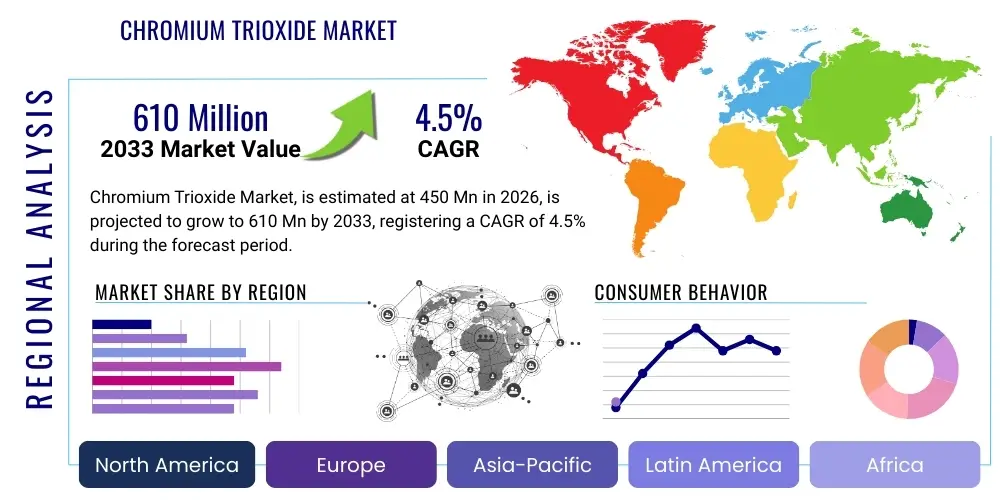

Chromium Trioxide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440911 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Chromium Trioxide Market Size

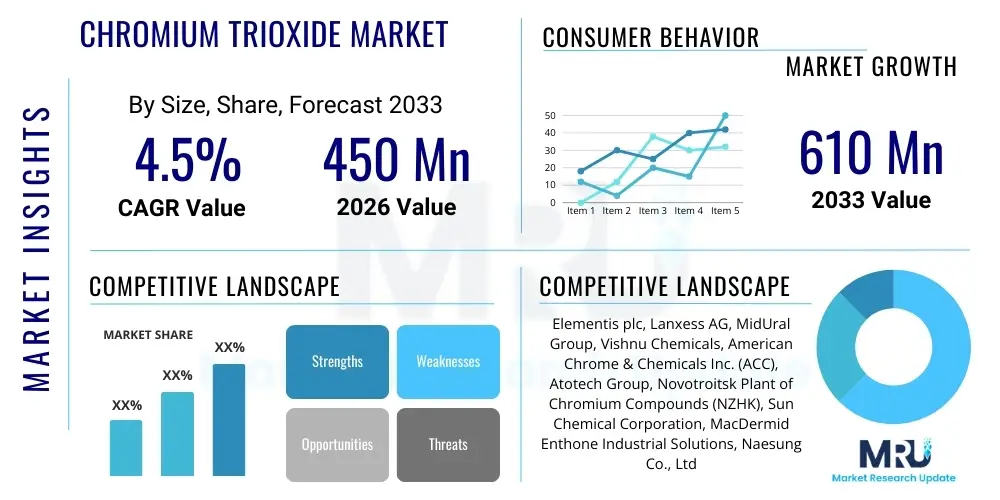

The Chromium Trioxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 610 Million by the end of the forecast period in 2033.

Chromium Trioxide Market introduction

Chromium trioxide, chemically represented as CrO3 and often referred to as chromic acid, is a highly versatile and potent oxidizing agent crucial for numerous industrial applications. It typically appears as dark purple-red crystals and is highly soluble in water. Its primary function in the global market revolves around its application in metal finishing processes, particularly chrome plating, which imparts superior corrosion resistance, hardness, and aesthetic appeal to various substrates used in automotive, aerospace, and construction sectors. Furthermore, CrO3 is instrumental in the production of high-performance pigments, catalysts, and specialized chemicals, sustaining demand across diverse manufacturing ecosystems despite increasing regulatory scrutiny regarding its toxicity and environmental persistence.

The market dynamics for chromium trioxide are intrinsically linked to the performance of heavy industries, notably the growth trajectory of the automotive industry in emerging economies requiring decorative and functional chrome finishes. The product’s utility extends significantly into the wood preservation industry, offering fungicidal protection, though this application is facing increased replacement by less toxic alternatives in many developed regions. The undeniable benefits of using CrO3, such as facilitating complex chemical reactions and providing durable coatings, continue to drive its consumption. Key driving factors include industrial expansion in Asia Pacific, the persistent demand for high-strength, corrosion-resistant components in aerospace and defense, and its indispensable role in the synthesis of organic chemicals.

However, the operational environment is complex, marked by stringent global health and safety regulations, particularly REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in the European Union, which classifies Chromium (VI) compounds, including trioxide, as substances of high concern due to their carcinogenic nature. This regulatory pressure necessitates significant investment in advanced effluent treatment technologies and the exploration of viable, less harmful substitutes. Despite these challenges, the established efficiency and cost-effectiveness of traditional chromium plating processes ensure its continued dominance in niche high-performance applications where substitution remains technically challenging or economically prohibitive.

Chromium Trioxide Market Executive Summary

The Chromium Trioxide market demonstrates resilience supported by robust demand from the metal finishing and catalyst manufacturing sectors, predominantly localized in rapidly industrializing nations. Business trends indicate a marked shift towards implementing safer handling and disposal procedures, driven by mandatory global environmental standards, which increases operational expenditure but ensures market sustainability. Key market participants are focusing on vertical integration and optimizing logistics to manage fluctuating raw material costs (primarily chromite ore) and secure supply chains. Furthermore, there is a distinct competitive trend involving the development of chromic acid alternatives and closed-loop recycling systems, aimed at mitigating regulatory risks associated with Cr(VI) compounds while maintaining necessary performance characteristics for critical end-use applications like hard chrome plating.

Regionally, the market exhibits bifurcation: Asia Pacific (APAC) stands as the primary consumption hub, fueled by expansive manufacturing bases in China and India, particularly in automotive and construction materials. Conversely, markets in North America and Europe are characterized by high regulatory stringency and sophisticated environmental controls, necessitating specialized product grades and advanced waste management. European growth is constrained by the necessity of obtaining Authorisation under REACH for continued use, pushing certain operations to migrate or invest heavily in abatement technologies. North America maintains stable demand driven by the aerospace and defense sectors, which prioritize the superior performance of CrO3 coatings for demanding applications.

Segment-wise, the Metal Finishing application segment dominates the market share due to the indispensable nature of chrome plating in engineering applications demanding exceptional hardness and wear resistance. Within the segmentation by grade, the Technical Grade maintains the largest volume share, serving high-volume industrial plating and chemical synthesis, while the Pure Grade commands a premium price point, dedicated primarily to sensitive catalyst preparation and specialty chemical manufacturing. The overarching trend across all segments involves a growing preference for suppliers demonstrating advanced environmental compliance and verifiable sustainability practices, impacting procurement decisions even in cost-sensitive segments.

AI Impact Analysis on Chromium Trioxide Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Chromium Trioxide market typically center on optimizing complex chemical manufacturing processes, ensuring regulatory adherence, and predicting highly volatile raw material pricing. Users frequently question how AI algorithms can improve the efficiency of electrolyte bath composition monitoring in hard chrome plating, thereby reducing hazardous waste generation and lowering the risk of defects. A significant concern revolves around leveraging machine learning models for sophisticated predictive maintenance of production equipment used in CrO3 synthesis, which minimizes downtime and improves reactor yields. Additionally, questions often arise regarding AI's ability to analyze complex global regulatory data (like evolving REACH requirements) in real-time to adjust supply chain and operational strategies automatically, addressing the core toxicity risk associated with the product.

- AI-driven optimization of electrolytic bath parameters to minimize chromium discharge and enhance plating consistency.

- Predictive modeling of chromite ore supply and price fluctuations, improving procurement strategy and inventory management.

- Automated monitoring and anomaly detection in wastewater treatment systems to ensure continuous compliance with stringent environmental discharge limits.

- Machine learning algorithms supporting research into less toxic or safer Cr(VI) substitution compounds by analyzing chemical structures and performance data.

- Enhancing worker safety protocols through AI-enabled surveillance and real-time hazard detection in production facilities handling toxic materials.

DRO & Impact Forces Of Chromium Trioxide Market

The Chromium Trioxide market is governed by a complex interplay of strong industrial drivers balanced against severe regulatory and environmental constraints. The primary driver is the sustained global demand for high-performance, corrosion-resistant metallic components, particularly in the infrastructure, automotive refinishing, and aerospace sectors where the durability provided by chrome plating is unmatched by many alternatives. Opportunities arise from technological advancements focusing on developing cleaner production routes and efficient recycling of chromium from spent electrolytes, reducing the overall environmental footprint and potentially extending the lifecycle of current industrial practices. Conversely, the market faces intense resistance from increasingly strict global environmental regulations, specifically the classification of Cr(VI) compounds as carcinogens, which drives up compliance costs, restricts usage in certain consumer applications, and pushes end-users toward non-chromium alternatives, creating a continuous downward pressure on demand in highly regulated Western markets.

Drivers: The rapid expansion of manufacturing capabilities in emerging Asian economies, coupled with increased consumer spending on durable goods, significantly boosts demand for metal finishing. Specifically, the military and defense industries rely heavily on hard chrome plating for critical components requiring exceptional wear resistance and longevity, maintaining a stable demand segment. Furthermore, the use of chromium trioxide as a key ingredient in producing catalysts necessary for various organic syntheses, including high-density polyethylene (HDPE), ensures its continued relevance in the petrochemical industry. Technological improvements in high-speed, high-efficiency plating processes also make chromium trioxide a compelling choice for mass production lines where speed and reliability are paramount.

Restraints: The most significant restraint is the severe toxicity profile of Chromium Trioxide, leading to widespread regulatory restrictions, particularly the sunsetting provisions under European REACH regulations, which pose an existential threat to its use in the EU. High costs associated with sophisticated effluent treatment and worker protection measures increase the total cost of ownership for end-users. Additionally, the development and increasing commercial viability of substitute technologies, such as physical vapor deposition (PVD) and thermal spray coatings, particularly for decorative and lighter industrial applications, present a substantial competitive restraint. Public awareness and pressure from environmental non-governmental organizations (NGOs) further complicate market operations, necessitating transparent and costly environmental management systems.

Opportunities: Opportunities lie primarily in innovations focused on making Chromium Trioxide use safer and more sustainable. This includes developing enhanced closed-loop systems for chromium recycling, which recapture the chemical efficiently and reduce reliance on new feedstock. The market also benefits from the rising demand for high-purity CrO3 in niche applications like magnetic media manufacturing and specialized laboratory reagents. Furthermore, global investment in infrastructure renewal and repair, particularly in developing regions, ensures a continued requirement for durable, chrome-plated components, offering growth pockets even as mature markets decelerate their consumption due to regulatory shifts. The development of Trivalent Chromium (Cr(III)) plating technologies, which still require CrO3 in some precursor forms, could also provide transitional opportunities.

Segmentation Analysis

The Chromium Trioxide market is segmented primarily based on application, which dictates the volume and purity requirements, and by grade, which reflects the necessary quality and target end-use. Application segmentation highlights the dominance of metal finishing, covering both hard (engineering) and decorative chrome plating, followed by chemical synthesis and wood preservation. This structure reveals distinct regional market characteristics, where high-value, stringent applications like aerospace plating are concentrated in developed regions, while mass-market applications like decorative plating and anticorrosion treatments are expanding rapidly in Asia Pacific. The segmentation analysis is crucial for understanding the regulatory exposure of different market segments; for instance, wood preservation has seen significant contraction due to environmental concerns, while the specialized aerospace segment, where substitution is difficult, remains robust.

The market relies heavily on the availability of technical and pure grades of chromium trioxide, each serving fundamentally different industrial needs. Technical grade, being less refined, is cost-effective and suitable for large-scale applications such as industrial plating baths and producing basic intermediate chemicals. The pure grade, characterized by extremely low impurity levels, is vital for highly sensitive processes, including the production of catalysts for petrochemical cracking and the precise formulation of specialized chemical solutions. Analyzing these segments helps manufacturers tailor production capabilities and marketing strategies, focusing on compliance and logistics for the high-volume technical segment, while emphasizing purity and technical support for the niche pure grade segment.

Geographic segmentation underscores the disparity in market maturity and regulatory environments. Asia Pacific leads consumption due to robust industrial activity, minimal substitution penetration, and less stringent regulatory enforcement compared to the West. Conversely, European and North American segments, despite showing slower volume growth, drive innovation in sustainability and compliance technology. This segmentation provides insights into future investment priorities, suggesting that growth capital should be directed toward capacity expansion in APAC, while research and development funds should be allocated to compliance-enhancing technologies in Europe and North America to secure existing high-value business lines.

- By Application:

- Metal Finishing (Hard Chrome Plating, Decorative Plating)

- Chemical Synthesis (Catalysts, Pigments, Oxidizing Agents)

- Wood Preservation

- Pesticides & Fertilizers

- Others (Magnetic media, Dyes)

- By Grade:

- Technical Grade

- Pure Grade

- By End-Use Industry:

- Automotive

- Aerospace & Defense

- Construction & Infrastructure

- Chemical & Petrochemical

- General Manufacturing

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (MEA)

Value Chain Analysis For Chromium Trioxide Market

The value chain for Chromium Trioxide commences with the upstream acquisition and processing of chromite ore, the primary raw material. Major producers secure access to high-quality ore, which is then processed through roasting with alkali and subsequent leaching and purification steps to yield sodium dichromate, the essential precursor chemical. This upstream phase is highly capital-intensive and susceptible to geopolitical risks and commodity price volatility. Efficient management of this initial stage, particularly energy consumption during the high-temperature roasting process, is critical to maintaining competitive pricing in the final CrO3 market. Suppliers who possess integrated mining and chemical processing capabilities enjoy significant cost advantages and supply stability over those reliant on external procurement of intermediate dichromate compounds.

The midstream phase involves the conversion of sodium dichromate into chromium trioxide through sulfuric acid treatment and crystallization. This manufacturing stage requires specialized chemical expertise and robust environmental control systems due to the highly corrosive and toxic nature of the inputs and outputs. Manufacturing facilities are often strategically located near major consumption centers in industrial clusters to minimize transportation costs for this hazardous material. The distribution channel is crucial, as CrO3 is classified as dangerous goods (Class 5.1 Oxidizer) under international shipping regulations, demanding specialized packaging, certified handlers, and complex logistics networks. Direct distribution is favored for large industrial users in the metal finishing and catalyst sectors, while indirect distribution through specialized chemical distributors handles smaller volumes and regional market penetration.

The downstream segment consists of the various end-user industries that apply the product. Direct buyers are typically large electroplating firms serving the automotive and aerospace Tier 1 suppliers, or major chemical manufacturers utilizing CrO3 as a catalyst precursor. Indirect consumption occurs when smaller job plating shops purchase the chemical from distributors. Crucially, the downstream segment is responsible for the disposal and management of chromium-laden waste streams. Regulatory compliance at this stage significantly influences procurement decisions, driving demand toward suppliers who can offer take-back schemes or technical support for waste minimization and treatment. The performance of the entire value chain is therefore intrinsically linked to global industrial output and the stringency of environmental regulatory frameworks.

Chromium Trioxide Market Potential Customers

The primary customer base for Chromium Trioxide resides within the industrial processing sectors that require superior material performance in terms of hardness, wear resistance, and corrosion protection. The largest end-users are electroplating companies, which use CrO3 to create decorative chrome finishes for consumer goods (faucets, automotive trim) and critical hard chrome plating for industrial machinery (hydraulic cylinders, rollers, engine components). The demand from this segment is cyclical, tracking global automotive production rates and capital expenditure in heavy manufacturing. Due to the high performance requirements, particularly in aerospace and defense, these customers often seek high-purity, consistent supply, and increasingly demand traceability and regulatory documentation demonstrating the chemical's compliance with strict usage mandates.

A secondary, yet significant, customer segment includes the chemical synthesis industry, particularly manufacturers of specialized inorganic and organic chemicals, pigments, and catalysts. Chromium trioxide is indispensable in the production of catalysts used in polymerization processes (e.g., Phillips catalyst for HDPE) and in the synthesis of certain vitamin K forms and corrosion inhibitors. These customers prioritize product purity and consistent chemical reactivity, often requiring the more expensive Pure Grade. Their purchasing decisions are driven by the need to maintain complex, continuous chemical processes, making reliable supply and technical specification adherence paramount, rather than purely cost considerations.

The final key customer group encompasses wood treatment facilities, although this segment has contracted significantly in regulated markets. Historically, CrO3 was used in Chromated Copper Arsenate (CCA) formulations for preserving timber used in construction and utility poles. While residential use is banned in many developed nations, industrial and utility applications still maintain residual demand, particularly in regions where low-cost, durable protection is necessary for structural timber exposed to severe weather conditions. These buyers prioritize bulk supply and competitive pricing, though they are under increasing pressure to adopt alternative preservation methods, representing a declining but stable short-term customer base in specific developing markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 610 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elementis plc, Lanxess AG, MidUral Group, Vishnu Chemicals, American Chrome & Chemicals Inc. (ACC), Atotech Group, Novotroitsk Plant of Chromium Compounds (NZHK), Sun Chemical Corporation, MacDermid Enthone Industrial Solutions, Naesung Co., Ltd., Chongqing Minfeng Chemical, Hunter Chemical LLC, Sichuan Jinhong Chemical, Jilin Hexing Chemical, Nippon Chemical Industrial Co., Ltd., China Minmetals Corporation, Alkali Metals Ltd., Bohai Chemical Group, S.A. Lipesa S.A., Dalian Xingang Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chromium Trioxide Market Key Technology Landscape

The manufacturing technology for Chromium Trioxide is mature, largely based on the chemical processing of chromite ore. The prevailing industrial method involves the roasting of chromite ore with sodium carbonate or potassium carbonate under high temperatures in rotary kilns to form soluble sodium chromate, which is subsequently converted to sodium dichromate. The final step involves treating the dichromate solution with sulfuric acid, followed by crystallization and separation to yield CrO3 crystals. The key technological focus in this production phase is not revolutionary process change, but rather optimizing energy efficiency during roasting and significantly enhancing purification and waste treatment protocols to minimize the hazardous hexavalent chromium content in industrial effluent. Advanced filtration and ion exchange systems are crucial technological components ensuring environmental compliance.

Beyond the core manufacturing, the technological landscape is increasingly shaped by innovations in application and hazard mitigation. In the metal finishing segment, the focus is on developing high-efficiency plating systems, such as pulsed current plating, which can improve deposit characteristics and reduce the concentration of chromic acid required in the bath. Crucially, engineering technology dedicated to waste management, including membrane separation, electrodialysis, and advanced reduction-precipitation techniques, is gaining prominence. These technologies are essential for end-users in highly regulated markets to treat spent plating solutions effectively, reducing Cr(VI) to the less toxic Cr(III) state before discharge, thus enabling continued operation under strict permits.

A significant technological development is the ongoing research and commercialization of alternative processes and materials aimed at substitution. While not directly CrO3 technology, the success of technologies like Trivalent Chromium Plating (TCP) and various PVD/CVD coatings significantly influences the future demand trajectory. For example, some TCP processes utilize CrO3 indirectly or as a high-purity input for specific precursor steps, maintaining a tangential market link. Manufacturers are investing in process control automation, often integrating spectroscopic analysis and closed-loop feedback systems to maintain bath quality and chemical balance, maximizing efficiency and safety, which is paramount when handling this highly regulated substance.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for Chromium Trioxide consumption, largely driven by mass manufacturing and infrastructure development, particularly in China and India. The robust automotive industry, coupled with expansive construction activity requiring durable metal components, fuels high-volume demand, primarily for technical grade CrO3 in decorative and hard chrome plating. While environmental regulations are tightening, enforcement mechanisms are often less restrictive than in Western counterparts, allowing for lower operational costs and rapid industrial growth. The region presents the highest growth potential for the forecast period, attracting significant investment in new chemical production capacities, especially focused on serving regional demand rather than export.

- Europe: The European market is defined by regulatory pressure, dominated by the REACH authorization framework, which mandates that users prove no viable substitute exists and implement the strictest control measures. This has led to contraction in high-volume, low-margin applications like wood preservation. However, demand remains stable in niche, high-value segments such as aerospace, defense, and specialized catalyst manufacturing, where the technical performance of chromium coatings is irreplaceable. European manufacturers lead the world in developing advanced effluent treatment technologies and closed-loop recycling systems to sustain their operations under rigorous environmental scrutiny.

- North America: North America presents a mature market characterized by steady, albeit slower, growth. Demand is strongly correlated with the aerospace and defense sectors, which maintain high standards for corrosion and wear resistance, often relying on military specifications that favor hard chrome plating. The automotive industry also contributes, particularly in replacement and high-end vehicle finishing. U.S. Environmental Protection Agency (EPA) regulations govern usage, pushing manufacturers toward adopting best available control technologies (BACT) for emissions and waste management, ensuring a focus on sustainability and compliance from all market participants.

- Latin America and MEA: These regions represent developing markets for CrO3, primarily linked to localized metal finishing needs for basic infrastructure projects, automotive assembly, and chemical production. Consumption is heavily dependent on commodity prices and regional economic stability. Growth is projected to be moderate, driven by urbanization and industrialization, but these markets often struggle with establishing advanced recycling and waste management infrastructure, making cost-effectiveness a key purchasing factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chromium Trioxide Market.- Elementis plc

- Lanxess AG

- MidUral Group

- Vishnu Chemicals

- American Chrome & Chemicals Inc. (ACC)

- Atotech Group (MacDermid Enthone Industrial Solutions)

- Novotroitsk Plant of Chromium Compounds (NZHK)

- Sun Chemical Corporation

- Jilin Hexing Chemical

- Nippon Chemical Industrial Co., Ltd.

- China Minmetals Corporation

- Alkali Metals Ltd.

- Bohai Chemical Group

- S.A. Lipesa S.A.

- Hunter Chemical LLC

- Chongqing Minfeng Chemical

- Sichuan Jinhong Chemical

- Naesung Co., Ltd.

- Dalian Xingang Chemical Co., Ltd.

- Hebei Chromate Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Chromium Trioxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Chromium Trioxide?

The predominant application is metal finishing, specifically hard chrome plating used extensively in the automotive, aerospace, and general engineering sectors for enhanced wear resistance and corrosion protection. Secondary drivers include chemical synthesis for catalysts and high-performance pigments.

How do global regulations like REACH affect the Chromium Trioxide market?

Regulations such as the EU's REACH classify CrO3 as a Substance of Very High Concern (SVHC) due to its toxicity, necessitating special authorization for continued use. This significantly increases compliance costs and accelerates the search for viable, less toxic alternatives, particularly impacting market consumption in Europe.

Which geographical region holds the largest market share and why?

Asia Pacific (APAC), particularly China and India, holds the largest market share. This dominance is attributed to high-volume industrialization, rapid growth in automotive and manufacturing industries, and generally lower adoption rates of costly Cr(VI) substitutes compared to North America and Europe.

What are the key substitutes challenging the Chromium Trioxide market?

Key substitutes include Trivalent Chromium Plating (TCP), which offers a less hazardous alternative for decorative applications, and various advanced coating technologies like Physical Vapor Deposition (PVD) and thermal spray coatings for engineering applications requiring superior hardness.

How does the value chain manage the environmental risk associated with CrO3?

Environmental risk management is focused on advanced waste treatment technologies (reduction and precipitation) at the manufacturing and end-user levels. Furthermore, specialized logistics and distribution channels certified for handling hazardous materials ensure safe transportation, minimizing environmental and safety incidents throughout the supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager