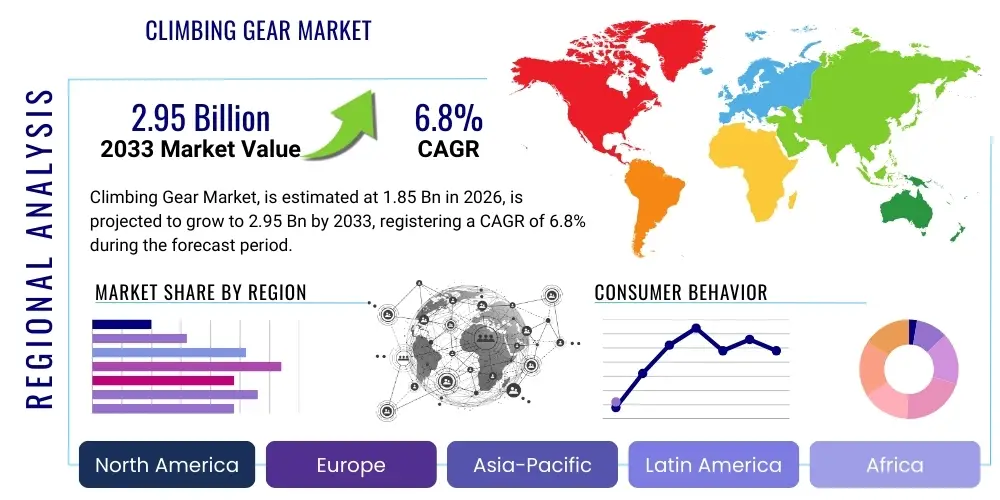

Climbing Gear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442458 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Climbing Gear Market Size

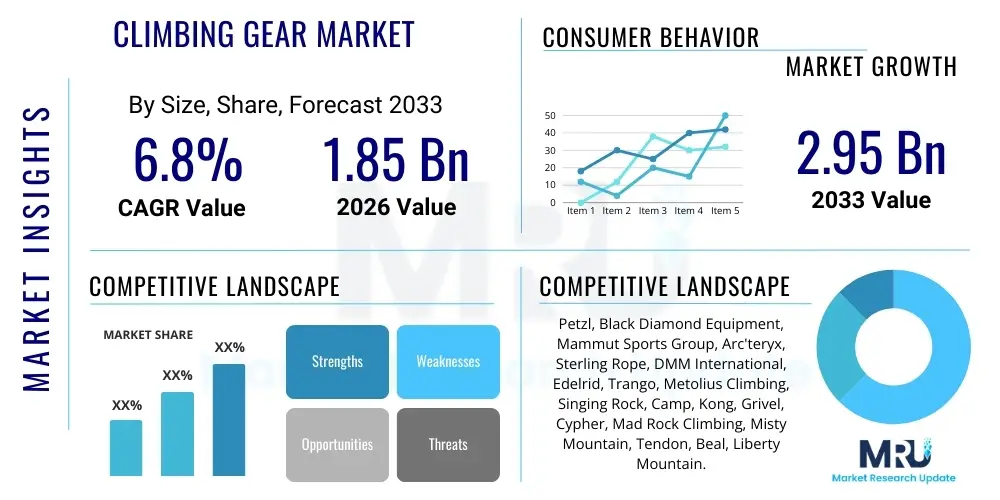

The Climbing Gear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This robust growth trajectory is underpinned by increasing global participation in adventure sports and the rising popularity of indoor climbing facilities, which necessitate continuous investment in certified safety equipment. The market dynamics are highly influenced by stringent safety standards and the demand for lightweight, high-performance materials.

The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.95 Billion by the end of the forecast period in 2033. This valuation reflects not only the expanding base of traditional outdoor climbers but also the significant proliferation of commercial climbing gyms worldwide. Key drivers include innovation in rope technology, advancements in harness ergonomics, and the integration of smart features in safety hardware, enhancing both performance and user security across varied climbing disciplines.

Climbing Gear Market introduction

The Climbing Gear Market encompasses a comprehensive range of specialized equipment designed to ensure the safety, performance, and accessibility of climbing activities, including rock climbing, ice climbing, mountaineering, and rescue operations. Core products include ropes, harnesses, protective headwear, carabiners, belay devices, cams, nuts, and specialized footwear. The fundamental purpose of this gear is to mitigate the inherent risks associated with ascending challenging vertical terrain, thereby facilitating safer engagement in one of the fastest-growing recreational activities globally.

Major applications of climbing gear span professional expeditions, recreational outdoor pursuits, commercial gym climbing, and essential rescue and industrial rope access tasks. The primary benefits derived from high-quality climbing equipment include superior load-bearing capacity, enhanced durability against abrasion and environmental factors, improved user comfort, and adherence to crucial international safety certifications (such as CE and UIAA). Continuous material science breakthroughs, particularly in polymers and lightweight alloys, ensure that contemporary gear offers an optimal balance between low weight for carrying and maximum strength for safety.

The market’s substantial growth is predominantly driven by several interconnected factors: the growing global awareness of physical fitness and adventure tourism, the inclusion of climbing (sport climbing) in the Olympic Games, and significant infrastructural investment in indoor climbing facilities, making the sport accessible to urban populations regardless of weather conditions. Furthermore, enhanced disposable incomes in emerging economies are fueling discretionary spending on high-cost recreational equipment, positioning safety gear as a non-negotiable prerequisite for participation.

Climbing Gear Market Executive Summary

The Climbing Gear Market is characterized by intense focus on innovation, driven primarily by safety regulations and consumer demand for lighter, stronger products. Current business trends indicate a strong shift towards sustainability, with major manufacturers increasingly adopting recycled materials and optimizing supply chains to reduce environmental impact, appealing directly to the environmentally conscious outdoor community. Furthermore, digitalization is influencing distribution, with direct-to-consumer (D2C) online channels gaining significant traction, allowing brands greater control over pricing and customer engagement, complementing the traditional reliance on specialized retail stores.

Geographically, North America and Europe remain the dominant revenue contributors due to established climbing cultures, high levels of disposable income, and the presence of leading manufacturers and rigorous certification bodies. However, the Asia Pacific region, particularly countries like China and India, is emerging as the fastest-growing market segment. This accelerated growth is attributed to rising interest in adventure tourism, rapid urbanization leading to the proliferation of indoor climbing gyms, and government initiatives promoting outdoor sports, driving new user acquisition at an unprecedented rate.

Segmentation trends highlight that the Hardware segment (carabiners, protection devices) and Ropes segment continue to hold significant market share, reflecting the high replacement frequency and critical safety role these items play. In terms of application, recreational rock climbing, encompassing both indoor and outdoor activities, constitutes the largest segment, consistently driving volume sales. The increasing adoption of advanced materials like Dyneema and specialized treatments for ropes (e.g., dry treatments) underscores a key segment trend toward premium, high-performance gear designed for extreme conditions.

AI Impact Analysis on Climbing Gear Market

Analysis of common user questions regarding AI's influence on the Climbing Gear Market reveals key themes centered around safety augmentation, personalized gear recommendations, and supply chain efficiency. Users frequently inquire about the feasibility of AI-driven safety monitoring systems integrated into harnesses or helmets that could detect user fatigue or improperly set anchors in real-time. There is also substantial curiosity regarding how AI algorithms might be used by retailers or manufacturers to analyze personal climbing data (e.g., body metrics, typical routes, climbing style) to recommend the optimal size, material, and type of specialized gear, significantly improving fit and performance. Furthermore, consumers and industry stakeholders are keen on understanding how predictive analytics, powered by machine learning, could optimize inventory management for highly seasonal and geographically fragmented products like climbing gear, ensuring specialty retailers maintain adequate stock of critical safety items.

AI’s influence is moving beyond theoretical application and into practical manufacturing and retail operations. The primary expectation is that AI will enhance safety features through predictive maintenance and real-time risk assessment, ultimately reducing accidents. Manufacturing processes are also being analyzed, with AI potentially optimizing material cutting and assembly of complex textile products like harnesses and ropes, minimizing waste and ensuring precision. The retail experience is expected to become significantly more personalized, using large datasets of user behavior, product returns, and performance reviews to drive hyper-accurate merchandising and product development tailored to specific climbing disciplines and skill levels.

The incorporation of sensors into equipment, coupled with AI processing, represents a paradigm shift in equipment functionality. While traditional gear relies purely on mechanical integrity, future iterations could offer instantaneous feedback, logging every stress event or detecting minute damage invisible to the human eye. This integration will mandate new industry standards for smart gear data privacy and reliability, necessitating collaborative efforts between gear manufacturers, software developers, and international safety organizations to manage user expectations and maintain regulatory compliance in critical life-support equipment.

- AI-driven real-time safety monitoring embedded in harnesses (e.g., detecting improper knots or excessive loading).

- Predictive maintenance analytics for ropes and hardware based on usage intensity logged via smart sensors.

- Optimized gear sizing and recommendation engines using machine learning algorithms based on user biometrics and climbing profile.

- Enhanced supply chain forecasting for seasonal and specialized gear, minimizing stockouts and overstocking.

- Automated quality control systems in manufacturing, using computer vision to detect material flaws in textiles and metal components.

- Development of AI-powered virtual training simulations that recommend specific gear setups based on simulated route difficulty.

DRO & Impact Forces Of Climbing Gear Market

The Climbing Gear Market is shaped by powerful Drivers, significant Restraints, emerging Opportunities, and defining Impact Forces. Key drivers propelling the market include the global surge in interest in adventure tourism and outdoor recreation, the growing accessibility provided by indoor climbing gyms, and the mandatory need for frequent equipment replacement due to safety standards and material degradation over time. Restraints primarily involve the high initial cost of specialized, certified equipment, potential regulatory hurdles related to new materials, and the persistent challenge of counterfeit products which undermine safety trust in the market. Opportunities are abundant in the development of sustainable, biodegradable materials for ropes and packaging, the integration of smart technologies (IoT) into safety gear for enhanced monitoring, and expansion into untapped regional markets in Asia and Latin America. The market is constantly impacted by forces such as stringent international safety certifications (UIAA, CE), fluctuating raw material costs (nylon, aluminum alloys), rapid technological obsolescence, and the intense competitive pressure among established global brands focusing on material science innovations.

Segmentation Analysis

The Climbing Gear Market is analyzed across multiple critical dimensions, including Product Type, Application, and Distribution Channel, to provide a granular understanding of consumer purchasing behavior and market dynamics. The segmentation by Product Type is essential as it differentiates between life-safety critical equipment and support accessories, influencing pricing strategies and regulatory compliance focus. Application segmentation helps manufacturers tailor product features to specific user needs, such as the lightweight requirements for alpine mountaineering versus the durability demanded by professional rescue teams. Finally, the Distribution Channel segmentation illuminates the evolving landscape of retail, highlighting the increasing importance of digital platforms alongside traditional specialty outdoor retailers for market access and sales.

Detailed analysis reveals that within Product Type, the Ropes and Harnesses segments collectively account for the largest revenue share, driven by their critical safety function and regular required replacement cycles dictated by usage intensity and material shelf life. The fastest-growing segment, however, is likely the Climbing Footwear category, benefiting from specialized materials science breakthroughs offering improved grip and comfort for both high-performance outdoor climbing and intensive indoor gym use. The increasing complexity of consumer choice necessitates clear categorization across all segments to effectively target diverse climbing communities, from beginners requiring basic starter kits to elite athletes demanding ultra-light, high-tech professional equipment.

- Product Type:

- Ropes (Dynamic, Static, Accessory Cords)

- Harnesses (Sport, Alpine, Chest)

- Helmets (Hardshell, Foam, Hybrid)

- Hardware (Carabiners, Quickdraws, Belay Devices, Protection Devices – Cams, Nuts)

- Climbing Footwear

- Apparel and Accessories

- Application:

- Rock Climbing (Sport, Traditional)

- Mountaineering and Alpine Climbing

- Ice Climbing

- Rescue Operations and Industrial Rope Access

- Training and Gym Use

- Distribution Channel:

- Offline (Specialty Outdoor Stores, Department Stores, Hypermarkets)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Climbing Gear Market

The value chain for the Climbing Gear Market begins with intensive upstream activities focused on raw material procurement, primarily high-strength synthetic fibers (Nylon, Polyester, Dyneema) for ropes and webbing, and specialized aluminum or steel alloys for hardware components. Upstream analysis highlights the dependency on petrochemical and metallurgy industries, where input price volatility significantly impacts the final product cost. Manufacturers heavily invest in R&D during this stage to ensure materials meet stringent safety and performance metrics, often working closely with chemical suppliers to develop proprietary textile treatments, such as dry finishes for ropes that enhance water resistance and durability in harsh alpine environments. Compliance with global safety standards (UIAA and CE) is the defining characteristic of this initial phase.

Midstream processes involve specialized manufacturing, assembly, and rigorous testing. This stage demands precision engineering, particularly in the forging and machining of load-bearing hardware like carabiners and protection devices, which require zero-defect tolerance. For textile products, specialized stitching and braiding techniques are utilized to maximize strength while maintaining flexibility. After manufacturing, products move to the distribution channels, which are characterized by a mix of direct and indirect methods. Direct channels involve manufacturers selling through their proprietary websites or brand stores, offering better margin control and direct customer feedback. Indirect channels primarily rely on authorized specialty outdoor retailers who provide crucial expert advice and product education to consumers, often stocking a wide range of competitive brands.

The downstream segment focuses on the end-user interaction, encompassing retail, consumer education, and post-sales support. Given the safety-critical nature of the product, consumer trust is paramount. Retailers play a key role in educating buyers on gear selection, proper usage, and replacement cycles. The increasing dominance of online distribution channels requires sophisticated logistics and robust digital content, including detailed video tutorials and certification documentation, to replace the in-person expertise offered by brick-and-mortar specialty stores. Effective post-sales support, including warranty services and prompt recall procedures, is vital for maintaining brand loyalty and addressing safety concerns efficiently across the global user base.

Climbing Gear Market Potential Customers

The potential customer base for the Climbing Gear Market is highly diverse, spanning recreational enthusiasts, professional athletes, and specialized industrial users, each segment possessing distinct purchasing motivations and product requirements. Recreational climbers, who make up the largest demographic, are typically budget-conscious but prioritize recognizable safety brands, participating in activities ranging from local boulder hopping to multi-pitch rock routes. This group heavily consumes starter kits, gym-specific gear (e.g., specific sticky rubber footwear), and frequently replaces ropes and harnesses as they wear out. The proliferation of indoor gyms has significantly expanded this base to include urban dwellers and younger individuals seeking fitness and social engagement.

A second crucial customer segment comprises professional mountaineers, alpine climbers, and expedition teams. These end-users prioritize ultra-light, technologically advanced, and extremely durable gear designed for high altitude, ice, and extreme weather conditions. Their purchases are characterized by high price points, specialized equipment (ice axes, technical crampons, specialized alpine harnesses), and a high reliance on proven, top-tier brands known for reliability in critical situations. These customers often act as key influencers, driving product trends and validating new technologies within the broader climbing community, despite representing a smaller volume of total sales.

The third significant group includes institutional buyers such as search and rescue teams (SAR), military, fire departments, and industrial rope access technicians (IRATA-certified professionals). For these customers, purchases are driven strictly by mandated safety standards, governmental regulations, and long-term durability metrics, often resulting in bulk purchases and specialized equipment procurement based on strict tender specifications. While less sensitive to aesthetic trends, this segment requires gear with specific load ratings, certifications, and traceability, often favoring static ropes, robust industrial harnesses, and specialized hardware designed for continuous heavy-duty use in professional environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Petzl, Black Diamond Equipment, Mammut Sports Group, Arc'teryx, Sterling Rope, DMM International, Edelrid, Trango, Metolius Climbing, Singing Rock, Camp, Kong, Grivel, Cypher, Mad Rock Climbing, Misty Mountain, Tendon, Beal, Liberty Mountain. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Climbing Gear Market Key Technology Landscape

The technological landscape of the Climbing Gear Market is rapidly evolving, driven primarily by material science innovations aimed at reducing weight while maximizing strength and durability. Key advancements include the widespread adoption of high-modulus polyethylene (HMPE) fibers, such as Dyneema and Spectra, which are used to construct ultra-strong and lightweight slings, quickdraw components, and specialized cordage, offering superior strength-to-weight ratios compared to traditional nylon. Furthermore, thermal treatments and sophisticated braiding techniques in rope manufacturing (e.g., core and sheath fusion) enhance abrasion resistance, water repellency (dry treatments), and longevity, which are critical factors for safety and performance in alpine and ice environments.

In the hardware sector, computer-aided design (CAD) and advanced forging processes are utilized to create complex, highly optimized carabiner and protection geometries, ensuring load paths are managed efficiently while minimizing material use. Technology is also increasingly focused on user interface and usability. Examples include innovations in belay devices that offer enhanced braking assistance (e.g., assisted braking devices) to improve safety margins for novice and intermediate climbers. These mechanical technologies rely on precision machining and testing to meet the stringent mechanical performance requirements mandated by international standards bodies, which continuously update their protocols based on new failure analysis data.

The future technology landscape is centered on digitalization and sustainability. The integration of Internet of Things (IoT) technology is beginning to appear in high-end gear, such as helmets and harnesses embedded with RFID tags or small sensors. These technologies allow for better inventory management, tracking of usage history, and digital identification for mandatory safety inspections. In parallel, significant R&D efforts are dedicated to developing sustainable alternatives, exploring bio-based plastics and recycled aluminum alloys, without compromising the structural integrity or safety performance, reflecting a crucial trend towards environmentally conscious engineering within the industry.

Regional Highlights

The global Climbing Gear Market exhibits distinct regional consumption patterns and growth drivers, necessitating tailored market strategies.

- North America: This region holds a significant share due to a deeply entrenched outdoor recreation culture, particularly in the Western US and Canadian Rockies. High disposable incomes and the presence of numerous dedicated climbing areas drive consistent demand for premium, high-performance gear. The US is also a hub for innovation and the headquarters of several global market leaders. Stringent consumer protection laws ensure high standards for safety equipment, maintaining strong growth in replacement cycles.

- Europe: Europe represents a mature market with high penetration, fueled by the historical significance of alpine mountaineering (The Alps) and widespread organized climbing clubs. Countries like Germany, France, and Italy are key consumption centers, characterized by strong brand loyalty and a preference for products adhering strictly to CE and UIAA certifications. European consumers often prioritize technical innovation and ecological sustainability in their purchasing decisions, influencing global product development trends.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, driven by infrastructure development in large economies like China and India, which are rapidly expanding their number of indoor climbing gyms. Growing adventure tourism, rising youth engagement, and increasing discretionary spending are major accelerators. While still price-sensitive in some sub-regions, the demand for certified international brands is increasing substantially as safety awareness improves.

- Latin America (LATAM): The market here is emerging, showing potential driven by specific climbing destinations in Patagonia and the Andes. Growth is steady but often hindered by economic instability and reliance on imported gear, making price competitiveness a critical factor. Brazil and Chile are key focal points for market entry and distribution expansion.

- Middle East and Africa (MEA): This region is niche but growing, primarily driven by professional industrial rope access (oil, gas, infrastructure maintenance) and nascent adventure tourism initiatives. Consumption is concentrated in urban centers and energy sector hubs, requiring high-durability and specialized industrial climbing and safety gear.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Climbing Gear Market.- Petzl

- Black Diamond Equipment

- Mammut Sports Group

- Arc'teryx

- Sterling Rope

- DMM International

- Edelrid

- Trango

- Metolius Climbing

- Singing Rock

- Camp

- Kong

- Grivel

- Cypher

- Mad Rock Climbing

- Misty Mountain Threadworks

- Tendon S.R.O.

- Beal (Groupe GM)

- Liberty Mountain

- Faders S.L. (Fixe Hardware)

Frequently Asked Questions

Analyze common user questions about the Climbing Gear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Climbing Gear Market?

The primary growth drivers are the significant global increase in participation in adventure sports, the rising popularity and expansion of accessible indoor climbing gyms, and the mandatory requirement for climbers to frequently replace safety-critical equipment due to wear and material degradation over time, adhering to stringent international safety standards.

Which product segment holds the largest market share in Climbing Gear?

The Hardware segment, comprising items like carabiners, quickdraws, and specialized protection devices (cams, nuts), typically holds the largest market share, closely followed by the Ropes segment. This dominance is due to their non-negotiable role in safety systems and the high technical precision required in their manufacturing.

How is sustainability impacting product development in climbing gear?

Sustainability is a crucial factor, influencing manufacturers to use recycled and bio-based raw materials, particularly in harnesses and ropes, and to adopt eco-friendly packaging. Consumers are increasingly demanding durable, ethically sourced products, pressuring brands to optimize their supply chains and reduce their environmental footprint.

Which geographical region is showing the fastest growth potential?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is fueled by rapid urbanization, significant investment in commercial climbing infrastructure (gyms), and rising disposable incomes leading to greater adoption of outdoor recreational activities across countries like China and India.

What role does technology play in modern climbing safety gear?

Technology enhances modern climbing safety gear through advanced material science, utilizing lightweight yet strong fibers (like Dyneema) and optimized metal alloys. Furthermore, emerging IoT technology is enabling the integration of smart features for real-time monitoring, usage tracking, and digital inspection compliance of critical safety equipment.

The extensive analysis of the Climbing Gear Market underscores a highly competitive landscape driven by safety, innovation, and consumer demand for high-performance, lightweight equipment. The market's resilience is tied to the non-discretionary nature of safety gear, ensuring sustained growth regardless of minor economic fluctuations. Manufacturers are continually challenged to balance cost-effectiveness with the stringent requirements of international certification bodies, pushing the boundaries of material science and engineering precision. The shift towards digitalization in retail and the emphasis on environmental stewardship define the strategic trajectory for industry stakeholders through the forecast period. The increasing accessibility provided by indoor facilities worldwide guarantees a continuous influx of new participants, thereby securing the long-term vitality and expansion of the market across all product and application segments.

Future growth will be significantly shaped by the adoption of smart safety technologies and predictive maintenance models, especially in professional and institutional applications. Integrating sensors and AI analysis into ropes and hardware offers an unprecedented opportunity to move from passive safety measures to proactive risk management. Furthermore, successful market penetration in emerging economies will require localized distribution strategies, addressing regional pricing sensitivities while maintaining global standards of equipment safety and quality. The focus on robust material traceability and anti-counterfeiting measures will be paramount in upholding consumer trust, which is the foundational pillar of the safety-critical climbing gear industry.

In summary, the Climbing Gear Market is positioned for robust expansion, maintaining its status as a critical sector within the broader sporting goods and adventure travel industries. Strategic investment in research and development, coupled with an adaptable approach to regional market dynamics, will be essential for companies seeking to capture maximum value. The convergence of rising global participation, technological innovation in material science, and the non-negotiable demand for certified safety systems ensures a strong and secure pathway for market growth towards the projected $2.95 Billion valuation by 2033.

The market environment necessitates that key players focus on vertical integration where feasible, allowing greater control over the supply chain quality, particularly concerning specialty alloys and advanced synthetic fibers. Brand reputation, built on decades of reliability and safety track record, remains the most powerful competitive differentiator. Companies that successfully combine superior product engineering with compelling narratives around sustainability and user experience are best positioned to dominate market share. The steady replacement cycle inherent in the product category, combined with demographic expansion, provides a solid economic foundation for sustained high single-digit growth throughout the forecast period, cementing the market’s positive outlook.

Further granular analysis reveals subtle shifts within the hardware segment, where specialized friction devices and personalized fit systems are seeing increased adoption rates. Traditional protection hardware is being constantly refined, moving towards lighter and more user-friendly designs that appeal to beginner and intermediate climbers while meeting the stringent demands of advanced users. This focus on optimization across the entire product spectrum ensures that manufacturers capture diverse consumer needs, from the high-volume entry-level market to the low-volume, high-margin professional market. The interaction between technology, regulation, and consumer education will define successful market penetration strategies over the next seven years.

The structural transformation of the distribution channel, characterized by the acceleration of e-commerce platforms, requires traditional brick-and-mortar specialty stores to redefine their value proposition. While online retail offers convenience and price transparency, specialty stores retain a critical advantage in providing expert advice, crucial for first-time buyers and advanced gear selection. Therefore, successful market participants are adopting omnichannel strategies, integrating online efficiency with in-person expertise, often offering clinics or gear testing events to solidify customer loyalty. This integrated approach ensures that the highly technical nature of climbing gear purchasing is properly supported, mitigating risks associated with misinformed online purchases.

Investment trends indicate a growing appetite for mergers and acquisitions focused on consolidating specialized technology or achieving vertical integration. Smaller, innovative material science firms or highly specialized hardware manufacturers are attractive targets for larger global players seeking to enhance their product portfolios and secure intellectual property related to lightweight and durable materials. This M&A activity contributes to market maturity and efficiency by streamlining distribution networks and standardizing best practices across the industry, further reinforcing the established safety requirements imposed by governing bodies globally. These consolidations are expected to intensify competition at the premium end of the market, focusing development efforts on revolutionary, rather than incremental, improvements in safety and performance metrics.

The socio-cultural impact of climbing gear extends beyond recreational use, deeply influencing rescue and access industries. Innovations developed for extreme sport often cascade into essential safety equipment used by emergency services globally. For example, advancements in rope treatment or harness ergonomics driven by alpine climbers quickly find application in urban rescue or industrial settings, highlighting the interconnected nature of the market. This cross-pollination ensures a high benchmark for product quality across all applications, providing manufacturers with diverse revenue streams and promoting continuous refinement of core safety technologies, ultimately benefiting the entire ecosystem dependent on reliable height safety equipment.

In conclusion of the expanded market overview, the Climbing Gear Market is driven by a unique blend of passion, performance, and paramount safety concerns. Its forecasted trajectory is robust, supported by stable demographic growth in participation, structural investments in infrastructure, and relentless technological pursuit of lighter, stronger, and smarter equipment. Stakeholders must remain vigilant regarding regulatory changes and material sourcing constraints, positioning innovation and integrity at the core of their operational strategies to capitalize fully on the promising market expansion forecasted through 2033.

The ongoing globalization of climbing as a recognized sport, magnified by its Olympic inclusion, guarantees increasing visibility and sustained interest from demographics previously unaware of the sport. This mainstream exposure necessitates product diversification, especially in entry-level and intermediate gear that is designed to be highly intuitive and forgiving for newcomers. The long-term success of the market hinges on maintaining impeccable safety records, which requires not only high-quality manufacturing but also comprehensive user education programs supported by both brands and retailers. This commitment to safety and accessibility is the defining characteristic that will ensure the market surpasses the $2.95 Billion milestone.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Rock Climbing Gear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Climbing Gear Market Statistics 2025 Analysis By Application (Men, Women, Kids), By Type (Climbing Harnesses, Specialized Clothing, Passive Protection, Belay Device, Climbing Carabiner, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager