Circular Connectors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443326 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Circular Connectors Market Size

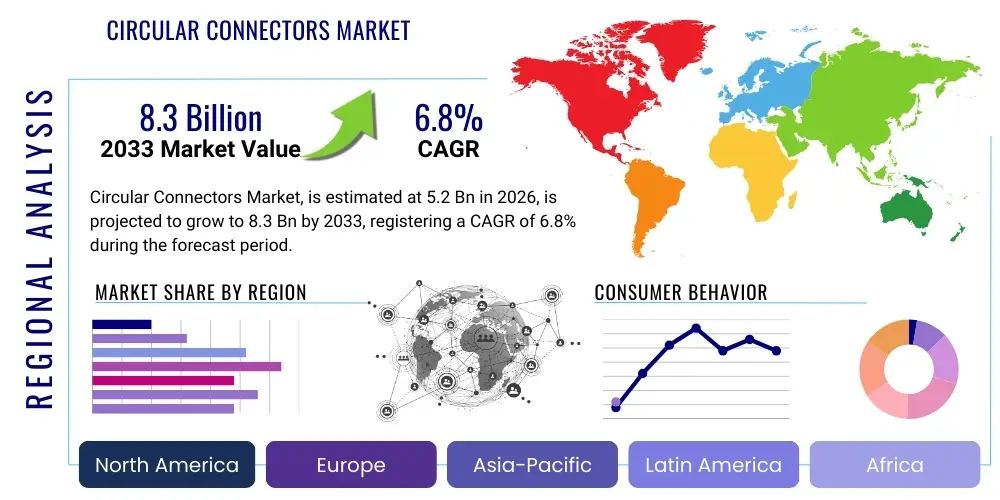

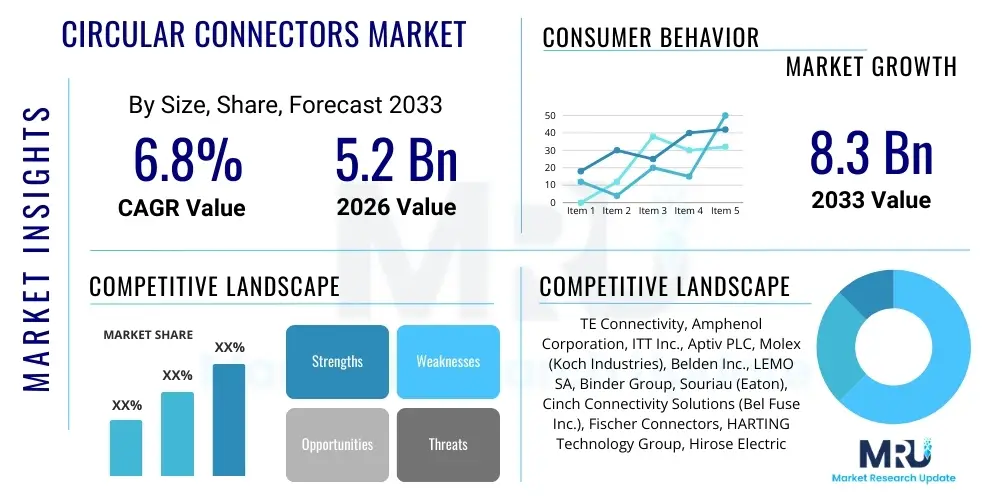

The Circular Connectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.3 Billion by the end of the forecast period in 2033.

Circular Connectors Market introduction

The Circular Connectors Market encompasses specialized electrical and electronic components designed for robust, reliable, and frequent connection and disconnection in harsh environments. These connectors, characterized by their cylindrical shape and secure locking mechanisms (such as thread coupling, bayonet, or push-pull), are essential for transmitting power, signal, and data across various mission-critical systems. They offer superior shielding against electromagnetic interference (EMI) and radio-frequency interference (RFI), along with enhanced resistance to vibration, shock, and environmental ingress (IP rating), making them indispensable in challenging operational settings.

Major applications of circular connectors span high-reliability sectors, including aerospace and defense (avionics, ground support), heavy industrial machinery (robotics, automation), medical devices (imaging equipment, patient monitoring), and transportation (rail, automotive high-voltage systems). The primary benefit derived from these components is their exceptional durability and coupling security, ensuring continuous operation and minimizing downtime in applications where failure is not an option. Furthermore, their standardized designs facilitate interchangeability and ease of maintenance, crucial factors in complex integrated systems.

The market growth is primarily driven by the global surge in industrial automation and the proliferation of Industry 4.0 initiatives, requiring ruggedized connectivity for sensor networks and control systems. Additionally, continuous advancements in electric vehicle (EV) technology necessitate high-power, secure circular connectors for battery management systems and charging infrastructure. The escalating defense expenditure globally, focusing on modernizing military communication and intelligence systems, further fuels the demand for high-performance, miniaturized circular solutions capable of handling increasing data rates.

Circular Connectors Market Executive Summary

The Circular Connectors Market is witnessing robust expansion, driven predominantly by structural shifts in global manufacturing toward smart factory models and the accelerated deployment of 5G infrastructure, which demands reliable fiber-optic and high-speed copper circular interfaces. Business trends indicate a strong focus on developing highly specialized hybrid connectors that integrate power, signal, and optical fibers into a single form factor, catering to the complexity of modern robotics and autonomous systems. Mergers and acquisitions remain a crucial strategy for key players seeking to consolidate technological expertise, particularly in miniaturization and integration capabilities, thereby enhancing market reach into emerging high-growth segments like medical diagnostics and space exploration.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investment in electronics manufacturing, automotive production, and governmental defense programs, notably in China, Japan, and South Korea. North America and Europe maintain a leading position in terms of technological innovation and high-specification demand, particularly within the aerospace and medical industries, demanding compliance with stringent regulatory standards (e.g., MIL-SPEC). Market participants are actively responding to supply chain resilience challenges by adopting localized manufacturing strategies and dual-sourcing approaches to mitigate geopolitical risks and meet rapidly increasing demand across diverse industrial hubs.

Segment trends reveal that the industrial sector retains the largest market share, though the fastest growth trajectory is observed within the high-speed data transmission segment, specifically circular connectors rated for 10Gbps or higher, necessitated by advanced computing and communication architectures. Bayonet coupling mechanisms remain popular due to their quick-lock capabilities, especially in field deployment scenarios. However, push-pull mechanisms are gaining traction in medical and test & measurement environments where space constraints and ergonomic operation are paramount. The continued demand for ruggedized solutions capable of enduring extreme temperatures and corrosive elements underscores the market's trajectory towards increased specialization and material science innovation.

AI Impact Analysis on Circular Connectors Market

Common user questions regarding AI's impact on the Circular Connectors Market typically revolve around whether AI will automate design processes, improve predictive maintenance reliability, or fundamentally change the physical requirements of connectivity components. Users are concerned about how increased data throughput generated by AI-driven systems (e.g., autonomous vehicles, smart factories) translates into demands for higher bandwidth, lower latency, and greater connector density. Analysis indicates that while AI does not directly replace the physical connector, its influence is significant in optimizing manufacturing workflows, driving the need for ultra-high-reliability connectors for edge computing infrastructure, and enabling self-monitoring connector systems that communicate their operational status, enhancing overall system uptime.

AI's primary influence is seen in the acceleration of product lifecycle management and quality assurance. Machine learning algorithms analyze vast datasets derived from production lines, identifying subtle defects and optimizing material usage, thereby increasing the yield of high-precision connectors, which is critical given the tight tolerances required for high-frequency applications. Furthermore, the deployment of industrial AI solutions necessitates a massive upgrade in the underlying sensing and control infrastructure, directly increasing the volume and complexity of circular connectors required to link distributed AI components, cameras, and processing units in real-time environments.

The integration of AI also pushes the boundaries of connector functional requirements. For instance, in robotics where AI governs movement and decision-making, connectors must withstand extremely dynamic flexing cycles and vibration while maintaining perfect signal integrity. This pressure drives manufacturers to innovate in areas like contact geometry, lightweight materials, and enhanced shielding solutions that minimize data degradation, ensuring the reliable execution of AI models running at the edge.

- AI optimizes manufacturing processes, leading to higher precision and quality control in circular connector production.

- Increased data generation from AI-enabled systems (IoT, autonomous driving) drives demand for high-speed, high-density circular connectors.

- AI-driven predictive maintenance relies on integrated smart connectors capable of monitoring temperature, vibration, and performance parameters.

- Accelerated development cycles using AI simulation tools shorten the time-to-market for new connector designs tailored to harsh environments.

- AI facilitates the development of next-generation hybrid circular connectors supporting integrated power delivery alongside high-bandwidth data requirements for advanced robotics.

DRO & Impact Forces Of Circular Connectors Market

The Circular Connectors Market dynamics are shaped by strong foundational drivers centered on industrial digitalization and global defense modernization, counterbalanced by inherent restraints related to standardization complexity and high initial investment costs. Opportunities are abundant in niche, high-growth sectors such as space technology and EV charging infrastructure. These dynamics create powerful impact forces that influence technological innovation, competitive pricing strategies, and regional market prioritization among manufacturers.

Major drivers include the rapid expansion of the global factory automation sector, necessitating ruggedized connectivity solutions that withstand environmental extremes, coupled with significant governmental spending on C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems, which require MIL-SPEC compliant circular interconnects. However, the high degree of customization required for many circular connectors leads to complexity in achieving universal standardization, acting as a restraint. Furthermore, the initial tooling and certification costs associated with producing high-reliability, qualified connectors (e.g., for aerospace) represent significant financial hurdles for new market entrants.

The core opportunities lie in the booming market for Electric Vehicle (EV) high-voltage battery connection systems, where large, robust circular connectors are critical for safety and efficiency, and in the burgeoning field of medical miniaturization, demanding smaller, lightweight, and sterilizable connectors for portable devices. The overriding impact forces compel market players toward continuous R&D investment in material science (e.g., specialized plastics, advanced contact plating) to improve ingress protection and reduce weight while maintaining high current capacity, simultaneously driving consolidation among smaller specialized firms and larger, diversified electronic component manufacturers.

Segmentation Analysis

The Circular Connectors Market is comprehensively segmented based on several critical factors, primarily coupling type, contact size, data rate capability, and the major end-use application areas where reliability and ruggedness are paramount. Understanding these segments is crucial for strategic market planning, as each category responds differently to macro-economic trends and technological shifts. The industrial and aerospace & defense segments consistently dictate the highest specification requirements, driving innovation across material science and environmental sealing technologies, while segments like telecommunications push the limits of data transmission speeds.

Coupling mechanisms, such as threaded, bayonet, and push-pull, define operational efficiency and suitability for specific environments. Threaded connectors offer maximum vibration resistance but are slower to mate; bayonet offers speed and security; and push-pull mechanisms are optimized for ease of use in crowded device panels. Technological advancement is focused on hybridizing these capabilities, integrating power and high-speed data within increasingly smaller form factors. The trend towards miniaturization (driven by portable electronics and unmanned aerial systems) also heavily influences segment development, necessitating specialized micro-circular connectors.

The market structure reflects a bifurcated demand profile: high-volume, standardized industrial connectors used in factory floors versus low-volume, highly customized, and heavily certified connectors required for applications such as deep-sea exploration or military avionics. Success in the market requires manufacturers to maintain diverse product portfolios capable of addressing the full spectrum of environmental challenges, from dust and moisture protection (IP ratings) to extreme temperature resilience and resistance to harsh chemicals encountered in process industries.

- By Type:

- Threaded Coupling

- Bayonet Coupling

- Push-Pull Coupling

- Breakaway (Quick-Release)

- By Contact Termination:

- Solder Cup

- Crimp

- PCB Mount

- Wire Wrap

- By Data Rate Capability:

- Low-Speed Signal (Analog/Digital)

- High-Speed Data (Ethernet, Fiber Optic, USB)

- By End-Use Industry:

- Aerospace & Defense

- Industrial Automation & Control

- Medical Devices

- Automotive & Transportation (EVs, Rail)

- Telecommunications

- Oil & Gas/Marine

Value Chain Analysis For Circular Connectors Market

The value chain for circular connectors is intricate, starting from the procurement of highly specialized raw materials, moving through precision manufacturing processes, and concluding with complex distribution channels that serve specialized end-users. Upstream activities are critical, involving sourcing high-purity metals (copper alloys, brass, specialized steel) for contacts and shells, and engineering plastics and elastomers for insulators and seals. Pricing fluctuations and geopolitical stability concerning critical raw materials heavily influence the overall cost structure. High-precision machining and plating processes (e.g., gold, nickel, palladium plating) are intensive, requiring specialized intellectual property and advanced manufacturing facilities to achieve the necessary durability and electrical performance metrics, particularly for high-reliability military and medical grades.

Midstream activities focus on the sophisticated assembly of thousands of components, involving stamping, molding, and automated insertion, followed by stringent quality control and testing, often according to rigorous international standards (e.g., MIL-DTL, IEC). Downstream distribution is segmented, utilizing both direct sales models for large, highly customized aerospace and military contracts, and indirect channels through specialized electronics distributors for standard industrial and commercial off-the-shelf (COTS) products. Large Original Equipment Manufacturers (OEMs) often purchase directly to ensure technical collaboration during the design-in phase, leveraging the connector manufacturer’s expertise to optimize system integration and reliability.

The strategic differentiation in the distribution channel lies in the technical support provided. Indirect distributors often serve smaller system integrators and MRO (Maintenance, Repair, and Operations) needs, offering local stock and quick turnaround. Direct sales teams focus on strategic accounts, providing comprehensive engineering support, application training, and qualification documentation necessary for regulated industries. The efficiency of the supply chain, particularly logistics for international component transfer, is vital to maintaining competitive lead times, especially considering the rapid prototyping demands of emerging sectors like industrial robotics and advanced sensing platforms.

Circular Connectors Market Potential Customers

Potential customers for circular connectors represent sectors demanding uncompromising reliability, environmental robustness, and adherence to specific regulatory or military standards. These end-users typically integrate the connectors into expensive, long-lifecycle equipment where component failure results in significant operational costs or safety hazards. The largest buyers are global integrators and manufacturers in the Defense and Aerospace sectors, purchasing large volumes of highly specified, often customized, MIL-SPEC or equivalent connectors for aircraft wiring, ground vehicles, satellite communication systems, and missile guidance platforms.

The second major cohort comprises industrial automation firms and machine builders who require reliable connectivity for harsh factory floor environments, including robotics, programmable logic controllers (PLCs), and vision systems. These customers prioritize features like high IP ratings, resistance to cutting fluids, and quick-lock mechanisms (bayonet or push-pull) to minimize installation time. Additionally, the rapidly growing Electric Vehicle (EV) industry acts as a crucial buyer, demanding high-power, high-voltage circular connectors for battery charging inlets and internal battery connection systems that meet rigorous thermal management and safety standards.

Furthermore, medical device manufacturers represent a high-value customer segment, requiring miniaturized, sterilizable (autoclavable), and chemically inert circular connectors for patient monitoring systems, surgical tools, and diagnostic imaging equipment. These buyers emphasize low mating forces, high aesthetic quality, and compliance with stringent FDA and global medical device regulations. Test and measurement equipment manufacturers also form a significant base, seeking high-frequency, low-crosstalk connectors to maintain signal integrity in sensitive diagnostic and calibration instruments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Amphenol Corporation, ITT Inc., Aptiv PLC, Molex (Koch Industries), Belden Inc., LEMO SA, Binder Group, Souriau (Eaton), Cinch Connectivity Solutions (Bel Fuse Inc.), Fischer Connectors, HARTING Technology Group, Hirose Electric Co. Ltd., Delphi Technologies, ODU GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Circular Connectors Market Key Technology Landscape

The current technology landscape in the circular connectors market is dominated by advancements aimed at increasing data density, improving environmental sealing, and facilitating easier, faster mating in field conditions. A significant technological focus is on developing hybrid interfaces that combine various functions—power, signal, and optical fiber—within a single connector shell, minimizing panel space and weight, a critical requirement for applications such as UAVs (Unmanned Aerial Vehicles) and high-performance industrial robotics. Material science innovation is driving the creation of lighter-weight composite shells that offer comparable durability and shielding to traditional aluminum or stainless steel while reducing overall mass, particularly important in aerospace applications where weight reduction translates directly into fuel efficiency.

Furthermore, critical improvements are being made in contact technology to handle high-speed data transmission required by protocols like 10 Gigabit Ethernet (10GBASE-T) and beyond. This involves optimizing contact geometry and utilizing advanced plating techniques to minimize insertion loss and crosstalk, ensuring signal integrity in electrically noisy environments. The integration of fiber optic contacts (often referred to as Expanded Beam technology) within standard circular form factors is becoming more prevalent, offering immunity to EMI and vastly increased bandwidth over traditional copper solutions, addressing the needs of modern telecommunication and defense systems.

Another pivotal technological trend involves the transition toward smart connectors enabled by embedded electronics and sensors. These intelligent components can monitor crucial parameters such as temperature, mating cycles, vibration, and even contact resistance in real-time. This capability supports predictive maintenance strategies by reporting performance degradation before system failure occurs. Moreover, manufacturers are continuously enhancing ingress protection (IP) ratings, with many circular connectors now offering IP68 or higher protection, making them suitable for prolonged submersion or operation in extremely dusty, corrosive industrial settings, securing the reliability demanded by the burgeoning oil & gas and marine technology sectors.

Regional Highlights

The Circular Connectors Market exhibits distinct growth patterns and demand drivers across major geographic regions, reflecting varied industrial maturity levels, regulatory frameworks, and technological adoption rates. North America and Europe traditionally lead in demanding high-specification, MIL-SPEC compliant connectors due to their established aerospace, defense, and medical device manufacturing bases, focusing heavily on miniaturization and high-speed fiber integration. Conversely, the Asia Pacific region dominates in terms of sheer volume and manufacturing output, driven by rapid industrialization and governmental investment in infrastructure.

-

North America: This region is characterized by high demand for ruggedized connectors in the Aerospace and Defense sectors, driven by significant investment in military modernization (F-35 program, missile defense systems) and the robust commercial space industry. The stringent quality and regulatory requirements (ITAR, MIL-STD) necessitate domestic production or highly certified imports, favoring established global players with strong local R&D capabilities. Furthermore, the burgeoning EV and medical technology sectors in the US and Canada are adopting advanced, lightweight circular connectors for high-power and sterilized applications, respectively.

The U.S. remains the core market for advanced connectivity solutions, prioritizing technological leadership in high-reliability applications. Defense spending acts as a stable anchor for demand, requiring connectors capable of extreme environmental tolerance and high-speed data handling in tactical communication and unmanned systems. The presence of major technology hubs also fuels innovation in data center and telecom connectivity, where circular hybrid connectors facilitate rapid deployment and disconnection of network infrastructure, ensuring market stability and driving pricing premiums for high-performance products.

-

Europe: European demand is strongly influenced by the adoption of Industry 4.0, particularly in Germany, France, and Italy, leading to significant consumption of industrial circular connectors for factory automation, robotics, and machine tools. The European Union’s focus on sustainable energy and electric mobility also generates substantial demand for specialized, heavy-duty circular connectors for charging stations and e-mobility platforms (e.g., high-voltage busbar connections). Compliance with stringent European standards (e.g., REACH, RoHS) drives material and manufacturing innovation toward environmentally friendly processes.

The aerospace sector in countries like France (Airbus) and the UK contributes heavily to the high-reliability segment, requiring certified components for commercial aviation and defense programs. European manufacturers often excel in specialized niche markets such as medical imaging and high-end audio/visual equipment, demanding push-pull connectors known for ease of use and aesthetics. The emphasis across Europe is generally on long-term reliability and high quality, often necessitating customized solutions rather than relying solely on COTS products, which supports stable pricing in the premium segment.

-

Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, fueled by robust manufacturing activity, massive infrastructure development, and accelerated deployment of 5G networks across China, India, and Southeast Asia. China is both the largest consumer and producer of circular connectors globally, driven by its massive automotive market (both traditional and EV) and its aggressive targets for industrial automation. The sheer volume of electronics and systems manufacturing in this region creates an unparalleled demand base.

The regional growth is also significantly supported by governments’ investment in local defense and aerospace capabilities (e.g., India's modernization efforts). While cost-sensitivity remains a factor in high-volume industrial applications, the rising sophistication of local manufacturing is increasing the demand for mid-to-high reliability connectors. The rapid expansion of factory floor digitization and the increasing complexity of localized supply chains necessitate scalable and highly reliable standard circular connector formats that can be rapidly integrated into diverse equipment, often favoring local or regional suppliers capable of fast turnaround times.

-

Latin America, Middle East, and Africa (MEA): This combined region represents an emerging market with specialized demand concentrated primarily in the resource extraction, telecommunications, and infrastructure sectors. In the Middle East, substantial defense spending and major construction projects (e.g., smart cities) drive demand for ruggedized and high-security connectors. Latin America sees demand primarily from the oil & gas industry (offshore drilling) and renewed investment in rail and transportation infrastructure, requiring specialized environmental sealing and corrosion resistance.

Market penetration in these regions is heavily dependent on imported components, often from North America and Europe, due to limited local high-specification manufacturing capacity. Telecommunications expansion, especially in connecting remote areas, necessitates robust, weather-resistant circular connectors for cell towers and satellite equipment. Growth is often volatile, tied directly to commodity prices (oil) and governmental infrastructure budgets, requiring suppliers to focus on competitive procurement and localized support structures to overcome logistical challenges inherent to the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Circular Connectors Market.- TE Connectivity

- Amphenol Corporation

- ITT Inc.

- Aptiv PLC

- Molex (Koch Industries)

- Belden Inc.

- LEMO SA

- Binder Group

- Souriau (Eaton)

- Cinch Connectivity Solutions (Bel Fuse Inc.)

- Fischer Connectors

- HARTING Technology Group

- Hirose Electric Co. Ltd.

- Delphi Technologies

- ODU GmbH & Co. KG

- Phoenix Contact

- Radiall S.A.

- Glenair Inc.

- JAE (Japan Aviation Electronics Industry, Limited)

- NorComp Inc.

Frequently Asked Questions

Analyze common user questions about the Circular Connectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of choosing circular connectors over rectangular ones?

Circular connectors are inherently superior in harsh environments due to their robust geometry, which provides excellent mechanical stability, easier sealing for ingress protection (IP ratings), and better resistance to shock, vibration, and EMI shielding. Their cylindrical shape allows for 360-degree environmental sealing and efficient cable routing, making them preferred in aerospace, defense, and heavy industrial applications.

How is Industry 4.0 influencing the design and adoption of circular connectors?

Industry 4.0 requires highly distributed sensor networks and real-time control systems, dramatically increasing the demand for ruggedized, high-density circular connectors with high IP ratings (IP67/68) and fast data transfer capabilities (Industrial Ethernet). Designs are moving toward hybrid connectors that simultaneously manage power, control signals, and gigabit data to simplify complex robotic and automated machinery installations.

What role does miniaturization play in the current Circular Connectors Market trends?

Miniaturization is a dominant trend, particularly in portable medical devices, military wearables, and unmanned aerial vehicles (UAVs). End-users demand connectors that are smaller, lighter, and easier to handle without sacrificing electrical performance or environmental durability. This requires advanced material science and high-precision manufacturing techniques to maintain tight tolerances and high contact density in compact form factors.

Which coupling mechanisms are most common, and where are they typically used?

The most common coupling mechanisms are threaded, bayonet, and push-pull. Threaded coupling offers maximum security against vibration, ideal for aerospace and heavy machinery. Bayonet coupling provides quick, secure mating, favored in defense and general industrial use. Push-pull coupling allows for rapid connection/disconnection with low insertion force, making it popular in medical and test & measurement equipment.

What key standards and certifications must circular connectors meet for regulated industries?

Circular connectors serving regulated industries must adhere to stringent standards. For defense and aerospace, this includes MIL-SPEC (e.g., MIL-DTL-38999). Medical devices require ISO 13485 compliance and often specific FDA approvals for materials. Industrial applications rely on IEC standards for environmental protection (IP ratings) and electrical safety. Compliance ensures reliability, interoperability, and system safety in mission-critical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Circular Connectors Market Size Report By Type (Hybrid connectors, Signal connectors, Data connectors, Power connectors), By Application (Military, Transportation, Industrial, Residential, Medical), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Circular Connectors Market Statistics 2025 Analysis By Application (Military, Transportation, Industrial, Residential, Medical), By Type (Hybrid connectors, Signal connectors, Data connectors, Power connectors), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager