Civil Air Transport Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442937 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Civil Air Transport Service Market Size

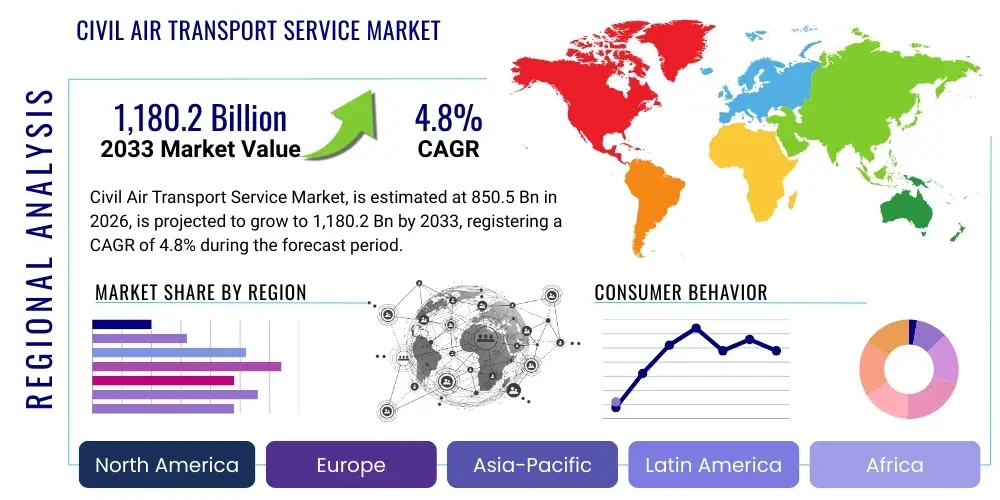

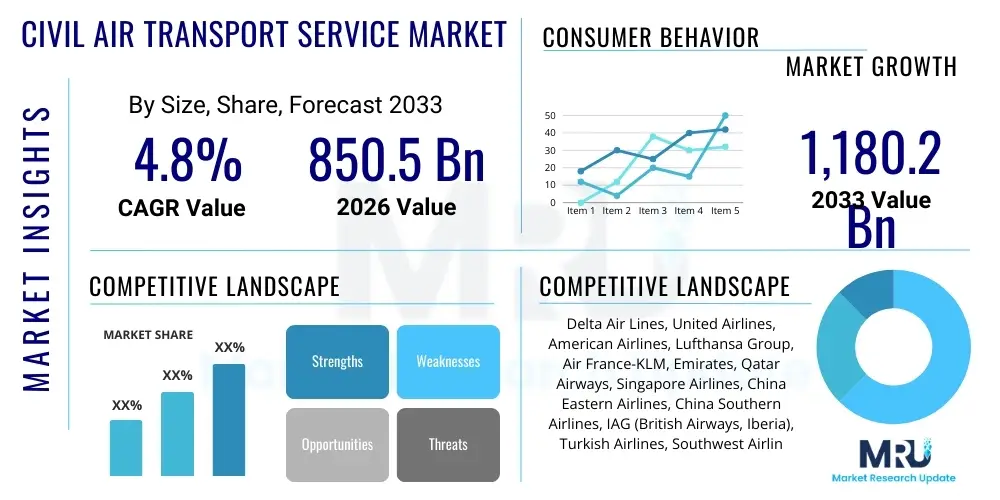

The Civil Air Transport Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850.5 Billion in 2026 and is projected to reach USD 1,180.2 Billion by the end of the forecast period in 2033.

The steady expansion of the global middle class, particularly in high-growth economies across Asia Pacific and Latin America, is a primary catalyst driving this valuation increase. Increased disposable incomes directly translate into higher propensity for both leisure and business travel, placing sustained demand pressure on established and emerging air carriers. Furthermore, the imperative for enhanced global connectivity, underpinning complex supply chains and just-in-time inventory systems, cements the critical role of air cargo transport, which contributes significantly to the overall market valuation. Market growth is structurally linked to macroeconomic stability and the progressive liberalization of bilateral and multilateral air service agreements, facilitating greater route density and competitive pricing structures.

Forecasting models indicate that technological advancements in fleet management, predictive maintenance, and next-generation fuel efficiency will act as key enablers for profitability and scalability within the sector. While the market demonstrates resilience, investment cycles in wide-body aircraft renewal programs and infrastructure upgrades at major international hubs necessitate substantial capital expenditure. The projected market size incorporates anticipated recoveries in international long-haul travel, which suffered setbacks during recent global disruptions, positioning the sector for robust, albeit measured, expansion toward the end of the forecast period.

Civil Air Transport Service Market introduction

The Civil Air Transport Service Market encompasses all commercial and private operations related to the movement of passengers and cargo via aircraft, fundamentally serving as the backbone of global connectivity and trade facilitation. This sector includes scheduled and non-scheduled air carriers, comprehensive Maintenance, Repair, and Overhaul (MRO) services, ground handling operations, and associated airport services that ensure efficient, safe, and reliable air travel and logistics. Major applications span leisure tourism, business executive travel, high-value goods transport (e.g., pharmaceuticals, electronics), and essential humanitarian logistics. The primary benefit derived from this market is the dramatic reduction in transit time over long distances, which is indispensable for modern global commerce and cultural exchange. Driving factors for sustained growth include the rapid urbanization of populations, deregulation encouraging market entry and competition, and continuous innovation in aerospace engineering that delivers quieter, more efficient, and larger-capacity aircraft.

Market participants range from multinational flag carriers operating extensive global networks to specialized regional airlines and dedicated cargo operators. The complexity of the market is defined by stringent safety regulations imposed by international bodies such as the International Civil Aviation Organization (ICAO) and domestic regulators like the FAA and EASA, ensuring standardized operational protocols worldwide. Product offerings are becoming increasingly differentiated, moving beyond basic transport to incorporate enhanced passenger experiences through in-flight connectivity, personalized services, and sophisticated loyalty programs. The long-term trajectory of the market is heavily influenced by commitments to sustainability, with significant emphasis placed on developing Sustainable Aviation Fuels (SAF) and optimizing air traffic management to minimize environmental impact.

Furthermore, the inherent interdependence between the Civil Air Transport Service Market and global economic indicators means that fluctuations in GDP, fuel prices, geopolitical stability, and consumer confidence profoundly impact sector performance. As economies worldwide pivot towards services and digital commerce, the need for rapid, reliable cargo movement is elevating the strategic importance of air logistics, especially for e-commerce fulfillment and time-sensitive delivery of perishable goods. The market structure, highly capital-intensive and subject to long planning horizons for fleet acquisition and route development, requires consistent investment and operational agility to navigate cyclical demand patterns and manage unforeseen external shocks, yet its essential role in globalization ensures fundamental long-term stability.

Civil Air Transport Service Market Executive Summary

The Civil Air Transport Service Market is navigating a phase of targeted recovery and structural transformation, marked by accelerated digitalization and a renewed focus on environmental, social, and governance (ESG) metrics. Business trends are characterized by consolidation among major carriers seeking operational synergies and pricing power, coupled with aggressive expansion of low-cost carriers (LCCs) targeting short-to-medium haul leisure markets. Carriers are heavily investing in fleet modernization to achieve mandated fuel efficiency targets and reduce carbon emissions, directly impacting procurement cycles for new generation aircraft. Geopolitically, the recalibration of major trade routes and shifting tourism preferences necessitate dynamic route planning and risk management strategies. The immediate future is projected to witness elevated labor negotiations and inflationary pressures on input costs, particularly fuel and airport charges, compelling airlines to optimize yield management through sophisticated algorithmic pricing models.

Regional trends reveal the Asia Pacific (APAC) market as the principal driver of future growth, owing to robust demographic expansion, rapid infrastructure development, and increasing intra-regional connectivity, particularly within China, India, and Southeast Asia. North America and Europe, while mature, maintain high profitability driven by dense premium long-haul routes and sophisticated maintenance infrastructures (MRO). The Middle East continues to leverage its strategic geographical position to act as a crucial hub connecting East and West, supported by substantial state investment in airport capacity. Conversely, Latin America and Africa face challenges related to regulatory fragmentation and inconsistent infrastructure quality but offer substantial untapped potential in regional connectivity once these hurdles are addressed, driving investment toward smaller, more flexible aircraft types.

Segment trends indicate that the Cargo Transport segment, following the surge experienced during the pandemic, is normalizing but structurally stronger due to entrenched e-commerce demands and pharmaceutical logistics requirements. Passenger Transport is seeing a bifurcated recovery, with leisure travel consistently outperforming business travel, necessitating airlines to re-evaluate cabin configurations and service differentiation. The MRO segment is experiencing high demand driven by the aging global fleet and complex maintenance schedules, pushing providers toward digitalization, predictive analytics, and component pooling solutions to improve turnaround times and resource utilization. Segmentation by aircraft type favors narrow-body jets for their flexibility and lower operating costs in high-frequency, short-haul networks, although wide-body demand remains steady for strategic long-haul global routes.

AI Impact Analysis on Civil Air Transport Service Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Civil Air Transport Service Market center predominantly on three core themes: operational efficiency, safety enhancements, and personalized customer experience. Common questions address how AI can optimize complex flight planning, predict maintenance failures before they occur, manage burgeoning air traffic control demands, and streamline airport security and turnaround processes. There is a palpable expectation that AI will deliver significant cost savings through fuel optimization and labor efficiency, alongside mitigating human error in high-stakes operational environments. Concerns, however, revolve around data security, the ethical implications of autonomous decision-making (e.g., in abnormal situations), and the potential for widespread job displacement in ground handling and administrative roles. Users seek clarification on the practical timelines for AI adoption, the regulatory hurdles involved, and how airlines can leverage machine learning to move beyond simple automation to genuine personalized service delivery, particularly in disruption management.

AI's role is transformative, moving the industry from reactive maintenance and static planning to predictive, data-driven operations. For air carriers, machine learning algorithms are optimizing scheduling, crew rostering, and pricing strategies in real-time based on dynamic demand forecasting and competitive intelligence. This optimization extends significantly into fuel management, where AI analyzes weather patterns, flight paths, and aircraft performance data to calculate the most efficient route, minimizing fuel burn and contributing directly to sustainability goals. Furthermore, in the Maintenance, Repair, and Overhaul (MRO) sector, AI-powered predictive analytics monitor thousands of sensor data points on aircraft components, allowing for timely, condition-based maintenance rather than adherence to rigid schedules, thereby maximizing aircraft availability and reducing unexpected delays that heavily impact consumer satisfaction.

The consumer-facing aspects of the Civil Air Transport Service Market are also being revolutionized by AI. Chatbots and virtual assistants handle a substantial portion of customer service inquiries, including booking changes, baggage tracking, and flight status updates, enabling human agents to focus on complex problem resolution. More critically, AI enhances security protocols by analyzing biometric data and behavioral patterns at checkpoints, improving throughput while maintaining stringent security levels. The future success of major carriers will increasingly rely on their ability to integrate deep learning models into their core IT infrastructure to provide hyper-personalized offers, manage major operational disruptions seamlessly, and ensure that the end-to-end travel experience is characterized by predictability and minimal friction.

- AI-driven Predictive Maintenance (PdM) dramatically reduces component failure rates and maximizes aircraft operational time.

- Dynamic Revenue Management systems utilize machine learning for optimal real-time pricing and capacity allocation.

- Enhanced Air Traffic Management (ATM) modeling improves route efficiency, reducing congestion and associated fuel consumption.

- AI-powered biometrics and video analytics streamline airport security and check-in processes, enhancing passenger flow.

- Automated customer interaction through natural language processing (NLP) improves scalability and responsiveness in service delivery.

- Simulation models based on AI optimize crew scheduling and rostering, complying with complex regulatory rest requirements.

DRO & Impact Forces Of Civil Air Transport Service Market

The Civil Air Transport Service Market is propelled by significant underlying drivers such as the escalating volume of international commerce, the global expansion of e-commerce necessitating expedited air freight solutions, and the sustained growth of middle-class populations globally, fueling both short-haul and long-haul travel demands. However, the market faces considerable restraints, including volatility in jet fuel prices, which represents a major operational cost component, stringent and often disparate international regulatory frameworks that complicate cross-border operations, and heightened public and governmental pressure concerning the industry's substantial carbon footprint. Opportunities abound, particularly in the adoption of Sustainable Aviation Fuels (SAF), the integration of advanced digital twins for operational modeling, and the strategic expansion into untapped regional routes, especially within developing economies where road and rail infrastructure remains inadequate. These internal and external forces interact complexly, determining market viability and strategic investment choices.

Impact forces acting upon the market are highly correlated with external macroeconomic and geopolitical events. Economic volatility directly impacts passenger willingness to travel and cargo volumes, while geopolitical conflicts can suddenly restrict airspace access, forcing costly rerouting. Regulatory impact forces are continually evolving, especially regarding safety standards and environmental mandates, requiring continuous fleet upgrades and compliance expenditures. The rise of protectionist trade policies acts as a structural restraint on cargo volumes, whereas open skies agreements serve as powerful drivers for competitive market expansion. Technological obsolescence acts as a critical impact force, pressuring companies to invest heavily in digitalization and advanced avionics, lest they fall behind competitors utilizing state-of-the-art efficiency tools.

The balance between these forces dictates the competitive landscape and profitability margins. Carriers successful in the long term are those that can effectively hedge against fuel price fluctuations, rapidly implement digital transformation initiatives to enhance customer touchpoints, and proactively secure access to Sustainable Aviation Fuels to meet impending decarbonization goals. Restraints such as labor shortages in technical roles (pilots, MRO engineers) also significantly impact operational scalability and reliability, reinforcing the need for targeted investment in training and automation technologies. The overall trajectory suggests that market growth will be structurally robust, but operational margins will remain tight, rewarding highly efficient, technologically sophisticated organizations capable of navigating a complex regulatory and environmental mandate environment.

Segmentation Analysis

The Civil Air Transport Service Market is highly differentiated, categorized primarily by the core services offered, the type of aircraft utilized, the ownership structure of the operators, and the ultimate end-user of the service. Analyzing these segments provides crucial insight into market dynamics, identifying areas of rapid growth (such as specialized cargo or regional jet operations) versus mature, stable segments (like wide-body long-haul passenger transport). This granular segmentation helps stakeholders understand where capital investments yield the highest returns and how different regulatory and economic environments favor specific segments, allowing carriers and investors to tailor their strategies to specific market niches effectively.

- By Service Type:

- Passenger Transport (Scheduled & Charter)

- Cargo Transport (Express & General Freight)

- Maintenance, Repair, and Overhaul (MRO)

- Ground Handling and Auxiliary Services

- By Aircraft Type:

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Jets and Turboprops

- By Ownership:

- Government/State-owned Carriers

- Private/Commercial Carriers

- By End-User:

- Leisure Travel

- Business Travel and Corporate Logistics

- Government and Military Logistics

Value Chain Analysis For Civil Air Transport Service Market

The Civil Air Transport Service value chain is characterized by multiple interdependent stages, starting with upstream suppliers and concluding with the ultimate end-user. The upstream segment is dominated by highly specialized and concentrated industries, namely aircraft manufacturers (Airbus, Boeing, etc.), engine producers (GE Aerospace, Rolls-Royce, Pratt & Whitney), and advanced avionics providers. These suppliers dictate the technological trajectory, capital expenditure requirements, and long-term operating costs for carriers, as aircraft acquisition and maintenance form the largest barrier to entry. Key elements of upstream analysis include assessing the supply chain resilience for critical components, managing long lead times for new aircraft orders, and negotiating favorable long-term maintenance contracts, which significantly influence operational efficiency.

The midstream of the value chain is composed of the core operators: the air carriers themselves. Their activities involve securing financing, establishing route networks, managing complex logistical schedules, and delivering the transport service (passenger or cargo). The distribution channel for air transport services is bifurcated into direct and indirect methods. Direct distribution involves sales through the airline's own website, mobile apps, and proprietary sales offices, offering higher yield control. Indirect distribution relies heavily on Global Distribution Systems (GDS) like Amadeus, Sabre, and Travelport, and third-party Online Travel Agencies (OTAs) such as Expedia and Booking.com. The ongoing shift toward direct bookings is a strategic imperative for airlines seeking to reduce GDS fees and enhance customer data control for personalized marketing efforts.

Downstream analysis focuses on the services immediately surrounding the flight, primarily provided by airports and specialized ground handlers. These services include air traffic control, baggage handling, catering, refueling, and MRO support, which are critical for ensuring fast turnaround times and operational safety. Ultimately, the potential customers—corporate travelers, leisure tourists, and shippers—consume the service, but their experience is a composite function of all preceding stages. Efficiency and reliability throughout the entire chain, from aircraft manufacturing quality to timely baggage delivery, directly determine consumer satisfaction and competitive success. Supply chain optimization, particularly in fuel procurement and MRO component logistics, remains a significant focus area for cost reduction across the entire ecosystem.

Civil Air Transport Service Market Potential Customers

The Civil Air Transport Service Market targets a diverse array of potential customers, segmented broadly into individuals (leisure and business travelers) and organizations (commercial enterprises, freight forwarders, and governmental bodies). Leisure travelers represent a vast and highly price-sensitive segment, driven by disposable income, seasonal trends, and destination accessibility, often favoring low-cost carriers (LCCs) for short-to-medium haul routes. This segment requires high flexibility in booking and value-added services, often relying heavily on indirect distribution channels like OTAs. The purchasing decision for leisure travelers is highly influenced by dynamic pricing models and the overall perceived value of the travel experience, including in-flight entertainment and seating comfort.

In contrast, business travelers and corporate buyers constitute the high-yield segment, prioritizing reliability, schedule frequency, route connectivity, and premium amenities (e.g., business class seating, lounge access). These buyers are often secured through corporate travel agreements managed by specialized travel management companies (TMCs) or direct negotiations with airline sales teams. For the business segment, time is the critical asset, making on-time performance and seamless connection capabilities non-negotiable requirements. Airlines focus heavily on loyalty programs and high-frequency schedules on strategic business routes to retain this valuable customer base, which typically exhibits lower price elasticity compared to leisure tourists.

The third major customer category is the commercial logistics sector, encompassing freight forwarders, e-commerce giants, and specialized shippers (e.g., pharmaceutical companies requiring cold chain logistics). These customers purchase cargo capacity and services, prioritizing factors such as payload capacity, route availability, speed of delivery, and compliance with strict handling requirements for sensitive or perishable goods. Governmental and defense entities represent another consistent, albeit specialized, customer base, requiring tailored charter services, military logistics support, and emergency response capabilities. The future growth of e-commerce ensures that the cargo segment will continue to expand, demanding innovative air logistics solutions, including the integration of drone technology for last-mile delivery and sophisticated track-and-trace capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Billion |

| Market Forecast in 2033 | USD 1,180.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Delta Air Lines, United Airlines, American Airlines, Lufthansa Group, Air France-KLM, Emirates, Qatar Airways, Singapore Airlines, China Eastern Airlines, China Southern Airlines, IAG (British Airways, Iberia), Turkish Airlines, Southwest Airlines, Ryanair, FedEx Express, UPS Airlines, Cathay Pacific, All Nippon Airways, Japan Airlines, Korean Air |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Civil Air Transport Service Market Key Technology Landscape

The Civil Air Transport Service Market is rapidly adopting sophisticated technological solutions to enhance operational efficiency, safety, and customer experience. A cornerstone of the current technology landscape is the widespread deployment of next-generation Air Traffic Management (ATM) systems, such as SESAR in Europe and NextGen in the US, which utilize satellite navigation and data-link communication to enable more direct routes and optimized spacing between aircraft. This modernization dramatically improves flight efficiency, reduces holding patterns, and lowers overall fuel consumption. Concurrently, the industry is heavily investing in digitalized cockpit technology, including electronic flight bags (EFBs) and advanced avionics, which provide real-time weather and performance data to pilots, significantly enhancing situational awareness and flight safety protocols, moving away from paper-based operations.

Another critical area of technological focus is the maintenance and operational domain, driven by the Industrial Internet of Things (IIoT) and Big Data analytics. Modern aircraft are equipped with thousands of sensors generating massive datasets on engine performance, structural health, and subsystem functionality. These data streams are processed by predictive maintenance platforms utilizing machine learning to forecast potential component failures, shifting the MRO strategy from time-based overhauls to condition-based interventions. This technological shift, coupled with the adoption of advanced robotics for inspections and repairs, minimizes aircraft downtime, optimizes inventory management for spare parts, and drastically reduces long-term maintenance costs, thereby improving overall fleet availability and financial performance.

Furthermore, customer engagement and security are being redefined through technological innovation. Airlines are implementing high-speed in-flight connectivity (broadband internet via satellite), turning the aircraft into a seamless extension of the ground-based office or entertainment environment, which is becoming a standard expectation for premium travelers. Security technology, including advanced biometric identification systems (facial recognition, fingerprint scanning) integrated at check-in and boarding gates, significantly accelerates passenger processing while bolstering security efficacy. Finally, the commitment to sustainability is driving substantial R&D into electric and hydrogen propulsion technologies for short-haul and regional aircraft, alongside optimizing blending technologies for Sustainable Aviation Fuels (SAF), signaling a long-term technological pivot toward environmentally responsible air travel.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the engine of growth, benefiting from the fastest-growing middle-class population and sustained infrastructure investment in countries like China, India, and Indonesia. The region is characterized by high demand for narrow-body aircraft for dense, short-to-medium haul routes and significant ongoing construction of new mega-hubs. Regulatory liberalization in Southeast Asia further stimulates competition and route development. However, challenges include air traffic congestion and varying degrees of standardization across national airspaces.

- North America: Representing a mature yet highly profitable market, North America is defined by high domestic traffic volumes, driven by robust competition between legacy carriers and ultra-low-cost operators. Key trends include advanced digitalization of customer touchpoints, early adoption of next-generation ATM systems (NextGen), and continuous focus on fleet renewal to meet domestic emissions standards. The high concentration of major MRO facilities and technology developers solidifies its leading role in innovation.

- Europe: The European market is highly fragmented yet heavily regulated under the European Union Aviation Safety Agency (EASA). Growth is underpinned by strong intra-European LCC dominance and strategic long-haul operations by major European flag carriers. The region leads in implementing aggressive decarbonization policies, mandating the accelerated adoption of Sustainable Aviation Fuels (SAF). Key challenges include managing capacity constraints at major international hubs and mitigating the impact of potential airspace disruptions due to geopolitical factors.

- Middle East and Africa (MEA): The Middle East acts as a crucial intercontinental bridge, driven by massive investment in capacity expansion by state-owned mega-carriers (Emirates, Qatar Airways, Etihad) that leverage geographical advantages for East-West connectivity. Africa presents substantial long-term opportunity due to rapidly growing air connectivity needs across large distances, although it currently faces obstacles related to political instability, regulatory harmonization, and the need for significant infrastructure modernization investment to support international standards.

- Latin America: This region is characterized by volatile economic conditions but steady underlying demand for domestic and regional travel, often driven by LCCs filling service gaps. Market stability is challenged by currency fluctuations and high operational taxes, but strategic investments are increasing in countries like Brazil and Mexico to upgrade airport facilities and align regulatory practices, particularly focusing on optimizing connectivity to North American trade partners.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Civil Air Transport Service Market.- Delta Air Lines

- United Airlines

- American Airlines

- Lufthansa Group

- Air France-KLM

- Emirates

- Qatar Airways

- Singapore Airlines

- China Eastern Airlines

- China Southern Airlines

- IAG (British Airways, Iberia)

- Turkish Airlines

- Southwest Airlines

- Ryanair

- FedEx Express

- UPS Airlines

- Cathay Pacific

- All Nippon Airways

- Japan Airlines

- Korean Air

Frequently Asked Questions

What is the primary factor driving the growth of the Civil Air Transport Service Market?

The primary factor driving market growth is the consistent global expansion of the middle-class population, particularly in Asia Pacific, coupled with the exponential rise in global e-commerce, which necessitates highly reliable and expedited air cargo transport for high-value and time-sensitive goods.

How is the adoption of Sustainable Aviation Fuels (SAF) impacting operational costs for airlines?

While SAF reduces the carbon footprint and aids in regulatory compliance, its current high production cost and limited availability typically translate into increased short-term operational costs compared to traditional jet fuel, pressuring carriers to find efficiencies elsewhere or incorporate costs into pricing strategies.

What role does Artificial Intelligence (AI) play in enhancing airline safety and maintenance?

AI plays a critical role through predictive maintenance (PdM) programs, analyzing real-time sensor data from aircraft to forecast component failures before they occur. This prevents unscheduled grounding, improves safety margins, and optimizes MRO resource allocation for higher operational reliability.

Which geographical region is projected to exhibit the highest market CAGR during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate, driven by rapid urbanization, substantial investment in new airport infrastructure, and increasing demand for both domestic and international connectivity across the region's densely populated economies.

What are the main segments within the Civil Air Transport Service Market by service type?

The main segments by service type include Passenger Transport (scheduled and charter), Cargo Transport (express and general freight), Maintenance, Repair, and Overhaul (MRO), and specialized Ground Handling and Auxiliary Airport Services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager