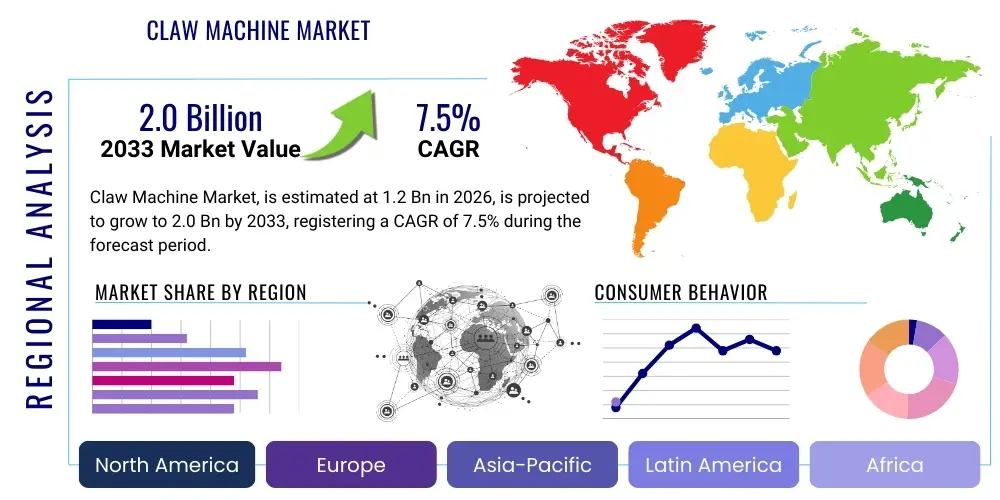

Claw Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441271 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Claw Machine Market Size

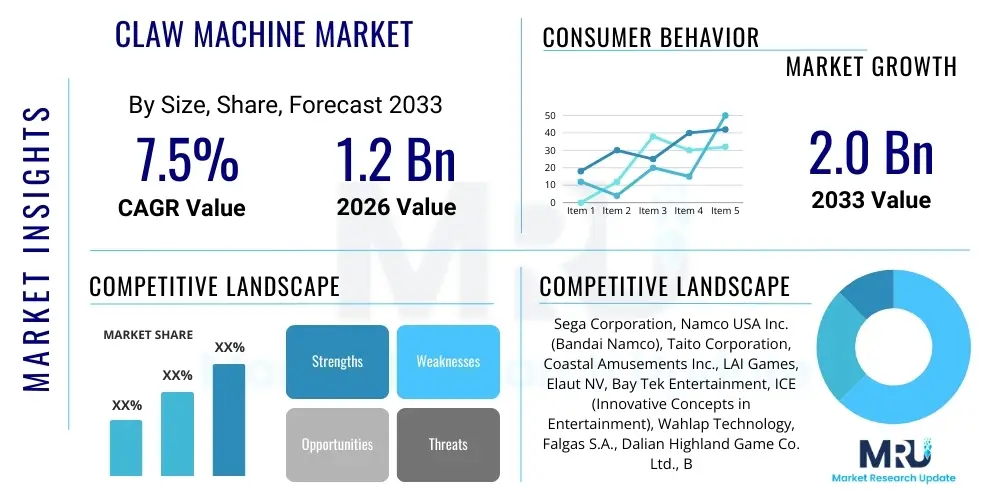

The Claw Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.0 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fueled primarily by the resurgence of location-based entertainment (LBE), continuous technological integration such as digital payment systems and augmented reality features, and the enduring nostalgic appeal these machines hold for diverse consumer demographics globally. Furthermore, expansion into non-traditional venues, including large retail centers and specialized pop-up installations, contributes significantly to the increasing market valuation.

Claw Machine Market introduction

The Claw Machine Market encompasses the manufacturing, distribution, operation, and maintenance of coin-operated or digitally-operated amusement devices designed to allow users to attempt to retrieve prizes using a mechanical claw or grapple. Historically rooted in traditional arcades, these machines have evolved into sophisticated automated retail platforms, leveraging modern sensor technology and operational analytics. The core product offering includes various sizes and configurations, ranging from miniature countertop units suitable for convenience stores to large, multi-prize cabinet systems dominating major entertainment complexes. Product differentiation often hinges on prize value, machine aesthetics, and the integration of interactive software elements that enhance the player experience.

Major applications for claw machines span across commercial entertainment, retail promotion, and leisure hospitality sectors. High-traffic venues such as family entertainment centers (FECs), cinemas, shopping malls, restaurants, and airports represent primary installation points. These machines serve as significant revenue generators for operators, characterized by high margins and relatively low maintenance requirements compared to complex simulator games. The inherent element of chance and skill fosters repeat engagement, positioning claw machines as essential components of the experiential economy, driving foot traffic and dwell time in physical retail environments.

Key driving factors accelerating market expansion include the globalization of arcade culture, increasing disposable income in emerging economies, and persistent innovation aimed at overcoming regulatory hurdles related to perceived gambling aspects. Benefits associated with these machines involve providing affordable, spontaneous entertainment, offering tangible rewards that increase player satisfaction, and functioning as dynamic marketing tools for featured prizes or brand collaborations. The shift towards incorporating Internet of Things (IoT) capabilities, enabling remote monitoring and predictive maintenance, further optimizes operational efficiency, thereby attracting larger corporate investment into the sector.

Claw Machine Market Executive Summary

The Claw Machine Market is currently experiencing robust momentum, underpinned by favorable business trends focused on operational modernization and prize diversification. A pivotal business trend involves the integration of contactless payment solutions, including mobile wallets and QR code scanning, which significantly improves user accessibility and spending velocity while providing operators with crucial data analytics on peak usage times and optimal pricing strategies. Furthermore, there is a pronounced shift towards premiumization, where machines feature high-value licensed merchandise and branded collectibles, transforming them from simple redemption games into targeted marketing vehicles, thus attracting a broader, often older, consumer base interested in specific intellectual properties (IPs).

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven by entrenched arcade cultures, particularly in East Asian economies like Japan, South Korea, and China, where dedicated amusement centers are prolific and highly sophisticated. North America and Europe, while representing mature markets, are experiencing revitalized growth through strategic placements in non-traditional locations such as convenience stores, laundromats, and specialized pop-up entertainment zones. Regional trends also reflect varying regulatory approaches; while some areas impose strict prize value limitations, others are promoting innovation in machine mechanics and digital interfacing, leading to segmented regional market strategies focusing either on volume (APAC) or premium experience (North America/Europe).

Segmentation trends highlight the increasing importance of machine type and prize offering. The Electronic Claw Machine segment, featuring digitally controlled movements and enhanced audio-visual feedback, is gaining market share over traditional mechanical units due to higher customization potential and superior reliability. Crucially, the prize segment is seeing a substantial increase in soft toys and licensed plush characters, which offer high appeal and relatively low unit cost compared to electronics or gift cards. The rapid adoption of cloud-based management systems across all operational segments is standardizing performance metrics and allowing for more agile deployment and remote software updates, signifying a maturation of the operational technology within the sector.

AI Impact Analysis on Claw Machine Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Claw Machine Market reveals key themes centered on fairness, optimization, and experience customization. Users frequently ask if AI will make the machines "rigged" or if algorithms will dictate win ratios to maximize profit, expressing concern over transparency and ethical operations. Conversely, there is significant interest in how AI can enhance the user experience—specifically questions regarding AI-driven personalization, such as recommending prize types based on player history or providing real-time difficulty adjustments tailored to player skill levels. The primary expectation is that AI will move beyond simple randomization to create a more engaging, yet ethically managed, entertainment environment, focusing on predictive maintenance and dynamic pricing rather than purely maximizing losses.

The implementation of AI is poised to revolutionize the operational side of the claw machine business, shifting management from reactive repair to predictive maintenance. AI algorithms can analyze performance data—including claw strength fluctuation, motor strain, and sensor irregularities—to predict component failures before they occur, drastically reducing downtime and increasing overall machine availability. This proactive approach significantly enhances the reliability of the machines, addressing a long-standing point of frustration for both operators and consumers regarding mechanical malfunctions and erratic claw performance.

Beyond maintenance, AI is critical for maximizing profitability through sophisticated pricing and prize placement optimization. Machine learning models analyze consumer demand patterns (e.g., specific prizes sought, time of day, location demographics) to dynamically adjust the cost per play or the internal payout percentage (the frequency of successful grabs). Ethical AI implementation ensures these adjustments remain within regulatory guidelines while optimizing revenue. Furthermore, AI can personalize the experience by analyzing a user's unsuccessful attempts and subsequently adjusting difficulty or offering targeted in-game incentives (e.g., temporary claw strength boost after a series of near misses) to maintain engagement and prolong play sessions.

- AI-driven Predictive Maintenance: Minimizing operational downtime by forecasting mechanical failures based on sensor data analysis.

- Dynamic Pricing Models: Optimizing revenue by adjusting play cost or payout frequency based on real-time foot traffic and demand patterns.

- Personalized Player Engagement: Utilizing machine learning to offer customized in-game incentives or difficulty adjustments to enhance retention.

- Automated Inventory Management: Using computer vision and AI to monitor prize levels and trigger alerts for restocking specific, high-demand merchandise.

- Enhanced Fraud Detection: Identifying unusual play patterns or manipulation attempts using behavioral analytics to ensure fair operation.

- Optimized Prize Placement: Recommending optimal internal configurations to maximize visual appeal and perceived grab chance.

DRO & Impact Forces Of Claw Machine Market

The Claw Machine Market is shaped by a confluence of influential factors encapsulated by Drivers, Restraints, and Opportunities (DRO), which collectively define the impact forces governing its trajectory. Primary drivers include the robust growth of the global experiential economy, where consumers prioritize leisure and entertainment spending, coupled with technological advancements that transform traditional mechanical games into modern, interactive digital platforms. Conversely, the market faces significant restraints, notably stringent regional regulations concerning gambling definitions, prize value limitations, and mandatory payout rates, which can restrict profitability and operational scope. However, substantial opportunities exist in market diversification, particularly the proliferation of 'mini' or 'micro' claw machines in unattended retail settings and the leveraging of licensing agreements with major entertainment studios for exclusive prize offerings.

Key impact forces driving market expansion stem from consumer behavioral shifts favoring instant gratification and tangible rewards. The psychological mechanism of intermittent reinforcement inherent in claw machine mechanics ensures high levels of repeat play, acting as a powerful intrinsic driver. Furthermore, rapid global urbanization increases the concentration of potential customers in high-traffic urban centers, providing ideal operational locations for these high-visibility entertainment units. The integration of social media sharing features, encouraging players to post their successes, amplifies the machines' visibility and inherent promotional value, effectively turning successful players into organic marketers for the locations and the brand.

Restraints primarily revolve around maintaining public trust and navigating the complex legal landscape. Negative perceptions, often centered around machines being perceived as "rigged" or having unjustly low payout rates, necessitate enhanced transparency and adherence to certified fairness standards (where applicable). Operational challenges, such as prize theft, vandalism, and the logistical complexities of frequently restocking varied merchandise across multiple sites, also impose significant operational costs. To mitigate these restraints, operators are investing in advanced anti-theft mechanisms, robust remote monitoring systems, and sophisticated compliance software that guarantees regulated payout percentages are met, thereby stabilizing the long-term viability of the enterprise.

Drivers

- Growing Global Experiential Entertainment Demand: Increased consumer spending on out-of-home leisure activities.

- Integration of Digital and Contactless Payment Systems: Improving transaction speed and user convenience.

- Nostalgia and Enduring Appeal: The classic charm maintains cross-generational interest and repeat play.

- Technological Advancements in Mechanics and IoT: Enhanced reliability, remote management, and interactive features.

Restraints

- Strict Regulatory Frameworks and Gambling Perceptions: Legal restrictions on prize value, odds, and mandatory payout ratios.

- High Operational Costs Associated with Prize Sourcing and Logistics: Maintaining a fresh, appealing inventory.

- Risk of Vandalism and Prize Theft: Security challenges in unattended retail environments.

- Negative Consumer Perception Regarding Payout Fairness: Erosion of trust due to past perceived manipulation.

Opportunities

- Expansion into Non-Traditional Venues: Deploying machines in laundromats, airports, office break rooms, and specialized pop-up stores.

- Leveraging Licensed Merchandise (IPs): Collaborations with major studios for exclusive, high-demand prizes.

- Development of Skill-Based Variants: Designing machines that emphasize player dexterity to circumvent gambling regulations.

- Implementation of Cloud-Based Data Analytics: Offering operators deep insights into profitability and consumer behavior.

Segmentation Analysis

The Claw Machine Market is systematically segmented based on crucial attributes including Machine Type, Prize Offering, and End-Use Application, providing a granular view of market dynamics and investment potential. Segmentation allows stakeholders to tailor their product development and marketing strategies to specific consumer niches, maximizing return on investment. The distinction between mechanical and electronic machines, for instance, dictates the level of technological complexity and operational flexibility available to the operator, influencing initial capital expenditure and subsequent maintenance protocols. Moreover, understanding end-user demographics, such as the preference for plush toys versus electronics, is vital for managing inventory and optimizing prize rotation schedules to maintain high player interest and expenditure.

Market segmentation also highlights the structural differences in demand across geographical regions and specific venue types. Family Entertainment Centers (FECs) represent a consistent, high-volume demand segment, requiring robust, large-format machines with high prize diversity. Conversely, the segmentation focusing on unattended retail, such as convenience stores or movie theaters, prioritizes smaller, more robust machines that require minimal staff intervention and feature prizes tailored to impulsive purchases. The continuing shift towards digital redemption options, where winning a play results in a digital coupon or in-app currency rather than a physical item, represents an emerging segmentation based on prize fulfillment method.

Crucially, the segmentation by prize type dictates the profit margin and the target audience. High-value electronics attract older adolescents and young adults willing to spend more for a desirable outcome, albeit with lower overall operational volumes. Soft toys, particularly licensed plush, appeal to a broader family audience, generating high volume and offering better margins due to lower wholesale costs. Comprehensive segmentation analysis supports strategic positioning, allowing manufacturers to specialize in producing high-tech electronic components, while operators focus on optimized prize logistics and location scaling based on the defined end-use application segments.

- By Machine Type:

- Standard/Traditional Mechanical Claw Machines

- Electronic/Digital Claw Machines (Featuring advanced controls and displays)

- Hybrid Machines (Integrating both mechanical operation and digital interaction)

- Mini/Countertop Machines

- By Prize Offering:

- Soft Toys/Plush (Licensed and Generic)

- Small Electronics and Gadgets

- Candy and Confectionery

- Gift Cards and Vouchers

- Collectibles and Figurines

- By End-Use Application:

- Family Entertainment Centers (FECs)

- Arcades and Gaming Zones

- Retail Locations (Shopping Malls, Supermarkets)

- Hospitality and Travel (Hotels, Airports)

- Cinemas and Theaters

- By Operation Mode:

- Coin-Operated

- Card/Token Operated

- Mobile Payment Integrated

Value Chain Analysis For Claw Machine Market

The value chain for the Claw Machine Market is complex, involving several distinct stages from component manufacturing to final consumer interaction, each adding value and opportunity for profit capture. Upstream activities begin with the procurement of specialized electronic components (e.g., microprocessors, sensor arrays, display screens), durable cabinet materials (typically metal and tempered glass), and the mechanical apparatus itself (claw assembly, motor drives). Key upstream players are highly specialized industrial component manufacturers who must adhere to specific safety and longevity standards required for commercial amusement equipment. Strategic relationships with these suppliers ensure cost efficiency and component reliability, which directly impacts the machine's uptime and player experience.

Midstream activities primarily encompass the design, assembly, and testing of the complete machine unit. Manufacturers focus heavily on aesthetic design—creating attractive, engaging cabinets—and optimizing the internal mechanics to comply with regional fairness regulations while maximizing durability. The distribution channel then takes prominence, often involving a mix of direct sales to large arcade chains and reliance on regional distributors who handle logistics, installation, and initial technical support for smaller independent operators. This stage is crucial for ensuring machines are deployed rapidly and correctly across diverse geographical locations, necessitating robust international logistics capabilities.

Downstream analysis focuses on the operational layer, where the machine interacts with the end-user. Direct operations involve large FECs or corporate chains owning and managing their machines. Indirect operations rely on independent location owners (e.g., convenience stores) partnering with third-party route operators who lease the space, install the machines, manage restocking, and split the revenue. The crucial value-add at this stage is the constant refreshing of prizes and the application of data-driven insights to maximize revenue per square foot. The final stage involves the consumer experience and prize redemption, which determines repeat business. Efficiency in prize sourcing and logistics, coupled with responsive technical maintenance, is paramount for sustainable downstream profitability.

Claw Machine Market Potential Customers

The potential customer base for the Claw Machine Market is highly diversified, encompassing both business-to-business (B2B) operators who purchase and deploy the machines, and the final business-to-consumer (B2C) end-users who engage in play. B2B potential customers are primarily composed of proprietors of Family Entertainment Centers (FECs), who require high-volume, highly reliable machines as anchor attractions in their venues. This segment demands customizable machines, seamless integration with existing arcade management systems, and robust warranties, viewing the purchase as a long-term capital investment designed to maximize foot traffic and revenue generation.

A secondary but rapidly growing B2B segment includes route operators and third-party management companies. These entities specialize in placing machines in diverse, often unattended retail environments, such as laundromats, grocery stores, and quick-service restaurants. Their purchasing decisions are driven by ease of maintenance, remote monitoring capabilities (IoT integration), and compact designs suitable for varied placement footprints. They prioritize operational efficiency and require inventory services, making them key consumers of associated market services like prize logistics and technical support contracts.

The B2C end-user segment is broad, including children (aged 6-12) attracted by the immediate visual appeal and the desire for soft toys; teenagers (aged 13-18) seeking higher-value electronics or licensed merchandise and social validation; and young adults (aged 19-35) often driven by nostalgia, collecting rare licensed items, or impulse entertainment in social settings like bars or cinemas. Effective market penetration requires manufacturers and operators to maintain appeal across these diverse demographics through continuous innovation in prize selection, machine themes, and pricing strategies that align with the disposable income levels of each target group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sega Corporation, Namco USA Inc. (Bandai Namco), Taito Corporation, Coastal Amusements Inc., LAI Games, Elaut NV, Bay Tek Entertainment, ICE (Innovative Concepts in Entertainment), Wahlap Technology, Falgas S.A., Dalian Highland Game Co. Ltd., Benchmark Games, Andamiro Co. Ltd., UNIS Technology Ltd., Astro Corporation, Valley Dynamo, Toy Shock International Ltd., Global Stuffed Toys, Komplete Gaming, Zest Gaming. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Claw Machine Market Key Technology Landscape

The Claw Machine Market has rapidly adopted several key technologies, moving far beyond simple electromechanical controls to embrace modern digital platforms, significantly improving operational performance and customer engagement. The most critical technological shift involves the integration of Internet of Things (IoT) sensors and connectivity. IoT allows machines to transmit real-time operational data, including coin counting, power consumption, machine fault status, and inventory levels, directly to a central cloud management platform. This capability enables predictive maintenance strategies, reducing the mean time between failures (MTBF) and maximizing revenue generation by ensuring machine availability, a crucial factor in high-traffic entertainment centers.

Furthermore, the technology landscape is defined by advancements in payment and interaction systems. Traditional coin mechanisms are being phased out in favor of robust, secure digital payment solutions, including proprietary game cards, NFC/RFID readers, and mobile payment gateways (e.g., Apple Pay, Google Pay). This transition enhances convenience and allows operators to capture valuable demographic data associated with digital transactions. Advanced Human-Machine Interface (HMI) technologies, such as high-definition touchscreens and enhanced LED lighting systems, are used to create more appealing and immersive cabinet designs, attracting consumer attention even in highly competitive entertainment environments.

Another defining element is the increasing reliance on sophisticated control software and adjustable mechanical components. Modern electronic claw machines utilize programmable logic controllers (PLCs) or embedded microprocessors to manage claw strength, travel speed, and drop timing with precise digital control. This software-driven approach allows operators to remotely adjust game difficulty and payout percentages in strict accordance with regulatory mandates, optimizing the balance between player satisfaction and commercial profitability. The rise of integrated security measures, utilizing small cameras and AI-powered vision systems to detect tampering or theft attempts, further protects these valuable assets deployed across vast, often unmanned, networks of locations.

Regional Highlights

Regional dynamics play a significant role in shaping the global Claw Machine Market, driven by cultural preferences, disposable income levels, and varying regulatory environments. The Asia Pacific (APAC) region stands out as the dominant market, particularly due to the deep-rooted arcade culture in countries like Japan, where claw machines (UFO catchers) are highly sophisticated and frequently updated with exclusive, high-value licensed merchandise. China also contributes substantially, benefiting from massive consumer populations and rapid proliferation of Family Entertainment Centers. APAC’s market is characterized by high operational volume, intense competition, and a focus on soft toys and collectibles tied to popular media franchises.

North America and Europe represent mature, high-value markets focused heavily on regulatory compliance and technological adoption. North American growth is characterized by expansion into diverse retail footprints and strong integration of digital payment solutions. Operators in this region prioritize durability and sophisticated data analytics tools to maximize per-unit efficiency. European markets, particularly Western Europe, exhibit slower but steady growth, with a strong emphasis on family-friendly venues and strict adherence to gambling definitions, often resulting in slightly lower prize values or more stringent payout guarantees compared to their Asian counterparts.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets demonstrating accelerating potential. LATAM growth is primarily driven by increasing urbanization and the rising middle class seeking affordable leisure options. MEA, particularly the GCC countries, sees substantial investment in large-scale shopping and entertainment complexes, providing fertile ground for the deployment of premium, aesthetically advanced claw machines. These regions are characterized by a high willingness to adopt new technology, including mobile payment systems, but often require custom machines designed to withstand local environmental conditions, such as high heat or humidity.

- Asia Pacific (APAC): Market leader driven by established arcade culture (Japan, South Korea, China); high volume; focus on licensed merchandise and rapid iteration of prize inventory.

- North America: Mature market characterized by advanced payment system integration; growth through non-traditional venue placement (e.g., bars, convenience stores); strong focus on data-driven operational optimization.

- Europe: Steady growth, cautious regulatory approach concerning gambling laws; emphasis on high-quality, durable equipment suitable for FECs and leisure parks; premiumization trend.

- Latin America (LATAM): Emerging high-growth market fueled by urbanization and rising disposable income; increasing demand for localized prize themes and affordable entertainment.

- Middle East & Africa (MEA): High investment in luxury retail and entertainment infrastructure; demand for sophisticated, large-format machines; rapid adoption of new payment technologies in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Claw Machine Market.- Sega Corporation

- Namco USA Inc. (Bandai Namco)

- Taito Corporation

- Coastal Amusements Inc.

- LAI Games

- Elaut NV

- Bay Tek Entertainment

- ICE (Innovative Concepts in Entertainment)

- Wahlap Technology

- Falgas S.A.

- Dalian Highland Game Co. Ltd.

- Benchmark Games

- Andamiro Co. Ltd.

- UNIS Technology Ltd.

- Astro Corporation

- Valley Dynamo

- Toy Shock International Ltd.

- Global Stuffed Toys

- Komplete Gaming

- Zest Gaming

Frequently Asked Questions

Analyze common user questions about the Claw Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Claw Machine Market?

The Claw Machine Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period from 2026 to 2033, driven by technology adoption and expansion into new retail formats.

How is AI impacting the operational efficiency of claw machines?

AI primarily enhances operational efficiency through predictive maintenance, reducing machine downtime, and implementing dynamic pricing models that optimize revenue based on real-time consumer demand and usage patterns.

Which geographical region dominates the global market share?

The Asia Pacific (APAC) region holds the dominant market share, largely attributed to its established arcade culture in countries such as Japan and China, coupled with high consumer engagement with licensed merchandise.

What are the primary restraints affecting market growth?

Key restraints include navigating complex, often stringent, regional regulatory frameworks pertaining to gambling definitions and mandatory payout percentages, alongside managing high operational costs associated with prize logistics and inventory management.

What types of technology are driving innovation in modern claw machines?

Innovation is driven by IoT integration for remote monitoring, advanced digital payment systems (NFC, mobile wallets), and sophisticated control software that allows for precise, remote adjustment of claw strength and game difficulty settings.

What is the difference between mechanical and electronic claw machines?

Traditional mechanical machines rely on simpler, analog controls, while modern electronic claw machines incorporate advanced microprocessors, digital displays, and customizable software to control movement and payout rates, offering greater reliability and customization.

Who are the primary potential customers (B2B) for claw machines?

Primary B2B customers include major Family Entertainment Center (FEC) chains, independent route operators who manage machines in third-party locations, and hospitality/retail businesses seeking engaging, automated entertainment options.

How do operators maximize profitability while ensuring fairness?

Operators maximize profitability by optimizing prize diversity, using AI for demand-based restocking, and adhering strictly to regulated payout algorithms to ensure a satisfactory, repetitive experience that maintains consumer trust and legal compliance.

Are licensed plush toys a significant segment in the market?

Yes, licensed plush toys constitute a critically significant segment, driving high consumer interest and expenditure, particularly in the APAC region, due to their perceived value and collectibility, offering strong profit margins for operators.

What role does the Value Chain Analysis play in the industry?

The Value Chain Analysis identifies key stages from upstream component manufacturing (ensuring reliability) to downstream operations (prize logistics and customer interaction), highlighting where efficiency and value addition can be maximized for competitive advantage.

What is the estimated market size of the Claw Machine Market in 2033?

The Claw Machine Market is projected to reach an estimated value of USD 2.0 Billion by the end of the forecast period in 2033, reflecting consistent investment and consumer demand for interactive leisure.

How do claw machines benefit retail environments?

Claw machines act as powerful tools to increase foot traffic and customer dwell time within retail environments, converting transient visitors into engaged, spending customers while providing an additional, high-margin revenue stream.

What emerging opportunity is noted in the market analysis?

A key emerging opportunity is the strategic expansion into non-traditional venues, such as corporate break rooms, fitness centers, and specialized pop-up entertainment stores, leveraging the compact design of mini-machines.

How are geopolitical events affecting the supply chain?

Geopolitical events primarily affect the upstream component supply chain, particularly components sourced from Asia, leading to potential delays or increased procurement costs for microprocessors, sensors, and cabinet materials, necessitating diversified supplier strategies.

What is the function of cloud-based management systems for operators?

Cloud-based systems provide operators with centralized, real-time access to performance metrics, remote diagnostics, inventory management alerts, and the ability to remotely execute software updates and pricing changes across a dispersed network of machines.

How significant is the impact of social media on claw machine usage?

Social media is highly significant, as players often share videos of successful wins, creating viral marketing loops that increase machine visibility, foster competitive play, and drive interest in specific prize collaborations and limited-edition items.

What security challenges do claw machine operators face?

Operators face challenges including prize theft, vandalism, and sophisticated fraud attempts to manipulate the mechanical components. This necessitates the use of integrated surveillance, AI-powered behavioral anomaly detection, and robust cabinet designs.

What is the primary factor driving growth in the North American market?

Growth in North America is strongly driven by strategic technological integration, particularly the widespread adoption of digital payment solutions, which streamlines transactions and appeals to the cashless consumer base.

Do skill-based variants of claw machines exist, and why are they important?

Yes, skill-based variants are increasingly developed to emphasize manual dexterity over random chance. This distinction is crucial as it often allows the machines to circumvent strict gambling regulations, opening up new deployment opportunities.

How does the market segment by Operation Mode influence revenue?

Segmentation by Operation Mode (e.g., mobile payment vs. coin) directly influences revenue by affecting convenience; mobile payment modes typically increase spending velocity and allow for higher average transaction values compared to traditional coin operation.

What is meant by the "Experiential Economy" in the context of claw machines?

The Experiential Economy refers to the consumer trend of prioritizing investment in memorable experiences and leisure activities over material goods. Claw machines fit this trend by offering affordable, engaging, and tangible-reward experiences outside the home.

Are environmental factors a consideration for machine deployment?

Yes, especially in emerging markets or outdoor venues, where machines must be designed to withstand extreme environmental factors like high humidity, dust, and temperature fluctuations, requiring specialized components and weather-proof casing.

Which company is known for its strong presence in the Japanese Claw Machine Market?

Taito Corporation, alongside Sega and Bandai Namco, maintains a dominant and innovative presence in the Japanese market, continually introducing new machine models and exclusive licensed prizes.

How is the market addressing negative consumer perceptions of fairness?

The market addresses these concerns by increasing transparency, adhering strictly to certified payout standards (often verified by software), and utilizing advanced digital controls to ensure predictable and regulated win ratios, thereby building consumer trust.

What technological advancement is reducing the Mean Time Between Failures (MTBF)?

The implementation of IoT sensors and AI-driven predictive maintenance technology is significantly reducing the MTBF by identifying and addressing potential component failures before they lead to machine breakdown.

What is the role of licensed IPs in market success?

Licensed Intellectual Properties (IPs) are vital for success as they dramatically increase the appeal and perceived value of the prizes, driving specific consumer segments and enabling premium pricing for both the prize and the play cost.

How do segmentation trends guide manufacturer specialization?

Segmentation trends guide manufacturers to specialize either in high-end electronic components for modern digital machines or in robust mechanical parts for traditional setups, ensuring optimized production based on defined market needs and regional demand profiles.

What major segment is crucial for high-traffic public areas?

The "Mini/Countertop Machines" segment is crucial for high-traffic areas with limited space, such as convenience stores or quick-service restaurants, maximizing revenue capture in constrained retail footprints.

What kind of analysis is necessary for optimized prize placement?

Optimized prize placement requires visual merchandising analysis combined with AI analytics, studying consumer eye-tracking and success rates to position high-demand items visibly and strategically, maximizing perceived grab-ability.

Why is customization important for Family Entertainment Centers (FECs)?

Customization is important for FECs because they require large, visually striking cabinets and the ability to integrate machines seamlessly into their existing redemption and management systems, often needing bespoke software configurations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager