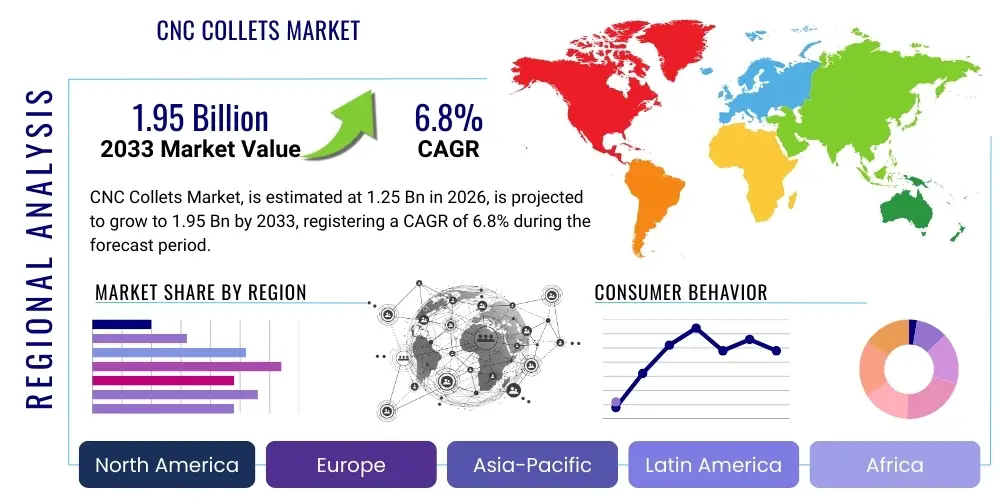

CNC Collets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441551 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

CNC Collets Market Size

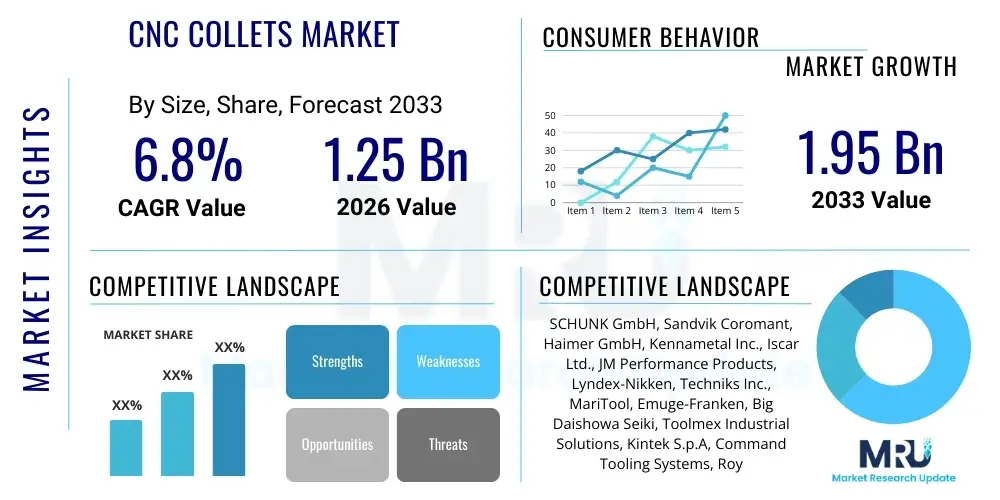

The CNC Collets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.95 Billion by the end of the forecast period in 2033.

CNC Collets Market introduction

The CNC Collets Market encompasses precision clamping devices essential for securely holding workpieces or cutting tools in Computer Numerical Control (CNC) machine tools, including lathes, mills, and routers. These components are critical for maintaining the accuracy, rigidity, and stability required during high-speed machining operations. CNC collets, typically manufactured from high-grade spring steel or specialty alloys, ensure minimal run-out, which directly impacts the quality and precision of the final machined product. Their standardized designs, such as ER (Elastic Range), TG (Tirger Grip), 5C, and R8, facilitate easy interchangeability and broad application across various demanding industrial sectors globally.

Key applications of CNC collets span across high-precision manufacturing environments, including the fabrication of components for the aerospace, automotive, medical device production, electronics, and general job shops. The market growth is intrinsically linked to the increasing globalization of manufacturing and the widespread adoption of automated and multi-axis CNC machinery that requires highly reliable, repeatable tool holding solutions. Collets provide superior concentricity and clamping uniformity compared to traditional chucks in many high-tolerance applications, proving vital for achieving the extremely tight dimensional specifications required in modern engineering and materials processing.

The primary benefits driving the market expansion include enhanced machining precision, substantial reduction in tool changeover time, maximized spindle speed capability without compromising safety, and superior vibration dampening characteristics. Furthermore, the modular nature of advanced collet systems allows manufacturing operations to quickly adapt tooling for diverse production tasks, thereby maximizing machine utilization and overall operational productivity. Continuous investment in material science and advanced surface treatments for collets, aimed at significantly improving wear resistance, thermal stability, and grip strength, further solidifies their indispensable role in the modern CNC tooling ecosystem for efficient, high-volume production lines.

CNC Collets Market Executive Summary

The CNC Collets Market is experiencing vigorous expansion, primarily fueled by the accelerating global transition towards smart manufacturing philosophies and Industry 4.0 integration, demanding tooling components that ensure ultra-high precision within highly automated systems. Key business trends highlight a concerted effort toward the development of application-specific collets designed to handle advanced, difficult-to-machine materials such as titanium alloys and composites, coupled with the integration of smart features like dynamic balancing optimization and thermal monitoring capabilities to support next-generation ultra-high-speed machining centers. Leading market participants are strategically focusing on fortifying their distribution networks, particularly targeting rapidly industrializing economies in Asia, and committing substantial resources to material innovation aimed at delivering collets with extended operational lifecycles and significantly improved run-out accuracy, specifically catering to the demanding needs of the aerospace and medical instrumentation segments.

From a regional perspective, the Asia Pacific (APAC) region stands out definitively as both the largest revenue contributor and the most rapidly expanding market globally. This exponential growth is powerfully sustained by massive infrastructural investments in sophisticated manufacturing capabilities across sectors such as electric vehicle production and consumer electronics in countries including China, India, and Vietnam. In contrast, mature markets such as North America and Europe retain substantial market share, driven by necessary replacement cycles of legacy CNC equipment and the unwavering demand for highly specialized, premium collet systems that comply with the rigorous quality standards mandated by the aerospace and high-end defense industries. Latin America and the Middle East and Africa (MEA) are characterized as emerging markets, showing consistent, moderate growth driven fundamentally by foundational industrial infrastructure build-out and localized resource processing projects.

Analyzing segment trends reveals that the ER Collets segment maintains a dominant position globally due to its unmatched versatility, high degree of standardization, and pervasive utility across both milling and turning processes. In terms of material composition, while high-grade spring steel remains the industry standard, there is a pronounced and accelerating demand for specialized carbide-reinforced and advanced coated collets. This shift reflects the manufacturing sector's imperative need for tool holding solutions capable of reliably withstanding increasingly high thermal loads and highly abrasive operational environments. End-user demand profiling indicates heavy consumption concentration within the automotive industry and general machinery manufacturing sectors, which require robust volumes of standardized tooling, whereas the technologically advanced aerospace sector drives the demand for highly customized, ultra-precise tool holder systems.

AI Impact Analysis on CNC Collets Market

Analysis of common user queries related to AI and the CNC Collets Market reveals a strong interest in leveraging data analytics and machine learning to overcome traditional tooling challenges. Users are consistently asking about the implementation of AI for predictive maintenance to anticipate collet failure, methodologies for optimizing tool life through automated operational adjustments, and integrating collet performance metrics into wider Industrial Internet of Things (IIoT) platforms. The central concerns revolve around maximizing machine uptime, ensuring consistently high component quality by proactively mitigating run-out, and achieving efficiency in inventory and replacement management. Users anticipate AI will provide unprecedented, actionable insights into complex phenomena like thermal deformation, material fatigue, and subtle clamping force degradation, automating decisions currently left to experienced human operators.

The core expectation is that AI will transform collets from simple mechanical components into smart, data-generating assets within the digital factory. By analyzing data streams—including acoustics, vibration signatures, power consumption, and thermal images—AI systems can detect minute changes indicative of impending collet wear or failure long before they impact component quality. This shift towards data-driven maintenance and performance optimization significantly reduces reliance on fixed maintenance schedules, moving towards highly efficient condition-based replacement. This optimization not only lowers operational expenditure by maximizing tool life but also dramatically elevates the consistency and precision of the machining process.

- AI-driven predictive maintenance utilizes real-time sensor data (e.g., vibration, acoustic emission) associated with the tool holder to precisely forecast the end-of-useful life for collets, thereby preventing catastrophic failures and minimizing unscheduled machine downtime.

- Machine Learning algorithms process vast datasets of cutting parameters (feed rate, spindle speed, material hardness) to generate optimal operational recommendations, ensuring the selected collet type and clamping force maximize run-out performance and tool utilization.

- Integration with smart monitoring systems allows AI to detect subtle deviations in clamping pressure or thermal expansion, automatically triggering adjustments or warnings to maintain consistent precision and surface integrity.

- AI enhances automated quality inspection by analyzing high-resolution images of used collets for signs of microscopic cracks, slot deformation, or surface degradation, far surpassing the speed and objectivity of traditional visual inspection methods.

- Generative design and optimization software, leveraging AI, explores novel collet geometries and material distribution patterns to enhance rigidity, reduce mass for high-speed balancing, and improve thermal dissipation properties.

- Supply chain logistics benefit from ML models that analyze production forecasting and historical consumption rates to optimize the inventory levels and procurement cycles for specific, high-demand collet sizes and types.

- AI systems facilitate closed-loop process control by correlating collet performance metrics directly with resulting workpiece quality data, allowing manufacturers to rapidly identify and correct tooling deficiencies in real-time.

DRO & Impact Forces Of CNC Collets Market

The operational dynamics of the CNC Collets Market are intensely influenced by an intricate web of demand-side drivers, supply constraints, technological advancement opportunities, and macro-economic factors. The key drivers maintaining and accelerating market expansion include the sustained, global increase in capital expenditure on high-performance CNC machinery, the non-negotiable demand for extremely high-precision components across strategically vital industrial sectors such as aerospace, medical implants, and advanced electronics, and the necessity imposed by modern high-speed machining environments for tooling that guarantees minimal vibration and absolute stability. Furthermore, the inherent nature of collets as consumables, subject to wear and tear, ensures a continuous and stable demand base through necessary replacement cycles.

Conversely, the market faces several significant and structural restraints. A primary concern is the inherent vulnerability and complexity within the specialized raw material supply chains, particularly concerning high-grade spring steels, high-alloy materials, and advanced coating precursors, leading to persistent price volatility, extended lead times, and increased complexity in manufacturing logistics. An additional restraint is the pervasive threat posed by the market penetration of low-cost, substandard collet alternatives, primarily originating from certain Asian regions, which places intense downward pressure on pricing, forcing premium manufacturers to continually justify their higher cost through demonstrable superiority in run-out accuracy and longevity. The need to maintain extremely tight tolerances, often below 3 µm TIR (Total Indicated Run-out), necessitates substantial, continuous investment in R&D and precision grinding equipment, acting as a considerable barrier to entry for smaller or less technologically advanced firms.

Substantial growth opportunities are concentrated in the realm of technological innovation and market penetration. The most significant opportunity lies in pioneering and commercializing the next generation of "smart collets," which incorporate integrated micro-sensor technology for real-time performance diagnostics—a development perfectly aligned with the Industry 4.0 evolution. Further opportunities exist in the specialized application of advanced surface modification techniques, such as proprietary ceramic or DLC coatings, designed to dramatically boost wear resistance, improve the coefficient of friction, and enhance gripping reliability in high-temperature or dry machining applications. The broader manufacturing focus on environmental sustainability and energy efficiency also creates pathways for developing ultra-lightweight, high-stiffness collet designs, which minimize spindle inertia and reduce power consumption, presenting compelling differentiation strategies for forward-thinking market leaders.

The primary impact forces shaping competitive strategy and market trajectory are multifaceted. Technological forces, particularly the rapid proliferation of 5-axis and high-speed milling technologies, constantly push the boundary on required collet precision and dynamic balance standards. Economic forces, tied to global manufacturing output and cyclical capital equipment purchasing, directly influence demand volumes. Regulatory forces, stemming from quality assurance standards in sectors like aerospace (AS9100) and medical devices (ISO 13485), mandate the use of traceable, high-quality tooling, significantly benefiting established premium brands. Finally, competitive forces, marked by the ongoing tension between price competition (driven by mass producers) and quality differentiation (driven by specialists), dictate market segmentation and profit margins, forcing companies to specialize either in high-volume, low-cost standardization or highly engineered, high-margin solutions.

Segmentation Analysis

The CNC Collets Market is rigorously segmented across multiple criteria including Type, Material, Application, and End-Use Industry, enabling a granular understanding of diverse market needs and purchasing behaviors. This segmentation analysis is vital for identifying concentrated pockets of demand, informing product development roadmaps, and optimizing regional commercial strategies. The structural differentiation in segmentation reflects the wide range of operational requirements, from generalized production environments demanding flexible, easily interchangeable tooling to specialized sectors demanding absolute rigidity and thermal control for complex, high-tolerance tasks.

By Type, the market is primarily divided into generic, standardized mechanical systems like ER, TG, and 5C, which account for the largest volume, and specialized, high-performance systems such as hydraulic, mechanical locking, and thermal shrink-fit collets, which command premium pricing due to their exceptional run-out performance and superior dampening capabilities. The Material segmentation separates standard high-fatigue spring steel collets from advanced alternatives featuring high alloy compositions (e.g., chromium-vanadium) or supplementary reinforcements such as sintered carbide inserts, necessary for working with exceptionally hard or abrasive workpiece materials. Application segmentation distinguishes between the distinct operational demands of milling (high lateral forces), turning (consistent clamping), drilling (deep hole precision), and specialized grinding processes.

- By Type:

- ER Collets (Elastic Range)

- TG Collets (Tirges Grip)

- R8 Collets

- 5C Collets

- DA/SC Collets (Double Angle/Straight Collets)

- Hydraulic Tool Holder Collets

- Shrink Fit Tooling Systems

- By Material:

- High-Grade Spring Steel (Standard Alloy)

- Advanced Alloy Steel (High Chromium/Vanadium Content)

- Carbide Reinforced or Inserted Collets

- Stainless Steel (for specialized clean room/medical applications)

- By Application:

- Milling and High-Speed Machining Centers

- Turning and Lathe Operations

- Drilling and Reaming Applications

- Grinding, Polishing, and Finishing Operations

- By End-Use Industry:

- Automotive Manufacturing (Component and EV production)

- Aerospace and Defense (Turbine, Airframe, and structural components)

- Medical Device Manufacturing (Implants and surgical instruments)

- Electronics and Semiconductor Fabrication (Micro-machining)

- General Machinery and Fabrication Shops

- Die & Mold Production

Value Chain Analysis For CNC Collets Market

The value chain initiates with critical upstream activities focused on the procurement of high-specification raw materials, primarily specialized high-carbon spring steels (e.g., 65Mn or proprietary alloys) and other high-strength steels. Material suppliers undergo rigorous vetting to ensure chemical composition consistency and appropriate material properties (hardness, elasticity) required for subsequent heat treatment. The manufacturing stage is highly technology-intensive, involving precision turning, multi-stage grinding (often employing cryogenic grinding for improved material structure), vacuum heat treatment essential for achieving the required spring memory, slot cutting, and final surface treatment applications. Quality control at this stage is absolutely crucial, focusing on guaranteeing concentricity (TIR) and maximum gripping force repeatability.

The distribution segment effectively links the highly focused manufacturing base with the geographically dispersed end-users. While large-scale collet manufacturers maintain direct sales teams for key original equipment manufacturers (OEMs) and major tier-one suppliers (particularly in automotive and aerospace), the majority of sales transactions utilize extensive indirect distribution networks. These channels include industrial supply giants, localized tooling specialists, and e-commerce platforms. These distributors play a vital role by offering immediate localized stock availability, managing fragmented demand from SMEs (Small and Medium Enterprises), providing technical application support, and facilitating rapid global logistics, particularly crucial for time-sensitive replacement demand.

Downstream activities center on product implementation, application engineering, and ongoing lifecycle support provided to the end-users. The performance and longevity of the collet are continually assessed in the manufacturing environment. Post-sale services, including technical training on proper tightening procedures, assistance with tool holder balancing, and rapid replacement services, significantly influence customer loyalty and future purchasing decisions. Furthermore, successful collet manufacturers often engage in proactive collaboration with CNC machine tool builders to ensure their tool holders and collet systems are optimally engineered to handle the maximum speeds, loads, and coolant pressures specified for the latest generation of machine spindles, thereby securing preferred vendor status and increasing market penetration.

CNC Collets Market Potential Customers

The customer base for CNC Collets is defined by its universal need for repeatable, high-precision component clamping in automated operations. The largest purchasing segment remains the Automotive Manufacturing industry, which demands standardized, robust collets in immense volumes for critical components ranging from powertrain elements to EV battery mounting systems. These customers prioritize cost-effective durability, immediate availability, and adherence to established industry standards like ER and 5C systems, often negotiating long-term contracts for standardized tooling supply with multiple vendors to mitigate risk and ensure supply consistency across global facilities.

The Aerospace and Defense sectors constitute the most technologically demanding customer segment. Their purchasing criteria heavily focus on absolute concentricity, superior material traceability, and guaranteed thermal stability, typically requiring premium hydraulic and shrink-fit collets capable of holding expensive, complex workpieces or cutting tools with zero slippage during high-stress, prolonged machining operations involving exotic aerospace alloys (e.g., Inconel, Titanium). These buyers mandate extremely low run-out specifications and often require specialized certifications, driving demand for the highest-end, customized tooling solutions available globally.

Another crucial customer group is the Medical Device Manufacturing sector, which relies on micro-machining and precision tooling for implants, prosthetic joints, and surgical instruments. Customers here prioritize flawless surface finish and dimensional accuracy above all else, requiring ultra-precision collets that are often stainless steel or specially coated for clean-room compatibility. General engineering job shops and fabrication facilities form the fragmented backbone of the market, requiring a versatile inventory of standard ER collets to handle diverse daily tasks. These SMEs rely heavily on industrial distributors for localized inventory, technical troubleshooting, and a balance of performance and competitive pricing, making distribution efficiency a key factor for reaching this segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SCHUNK GmbH, Sandvik Coromant, Haimer GmbH, Kennametal Inc., Iscar Ltd., JM Performance Products, Lyndex-Nikken, Techniks Inc., MariTool, Emuge-Franken, Big Daishowa Seiki, Toolmex Industrial Solutions, Kintek S.p.A, Command Tooling Systems, Royal Products, Hardinge Inc., WTO GmbH, Tungaloy Corporation, Mapal Präzisionswerkzeuge Dr. Kress KG, Guhring KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CNC Collets Market Key Technology Landscape

The technological evolution within the CNC Collets Market is characterized by a significant transition toward integrated high-performance tool holding systems necessary to keep pace with modern high-axis and ultra-high-speed machining centers. A foundational shift involves the widespread adoption and refinement of non-mechanical clamping technologies, specifically hydraulic and thermal shrink-fit collet systems. Hydraulic collets utilize a pressurized fluid chamber to distribute clamping force uniformly around the tool shank, which inherently maximizes vibration dampening and achieves run-out figures consistently below 3 micrometers, crucial for ensuring long tool life and flawless surface finishes in demanding milling operations. Similarly, shrink-fit technology offers arguably the highest clamping force and rigidity through thermal expansion, making it the preferred method for demanding applications requiring rotational speeds exceeding 30,000 RPM due to superior balance characteristics.

Material science and surface engineering represent another critical technological frontier. Manufacturers are actively investing in proprietary spring steel alloys featuring optimized microstructures and enhanced fatigue limits, allowing collets to withstand hundreds of thousands of clamping cycles without permanent deformation or loss of spring action. Furthermore, the application of advanced PVD (Physical Vapor Deposition) and PACVD (Plasma Assisted Chemical Vapor Deposition) coatings is becoming standard in the premium segment. Coatings such as Diamond-Like Carbon (DLC), specialized titanium aluminum nitride (TiAlN), and proprietary ceramic nanocomposites drastically improve the collets' resistance to wear, heat, and corrosion from aggressive coolants. These coatings also improve the grip friction between the collet and tool shank, preventing pull-out during aggressive heavy-duty cutting operations and maintaining precision.

The most forward-looking technological development is the implementation of smart tooling features, integral to the overarching goals of Industry 4.0. This involves embedding highly miniaturized sensors, such as MEMS accelerometers or thermal arrays, directly into the collet or tool holder body. These integrated sensors continuously measure operational parameters including lateral run-out, vibrational amplitude, and localized temperature spikes. The collected data is wirelessly transmitted via NFC or Bluetooth to the machine's control unit or a centralized monitoring hub, facilitating real-time condition monitoring, automated adjustment of machining parameters to compensate for thermal drift, and providing the necessary data foundation for advanced AI-powered predictive maintenance models, effectively transforming the collet into a critical data-generating component of the digital manufacturing process.

Regional Highlights

- Asia Pacific (APAC): Global Manufacturing Core and Volume Leader

The APAC region commands the largest segment of the CNC Collets Market and simultaneously registers the highest projected growth rate. This market dynamic is fueled by the region's concentration of global production capacity across critical sectors, including consumer electronics, electric vehicle (EV) components, and heavy industrial machinery, centered in nations like China, South Korea, and India. Large-scale government support through industrial policies, coupled with rapid urbanization and modernization of manufacturing facilities, drives explosive demand for high-volume, standardized ER collets. Local manufacturers have achieved global scale, offering competitive pricing that dictates global market trends, particularly in the entry-to-mid-level precision segments.

In mature APAC economies such as Japan and Taiwan, the emphasis shifts toward ultra-high-precision and specialty collets, driven by advanced industries like robotics, high-end mold making, and semiconductor manufacturing equipment. These nations invest heavily in domestic R&D to develop proprietary shrink-fit and high-balance tooling capable of supporting 5-axis machining with minimal run-out, positioning them as key technological innovators alongside Western counterparts.

- North America: Premium Tooling and Specialized Sector Demand

North America is a technologically mature market characterized by extremely high quality and performance requirements, particularly due to the dominance of the aerospace, defense, and high-end energy sectors. Demand is heavily skewed towards premium collet solutions—specifically hydraulic and advanced shrink-fit systems—that offer superior reliability, thermal compensation, and certified run-out accuracy necessary for machining expensive, complex materials like titanium and nickel superalloys. The replacement and modernization cycle of aging machining infrastructure contributes substantially to ongoing demand, favoring suppliers who can provide sophisticated technical support and certified traceability.

The regional market also sees rapid adoption of 'smart' tooling technologies, with manufacturers frequently implementing sensor-equipped collets and digitally integrated tool management systems to maximize spindle uptime and adhere to demanding quality assurance protocols. Although the volume growth rate is less pronounced than APAC, the high Average Selling Price (ASP) of specialized, high-performance tooling ensures the North American market remains critically important in terms of value generated and technological influence.

- Europe: Engineering Excellence and Industry Standards

The European market, led by key manufacturing powerhouses such as Germany, Switzerland, and Italy, is defined by its deep tradition of precision engineering and stringent adherence to quality standards (DIN, ISO). This region is a major consumer of mid-to-high-end ER collets, hydraulic holders, and precision-ground collets, driven by robust sectors including automotive luxury and performance components, specialized machine tool construction, and medical technology. European manufacturers place a strong emphasis on verifiable tool holder longevity, dynamic balancing, and optimal thermal performance, ensuring a stable demand for technologically refined products.

Europe serves as a global hub for collet and tool holder innovation, with leading companies driving research into novel dampening mechanisms and material science applications to improve high-speed performance. Furthermore, strong environmental and occupational safety regulations encourage the adoption of closed-loop systems and precision tooling that reduces material waste and minimizes machining noise and vibration, reinforcing the demand for high-performance, precision solutions.

- Latin America (LATAM) and Middle East & Africa (MEA): Growth Fueled by Industrialization

Both LATAM and MEA are categorized as developing markets in the CNC Collets landscape, exhibiting moderate but consistent growth rates linked to ongoing industrialization efforts. In LATAM, particularly in Brazil and Mexico, the automotive assembly and mining sectors are the primary demand generators, requiring substantial volumes of durable, standard-grade collets for maintenance and high-volume production. This market segment is highly price-sensitive and heavily reliant on established distribution channels for imports.

The MEA region, particularly driven by economic diversification strategies in the Gulf Cooperation Council (GCC) states, is seeing increased investment in localized defense, aerospace maintenance, and non-oil manufacturing capabilities. Initial demand is focused on foundational tooling and replacement parts, but as industrial sophistication increases, there is a gradual shift towards higher-precision collets to support complex infrastructure and energy-related projects. Market entry here often requires localized partnerships to navigate complex regulatory environments and supply chain logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CNC Collets Market. These companies are actively engaged in product innovation, strategic partnerships, and geographical expansion to maintain market leadership, focusing heavily on enhancing precision, rigidity, and the integration of smart features into their tool holding solutions.- SCHUNK GmbH

- Sandvik Coromant

- Haimer GmbH

- Kennametal Inc.

- Iscar Ltd.

- JM Performance Products

- Lyndex-Nikken

- Techniks Inc.

- MariTool

- Emuge-Franken

- Big Daishowa Seiki

- Toolmex Industrial Solutions

- Kintek S.p.A

- Command Tooling Systems

- Royal Products

- Hardinge Inc.

- WTO GmbH

- Tungaloy Corporation

- Mapal Präzisionswerkzeuge Dr. Kress KG

- Guhring KG

- Dorian Tool International

- Zurning Tool Holders

- Parlec, Inc.

Frequently Asked Questions

Analyze common user questions about the CNC Collets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ER collets and Hydraulic collets, and which is better for high-speed machining?

ER (Elastic Range) collets are the most common mechanical clamping device, offering versatility and cost-effectiveness for general-purpose milling and drilling. Hydraulic collets, conversely, use internal fluid pressure for clamping, providing superior vibration dampening and exceptionally low run-out (under 3 µm). For critical high-speed machining (above 20,000 RPM) where precision, balance, and surface finish are paramount, hydraulic or shrink-fit systems are generally considered superior due to better rigidity and consistency.

How does run-out affect the performance and lifespan of cutting tools?

Run-out, defined as the deviation from the true axis of rotation, is a critical factor. High run-out causes excessive, asymmetrical stress on the cutting tool’s edge, leading to rapid, non-uniform wear, premature chipping, and catastrophic failure, resulting in poor surface finish and dimensional inaccuracy on the workpiece. Minimizing run-out, achieved through high-quality collets and precision holders, is essential for maximizing tool lifespan, achieving tight tolerances, and maintaining process reliability across production runs.

Which end-use industry drives the highest volume demand for CNC Collets globally?

The Automotive Manufacturing industry currently represents the largest segment for CNC Collets globally in terms of volume consumption of standardized collet types (e.g., ER, 5C). This high demand is driven by the massive scale of components manufactured, including engine blocks, transmission parts, and increasingly, components for electric vehicle (EV) production, all of which require robust and reliable tooling for continuous, high-volume production cycles worldwide.

What technological innovations are defining the future of the CNC Collets Market?

The future of the market is defined by the integration of Industry 4.0 and advanced material science. Key innovations include Smart Collets embedded with micro-sensors for real-time monitoring of vibration, temperature, and clamping force, enabling predictive maintenance and dynamic machining adjustments. Other trends involve advanced wear-resistant surface coatings (like DLC and ceramics) and the use of proprietary, high-fatigue alloys to handle increasing machining speeds and the processing of tough, exotic workpiece materials.

How important are specialized coatings (e.g., DLC) for modern CNC collets?

Specialized coatings are critically important, particularly for high-performance and dry machining environments. Coatings such as Diamond-Like Carbon (DLC) drastically reduce friction between the collet and the tool shank, which prevents pull-out, improves clamping stability, and enhances resistance to thermal degradation and corrosion from cutting fluids. This technological enhancement extends the functional lifespan of the collet and maintains precision under high stress and elevated temperatures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager