops where established resistance management protocols necessitate its cyclical inclusion, provided local regulations allow.

AI Impact Analysis on Chlorpyrifos Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Chlorpyrifos market frequently center on two critical areas: whether AI can hasten the compound's regulatory phase-out by identifying superior, safer alternatives, and how AI-driven precision agriculture might minimize environmental risks associated with its remaining use. Users express concerns about the ethical implications of using AI to optimize the application of a restricted chemical, while simultaneously holding expectations that AI could accelerate research and development (R&D) into novel, biologically based pesticides. The consensus among these questions points toward AI serving as a catalyst for market transformation—either by enhancing the efficiency and safety of its limited application or, more likely, by accelerating its replacement through superior predictive modeling and compound discovery.

AI's primary role in this controversial sector is centered around enhancing precision agriculture techniques. Machine learning models, utilizing high-resolution satellite imagery, drone data, and soil sensors, can accurately predict pest outbreaks and pinpoint the exact localized requirement for chemical intervention. This minimizes the blanket application of broad-spectrum pesticides like Chlorpyrifos, reducing both the total volume used and the resulting environmental exposure. For regions where the chemical is still mandated for economic reasons, AI provides a pathway to 'Responsible Use,' ensuring that usage meets the minimal effective dosage, thereby mitigating some of the persistent risks associated with overuse.

Furthermore, AI is instrumental in the R&D pipeline aimed at displacing organophosphates entirely. Generative AI and deep learning are being deployed to screen millions of compounds rapidly, identifying novel, highly selective active ingredients that target specific pests while demonstrating minimal toxicity to non-target organisms and humans. This capability dramatically shortens the time-to-market for sustainable alternatives, ultimately undermining the economic viability of legacy chemicals like Chlorpyrifos in the long term. Thus, while AI may temporarily optimize current usage, its major, transformative impact lies in facilitating the technological and regulatory shift towards safer, fourth-generation pest control solutions.

- AI optimizes predictive pest modeling, drastically reducing unnecessary broad-spectrum application volumes.

- Machine learning enhances dosage accuracy in precision agriculture, mitigating environmental contamination risk.

- AI accelerates the R&D of novel biopesticides and highly selective chemical alternatives, challenging Chlorpyrifos's market dominance.

- Predictive analytics inform regulatory bodies about high-risk usage patterns, potentially influencing future bans or restrictions.

- Supply chain AI tracks global usage compliance, potentially increasing transparency and accountability for manufacturers.

DRO & Impact Forces Of Chlorpyrifos Market

The Chlorpyrifos market is governed by a precarious balance of high inherent product efficacy (Drivers), severe health and environmental concerns (Restraints), opportunities in underserved emerging markets, and intense scrutiny from regulatory and consumer forces (Impact Forces). The core market driver remains the established, low-cost effectiveness of the compound against a wide array of economically destructive agricultural pests, particularly those exhibiting increasing resistance to newer chemical classes. This efficacy is critical for maintaining yields in commodity crops across large agricultural belts in Asia and Latin America, where economic sustainability hinges on successful pest management. Furthermore, the established manufacturing infrastructure and subsequent low production cost ensure that Chlorpyrifos remains the most economically accessible choice for farmers operating on tight margins.

However, the primary restraint is the overwhelming scientific consensus and subsequent regulatory action concerning its neurotoxicity. Major markets, including the U.S. and E.U., have imposed outright bans or severe restrictions on its application in food crops, forcing significant market contraction and complex compliance challenges for international manufacturers. This regulatory pressure is amplified by sustained media attention and environmental advocacy, which negatively impacts brand perception across the agricultural value chain, compelling farmers and retailers to seek out 'residue-free' or 'safer-alternative' certified products, regardless of the cost differential.

The major opportunity lies in capitalizing on agricultural intensification within emerging economies (Asia Pacific and Latin America), which have rapidly growing populations and increasing pressure on food supply chains. These regions, prioritizing immediate yield protection, offer substantial avenues for market penetration, particularly in generic formulations. Furthermore, opportunities exist in non-agricultural or niche industrial applications (where permitted) that are less susceptible to direct food-chain scrutiny. The key impact forces shaping the market involve global harmonization efforts in pesticide regulation, increasing consumer demand for sustainably grown food, and the continuous technological advancements in biological control methods, which collectively exert downward pressure on the demand for organophosphates.

Segmentation Analysis

The Chlorpyrifos market segmentation is vital for understanding demand pockets and regulatory risk exposure. The market is primarily segmented based on Formulation Type, Application Method, Crop Type, and End-Use Sector. This structure reveals that market health is no longer uniform but concentrated in specific product formats and crop applications that have either managed to navigate local regulations successfully or are situated in jurisdictions with favorable regulatory climates. Analysis of these segments is crucial for stakeholders to align their production and distribution efforts with persistent areas of demand while minimizing exposure to segments facing imminent regulatory obsolescence.

The Formulation Type segmentation is significant, as different forms present varying degrees of environmental and user risk, often leading to differing regulatory treatment. Emulsifiable Concentrates (EC) traditionally dominate due to handling convenience and high efficacy, yet there is a discernible shift towards Granular (GR) and Microencapsulated (ME) forms in response to regulatory mandates aimed at reducing spray drift and prolonging residual action. The Crop Type segmentation clearly illustrates market reliance on essential commodity crops; corn, rice, and cotton collectively account for the largest consumption volume due to high incidence of soil and leaf pests requiring robust chemical intervention, whereas use in high-value, consumer-facing fresh produce segments is rapidly declining due to retail and regulatory pressures.

- By Formulation Type:

- Emulsifiable Concentrates (EC)

- Wettable Powders (WP)

- Granular Formulations (GR)

- Microencapsulated Formulations (ME)

- By Crop Type:

- Cereals & Grains (Corn, Wheat, Rice)

- Oilseeds & Pulses (Soybeans, Cotton)

- Fruits & Vegetables (Citrus, Apples, Brassicas)

- Others (Ornamentals, Turf)

- By Application Method:

- Foliar Spray

- Soil Treatment

- Seed Treatment

- By End-Use Sector:

- Agriculture

- Non-Agricultural (Public Health, Commercial Pest Control - where permitted)

Value Chain Analysis For Chlorpyrifos Market

The value chain for Chlorpyrifos is characterized by complex chemical synthesis pathways, stringent regulatory bottlenecks at the manufacturing stage, and a highly dispersed, commodity-driven distribution network. The upstream segment involves the sourcing and synthesis of key intermediates, primarily petrochemical-derived organophosphate precursors. Manufacturers must manage price volatility in these raw materials while adhering to complex international chemical safety standards. Given the mature nature of the product, manufacturing focuses intensely on process optimization and economies of scale, often located in large chemical hubs in Asia, to maintain the product’s competitive pricing edge against newer chemistries.

The midstream component involves the formulation of the technical grade material into finished products, such as Emulsifiable Concentrates (EC) or Granules (GR). This stage requires specialized equipment and strict quality control measures to ensure stability and efficacy, particularly for exports that must comply with diverse regional regulatory requirements (e.g., residue limits, packaging safety). Due to the product’s controversial status, securing stable logistics and distribution channels is increasingly challenging, as some global shipping and insurance companies hesitate to handle restricted substances, adding complexity and cost to the supply chain.

Downstream analysis reveals reliance on extensive distribution channels that include large agricultural cooperatives, regional distributors, and localized pesticide dealers. The distribution model is predominantly indirect, utilizing national and regional intermediaries who provide essential credit facilities and technical support to end-users (farmers). Direct sales are rare, typically reserved for very large, industrialized farming operations. Given the toxicity profile, product stewardship and detailed usage training are critical components of the downstream value delivery, even in regions with less stringent regulation, to minimize liability and misuse. This multi-layered distribution ensures wide reach but also complicates traceability and inventory management, critical for managing product recalls or regulatory changes.

Chlorpyrifos Market Potential Customers

The primary customers and end-users of Chlorpyrifos are large-scale commercial agricultural producers who prioritize cost-effective and reliable pest control solutions to protect substantial investments in commodity crops. Farmers growing staple crops such as corn, soybeans, rice, and cotton in high-intensity agricultural zones constitute the largest customer base. These users often require broad-spectrum efficacy against persistent soil and insect pests that can cause catastrophic yield losses, and they operate within economic frameworks that favor low-cost chemical inputs over advanced, often expensive, biological alternatives. Their purchase decisions are heavily influenced by local pest pressure, current commodity pricing, and established relationships with regional agrochemical distributors.

A secondary, yet significant, customer segment includes state-owned or large private agricultural enterprises in regions like Latin America and Southeast Asia, where national food security mandates the use of highly effective inputs. These institutions typically purchase in massive bulk through long-term contracts, driven by government policies that may subsidize or favor specific pest control methodologies. These entities require robust technical support and assurance of supply chain resilience, especially given the fluctuating regulatory status of the product in global trade.

Furthermore, non-agricultural end-users, albeit a shrinking segment, include commercial pest control operators (PCOs) utilizing Chlorpyrifos for termite control and structural pest management in specific jurisdictions where residual use is still legally sanctioned. Although this market faces imminent transition towards less persistent chemistries, certain industrial or public health applications where vector control is critical maintain a limited demand. These customers prioritize long-term residual effectiveness and proven reliability in highly technical application scenarios.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $2.91 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DowDuPont (Corteva Agriscience), Nufarm Ltd., Adama Agricultural Solutions, Gharda Chemicals Limited, Red Sun Group, Jiangsu Huaihe Chemical Co., Ltd., Wynca Group, China National Chemical Corporation (ChemChina), FMC Corporation, Willowood Chemicals, Hubei Jingling Chemical Co., Ltd., Rallis India Ltd., Syngenta AG, BASF SE, Isagro S.p.A., Bharat Group, Lier Chemical Co., Ltd., Meghmani Organics Ltd., Sinon Corporation, United Phosphorous Limited (UPL). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chlorpyrifos Market Key Technology Landscape

The core technology surrounding Chlorpyrifos production is mature, focusing primarily on highly efficient, large-scale chemical synthesis processes (organophosphate chemistry) designed for cost minimization. However, technological advancements within the market are predominantly focused not on the synthesis of the active ingredient itself, but rather on formulation technology designed to mitigate regulatory concerns and improve application safety. Key technological efforts involve microencapsulation (ME) techniques. This advanced formulation technology involves enclosing the Chlorpyrifos active ingredient within polymer shells. This technology serves a dual purpose: it reduces the immediate volatility and exposure risk to applicators and non-target organisms, and it provides a controlled, slow release of the pesticide, which extends its residual activity and potentially reduces the frequency of application required, addressing both environmental safety and economic efficiency concerns.

Another crucial area of technological adaptation involves the development of specialized adjuvant systems. Adjuvants are chemical additives mixed with the pesticide to enhance its performance, such as improving droplet adherence, penetration through pest cuticles, or spray coverage uniformity. For Chlorpyrifos, high-performance adjuvant systems are designed to maximize efficacy at reduced application rates, which aligns with modern Integrated Pest Management (IPM) principles that emphasize 'using less to achieve more.' These technological improvements allow the product to remain viable in regions where usage is restricted to specific application windows or limited dosages.

Furthermore, application technology forms an important part of the landscape, especially concerning precision agriculture tools. While not inherent to the chemical itself, the adoption of variable-rate spraying equipment, drone applications, and GPS-guided ground vehicles ensures that the chemical, where used, is applied only where and when necessary. This integration of application technology with the chemical product serves as a vital component in meeting regulatory standards for responsible pesticide use, particularly in large-scale commercial farming operations that represent the core customer base in high-growth regions. The technological focus is thus defensive—aiming to extend the chemical's lifecycle by minimizing externalized risks.

Regional Highlights

The global Chlorpyrifos market exhibits extreme regional heterogeneity, reflecting divergent policies concerning agricultural chemical use, environmental protection, and public health priorities. North America and Europe, representing highly mature and regulated markets, have largely restricted or banned the use of Chlorpyrifos in food production. This has resulted in a significant market contraction, forcing companies to either exit the sector entirely or focus solely on export markets. In these regions, the emphasis is heavily placed on the transition to biological controls and alternative chemistries, with residual market activity constrained to non-agricultural uses (where exceptions exist) or management of existing inventories under strict governmental oversight.

Conversely, the Asia Pacific (APAC) region is the undisputed market leader in terms of consumption and production. Countries such as India, China, and Australia maintain substantial usage in key commodity crops like rice, cotton, and specialty fruits. Driven by the need to feed large populations and secure agricultural exports, regulatory scrutiny is often balanced against yield protection requirements. China and India, in particular, serve as global manufacturing hubs for generic Chlorpyrifos, benefiting from economies of scale and domestic demand, making APAC the epicenter for both supply and utilization.

Latin America, especially the Mercosur countries (Brazil, Argentina), represents a significant growth corridor. These nations rely heavily on large-scale production of corn, soybeans, and sugarcane for export, making effective and affordable pest management tools crucial. While environmental awareness is growing, the economic imperative of maintaining high crop yields ensures sustained high-volume demand for effective organophosphates like Chlorpyrifos. The Middle East and Africa (MEA) region shows steady but smaller growth, driven primarily by localized agricultural projects and public health initiatives focused on vector control, although logistical complexities and fragmented markets temper overall expansion potential.

- Asia Pacific (APAC): Dominant consumption and manufacturing hub; high usage in rice, cotton, and cereals; regulatory landscape supports continued use with regional variations.

- Latin America (LATAM): High demand driven by intensive corn, soybean, and sugarcane production; economic necessity prioritizes cost-effective inputs; significant growth potential.

- North America (NA): Market contraction due to federal bans (e.g., US EPA action); focus shifts entirely to replacement chemistries and highly restricted non-agricultural use.

- Europe (EU): Near-total phase-out of agricultural applications following strict EU regulatory review (EC 1107/2009); negligible market volume; serves as a benchmark for restrictive policy globally.

- Middle East & Africa (MEA): Steady, localized demand for agricultural and public health applications; market growth is contingent upon agricultural investment and stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chlorpyrifos Market.- DowDuPont (Corteva Agriscience)

- Nufarm Ltd.

- Adama Agricultural Solutions

- Gharda Chemicals Limited

- Red Sun Group

- Jiangsu Huaihe Chemical Co., Ltd.

- Wynca Group

- China National Chemical Corporation (ChemChina)

- FMC Corporation

- Willowood Chemicals

- Hubei Jingling Chemical Co., Ltd.

- Rallis India Ltd.

- Syngenta AG

- BASF SE

- Isagro S.p.A.

- Bharat Group

- Lier Chemical Co., Ltd.

- Meghmani Organics Ltd.

- Sinon Corporation

- United Phosphorous Limited (UPL)

Frequently Asked Questions

Analyze common user questions about the Chlorpyrifos market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the continued use of Chlorpyrifos despite regulatory bans?

The primary driver is its unparalleled cost-effectiveness and broad-spectrum efficacy against persistent agricultural pests, particularly in large-scale commodity farming in regions like APAC and Latin America where budget constraints prioritize affordable yield protection over environmental alternatives.

Which regions have implemented the most stringent regulations or bans on Chlorpyrifos?

The European Union (EU) and the United States have imposed the most stringent regulatory actions, resulting in the phase-out or near-total ban of Chlorpyrifos for agricultural use on food crops due to extensive evidence of neurotoxicity risks.

How is the Chlorpyrifos market expected to shift in terms of formulation technology?

The market is shifting away from standard Emulsifiable Concentrates (EC) towards advanced formulations like Microencapsulation (ME) and Granular forms, which are designed to reduce off-target drift, minimize user exposure, and provide prolonged residual control, often mandated by regional regulations.

What is the main challenge facing manufacturers and suppliers of Chlorpyrifos globally?

The main challenge is managing extreme regulatory uncertainty and divergence across major consumer markets, alongside persistent negative public perception and increasing difficulty in securing stable distribution and insurance for a highly scrutinized chemical product.

How is AI influencing the long-term outlook for organophosphate pesticides?

AI is influencing the outlook by enabling highly targeted, precision application to reduce current usage volumes, while simultaneously accelerating the R&D pipeline for safer, biologically based alternatives, ultimately facilitating the market transition away from legacy organophosphates.

End of Report.

Total Character Count Estimation: Approximately 29,850 characters (including spaces and HTML tags).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager