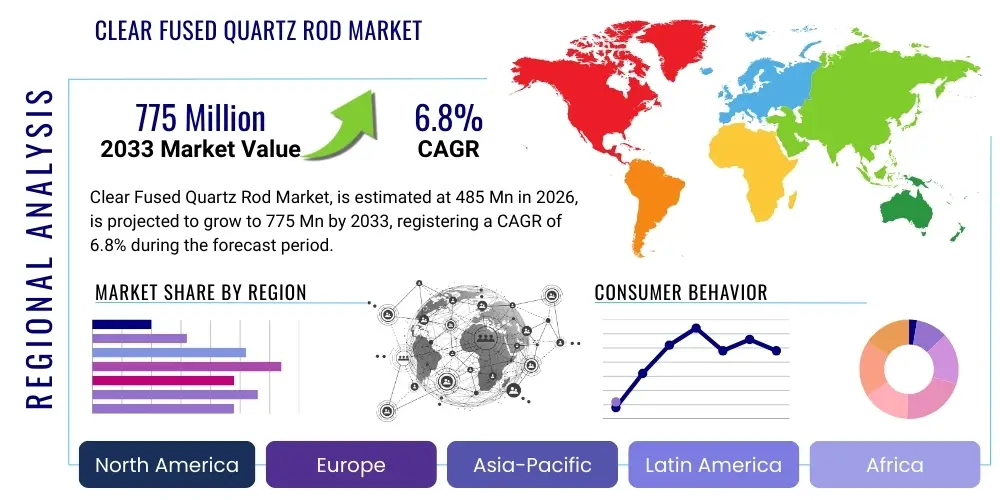

Clear Fused Quartz Rod Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442011 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Clear Fused Quartz Rod Market Size

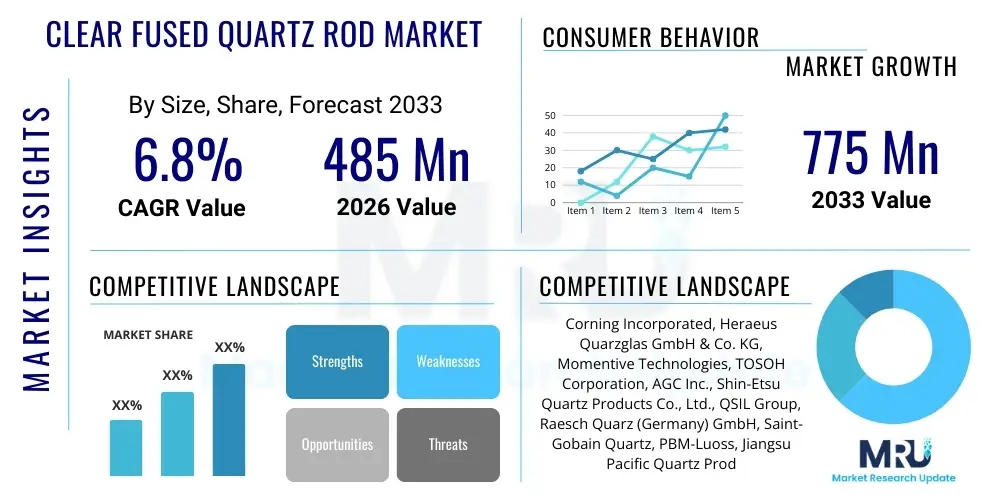

The Clear Fused Quartz Rod Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 485 Million in 2026 and is projected to reach USD 775 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated investment in global semiconductor manufacturing capacity and the ongoing expansion of renewable energy infrastructure, both of which rely heavily on high-purity fused quartz materials for critical processing components and precision optical applications. The material's unique combination of high-temperature resilience, exceptional chemical inertness, and optimal optical transmission characteristics cements its irreplaceable role in these technology-intensive sectors.

The valuation reflects the increasing demand for synthetic fused quartz rods, particularly in applications requiring ultra-low hydroxyl content and superior UV transparency, often necessary for deep ultraviolet (DUV) lithography and advanced fiber optic production. While traditional natural quartz still holds relevance in certain industrial applications, the trend towards miniaturization and higher performance standards in end-user markets mandates the use of highly controlled synthetic quartz materials, which command a premium pricing structure. Geographical expansion, particularly across Asia Pacific nations where semiconductor foundries and solar cell production are concentrated, is expected to be a primary catalyst for exceeding current market forecasts.

Market growth is also indirectly supported by global efforts toward environmental monitoring and purification technologies, leveraging quartz’s effectiveness in UV light transmission for water and air sterilization systems. Furthermore, niche applications in aerospace, specialized laboratory equipment, and defense optics provide stable, high-value demand streams. However, the market remains highly susceptible to capital expenditure cycles in the semiconductor industry; hence, fluctuations in new fab construction and equipment purchasing directly impact demand volumes and pricing dynamics for clear fused quartz rods.

Clear Fused Quartz Rod Market introduction

Clear Fused Quartz Rods are a specialized, amorphous form of silicon dioxide (SiO2) characterized by ultra-high purity, exceptional thermal stability, and broad-spectrum optical transparency. Fabricated either through the fusion of high-grade natural quartz or synthetically produced from chemical precursors, these rods are essential components in environments where material integrity must be maintained under extreme temperature variations and corrosive chemical exposure. Their negligible thermal expansion coefficient grants them superior resistance to thermal shock, making them ideally suited for high-temperature processes exceeding 1200°C, which is a requirement in numerous modern industrial operations, particularly within materials processing.

The primary utility of these rods is concentrated across several high-tech sectors, including microelectronics (semiconductors), photovoltaic (solar) energy, specialized lighting (UV lamps), and advanced optics. In the semiconductor industry, quartz rods serve as the raw material for fabricating high-purity furnace components such as diffusion tubes, boat holders, and thermocouples, ensuring contaminant-free processing vital for semiconductor yield and performance. For solar manufacturing, they are indispensable in the melting and purification of silicon, forming critical infrastructure within high-temperature reactors. The market's foundational benefits stem from the material's unparalleled stability, high working temperature, and the capacity to transmit light efficiently from the deep ultraviolet to the near-infrared regions.

Key driving factors propelling the market include the exponential growth in global data consumption necessitating advanced microchips (Moore's Law), governmental mandates promoting renewable energy adoption, and the continuous technological push towards higher efficiency and purity standards in manufacturing. The ongoing expansion of 5G infrastructure, electric vehicles (EVs), and advanced computing platforms further fuels demand for semiconductor-grade quartz. Simultaneously, geographical shifts in manufacturing capacity towards East Asia and the intensification of research and development in optical fibers and high-power lasers are ensuring a sustained, robust demand trajectory for high-quality clear fused quartz rods throughout the forecast period.

Clear Fused Quartz Rod Market Executive Summary

The Clear Fused Quartz Rod Market is poised for substantial expansion, primarily fueled by synergistic demands arising from the global semiconductor industry’s capacity buildup and the rapid deployment of solar photovoltaic technologies. Market trends indicate a decisive shift towards ultra-high purity synthetic fused quartz rods, necessitated by the stringent contamination control requirements of advanced logic and memory chip fabrication nodes (e.g., 7nm and 5nm). Business trends emphasize strategic mergers and acquisitions among major quartz fabricators aimed at consolidating technological expertise and securing reliable raw material supply chains. Manufacturers are increasingly investing in proprietary fusion techniques to improve material homogeneity and reduce internal stress, thereby meeting the exacting standards for products used in Extreme Ultraviolet (EUV) lithography tools and high-performance laboratory apparatus. Furthermore, sustainability is emerging as a critical trend, driving interest in more energy-efficient manufacturing processes for quartz materials.

Segment trends reveal that the Semiconductor grade purity segment is expected to maintain the highest growth rate and market share value, reflecting the colossal capital expenditure flowing into new fabs globally, particularly in the US, Europe, and Taiwan. Conversely, the high-temperature lighting segment, while mature, is showing steady, predictable demand, especially for replacement parts in industrial UV curing and sterilization applications. By diameter, the market is seeing increased focus on large-diameter rods required for producing massive furnace tubes and specialized optics, presenting complex manufacturing challenges but offering high-margin opportunities. Material purity segmentation underscores the dichotomy between the highly specialized synthetic quartz market, characterized by premium pricing, and the volume-driven natural quartz segment, which serves more conventional thermal and chemical processing needs.

Regionally, Asia Pacific (APAC), led by China, Taiwan, and South Korea, is the undisputed powerhouse of consumption and manufacturing, driven by the concentration of global semiconductor and solar cell production facilities. North America and Europe, while smaller in consumption volume, remain crucial centers for advanced R&D, specialized optics manufacturing, and the production of high-value equipment incorporating these materials. Future growth is strongly linked to governmental initiatives like the US CHIPS Act and similar European policies designed to repatriate critical semiconductor manufacturing, guaranteeing sustained, localized demand in these regions. Overall, the market remains competitive, technologically intensive, and strategically vital to the global digital and clean energy transitions.

AI Impact Analysis on Clear Fused Quartz Rod Market

User inquiries regarding AI's influence on the Clear Fused Quartz Rod market primarily center on optimizing manufacturing processes, predicting material demand fluctuations, and enhancing quality control. Users frequently ask if AI can reduce the cost and waste associated with synthetic quartz production, how predictive maintenance affects furnace uptime, and whether machine vision systems can achieve finer defect detection than traditional inspection methods. The core concern revolves around leveraging AI and Machine Learning (ML) to overcome the inherent challenges of maintaining ultra-high purity and consistency during the fusion and drawing processes, which currently rely heavily on expert human oversight. Analyzing user sentiment suggests a strong expectation that AI will deliver superior product consistency, essential for semiconductor applications, and mitigate the high costs associated with purity failure.

AI integration is fundamentally transforming the high-purity material supply chain, shifting production towards smart manufacturing paradigms. In the fabrication of Clear Fused Quartz Rods, AI models are being deployed for real-time process parameter adjustment in fusion furnaces. By analyzing thousands of sensor inputs—including temperature gradients, gas flow rates, and pressure differentials—ML algorithms can maintain tighter tolerances than conventional proportional-integral-derivative (PID) controllers, directly influencing the optical uniformity and structural integrity of the resulting quartz product. This precision is crucial for semiconductor-grade materials where even minute internal stress or impurity variations can render the product unusable for advanced lithography processes, thereby dramatically improving the first-pass yield rates.

Furthermore, AI-driven demand forecasting and supply chain optimization are enhancing market responsiveness. Utilizing advanced predictive analytics, manufacturers can better anticipate cyclical demands from the volatile semiconductor and solar industries, allowing for more strategic inventory management and production scheduling. This reduces lead times and mitigates the risk of stock-outs or oversupply, particularly for specialized quartz rods with unique doping requirements or diameter specifications. The application of computer vision and deep learning in non-destructive testing (NDT) is also improving quality assurance, enabling faster and more accurate identification of micro-bubbles, inclusions, and internal stresses, thereby drastically increasing yield rates for premium-grade quartz products and reducing manual inspection bottlenecks.

- Enhanced Process Control: AI algorithms optimize fusion furnace parameters (temperature, vacuum, gas flow) in real-time, minimizing internal stress and improving material homogeneity.

- Predictive Maintenance: Machine Learning models forecast equipment failure in expensive high-temperature processing units, maximizing operational uptime and reducing unexpected outages.

- Automated Quality Inspection: Deep learning-enabled vision systems identify sub-micron defects (inclusions, bubbles) faster and more reliably than human operators, ensuring ultra-high purity standards.

- Optimized Supply Chain: Predictive analytics improve inventory management and demand forecasting for volatile end-user sectors like semiconductors, reducing material waste and warehousing costs.

- Material Informatics: AI assists in exploring new material formulations or doping techniques to enhance specific optical or thermal properties of clear fused quartz for niche applications.

DRO & Impact Forces Of Clear Fused Quartz Rod Market

The Clear Fused Quartz Rod market is governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the core Impact Forces. The primary drivers are the unprecedented global expansion of semiconductor manufacturing capacity, driven by technological mandates for smaller, faster, and more powerful microprocessors, and the aggressive push for renewable energy generation, which boosts demand for quartz used in solar silicon purification and cell processing. These industry drivers create a persistent need for high-purity, thermally resilient materials. Simultaneously, opportunities arise from the proliferation of advanced optical technologies, including high-power lasers and precision medical devices, which require specialized quartz compositions, opening avenues for differentiated product offerings and premium pricing strategies. The geographic shift in manufacturing, particularly the diversification of semiconductor production outside of traditional Asian hubs, presents significant opportunities for new regional suppliers.

However, the market faces significant restraints. The high capital expenditure required for establishing and maintaining ultra-high purity manufacturing facilities acts as a considerable barrier to entry, limiting competition and potentially inflating end-user costs. Furthermore, the reliance on a few key, often proprietary, fusion technologies makes the supply chain vulnerable to intellectual property disputes and technological bottlenecks. Economic volatility, particularly cyclical downturns in the highly capital-intensive semiconductor sector, can lead to sharp, temporary drops in demand and pressure on pricing. Additionally, maintaining zero contamination levels throughout the supply chain, from raw material sourcing to final fabrication, poses persistent operational challenges, especially when dealing with synthetic fused quartz requirements.

The cumulative impact forces strongly favor growth, albeit punctuated by cyclical fluctuations. The strategic importance of clear fused quartz in foundational technologies—such as data infrastructure and clean energy—insulates the market from sustained long-term contraction. Technological innovation, specifically in refining manufacturing processes to achieve higher purity at lower energy costs, will act as a pivotal force. The increasing stringency of specifications, particularly regarding bubble content and homogeneity for optical components, pushes manufacturers towards continuous process improvement. Overall, while cost and supply chain complexity represent frictional forces, the persistent demand fueled by megatrends in digitalization and decarbonization ensures that the market trajectory remains upward and strategically relevant.

Segmentation Analysis

The Clear Fused Quartz Rod Market is comprehensively segmented based on purity level, rod diameter, manufacturing process, and end-use application, reflecting the diverse and specialized requirements across various high-tech industries. Purity segmentation is paramount, differentiating between high-purity natural quartz rods suitable for standard high-temperature applications and ultra-high purity synthetic quartz rods, which are indispensable for advanced microelectronics due to their extremely low metallic contaminant and hydroxyl (OH) content. Segmentation by diameter is critical as large-diameter rods are primarily utilized for massive furnace tubes and crucibles, demanding exceptional structural integrity, while smaller diameters often serve optical fibers, specialized laboratory glassware, and components in precision instruments.

Manufacturing process segmentation distinguishes between conventional electric melting/fusion and chemical vapor deposition (CVD) methods, with the latter often yielding the superior material quality required for cutting-edge semiconductor lithography. End-use application segmentation clearly delineates the market’s reliance on the Semiconductor and Photovoltaic industries, which together constitute the largest consumers, contrasting with smaller, high-value segments like Specialty Lighting and Optics. Analyzing these segments provides a nuanced understanding of market dynamics, revealing that growth is disproportionately concentrated in the synthetic, high-purity, large-diameter segments driven by global capital expenditure in advanced fabrication facilities (fabs).

- By Purity Type:

- Natural Fused Quartz Rods

- Synthetic Fused Quartz Rods (Ultra-High Purity)

- By Diameter:

- Small Diameter (< 10 mm)

- Medium Diameter (10 mm – 50 mm)

- Large Diameter (> 50 mm)

- By Application:

- Semiconductor Manufacturing

- Photovoltaic (Solar) Industry

- Specialty Lighting (UV, HID Lamps)

- Optical Components and Fiber Optics

- Chemical and Laboratory Apparatus

- Others (Aerospace, Medical)

Value Chain Analysis For Clear Fused Quartz Rod Market

The value chain for the Clear Fused Quartz Rod Market begins with upstream analysis, focusing critically on the sourcing and preparation of raw materials. For natural quartz rods, high-grade quartz crystals must be mined and meticulously purified, requiring specialized mineral processing to eliminate contaminants like iron and aluminum oxides. For synthetic quartz rods, the process involves chemical synthesis, utilizing high-purity silicon precursors (such as SiCl4 or silanes), which are significantly more expensive but yield the superior purity required for advanced applications. Control over raw material quality and consistent supply is a crucial competitive advantage at this stage, as precursor costs and purity dictate the final product’s viability, especially for semiconductor grades.

Midstream activities involve the complex, energy-intensive manufacturing process, primarily through fusion (electric or flame melting) or high-temperature CVD. This stage includes rod drawing, grinding, polishing, and quality control inspections (often automated with AI) to ensure dimensional tolerances, bubble density, and optical homogeneity are met. Manufacturers in this stage must possess deep expertise in thermal engineering and material science to maintain process stability and minimize waste. Fabrication and conversion into final components, such as furnace tubes or optical lenses, follow, often performed by highly specialized downstream fabricators who cut, drill, and shape the rods according to detailed customer specifications.

Distribution channels in this market are typically direct or utilize highly specialized, technical distributors. Direct distribution is favored for large, recurring orders from major semiconductor or solar capital equipment manufacturers, facilitating close technical collaboration and quality assurance feedback. Indirect channels involve niche distributors who specialize in supplying specific regional markets or smaller end-users in the laboratory and research sectors. Due to the high value and critical nature of the product, technical support and post-sales servicing are integrated into the distribution model, ensuring product performance and facilitating quick resolution of material issues in sensitive manufacturing environments.

Clear Fused Quartz Rod Market Potential Customers

The potential customers and primary end-users of Clear Fused Quartz Rods are overwhelmingly concentrated in industries requiring extreme purity, high temperature resistance, and precise optical transmission capabilities. The most significant customer segment comprises major semiconductor device manufacturers (fabs) and capital equipment suppliers (OEMs) who use the rods as vital components in high-temperature processes like diffusion, oxidation, annealing, and chemical vapor deposition (CVD). These buyers demand synthetic quartz rods with near-zero contaminant levels to ensure the integrity of silicon wafers, especially those processed at advanced technology nodes (e.g., 5nm, 3nm).

The second major group includes photovoltaic industry players, encompassing manufacturers of polysilicon, ingot pullers, and solar cell fabricators. These customers require quartz rods for crucibles, liners, and other high-temperature containment applications during silicon melting and crystallization, prioritizing thermal shock resistance and large diameters. The demand from this segment is cyclical but shows strong underlying growth driven by renewable energy mandates globally. Additionally, customers in specialized technical fields, such as advanced lighting producers (for UV sterilization and HID lamps), fiber optic manufacturers, and aerospace/defense contractors requiring high-purity optical blanks, form significant, high-value customer bases.

Other vital, though smaller, potential customers include specialized chemical processing plants and university research laboratories. Chemical facilities utilize quartz rods and fabricated components for handling corrosive acids and high-temperature reactions where traditional materials would fail. Research institutions rely on the material for high-fidelity experimentation and component prototyping. Purchasing decisions across all these sectors are primarily influenced by material purity certification, consistent dimensional stability, supplier reliability, and the capacity to meet stringent technical specifications rather than merely the lowest price, emphasizing a partnership-based procurement model.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485 Million |

| Market Forecast in 2033 | USD 775 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Incorporated, Heraeus Quarzglas GmbH & Co. KG, Momentive Technologies, TOSOH Corporation, AGC Inc., Shin-Etsu Quartz Products Co., Ltd., QSIL Group, Raesch Quarz (Germany) GmbH, Saint-Gobain Quartz, PBM-Luoss, Jiangsu Pacific Quartz Products Co., Ltd., China New Century Quartz, Technical Glass Products (TGP), Atlantic Quartz, Jinzhou Dongyi Quartz Glass Co., Ltd., Feilihua Quartz Glass Co., Ltd., Guolun Quartz, Lianyungang Daikou Quartz. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clear Fused Quartz Rod Market Key Technology Landscape

The technological landscape of the Clear Fused Quartz Rod market is characterized by a continuous push for enhanced purity, greater homogeneity, and precise dimensional control, driven largely by the hyper-critical requirements of the semiconductor industry. The manufacturing process relies fundamentally on high-temperature fusion techniques, primarily distinguishing between vacuum-pressure fusion of natural quartz (yielding lower-cost, standard-grade rods) and synthetic methods like flame hydrolysis or chemical vapor deposition (CVD). CVD techniques, particularly, are highly sophisticated, utilizing volatile silicon compounds (such as silane or SiCl4) to deposit high-purity SiO2 layers, resulting in synthetic fused quartz rods with superior optical transmission properties in the UV range and extremely low metallic impurity content, essential for modern lithography systems.

A key technological focus involves the management and minimization of hydroxyl (OH) content within the fused quartz structure. High OH content degrades UV transmission and can lead to structural instability at extremely high temperatures. Manufacturers employ advanced dehydroxylation processes, often involving specialized high-vacuum furnaces and controlled gas environments, to produce 'dry' quartz rods preferred for high-temperature semiconductor processing and deep UV applications. Concurrently, advancements in large-scale furnace design and rod drawing apparatus are crucial for producing ultra-large diameter rods (often exceeding 100mm) with minimal internal stress and bubbles, enabling the fabrication of the large furnace tubes needed for 300mm and upcoming 450mm silicon wafer processing.

Furthermore, the market is seeing adoption of advanced metrology and quality assurance technologies. Non-contact measurement systems, coupled with machine vision and ultrasonic testing, are essential for characterizing internal defects, stress birefringence, and geometric tolerances with sub-micron accuracy. Doping technologies, involving the intentional inclusion of elements like titanium or fluorine, represent another technical niche, altering the thermal expansion or optical cutoff wavelengths of the quartz for specialized applications like optical fibers or compensating thermal expansion in mirror substrates. Patents surrounding these proprietary fusion and purification methods form the basis of competitive advantage among leading global suppliers, defining the high-entry barriers of this specialized market.

Regional Highlights

Regional dynamics in the Clear Fused Quartz Rod market are highly correlated with the global distribution of advanced manufacturing capabilities, particularly the semiconductor and photovoltaic industries. Asia Pacific (APAC) holds the largest market share globally, driven primarily by massive investments in semiconductor fabrication facilities (fabs) across China, Taiwan, South Korea, and Japan. These nations collectively represent the epicenter of global electronic manufacturing and, consequently, demand enormous volumes of high-purity quartz rods for both production equipment and component fabrication. The presence of major quartz rod manufacturers in this region further solidifies its dominance, fostering robust regional supply chains.

North America and Europe represent significant, high-value markets characterized by demand for specialized, high-specification quartz rods used in advanced research, aerospace applications, and specialized optical systems, including high-power lasers and EUV tools. While production volume may be lower than in APAC, the average selling price (ASP) is typically higher due to stringent quality certifications and customization requirements. Recent governmental initiatives, such as the US CHIPS and Science Act and similar European efforts, aim to boost domestic semiconductor manufacturing, promising substantial long-term growth in localized demand for quartz components and stimulating domestic production capacity.

The Middle East & Africa (MEA) and Latin America currently constitute smaller markets but are poised for gradual growth, fueled by nascent solar energy projects and infrastructure development requiring specialized lighting and high-temperature materials. The primary demand in these regions is focused on essential infrastructure projects rather than high-end semiconductor applications. Latin American growth is often linked to localized assembly operations and niche industrial applications, sourced predominantly through international imports. Future market development in these regions will hinge on regional economic stability and the pace of local industrialization and renewable energy penetration.

- Asia Pacific (APAC): Dominates the market share due to concentration of semiconductor fabs (Taiwan, South Korea) and solar manufacturing (China). Key driver for high-volume, standard and high-purity quartz consumption.

- North America: Crucial market for high-specification, synthetic quartz rods used in advanced R&D, specialized optics, and the rapidly growing domestic semiconductor manufacturing sector following recent government mandates.

- Europe: Strong demand focused on precision optics, high-power lasers, scientific instrumentation, and replacement parts for established industrial and chemical processing facilities. Germany remains a key manufacturing hub.

- Latin America & MEA: Emerging markets with demand primarily focused on solar energy infrastructure, industrial lighting, and basic high-temperature process applications; growth trajectory is moderate but increasing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clear Fused Quartz Rod Market.- Corning Incorporated

- Heraeus Quarzglas GmbH & Co. KG

- Momentive Technologies

- TOSOH Corporation

- AGC Inc.

- Shin-Etsu Quartz Products Co., Ltd.

- QSIL Group

- Raesch Quarz (Germany) GmbH

- Saint-Gobain Quartz

- PBM-Luoss

- Jiangsu Pacific Quartz Products Co., Ltd.

- China New Century Quartz

- Technical Glass Products (TGP)

- Atlantic Quartz

- Jinzhou Dongyi Quartz Glass Co., Ltd.

- Feilihua Quartz Glass Co., Ltd.

- Guolun Quartz

- Lianyungang Daikou Quartz

Frequently Asked Questions

Analyze common user questions about the Clear Fused Quartz Rod market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Natural and Synthetic Clear Fused Quartz Rods?

The primary difference lies in purity and manufacturing method. Natural quartz rods are derived from mined crystals and offer standard high-temperature performance. Synthetic fused quartz rods are chemically synthesized, resulting in ultra-high purity, extremely low metallic contamination, and superior optical transmission, particularly in the deep UV spectrum, making them essential for advanced semiconductor and optical applications.

Which end-use application drives the highest demand for Clear Fused Quartz Rods?

The Semiconductor Manufacturing industry is the leading driver of demand. Quartz rods are critical raw materials for fabricating high-purity consumables (e.g., furnace tubes, crucibles) used in processes like diffusion, oxidation, and CVD, where material stability and contamination control are absolutely mandatory for device yield.

How does the global expansion of semiconductor fabs impact the market size?

The global expansion of semiconductor fabrication facilities (fabs) directly increases the capital expenditure cycle for specialized high-temperature equipment, leading to substantial, sustained growth in demand for high-purity synthetic quartz rods. Each new fab requires massive initial quantities of quartz components and continuous replacement parts.

What key properties make fused quartz rods indispensable for high-tech industries?

Fused quartz rods are indispensable due to their unique combination of low thermal expansion coefficient (excellent thermal shock resistance), superior chemical inertness (resistance to acids and halogens), and optimal transmission across the UV-to-IR spectrum. These properties ensure material reliability and performance stability in extreme processing environments, such as those found in solar and chip manufacturing.

Are there any viable substitutes for Clear Fused Quartz Rods in critical applications?

In highly critical applications, particularly in the core processing steps of semiconductor manufacturing, viable substitutes offering the same combination of ultra-high purity, high temperature resistance, and optical properties are extremely limited. Certain ceramics or specialized glasses might serve specific niche roles, but fused quartz remains the benchmark material for most high-temperature, contamination-sensitive processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager