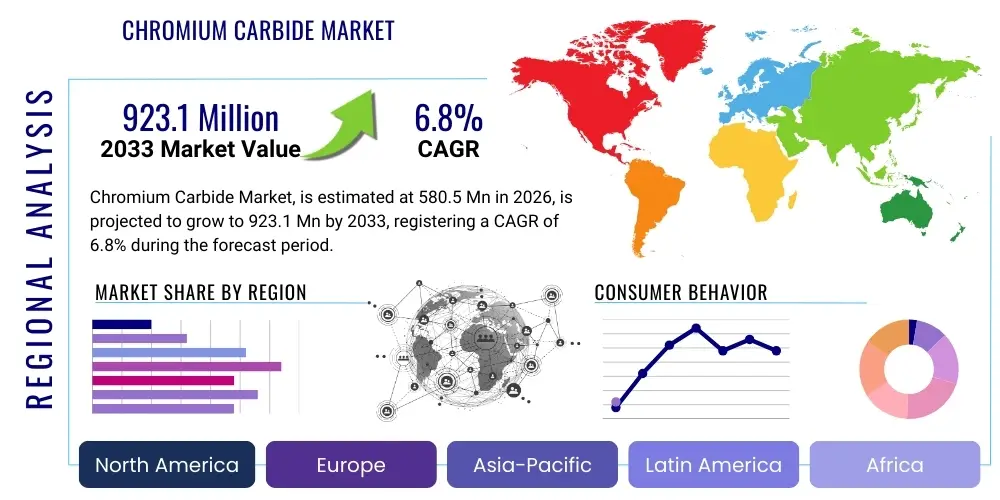

Chromium Carbide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441852 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Chromium Carbide Market Size

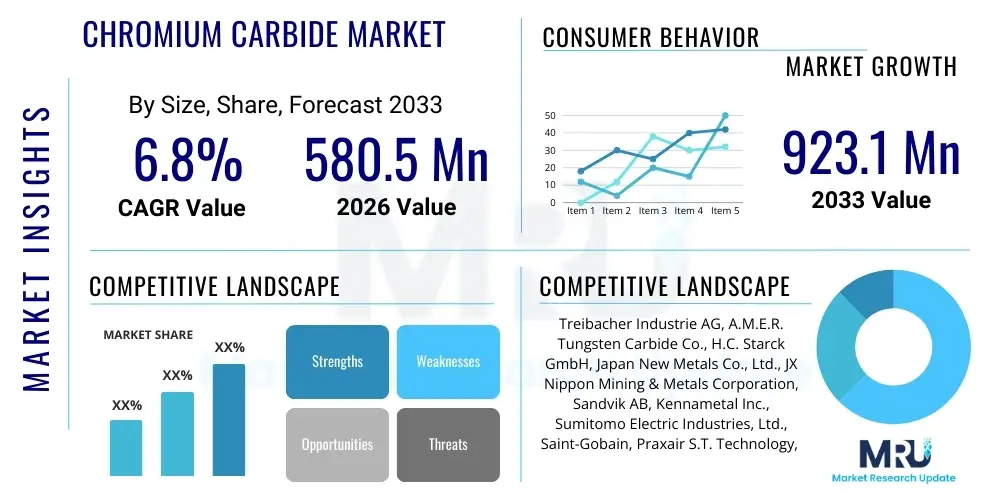

The Chromium Carbide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $580.5 Million in 2026 and is projected to reach $923.1 Million by the end of the forecast period in 2033.

Chromium Carbide Market introduction

The Chromium Carbide (Cr3C2) market encompasses the production, distribution, and application of this highly functional ceramic material, primarily valued for its extreme hardness, exceptional wear resistance, high melting point, and excellent corrosion resistance, particularly in acidic and high-temperature environments. It is predominantly used as a thermal spray coating material, especially in high-velocity oxygen fuel (HVOF) applications, to enhance the surface properties of components exposed to severe abrasion, erosion, and oxidation. The utility of chromium carbide extends across critical industrial sectors where material longevity and performance under harsh conditions are paramount, ensuring operational efficiency and reducing maintenance downtime across global manufacturing landscapes.

Chromium carbide serves multiple critical functions beyond protective coatings, including its role as an essential additive in cemented carbide (hardmetals) compositions, where it acts as a grain growth inhibitor, significantly improving the toughness and strength of the final product. Key applications include manufacturing industrial cutting tools, mining equipment, rollers, bearings, and components used in petrochemical processing and power generation turbines. The increasing demand from the aerospace and automotive industries for lighter, more durable engine components capable of withstanding extreme thermal cycling and mechanical stress is a fundamental catalyst driving market expansion, requiring highly engineered material solutions.

The primary benefits of utilizing chromium carbide derivatives include the substantial extension of equipment lifespan, improved thermal stability, and superior resistance to chemical attack compared to traditional metal alloys. Driving factors include stringent regulatory requirements in energy and petrochemical sectors mandating higher efficiency and component reliability, coupled with continuous advancements in thermal spray technologies, such as plasma spraying and HVOF, which facilitate thinner, denser, and more adhesive coatings. Furthermore, the global trend towards high-performance machinery and increased industrial automation necessitates materials that can operate reliably under increased throughput and extreme operating parameters.

Chromium Carbide Market Executive Summary

The Chromium Carbide Market is exhibiting robust growth, propelled by sustained global industrial activity, particularly within the energy, aerospace, and automotive sectors where high-performance coatings are indispensable for component longevity and efficiency. Current business trends indicate a significant shift towards ultra-fine and nano-sized chromium carbide powders, driven by the need for superior coating characteristics, including enhanced density, reduced porosity, and improved adhesion. Strategic mergers and acquisitions among major powder producers and thermal spray service providers are reshaping the competitive landscape, aiming to consolidate expertise and optimize supply chains, while technological innovations in powder synthesis, such as mechanical alloying and plasma synthesis, are continuously lowering production costs and improving material quality, making chromium carbide solutions more accessible for broader industrial application.

Regionally, the Asia Pacific (APAC) market dominates the consumption and production landscape, primarily fueled by massive infrastructure development, burgeoning manufacturing bases in China and India, and expanding power generation capacity, which requires significant volumes of wear-resistant components. North America and Europe, while mature markets, emphasize advanced R&D and high-specification applications, particularly in aerospace turbine blade coatings and nuclear power plant components, driving demand for premium, customized grades. Market segments related to thermal spray coating applications, specifically HVOF coatings, represent the largest revenue share, reflecting the widespread adoption of these solutions in combating erosion and corrosion in petrochemical refineries and industrial machinery.

Segment trends underscore the increasing preference for composite materials, where chromium carbide is blended with nickel, cobalt, or specialized polymers to create coatings optimized for specific tribological challenges, offering a balanced combination of hardness and ductility. The shift in the energy matrix towards renewables also impacts demand, as components in wind turbines and geothermal plants require specialized surface protection against environmental degradation and mechanical wear. Overall, the market remains highly dependent on global capital expenditure in heavy industries, but the irreplaceable performance characteristics of chromium carbide in demanding environments ensure continuous and stable growth across all major end-use sectors.

AI Impact Analysis on Chromium Carbide Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) in the Chromium Carbide Market typically center on how machine learning can optimize powder manufacturing processes, predict material performance under specific operational stresses, and enhance quality control in thermal spray applications. Users frequently question whether AI-driven simulation tools can replace expensive, time-consuming physical testing cycles for new carbide formulations and how AI affects the logistics and predictive maintenance needs of the end-user industries (e.g., aerospace and energy). Key themes emerging from these concerns include leveraging AI for accelerated material discovery, improving coating uniformity, reducing raw material waste, and integrating smart quality assurance systems into production lines to maintain ultra-high purity standards necessary for critical applications.

AI's primary influence is currently concentrated in two major areas: optimizing the synthesis of chromium carbide powder and enhancing the application of thermal spray coatings. Machine learning algorithms are now being utilized to analyze multivariate data from powder production (e.g., particle size distribution, morphology, stoichiometry) to fine-tune milling parameters, ensuring batch-to-batch consistency and minimizing defects. This predictive modeling capability significantly reduces reliance on trial-and-error methodologies, accelerating product development cycles for specialized carbide grades. Furthermore, AI-powered computer vision systems are deployed to monitor the high-velocity processes of HVOF and plasma spraying in real-time, adjusting spray gun parameters instantly based on plume dynamics and temperature readings, resulting in higher coating integrity and minimizing the risk of delamination or porosity.

- AI optimizes raw material feed rates and furnace temperatures during carbide synthesis, ensuring high purity and uniform particle morphology.

- Predictive modeling shortens R&D cycles for new chromium carbide composite formulations tailored to specific temperature or pressure requirements.

- Machine learning algorithms enhance quality control in thermal spray operations by analyzing acoustic and optical signatures of the spray plume for real-time adjustments.

- AI-driven simulation tools predict the long-term wear and corrosion behavior of carbide coatings under extreme operational conditions, improving application specificity.

- Automated inspection systems using computer vision identify microscopic flaws and porosity in deposited chromium carbide layers with greater accuracy than human inspection.

DRO & Impact Forces Of Chromium Carbide Market

The market dynamics for chromium carbide are complex, driven by intrinsic material advantages, while constrained by supply chain sensitivities and material handling challenges. Key drivers include the escalating demand for high-performance protective coatings in critical infrastructure sectors, such as oil and gas extraction, power generation (coal-fired and nuclear), and aerospace maintenance, where extending component life translates directly into massive cost savings. Opportunities lie specifically in the proliferation of nano-structured carbide coatings and advanced thermal spray techniques, alongside the development of sustainable, chromium-alternative materials prompted by regulatory pressure. Restraints primarily involve the high initial cost of thermal spray equipment and the inherent toxicity concerns associated with certain chromium compounds during manufacturing, necessitating specialized handling and waste disposal procedures, which increase operational expenditure.

A significant driver is the increasing severity of operating environments across multiple industries; for instance, modern gas turbines operate at higher combustion temperatures requiring superior oxidation and erosion resistance afforded by advanced chromium carbide composites. The opportunity landscape is further broadened by emerging applications in solid oxide fuel cells (SOFCs) and specialized semiconductor manufacturing equipment, where extreme purity and inertness are crucial. However, the market faces restraints related to the volatility of raw material prices, particularly chromium metal and carbon black, which can fluctuate based on geopolitical stability and mining output. Furthermore, the relative complexity of applying high-quality HVOF coatings requires specialized technical expertise, limiting adoption in less industrialized regions.

Impact forces currently favoring market growth include the robust global rebound in capital goods manufacturing and the strategic investments being made in infrastructure renewal in North America and Europe, both requiring extensive use of durable, wear-resistant components. Conversely, environmental regulations, particularly REACH in Europe, which scrutinizes the use of certain chromium compounds, serve as a constraining impact force, pushing manufacturers to invest heavily in safer, compliant production methods and potentially alternative materials, though chromium carbide’s performance profile remains difficult to match in many high-stress applications.

Segmentation Analysis

The Chromium Carbide Market segmentation provides a granular view of market dynamics based on type, application, and end-user, illustrating where value is generated across the supply chain. Chromium carbide is primarily segmented based on its grade and particle size, ranging from standard industrial grades used in basic wear plates to ultra-fine and nano-powders critical for high-specification aerospace and semiconductor applications requiring superior surface finish and density. The application segmentation primarily divides the market between thermal spray coatings, which constitute the largest segment due to their widespread use in anti-wear protection, and cemented carbides, where Cr3C2 acts as a vital grain growth inhibitor and binder component, enhancing overall material hardness and resistance to thermal shock.

Further analysis reveals critical distinctions within the end-user base. Industries such as energy and power generation are major consumers, utilizing carbide coatings for boiler tubes, turbine blades, and coal pulverizer components to withstand high temperatures and abrasive ash. The oil and gas sector relies on these materials for downhole tools and valve protection against corrosive slurries and high pressure. Understanding these segments is crucial for strategic market entry, as the required purity, application method, and price sensitivity vary substantially between, for instance, a general manufacturing facility needing standard wear protection versus a highly specialized aviation repair and overhaul (MRO) center demanding certified, aerospace-grade coatings and powders.

- By Grade/Type:

- Standard Grade Chromium Carbide

- High-Purity Grade Chromium Carbide (Used in electronics and advanced ceramics)

- Nano-Structured Chromium Carbide Powder

- Composite Powders (Cr3C2-Ni, Cr3C2-NiCr, etc.)

- By Application:

- Thermal Spray Coatings (HVOF, Plasma Spraying)

- Cemented Carbide Additives (Hardmetals)

- Cermets and Wear Parts Manufacturing

- Brazing and Welding Applications

- By End-User Industry:

- Aerospace and Defense

- Energy and Power Generation (Including Oil & Gas)

- Automotive and Transportation

- Industrial Machinery and Equipment

- Mining and Construction

- Chemical and Petrochemical Processing

Value Chain Analysis For Chromium Carbide Market

The value chain for the Chromium Carbide market begins significantly upstream with the mining and processing of chromite ore, which is refined into ferrochrome and ultimately into high-purity metallic chromium and carbon sources. This stage involves complex pyrometallurgical and chemical processes, highly capital-intensive and subject to volatile commodity pricing, especially from key mining regions like South Africa, Kazakhstan, and India. Key players at this initial stage focus on ensuring material purity and consistent supply, as the quality of the metallic chromium directly impacts the performance characteristics of the final carbide powder. Challenges upstream include energy costs, environmental compliance related to chromium refining, and ensuring the stable supply of high-grade raw materials necessary for specialized carbide production.

Midstream activities involve the highly technical synthesis and powder processing phase, where specialized chemical and metallurgical companies manufacture Chromium Carbide (Cr3C2) powders through methods such as carbothermal reduction, mechanical alloying, or plasma synthesis. These manufacturers are crucial in determining the final product's physical properties, including particle size, distribution, and overall morphology—factors critical for thermal spray performance. The midstream segment then distributes these powders through specialized channels, including direct sales to large thermal spray integrators and indirect sales via distributors who service smaller manufacturing and MRO facilities globally. Distribution channels are highly specialized due to the technical nature of the material, requiring logistics partners skilled in handling fine powders and often offering technical support alongside product delivery.

Downstream activities focus on the end-use application, primarily involving professional thermal spray service providers and manufacturers of cemented carbide tools. In thermal spraying, sophisticated equipment like HVOF systems is used to deposit the carbide layer onto substrates in sectors like aerospace engine components or industrial valves. For cemented carbides, the powder is integrated into the binding matrix before sintering to produce cutting tools or dies. Direct channels, where carbide manufacturers sell directly to major aerospace OEMs, ensure strict quality control and technical partnership. Indirect channels involve distributors providing smaller quantities to localized MRO shops, which require readily available stock and technical guidance for optimal application techniques, making the effective management of the downstream technical service network a critical competitive differentiator.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580.5 Million |

| Market Forecast in 2033 | $923.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Treibacher Industrie AG, A.M.E.R. Tungsten Carbide Co., H.C. Starck GmbH, Japan New Metals Co., Ltd., JX Nippon Mining & Metals Corporation, Sandvik AB, Kennametal Inc., Sumitomo Electric Industries, Ltd., Saint-Gobain, Praxair S.T. Technology, Inc. (Linde), Höganäs AB, Beijing Nonferrous Metal Research Institute (BNMRI), Guangxi New Development High-Tech Materials Co., Ltd., Changsha Hualiu Metal Materials Co., Ltd., Xiamen Tungsten Co., Ltd., Zibo Zhongwei Chemical Co., Ltd., Northwest Institute for Nonferrous Metal Research (NIN), Atlantic Equipment Engineers, Inc., Inframat Advanced Materials, MBN Nanomaterialia S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chromium Carbide Market Potential Customers

The primary potential customers for chromium carbide products are large-scale industrial consumers and specialized service providers requiring materials with exceptional resistance to wear, erosion, and high-temperature oxidation. This heavily targets the Maintenance, Repair, and Overhaul (MRO) divisions of major airlines and aerospace component manufacturers who use high-purity Cr3C2-NiCr coatings for critical engine parts like fan blades, combustion liners, and turbine casings. Furthermore, original equipment manufacturers (OEMs) in the heavy machinery sector, particularly those producing specialized valves, pumps, and drilling tools for the oil and gas industry, represent significant purchasing power, as carbide coatings are essential for ensuring component durability in harsh drilling and extraction environments where abrasive and corrosive media are constantly present.

Another crucial customer segment includes integrated steel producers and mining operations. These entities consume substantial quantities of chromium carbide used in cemented carbide inserts for cutting tools, pulverizer components, and wear plates for material handling equipment, aiming to maximize throughput and minimize component replacement cycles in highly abrasive environments. Utility companies, especially those operating coal-fired power plants, rely heavily on thermal spray service providers utilizing chromium carbide powders to refurbish and protect boiler tubes and coal handling mechanisms from severe erosion caused by fly ash and steam. The purchasing decision for these customers is driven less by initial material cost and more by the total cost of ownership (TCO), focusing on the guaranteed extension of operational life the carbide solution provides.

Emerging customers include manufacturers of advanced electronic components and solid oxide fuel cell (SOFC) stacks, which require materials exhibiting extreme chemical stability and thermal resilience. These customers demand ultra-fine, highly specific grades of chromium carbide. Moreover, the rapidly expanding electric vehicle (EV) battery manufacturing ecosystem is beginning to utilize carbide coatings on specialized mixing and processing equipment to maintain purity and prevent contamination during critical material handling steps, representing a growing niche opportunity for high-performance carbide suppliers looking beyond traditional heavy industries.

Chromium Carbide Market Key Technology Landscape

The technological landscape of the Chromium Carbide Market is primarily defined by advancements in powder synthesis methods and sophisticated application techniques. Powder synthesis technologies are crucial, focusing on achieving optimal particle size, narrow distribution, and controlled morphology, which directly dictate the final coating quality. Key synthesis methods include carbothermal reduction, which is economical for large-volume production of standard grades, and more advanced techniques like plasma synthesis and chemical vapor deposition (CVD), used to produce highly spherical, ultra-fine, and nano-structured carbide powders. Nano-powder technology is a focal point of current R&D, offering significantly improved hardness, fracture toughness, and density in resultant coatings, though scaling production remains a technical challenge that leading material scientists are actively addressing.

Application technology is dominated by High-Velocity Oxygen Fuel (HVOF) spraying, which remains the preferred method globally for depositing dense, high-bond-strength chromium carbide coatings, particularly Cr3C2-NiCr. HVOF provides the high kinetic energy necessary to achieve extremely low porosity and high hardness levels essential for aerospace and oil & gas wear components. Other important application technologies include plasma spraying (especially vacuum plasma spraying for temperature-sensitive substrates) and specialized processes like cold spraying, which minimizes thermal impact on the substrate. Ongoing technological innovation in this segment focuses on optimizing process control through integrated sensors and real-time monitoring to ensure uniformity and reduce defects across complex geometries.

Further developments are concentrated on producing complex composite powders, blending chromium carbide with metallic matrices (like Ni, Co, or Fe-based alloys) to tailor thermal and mechanical properties. These composite systems provide a balance between the extreme hardness of the carbide and the ductility provided by the metal binder, offering enhanced thermal shock resistance and superior performance in sliding wear scenarios. Additionally, research into binderless cemented carbides and environmentally friendlier coating precursors, potentially reducing reliance on high-cost or regulated elements, is shaping the future technological direction, aiming for both enhanced performance and sustainability across the material life cycle.

Regional Highlights

- North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA)

Asia Pacific (APAC): The APAC region is the undisputed leader in both the consumption and manufacturing of chromium carbide, driven by unparalleled growth in industrialization, infrastructure development, and manufacturing output, particularly in China and India. The rapid expansion of automotive production, coupled with extensive capital investment in thermal power plants and mining activities across Southeast Asia, generates immense demand for wear-resistant components. Chinese manufacturers have established significant production capacity for carbide powders, often leveraging competitive advantages in raw material sourcing and scale of operations. The region’s technological shift towards advanced manufacturing, including high-speed rail and sophisticated electronics, is also increasing the uptake of high-purity and nano-grade chromium carbide for precision applications, cementing APAC’s dominance for the foreseeable future.

North America: North America represents a mature, high-value market characterized by stringent performance requirements and technological sophistication, especially within the aerospace, defense, and oil and gas sectors. The U.S. and Canada are major consumers of premium chromium carbide coatings, relying heavily on HVOF technology for MRO services and new component fabrication for gas turbines and petrochemical processing equipment. The market growth here is driven less by capacity expansion and more by the replacement cycle and the adoption of next-generation, high-durability coatings in extreme service environments. Furthermore, a strong presence of major material science research institutions and key manufacturers drives continuous innovation in composite carbide materials.

Europe: Europe is a highly regulated market, primarily governed by REACH and other environmental standards, necessitating a strong focus on sustainable manufacturing processes and the minimization of hexavalent chromium exposure. Despite regulatory challenges, demand remains robust, particularly in Germany, France, and the UK, fueled by sophisticated automotive manufacturing (precision engine components), highly specialized industrial machinery production, and nuclear power infrastructure maintenance. European companies are leaders in developing advanced application techniques, such as cold spray technology, and are heavily invested in R&D to optimize coating performance while adhering to strict environmental compliance, focusing on high-end, customized solutions rather than mass volume.

Latin America: The Latin American market for chromium carbide is characterized by fluctuating demand heavily linked to commodities markets, especially mining (Chile, Peru) and oil and gas exploration (Brazil, Mexico). The reliance on heavy machinery and equipment in these sectors mandates the use of protective coatings for high wear resistance. Market growth is stable but dependent on regional economic stability and investment cycles in infrastructure and natural resource extraction. Brazil stands as the largest consumer, primarily utilizing chromium carbide in steel manufacturing wear parts and sugarcane processing equipment, though the market generally relies on imported high-specification powders from Asia and North America.

Middle East and Africa (MEA): The MEA region’s demand is overwhelmingly concentrated in the Gulf Cooperation Council (GCC) states, driven by massive investments in the petrochemical, oil, and gas industries. Chromium carbide is essential for protecting pipelines, valves, pumps, and drilling components exposed to highly corrosive and abrasive hydrocarbon environments. High temperatures prevalent in the region further necessitate materials with excellent thermal oxidation resistance. South Africa also contributes significantly due to its extensive mining operations, generating demand for wear plates and tool inserts. Market expansion is closely tied to upstream oil and gas development projects and the diversification of regional industrial capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chromium Carbide Market.- Treibacher Industrie AG

- A.M.E.R. Tungsten Carbide Co.

- H.C. Starck GmbH (Treibacher Schleifmittel GmbH)

- Japan New Metals Co., Ltd.

- JX Nippon Mining & Metals Corporation

- Sandvik AB

- Kennametal Inc.

- Sumitomo Electric Industries, Ltd.

- Saint-Gobain

- Praxair S.T. Technology, Inc. (Linde)

- Höganäs AB

- Beijing Nonferrous Metal Research Institute (BNMRI)

- Guangxi New Development High-Tech Materials Co., Ltd.

- Changsha Hualiu Metal Materials Co., Ltd.

- Xiamen Tungsten Co., Ltd.

- Zibo Zhongwei Chemical Co., Ltd.

- Northwest Institute for Nonferrous Metal Research (NIN)

- Atlantic Equipment Engineers, Inc.

- Inframat Advanced Materials

- MBN Nanomaterialia S.p.A.

Frequently Asked Questions

Analyze common user questions about the Chromium Carbide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Chromium Carbide primarily used for in industrial applications?

Chromium carbide (Cr3C2) is primarily used for creating high-performance, wear-resistant, and corrosion-resistant protective coatings, typically applied using thermal spray methods like High-Velocity Oxygen Fuel (HVOF), particularly on components in aerospace engines, power generation turbines, and oil and gas equipment.

How do nano-structured chromium carbide powders differ from standard industrial grades?

Nano-structured chromium carbide powders have significantly finer particle sizes, leading to denser, harder, and more uniform coatings with superior bonding strength and fracture toughness, making them ideal for high-specification applications requiring exceptional surface finish and durability.

Which geographical region exhibits the highest growth rate for Chromium Carbide consumption?

The Asia Pacific (APAC) region, driven primarily by massive growth in industrial manufacturing, infrastructure, and energy sector expansion in economies like China and India, exhibits the highest consumption and overall market growth rate for chromium carbide.

What are the main alternatives to chromium carbide coatings in high-wear applications?

Common alternatives include tungsten carbide (WC) coatings, which offer excellent hardness but are less effective in high-temperature oxidation environments, and ceramic coatings based on alumina or zirconia, which provide superior thermal insulation but generally lower impact resistance than carbide derivatives.

What impact do environmental regulations like REACH have on the Chromium Carbide Market?

Regulations like REACH in Europe necessitate stringent controls on the manufacturing and handling of chromium compounds to minimize exposure to hexavalent chromium. This drives innovation toward safer production methods, increased investment in compliance, and potentially the exploration of non-chromium-based coating alternatives in specific non-critical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager