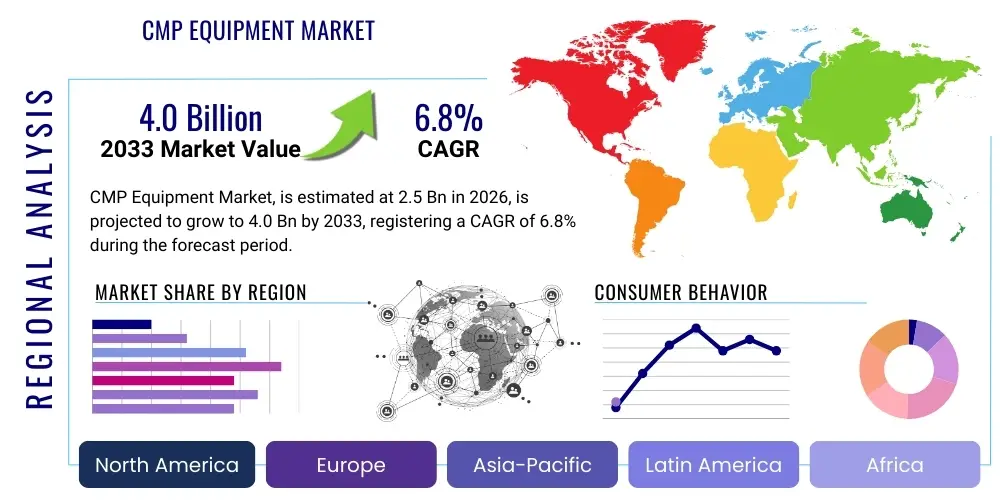

CMP Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441462 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

CMP Equipment Market Size

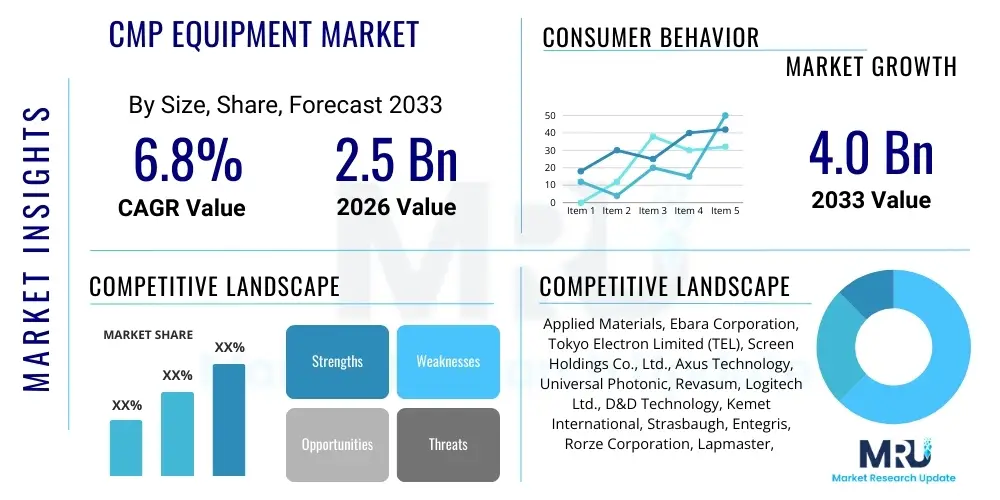

The CMP Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the relentless miniaturization of semiconductor features and the subsequent increase in demand for advanced planarization techniques crucial for multi-layered 3D integrated circuits (ICs) and memory devices like 3D NAND and advanced DRAM.

Market expansion is particularly sensitive to capital expenditure cycles within the global semiconductor fabrication industry. As leading foundry companies invest heavily in new fabrication plants (fabs) equipped for 5nm, 3nm, and even sub-3nm nodes, the requirement for high-precision, highly automated CMP systems escalates. These systems are essential for achieving the extremely tight topographical uniformity required for successful lithography steps, making CMP equipment a bottleneck technology whose sophistication dictates the pace of semiconductor advancement.

CMP Equipment Market introduction

The Chemical Mechanical Planarization (CMP) Equipment Market encompasses the specialized machinery used in semiconductor manufacturing to polish and smooth wafer surfaces during various stages of integrated circuit fabrication. CMP is a critical enabling technology that combines chemical etching and mechanical abrasion using abrasive slurries and rotating polishing pads to achieve nanometer-scale flatness across the entire wafer surface. This process is indispensable for preparing the surface prior to deposition or lithography, especially in complex manufacturing processes involving multiple metal layers, insulating layers, and high-aspect-ratio structures that necessitate ultra-precise topography control.

Key applications of CMP equipment include the planarization of Shallow Trench Isolation (STI), inter-layer dielectrics (ILD), tungsten plugs, and copper interconnects. The benefits derived from advanced CMP processes are manifold, including improved device yield, enhanced reliability, and the ability to manufacture high-performance, compact ICs. Driving factors for market growth include the escalating global demand for advanced consumer electronics, the widespread adoption of artificial intelligence and machine learning technologies requiring powerful data centers, and the pervasive rollout of 5G and 6G infrastructure, all of which mandate higher complexity and density in semiconductor chips.

The CMP equipment segment is characterized by high barriers to entry due to the complexity of the technology, the requirement for extensive intellectual property protection, and the stringent process qualification demanded by major semiconductor foundries. Continuous innovation in polishing head design, slurry delivery systems, endpoint detection mechanisms, and metrology integration are crucial for market participants to maintain a competitive edge. The shift towards exotic materials and challenging geometries, such as those found in silicon carbide (SiC) and gallium nitride (GaN) wafers for power electronics, further drives the need for next-generation CMP solutions capable of handling these specialized substrates with high throughput and minimal defectivity.

CMP Equipment Market Executive Summary

The CMP Equipment Market is poised for substantial growth, driven primarily by favorable business trends in advanced semiconductor manufacturing and significant regional investments in new fabrication capacity. Business trends indicate a strong market preference for highly automated, multi-station CMP systems capable of minimizing cross-contamination and maximizing throughput efficiency, directly addressing the scaling challenges associated with sub-5nm manufacturing nodes. Furthermore, there is an increasing strategic focus among leading equipment vendors on integrating advanced real-time metrology and sophisticated process control software directly into the CMP platform, transitioning from discrete measurement steps to closed-loop planarization control. This integration enhances process stability and reduces variability, critical requirements for advanced IC fabrication.

Regional trends highlight Asia Pacific (APAC), particularly China, Taiwan, and South Korea, as the epicenter of demand, accounting for the largest share of equipment procurement due to the heavy concentration of leading semiconductor foundries and memory manufacturers. While APAC maintains dominance, significant governmental incentives in North America and Europe, aimed at boosting domestic semiconductor supply chain resilience (e.g., the U.S. CHIPS Act and the EU Chips Act), are stimulating new fab construction and substantial capital equipment investments, diversifying the market geographically and offering new opportunities for vendors. This geopolitical push for regional self-sufficiency acts as a robust catalyst for equipment sales globally.

Segment trends underscore the increasing importance of segment-specific equipment tailored for emerging materials and applications. The advanced packaging segment, specifically utilizing hybrid bonding and fan-out wafer-level packaging (FOWLP), requires unique CMP capabilities focused on extreme uniformity for thin wafers. Moreover, the consumables segment, including polishing pads and slurries, exhibits stable growth, driven by the need for customized chemical formulations optimized for novel metallization schemes (like cobalt and ruthenium) and high-density logic structures. Technological advancements in pad conditioning and slurry recycling systems are gaining traction to improve operational costs and environmental sustainability within fabrication facilities.

AI Impact Analysis on CMP Equipment Market

Common user questions regarding AI's influence on the CMP Equipment Market revolve primarily around predictive maintenance capabilities, enhanced process control, and the acceleration of R&D cycles. Users frequently inquire about the feasibility of leveraging machine learning (ML) algorithms to predict equipment failures before they occur, optimizing tool utilization and minimizing costly downtime, which is particularly detrimental in a high-volume manufacturing environment. Another critical area of concern is whether AI can refine the complex, non-linear relationships between slurry composition, platen speed, pressure, and resulting wafer topography, moving beyond traditional empirical models to achieve near-perfect uniformity and zero defects consistently.

Based on this analysis, the key themes summarize the shift from reactive maintenance and static process recipes to intelligent, adaptive manufacturing. Users expect AI to integrate massive datasets generated by in-situ metrology sensors—pressure, temperature, acoustic emissions, and motor current—to create digital twins of the CMP process. The primary concern is data security, the high computational cost of deploying complex ML models in a manufacturing setting, and the necessity for highly specialized engineering talent to bridge the gap between data science and semiconductor process engineering. Expectations are high that AI will not only boost equipment efficiency (OEE) but also dramatically reduce the time required for tool qualification and new process introduction (NPI).

AI's influence is expected to dramatically reshape the service and support models offered by CMP equipment manufacturers, moving towards subscription-based predictive services. For instance, sophisticated reinforcement learning algorithms could be used to adjust polishing parameters dynamically based on real-time feedback, compensating for variations in consumables (pad wear, slurry dilution) or ambient factors (facility temperature shifts). This level of autonomous operation will be crucial for the successful volume production of next-generation devices where process windows are shrinking severely, requiring control precision that exceeds human capability or static automation systems.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to forecast potential component failures (e.g., bearings, pumps, motors), reducing unplanned downtime and improving overall equipment effectiveness (OEE).

- Optimized Process Control: Machine learning models are deployed to adjust polishing pressure, flow rates, and platen speed dynamically in real-time, compensating for process drift and achieving superior wafer uniformity.

- Automated Defect Classification: Computer vision and deep learning techniques accelerate the real-time identification and classification of subtle defects post-CMP, improving yield management.

- Digital Twin Simulation: Creation of high-fidelity virtual models of CMP tools and processes for rapid experimentation, recipe development, and scenario testing without interrupting production.

- Slurry and Pad Lifetime Optimization: AI monitors wear patterns and chemical degradation to maximize the useful life of expensive consumables, lowering operational costs per wafer.

DRO & Impact Forces Of CMP Equipment Market

The CMP Equipment Market is governed by powerful drivers related to technological scaling, stringent restraints imposed by high operational complexity and cost, unique opportunities arising from emerging materials, and strong impact forces stemming from global economic cycles and geopolitical tensions. The primary driver remains Moore's Law, compelling manufacturers to push density limits, which necessitates tighter control over interconnect resistance and capacitance, directly correlating to the demand for superior planarization. Furthermore, the proliferation of data centers and automotive electronics requires highly reliable chips, making the removal of topography critical defects paramount, thereby sustaining demand for advanced CMP solutions.

Restraints center on the immense complexity and high capital investment associated with these systems. CMP equipment represents a significant portion of a fab’s capital expenditure, limiting purchasing power during economic downturns. Operationally, CMP is known for being a high-cost-of-ownership process due to the expensive slurries, disposable polishing pads, and high maintenance requirements. Additionally, achieving planarization on novel materials like SiC or GaN presents significant technical hurdles, as standard CMP chemistries and mechanics often prove inadequate, demanding specialized, high-cost equipment and R&D investment that acts as a temporary restraint on immediate deployment.

Opportunities are abundant in the areas of advanced materials processing and heterogeneous integration. The growing market for wide-bandgap semiconductors (SiC and GaN) in electric vehicles and renewable energy infrastructure opens a lucrative niche for specialized CMP equipment designed for extremely hard materials. Moreover, the trend towards 3D integration and chip stacking requires ultra-flat surfaces for hybrid bonding techniques, demanding next-generation precision tools capable of planarizing stacked layers without damaging underlying structures. The development of environmentally friendly, less toxic, and recyclable slurry formulations also presents a significant market opportunity driven by increasing regulatory scrutiny and corporate sustainability goals.

The key impact forces dictating market dynamics include the cyclical nature of semiconductor capital spending (K-cycles), which heavily influences purchasing decisions, and the intense competitive rivalry among a handful of dominant equipment suppliers (oligopoly structure). Geopolitical forces, particularly concerning U.S.-China trade relations and export control regulations (e.g., restrictions on equipment capable of producing sub-14nm chips), significantly impact regional sales strategies and supply chain diversification efforts. The rapid pace of technological obsolescence in the semiconductor industry also exerts pressure, forcing equipment manufacturers to continuously invest in R&D to deliver next-generation performance quickly, ensuring that their current offerings meet the future demands of leading-edge fabs.

Segmentation Analysis

The CMP Equipment Market is meticulously segmented based on type, application, and process component, reflecting the specialized requirements of advanced semiconductor manufacturing. Understanding these segmentations is crucial for identifying targeted growth pockets and competitive landscapes. Segmentation by equipment type typically distinguishes between single-wafer and batch processing systems, with single-wafer systems dominating due to their flexibility, precision control, and reduced risk of cross-contamination—essential attributes for leading-edge nodes. Segmentation also covers specialized equipment for different wafer sizes (300mm being standard, with increasing research focus on 450mm, although currently slow).

Application-based segmentation divides the market by the specific material being planarized, such as oxide CMP, metal CMP (copper, tungsten), and STI CMP, each requiring distinct machine configurations and slurry handling capabilities. The fastest-growing application segments are those associated with advanced logic and memory manufacturing, which utilize complex multi-layer metalization schemes. Furthermore, segmentation by sales channel differentiates between direct sales to original equipment manufacturers (OEMs) and sales through distributors or service providers, reflecting the complex global sales ecosystem of high-value capital equipment.

Process component segmentation further dissects the market, focusing on critical subsystems like the polishing head, the fluid delivery system (slurry and conditioning chemical supply), and the integrated metrology tools. This fine-grained analysis is important because improvements in component technology, such as advanced in-situ metrology sensors for real-time film thickness measurement or novel pad conditioning systems, often drive the purchase of new or upgraded CMP platforms, influencing vendor selection and market share dynamics within the overall equipment category.

- By Type:

- Single-Wafer CMP Systems

- Batch CMP Systems

- By Application:

- Oxide Planarization

- Metal Planarization (Copper, Tungsten, Barrier Layers)

- Shallow Trench Isolation (STI) CMP

- Advanced Packaging Applications (e.g., Micro-bumping, Hybrid Bonding)

- Non-IC Applications (e.g., SiC, GaN, Optical Devices)

- By Wafer Size:

- 300mm

- 200mm and Below

- By Consumables Requirement (Influencing Equipment Design):

- Standard Slurry Delivery Systems

- Specialized Slurry Recirculation and Filtration Units

- Pad Conditioners and Lifespan Monitoring Systems

Value Chain Analysis For CMP Equipment Market

The CMP Equipment value chain begins with upstream material and component suppliers, primarily focusing on high-precision mechanical components, advanced sensor technology, and complex software solutions. Upstream activities involve specialized suppliers providing high-purity fluidics, robotics for wafer handling, sophisticated motion control systems, and high-quality fabrication materials for the tool structure itself. These suppliers must adhere to extremely tight tolerances and maintain ISO certifications, as the reliability of the CMP tool is directly linked to the quality of its components. The reliance on a limited number of specialized component providers introduces supply chain risks that equipment manufacturers must actively mitigate through dual-sourcing and strategic inventory management.

Midstream activities are dominated by the Original Equipment Manufacturers (OEMs) who design, assemble, integrate, and test the complex CMP systems. This stage is characterized by significant R&D investment, rigorous process engineering, and proprietary software development for recipe management and process control. The CMP OEMs focus heavily on tool qualification and collaborative development with leading semiconductor foundries (key customers) to ensure their equipment meets the demands of the next-generation process nodes. Strategic alliances and licensing agreements for critical intellectual property, especially relating to polishing head mechanics and endpoint detection, are defining features of this midstream segment.

Downstream activities involve the distribution, installation, service, and maintenance of the equipment in customer fabrication plants. Distribution channels are predominantly direct, given the high value, complexity, and customization required for CMP tools. Indirect channels, primarily through local agents or third-party service providers, are sometimes utilized for spare parts logistics and routine maintenance in geographically distant regions. Post-sale support, including software updates, process optimization consulting, and immediate access to spare parts, constitutes a critical revenue stream and competitive differentiator in the downstream market. The performance and responsiveness of the after-market service significantly influence future procurement decisions by the semiconductor fabs.

CMP Equipment Market Potential Customers

The potential customers and primary buyers of CMP equipment are concentrated within the global semiconductor manufacturing ecosystem, spanning various segments from leading-edge foundries to specialized power device manufacturers. The most significant customers are the major Integrated Device Manufacturers (IDMs) and pure-play semiconductor foundries, such as TSMC, Samsung, Intel, and GlobalFoundries. These entities operate high-volume fabrication plants that require dozens of CMP tools to support their complex logic and memory production processes, particularly at advanced nodes (7nm, 5nm, 3nm, and below), where CMP process steps multiply.

Another rapidly expanding customer segment includes memory manufacturers specializing in 3D NAND flash and advanced DRAM (e.g., Micron, SK Hynix). These companies are heavy consumers of CMP equipment due to the immense number of vertical layers that must be planarized during the complex fabrication of stacked memory structures. Achieving uniformity across these deep trenches and high-aspect-ratio structures places severe technical demands on the CMP tools, driving demand for specialized systems and high-performance consumables optimized for dielectric and tungsten planarization.

Furthermore, emerging potential customers include specialty semiconductor manufacturers focusing on power devices (SiC, GaN), Micro-Electro-Mechanical Systems (MEMS), and compound semiconductors. While these manufacturers require smaller volumes of equipment, their needs are highly specialized, often requiring unique handling capabilities and processes that deviate significantly from standard silicon CMP. This niche segment presents opportunities for vendors offering highly customizable and flexible CMP platforms. Government-backed research institutions and university cleanrooms also constitute a small but influential customer base for lower-volume R&D tools, driving early adoption of new CMP technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Ebara Corporation, Tokyo Electron Limited (TEL), Screen Holdings Co., Ltd., Axus Technology, Universal Photonic, Revasum, Logitech Ltd., D&D Technology, Kemet International, Strasbaugh, Entegris, Rorze Corporation, Lapmaster, CMP Advanced Technologies, CETC, Hubei Huajing, Ningbo Xinfu, ACM Research, DISCO Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CMP Equipment Market Key Technology Landscape

The technological landscape of the CMP equipment market is characterized by intense focus on precision, integration, and throughput efficiency, driven by the constraints of sub-10nm manufacturing. A core technological trend involves the shift from traditional fixed-abrasive pads to increasingly sophisticated polishing pads combined with advanced slurry chemistries. Modern CMP systems rely heavily on multi-zone pneumatic or hydrodynamic polishing heads that allow for precise control of pressure distribution across the wafer surface, effectively compensating for initial non-uniformities and minimizing edge-roll off, which is critical for maintaining high yields on large 300mm wafers.

A second crucial technology is in-situ metrology and endpoint detection. As CMP processes become shorter and more critical, real-time feedback is mandatory. State-of-the-art CMP tools integrate optical sensors (like interferometers or spectrophotometers) capable of measuring film thickness and removal rates during the polishing process, allowing for precise stopping at the target layer (endpoint). These advanced detection methods, often coupled with sophisticated data processing and AI algorithms, minimize over-polishing or under-polishing, which can be catastrophic to device functionality. The drive for improved endpoint accuracy is paramount, particularly for thin films and selective removal processes utilizing advanced barrier materials.

Furthermore, slurry management systems have seen significant technological evolution. Contemporary CMP tools feature highly sophisticated closed-loop slurry delivery and temperature control systems to ensure consistent abrasive particle size and chemical concentration, directly impacting polishing consistency and defectivity. There is a growing focus on modular design, enabling rapid changeover between different slurry types required for sequential processing steps (e.g., switching from copper slurry to barrier slurry) without cross-contamination. Innovations in pad conditioning technology, including acoustic monitoring of diamond conditioner wear and automated cleaning cycles, further contribute to maintaining optimal process stability and extending consumable life, which is essential for reducing the total cost of ownership in high-volume production environments.

The integration of advanced automation and robotics is also defining the current technological generation of CMP equipment. These systems feature fully automated wafer handling, transfer, and cleaning modules, adhering to stringent cleanroom standards. The trend is moving towards modular, scalable platforms that can be easily configured for different applications or upgraded with new polishing stations or metrology modules as process requirements evolve. Finally, the development of specialized CMP tools for wide bandgap materials (SiC/GaN) represents a distinct technological path, focusing on high material removal rates while maintaining sub-nanometer surface roughness, often requiring highly rigid mechanical structures and specialized conditioning techniques optimized for extremely hard substrates.

Regional Highlights

- Asia Pacific (APAC): APAC represents the cornerstone of the CMP Equipment Market, driven by housing the majority of the world’s most advanced semiconductor fabrication facilities, particularly in Taiwan (TSMC), South Korea (Samsung, SK Hynix), and increasingly, Mainland China. The market dominance of APAC stems from sustained, aggressive capital expenditure cycles by regional memory and foundry giants aiming to stay ahead in the global technology race. China, propelled by significant state investment aimed at achieving semiconductor self-sufficiency, is a high-growth region for equipment deployment, often prioritizing local suppliers alongside established global leaders. The concentration of R&D and high-volume manufacturing ensures that APAC will remain the largest consumer and influencer of CMP equipment technology adoption throughout the forecast period.

- North America: The North American market is characterized by high technological sophistication and a resurgence in domestic manufacturing capacity, primarily fueled by supportive government legislation such as the CHIPS and Science Act. While not the largest market by volume, North America is a critical hub for CMP R&D and the headquarters for several key equipment manufacturers (e.g., Applied Materials). Current investments are focused on building new mega-fabs for leading-edge logic production (e.g., Arizona, Ohio), creating substantial, imminent demand for highly advanced 300mm CMP systems. The region also leads in specialized applications, including aerospace, defense, and power electronics (SiC/GaN), driving demand for niche planarization solutions.

- Europe: The European CMP equipment market is smaller but strategically important, focused on automotive semiconductors, power electronics, and specialized industrial applications. Government initiatives under the EU Chips Act are designed to dramatically increase chip production capacity, specifically targeting 2nm nodes and specialty technologies. This investment is leading to new fab construction and expansions (e.g., in Germany and France), which will significantly boost regional equipment procurement over the medium term. Europe excels in R&D collaboration between equipment vendors and end-users, focusing on sustainable manufacturing processes and highly localized, high-value specialty IC production.

- Latin America, Middle East, and Africa (LAMEA): The LAMEA region currently holds the smallest market share but presents future potential. Demand is sporadic, mainly linked to smaller specialty manufacturing operations, packaging facilities, or academic research centers. Growth in this region is dependent on foreign direct investment into local fabrication or assembly operations. For instance, initiatives in certain Gulf nations to diversify their economies through high-tech manufacturing may stimulate localized demand, but the overall contribution to the global CMP equipment market remains marginal compared to the established fabrication hubs in APAC, North America, and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CMP Equipment Market.- Applied Materials

- Ebara Corporation

- Tokyo Electron Limited (TEL)

- Screen Holdings Co., Ltd.

- Axus Technology

- Universal Photonic

- Revasum

- Logitech Ltd.

- D&D Technology

- Kemet International

- Strasbaugh

- Entegris (Consumables and Integration)

- Rorze Corporation

- Lapmaster

- CMP Advanced Technologies

- CETC (China Electronics Technology Group Corporation)

- Hubei Huajing

- Ningbo Xinfu

- ACM Research

- DISCO Corporation (Grinding and Polishing)

Frequently Asked Questions

Analyze common user questions about the CMP Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand spike for CMP equipment?

The primary driver is the transition to sub-5nm semiconductor nodes and the exponential growth of 3D integration technologies, such as 3D NAND and FinFET/GAA structures. These advanced structures require significantly more CMP steps (up to 30 or more per wafer) and ultra-high precision planarization to enable subsequent lithography and deposition processes, directly increasing the installed base of advanced CMP tools globally.

How is the adoption of SiC and GaN wafers impacting CMP equipment design?

SiC (Silicon Carbide) and GaN (Gallium Nitride) wafers, used for high-power and high-frequency applications, are significantly harder than silicon. This requires specialized CMP equipment featuring highly rigid mechanical systems, specialized diamond pad conditioners, and tailored high-removal-rate slurries to achieve the necessary surface finish without inducing crystalline damage, shifting the technological focus toward hard material processing capabilities.

What role does integrated metrology play in modern CMP systems?

Integrated metrology is critical for maximizing yield and precision. Modern CMP systems incorporate in-situ sensors (e.g., optical profilers, film thickness monitors) that provide real-time data on material removal rates and film thickness during the polishing process. This enables dynamic adjustment of process parameters and highly accurate endpoint detection, essential for managing the tight tolerances of advanced manufacturing nodes.

Which geographical region is currently leading CMP equipment investment?

Asia Pacific (APAC), particularly the markets of Taiwan, South Korea, and Mainland China, consistently leads in CMP equipment investment. This dominance is due to the heavy concentration of the world’s largest semiconductor foundries and memory manufacturers who continuously invest massive capital into expanding and upgrading their fabrication capabilities to support leading-edge technology nodes.

What are the main challenges facing CMP equipment manufacturers?

Key challenges include managing the escalating cost of ownership (CoO) for end-users, maintaining technological leadership in endpoint detection for increasingly complex thin films, mitigating supply chain vulnerabilities for specialized components, and adhering to strict defectivity requirements (zero-defect goal) while simultaneously maximizing equipment throughput and utilization in high-volume production environments.

The imperative for manufacturers to deliver defect-free wafers at the nanometer scale has cemented CMP equipment as one of the most technologically challenging and strategically important segments of the semiconductor capital equipment market. Future growth is inextricably linked to successful commercialization of emerging technologies such as Gate-All-Around (GAA) transistors, which introduce new planarization requirements, and the continued robust demand for advanced interconnect materials like ruthenium and cobalt, necessitating further innovation in slurry and process chemistry optimization. The market continues to evolve towards fully autonomous, AI-driven process control to minimize variability, ensuring process reliability remains paramount as feature sizes approach physical limits. Geopolitical risks are encouraging diversified manufacturing footprints, creating simultaneous demand surges across multiple continents, shifting market dynamics slightly but maintaining strong overall growth momentum fueled by digital transformation globally. The specialized nature of the equipment ensures that only a few key players dominate, necessitating continuous, substantial R&D expenditure to secure market share and influence future semiconductor roadmap planning.

In summary, the CMP equipment market is defined by high technological intensity, complex service requirements, and critical importance to semiconductor advancement. The interplay of drivers—miniaturization, 3D integration, and emerging materials—against restraints—high capital cost, technical complexity, and supply chain fragility—creates a dynamic landscape. Successful navigation of this market requires vendors to focus on enhanced automation, predictive maintenance powered by AI, and developing highly specialized solutions for next-generation materials like SiC, ensuring their platforms are future-proofed against the relentless scaling demands of the semiconductor industry. The forecast period anticipates strong revenue generation, underpinned by global government efforts to solidify regional semiconductor supply chains and continued private sector investment in advanced foundry capacity, particularly in the APAC region where the majority of leading-edge production capacity resides.

Strategic positioning within this highly specialized sector requires equipment manufacturers to go beyond just hardware performance, focusing heavily on software integration, data analytics capabilities, and global service responsiveness. As the number of critical CMP steps increases per device generation, the overall reliability (MTBF - Mean Time Between Failure) and the availability of the tools become non-negotiable operational metrics. The convergence of hardware precision and intelligent software control is defining the competitive edge, enabling customers to achieve unprecedented levels of planarization uniformity necessary for the successful volume manufacturing of the most complex integrated circuits currently being designed.

The CMP market is also seeing tangential growth influenced by the expansion of the equipment maintenance and refurbishment sector. Given the high initial capital investment, many fabs are electing to extend the operational life of existing 200mm and 300mm tools through extensive overhauls and technology upgrades rather than immediate replacement. This trend provides a steady revenue stream for equipment OEMs and specialized third-party service providers focused on modernizing legacy platforms with updated metrology and control systems, ensuring they can still handle less demanding, but high-volume, legacy node production or specialized SiC/GaN processes. This aftermarket ecosystem adds another layer of complexity and opportunity within the overall market structure.

Furthermore, the intensifying global focus on environmental, social, and governance (ESG) factors is beginning to influence CMP equipment design. The high consumption of deionized water and chemically aggressive slurries in the CMP process presents a significant environmental challenge. Consequently, future equipment designs are trending toward systems that incorporate enhanced water recycling capabilities, reduced slurry consumption through advanced dispensing techniques, and better handling of process waste streams. Equipment manufacturers who can demonstrably improve the environmental footprint of their tools will gain a crucial competitive advantage, particularly when selling to large multinational semiconductor companies committed to stringent sustainability targets. Innovation in green CMP solutions represents a burgeoning opportunity within the market.

Technological advancement is not limited solely to the polishing mechanics; significant innovation is occurring in the domain of defectivity reduction and contamination control. Given that particles as small as a few nanometers can cause catastrophic device failure at advanced nodes, the post-CMP cleaning process is almost as critical as the planarization step itself. Modern CMP tools integrate sophisticated megasonic cleaning baths and advanced chemical rinse stations, often proprietary to the equipment vendor, to ensure wafers emerge pristine. The ability of an OEM to minimize defects generated during the polishing step and maximize cleaning efficiency afterward is a key determinant of market success and customer preference in the fiercely competitive foundry space.

The cyclical nature of the semiconductor industry, characterized by periods of aggressive capital spending followed by pauses, dictates the near-term procurement cycles for CMP equipment. Currently, the market is benefitting from a major investment wave driven by global capacity expansion efforts, suggesting robust sales figures in the immediate forecast years. However, equipment vendors must remain agile, utilizing flexible production and inventory management to effectively navigate the inevitable cyclical downturns while continuing essential long-term R&D investment necessary to meet the demanding requirements of future 1nm and sub-1nm nodes, securing their positions as technology leaders.

Finally, intellectual property (IP) is a dominant force shaping the competitive dynamics. Leading vendors hold vast portfolios of patents covering slurry delivery, polishing head design, pad conditioning, and endpoint detection algorithms. New entrants face significant hurdles in developing competing technology without infringing on established IP. This concentration of specialized knowledge and patented technology acts as a strong barrier to entry, reinforcing the oligopolistic structure of the CMP equipment market, where technological superiority and IP ownership are paramount to securing long-term customer relationships and market dominance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager