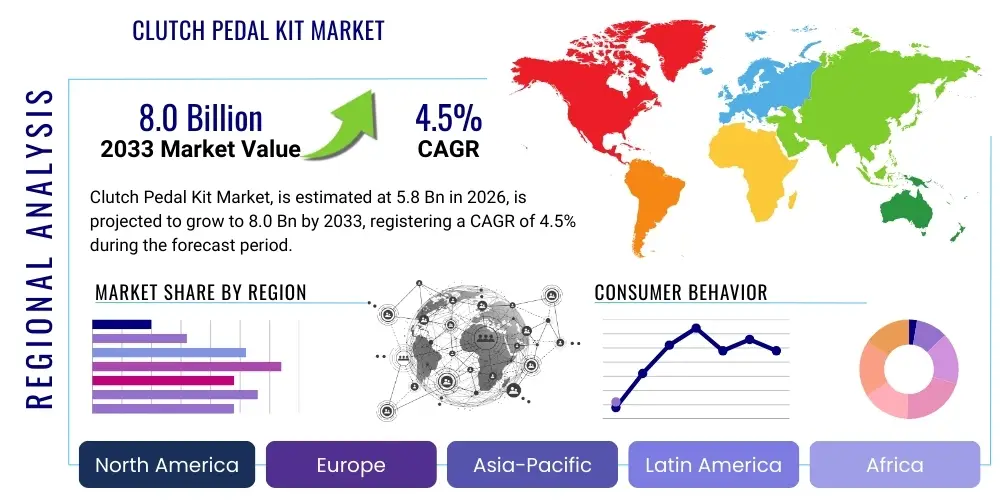

Clutch Pedal Kit Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443576 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Clutch Pedal Kit Market Size

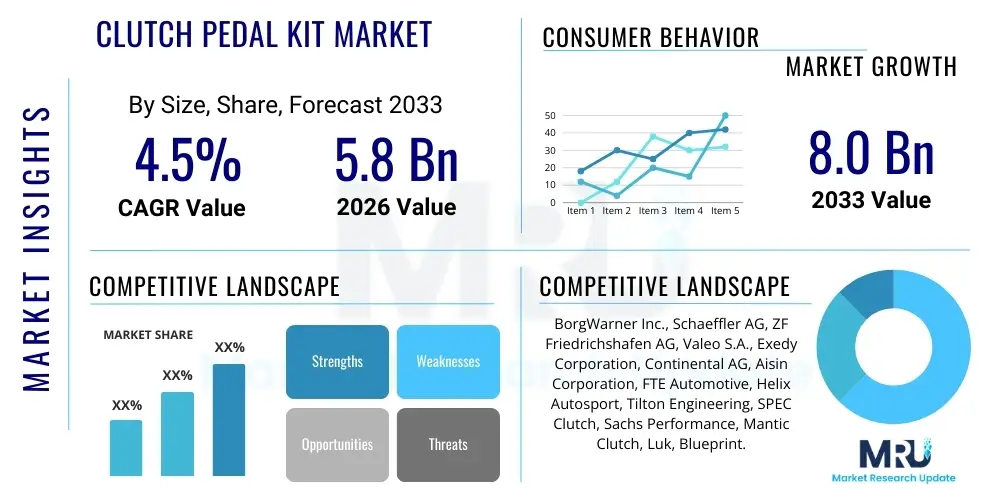

The Clutch Pedal Kit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Clutch Pedal Kit Market introduction

The Clutch Pedal Kit Market encompasses the design, manufacturing, distribution, and sale of integrated components necessary for the mechanical or hydraulic operation of the clutch system within vehicles, primarily those equipped with manual transmissions. These kits typically include the clutch pedal assembly, linkages, master and slave cylinders (for hydraulic systems), brackets, and associated hardware. The primary function is to enable the driver to engage and disengage the transmission from the engine, allowing for smooth gear changes and vehicle starting. This market is intrinsically linked to the global automotive manufacturing sector, particularly the production rates of entry-level and performance vehicles that utilize manual shifting mechanisms, while also servicing the substantial demand from the aftermarket segment for maintenance and performance upgrades.

The product, the clutch pedal kit, is critical for vehicle safety and performance, ensuring reliable power transmission control. Major applications span across passenger vehicles (sedans, hatchbacks, SUVs), light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). These kits must meet stringent Original Equipment Manufacturer (OEM) specifications regarding durability, ergonomics, and reliability. Benefits associated with high-quality clutch pedal kits include enhanced driver feel, reduced pedal effort, increased system longevity, and improved vehicle responsiveness, which are crucial factors driving purchasing decisions in both the OEM and aftermarket sectors.

Key driving factors propelling the market forward include the sustained production of manual transmission vehicles in developing economies, where manual options are preferred for their cost-efficiency and fuel economy. Furthermore, the robust global aftermarket demand, fueled by routine wear-and-tear replacement cycles and the increasing average age of vehicles on the road, contributes significantly to market growth. The ongoing technological evolution focuses on incorporating lightweight materials, such as specialized aluminum alloys and composites, to improve fuel efficiency and reduce overall vehicle weight, thereby maintaining the market's trajectory even as advanced automatic transmissions gain popularity in developed regions.

Clutch Pedal Kit Market Executive Summary

The Clutch Pedal Kit Market is characterized by moderate growth, primarily driven by strong replacement demand in the aftermarket segment and stable new vehicle production, especially across Asia Pacific and Latin America, where manual transmissions dominate vehicle sales. Business trends indicate a focus on material science innovation, with leading manufacturers investing in lighter and more durable components to comply with increasingly stringent automotive efficiency regulations. Consolidation among Tier 1 suppliers is a noticeable trend, aimed at achieving economies of scale and integrating advanced sensor technologies into pedal assemblies for modern vehicle safety systems, such such as cruise control disengagement mechanisms.

Regional trends reveal significant disparity in market maturity and growth drivers. North America and Europe exhibit mature markets where growth is concentrated in the performance aftermarket sector and LCV fleets, while the OEM segment faces headwinds due to the rapid shift toward automatic and electrified powertrains. Conversely, the Asia Pacific region, particularly India and China, serves as the primary engine of volume growth, thanks to high production rates of compact manual cars and extensive vehicle parc requiring frequent maintenance. Latin America mirrors this trend, prioritizing affordability and manual transmission longevity, thereby sustaining demand for high-quality clutch pedal kits.

Segment trends highlight the dominance of the aftermarket channel, which accounts for the majority of revenue due to the inherent wear components within the clutch system. In terms of material, the shift towards aluminum and specialized composite materials is accelerating, particularly for performance and premium vehicle applications, though steel components remain the mainstay in budget and heavy-duty segments due to their cost-effectiveness and robustness. The commercial vehicle segment is projected to show robust, albeit slower, growth compared to passenger vehicles, owing to the extreme durability requirements and longer service intervals typical of heavy-duty trucks and buses.

AI Impact Analysis on Clutch Pedal Kit Market

User inquiries regarding AI's influence on the Clutch Pedal Kit Market frequently center on automation, manufacturing efficiency, and future obsolescence due to autonomous and electric vehicles (EVs). Key themes revolve around how AI can optimize manufacturing processes, predict component failure rates (predictive maintenance), and whether the eventual dominance of EVs and fully autonomous cars, which often lack traditional clutch systems, will render this market obsolete. Users seek clarity on how supply chains for these mechanical components will adapt to smart factories and AI-driven quality control. Concerns often relate to the short-term benefit of using AI in production versus the long-term threat posed by automotive technology shifts.

While the clutch pedal kit itself is a mechanical component, the application of Artificial Intelligence (AI) profoundly impacts its design, production, and distribution lifecycle. AI algorithms are increasingly employed in generative design processes to optimize the geometry and material composition of pedal assemblies, minimizing weight while maximizing structural integrity and ergonomic performance. Furthermore, AI-driven quality control systems, utilizing machine vision and deep learning, analyze production line output in real-time, identifying minute flaws in stamping, casting, and assembly with greater accuracy than traditional methods. This enhances overall product reliability, which is paramount for safety-critical components like the clutch pedal.

In the aftermarket, AI influences inventory management and predictive maintenance strategies. Machine learning models analyze vehicle telematics and historical failure data to accurately forecast when a specific batch of clutch kits might fail or require replacement in regional vehicle fleets. This capability allows manufacturers and distributors to optimize stock levels and geographical distribution, reducing lead times and minimizing obsolescence. The integration of advanced diagnostics within modern vehicles, often leveraging AI, provides deeper insights into driver input and component stress, indirectly driving demand for more durable and sensor-compatible clutch pedal systems capable of communicating system status.

- AI optimizes manufacturing precision through real-time defect detection and quality assurance, improving component reliability.

- Generative design using AI minimizes material usage and optimizes pedal ergonomics and structural integrity.

- Machine learning models drive predictive maintenance schedules, enhancing aftermarket inventory forecasting and logistical efficiency.

- AI-driven supply chain management optimizes material procurement and global distribution based on anticipated demand curves.

- Though core mechanics remain, AI integration facilitates the adoption of electronic sensors within pedal assemblies for advanced driver-assistance systems (ADAS) compatibility.

DRO & Impact Forces Of Clutch Pedal Kit Market

The Clutch Pedal Kit Market dynamics are shaped by a complex interplay of growth drivers related to vehicle population and maintenance cycles, significant restraints stemming from technological shifts toward automatic transmissions and electrification, and compelling opportunities in emerging markets and high-performance segments. The primary drivers include the massive global vehicle parc, particularly in developing nations, ensuring continuous high volume demand for replacement parts due to wear and tear. Restraints are predominantly centered on the legislative push in developed economies towards low-emission vehicles, which favors powertrains that generally eliminate the need for a clutch pedal, such as full electric vehicles (EVs) and advanced hybrid systems. Opportunities lie in integrating smart features and lightweight materials, enabling manufacturers to capture value in premium and performance segments where manual control remains desirable.

The impact forces within the market are predominantly technological and competitive. Technological parity among major OEM suppliers means that incremental innovations in material strength and pedal feel become critical competitive differentiators. Furthermore, the threat of substitutes is high and structural, driven by the rapid penetration of dual-clutch transmissions (DCTs) and continuously variable transmissions (CVTs), which fundamentally alter the need for a traditional clutch pedal kit. Buyer bargaining power is moderate to high, especially in the aftermarket, where standardization and intense competition among multiple suppliers grant purchasing entities significant leverage. Supplier bargaining power is relatively low to moderate, depending on the specialization of the input materials, such as high-grade aluminum or specialized polymer compounds.

Economic and regulatory forces also exert profound influence. Economic expansion in populous regions boosts new vehicle sales, directly correlating with OEM clutch kit demand. Conversely, volatile raw material costs (steel, aluminum) can compress profit margins across the value chain. Regulatory mandates regarding vehicle safety necessitate continuous design updates for pedal assemblies, particularly related to impact absorption and positioning, driving investment in R&D. These forces collectively dictate the strategic direction for market participants, emphasizing efficiency, quality, and adaptation to the evolving powertrain landscape.

Segmentation Analysis

The Clutch Pedal Kit Market is comprehensively segmented based on several key operational and commercial characteristics, allowing for detailed analysis of demand patterns and strategic focus areas. Segmentation by Vehicle Type distinguishes between the high-volume passenger car segment and the highly durable, often custom-designed, commercial vehicle segment, each possessing unique regulatory and performance demands. Material segmentation addresses cost and performance trade-offs, differentiating between traditional steel, advanced aluminum alloys, and emerging composite solutions. Crucially, the segmentation by Sales Channel—OEM versus Aftermarket—defines the dominant revenue streams, with the aftermarket consistently providing stable, high-margin revenue due to necessary cyclical replacements.

Further granular analysis considers segmentation by End-User, such as heavy-duty transportation, light passenger applications, and high-performance racing, each demanding specific component tolerances and characteristics. Geographic segmentation is vital, reflecting the stark contrast between the mature, declining manual transmission markets of Western Europe and North America and the robust, growing manual transmission markets of Asia Pacific. Understanding these segments is crucial for manufacturers to tailor their product offerings, distribution strategies, and pricing models to maximize market penetration and profitability across diverse global operating environments.

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (LCVs, HCVs, Buses)

- By Material:

- Steel-Based Kits

- Aluminum-Based Kits

- Composite/Hybrid Kits

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Component:

- Pedal Assembly

- Master Cylinder

- Slave Cylinder

- Linkages and Brackets

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Clutch Pedal Kit Market

The value chain for the Clutch Pedal Kit Market begins with upstream activities involving the sourcing and processing of raw materials, primarily specialized steel alloys, high-grade aluminum, and precision-engineered plastics and rubber seals. Key upstream suppliers include metal foundries, forging specialists, and hydraulic component manufacturers. Critical activities at this stage focus on ensuring material quality, dimensional accuracy, and compliance with automotive standards (e.g., ISO/TS 16949). Manufacturers often maintain long-term relationships with a limited number of specialized material suppliers to ensure consistency and cost-efficiency, mitigating risks associated with supply volatility and geopolitical factors affecting commodity prices.

The midstream phase involves the core manufacturing process, encompassing casting, stamping, machining, heat treatment, surface finishing, and assembly. Tier 1 and Tier 2 suppliers focus on highly automated assembly lines utilizing robotic systems and stringent quality control protocols. Direct distribution involves supplying finished clutch pedal kits directly to OEMs on a just-in-time (JIT) basis for integration into new vehicle production lines. This requires seamless logistics and strict adherence to OEM production schedules. Indirect distribution involves selling products through authorized distributors, wholesalers, and specialized aftermarket retailers who cater to repair shops, service garages, and individual consumers seeking replacement or upgrade parts.

Downstream activities center on reaching the final customer. For the OEM channel, the kit becomes part of the new vehicle purchase. In the aftermarket, the distribution channel is significantly more complex, involving global networks of independent distributors, national auto parts chains, online e-commerce platforms, and specialized performance shops. Direct channels, through company-owned service centers, also play a role but are less dominant than indirect retail networks. The efficiency of this downstream segment relies heavily on effective inventory management, cataloging accuracy, and responsive fulfillment capabilities, particularly given the thousands of vehicle models and years requiring specific clutch kit configurations.

Clutch Pedal Kit Market Potential Customers

The primary consumers and end-users of Clutch Pedal Kits fall into two major categories: vehicle manufacturers and the expansive global network of vehicle owners and professional maintenance providers. Original Equipment Manufacturers (OEMs), such as Ford, Volkswagen, Tata Motors, and Toyota, represent the largest volume buyers, integrating these kits directly into manual transmission vehicles produced on their assembly lines. These customers demand strict quality control, high volume capabilities, and collaborative R&D efforts to ensure integration with new vehicle platforms and safety specifications. OEM demand is highly sensitive to overall vehicle production output and shifts in consumer preference towards transmission types.

The second major group comprises the aftermarket segment, which includes independent automotive repair garages, authorized service centers, specialized performance tuning shops, fleet maintenance operators, and individual DIY enthusiasts. Fleet operators, managing large numbers of commercial vehicles (trucks, buses), are critical potential customers due to the high stress placed on clutch systems in heavy-duty applications, leading to predictable replacement cycles. The aftermarket is driven by the sheer size and age of the global vehicle parc, necessitating replacement kits due to routine wear, failure, or planned performance upgrades. This customer base prioritizes durability, availability, and competitive pricing, often preferring globally recognized brands known for reliability.

Furthermore, emerging markets present a significant customer base due to the socio-economic preference for manual transmission vehicles, often favored for their lower purchase price, ease of maintenance, and perceived robustness in challenging road conditions. In regions like Southeast Asia, India, and parts of Africa, the density of manual transmission vehicles ensures a perpetually strong demand base for both OEM supply and replacement parts. Manufacturers strategically target distributors in these high-growth regions to ensure maximum retail shelf presence and rapid fulfillment capability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BorgWarner Inc., Schaeffler AG, ZF Friedrichshafen AG, Valeo S.A., Exedy Corporation, Continental AG, Aisin Corporation, FTE Automotive, Helix Autosport, Tilton Engineering, SPEC Clutch, Sachs Performance, Mantic Clutch, Luk, Blueprint. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clutch Pedal Kit Market Key Technology Landscape

The technology landscape in the Clutch Pedal Kit Market is evolving, albeit incrementally, focusing primarily on hydraulic system efficiency, weight reduction, and integration with modern electronic vehicle architecture. A major technological advancement is the widespread adoption of concentric slave cylinder (CSC) technology, which integrates the release bearing and slave cylinder into a single unit located inside the transmission bell housing. This design reduces complexity, improves clutch engagement smoothness, and minimizes pedal effort compared to traditional external slave cylinder configurations, thereby enhancing the overall driver experience and system reliability. Furthermore, polymer materials are increasingly replacing metal components in parts of the hydraulic system, offering corrosion resistance and reduced mass.

Material science innovation constitutes the second crucial pillar of technological advancement. Manufacturers are heavily investing in high-strength aluminum alloys and sophisticated carbon fiber-reinforced composites for the pedal arm and mounting brackets. These lightweight materials are essential for helping OEMs meet stringent corporate average fuel economy (CAFE) standards by minimizing unsprung mass. The integration of advanced sensor technology is also critical, particularly position sensors and force sensors embedded in the pedal assembly. These sensors provide vital input to the vehicle's Engine Control Unit (ECU) for functions such as engine start/stop systems, hill start assist, and cruise control disengagement, ensuring synchronization between mechanical input and electronic control systems.

Finally, manufacturing technologies, driven by concepts like Industry 4.0, are standardizing high-precision production. The use of advanced robotic welding, laser cutting, and precision machining ensures component conformity and tight tolerances, which are non-negotiable for critical safety components. Automated assembly and testing, often leveraging computer-aided design (CAD) and simulation tools, guarantee the functional integrity and longevity of the entire clutch pedal kit before it leaves the factory, setting high barriers to entry for smaller, less technologically advanced competitors.

Regional Highlights

Regional dynamics are critical determinants of demand and strategic focus within the Clutch Pedal Kit Market, reflecting diverse regulatory landscapes, consumer preferences, and economic development stages. The Asia Pacific (APAC) region stands out as the global powerhouse for both OEM production and high-volume aftermarket demand. Countries like India, China, and Indonesia have high population densities, resulting in massive vehicle production focused on affordable, manual transmission passenger cars and commercial vehicles. This reliance on manual transmissions, driven by cost sensitivity and historical preference, ensures that APAC will remain the fastest-growing and largest volume market throughout the forecast period, fueling extensive replacement cycles.

Europe and North America represent mature markets characterized by steady replacement demand and a focus on premium performance segments. In Europe, while manual transmission usage remains higher than in the U.S., the accelerated transition towards electric vehicles (EVs) and increasing adoption of advanced automatic transmissions pose a structural constraint on OEM growth for traditional clutch systems. Market growth here is largely sustained by the robust, high-value aftermarket sector and the specific demand from dedicated driving enthusiasts who favor manual control for performance vehicles. Strict emissions standards also necessitate lightweight and high-efficiency clutch hydraulic systems.

Latin America and the Middle East & Africa (MEA) are emerging regions exhibiting solid growth prospects, driven by expanding middle classes, infrastructure development, and increasing motorization rates. In these regions, manual vehicles are generally favored due to their perceived durability, lower acquisition costs, and easier field repairability. This sustains demand for durable, affordable clutch kits. However, market penetration in MEA can be fragmented and subject to political and economic instability, requiring suppliers to manage complex distribution networks and address challenges posed by counterfeit parts that undercut legitimate market pricing.

- Asia Pacific (APAC): Dominates the market due to high production volumes of manual transmission vehicles (especially in India and China) and a vast, rapidly growing vehicle parc creating consistent aftermarket demand.

- Europe: Characterized by strong high-performance and LCV aftermarket segments; OEM market constrained by rapid EV adoption and advanced automated transmission proliferation.

- North America: Market stability derived primarily from replacement cycles in light trucks and specialized enthusiast segments; overall demand trending downwards due to high automatic transmission preference.

- Latin America (LATAM): Growth driven by economic recovery and affordability constraints favoring manual transmission vehicle sales, leading to robust demand for standard, durable clutch kits.

- Middle East & Africa (MEA): Emerging market focused on durability and cost-effectiveness; growth potential tied to infrastructure expansion and increasing commercial fleet usage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clutch Pedal Kit Market.- BorgWarner Inc.

- Schaeffler AG

- ZF Friedrichshafen AG

- Valeo S.A.

- Exedy Corporation

- Continental AG

- Aisin Corporation

- FTE Automotive

- Helix Autosport

- Tilton Engineering

- SPEC Clutch

- Sachs Performance

- Mantic Clutch

- Luk

- Blueprint

- Wabco Holdings Inc. (now part of ZF)

- AISIN SEIKI Co., Ltd.

- Hella GmbH & Co. KGaA

- Denso Corporation

- Federal-Mogul Corporation (now part of Tenneco)

Frequently Asked Questions

Analyze common user questions about the Clutch Pedal Kit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the continued demand for Clutch Pedal Kits despite the rise of electric vehicles and automatic transmissions?

Demand is primarily sustained by the massive global installed base of manual transmission vehicles, particularly the vast and continually expanding vehicle parc in emerging markets like APAC and Latin America. This generates predictable, high-volume replacement demand in the stable aftermarket sector, offsetting declines in new OEM installations in developed regions.

How is the adoption of lightweight materials impacting the clutch pedal kit manufacturing process?

Lightweight materials such as aluminum alloys and composites are increasingly used to reduce the overall mass of the pedal assembly. This change aids vehicle manufacturers in meeting stringent fuel economy and emissions regulations while improving pedal feel and responsiveness. It necessitates advanced manufacturing techniques like precision casting and composites handling.

Which geographic region presents the most significant growth opportunity for clutch pedal kit manufacturers?

The Asia Pacific (APAC) region offers the most robust growth prospects. This is attributed to high population growth, increasing rates of motorization, and the sustained consumer preference for cost-effective manual transmission vehicles, ensuring a high volume of both OEM production and subsequent aftermarket maintenance requirements.

What role does hydraulic technology play in modern clutch pedal kits?

Modern kits overwhelmingly utilize hydraulic systems (master and slave cylinders) over purely mechanical linkages to reduce pedal effort, improve engagement consistency, and enhance modulation. Key technological trends include the integration of Concentric Slave Cylinders (CSCs) for improved packaging and system efficiency, and the use of corrosion-resistant polymer materials in hydraulic circuits.

Are Clutch Pedal Kits vulnerable to disruption from autonomous driving technology?

Traditional Clutch Pedal Kits are highly vulnerable in the long term, as fully autonomous vehicles are expected to utilize electric powertrains or sophisticated automatic transmissions that negate the need for a driver-operated clutch pedal. However, disruption is slow, and in the short-to-medium term, the integration of sensors into pedal assemblies ensures compatibility with ADAS and semi-autonomous features.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager