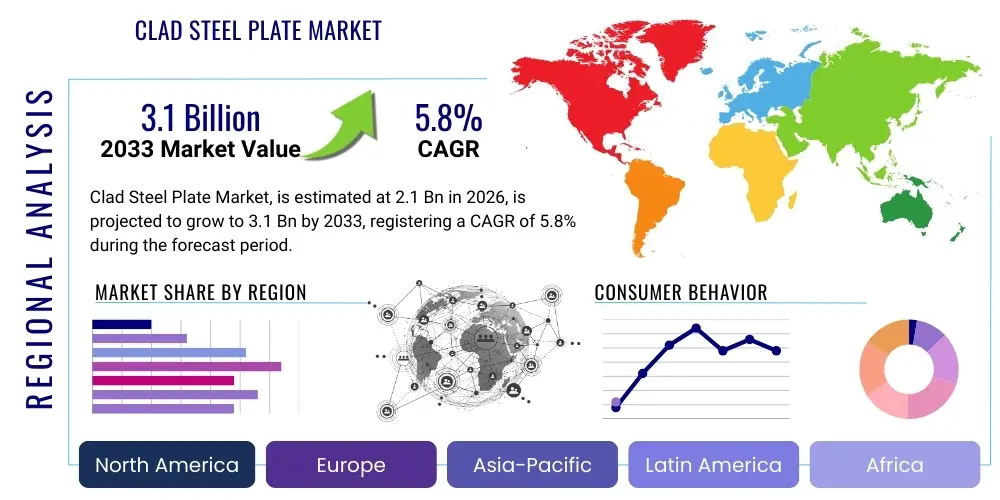

Clad Steel Plate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443141 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Clad Steel Plate Market Size

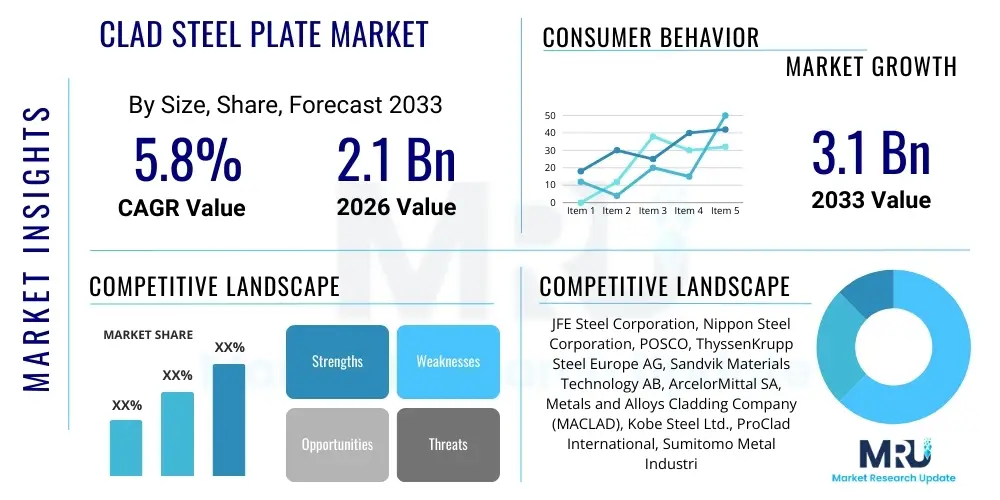

The Clad Steel Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.1 Billion by the end of the forecast period in 2033.

Clad Steel Plate Market introduction

The Clad Steel Plate Market involves the manufacturing and distribution of specialized metallic plates composed of two or more distinct layers of metal bonded together, typically featuring a base layer of carbon or low-alloy steel for structural strength and a cladding layer of higher-value material, such as stainless steel, titanium, nickel alloy, or copper, primarily for enhanced corrosion resistance and specific functional properties. This composite material construction allows industries to leverage the strength and cost-effectiveness of the base metal alongside the superior performance characteristics of the cladding material, making it an essential component in severe operating environments where standard materials would quickly degrade. Major applications span critical infrastructure across the energy sector, including reactors and pressure vessels in oil and gas refining, chemical processing facilities, power generation, and specialized maritime applications. The primary benefits include extended service life, reduced maintenance costs, superior thermal conductivity, and compliance with stringent safety and environmental regulations, particularly in handling highly corrosive substances or operating under high pressure and temperature conditions. Market expansion is fundamentally driven by escalating global investments in petrochemical infrastructure, the increasing demand for sustainable and durable material solutions in emerging economies, and the necessity to replace aging infrastructure worldwide with high-performance, corrosion-resistant components.

Clad Steel Plate Market Executive Summary

The global Clad Steel Plate Market is experiencing robust expansion underpinned by sustained growth in the energy and chemical processing sectors, particularly across the Asia Pacific region, which serves as the dominant manufacturing and consumption hub due to accelerated industrialization and infrastructure development in China and India. Business trends indicate a strong move toward advanced manufacturing techniques, such as hybrid rolling and explosion bonding, aimed at improving bond strength and reducing production costs, thereby making clad steel more competitive against solid high-alloy materials. Segment trends highlight the Nickel and Nickel Alloy Clad segment as a significant growth driver, attributed to its unparalleled resistance to highly corrosive environments prevalent in desalination plants and advanced chemical reactors. Regionally, while APAC dominates in volume, North America and Europe maintain high demand for high-specification plates, primarily driven by stringent regulatory frameworks concerning environmental safety and aging pipeline replacement projects. The overall market trajectory suggests that technological innovation in bonding methodologies and increased adoption of clad solutions in non-traditional applications, such as renewable energy components, will define future competitive advantages and market penetration strategies for key industry players.

AI Impact Analysis on Clad Steel Plate Market

Common user questions regarding AI's impact on the Clad Steel Plate Market center predominantly on themes of operational efficiency, quality assurance, and predictive modeling for material performance. Users frequently inquire about how AI can optimize complex cladding processes, such as explosion bonding, to ensure perfect interfacial metallurgy and bond integrity, minimizing defects that are costly and difficult to detect post-production. Key concerns revolve around the integration cost of sophisticated sensor arrays and machine learning algorithms into legacy manufacturing environments, and the ability of AI to accurately predict the long-term corrosion resistance and mechanical failure points of composite materials under extreme conditions. Consequently, the user expectation is that AI will transform quality control from reactive inspection to proactive, real-time process adjustment, leading to significant material savings, shortened lead times, and superior material traceability throughout the supply chain, ultimately enhancing the reliability and safety of end-use industrial applications.

- AI-driven optimization of explosion bonding parameters (charge quantity, standoff distance) for maximized bond strength and uniformity.

- Implementation of machine vision and deep learning algorithms for real-time defect detection during rolling and welding processes, minimizing scrap rates.

- Predictive maintenance models utilizing sensor data to forecast equipment failure in critical manufacturing assets, such as cladding mills and heat treatment furnaces.

- Simulation and modeling of corrosion behavior and mechanical fatigue using AI to accelerate R&D cycles for new clad combinations.

- Supply chain optimization and raw material procurement forecasting based on global commodity price fluctuations and project demand signals.

DRO & Impact Forces Of Clad Steel Plate Market

The market is primarily driven by the escalating necessity for highly durable and cost-effective materials in critical infrastructure sectors, particularly the global expansion of oil refining, liquefied natural gas (LNG) infrastructure, and complex chemical production where severe corrosion environments mandate the use of clad solutions to ensure operational longevity and safety. A significant restraint on market growth is the high initial capital investment required for establishing advanced cladding facilities and the technical complexity inherent in processes like explosion bonding, which require specialized expertise and rigorous quality control measures, alongside the inherent volatility in raw material prices, specifically nickel and titanium alloys, impacting final product cost structures. However, substantial opportunities arise from the increasing adoption of clad materials in non-traditional sectors, such as green hydrogen production and carbon capture technologies, demanding customized, high-performance alloys resistant to novel corrosive agents. The impact forces acting on the market are high, driven by the intense regulatory pressure, especially concerning safety and environmental protection in the chemical and nuclear industries, which continually pushes manufacturers to innovate and certify higher-quality clad products, coupled with the strong influence of global macroeconomic cycles on capital expenditure for large-scale energy projects.

Segmentation Analysis

The Clad Steel Plate Market exhibits comprehensive segmentation based on the cladding material utilized, the core bonding technology employed, and the diverse applications in end-use industries, enabling targeted manufacturing and specialized market penetration strategies. Analyzing these segments provides critical insights into high-growth areas, particularly within the energy and processing sectors where material specifications are exceptionally demanding. The technological segmentation, encompassing explosion bonding, roll cladding, and weld overlay, dictates the cost structure and the permissible size and thickness of the final product, influencing procurement decisions across various engineering, procurement, and construction (EPC) firms globally. Furthermore, understanding the regional adoption of specific clad types, such as titanium clad steel in desalination or nickel clad steel in petrochemicals, is crucial for forecasting geographical market shifts and identifying strategic investment opportunities for maximizing market share and addressing niche material requirements efficiently.

- By Cladding Material: Stainless Steel Clad, Nickel and Nickel Alloy Clad, Titanium Clad, Copper Clad, Zirconium Clad, Others.

- By Bonding Technology: Explosion Bonding, Roll Bonding (Hot and Cold), Weld Overlay, Brazing.

- By Base Material: Carbon Steel, Low Alloy Steel, High Strength Low Alloy (HSLA) Steel.

- By End-use Industry: Oil and Gas (Upstream, Midstream, Downstream), Chemical and Petrochemical, Electric Power Generation (Fossil Fuel and Nuclear), Desalination, Shipbuilding, Non-ferrous Metals, Others.

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA).

Value Chain Analysis For Clad Steel Plate Market

The value chain for the Clad Steel Plate Market is complex, beginning with the upstream sourcing of two disparate raw material streams: commodity base metals (carbon/low alloy steel) and high-value cladding metals (nickel, titanium, specialized stainless steels). Upstream analysis reveals that raw material procurement is a highly sensitive stage, susceptible to global commodity price volatility and supply chain disruptions, necessitating robust long-term contracting and hedging strategies by plate manufacturers to stabilize input costs and ensure material availability for specialized projects. The primary value addition occurs during the manufacturing or processing stage, where specialized techniques like explosion bonding or hot roll cladding are applied to permanently fuse the layers, demanding high precision, specialized equipment, and significant energy consumption. Processors must adhere strictly to international standards (e.g., ASME, ASTM) for quality control and material certification, which are prerequisites for market entry into highly regulated end-use sectors.

The midstream phase focuses on the secondary processing of the clad plate, including cutting, welding preparation, forming, and heat treatment, often involving custom fabrication to meet specific project dimensional requirements, transforming the standard plate into a component ready for integration into a vessel, heat exchanger, or pipe. This phase is characterized by specialized fabricators who work closely with EPC contractors. Distribution channels for clad steel plates are generally divided between direct sales and indirect channels. Direct sales are common for large-scale, highly customized projects (e.g., nuclear reactors or large refinery columns), where the manufacturer interacts directly with the end-user or the primary EPC firm to ensure precise specification adherence and technical support. Indirect channels involve distributors or specialized stockists who maintain inventories of common sizes and material combinations, serving smaller or fast-turnaround maintenance, repair, and operations (MRO) requirements across diverse geographical regions. These specialized distributors provide crucial local logistical support and technical consultancy.

Downstream analysis highlights the critical role of the end-user fabrication and assembly processes, particularly in the oil and gas and chemical sectors. Successful utilization of clad plates requires specialized welding procedures and handling to maintain the integrity of both the base and cladding layers, demanding highly skilled labor and adherence to stringent safety protocols. The final market penetration and adoption rates are heavily influenced by the product's performance validation in extreme environments and the total cost of ownership (TCO) calculation, where the initial premium price of clad steel is justified by its drastically reduced lifetime maintenance requirements and superior lifespan compared to lower-cost alternative materials.

Clad Steel Plate Market Potential Customers

Potential customers for the Clad Steel Plate Market are concentrated within heavy industrial sectors characterized by operations involving high pressures, high temperatures, and exposure to corrosive media, where material failure is not only costly but poses severe safety and environmental risks. The largest end-users include major international and national oil companies (IOCs and NOCs) and large independent refining and petrochemical operators globally, who utilize clad plates extensively in hydrocrackers, catalytic reformers, sour water strippers, and crude distillation units to combat sulfur and acid corrosion. Power generation companies, particularly those involved in nuclear power facilities or large thermal power plants, constitute another critical customer base, requiring certified clad materials for steam generators, condenser units, and reactor components that must withstand aggressive chemical conditions and irradiation exposure over decades. Furthermore, engineering, procurement, and construction (EPC) firms specializing in large capital projects serve as immediate buyers, as they manage the sourcing and integration of these materials into complex plant builds.

Beyond the core energy sectors, the market extends significantly to specialized industrial segments. This includes producers of large-scale desalination equipment, who rely heavily on titanium and stainless steel clad plates to manage the highly corrosive nature of hot brine, extending the life of multi-stage flash and reverse osmosis units. Metallurgical plants, especially those handling non-ferrous metals like copper and zinc, use clad steel for specialized tanks and processing vessels where concentrated acids are involved. The shipbuilding industry, focused increasingly on high-specification vessels like LNG carriers and chemical tankers, requires clad plates for cargo containment systems to ensure structural integrity and resistance against aggressive chemical cargoes, representing a consistent, albeit cyclical, demand source that emphasizes high-quality fabrication and long-term durability metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JFE Steel Corporation, Nippon Steel Corporation, POSCO, ThyssenKrupp Steel Europe AG, Sandvik Materials Technology AB, ArcelorMittal SA, Metals and Alloys Cladding Company (MACLAD), Kobe Steel Ltd., ProClad International, Sumitomo Metal Industries, Yichang Deepsea Clad Material Co., Ltd., China National Petroleum Corporation (CNPC), Hitachi Zosen Corporation, Voestalpine AG, Explosive Fabrication Inc. (EFI), Clad Metal Manufacturing Co., Ltd., Mottram Clad Products Ltd., G&Z Industries, TWI Ltd. (Technology Partner), Zhejiang Southeast Space Frame Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clad Steel Plate Market Key Technology Landscape

The technological landscape of the Clad Steel Plate Market is defined by three principal bonding methodologies: explosion bonding, roll cladding, and weld overlay, each optimized for different material combinations, thickness requirements, and structural integrity demands. Explosion bonding remains the preferred method for achieving superior metallurgical bond strength, particularly suitable for cladding dissimilar metals like titanium or zirconium onto steel, which are difficult to bond using thermal processes. This process uses precisely controlled explosive charges to achieve high-velocity collision between the base and cladding plates, creating an atomic level fusion at the interface. The key technological focus in explosion bonding involves enhancing process safety, improving yield rates through advanced computational fluid dynamics (CFD) modeling of the explosion wave, and achieving consistent bond quality across very large plate formats, ensuring minimal post-cladding deformation and surface imperfections necessary for demanding industrial specifications.

Roll cladding, encompassing both hot and cold rolling techniques, represents a more scalable and economically viable method for cladding materials that share closer metallurgical characteristics, such as stainless steel onto carbon steel. Hot roll cladding involves heating the sandwiched composite slab (comprising the base and cladding metals, often with an intermediate barrier layer) and rolling it under immense pressure to achieve diffusion bonding. Technological advancements here focus on optimizing the pre-treatment of the surfaces to enhance bonding efficacy, controlling the heating profile to prevent detrimental intermetallic formation, and developing continuous rolling processes that increase production throughput. The competitive edge in roll cladding is often tied to the mill's capacity to produce extremely large plates with minimal thickness variation, satisfying the structural requirements of large-scale pressure vessels and heat exchangers.

Weld overlay technology is utilized primarily for localized cladding applications or for repairing/upgrading existing structures, where the cladding material (e.g., a nickel alloy) is deposited onto the base steel surface using specialized welding processes like submerged arc welding (SAW), electro-slag welding (ESW), or flux-cored arc welding (FCAW). While not strictly a 'plate' manufacturing technology, weld overlay is critical in the value chain for lining large complex vessels and components. Recent technological shifts involve integrating automation and robotics to ensure highly uniform weld bead geometry and consistent dilution control, minimizing the penetration of the base metal into the cladding layer to maintain the required corrosion resistance performance, especially important when using exotic, expensive cladding materials like Inconel or Hastelloy in harsh chemical processing environments.

Regional Highlights

- Asia Pacific (APAC): Dominates the market both in production volume and consumption value, driven by massive infrastructure investments in China, India, and Southeast Asia, particularly in oil refining expansion, coal-to-chemical projects, and power generation capacity additions. Significant manufacturing capabilities and lower operational costs bolster its competitive position globally.

- North America: Characterized by high demand for complex, high-specification clad plates, primarily serving the mature oil and gas sector (especially sour gas processing) and the nuclear power industry. Regulatory requirements and emphasis on long-term asset integrity drive the adoption of premium clad materials like Nickel alloy clad steel.

- Europe: Focuses on niche, high-value applications, including advanced chemical reactors, stringent nuclear industry requirements, and the burgeoning sustainable energy sector (e.g., specialized equipment for green hydrogen production). Emphasis is placed on technological innovation and environmental compliance in material selection.

- Middle East and Africa (MEA): Exhibits robust growth driven by ongoing large-scale oil and gas upstream and downstream projects (refineries, LNG terminals) and desalination plant construction, necessitating high volumes of stainless steel and titanium clad plates to withstand severe coastal and chemical corrosion.

- Latin America: Market growth is linked to the development of offshore oil reserves (Brazil) and necessary upgrades to aging petrochemical facilities across the region, requiring periodic investment in high-performance clad solutions for pressure vessel modernization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clad Steel Plate Market.- JFE Steel Corporation

- Nippon Steel Corporation

- POSCO

- ThyssenKrupp Steel Europe AG

- Sandvik Materials Technology AB

- ArcelorMittal SA

- Metals and Alloys Cladding Company (MACLAD)

- Kobe Steel Ltd.

- ProClad International

- Sumitomo Metal Industries

- Yichang Deepsea Clad Material Co., Ltd.

- China National Petroleum Corporation (CNPC)

- Hitachi Zosen Corporation

- Voestalpine AG

- Explosive Fabrication Inc. (EFI)

- Clad Metal Manufacturing Co., Ltd.

- Mottram Clad Products Ltd.

- G&Z Industries

- Bohler Uddeholm Corporation

- Triten Clad International

Frequently Asked Questions

Analyze common user questions about the Clad Steel Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using clad steel plates over solid high-alloy materials?

Clad steel plates offer a cost-effective alternative by combining the structural strength and lower cost of a base metal (like carbon steel) with the superior corrosion resistance, heat resistance, or wear resistance of an expensive cladding metal (like nickel alloy or titanium), significantly reducing overall material expenditure while maintaining critical performance specifications necessary for harsh industrial environments.

Which bonding technology dominates the Clad Steel Plate Market in terms of performance and versatility?

Explosion bonding is widely regarded as offering the highest bond strength and the greatest metallurgical versatility, allowing the successful fusion of highly dissimilar metals that cannot be joined effectively by conventional thermal methods, making it indispensable for high-specification applications such as chemical reactors and aerospace components.

How is the volatility of raw material prices impacting the clad steel market?

The high price volatility of strategic cladding materials, particularly nickel, titanium, and specialized alloys, directly impacts the manufacturing cost and pricing stability of clad steel plates. This necessitates advanced hedging strategies and long-term contracts by manufacturers, as material costs constitute a significant portion of the final product price, particularly affecting sectors with fixed-price construction contracts.

What key factors are driving the growth of the Nickel and Nickel Alloy Clad segment?

Growth in the Nickel and Nickel Alloy Clad segment is primarily fueled by accelerated global investment in the downstream oil and gas sector and chemical processing, where these alloys offer superior resistance to highly acidic and chloride stress corrosion cracking environments, ensuring extended operational life for critical pressure vessels and heat exchangers.

Where does the Asia Pacific region stand in global clad steel production and consumption?

The Asia Pacific region, led by China and India, maintains market dominance in the Clad Steel Plate Market due to extensive industrial expansion, massive petrochemical and infrastructure development projects, and established, high-volume manufacturing capabilities, making it the central hub for both production and consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager