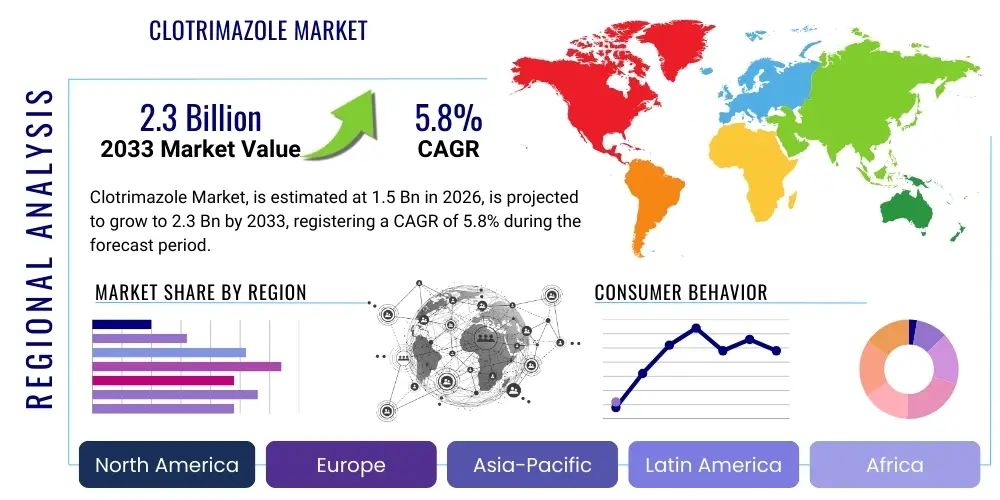

Clotrimazole Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442751 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Clotrimazole Market Size

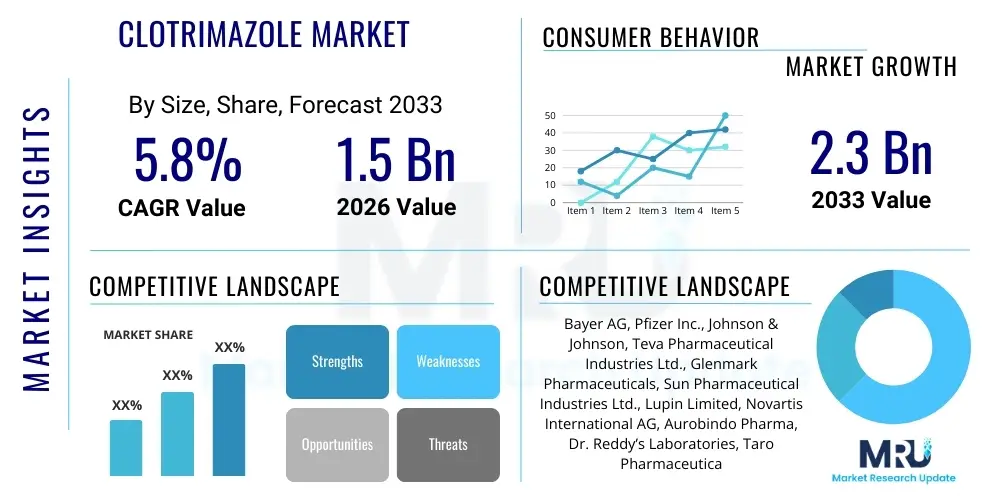

The Clotrimazole Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033. This consistent expansion is driven by the high prevalence of superficial fungal infections globally, the increasing availability of over-the-counter (OTC) formulations, and improved accessibility to healthcare in developing economies. The established efficacy and safety profile of clotrimazole, coupled with rising patient awareness regarding hygiene and fungal dermatoses, significantly contribute to the robust market trajectory observed across various geographical regions. Furthermore, the continuous introduction of combination therapies incorporating clotrimazole is broadening its application scope.

Clotrimazole Market introduction

The Clotrimazole Market encompasses the global trade and utilization of the synthetic azole antifungal agent, primarily used for treating a wide spectrum of fungal infections, including candidiasis, dermatophytosis, and pityriasis versicolor. Clotrimazole functions by inhibiting the synthesis of ergosterol, an essential component of the fungal cell membrane, leading to membrane destabilization and subsequent cell death. It is available in diverse formulations such as topical creams, lotions, solutions, oral lozenges, and vaginal tablets, catering to both localized cutaneous infections and mucosal candidiasis. The high effectiveness and broad-spectrum activity against common pathogenic fungi establish clotrimazole as a staple therapeutic agent in dermatology and gynecological practice globally.

Major applications driving the market include the treatment of athlete's foot (tinea pedis), jock itch (tinea cruris), ringworm (tinea corporis), and vaginal yeast infections. The shift towards self-medication for mild superficial infections, facilitated by regulatory approvals classifying lower concentrations of clotrimazole as OTC products in many key markets, provides significant momentum. Increased awareness regarding personal hygiene, lifestyle factors contributing to immunocompromised states (such as diabetes), and climatic conditions favoring fungal growth, particularly in tropical and subtropical regions, are fundamental market drivers. The ease of administration and the favorable cost profile of generic clotrimazole formulations further bolster its market acceptance globally.

The core benefits of clotrimazole utilization are rapid symptom relief, high cure rates, and a generally low incidence of systemic side effects when used topically. Key driving factors include the escalating incidence of immunocompromised populations susceptible to opportunistic fungal infections, continuous pharmaceutical research aiming for enhanced drug delivery systems (e.g., liposomal or nanoparticle formulations for better skin penetration), and supportive government initiatives focused on improving access to essential medicines. However, the market must navigate challenges such as the emergence of antifungal resistance and intense price competition stemming from generic manufacturers, which necessitate strategic innovation in formulation and distribution channels to maintain profitability and market share.

Clotrimazole Market Executive Summary

The global Clotrimazole Market is characterized by steady growth driven predominantly by the expanding scope of self-medication for common dermatological and gynecological fungal ailments, particularly in developed economies where access to OTC products is widespread. Business trends indicate a strong focus on reformulating existing products to improve patient compliance, such as developing once-daily or sustained-release dosage forms. Furthermore, key players are strategically investing in emerging markets, especially in Asia Pacific and Latin America, where rapid urbanization, improving healthcare infrastructure, and high population density contribute to a higher incidence of transmissible fungal infections. Competition remains fierce, heavily weighted towards generic manufacturers who capitalize on expired patents, leading to significant price erosion in standard formulations, compelling originator companies to focus on combination therapies and specialized delivery technologies to differentiate their portfolios.

Regional trends reveal that North America and Europe currently hold substantial market shares due to high healthcare expenditure, established regulatory frameworks promoting OTC availability, and sophisticated distribution networks. However, the Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth in APAC is underpinned by vast underserved patient populations, increasing disposable incomes enabling greater access to private healthcare services, and the region's climate which predisposes populations to various skin and mucosal fungal infections. Regulatory convergence efforts across ASEAN nations and China’s expanding pharmaceutical sector are also vital catalysts for regional market expansion, attracting foreign direct investment and localized manufacturing partnerships.

Segmentation analysis highlights that the topical formulation segment (creams, gels, and lotions) remains the dominant revenue generator due to its direct application efficacy and safety profile, making it highly suitable for OTC sales. However, the vaginal segment (tablets and pessaries) is expected to grow robustly, primarily driven by rising awareness concerning vulvovaginal candidiasis and the demand for convenient, short-course treatment regimens. End-user analysis underscores that retail pharmacies and drug stores are the primary distribution channels, particularly for OTC products, while hospitals and clinics maintain relevance for prescription-strength formulations and complex or recurrent infections requiring professional diagnosis and combination therapy. The long-term trajectory of the market relies heavily on maintaining a balance between affordability for high-volume consumer markets and continuous innovation to combat emerging fungal strains and resistance patterns.

AI Impact Analysis on Clotrimazole Market

Analysis of common user questions concerning the impact of Artificial Intelligence (AI) on the Clotrimazole Market reveals strong interest in areas such as enhanced diagnostic accuracy, optimization of drug discovery pipelines, and personalized treatment strategies. Users frequently ask: "Can AI diagnose fungal infections faster?", "How can AI reduce the time-to-market for new antifungal formulations?", and "Will AI help predict antifungal resistance patterns?". Key thematic concerns center around AI's ability to interpret complex clinical data (like dermatoscopic images or microbiome sequencing) to differentiate fungal infections from other skin conditions more accurately than traditional methods. Expectations are high regarding AI's potential to streamline manufacturing processes, particularly quality control and predictive maintenance in large-scale pharmaceutical production of clotrimazole derivatives, thereby improving cost-efficiency and product availability.

In the research and development phase, AI and machine learning algorithms are increasingly being deployed to analyze vast datasets of chemical compounds, accelerating the identification of novel drug targets or optimizing the scaffold of existing azoles like clotrimazole to potentially overcome resistance mechanisms. This computational approach significantly shortens the lead optimization phase, enabling quicker progression to preclinical trials. Furthermore, AI tools are enhancing clinical trial design by selecting optimal patient cohorts for new clotrimazole formulations or combination therapies, improving statistical power, and speeding up regulatory submissions. This efficiency gain is crucial in a market characterized by high volume and continuous need for cost management.

Within the commercial sphere, AI is transforming market forecasting and supply chain management for clotrimazole products. Predictive analytics can more accurately model seasonal variations in fungal infection incidence, allowing manufacturers and distributors to optimize inventory levels, thereby reducing waste and preventing stockouts, especially for essential OTC products. Moreover, AI-powered diagnostic applications linked to telemedicine platforms are democratizing access to preliminary dermatological consultations, allowing patients to potentially self-diagnose common conditions treatable with OTC clotrimazole, provided appropriate safeguards and professional oversight are integrated. This integration of technology enhances market penetration and consumer engagement.

- AI-enhanced imaging analysis for rapid and accurate differential diagnosis of fungal infections.

- Machine learning applied to drug discovery to modify clotrimazole structure, improving efficacy against resistant strains.

- Predictive modeling used for optimizing supply chain logistics and inventory management based on seasonal disease patterns.

- Integration of AI symptom checkers in telehealth platforms to guide patients toward appropriate clotrimazole formulations.

- Automated quality control systems utilizing computer vision in clotrimazole manufacturing facilities to ensure product consistency.

DRO & Impact Forces Of Clotrimazole Market

The Clotrimazole Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces that dictate market dynamics and future growth potential. Primary drivers include the persistently high global incidence of fungal infections, particularly dermatophytosis and candidiasis, fueled by lifestyle changes, globalization leading to pathogen migration, and the growing population of individuals with chronic conditions like diabetes or HIV, which compromise immune function. The established safety profile and widespread availability of affordable generic and OTC clotrimazole formulations further amplify patient access and adoption. These pervasive drivers ensure a sustained base demand for the product across all income groups and geographies, making it a foundation drug in antifungal therapy.

Conversely, the market faces significant Restraints that moderate its expansion. The most critical restraint is the intensifying price competition, largely driven by the presence of numerous generic manufacturers, which compresses profit margins for key players, particularly in mature markets. Furthermore, the burgeoning issue of antifungal resistance, though less pronounced for older topical azoles like clotrimazole compared to systemic agents, poses a long-term threat requiring continuous surveillance and the need for combination therapies or novel delivery systems. Regulatory hurdles, especially concerning the switch from prescription (Rx) to over-the-counter (OTC) status in certain markets, and stringent quality control standards for pharmaceutical manufacturing also add complexity and cost to market operations.

Despite the restraints, substantial Opportunities exist for market growth. These include developing novel combination products that pair clotrimazole with steroids or antibacterial agents to address polymicrobial infections and inflammation effectively. Moreover, expanding the market through enhanced education and awareness programs, particularly in rural and low-income regions, can significantly improve diagnostic rates and subsequent treatment initiation. Technological advances in drug delivery, such as microneedle patches or improved nano-emulsions for better skin penetration and reduced application frequency, represent significant commercial opportunities. The final impact forces stem from governmental policies favoring essential medicines and the ongoing global movement towards preventive healthcare, both of which solidify clotrimazole's position as a low-cost, effective frontline treatment for common fungal dermatoses.

Segmentation Analysis

The Clotrimazole Market is extensively segmented based on formulation type, application, distribution channel, and end-user, allowing for a detailed analysis of market dynamics and revenue concentration. Formulation segmentation is critical, as it directly impacts patient compliance and the targeted fungal infection site, ranging from topical solutions for skin infections to vaginal tablets for mucosal candidiasis. Application segmentation provides insight into the primary therapeutic uses, with dermatophytosis and vulvovaginal candidiasis representing the largest revenue contributors globally, reflecting their high prevalence across diverse demographics. Understanding these segmentations is paramount for manufacturers to tailor their marketing strategies and research investments effectively.

Distribution channel analysis differentiates between the high-volume retail pharmacy sector, dominant for OTC products, and the institutional sales channels, which cater to hospital prescriptions and specialized clinical use. The increasing preference for self-medication and the convenience offered by drug stores and online pharmacies have cemented the retail segment’s dominance. End-user categorization, focused on hospitals, clinics, and individual patients, reflects the varying levels of medical intervention required, from routine topical application managed by the patient to complex, recurrent infections managed in a clinical setting requiring higher-strength or complementary treatment modalities. This multilayered segmentation structure provides a robust framework for competitive analysis and strategic planning within the pharmaceutical sector.

The continuous evolution within these segments, such as the increasing popularity of advanced topical gels offering non-greasy formulations, or the development of specialized vaginal suppositories designed for reduced leakage and improved adherence, drives overall market value. Furthermore, the segmentation by strength (e.g., 1%, 2%, or higher concentrations) reflects the regulatory differences and clinical requirements across various geographical regions, necessitating localized product portfolios for global success. Generic clotrimazole continues to dominate most segments due to cost-effectiveness, pushing branded formulations toward unique delivery mechanisms or fixed-dose combinations to justify a price premium.

- By Formulation: Creams, Solutions/Lotions, Powders, Tablets (Oral & Vaginal), Others (Suppositories, Sprays)

- By Application: Dermatophytosis (Tinea), Vulvovaginal Candidiasis, Oral Candidiasis, Pityriasis Versicolor, Others

- By Distribution Channel: Retail Pharmacies and Drug Stores, Hospital Pharmacies, Online Pharmacies, Clinics

- By End User: Hospitals, Clinics, Individual Patients/Homecare Settings

Value Chain Analysis For Clotrimazole Market

The value chain of the Clotrimazole Market commences with upstream activities involving the sourcing and synthesis of raw materials, primarily the active pharmaceutical ingredient (API), clotrimazole, and various excipients like polyethylene glycol, cetostearyl alcohol, and various emulsifiers essential for topical formulations. API manufacturing is highly specialized and often outsourced to large chemical synthesis firms in cost-efficient regions, predominantly Asia Pacific, ensuring compliance with rigorous Good Manufacturing Practices (GMP) standards. Quality control and intellectual property management at this initial stage are crucial, particularly as generic competition dictates the need for streamlined, high-yield synthesis processes to maintain profitability in the final product pricing.

Midstream processes involve formulation development and manufacturing, where the API is combined with excipients to create the final dosage forms (creams, tablets, solutions). This stage requires specialized pharmaceutical manufacturing facilities capable of aseptic processing for certain products and packaging specific to regulatory requirements (e.g., child-resistant packaging or specific tube materials). Direct distribution involves manufacturers supplying large institutional buyers, such as hospitals or government health programs, often under long-term tender agreements. Indirect distribution, which accounts for the majority of the market volume, relies heavily on complex networks of regional distributors, wholesalers, and third-party logistics (3PL) providers to reach retail pharmacies and online platforms effectively.

Downstream activities focus on sales, marketing, and post-market surveillance. Marketing strategies must differentiate between prescription (Rx) products requiring physician detailing and OTC products relying on direct-to-consumer advertising and placement in retail settings. Retail pharmacies and drug stores serve as the critical final distribution point, providing advice and dispensing the product to the end consumer. Post-market surveillance ensures continuous safety monitoring and compliance reporting. The effectiveness of the distribution channel—whether direct sales to institutions or indirect sales through wholesalers to retail chains—significantly impacts market penetration and shelf visibility, particularly for high-volume OTC fungal treatments like clotrimazole.

Clotrimazole Market Potential Customers

Potential customers for the Clotrimazole Market span a broad spectrum, primarily defined by the prevalence of fungal infections and access to healthcare services, encompassing individual patients, various healthcare institutions, and public health bodies. The largest segment of end-users consists of individual patients seeking relief from common superficial fungal infections such as athlete's foot, ringworm, and vaginal thrush. These consumers are typically influenced by ease of access (OTC availability), affordability (generic pricing), and brand trust, frequently utilizing retail pharmacies and drug stores for immediate treatment purchase. Consumer education campaigns targeting hygiene practices and early self-diagnosis are paramount for reaching this large, geographically dispersed customer base.

Institutional customers form the second critical group, including large hospital networks, specialized dermatological clinics, gynecological practices, and pediatric centers. These entities utilize clotrimazole, often in higher volumes or specific prescription-strength formulations, for treating severe, chronic, or institutional outbreaks of fungal infections. Government healthcare programs and military health systems also represent significant institutional buyers, procuring large quantities through centralized tenders to supply public clinics and ensure access to essential antifungal medicines across lower-income populations. Their purchasing decisions are primarily influenced by bulk pricing, consistent supply chain reliability, and adherence to national essential medicines lists.

Furthermore, specialized segments, such as long-term care facilities and immunocompromised patient treatment centers (e.g., oncology units), rely on clotrimazole as a prophylactic or therapeutic agent, underscoring the necessity for reliable supply chains for specialized hospital pharmacies. The global demand is also subtly influenced by veterinary medicine, where clotrimazole is utilized for treating fungal infections in animals, representing a niche but important B2B customer segment. Ultimately, the market success depends on meeting the diverse requirements of the self-medicating consumer for convenience and affordability, while simultaneously satisfying the institutional need for quality assurance and high-volume consistency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Pfizer Inc., Johnson & Johnson, Teva Pharmaceutical Industries Ltd., Glenmark Pharmaceuticals, Sun Pharmaceutical Industries Ltd., Lupin Limited, Novartis International AG, Aurobindo Pharma, Dr. Reddy’s Laboratories, Taro Pharmaceutical Industries Ltd., Viatris (formerly Mylan), Perrigo Company plc, Strides Pharma Science Limited, Cipla Ltd., Merck & Co., Sanofi S.A., GSK plc, Reckitt Benckiser Group plc, J. B. Chemicals & Pharmaceuticals Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clotrimazole Market Key Technology Landscape

The technology landscape surrounding the Clotrimazole Market is primarily focused on enhancing the drug's performance through advanced delivery systems and manufacturing optimization, rather than fundamental changes to the API itself. Key technological efforts are directed toward improving topical bioavailability, ensuring better penetration through the stratum corneum, and minimizing systemic absorption to maximize localized efficacy while reducing potential side effects. Novel formulation technologies, such as micro-emulsions, nano-suspensions, and liposomal carriers, are being explored to encapsulate clotrimazole, offering improved stability, prolonged release characteristics, and enhanced patient compliance due to less frequent dosing schedules. These advancements are crucial for overcoming skin barrier challenges, especially in treating chronic or deep-seated fungal infections.

Another area of significant technological development involves the incorporation of clotrimazole into specialized transdermal patches or microneedle arrays. While traditional topical applications require multiple daily applications, these advanced delivery methods aim to deliver a sustained, therapeutic concentration of the drug over several days with a single application. This not only improves patient adherence but also opens new avenues for treating hard-to-reach or sensitive body areas more effectively. Furthermore, manufacturing technology plays a critical role, with continuous manufacturing processes and advanced process analytical technology (PAT) being implemented by leading pharmaceutical companies. These technologies ensure higher batch consistency, reduce manufacturing cycle times, and lower production costs, providing a competitive edge in a price-sensitive market dominated by generic competition.

In the diagnostic realm, technological innovations, including rapid point-of-care (POC) tests and integration with telemedicine platforms utilizing digital imaging and AI algorithms, indirectly support the clotrimazole market by facilitating quicker and more accurate diagnosis of treatable fungal infections. For example, high-resolution digital dermatoscopes coupled with AI can aid primary care physicians in differentiating fungal lesions from other dermatoses, ensuring appropriate and timely application of clotrimazole. While clotrimazole itself is a mature molecule, the surrounding technological ecosystem focused on delivery, manufacturing efficiency, and diagnostics remains highly dynamic, ensuring the drug maintains its relevance and effectiveness in the modern therapeutic landscape by continuously improving its user profile and economic viability.

Regional Highlights

The Clotrimazole Market exhibits substantial regional variations in terms of growth rates, consumption patterns, and product preference, primarily dictated by climate, regulatory environment, and healthcare infrastructure maturity. North America, encompassing the United States and Canada, represents a mature market characterized by high healthcare expenditure and well-established regulatory pathways, facilitating the widespread availability of OTC clotrimazole products. The high incidence of lifestyle-related fungal infections, coupled with robust consumer awareness and aggressive direct-to-consumer marketing by major players, maintains consistent revenue generation in this region. The market here is driven by innovation in packaging and compliance-enhancing formulations, often utilizing premium pricing strategies for combination products.

Europe holds a significant market share, driven by strong demand across major economies like Germany, France, and the UK. The European market benefits from a high level of generic competition, promoting affordability, although regulatory fragmentation across the European Union can sometimes complicate cross-border marketing and distribution strategies. Southern and Eastern European countries, influenced by warmer climates and lower public health expenditure, present strong demand potential for affordable generic topical treatments. Furthermore, the robust pharmaceutical R&D base in Western Europe continues to drive advancements in new clotrimazole-containing combination therapies targeting complex infections.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally, propelled by densely populated nations like China, India, and Southeast Asian countries, which have climates highly conducive to fungal growth. The rapid expansion of healthcare access, increasing disposable income, and governmental emphasis on combating infectious diseases are key accelerators. The APAC market is primarily driven by affordability; therefore, local generic manufacturers play a dominant role. However, stringent regulatory shifts toward global standards in major economies like China are creating opportunities for high-quality branded and advanced formulations. Latin America (LATAM) and the Middle East and Africa (MEA) markets are growing steadily, characterized by evolving healthcare infrastructures and increasing urbanization, leading to higher rates of skin infections and subsequent demand for essential antifungal medications like clotrimazole.

- North America: Dominant market share fueled by high OTC availability, strong consumer marketing, and high prevalence of lifestyle-related infections.

- Europe: Stable growth driven by mature healthcare systems and high generic penetration, focusing on standardized regulatory compliance and R&D for combination products.

- Asia Pacific (APAC): Highest projected CAGR due to favorable climate, expanding healthcare infrastructure, rising disposable incomes, and large, underserved populations demanding affordable treatments.

- Latin America (LATAM): Growth acceleration linked to improving economic conditions, increased healthcare access, and regional efforts to manage infectious diseases.

- Middle East and Africa (MEA): Emerging growth market driven by urbanization, high incidence of dermatological issues, and international aid programs providing essential medicines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clotrimazole Market, encompassing multinational pharmaceutical giants, specialized dermatological companies, and dominant generic manufacturers who collectively influence pricing, innovation, and distribution channels globally. Strategic activities of these players include portfolio diversification, geographical expansion through partnerships, and continuous investment in OTC branding and consumer trust.- Bayer AG

- Pfizer Inc.

- Johnson & Johnson

- Teva Pharmaceutical Industries Ltd.

- Glenmark Pharmaceuticals

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Novartis International AG

- Aurobindo Pharma

- Dr. Reddy’s Laboratories

- Taro Pharmaceutical Industries Ltd.

- Viatris (formerly Mylan)

- Perrigo Company plc

- Strides Pharma Science Limited

- Cipla Ltd.

- Merck & Co.

- Sanofi S.A.

- GSK plc

- Reckitt Benckiser Group plc

- J. B. Chemicals & Pharmaceuticals Ltd.

Frequently Asked Questions

Analyze common user questions about the Clotrimazole market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Clotrimazole Market?

The Clotrimazole Market is projected to experience a Compound Annual Growth Rate (CAGR) of 5.8% between the forecast years of 2026 and 2033, driven by increasing prevalence of fungal infections and expanding over-the-counter availability globally.

Which geographical region dominates the Clotrimazole Market?

North America currently holds a significant market share due to high consumer spending on healthcare, robust regulatory support for OTC products, and high demand for treatments of common dermatological fungal infections. However, Asia Pacific is anticipated to show the fastest growth rate.

What are the primary applications driving demand for Clotrimazole?

The primary applications fueling demand include the topical treatment of dermatophytosis (like ringworm and athlete's foot) and the vaginal treatment of vulvovaginal candidiasis. These high-incidence conditions make clotrimazole a highly utilized frontline antifungal agent.

How does generic competition impact the Clotrimazole Market?

Generic competition is intense and constitutes a major restraint on market profitability, leading to price erosion in standard formulations. This compels key branded players to focus on specialized delivery systems and combination therapies to differentiate and maintain value.

Which formulation segment holds the largest share in the Clotrimazole Market?

The topical formulations segment, including creams, lotions, and solutions, dominates the market share. This dominance is attributed to their widespread use, high patient compliance, and easy accessibility through over-the-counter distribution channels for common skin infections.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager