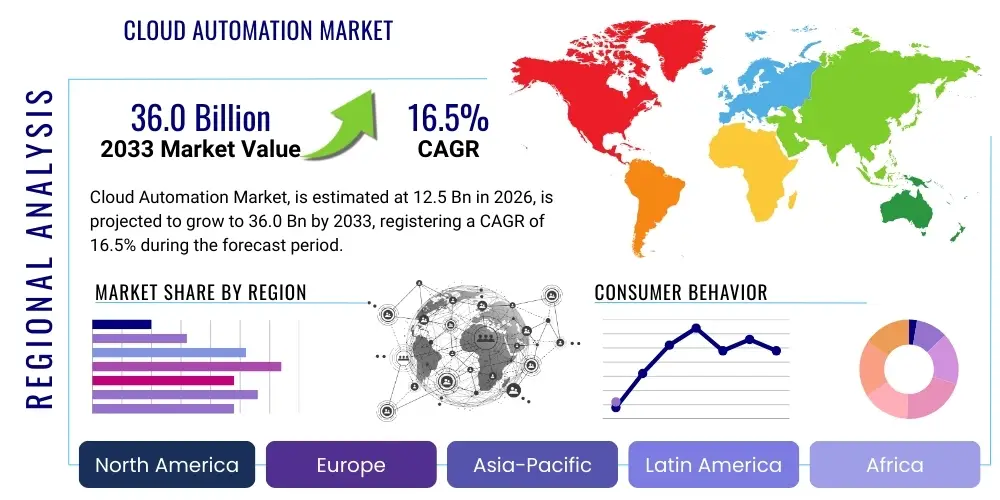

Cloud Automation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443192 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Cloud Automation Market Size

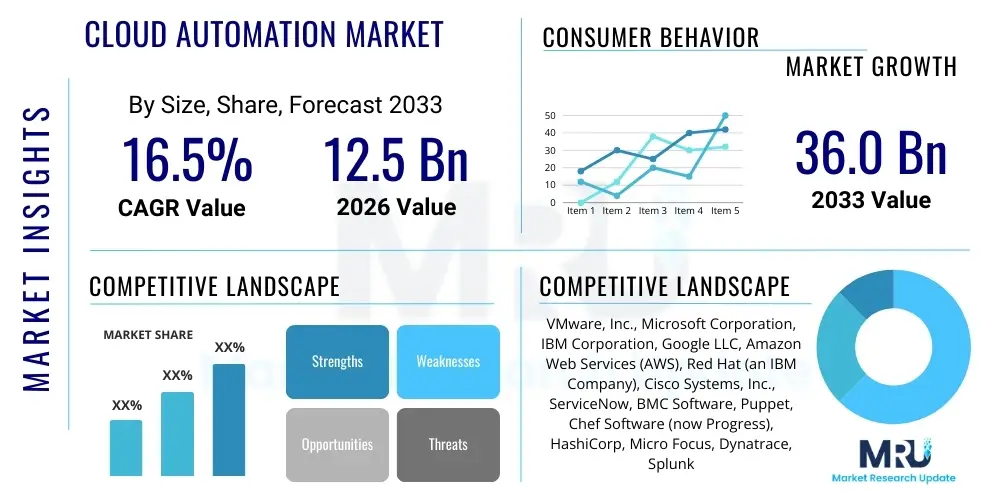

The Cloud Automation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 36.0 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the accelerating global shift toward multi-cloud and hybrid cloud environments, necessitating sophisticated tools for efficient resource provisioning, management, and operational oversight.

The imperative for organizations to enhance operational agility and reduce manual intervention in complex cloud infrastructure management serves as the foundational impetus for market growth. As enterprises scale their digital transformation initiatives, the limitations of traditional, manual IT management become increasingly pronounced, driving urgent demand for integrated cloud automation platforms that can handle continuous integration/continuous deployment (CI/CD) pipelines, security compliance, and cost optimization across disparate cloud service providers (CSPs). Furthermore, the inherent complexity introduced by serverless architectures and microservices demands highly automated governance frameworks, solidifying the long-term upward trajectory of market valuation throughout the forecast period.

Cloud Automation Market introduction

Cloud Automation encompasses the use of software and pre-defined policies to automatically manage, monitor, and scale cloud infrastructure, applications, and services without human intervention. This market delivers solutions ranging from infrastructure as code (IaC) tools like Terraform and Ansible to advanced robotic process automation (RPA) and Artificial Intelligence Operations (AIOps) platforms designed specifically for cloud environments. Key applications include automated provisioning, compliance enforcement, cost management, security policy orchestration, and self-healing systems. The primary benefits realized by adopting these technologies are drastically reduced operational costs, minimized human error, increased deployment speed, enhanced security posture, and the ability to maintain continuous compliance across regulatory landscapes such as GDPR, HIPAA, and PCI DSS.

Major applications of cloud automation span across various critical IT functions, including configuration management, patch management, incident response, and performance monitoring. In financial services, automation ensures rapid, compliant deployment of trading platforms, while in healthcare, it secures patient data access and manages complex electronic health record (EHR) systems with automated scaling. Driving factors for this market include the proliferation of highly fragmented, multi-cloud strategies, the urgent need for DevSecOps adoption to accelerate software delivery cycles, and the massive operational scale required by large digital native companies and hyperscale cloud users. Moreover, the shortage of skilled cloud engineers encourages organizations to invest in tools that abstract complexity and automate routine tasks, thereby optimizing existing human capital.

The core product offering is typically a centralized control plane or suite of tools integrated with major CSP APIs (AWS, Azure, GCP), enabling seamless orchestration. These platforms facilitate the entire cloud lifecycle, from initial resource creation to eventual decommissioning. Key driving factors also include the need for superior governance in remote work environments and the push towards FinOps (Financial Operations) methodologies, where automation plays a crucial role in rightsizing resources and automatically shutting down non-essential infrastructure to minimize wastage. The maturation of open-source automation frameworks also lowers the barrier to entry for many small and medium enterprises (SMEs), further fueling widespread adoption across all industry verticals.

Cloud Automation Market Executive Summary

The Cloud Automation Market is witnessing robust expansion, characterized by a significant transition from siloed automation scripts to integrated, end-to-end platforms leveraging AIOps capabilities. Business trends highlight a strong M&A environment as major technology players seek to acquire niche firms specializing in specific areas such as container orchestration security and serverless monitoring. The shift toward consumption-based pricing models for automation tools is gaining traction, making high-end solutions accessible to a broader user base. Furthermore, the increasing prominence of hybrid IT environments—combining on-premises data centers with multiple public clouds—mandates vendor development focus on tools that ensure consistent policy enforcement and workload mobility across these heterogeneous environments, thereby generating high commercial value for cross-platform solutions.

Regional trends indicate North America maintaining its dominant market share due to the high concentration of hyperscale cloud providers, early technology adoption rates, and significant enterprise spending on digital transformation, particularly in the financial technology and high-tech sectors. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapid digitalization in emerging economies like India and China, coupled with substantial governmental investments in cloud infrastructure and smart city projects. European market growth is steady, strongly influenced by stringent data residency requirements and regulatory pressures (e.g., GDPR), which necessitate highly automated compliance and data governance tools capable of audit-ready reporting and localized data control.

Segment trends reveal that the Services component (including consulting, integration, and managed services) is expanding faster than the Software component, reflecting the complexity associated with deploying and customizing sophisticated automation solutions in large, legacy IT environments. Among deployment types, the hybrid cloud segment is expected to remain the largest adopter of advanced automation, as managing the complexity of intertwining on-premises resources with multi-cloud platforms requires specialized orchestration capabilities. From an application perspective, automated security and compliance management are emerging as the fastest-growing sub-segments, spurred by the increasing frequency and sophistication of cyber threats and evolving regulatory mandates that demand continuous security validation and automated policy remediation.

AI Impact Analysis on Cloud Automation Market

User queries regarding the impact of AI on Cloud Automation frequently revolve around themes such as the transition from reactive scripting to proactive, predictive remediation; the integration of Machine Learning (ML) for anomaly detection; and the future role of human engineers (Will AI replace cloud administrators?). There is significant user interest in how Artificial Intelligence Operations (AIOps) platforms utilize vast amounts of operational data (logs, metrics, traces) to identify performance bottlenecks and security threats before they escalate into service disruptions. Key concerns often center on data privacy requirements for training AI models and the explainability (transparency) of automated AI-driven decisions. The consensus expectation is that AI will dramatically increase the scope and sophistication of automation, moving beyond simple task execution to encompass complex decision-making, predictive capacity planning, and automated root cause analysis, fundamentally redefining the responsibilities of cloud operations teams.

The incorporation of AI and Machine Learning capabilities is revolutionizing the Cloud Automation market by transforming traditional operational monitoring into proactive AIOps frameworks. These systems leverage sophisticated algorithms to analyze historical and real-time data, enabling automated prediction of potential failures, optimization of resource allocation based on anticipated demand spikes, and significantly accelerating the mean time to resolution (MTTR) for incidents. This predictive maintenance approach drastically improves service reliability and performance efficiency, moving cloud management from reactive firefighting to strategic foresight. The ability of AI to process unstructured data and identify subtle patterns invisible to rule-based systems provides a compelling value proposition for enterprise adoption.

Furthermore, AI is instrumental in enhancing automated security compliance. ML models can continuously scan infrastructure configurations for deviations from predefined security baselines, automatically generate remediation actions for non-compliant resources, and detect zero-day threats or unusual access patterns in real-time. This automated security orchestration is crucial in multi-cloud environments where maintaining a unified security posture manually is nearly impossible. The integration of Natural Language Processing (NLP) is also improving the usability of automation tools by enabling conversational interfaces for incident management and provisioning requests, thus broadening the accessibility of complex automation capabilities to a wider range of technical and non-technical staff within the organization.

- Predictive Scaling and Capacity Management: AI algorithms forecast resource needs, automating scale-up/scale-down actions to optimize cost and performance.

- Automated Incident Remediation (AIOps): ML analyzes log and telemetry data to diagnose root causes and trigger self-healing scripts without human intervention.

- Enhanced Security Posture: AI identifies and remediates configuration drifts and compliance violations continuously across multi-cloud setups.

- Intelligent Cost Optimization: ML determines optimal resource sizing and scheduling, significantly reducing cloud wastage.

- Code Generation and Refactoring: AI assists DevSecOps teams by automating the generation of IaC templates and suggesting performance improvements.

DRO & Impact Forces Of Cloud Automation Market

The Cloud Automation Market is significantly propelled by the undeniable Driver of complexity stemming from multi-cloud adoption and the necessity for robust DevSecOps practices to maintain competitive deployment speeds. However, this growth is partially Restrained by challenges related to integrating automation tools with disparate legacy systems and the persistent shortage of highly specialized personnel capable of designing and maintaining sophisticated automation pipelines. Substantial Opportunities arise from the rapidly expanding edge computing market, requiring centralized, automated orchestration, and the increasing demand for FinOps solutions where automation directly translates into quantifiable cost savings. These forces collectively Impact the market by accelerating innovation in cross-platform interoperability, pushing vendors toward unified AIOps offerings, and fostering collaborative efforts to simplify the user experience for complex deployment architectures.

Key Drivers include the stringent requirement for agility in software delivery, driven by market pressures to achieve continuous innovation. Cloud automation, through the implementation of Infrastructure as Code (IaC) and Configuration Management Database (CMDB) integration, ensures that environments are consistently provisioned and configured, dramatically reducing deployment time from weeks to minutes. Another major driver is the substantial economic benefit derived from eliminating manual, repetitive tasks, allowing highly paid technical staff to focus on strategic initiatives rather than routine maintenance. Regulatory compliance overheads also force automation adoption; tools that automatically generate audit logs and enforce security policies streamline governance processes, especially in heavily regulated sectors like banking and pharmaceutical research.

The primary Restraints include significant initial investment costs associated with advanced automation platforms, particularly for large enterprises requiring comprehensive customization and deep integration with existing on-premises infrastructure. Organizational inertia and resistance to change—the "fear of the machine"—also slow adoption, necessitating extensive training and change management protocols. Furthermore, security concerns surrounding automated privileged access and the risk associated with errors in automation code propagating across the entire infrastructure pose a significant psychological and technical hurdle for decision-makers. The inherent proprietary nature of certain vendor-specific cloud APIs also creates vendor lock-in concerns, restricting the flexibility required for true multi-cloud automation strategies and complicating seamless data migration.

The Opportunities for market expansion are vast, particularly within the burgeoning areas of managed security services and industry-specific automation templates. The rise of 5G and IoT deployments generates massive data streams at the edge, requiring automated provisioning and management of distributed compute resources, which presents a greenfield for specialized cloud automation providers. Furthermore, the push towards sustainability and energy efficiency in IT operations offers opportunities for automation tools to optimize workload placement and power consumption dynamically. The increasing maturity of low-code/no-code automation platforms also lowers the technical barrier for adoption, enabling citizen developers and non-specialist IT staff to build and deploy automated workflows, thereby widening the potential customer base significantly across mid-market segments globally.

Segmentation Analysis

The Cloud Automation Market is typically segmented based on component, deployment type, organization size, application, and vertical industry. Component segmentation highlights the interplay between automation platforms (software) and the necessary supporting ecosystem (services). Deployment typology reflects the core IT infrastructure strategies employed by organizations, namely public, private, and hybrid cloud models, with hybrid leading due to complexity management needs. Application segmentation clearly delineates functional areas driving adoption, such as automated compliance, network orchestration, and specialized disaster recovery workflows. Understanding these segment dynamics is critical for vendors to tailor their solutions, focusing on the higher-growth areas like specialized security automation and managed services aimed at medium-sized enterprises navigating multi-cloud complexity.

In terms of organization size, the Large Enterprise segment currently holds the dominant revenue share due to their vast infrastructure footprints and substantial budgets for sophisticated, customized automation solutions necessary to manage petabytes of data and thousands of virtual machines. However, the Small and Medium Enterprise (SME) segment is anticipated to witness the highest growth rate during the forecast period. This accelerated growth is attributed to the increasing availability of affordable, SaaS-based automation tools and the compelling need for SMEs to achieve competitive parity in operational efficiency without employing extensive internal IT teams. Cloud Service Providers often package basic automation functionalities, further lowering the entry barrier for smaller organizations.

Vertical industry analysis reveals that Banking, Financial Services, and Insurance (BFSI), along with IT and Telecommunications, are the largest consumers of cloud automation, driven by high transaction volumes, stringent regulatory requirements, and the necessity for continuous uptime. The BFSI sector heavily utilizes automation for risk management, trade execution, and regulatory reporting. Conversely, the Healthcare and Life Sciences sectors are poised for substantial growth, motivated by the urgent need for automated data governance for clinical trials, secure management of patient records (e.g., automated HIPAA compliance), and the deployment of AI-driven diagnostic applications, all requiring highly reliable and compliant cloud infrastructure provisioning.

- Component:

- Solution (Platform & Software)

- Services (Professional Services, Managed Services)

- Deployment Type:

- Public Cloud

- Private Cloud

- Hybrid Cloud (Leading Segment)

- Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Application:

- Cloud Orchestration and Provisioning

- Automated Security and Compliance Management

- Network Automation

- Change Management

- Monitoring and Log Management

- Incident Response and Remediation

- Vertical Industry:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunications

- Retail and E-commerce

- Healthcare and Life Sciences

- Manufacturing

- Government and Public Sector

Value Chain Analysis For Cloud Automation Market

The Value Chain for the Cloud Automation Market begins with Upstream Analysis, which focuses on core infrastructure providers, including hyperscale Cloud Service Providers (CSPs) like Amazon Web Services, Microsoft Azure, and Google Cloud Platform, which supply the underlying computational resources and foundational automation APIs. This stage also includes specialized technology providers delivering essential components such as Infrastructure as Code (IaC) tooling (e.g., HashiCorp), monitoring and logging solutions (e.g., Datadog, Splunk), and open-source communities contributing to foundational frameworks like Kubernetes and Ansible. The quality and openness of these foundational APIs and tools directly influence the complexity and effectiveness of subsequent automation solutions built upon them, making strong upstream partnerships critical for market leaders.

Midstream activities involve the core market players—the Cloud Automation Platform providers—who aggregate these foundational elements to create integrated, commercial automation suites. This involves developing sophisticated orchestration engines, policy definition frameworks, AIOps capabilities, and user-friendly control panels. These providers focus on interoperability, ensuring their platforms can seamlessly manage resources across different CSPs and hybrid environments. Distribution Channels are primarily dominated by Direct Sales channels for large enterprise contracts, given the complexity of integration and the requirement for customized professional services. However, Indirect Channels, involving Managed Service Providers (MSPs), Value-Added Resellers (VARs), and system integrators (SIs), play a crucial role in reaching SMEs and delivering localized support, particularly for the deployment and ongoing management of hybrid cloud automation solutions, thereby leveraging expertise and extending market reach.

Downstream Analysis centers on the end-users and the operational benefits derived from automation adoption. End-users include internal IT operations teams, DevSecOps practitioners, and financial controllers utilizing the automation platform for resource optimization and governance. The value delivered downstream manifests as accelerated time-to-market, improved service reliability, and demonstrable cost savings (FinOps). Feedback loops from these Downstream users, specifically related to pain points in security and cross-cloud management, drive iterative product development and feature enhancements Upstream. The long-term viability of automation solutions depends heavily on the effectiveness of the integration services provided by SIs and MSPs who bridge the gap between complex software and diverse organizational requirements, ensuring successful adoption and maximum ROI for the enterprise buyer.

Cloud Automation Market Potential Customers

The primary End-Users and Buyers of Cloud Automation solutions are organizations across all industry verticals facing significant scaling challenges and regulatory pressure in their IT environments. Large multinational enterprises, particularly those operating globally and utilizing a multi-cloud or hybrid cloud strategy, represent the most critical customer segment. These organizations require sophisticated orchestration tools to maintain consistent security policies and operational visibility across diverse infrastructure landscapes, making Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Heads of Infrastructure and Operations key decision-makers focused on reducing technical debt and maximizing resource utilization efficiency.

A rapidly expanding segment of potential customers includes Medium-sized Businesses (SMBs) that are undergoing aggressive digital transformation but lack the internal resources for large-scale, manual cloud management. For these customers, SaaS-based, low-code automation platforms offer an ideal solution, providing enterprise-grade functionality without massive upfront investment or specialized developer teams. Their purchase decisions are heavily influenced by the speed of deployment, ease of integration with existing SaaS tools (e.g., Salesforce, ServiceNow), and clear demonstrations of cost optimization and compliance assurance, often preferring solutions delivered through trusted Managed Service Providers (MSPs) who handle the complexity.

Furthermore, technology-intensive sectors such as Gaming, High-Performance Computing (HPC), and Digital Native companies (e.g., large e-commerce platforms and streaming services) constitute high-value customers due to their extreme requirements for automated elastic scaling and near-zero downtime. For these users, automation is not merely an operational efficiency tool but a core requirement for their business model, driving demand for advanced AIOps and highly specialized network automation capabilities. Regulatory bodies and government agencies also represent a stable customer base, increasingly utilizing cloud automation to enforce security protocols for sensitive data and streamline public service deployment with audited, compliant infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 36.0 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VMware, Inc., Microsoft Corporation, IBM Corporation, Google LLC, Amazon Web Services (AWS), Red Hat (an IBM Company), Cisco Systems, Inc., ServiceNow, BMC Software, Puppet, Chef Software (now Progress), HashiCorp, Micro Focus, Dynatrace, Splunk Inc., Morpheus Data, CloudBees, GitLab Inc., Dell Technologies, Hewlett Packard Enterprise (HPE) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cloud Automation Market Key Technology Landscape

The Cloud Automation Market is underpinned by several synergistic core technologies, chief among them being Infrastructure as Code (IaC). IaC tools like Terraform, Ansible, and CloudFormation enable the definition of cloud resources and topologies through declarative configuration files, ensuring repeatability, version control, and immutability of infrastructure deployments. This shift from manual configuration to coded blueprints is fundamental to achieving scalable, repeatable automation across diverse environments. Alongside IaC, the proliferation of Containerization technologies, specifically Docker and Kubernetes, necessitates specialized automation tools for managing complex microservices deployment, scaling, and networking. Cloud automation platforms must provide robust integration with these container orchestration systems to automate lifecycle management from build to production seamlessly.

Furthermore, Artificial Intelligence Operations (AIOps) represents the next frontier in the technology landscape. AIOps platforms utilize Machine Learning algorithms to ingest and analyze massive streams of operational data—logs, metrics, and traces—to automate incident detection, root cause analysis, and self-healing actions. This technology is critical for moving beyond simple scripting to intelligent, proactive automation that minimizes service disruptions and optimizes performance dynamically. The integration of advanced AIOps features, such as predictive modeling for capacity planning and anomaly detection in security logs, differentiates leading vendor solutions and drives significant enterprise adoption, particularly in mission-critical applications where latency and downtime are unacceptable.

Lastly, the increasing demand for specialized automation within the networking domain has elevated the importance of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) technologies. Cloud automation solutions leverage SDN controllers to programmatically manage and orchestrate virtual networks, ensuring that network provisioning keeps pace with rapid application deployment requirements. Coupled with these operational technologies, robust Security Automation platforms utilizing policy-as-code and cloud security posture management (CSPM) tools are indispensable. These tools automatically enforce granular security policies across all provisioned resources, providing continuous compliance checks and automated remediation, which is a non-negotiable requirement for highly regulated industries and complex hybrid cloud architectures seeking to maintain a zero-trust security model.

Regional Highlights

North America currently dominates the Cloud Automation Market, attributed to the presence of major technological innovation hubs, including Silicon Valley, and the headquarters of nearly all hyperscale cloud service providers and leading enterprise software vendors. The region benefits from a highly mature IT infrastructure ecosystem, substantial venture capital investment in cloud native startups, and the early, widespread adoption of advanced technologies like AIOps and DevSecOps within critical sectors such as finance, tech, and defense. High corporate spending on digital transformation initiatives, especially the accelerated migration to multi-cloud architectures following the shift to remote work models, sustains North America's leadership position and continues to drive demand for integrated, sophisticated automation and orchestration platforms.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is fueled by aggressive governmental mandates for digitalization in countries like Singapore, South Korea, and Japan, alongside massive market expansion in China and India where enterprises are leapfrogging legacy systems straight to cloud-native adoption. Increasing investments in IT infrastructure, a burgeoning start-up ecosystem, and the urgent need for scalable operational solutions in densely populated, hyper-competitive markets are key accelerators. The complex regulatory fragmentation across APAC countries also necessitates automated compliance and data governance tools, providing a fertile ground for sophisticated security and compliance automation offerings tailored for localized requirements.

Europe represents a stable and high-value market, primarily driven by stringent regulatory environments, most notably the General Data Protection Regulation (GDPR), which makes automated data governance and policy enforcement essential. European organizations, particularly those in BFSI and manufacturing, are heavily investing in hybrid cloud automation solutions to maintain data sovereignty while capitalizing on public cloud elasticity. While growth rates may be slightly lower than APAC, the focus is on high-assurance, secure automation platforms that guarantee auditability and minimize data transfer risks. The Middle East and Africa (MEA) region, though smaller in market size, is demonstrating accelerated growth due to large-scale government-led digital initiatives and massive infrastructure projects, particularly in the UAE and Saudi Arabia, necessitating new-age cloud automation tools for greenfield data center deployments.

- North America: Market leader, driven by high R&D spending, established CSP presence, and early adoption of AIOps and DevSecOps frameworks in finance and technology sectors.

- Asia Pacific (APAC): Fastest-growing region, fueled by large-scale digital initiatives in emerging economies, governmental cloud mandates, and rapid enterprise cloud migration.

- Europe: Stable growth, highly focused on compliance automation (GDPR), demanding secure hybrid cloud orchestration solutions, particularly in Germany and the UK.

- Latin America (LATAM): Emerging market, showing increased automation adoption in telecommunications and banking sectors to improve operational efficiency and competitiveness.

- Middle East & Africa (MEA): Growth driven by government-backed digitalization strategies and significant investment in new smart infrastructure and data center projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cloud Automation Market.- VMware, Inc.

- Microsoft Corporation

- IBM Corporation

- Google LLC

- Amazon Web Services (AWS)

- Red Hat (an IBM Company)

- Cisco Systems, Inc.

- ServiceNow

- BMC Software

- Puppet

- Chef Software (now Progress)

- HashiCorp

- Micro Focus

- Dynatrace

- Splunk Inc.

- Morpehus Data

- CloudBees

- GitLab Inc.

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

Frequently Asked Questions

Analyze common user questions about the Cloud Automation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Cloud Automation Market?

The Cloud Automation Market is projected to experience a robust CAGR of 16.5% during the forecast period from 2026 to 2033, driven primarily by multi-cloud complexity and the increasing demand for AIOps solutions.

How is AI impacting the future of Cloud Automation?

AI is transforming Cloud Automation through AIOps, enabling predictive maintenance, automated root cause analysis, and intelligent resource optimization. This shift moves automation from simple task execution to complex, proactive decision-making for enhanced reliability and security.

Which deployment model holds the highest potential for advanced Cloud Automation adoption?

The Hybrid Cloud deployment model is the largest and fastest-growing segment for advanced automation. Managing the complexity of interconnecting on-premises infrastructure with multiple public cloud environments mandates sophisticated, cross-platform orchestration and governance tools.

What are the primary restraints affecting the growth of the Cloud Automation Market?

Key restraints include the high initial integration costs, the technical challenge of integrating automation tools with aging legacy infrastructure, and a persistent global shortage of skilled professionals experienced in designing complex, cross-cloud automation pipelines.

Which geographical region is anticipated to record the fastest growth in the market?

The Asia Pacific (APAC) region is expected to register the highest growth rate, propelled by accelerated governmental digitalization initiatives, rapid enterprise cloud adoption in emerging economies, and substantial investment in new IT infrastructure projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager