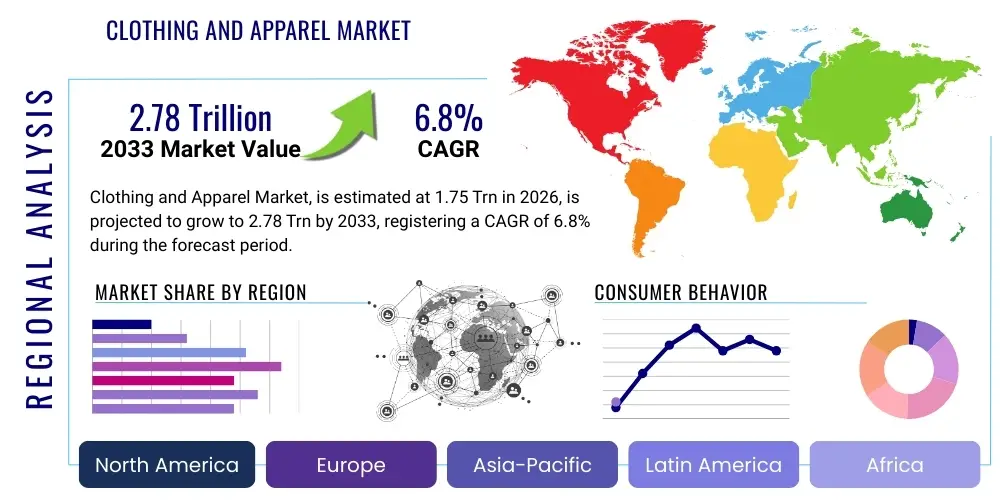

Clothing and Apparel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442350 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Clothing and Apparel Market Size

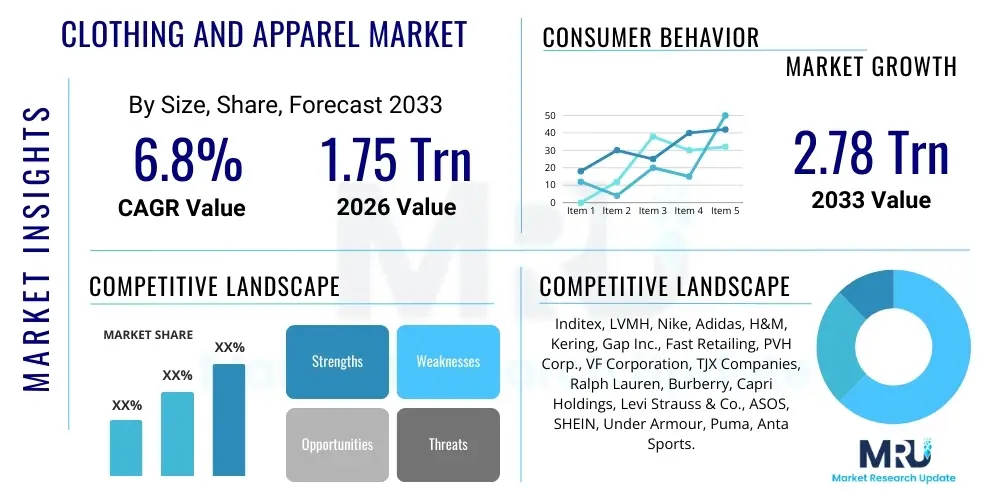

The Clothing and Apparel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.75 Trillion in 2026 and is projected to reach USD 2.78 Trillion by the end of the forecast period in 2033. This substantial expansion is driven by a confluence of factors, including rapid urbanization in emerging economies, increasing disposable incomes, and the pervasive influence of social media trends that accelerate fashion cycles and demand for novelty. Furthermore, the growing focus on health and wellness is significantly bolstering the demand for specialized activewear and athleisure segments, which often command premium pricing and drive overall market valuation upward.

The transition toward sustainable and ethical fashion practices is reshaping market dynamics, compelling major industry players to invest heavily in circular economy models and transparency in their supply chains. While these investments initially raise operational costs, they cater to a rapidly expanding consumer segment—particularly Gen Z and Millennials—who prioritize brand values alongside product quality and aesthetic appeal. The integration of advanced manufacturing technologies, such as 3D printing and on-demand production, is also contributing to market growth by enabling faster time-to-market for trendy products and minimizing inventory risk, thereby optimizing revenue streams and supporting the projected CAGR.

Clothing and Apparel Market introduction

The Global Clothing and Apparel Market encompasses the manufacturing, design, distribution, and retailing of all garments, footwear, and accessories designed for human adornment and protection. This expansive industry covers a diverse range of products, including basic necessities like everyday wear, specialized functional clothing such as professional uniforms and protective gear, and high-fashion luxury goods. Major applications span casual, formal, sports, and industrial uses, reflecting the breadth of consumer needs addressed by the sector. The market's intrinsic benefit lies not only in providing fundamental coverage but also serving as a crucial vehicle for personal expression and social signaling, deeply intertwined with cultural and societal norms. A primary driving factor for market acceleration is the digital transformation of retail, specifically the proliferation of e-commerce platforms and mobile shopping applications, which has dramatically lowered barriers to entry for new brands and expanded geographic reach for established players, simultaneously fueling personalized consumer experiences and rapid trend adoption cycles globally.

Product descriptions within this market vary widely but generally include classifications based on utility and material science: natural fibers (cotton, silk, wool), synthetic fibers (polyester, nylon, spandex), and blends. Recent innovation emphasizes performance-enhancing textiles, such as moisture-wicking, antimicrobial, or UV-protective fabrics, particularly prominent in the burgeoning activewear category. Key applications extend beyond general consumer use into niche segments, including technical apparel for extreme sports, adaptive clothing for individuals with disabilities, and specialized workwear adhering to stringent safety standards. The sustained growth is underpinned by demographic shifts, especially the rising middle class in the Asia Pacific region, whose increasing purchasing power directly translates into higher expenditure on branded and fashionable apparel. Furthermore, strategic marketing efforts utilizing influencer collaborations and direct-to-consumer (DTC) models are pivotal in maintaining high consumer engagement and driving repeat purchases across all geographic segments.

Clothing and Apparel Market Executive Summary

The global Clothing and Apparel Market is characterized by intense competition and rapid technological integration, driving business trends focused on supply chain agility, digital engagement, and sustainability mandates. Key business trends indicate a fundamental shift toward omnichannel retailing, where physical stores transition into experiential hubs complementing robust e-commerce operations powered by advanced data analytics for inventory management and predictive personalized marketing. Regional trends highlight Asia Pacific (APAC) as the undisputed leader in both production and consumption, fueled by population size, economic prosperity, and early adoption of mobile commerce technologies. Conversely, mature markets in North America and Europe are focusing heavily on premiumization, circular fashion initiatives, and optimizing logistics for faster delivery times, reacting to increasingly demanding consumer expectations regarding speed and ethical sourcing. The market segments are exhibiting distinct trajectories: luxury apparel shows resilience despite economic fluctuations, driven by aspirational buying; meanwhile, fast fashion continues to dominate based on price and speed, though facing increasing regulatory and consumer pressure to improve its environmental footprint, leading to significant investment in sustainable materials by mainstream players.

Segment trends further reveal the substantial penetration of specialized categories, notably the high-performance activewear segment, which has transcended its original application to become acceptable in diverse casual settings, a phenomenon known as 'athleisure.' This blurring of lines between functional and everyday wear necessitates continuous material innovation and rapid design cycles. Additionally, the increasing demand for customized or personalized apparel, enabled by mass customization technologies, is transforming the manufacturing landscape, making smaller, more flexible production runs economically viable. Geographically, while APAC dictates volume, North America remains the primary incubator for technological retail advancements, including virtual try-ons (VTO) and augmented reality (AR) shopping experiences. The overarching market narrative is one of adaptation: companies succeeding are those that seamlessly merge digital innovation with transparent ethical operations, appealing to the modern consumer who values convenience, quality, and corporate responsibility equally, thereby securing future market share in a highly fragmented environment.

AI Impact Analysis on Clothing and Apparel Market

Analysis of common user questions regarding AI's impact on the clothing and apparel market reveals a strong interest in personalization, operational efficiency, and predicting future trends. Users frequently inquire about how AI can enhance the online shopping experience through better recommendation engines and virtual try-on technologies. Concerns often revolve around data privacy related to body scanning and style profiling, and the potential displacement of creative roles by generative AI design tools. Expectations are high regarding AI’s ability to minimize waste by improving demand forecasting accuracy, thereby reducing overproduction—a critical environmental challenge facing the industry. The consensus theme is that AI will fundamentally revolutionize the sector from design conception and supply chain logistics to customer interaction, transforming it into a more responsive, efficient, and highly customized industry ecosystem.

- AI-driven Demand Forecasting: Machine learning algorithms analyze historical sales data, social media trends, and macroeconomic indicators to predict future demand with significantly improved accuracy, minimizing dead stock and reducing waste.

- Personalized Styling and Recommendation Engines: Utilizing consumer purchase history, behavioral data, and visual recognition, AI offers highly customized product suggestions, increasing conversion rates and enhancing customer loyalty.

- Virtual Try-On (VTO) and Sizing Solutions: Implementing AR and sophisticated image processing to allow customers to digitally visualize how clothing fits and looks on their body before purchase, drastically lowering return rates associated with size and fit issues.

- Generative Design and Trend Spotting: AI analyzes massive datasets of runway shows, street style, and consumer sentiment to identify emerging trends and assist designers in creating preliminary patterns and styles, accelerating the product development lifecycle.

- Supply Chain Optimization: AI algorithms optimize logistics, warehouse management, and resource allocation, identifying bottlenecks and ensuring efficient movement of goods from raw material sourcing to final consumer delivery.

- Automated Quality Control: Deployment of computer vision systems in manufacturing facilities to rapidly and accurately detect defects in fabrics and finished garments, improving product quality consistency.

DRO & Impact Forces Of Clothing and Apparel Market

The Clothing and Apparel Market is powerfully shaped by a combination of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory and competitive dynamics. Key drivers include accelerating digitization of retail channels, the burgeoning middle-class population in emerging economies demanding lifestyle upgrades, and the pervasive global influence of social media leading to rapid consumption cycles and high fashion volatility. These factors create sustained momentum for market expansion, particularly in high-growth e-commerce sectors. Conversely, major restraints are centered around the environmental impact of textile production, increasing regulatory scrutiny on sustainable practices, and the inherent complexity and vulnerability of global supply chains, often exposed to geopolitical and logistical disruptions. Navigating these restraints requires substantial capital investment in traceability and circular models. Opportunities primarily reside in adopting advanced technologies like AI and blockchain for supply chain transparency, expanding into niche markets such as customized and adaptive apparel, and capitalizing on the growing consumer willingness to pay a premium for ethically sourced and sustainable clothing items, offering a pathway toward higher margin growth and improved brand equity across the entire industry value chain.

The interplay between these forces necessitates a strategic approach from market participants. For instance, the driver of consumer demand for sustainability simultaneously intensifies the restraint of environmental compliance, pushing opportunities toward innovation in biodegradable materials and closed-loop manufacturing processes. Geopolitical tensions, acting as an impactful force, compel diversification of manufacturing bases away from traditionally concentrated regions, prioritizing resilience over pure cost efficiency. This strategic shift is mandatory for mitigating risks associated with trade disputes and unexpected lockdowns. Furthermore, the rising prominence of the direct-to-consumer (DTC) model acts as both a driver—by enabling greater control over branding and pricing—and an opportunity—by generating proprietary consumer data essential for AI-driven personalization. The successful companies are those that transform the restraints, such as waste reduction mandates, into competitive opportunities through pioneering sustainable business models, setting new industry standards and capturing the environmentally conscious consumer base effectively.

Segmentation Analysis

Segmentation analysis provides a critical framework for understanding the diverse consumption patterns and operational requirements within the Clothing and Apparel Market. The market is broadly categorized based on Product Type, catering to specific functional needs; End-User, reflecting demographic spending patterns; and Distribution Channel, outlining the pathways to market access and sales execution. This detailed breakdown allows companies to strategically allocate resources, tailor product lines, and optimize marketing campaigns for maximum impact within target demographic and functional niches. Product segmentation, encompassing categories like Innerwear, Outerwear, and Accessories, reflects varying material costs, design complexities, and replacement cycle frequencies. Simultaneously, the distribution channel segmentation underscores the seismic shift from traditional brick-and-mortar retail toward advanced online marketplaces and mobile shopping applications, fundamentally altering consumer purchasing behavior and forcing retailers to adopt robust omnichannel strategies to maintain relevance and market penetration across all demographics globally.

- By Product Type:

- Outerwear (Jackets, Coats, Suits)

- Bottomwear (Trousers, Jeans, Skirts)

- Innerwear and Sleepwear

- Knitwear and Sweaters

- Accessories (Hats, Scarves, Gloves)

- Formal Wear and Business Attire

- Sports and Activewear

- Infant and Toddler Wear

- By End-User:

- Men

- Women

- Kids and Infants

- By Distribution Channel:

- Offline Retail (Specialty Stores, Department Stores, Supermarkets and Hypermarkets)

- Online Retail (E-commerce Portals, Brand Websites, Social Commerce Platforms)

- By Geographic Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Clothing and Apparel Market

The Clothing and Apparel market value chain is extensive and highly complex, stretching from upstream raw material sourcing to downstream consumer sales, involving numerous processes that add value and complexity. Upstream activities predominantly involve the cultivation of natural fibers (cotton, wool) and the synthesis of man-made fibers (polyester, nylon), followed by textile manufacturing such as spinning, weaving, and dyeing. Key challenges in this phase include volatile commodity prices, stringent environmental regulations concerning water usage and chemical disposal, and securing sustainable raw material certification. Effective management of the upstream segment is critical as it dictates the cost structure and sustainability profile of the final product, directly impacting the brand's ethical standing in the highly scrutinized modern marketplace.

The midstream section of the value chain is focused on design, sample creation, and large-scale garment manufacturing, often involving intricate global outsourcing networks in labor-cost-competitive regions, predominantly in Asia. This manufacturing segment is increasingly adopting automation and digital prototyping technologies, such as CAD/CAM systems and robotic sewing, to enhance precision and reduce lead times. Downstream activities are centered on logistics, warehousing, distribution, and retailing. The distribution channel is bifurcated into direct channels, exemplified by brand-owned stores and official e-commerce platforms (DTC), offering maximum control over customer data and branding, and indirect channels, involving multi-brand retailers, department stores, and independent specialty boutiques, which provide broader market reach and physical presence. The choice of distribution strategy significantly influences profit margins, inventory risk, and speed-to-market execution.

The shift towards an omnichannel approach is integrating these direct and indirect channels, necessitating seamless communication and inventory synchronization to deliver consistent customer experiences across all touchpoints. Furthermore, reverse logistics—handling product returns and recycling—is becoming an increasingly important, value-adding component of the downstream operation, driven by e-commerce proliferation and the industry’s commitment to circular economy principles. Companies that excel in optimizing the flow of information and goods across this entire fragmented value chain—from sustainable fiber extraction to end-of-life product management—are best positioned to achieve cost efficiencies, improve responsiveness, and secure a competitive advantage in the volatile global apparel sector, while simultaneously building trust with environmentally conscious consumers who demand supply chain transparency.

Clothing and Apparel Market Potential Customers

Potential customers for the Clothing and Apparel Market encompass virtually every demographic globally, yet targeted analysis reveals several critical segments based on psychographics, purchasing power, and specific product needs. The primary consumer base includes three major end-user groups: Men, Women, and Kids/Infants, each with distinct needs regarding style, comfort, durability, and price sensitivity. Within these groups, purchasing behavior is further stratified by lifestyle and economic status, ranging from the high-net-worth individuals purchasing luxury, exclusive, and designer apparel where brand heritage and scarcity are paramount, to value-conscious consumers prioritizing functionality and affordability found in mass-market retail and fast fashion outlets. The fastest-growing potential customer segment is the ethically conscious consumer, typically Millennials and Gen Z, who actively seek out brands demonstrating verifiable commitments to sustainability, fair labor practices, and material traceability, influencing major market shifts toward circular and organic fashion lines.

Geographically, emerging markets in Asia, particularly China and India, represent enormous potential customer bases due to rapidly expanding middle classes and increasing internet penetration driving first-time brand engagement and premium consumption. Behaviorally, a significant customer group comprises those prioritizing convenience, heavily relying on online platforms, mobile applications, and subscription services for curated boxes and automated replenishment of wardrobe basics. This group values seamless digital integration, efficient logistics, and sophisticated recommendation engines provided by AI-powered platforms. Another essential segment includes B2B purchasers, such as corporate buyers and governmental institutions, acquiring specialized functional apparel like uniforms, protective gear, and technical textiles, where regulatory compliance, durability, and technical specifications override aesthetic considerations. Effectively targeting these diverse segments requires multifaceted marketing strategies that address distinct value propositions, whether it be aspirational luxury, functional performance, or verifiable environmental integrity, ensuring comprehensive market coverage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.75 Trillion |

| Market Forecast in 2033 | USD 2.78 Trillion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Inditex, LVMH, Nike, Adidas, H&M, Kering, Gap Inc., Fast Retailing, PVH Corp., VF Corporation, TJX Companies, Ralph Lauren, Burberry, Capri Holdings, Levi Strauss & Co., ASOS, SHEIN, Under Armour, Puma, Anta Sports. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clothing and Apparel Market Key Technology Landscape

The technological landscape of the Clothing and Apparel Market is undergoing a rapid transformation, shifting from traditional, labor-intensive processes toward digital integration across the entire value chain, primarily driven by the imperative for speed, personalization, and sustainability. Key enabling technologies include advanced data analytics and Artificial Intelligence (AI) algorithms, which are essential for precise demand forecasting, optimizing inventory levels, and delivering hyper-personalized marketing messages and product recommendations to individual consumers. Furthermore, 3D body scanning and computer-aided design (CAD) software are revolutionizing the design and fitting process, drastically reducing the need for physical prototyping and enabling mass customization models that cater to unique body shapes and style preferences, thereby reducing production waste and accelerating time-to-market for complex items.

In manufacturing, the adoption of robotics and automation is growing, particularly in cutting, sewing (with specialized machines like robotic arms), and finishing processes, addressing rising labor costs and improving quality consistency. Smart manufacturing techniques, often categorized under Industry 4.0 principles, involve interconnected factory systems using the Internet of Things (IoT) sensors to monitor production efficiency and material usage in real-time, facilitating dynamic adjustments and preventive maintenance. A crucial technological layer is the integration of Blockchain technology, used primarily for enhanced supply chain transparency and product traceability. This allows brands to provide verifiable proof of origin and ethical sourcing of materials to consumers, directly addressing growing ethical consumption demands and bolstering anti-counterfeiting measures for luxury and high-value apparel items, ensuring product authenticity and brand integrity in global markets.

The consumer-facing technology segment is defined by immersive retail experiences, leveraging Augmented Reality (AR) and Virtual Reality (VR) platforms. AR virtual try-on features, accessible via smartphones, allow consumers to visualize how garments look in a home environment without physically wearing them, significantly improving the remote shopping experience and mitigating one of e-commerce’s major drawbacks: high return rates due to poor fit or visual incompatibility. Additionally, the increasing incorporation of smart textiles and wearable technology, such as fabrics embedded with biometric sensors or heating elements, expands the functional application of apparel, particularly in high-performance sports and specialized protective clothing. These technological advancements collectively underpin the market’s shift towards a demand-driven, highly responsive, and digitally integrated operating model, providing a substantial competitive edge to organizations willing to commit the necessary capital for strategic digital transformation and R&D investment.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region, serving as both the world's largest manufacturing hub and the fastest-growing consumption market. This dual role is propelled by massive population growth, expanding middle-class disposable income, and exceptional rates of digital adoption, particularly mobile commerce, across countries like China, India, and Southeast Asian nations. Regional growth is highly characterized by domestic brands scaling rapidly and strong government support for textile modernization and infrastructure development, although challenges persist related to ensuring sustainable labor practices and managing intense environmental impacts from production.

- North America: This region is characterized by high consumer spending power, a strong preference for branded and luxury apparel, and significant demand for activewear (athleisure). North America is a major center for retail technological innovation, driving trends in AI-powered personalization, omnichannel retailing, and advanced logistics. The market is highly saturated and competitive, requiring brands to differentiate through rapid product cycles, superior customer experience, and compelling sustainability narratives to maintain market relevance against both domestic and international entrants.

- Europe: Europe represents a mature market with a sophisticated consumer base that strongly emphasizes fashion heritage, quality, and, increasingly, regulatory-driven sustainability and ethical sourcing. Strict EU regulations regarding material safety and environmental impact are pushing the region to the forefront of circular economy initiatives, including clothing repair and recycling programs. Western European countries, particularly France and Italy, retain global leadership in luxury and high-end fashion, driving premium pricing and innovative design aesthetics globally.

- Latin America (LATAM): The LATAM market exhibits high growth potential, driven by urbanization and rising youth populations adopting global fashion trends rapidly, largely influenced by social media. Market dynamics are often complicated by economic volatility and high import tariffs, making local manufacturing or near-shoring a viable strategy for regional players. E-commerce penetration is growing steadily, demanding improved logistics and secure payment systems across diverse national regulatory environments.

- Middle East and Africa (MEA): This region is highly heterogeneous. The Middle East, particularly the GCC countries, shows high consumption of luxury goods, supported by substantial disposable incomes and a strong affinity for high-end international brands. Africa presents vast, untapped growth opportunities due to a young, rapidly urbanizing population, though market development is uneven, dependent heavily on infrastructure improvements and political stability in individual nations, fostering niche markets like modest fashion and domestically produced textiles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clothing and Apparel Market.- Inditex (Zara, Massimo Dutti)

- LVMH Moët Hennessy Louis Vuitton SE

- Nike, Inc.

- Adidas AG

- Hennes & Mauritz (H&M) AB

- Kering SA

- The Gap Inc.

- Fast Retailing Co., Ltd. (Uniqlo)

- PVH Corp. (Tommy Hilfiger, Calvin Klein)

- VF Corporation (The North Face, Vans)

- The TJX Companies, Inc.

- Ralph Lauren Corporation

- Burberry Group plc

- Capri Holdings Limited (Versace, Michael Kors)

- Levi Strauss & Co.

- ASOS Plc

- SHEIN (Roadget Business Pte. Ltd.)

- Under Armour, Inc.

- Puma SE

- Anta Sports Products Limited

Frequently Asked Questions

Analyze common user questions about the Clothing and Apparel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the sustainable fashion segment?

The sustainable fashion segment growth is primarily driven by heightened consumer awareness regarding climate change and labor practices, increased regulatory pressures (especially in Europe), and technological advancements enabling the cost-effective use of recycled and organic materials. Brands adopting circular economy models and transparent sourcing practices are capturing this high-growth niche.

How is e-commerce penetration transforming the retail model in this market?

E-commerce penetration is forcing a fundamental shift towards omnichannel retailing, integrating physical store experiences with robust digital platforms. This transformation enables greater personalization through data analytics, reduces geographical market limitations, and necessitates advanced logistics and virtual try-on technologies to mitigate traditionally high online return rates, optimizing the consumer purchase journey significantly.

Which geographical region holds the largest potential for future market expansion?

The Asia Pacific (APAC) region is projected to hold the largest potential for future market expansion. This is attributed to the substantial and rapid expansion of the middle-class population, urbanization trends, and high rates of mobile internet adoption, translating directly into increased consumer expenditure on branded and luxury apparel items across major developing economies.

What are the primary operational challenges facing the global apparel supply chain?

Primary operational challenges include pervasive supply chain vulnerability exacerbated by geopolitical tensions and trade restrictions, fluctuating raw material costs (especially for cotton and synthetic fibers), and the urgent need to comply with stringent global labor and environmental standards, requiring massive investment in traceability tools like blockchain and supply network diversification.

What role does Artificial Intelligence (AI) play in enhancing product development?

AI plays a critical role in enhancing product development by improving demand forecasting accuracy, minimizing inventory risk, and enabling rapid trend prediction through sophisticated analysis of consumer data and social media sentiment. AI also facilitates mass customization by processing 3D body scans and personalizing fit and style recommendations at scale, dramatically accelerating time-to-market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager