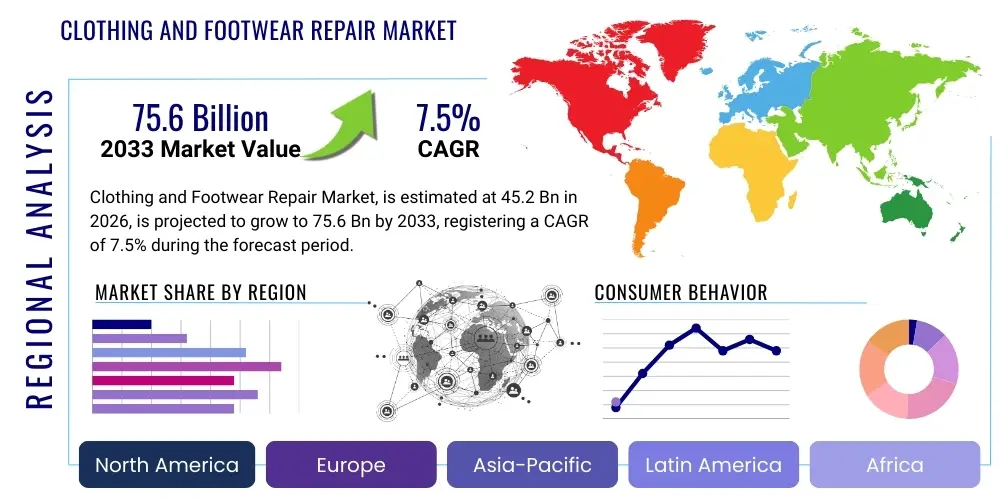

Clothing and Footwear Repair Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441691 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Clothing and Footwear Repair Market Size

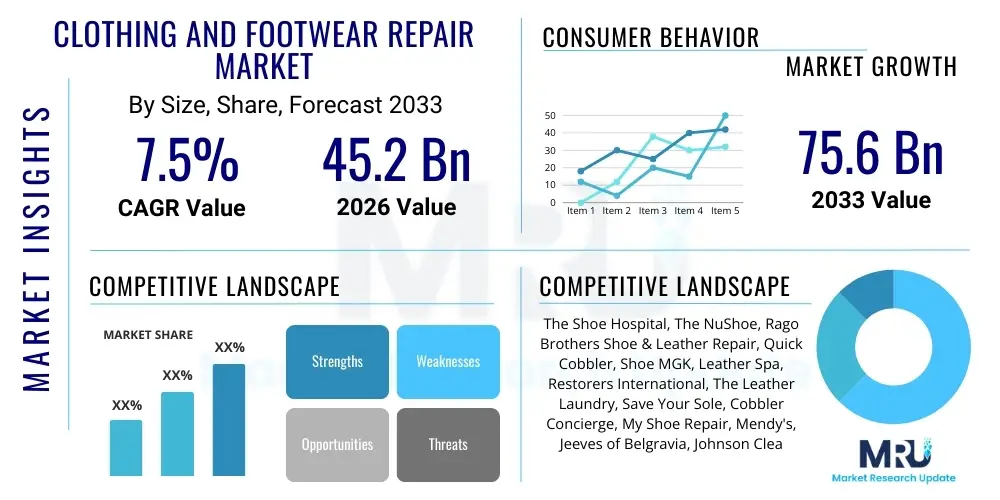

The Clothing and Footwear Repair Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 75.6 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by a global shift towards sustainable consumption, driven by consumer awareness regarding environmental waste and the economic benefits of extending product lifecycles. The normalization of repair culture, especially among younger, environmentally conscious demographics, is a primary accelerator for market expansion, moving repair services from necessity to a preferred lifestyle choice.

Clothing and Footwear Repair Market introduction

The Clothing and Footwear Repair Market encompasses a vast array of specialized services dedicated to maintaining, restoring, altering, and extending the usability of textile and leather goods. This market serves as a critical component of the circular economy, focusing on minimizing fashion waste and maximizing the lifespan of durable consumer items. Services range from fundamental tasks such as sole replacement, heel repair, zipper replacement, and stitching, to complex alterations, resizing, and material patching. The modern scope of this industry increasingly integrates high-end garment restoration and tailored customization, adapting to evolving consumer needs for personalized, durable, and sustainable wardrobe solutions. Furthermore, the product description includes services for luxury items, which often require highly specialized craftsmanship and materials, differentiating the quality spectrum within the market.

Major applications of these repair services span personal consumer usage, ensuring the longevity of daily wear, special occasion attire, and professional gear. Commercially, businesses utilize these services for uniform maintenance, textile inventory repair, and specialized equipment upkeep. The primary benefits driving market adoption include significant cost savings compared to purchasing new items, reduced environmental footprint by decreasing landfill contributions, and preservation of sentimental or high-value garments and footwear. The driving factors accelerating this market's growth are multifaceted: increasing disposable income in emerging economies, facilitating investment in higher-quality, repairable goods; stringent global environmental regulations encouraging corporate sustainability practices; and the powerful influence of social media campaigns advocating for sustainable fashion choices, making repair services highly visible and desirable. The perceived value of craftsmanship and bespoke fitting further cements the market’s positive outlook.

Clothing and Footwear Repair Market Executive Summary

The Clothing and Footwear Repair Market is experiencing robust acceleration, transitioning from a marginalized service sector to a recognized pillar of the circular economy. Key business trends indicate a significant consolidation of independent cobblers and tailors under regional or national franchise models, enhancing service standardization and accessibility. Technology integration, notably through optimized online booking systems and digital consultations, is revolutionizing customer experience, allowing for seamless drop-off, tracking, and collection processes. Regional trends reveal Europe leading in market maturity due to historically strong repair traditions and proactive governmental circular economy policies, while the Asia Pacific region exhibits the highest growth potential, fueled by rapid urbanization, rising middle-class consumption, and growing awareness of fast fashion consequences. The proliferation of specialized luxury repair services in major metropolitan hubs worldwide is also a defining trend, catering to consumers who prioritize preserving high-ticket items. Furthermore, sustainable financing initiatives and green investment focusing on repair infrastructure are increasingly common, signaling mainstream acceptance of the sector's economic and environmental viability.

Segment trends emphasize the rapid expansion of the footwear repair segment, particularly for premium leather goods and specialized athletic footwear, driven by brand partnerships offering authenticated repair services. The alteration and customization services segment is also seeing increased demand, fueled by personalized fashion trends and the need to extend the wearable life of inherited or second-hand clothing. Commercial end-users, including hospitality, healthcare, and airline industries, are prioritizing outsourced repair contracts for uniform management to improve efficiency and reduce procurement costs. Distribution trends indicate a hybrid model becoming dominant, combining traditional physical workshops with highly efficient, centralized logistics networks that manage repairs across vast geographical areas. The intersection of repair with resale platforms (Recommerce) is creating symbiotic business relationships, where repaired and refurbished items command higher resale values, further legitimizing the repair value chain. These collective trends underline a fundamental structural shift in consumer behavior and industry operation, favoring durability and sustainability over disposable consumption.

AI Impact Analysis on Clothing and Footwear Repair Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Clothing and Footwear Repair Market predominantly revolve around efficiency, quality control, and personalization. Consumers and businesses frequently ask how AI can automate damage assessment, specifically inquiring about image recognition software for immediate repair quotes and material analysis. Key concerns center on whether AI-driven processes might diminish the traditional craftsmanship and skilled human labor essential for complex repairs, especially for luxury items. Expectations are high regarding AI's ability to optimize inventory management for spare parts, predict demand spikes for seasonal repairs, and streamline complex logistics for centralized repair hubs. Furthermore, users are keen to understand if AI can facilitate predictive maintenance recommendations based on usage patterns tracked via smart garments or footwear, extending the item's life proactively. The general consensus is that AI will act as an augmentative tool, increasing the speed and precision of initial triage and operational management rather than replacing the core repair skills.

- AI-Powered Damage Assessment: Utilizing machine vision for rapid and accurate categorization of garment or footwear damage (e.g., tears, sole wear, material degradation), leading to instant, standardized repair quotations.

- Predictive Inventory Management: AI algorithms optimize the stock levels of specialized spare parts (e.g., specific zippers, sole compounds, luxury leathers) based on geographical demand patterns and seasonal trends, minimizing wait times.

- Logistics Optimization: Implementing AI for routing and scheduling repair item collection and delivery, ensuring efficient transport between customers, central facilities, and specialized workshops.

- Personalized Repair Recommendations: Using customer purchase history and usage data to suggest the most cost-effective or sustainable repair methods, enhancing customer loyalty and lifetime value.

- Quality Control Automation: Employing automated inspection systems post-repair to verify the quality and durability of the mend against predefined standards, reducing human error.

- Training and Skill Augmentation: AI-driven simulations and augmented reality tools assisting apprentice repair technicians in mastering complex or rare repair techniques.

DRO & Impact Forces Of Clothing and Footwear Repair Market

The market is predominantly driven by increasing consumer ecological consciousness, which translates into a preference for repairing existing items over purchasing new ones, reinforced by global sustainable development goals and media focus on fashion waste. Restraints include the persistent cost-effectiveness of mass-produced, low-quality fast fashion, which often makes replacement cheaper than repair, alongside a diminishing global pool of highly skilled artisans necessary for complex repairs. Opportunities abound in the establishment of formal repair networks and partnerships with major fashion brands (brand-authorized repair programs), leveraging technology for standardized service delivery and geographical expansion. The market is influenced by significant impact forces including accelerating regulatory pressures on textile waste, shifting consumer demographics prioritizing experiences and sustainability over material ownership, and the disruptive potential of digitalization which enhances service reach and visibility. These forces collectively propel the market towards institutionalization and significant growth, mitigating the historical challenges posed by fragmentation and lack of standardization. The integration of repair services into major retail ecosystems, offering repairs at the point of sale, is a major leveraging factor.

Segmentation Analysis

The Clothing and Footwear Repair Market is highly diverse, segmented based on the nature of service provided, the product type being repaired, the end-user (whether individual consumer or commercial enterprise), and the distribution channel utilized. This stratification allows for precise targeting and specialization within the industry, catering to needs ranging from routine shoe shines to bespoke garment reconstruction. Key segments reflect the core operational activities and target audiences, influencing pricing strategies and required technical expertise. Understanding these segments is crucial for stakeholders to identify high-growth niches, particularly the convergence of luxury repair and online convenience, which currently drives premium revenue streams. The market’s segmentation highlights a critical shift: repair is no longer a monolithic service but a highly specialized, multi-tiered offering catering to durability, aesthetic enhancement, and cost efficiency across the entire product lifecycle.

- By Service Type

- Repair and Restoration (Standard Mending, Sole Replacement, Zipper Fixes)

- Alteration and Tailoring (Resizing, Custom Fitting)

- Customization and Personalization (Embroidery, Unique Additions)

- Cleaning and Conditioning (Specialized Material Care)

- By Product Type

- Footwear Repair (Leather, Athletic, Formal, Specialty Boots)

- Clothing Repair (Outerwear, Denim, Formalwear, Knitwear, Casualwear)

- Accessories Repair (Bags, Belts, Leather Goods)

- By End-User

- Individual Consumers (B2C)

- Commercial/Institutional (B2B: Hotels, Airlines, Corporate Uniforms)

- By Distribution Channel

- Local Independent Service Providers (Cobblers, Tailors)

- National/Regional Chains and Franchises

- Online Service Aggregators and Mail-in Repair Platforms

Value Chain Analysis For Clothing and Footwear Repair Market

The value chain for the Clothing and Footwear Repair Market begins with the upstream procurement of specialized raw materials and components, including high-quality leather hides, specialized threads, durable adhesives, branded zippers, and machinery parts. Upstream analysis focuses on securing reliable suppliers who can provide repair materials that match or exceed the original product quality, which is particularly vital for luxury repairs where material authenticity is paramount. The efficiency and environmental footprint of these suppliers (e.g., using low-VOC adhesives or sustainably sourced leather) directly impact the overall sustainability credentials of the repair service provider. Strong supplier relationships are essential for accessing specialized tools and ensuring material consistency across multiple service locations. This initial stage defines the quality potential of the subsequent repair work, emphasizing the necessity of a robust, certified supply chain.

The core midstream process involves the skilled labor and operational execution of the repair or alteration, which is the primary value-adding activity. Distribution channels play a critical role in connecting the repair service with the end-user. Direct distribution involves customers physically bringing items to local independent cobblers or centralized franchised workshops. This channel relies on local visibility and reputation. Indirect distribution is rapidly growing, encompassing online aggregators and mail-in repair services where logistics partners manage the pickup and delivery. These indirect models require sophisticated IT infrastructure, tracking capabilities, and streamlined operational flow to maintain efficiency and transparency. Downstream activities involve post-repair quality assurance, customer feedback mechanisms, and potentially integrating the repaired item back into the retail or resale ecosystem (Recommerce), thus extending the item's economic life and completing the circular value loop. Effective management of both direct (in-person service) and indirect (online logistics) channels is key to maximizing market reach and customer convenience, particularly as consumer expectations for service speed and transparency increase.

Clothing and Footwear Repair Market Potential Customers

The primary customers for the Clothing and Footwear Repair Market are highly segmented, encompassing individual consumers across all socio-economic strata and diverse commercial entities. Individual customers fall into several categories: those driven by necessity (seeking cost-effective repairs for essential items), those prioritizing luxury and preservation (seeking specialized restoration for high-value designer goods), and the rapidly growing demographic of sustainability-conscious consumers (prioritizing repair as an ethical alternative to fast fashion). This latter group, often Millennials and Gen Z, views repair as an extension of their environmental values. Potential individual customers are also highly sensitive to the inconvenience factor, making rapid turnaround times and accessible online booking essential selling points.

Commercial customers represent a significant growth area, particularly B2B services focusing on institutional uniform management. Key end-users include airlines, where strict safety and aesthetic standards require routine and reliable repair of flight attendant and pilot uniforms; major hospitality chains, needing consistent maintenance of employee attire and textile décor; and large corporate entities managing specialized protective gear or inventory. These commercial clients typically require large-scale, contracted services with guaranteed quality control and efficient logistics. Furthermore, the burgeoning Recommerce sector (online resale platforms) is a major institutional buyer of repair services, utilizing professional restoration to elevate the condition and resale value of used garments and footwear, effectively acting as an intermediary customer bridging the gap between repair and secondary retail. Tailoring service demand from menswear and bridal sectors remains consistently strong, driven by the persistent need for perfect fit and customization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 75.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Shoe Hospital, The NuShoe, Rago Brothers Shoe & Leather Repair, Quick Cobbler, Shoe MGK, Leather Spa, Restorers International, The Leather Laundry, Save Your Sole, Cobbler Concierge, My Shoe Repair, Mendy's, Jeeves of Belgravia, Johnson Cleaners, Timpson Group, Modern Shoe Repair, Sole Revival, Mastercraft, Alterations Express, Repairable. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clothing and Footwear Repair Market Key Technology Landscape

The Clothing and Footwear Repair Market is undergoing a rapid technological transformation, moving beyond traditional hand tools and basic machinery. Key technological adoption centers around improving precision, speed, and logistics efficiency. Modern repair workshops utilize advanced computer numerical control (CNC) machinery for highly precise sole milling and leather cutting, ensuring exact fit and standardized quality, particularly important for orthopedic or specialty footwear repairs. Furthermore, ultrasonic welding and specialized heat-sealing technology are being integrated for repairing high-performance synthetic materials found in modern athletic wear and technical outerwear, where traditional stitching might compromise water resistance or fabric integrity. The adoption of laser etching and 3D scanning is revolutionizing the alteration and customization segments, allowing for hyper-accurate body measurements and garment pattern adjustments without invasive physical fittings, significantly reducing turnaround time and minimizing material waste during alteration processes. These hardware advancements are complemented by sophisticated material science innovations, including self-healing fabrics and advanced, flexible bonding agents that offer stronger, less visible repairs than ever before. The ability to source and utilize sustainable and high-tech repair compounds is increasingly influencing consumer choice.

Beyond physical tooling, digitalization forms the backbone of the market's technological landscape. This includes the widespread implementation of specialized Enterprise Resource Planning (ERP) systems tailored for repair service management, facilitating inventory tracking of unique spare parts, managing technician scheduling based on required skill sets, and integrating point-of-sale (POS) systems. The shift towards online service delivery has mandated the use of highly optimized mobile applications and e-commerce platforms, enabling customers to initiate repairs remotely, upload photographs for damage assessment, receive real-time updates via automated notifications, and coordinate convenient pickup and drop-off times. Crucially, the deployment of logistics software optimized for last-mile delivery and reverse logistics is essential for the success of mail-in repair services, ensuring efficiency and minimizing transit damage. The adoption of blockchain technology is being explored by luxury brands to create digital passports for repaired items, verifying the authenticity of both the original product and the restoration process, thereby enhancing resale value and building trust among discerning consumers.

The integration of Augmented Reality (AR) and Virtual Reality (VR) tools is also emerging as a significant technological trend. AR tools are used both in customer-facing applications (allowing customers to visualize potential alterations or repair outcomes before commitment) and for technician training, providing interactive guides and overlays for complex repair procedures. This technological augmentation helps address the persistent industry challenge of a shrinking skilled labor pool by accelerating the training process and standardizing complex repairs across different geographical locations. Overall, the technology landscape is characterized by a dual focus: maintaining the precision and quality expected of traditional craftsmanship while leveraging digital tools and automated machinery to achieve modern standards of speed, transparency, and operational scalability, positioning the market favorably for sustained, rapid growth in the global service economy.

Regional Highlights

- Europe: Market Maturity and Regulatory Leadership

Europe stands as the most mature market for clothing and footwear repair, driven by strong historical traditions of craftsmanship and proactive governmental policies promoting the circular economy. Countries such as Germany, the UK, and the Netherlands have robust frameworks that incentivize repair and penalize textile waste. The region benefits from a high density of skilled artisans, though challenges exist in attracting younger generations to the trade. The European market leads in the authorized brand repair model, with major luxury houses and established fashion retailers partnering with certified repair networks. Consumer demand here is highly concentrated on quality, material provenance, and specialized services for high-value goods. The market size is substantial, driven by high average price points of garments and footwear, making repair economically sensible.

- North America: Convenience and Digitalization Driving Growth

North America is characterized by rapid adoption of technology in the repair sector. Growth is largely fueled by the demand for convenient, mail-in, and digitally managed repair services, appealing to a time-constrained consumer base. The market sees significant investment in centralized repair facilities and advanced logistics to manage high volumes across large distances. While historically lagging behind Europe in sustainable consumption habits, there is a clear and accelerating trend, particularly among urban and coastal populations, prioritizing repair over replacement. The rise of footwear customization and sneaker restoration services is a unique, high-growth niche in this region, utilizing advanced materials and specialized aesthetic repair techniques. Brand-led repair initiatives are increasing, often mandated by corporate sustainability targets.

- Asia Pacific (APAC): Highest Growth Potential and Emerging Middle Class Demand

The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) due to rapid economic development, urbanization, and a massive expanding middle class that is increasingly able to afford high-quality, repairable consumer goods. While traditional, informal repair services (street cobblers, local tailors) remain prevalent, there is a fast-moving shift towards professional, sanitized, and technologically integrated repair chains in major economic hubs like China, India, and South Korea. Environmental awareness is catching up quickly, driven by domestic pollution concerns and government incentives promoting resource efficiency. The key challenge is standardizing service quality across vastly different economic and geographical areas, creating immense opportunities for franchised models offering consistent service delivery.

- Latin America (LATAM): Economic Resilience and Value Focus

In Latin America, the repair market is fundamentally driven by economic necessity and a deep-seated culture of resourcefulness. Consumers are highly value-conscious, seeking to maximize the lifespan of their purchases. Market growth is stable, supported by traditional local providers. The opportunity lies in formalizing and scaling these services, introducing modern tools and logistics to improve turnaround times and professionalize the sector. Brazil and Mexico are emerging as regional centers for specialized leather goods and shoe repair, leveraging local expertise and material availability. The adoption of basic digital booking systems is starting to enhance customer accessibility.

- Middle East and Africa (MEA): Luxury Specialization and Infrastructure Development

The MEA market presents a dichotomy. In the Middle East (GCC countries), demand is exceptionally high for specialized, luxury garment and accessory repair, driven by high net-worth individuals who require restoration services matching international luxury standards. Investment is focused on state-of-the-art facilities and importing specialized international expertise. In Africa, the market is primarily utility-driven, focusing on basic and necessary repairs. The future growth hinges on infrastructure development and the professionalization of the fragmented informal sector, with potential for mobile repair services catering to dispersed populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clothing and Footwear Repair Market.- Timpson Group (UK)

- The Shoe Hospital (USA)

- The NuShoe (USA)

- Rago Brothers Shoe & Leather Repair (USA)

- Quick Cobbler (Canada)

- Shoe MGK (USA)

- Leather Spa (USA)

- Restorers International (Global)

- The Leather Laundry (India)

- Save Your Sole (Australia)

- Cobbler Concierge (USA)

- My Shoe Repair (USA)

- Mendy's (USA)

- Jeeves of Belgravia (UK/Global Luxury Cleaning and Repair)

- Johnson Cleaners (UK)

- Modern Shoe Repair (USA)

- Sole Revival (Australia)

- Mastercraft (USA)

- Alterations Express (USA)

- Repairable (Europe - Digital Platform)

Frequently Asked Questions

Analyze common user questions about the Clothing and Footwear Repair market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Clothing and Footwear Repair Market globally?

The primary driver is the accelerating global focus on sustainability and the circular economy. Consumers are actively seeking alternatives to fast fashion due to environmental concerns, making repair economically and ethically preferable. Additionally, the increasing acquisition of high-quality, durable goods in emerging markets provides a larger base of items worth repairing, supported by technological advancements that make repair services more convenient and accessible via digital platforms.

How does digitalization impact traditional independent cobblers and tailors?

Digitalization initially presented a competitive threat, but it is now being adopted as an essential tool for survival and growth. Independent shops are leveraging online booking systems, localized SEO, and social media marketing to broaden their customer reach beyond immediate physical neighborhoods. Partnerships with online service aggregators allow traditional artisans to participate in national or global mail-in repair networks, accessing new high-value clientele without sacrificing their core craftsmanship.

Which segment of the repair market shows the highest projected CAGR?

The Footwear Repair segment, particularly specialized athletic shoe restoration and high-end luxury leather goods repair, is projected to demonstrate the highest Compound Annual Growth Rate (CAGR). This growth is fueled by the high material value of premium footwear, the demand for sneaker customization, and the introduction of advanced repair materials that maintain the integrity and performance of technical shoes, making repair a viable long-term investment.

What are the main restraints hindering the full potential of the repair market?

The primary restraint is the continued economic prevalence of cheap, low-quality garments that are designed for obsolescence, often making replacement cheaper than labor-intensive repair. Additionally, the global skill gap is a significant hurdle; the number of highly trained, specialized artisans required for complex textile and leather restoration is declining, necessitating investment in modern training and technology to standardize service quality and efficiency.

Are major fashion brands becoming actively involved in the repair market?

Yes, major fashion brands are increasingly integrating repair services into their business models. Many brands are establishing authorized repair programs, either in-house or through certified third-party partners, ensuring that repairs are conducted using authentic materials and adhering to brand-specific quality standards. This move is driven by consumer demand for sustainability transparency, and it enhances brand loyalty and the perceived long-term value of their products, directly contributing to the circular economy goals.

What role does Artificial Intelligence (AI) play in assessing repair needs?

AI primarily enhances the initial diagnostic phase of the repair process. Utilizing computer vision and machine learning algorithms, AI can analyze photos uploaded by customers to accurately assess the extent and type of damage (e.g., specific sole wear patterns, zipper failure types, tear severity). This allows service providers to generate instant, standardized quotes, optimize material allocation, and triage the item to the appropriately skilled technician before the item even arrives at the workshop, drastically improving efficiency and reducing manual assessment time.

How is the commercial (B2B) sector utilizing clothing and footwear repair services?

Commercial entities, such as airlines, hotel chains, and industrial firms, utilize B2B repair services extensively for managing and maintaining their employee uniforms and textile inventory. Outsourcing these repairs ensures uniform longevity, maintains a consistent professional appearance, and is often more cost-effective than frequent replacement. Contracted services offer scaled logistics, quality assurance, and quick turnaround times essential for large institutional operations.

In which geographical region are environmental regulations most impactful on the repair market?

Europe, particularly the European Union (EU), has the most impactful regulatory environment. EU directives focused on reducing textile waste and promoting product durability are creating legislative frameworks that either incentivize repair (e.g., tax breaks on repair services) or penalize disposal, forcing manufacturers and retailers to incorporate extended product responsibility, which directly fuels the growth and professionalization of the repair sector.

What kind of technology is used to repair modern high-performance fabrics?

Repairing modern high-performance fabrics (like technical outerwear, athletic gear, and performance synthetics) requires advanced technology such as ultrasonic welding, specialized heat-sealing machines, and chemical bonding agents. These methods ensure that critical features like waterproofing, breathability, and structural integrity, which would be compromised by traditional needle and thread, are maintained or fully restored to near-original specifications.

How do Recommerce platforms influence the demand for clothing and footwear repair?

Recommerce platforms (online resale sites) are major drivers of professional repair demand. To maximize resale value and appeal, used items often undergo professional cleaning, restoration, and repair before being listed. This necessity creates a symbiotic relationship, turning repair services into a vital step in the secondary market value chain and certifying the quality and longevity of pre-owned goods.

Why is supply chain management crucial for luxury footwear repair?

Supply chain management is critical for luxury footwear repair because authenticity and material quality are paramount. Repair providers must source certified, original, or equivalent high-grade materials (like specific leather types, branded hardware, or unique dyes) to match the item’s original specification. Robust supply chain management ensures materials are ethically sourced, consistently available, and meet the exacting standards required to preserve the item's investment value.

What distinguishes customization services from standard alteration services?

Standard alteration services involve adjusting the garment or shoe to better fit the wearer (e.g., shortening hems, taking in waists). Customization services go beyond fit modification to alter the aesthetic or functional design of the item, such as adding unique patches, changing the colorway of a shoe, applying specialized embroidery, or structurally modifying the garment to reflect personalized style preferences, thereby adding unique value to the original product.

How are repair franchises addressing the inconsistent quality challenge?

National and international repair franchises address inconsistent quality by implementing rigorous standardization protocols across all locations. This includes mandatory centralized training programs, the use of proprietary standardized machinery, centralized purchasing of quality-assured repair materials, and the deployment of digital quality control checklists and verification systems to ensure every repair meets the established corporate benchmark, irrespective of the geographic location of the workshop.

What is the primary difference between direct and indirect distribution in this market?

Direct distribution involves the customer physically delivering the item to a fixed service location (local cobbler, tailor shop). Indirect distribution relies on sophisticated logistics networks, such as postal services or third-party couriers, to transport the item between the customer and a centralized repair facility, often managed through an online booking platform. Indirect channels prioritize convenience and geographical reach, while direct channels emphasize immediate consultation and local relationship building.

Why is the ability to repair technical and specialty goods an opportunity for growth?

Technical goods, such as specialized hiking boots, professional protective gear, and high-end outdoor apparel, typically have a high initial purchase price and are built with durable, yet complex, materials. Repairing these items requires highly specialized skill sets and equipment. The high cost of replacement combined with the technical complexity makes the repair service an extremely high-value niche market with significant growth potential and high profit margins for providers capable of offering certified, expert restoration.

How does the increasing trend of sustainable financing affect the repair market?

Sustainable financing, through green bonds and environmental, social, and governance (ESG) focused investment, is increasingly targeting businesses that support the circular economy, including the repair market. This influx of capital allows repair service providers to invest in expansion, acquire advanced machinery, develop optimized logistics infrastructure, and undertake necessary digital transformation, accelerating the market's transition from fragmented small businesses to institutionalized service networks.

What specific challenges do repair services face when dealing with fast fashion items?

Fast fashion items are often made using low-cost materials and production methods that are not designed for repair. Challenges include extremely thin or low-denier fabrics that tear easily under stress, mismatched material compositions that are difficult to bond or stitch, and hardware that is impossible to replace with standard durable components, often making the repair cost disproportionately high compared to the item's purchase price.

How do consumers generally perceive the cost-benefit analysis of repair versus replacement?

For high-value or sentimental items, the perceived benefit of repair outweighs the cost, driven by preservation and emotional attachment. For mid-range, durable goods, the analysis is driven by economic rationality, where repair is chosen if the cost is significantly less than replacement (typically less than 40-50% of the original cost). However, for low-value items, the economic scale is often tipped toward replacement unless environmental consciousness is the overriding factor.

What is the function of 3D scanning technology in the alteration segment?

3D scanning technology captures highly accurate, non-contact measurements of the human body, creating a precise digital avatar. This allows tailors to make intricate pattern adjustments and predict how a garment will fit after alteration with minimal need for multiple physical fittings. This innovation minimizes errors, significantly speeds up the customization and alteration process, and ensures an optimal fit for complex body shapes.

What measures are taken to ensure the security and privacy of luxury items during mail-in repair?

Mail-in repair services for luxury items employ stringent security measures including specialized, highly traceable shipping containers, full insurance coverage during transit, video recording of receiving and unboxing processes, secure, monitored storage facilities, and blockchain-verified digital tracking logs to provide end-to-end transparency and accountability, mitigating risks associated with high-value item movement and handling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager