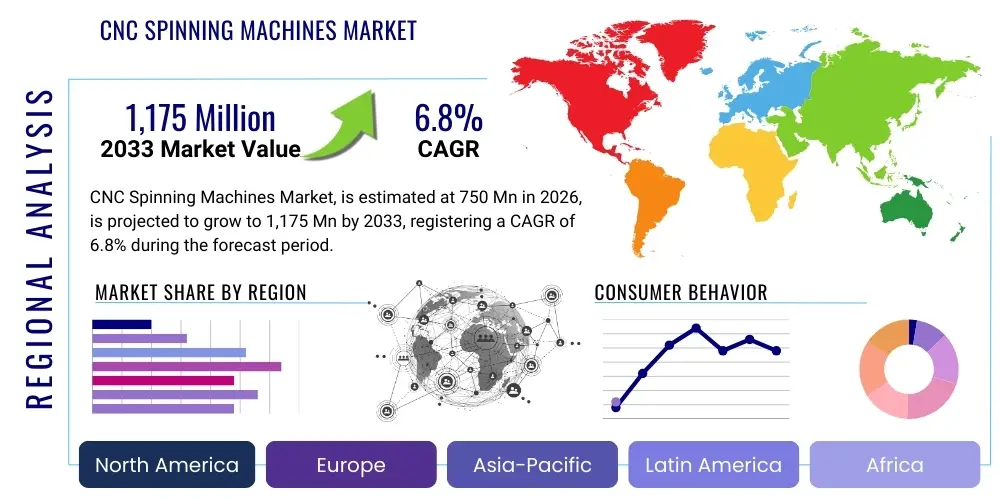

CNC Spinning Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441004 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

CNC Spinning Machines Market Size

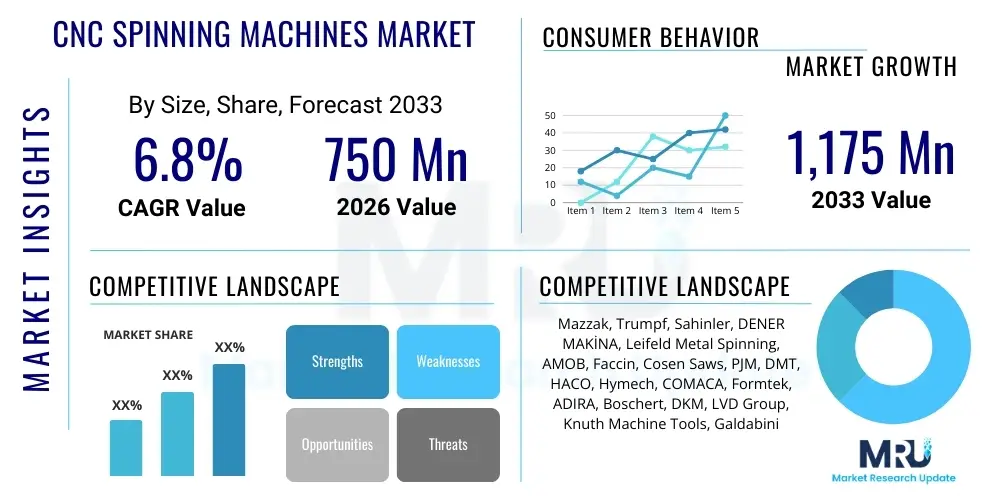

The CNC Spinning Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,175 Million by the end of the forecast period in 2033. This growth trajectory is significantly fueled by the increasing demand for precision components across high-stakes industries like aerospace, automotive, and defense, where the unique capabilities of flow forming and shear forming offered by advanced CNC spinning technology provide essential solutions for complex geometries and material strength requirements. Furthermore, the global shift towards lightweight materials and efficient manufacturing processes directly contributes to the expansion of this specialized machinery sector.

CNC Spinning Machines Market introduction

The CNC Spinning Machines Market encompasses advanced industrial equipment designed for metal forming through rotational deformation processes, primarily flow forming and shear forming, enabling the production of rotationally symmetric hollow parts, such as cones, cylinders, and complex contoured shapes, with exceptional precision and material integrity. These machines utilize computerized numerical control (CNC) systems to automate complex forming sequences, ensuring repeatable accuracy and superior surface finish compared to traditional stamping or deep drawing methods. The product range includes vertical and horizontal configurations, hydraulic and mechanical drive systems, tailored to handle a diverse array of materials including steel alloys, aluminum, titanium, and exotic metals crucial for demanding applications. Major applications span high-performance sectors such as jet engine components, rocket casings, automotive wheels, pressure vessels, and specialized lighting fixtures.

The core benefit of utilizing CNC spinning machines lies in their ability to achieve significant material savings, enhance material strength through work hardening, and produce components with tight dimensional tolerances and superior wall thickness control. The high degree of automation inherent in CNC systems drastically reduces labor costs, minimizes scrap rates, and allows for rapid changeovers between different product runs, making them ideal for high-mix, low-volume production environments typical in specialized engineering. These efficiencies translate directly into reduced operational costs and improved overall product quality for end-users in critical industries.

Key driving factors propelling the market forward include the escalating global focus on industrial automation and the necessity for producing complex, lightweight parts crucial for enhancing fuel efficiency in transportation sectors. The rapid expansion of the aerospace and defense industry, particularly in emerging economies, necessitates robust machinery capable of forming high-strength, temperature-resistant superalloys. Moreover, technological advancements in control software and machine rigidity, coupled with the integration of multi-axis control capabilities, continue to broaden the application scope of CNC spinning technology, moving beyond traditional metalworking into niche areas like energy production and medical device manufacturing.

CNC Spinning Machines Market Executive Summary

The global CNC Spinning Machines Market is characterized by robust growth driven primarily by escalating demand from the automotive lightweighting trend and substantial investment in the aerospace sector globally. Business trends indicate a strong move toward hybrid machines that combine spinning and forming capabilities, offering greater versatility and production efficiency. There is also a noticeable shift toward integrating sophisticated sensors and predictive maintenance features (Industry 4.0 compatibility) to maximize uptime and minimize operational variances. Regionally, Asia Pacific continues to lead in market expansion due to rapid industrialization and significant government support for manufacturing capabilities, particularly in China and India, while North America and Europe maintain dominance in high-precision, niche applications utilizing advanced material processing.

Segment trends reveal that hydraulic CNC spinning machines retain the largest market share owing to their robust force capabilities and suitability for heavy-duty applications involving thick materials or superalloys. However, the mechanical and hybrid segments are demonstrating the fastest growth rates, spurred by the need for high-speed precision forming in consumer electronics and medium-gauge sheet metal applications. Application-wise, the automotive sector remains the largest consumer, driven by the mass production requirements for components like transmission parts, brake drums, and structural elements, although the aerospace and defense segment commands higher average selling prices due to stringent quality and complexity demands.

Overall, the market landscape is moderately consolidated, featuring strong competition among established European and Japanese manufacturers known for precision engineering, alongside emerging Asian players who offer cost-competitive alternatives. Success factors are increasingly tied to technological innovation, particularly in enhancing tooling life, optimizing material utilization algorithms, and providing comprehensive integration services for automated production lines. Strategic collaborations between machine manufacturers and material scientists are becoming vital for tackling the challenges posed by increasingly complex and difficult-to-form materials, thereby securing competitive advantages in the high-value segments of the market.

AI Impact Analysis on CNC Spinning Machines Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the CNC Spinning Machines Market generally revolve around improving operational efficiency, enhancing part quality consistency, and optimizing material utilization, particularly when processing expensive or difficult materials. Users frequently ask about AI's role in predictive maintenance (preventing costly downtime), automating the complex programming required for new part geometries (reducing setup time), and real-time process monitoring to automatically adjust machine parameters (such as roller path, pressure, and temperature) to counteract material variations or minor tool wear. The key themes highlight expectations that AI will transition CNC spinning from an expert-driven craft to a highly automated, adaptive, and self-optimizing manufacturing process, thereby lowering the entry barrier for complex operations and significantly boosting productivity metrics across the board.

- AI-driven Predictive Maintenance (PdM): Utilizing machine learning algorithms to analyze vibration, temperature, and power consumption data for early identification of component failure, minimizing unexpected downtime and maximizing machine availability.

- Automated Process Optimization: Real-time adjustment of spinning parameters (feed rate, spindle speed, pressure) based on sensor feedback to maintain precise wall thickness and material integrity, especially during shear forming operations.

- Generative Design for Tooling: AI models assist in designing optimized spinning rollers and mandrels, predicting stress points and wear patterns to extend tool lifespan and reduce tooling costs.

- Quality Control and Defect Detection: Implementing computer vision and deep learning models to inspect parts post-spin for surface defects, micro-cracks, and dimensional inconsistencies, ensuring 100% compliance without manual intervention.

- Programming Automation: AI algorithms streamline the generation of complex, multi-pass spinning programs for novel geometries, significantly cutting down engineering and setup time required for new product introduction (NPI).

- Energy Consumption Management: Optimizing machine duty cycles and power usage patterns based on production schedules and load requirements, contributing to lower operational energy costs and improved sustainability profiles.

DRO & Impact Forces Of CNC Spinning Machines Market

The market dynamics for CNC spinning machines are fundamentally shaped by the confluence of rigorous demands for lightweight, high-performance components, economic pressures for enhanced manufacturing efficiency, and inherent technical constraints related to material handling and tool wear. The primary drivers include the escalating need for fuel-efficient vehicles necessitating lightweight aluminum and composite parts, and the expansion of the global aerospace industry requiring high-strength components formed from titanium and nickel-based alloys. Simultaneously, restraints such as the substantial initial capital investment required for high-precision CNC equipment and the shortage of highly skilled operators capable of programming and maintaining these sophisticated machines temper market growth. Opportunities, however, abound in developing automated handling systems, integrating advanced monitoring technologies, and penetrating emerging markets in Asia and Latin America seeking modern manufacturing infrastructure. These forces collectively dictate the adoption rate, pricing strategies, and technological development paths within the CNC spinning sector, leading to market polarization between high-end, complex machinery and more standardized, entry-level systems.

Impact forces are strongly concentrated in regulatory environments and material science breakthroughs. Stricter emissions standards worldwide (e.g., Euro 7, CAFE standards) directly amplify the demand for components manufactured using advanced forming techniques that ensure material integrity and weight reduction. Conversely, the continuous development of novel superalloys and composite materials poses a challenge, often requiring machine manufacturers to rapidly innovate in areas like force capacity, heating capabilities (for hot spinning), and control responsiveness. Competitive intensity remains high, driven by differentiation based on precision, machine longevity, and software capabilities, forcing vendors to prioritize R&D investment in areas that offer demonstrably superior Total Cost of Ownership (TCO) for end-users operating in critical manufacturing chains.

Furthermore, globalization of supply chains exerts significant influence. While it allows manufacturers to source components efficiently, it also exposes them to geopolitical risks and trade fluctuations, which can impact the cost and availability of raw materials (like high-grade steel for machine frames) and specialized electronic components necessary for CNC controls. The long-term success of market participants is increasingly dependent on resilient supply chain management and the ability to provide localized service and support, especially for mission-critical machinery used in sectors where downtime is prohibitively expensive, ensuring continuous operation and minimizing operational variance across global manufacturing sites.

Segmentation Analysis

The CNC Spinning Machines Market is segmented based on critical operational and technological criteria, enabling a granular view of market dynamics influenced by application demands and production requirements. Key differentiators include the primary forming mechanism (hydraulic versus mechanical), the orientation of the spindle (vertical versus horizontal), and the intended end-use application (such as automotive, aerospace, or industrial equipment). Hydraulic machines offer high force output suitable for thick materials, while mechanical and hybrid systems are favored for high-speed, light-to-medium gauge forming. The segmentation highlights distinct purchasing behaviors, with aerospace typically prioritizing precision and capability regardless of cost, and the general industrial sector focusing on versatility and TCO, thereby driving divergent product development strategies among market leaders targeting specific niches.

- By Type:

- Hydraulic CNC Spinning Machines

- Mechanical CNC Spinning Machines

- Hybrid CNC Spinning Machines

- By Operation (Axis Configuration):

- Vertical CNC Spinning Machines

- Horizontal CNC Spinning Machines

- By Forming Process:

- Flow Forming

- Shear Forming

- Tube Spinning

- By Application:

- Automotive Industry (Wheels, Braking Systems, Transmission Components)

- Aerospace and Defense (Rocket Casings, Jet Engine Components, Nose Cones)

- Industrial Equipment and Machinery (Pressure Vessels, Tanks, Machine Housings)

- Consumer Goods and Appliances (Cookware, Lighting Reflectors)

- HVAC and Energy (Turbine Components, Heat Exchangers)

Value Chain Analysis For CNC Spinning Machines Market

The value chain for the CNC Spinning Machines Market is characterized by highly specialized stages, beginning with sophisticated upstream component suppliers and culminating in complex installation and lifecycle support services for end-users. Upstream activities involve the procurement of high-precision components, including specialized high-rigidity steel and cast iron for machine beds, advanced servo motors, high-fidelity sensors, and sophisticated CNC control units (often sourced from highly specialized providers like Siemens, Fanuc, or Heidenhain). Machine builders focus on core competencies such as mechanical design, assembly, and rigorous testing, ensuring the structural integrity and precision necessary for high-force metal forming. The quality and reliability of these upstream inputs directly determine the machine's operational lifespan and precision capabilities, making supplier qualification a critical competitive factor.

Midstream activities primarily focus on manufacturing, integration, and distribution. Machine manufacturers integrate the purchased components, develop proprietary spinning software interfaces, and conduct extensive functional testing. Distribution channels are varied: large global players often utilize direct sales forces for major contracts (especially in aerospace), while regional distributors and specialized agents handle sales, installation, and localized support in geographically diverse markets. Effective distribution is crucial, as these heavy, complex machines require specialized logistics and often mandated pre- and post-sale engineering consultation to match the machine specifications to the client's specific application needs, which requires a highly knowledgeable and technically proficient sales network.

Downstream elements encompass installation, commissioning, tooling supply, maintenance, and technical training. For the end-user, the total cost of ownership is heavily influenced by the availability and cost of specialized tooling (rollers, mandrels) and timely, expert maintenance services, particularly given the stress and wear inherent in the spinning process. End-users, who are primarily high-volume manufacturers in the automotive and aerospace sectors, require comprehensive service packages, including remote diagnostics and rapid spare part delivery, ensuring minimal operational disruption. The complexity of the machine ensures that the service and after-sales support segment represents a significant revenue stream and a key differentiator among competing OEMs.

CNC Spinning Machines Market Potential Customers

The primary customers for CNC Spinning Machines are specialized manufacturers requiring components with rotational symmetry, superior material properties, and extremely tight wall thickness tolerances that cannot be economically achieved through drawing or stamping. End-users fall heavily within high-value manufacturing segments where performance and safety are paramount considerations. The automotive industry represents a massive segment, using these machines for wheels, transmission cones, brake drums, and exhaust components, particularly for electric vehicles seeking maximum weight reduction. The need for precise, durable, and structurally optimized components drives purchasing decisions in this sector, often involving large batch orders and long-term supply contracts, leading to significant investment in large fleets of automated spinning machinery.

Another crucial customer base resides within the aerospace and defense sector, including OEMs and Tier 1 suppliers specializing in components for jet engines (casings, nozzles), rocket propulsion systems (motor casings, tank domes), and missile bodies. These applications demand the forming of high-temperature resistant superalloys (like Inconel or titanium) with impeccable structural integrity, making the flow-forming capability of CNC machines indispensable. Purchasing criteria here are dominated by machine robustness, ability to handle exotic materials, and adherence to rigorous quality standards and certifications, often justifying the highest capital expenditures for the most advanced, multi-axis vertical spinning centers.

Further potential customers include specialized industrial equipment manufacturers producing pressure vessels, high-efficiency lighting reflectors (requiring fine surface finish), and components for the energy sector (e.g., oil and gas pipelines, turbine parts). These customers prioritize versatility, material thickness capacity, and the machine's ability to maintain high productivity while handling diverse product mix. The increasing complexity and scale of modern infrastructure projects globally continually expand the need for large-scale, high-precision metal forming capabilities provided by the latest generations of automated CNC spinning machinery, diversifying the customer portfolio beyond traditional automotive and aerospace strongholds.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,175 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mazzak, Trumpf, Sahinler, DENER MAKİNA, Leifeld Metal Spinning, AMOB, Faccin, Cosen Saws, PJM, DMT, HACO, Hymech, COMACA, Formtek, ADIRA, Boschert, DKM, LVD Group, Knuth Machine Tools, Galdabini |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CNC Spinning Machines Market Key Technology Landscape

The technological landscape of the CNC Spinning Machines Market is rapidly evolving, driven by the imperative to handle increasingly stronger and more complex materials with greater precision and speed. Central to this evolution is the sophistication of the Computerized Numerical Control (CNC) system itself. Modern machines utilize multi-axis CNC controllers, often 4-axis or 5-axis systems, which allow for simultaneous and precise control over spindle rotation, carriage movement, and the position and angle of multiple forming rollers. This multi-axis capability is essential for executing intricate flow-forming strategies, particularly on non-conical or asymmetric geometries. Furthermore, proprietary software algorithms are becoming standardized, offering simulation capabilities that predict material behavior (springback, thermal expansion) before actual forming, drastically reducing the time and cost associated with process validation and trial runs on expensive materials like titanium alloys.

Material handling and machine rigidity constitute another major technological focus. Given the immense radial and axial forces generated during the spinning process, contemporary CNC spinning machines feature heavy, vibration-dampening structures—often utilizing specialized mineral casting or highly stabilized steel—to maintain micron-level precision under heavy load. Advanced machines incorporate specialized roller designs and quick-change tooling systems that minimize changeover time, enhancing flexibility for manufacturers operating in high-mix environments. Furthermore, the integration of automation peripherals, such as robotic loading and unloading systems and automated parts inspection cells, is becoming standard, transforming standalone machines into fully integrated, lights-out production systems capable of continuous operation with minimal human intervention, thereby addressing the persistent skilled labor shortage.

A burgeoning technological segment involves in-situ monitoring and adaptive control systems. High-resolution sensors are deployed to monitor crucial parameters such as roller force, material temperature (especially relevant for hot spinning of superalloys), and acoustic emissions. This real-time data feeds into the CNC controller, allowing for immediate, micro-adjustments to the machine path or forming speed. This capability is critical for achieving consistent wall thickness and optimal material microstructures, particularly important in aerospace components where structural integrity must be validated at every point. Furthermore, machines designed specifically for hot spinning utilize induction heating or high-intensity lasers localized at the point of deformation, allowing manufacturers to process materials previously deemed unformable at room temperature, unlocking new application potential in highly specialized industries like power generation and extreme environment engineering.

Regional Highlights

The market for CNC Spinning Machines exhibits distinct growth patterns and maturity levels across different global regions, largely influenced by industrial infrastructure, local manufacturing priorities, and technological adoption rates. Asia Pacific (APAC) is projected to be the fastest-growing region, dominated by high volume manufacturing activities in China, India, and South Korea. This growth is driven by massive investment in automotive production (especially EVs), consumer electronics manufacturing, and rapidly expanding local aerospace ambitions. APAC manufacturers prioritize machinery that offers a balance of cost-effectiveness, reliability, and high throughput, often favoring locally manufactured or joint-venture machinery optimized for high-volume flow forming applications.

- North America: Characterized by a high demand for high-precision, large-format CNC spinning machines, primarily from the demanding aerospace and defense sectors, where processing complex materials like titanium and nickel superalloys is commonplace. The region leads in adopting advanced automation and Industry 4.0 integration, focusing on customized solutions and advanced software capabilities.

- Europe: A mature market known for pioneering high-end, highly specialized spinning technology, particularly in Germany, Italy, and Switzerland. European manufacturers are technological leaders, focusing on hybrid machines, sophisticated CNC controls, and sustainable manufacturing practices, serving complex industrial equipment, luxury automotive, and specialized energy applications.

- Asia Pacific (APAC): The dominant region in terms of volume growth, driven by massive manufacturing expansion in automotive, HVAC, and industrial infrastructure across China and India. The demand here spans the entire spectrum, from basic machinery for consumer goods to advanced flow forming for next-generation transportation components.

- Latin America (LATAM): Represents an emerging market with gradual growth, primarily centered around local automotive assembly and basic industrial machinery production. Market adoption is sensitive to commodity pricing and requires machinery that offers robust performance with lower maintenance complexity.

- Middle East and Africa (MEA): Growth is concentrated in the GCC nations, fueled by diversification efforts away from oil, leading to investment in localized defense manufacturing and energy infrastructure. Demand is highly focused on large-capacity machines suitable for pressure vessels and specialized piping components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CNC Spinning Machines Market.- Leifeld Metal Spinning GmbH

- Mazzak Corporation

- Trumpf GmbH + Co. KG

- Sahinler Metal Spinning Machinery

- DENER MAKİNA

- Faccin S.p.A.

- AMOB Máquinas Ferramentas S.A.

- Cosen Saws

- PJM Industrial

- DMT Machine Tools

- HACO Group

- Hymech Machine Tools

- COMACA S.r.l.

- Formtek Group

- ADIRA Metal Forming Solutions

- Boschert GmbH + Co. KG

- DKM Sheet Metal Working Machinery

- LVD Group

- Knuth Machine Tools

- Galdabini S.p.A.

Frequently Asked Questions

Analyze common user questions about the CNC Spinning Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between CNC spinning and traditional metal stamping?

CNC spinning, unlike stamping, is a rotational deformation process that forms hollow, axially symmetric parts by forcing a roller against a rotating blank over a mandrel. This process significantly improves material strength through work hardening, achieves superior wall thickness control, and minimizes material waste, making it ideal for high-performance and lightweight components, particularly those requiring specific grain structures.

Which industrial sectors are the largest consumers of high-end CNC flow forming technology?

The largest consumers of high-end CNC flow forming technology are the aerospace and defense industries, followed closely by high-performance automotive manufacturers. These sectors require components made from specialized alloys (e.g., titanium, Inconel) with extremely stringent dimensional tolerances and material homogeneity, capabilities that are uniquely provided by advanced multi-axis CNC spinning machines.

How is Industry 4.0 impacting the operational efficiency of CNC spinning machines?

Industry 4.0 significantly enhances efficiency through the integration of IoT sensors, real-time data analytics, and AI-driven predictive maintenance (PdM). This allows manufacturers to monitor machine health continuously, optimize spinning parameters instantaneously based on material variations, and prevent costly unplanned downtime, ultimately boosting overall equipment effectiveness (OEE) and reducing scrap rates.

What materials can be effectively processed using modern CNC spinning machines?

Modern CNC spinning machines are capable of processing a vast array of materials, ranging from standard carbon steels, stainless steel, and aluminum alloys, to specialized high-strength materials such as nickel-based superalloys (Inconel), titanium alloys, and refractory metals. The ability to process exotic materials often relies on advanced features like localized induction heating (hot spinning) and high-force hydraulic capabilities.

What is the expected Compound Annual Growth Rate (CAGR) for the CNC Spinning Machines Market?

The CNC Spinning Machines Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.8% throughout the forecast period from 2026 to 2033, driven by increasing global demand for precise, lightweight components across critical manufacturing sectors and continued investment in automated metal forming technologies, particularly in the APAC region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager