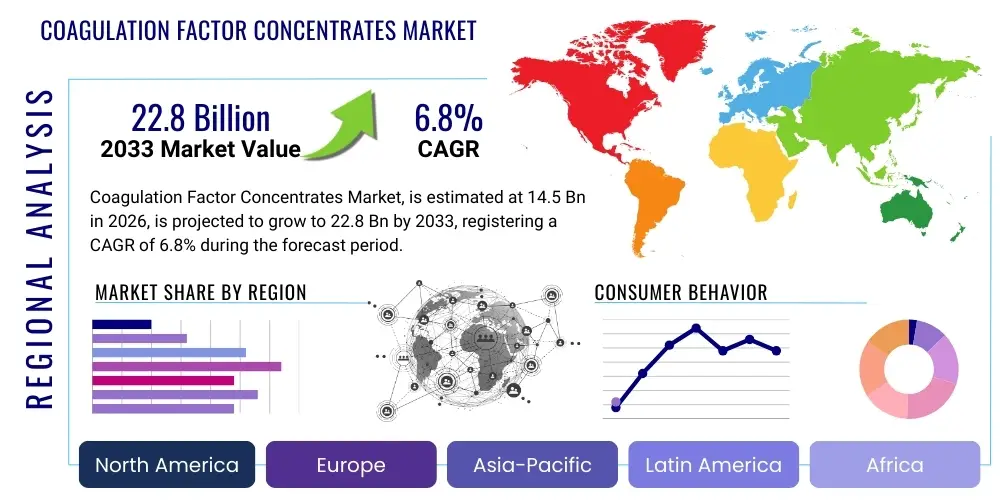

Coagulation Factor Concentrates Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441496 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Coagulation Factor Concentrates Market Size

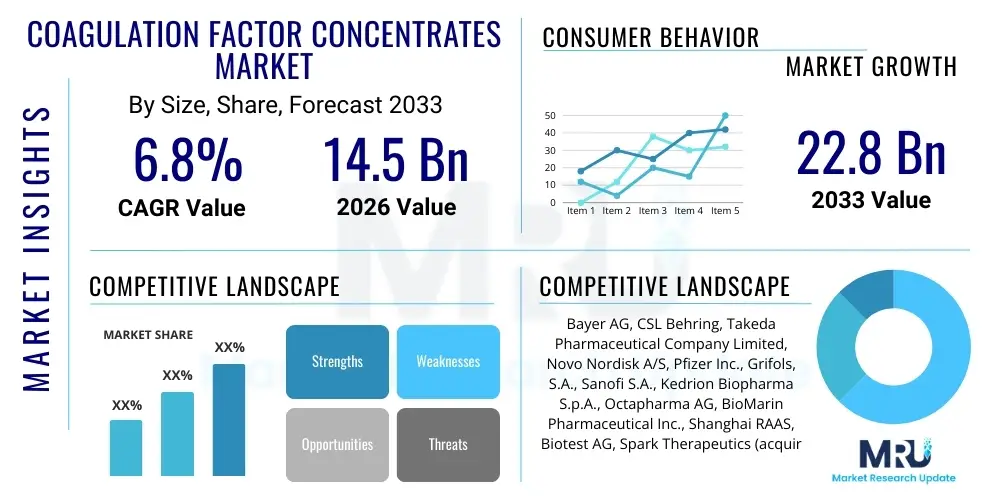

The Coagulation Factor Concentrates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $22.8 Billion by the end of the forecast period in 2033.

Coagulation Factor Concentrates Market introduction

The Coagulation Factor Concentrates Market encompasses pharmaceutical products derived from human plasma or produced through recombinant DNA technology, specifically designed to replace missing or deficient clotting factors in patients suffering from inherited or acquired bleeding disorders, most notably hemophilia (A and B), von Willebrand disease, and rare factor deficiencies. These concentrates are essential life-saving treatments, providing immediate hemostasis and enabling prophylactic care that significantly improves patient quality of life and reduces joint damage associated with recurrent bleeds. The clinical utility extends beyond inherited disorders to include management of severe bleeding during surgeries or trauma, particularly in patients with underlying coagulopathies, thereby establishing these products as fundamental pillars of modern hematology.

The product portfolio within this market is diverse, including Factor VIII (FVIII) concentrates, Factor IX (FIX) concentrates, Factor VIIa (FVIIa) concentrates, Prothrombin Complex Concentrates (PCCs), and Von Willebrand Factor (VWF) concentrates. Recent innovations, particularly the development of extended half-life (EHL) factors, have revolutionized treatment paradigms by requiring less frequent intravenous administration, enhancing patient adherence, and reducing treatment burden. Furthermore, the rise of plasma fractionation facilities globally, coupled with stringent regulatory standards ensuring product safety and viral inactivation, supports the continuous supply chain necessary to meet the growing global demand for these high-value biopharmaceuticals. Market growth is structurally driven by increasing diagnosis rates in emerging economies and the expanding adoption of prophylactic treatment regimens over on-demand treatment.

Major applications center around the prophylactic and on-demand treatment of hemophilia A (FVIII deficiency) and hemophilia B (FIX deficiency). Driving factors include advancements in recombinant technology leading to safer and more effective products, increasing awareness and screening programs for bleeding disorders, and supportive government initiatives focusing on healthcare infrastructure improvement, especially in developing regions where access to treatment remains a critical challenge. The economic benefit of these therapies is substantial, as prophylactic treatment minimizes costly hospitalizations and long-term disability, establishing a compelling health economic argument for their sustained utilization.

Coagulation Factor Concentrates Market Executive Summary

The global Coagulation Factor Concentrates market is characterized by robust growth, propelled primarily by the shift towards prophylactic treatments utilizing novel extended half-life (EHL) factors and non-factor replacement therapies, although factor concentrates remain the gold standard. Business trends indicate significant R&D investment focused on gene therapy approaches for hemophilia, which, while competitive, also drives innovation in existing concentrate formulations to maintain market relevance. Key strategic movements include mergers, acquisitions, and collaborations aimed at expanding global distribution networks and securing plasma supply chain sustainability, especially as regulatory scrutiny regarding plasma sourcing intensifies globally. The competitive landscape is dominated by a few major players with deep technological expertise in plasma fractionation and recombinant protein manufacturing.

Regional trends highlight North America and Europe as mature markets characterized by high penetration of advanced treatments and favorable reimbursement policies. These regions lead in the adoption of EHL factors and exhibit high per-capita expenditure on hemophilia care. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market due to increasing healthcare expenditure, improving diagnostic capabilities, and the vast, untapped patient pool, particularly in populous nations like India and China. Latin America and MEA continue to struggle with accessibility and affordability, but structured government efforts and humanitarian aid are slowly expanding treatment coverage, focusing initially on standard half-life concentrates before transitioning to advanced biologics.

Segment trends underscore the dominance of the recombinant factor concentrates segment over plasma-derived products, driven by superior safety profiles and reduced risk of pathogen transmission. Within recombinant factors, EHL products are rapidly gaining market share over standard half-life variants across both Factor VIII and Factor IX categories, reflecting physician and patient preference for reduced injection frequency. The Hemophilia A segment remains the largest application area due to its higher prevalence compared to Hemophilia B and other factor deficiencies, although innovative treatments for rarer disorders like VWD and Factor XIII deficiency are seeing incremental growth, further diversifying the market portfolio and ensuring sustained expansion.

AI Impact Analysis on Coagulation Factor Concentrates Market

User inquiries regarding Artificial Intelligence (AI) in the Coagulation Factor Concentrates Market center on how AI can optimize manufacturing efficiency, enhance diagnostic accuracy for rare bleeding disorders, and personalize treatment regimens, especially dosing for prophylactic care. Key concerns revolve around the ethical implications of using AI in clinical decision support and the potential displacement of traditional coagulation assays. Users anticipate AI playing a transformative role in managing complex inhibitor patients, predicting treatment response, and accelerating R&D timelines for next-generation factor concentrates and gene therapies. The overarching theme is the integration of predictive analytics to improve patient outcomes while reducing the cost burden associated with long-term hemophilia management, moving towards highly individualized treatment schedules.

- AI-driven optimization of plasma fractionation yield and process control, enhancing manufacturing efficiency.

- Predictive modeling for patient bleeding risk and subsequent prophylactic factor dosing, enabling personalized medicine.

- Accelerated discovery of novel factor variants and target identification for non-factor replacement therapies using machine learning.

- Improved diagnostic algorithms for rare factor deficiencies and early detection of inhibitor development.

- AI tools integrating real-world data (RWD) from patient monitoring devices to adjust treatment adherence strategies.

- Enhanced clinical trial design and patient stratification for new factor concentrate studies, shortening development cycles.

DRO & Impact Forces Of Coagulation Factor Concentrates Market

The Coagulation Factor Concentrates Market is influenced by a dynamic interplay of growth drivers (D), market restraints (R), and strategic opportunities (O), which collectively shape the competitive environment and future trajectory. Key drivers include the mandatory shift from on-demand treatment to prophylactic therapy globally, increasing longevity among hemophilia patients necessitating lifelong treatment, and continuous technological innovation, particularly in extended half-life factors that improve patient compliance. These forces exert substantial upward pressure on market valuation and volume consumption. However, the market faces significant restraints, including the high cost of treatment, which challenges affordability, particularly in middle and low-income nations, and the perennial risk associated with the plasma supply chain and donor recruitment challenges, which are critical for plasma-derived products.

Opportunities for market stakeholders lie in the expansion into high-growth emerging economies by developing tiered pricing models and engaging in public-private partnerships to improve access. Furthermore, the burgeoning field of gene therapy presents a dual opportunity: driving innovation in delivery systems and providing a potential cure, which concurrently compels factor concentrate manufacturers to focus on product differentiation and efficacy enhancements for patients ineligible or resistant to gene therapy. The competitive landscape is heavily impacted by regulatory scrutiny regarding product safety and the requirement for post-market surveillance, which acts as a barrier to entry for smaller firms but solidifies the position of established manufacturers with robust safety track records.

The core impact forces are rooted in clinical necessity and economic sustainability. The profound clinical need for life-saving factor replacement drives demand irrespective of economic cycles. Conversely, pricing pressures from national health systems and the entry of biosimilars/biobetters, particularly for older generation products, necessitate continuous strategic adjustment in marketing and distribution strategies. The market dynamics are highly sensitive to treatment guidelines published by international bodies like the World Federation of Hemophilia (WFH), which often dictate the standard of care adopted globally, solidifying the importance of clinical trial evidence and regulatory approvals as primary impact forces.

Segmentation Analysis

The Coagulation Factor Concentrates market is comprehensively segmented based on product type, source, indication, and distribution channel, providing granular insights into demand patterns and competitive positioning. Segmentation by source, distinguishing between recombinant and plasma-derived factors, highlights the technological shift towards safer, bio-engineered products. The indication-based segmentation reveals the disproportionate revenue contribution of Hemophilia A compared to B and other rare disorders, guiding R&D efforts. Detailed analysis of these segments is crucial for stakeholders developing targeted marketing strategies and optimizing production capabilities to meet highly specific clinical demands across different patient populations globally.

- By Product Type:

- Factor VIII Concentrates (FVIII)

- Factor IX Concentrates (FIX)

- Factor VIIa Concentrates (FVIIa)

- Prothrombin Complex Concentrates (PCCs)

- Von Willebrand Factor (VWF) Concentrates

- Others (e.g., Factor XIII)

- By Source:

- Recombinant Coagulation Factors (Standard and Extended Half-Life)

- Plasma-Derived Coagulation Factors

- By Indication:

- Hemophilia A

- Hemophilia B

- Von Willebrand Disease (VWD)

- Rare Factor Deficiencies (e.g., FXIII Deficiency)

- Acquired Coagulopathies

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Coagulation Factor Concentrates Market

The value chain for Coagulation Factor Concentrates is complex and resource-intensive, beginning with the upstream sourcing of raw materials, which is either human plasma (for plasma-derived products) or cell culture components (for recombinant factors). For plasma-derived products, the upstream segment involves rigorous donor screening, collection, and initial processing through licensed plasma collection centers, ensuring compliance with strict safety standards for viral inactivation and quality control. For recombinant factors, the upstream activity focuses on cell line development, high-yield fermentation, and initial purification steps. Efficiency at this stage is critical, as the cost and safety of the final product are heavily reliant on the quality and volume of the starting material, whether plasma or recombinant cell cultures.

The core manufacturing process, or midstream, involves complex, high-technology steps: large-scale protein purification, viral removal and inactivation, formulation, and aseptic filling. This stage demands significant capital investment in highly specialized, Good Manufacturing Practice (GMP)-compliant facilities. The focus here is on achieving maximum purity, potency, and stability of the delicate protein structures. Downstream activities involve rigorous quality assurance and testing, packaging, labeling, and logistical handling, requiring cold chain management due to the thermosensitive nature of factor concentrates. Strategic advantages are often derived from proprietary purification technologies and validated viral inactivation protocols, which differentiate products in terms of safety and overall yield.

Distribution channels for factor concentrates are highly regulated and specialized, operating both directly and indirectly. Direct distribution involves manufacturers supplying large hospital systems, hemophilia treatment centers (HTCs), or specialized national purchasing organizations. Indirect distribution utilizes specialized pharmaceutical wholesalers and third-party logistics (3PL) providers who manage the complex cold chain distribution to retail or specialty pharmacies, ultimately reaching the end-user patients or healthcare providers. The highly sensitive nature of these products and the critical need for timely supply necessitate robust, audited logistics systems. The reliance on highly specialized distribution ensures that market penetration and accessibility are often dictated by the efficiency and reliability of these specialized networks, impacting overall product availability globally.

Coagulation Factor Concentrates Market Potential Customers

The primary consumers of Coagulation Factor Concentrates are patients diagnosed with inherited bleeding disorders, predominantly hemophilia A and B, who require lifelong prophylactic treatment to prevent spontaneous and recurrent bleeding episodes. This patient population relies heavily on regular access to these concentrates, often managed through specialized Hemophilia Treatment Centers (HTCs). Other significant customer segments include individuals suffering from Von Willebrand Disease (VWD), and those with rare factor deficiencies such as Factor XIII, whose treatment requires specific factor replacement therapies, often managed by specialized hematologists or immunologists.

Institutional buyers represent the second crucial customer segment. This includes hospitals, particularly emergency departments and surgical units, which utilize Factor VIIa and Prothrombin Complex Concentrates (PCCs) for immediate hemostasis during trauma or complex surgeries, especially in non-hemophiliac patients with acquired bleeding tendencies (e.g., anticoagulant reversal). Furthermore, national healthcare systems, government procurement agencies, and large charitable organizations (like the World Federation of Hemophilia) are major bulk purchasers, managing national stockpiles and ensuring equitable distribution across their respective jurisdictions, often negotiating pricing based on volume and long-term supply agreements.

The buying process is characterized by high expertise and specialized prescribing. For prophylactic care, the end-users (patients/caregivers) administer the product at home, making patient education and user-friendliness (e.g., self-injection devices, EHL factors) key purchase considerations, alongside efficacy and safety. For institutional buyers, formulary inclusion, cost-effectiveness analysis, and reliable supply chain logistics are paramount. The long-term nature of treatment means customer loyalty is high, but competition exists based on product innovation (EHL features) and the ability of manufacturers to provide comprehensive patient support programs, distinguishing their offerings beyond the core product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $22.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, CSL Behring, Takeda Pharmaceutical Company Limited, Novo Nordisk A/S, Pfizer Inc., Grifols, S.A., Sanofi S.A., Kedrion Biopharma S.p.A., Octapharma AG, BioMarin Pharmaceutical Inc., Shanghai RAAS, Biotest AG, Spark Therapeutics (acquired by Roche), uniQure N.V., Genentech (Roche), Hemobiotics LLC, Reliance Life Sciences. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coagulation Factor Concentrates Market Key Technology Landscape

The technology landscape in the Coagulation Factor Concentrates market is characterized by ongoing innovation aimed at improving pharmacokinetic profiles, minimizing immunogenicity, and ensuring manufacturing safety. The most significant advancement in recent years has been the development of Extended Half-Life (EHL) factors, achieved primarily through technologies such as PEGylation (polyethylene glycol modification) or Fc fusion technology. These modifications prolong the circulation time of the factor protein in the bloodstream, allowing patients with hemophilia A and B to reduce their frequency of intravenous injections, which dramatically enhances adherence and quality of life. The adoption of these EHL technologies represents a key battleground for market share, compelling companies to continuously update their product lines to remain competitive against standard half-life concentrates.

Beyond EHL factors, technological development is strongly focused on enhancing the safety and purity of both recombinant and plasma-derived products. For plasma-derived concentrates, sophisticated viral inactivation and removal steps, including solvent/detergent treatment, nanofiltration, and heat treatment, are standard and continuously refined to maximize pathogen safety, covering known and emerging infectious agents. In the recombinant sector, high-titer cell culture systems (e.g., CHO cell lines) and advanced chromatographic purification techniques are employed to yield highly purified proteins free from human or animal additives. Furthermore, the development of bio-engineered factors with reduced potential for inhibitor development remains a critical area of research, leveraging targeted mutagenesis and structural biology insights.

A transformative layer of technology impacting the market is the development and increasing approval of non-factor replacement therapies and gene therapies. Non-factor replacements, such as bispecific antibodies targeting Factor IXa and Factor X (mimicking Factor VIII function), offer subcutaneous administration and simplified dosing, fundamentally altering the competitive dynamics of traditional intravenous concentrates. Meanwhile, Adeno-Associated Virus (AAV) vector-based gene therapy represents the technological apex, aiming for a functional cure by delivering the correct factor gene to the patient’s liver cells. While currently reserved for specific patient populations, the long-term success and accessibility of gene therapies will compel factor concentrate manufacturers to focus on highly specialized segments, such as patients with inhibitors or those receiving short-term factor cover post-surgery, maintaining the relevance of concentrates in a shifting therapeutic environment.

Regional Highlights

The geographical distribution of the Coagulation Factor Concentrates Market revenue reflects disparities in diagnosis rates, healthcare expenditure, and access to advanced treatment modalities. North America, primarily driven by the United States, accounts for the largest market share due to high prevalence awareness, established prophylactic treatment protocols, advanced adoption of EHL factor concentrates, and robust reimbursement frameworks ensuring access to high-cost specialty biologics. The region benefits from significant R&D activity and a concentration of major pharmaceutical manufacturers specializing in hematological products.

Europe is the second-largest market, characterized by universal healthcare coverage in many countries and well-organized national hemophilia care systems. Western European nations (Germany, France, UK) show high consumption of recombinant and EHL factors, supported by favorable regulatory pathways (EMA). However, pricing negotiations across different national markets introduce complexity compared to the US market structure. The region is also a key hub for clinical trials and post-market surveillance of new factor therapies.

Asia Pacific (APAC) is projected to exhibit the highest growth rate during the forecast period. This acceleration is attributed to rapid improvements in healthcare infrastructure, increasing economic development allowing for greater public and private investment in specialty drugs, and expanding governmental initiatives focused on improving the diagnosis and treatment of bleeding disorders in populous nations like China and India. While plasma-derived products often serve as the entry point due to cost constraints, the market is rapidly moving toward recombinant factors, fueled by educational programs supported by international organizations.

Latin America and the Middle East & Africa (MEA) represent emerging markets where growth is constrained by lower diagnosis rates and significant funding challenges, leading to a higher reliance on on-demand treatment rather than prophylactic care. Growth is driven by focused philanthropic efforts, increasing availability of lower-cost standard half-life factors, and regional initiatives aimed at centralized procurement to achieve economies of scale and improve access to essential concentrates.

- North America: Dominant market share; early and widespread adoption of EHL factors; significant R&D spending; strong regulatory support for specialized biologics.

- Europe: High market maturity; strong public healthcare coverage supporting prophylactic care; key driver for plasma-derived product refinement and viral safety advancements.

- Asia Pacific (APAC): Fastest growing region; driven by improving diagnostics, increasing healthcare spending, and expanding patient pool in China and India; growing shift from plasma-derived to recombinant products.

- Latin America: Growth tied to government procurement and international aid; focus on improving basic accessibility to standard factor concentrates; affordability remains a key challenge.

- Middle East and Africa (MEA): Nascent market development; reliance on humanitarian aid and localized partnerships; potential for growth in affluent Gulf Cooperation Council (GCC) states with robust healthcare systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coagulation Factor Concentrates Market.- Bayer AG

- CSL Behring

- Takeda Pharmaceutical Company Limited

- Novo Nordisk A/S

- Pfizer Inc.

- Grifols, S.A.

- Sanofi S.A.

- Kedrion Biopharma S.p.A.

- Octapharma AG

- BioMarin Pharmaceutical Inc.

- Shanghai RAAS

- Biotest AG

- Spark Therapeutics (acquired by Roche)

- uniQure N.V.

- Genentech (Roche)

- Hemobiotics LLC

- Reliance Life Sciences

Frequently Asked Questions

Analyze common user questions about the Coagulation Factor Concentrates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Coagulation Factor Concentrates and their primary use?

Coagulation Factor Concentrates are specialized biopharmaceuticals used for replacing deficient clotting factors in patients, primarily those with inherited bleeding disorders like hemophilia A and B. Their main use is prophylactic (preventive) treatment to minimize bleeding episodes and joint damage, or on-demand treatment for acute bleeds.

How are Extended Half-Life (EHL) factors impacting the market?

EHL factors significantly impact the market by requiring less frequent intravenous administration compared to standard concentrates. This improvement in dosing frequency enhances patient compliance, reduces treatment burden, and drives market preference, positioning EHL factors as the growth engine within the recombinant segment.

What is the main difference between recombinant and plasma-derived factor concentrates?

Plasma-derived concentrates are manufactured by fractionating human blood plasma, while recombinant factors are synthesized using genetically engineered cell lines (e.g., CHO cells). Recombinant factors generally offer a theoretically lower risk of viral transmission and higher consistency, driving their dominance in developed markets.

How does gene therapy pose a threat to the factor concentrates market?

Gene therapy offers the potential for a one-time functional cure for hemophilia, threatening the long-term reliance on frequent factor concentrate infusions. While still nascent and costly, its success could transition a segment of the patient population away from continuous factor replacement therapy, forcing concentrate manufacturers to innovate or focus on non-curable patient subsets.

Which geographical region exhibits the fastest growth potential for Coagulation Factor Concentrates?

The Asia Pacific (APAC) region, including large developing economies like China and India, is projected to show the fastest market growth. This is due to rapidly improving diagnostic infrastructures, increasing government focus on bleeding disorder care, and expanding patient access previously unmet by global supply chains.

The Coagulation Factor Concentrates Market continues its trajectory of innovation, moving beyond simple factor replacement toward sophisticated, patient-centric solutions. The sustained demand is underpinned by the essential nature of these life-saving therapies, particularly in prophylactic care, which is becoming the global standard. The market’s future dynamism will be defined by the successful integration of extended half-life technologies and the careful navigation of the disruptive potential introduced by emerging curative gene therapies and non-factor replacement approaches. Manufacturers must strategically invest in global outreach, particularly in emerging Asian markets, and maintain robust supply chain integrity for both plasma-derived and recombinant products to capitalize on the increasing global diagnosed patient pool. Regulatory alignment on product safety and sustained commitment to R&D, focusing on reducing inhibitor development risk and improving product stability, will remain paramount for maintaining competitive advantage and securing long-term market leadership. The industry is currently witnessing a critical inflection point where incremental improvements in factor delivery compete fiercely with potentially transformative, curative modalities, driving intense technological competition and demanding flexible business models.

Investment patterns are clearly shifting toward platforms that support advanced biologics, including large-scale bioreactors for recombinant factors and specialized purification systems optimized for EHL molecules. Furthermore, digital health integration is becoming crucial. Companies are investing in devices and software that monitor patient adherence, track bleeding episodes, and facilitate communication between patients and Hemophilia Treatment Centers (HTCs), thereby maximizing the clinical effectiveness of the concentrates. This digital ecosystem approach is enhancing the perceived value of factor concentrate brands beyond the physical product itself. Looking ahead, market stakeholders are placing strong emphasis on demonstrating the long-term health economic value of their products, utilizing real-world evidence (RWE) to justify premium pricing, especially in highly price-sensitive European and Asian markets. The emphasis is on proving that reduced bleeding rates and improved joint health justify the substantial investment in prophylactic treatment, ensuring sustained governmental and private payer support for these essential therapies, thus solidifying the market's growth foundation.

In terms of competitive differentiation, product innovation now extends to the delivery system and formulation stability under varying environmental conditions, particularly relevant for distribution in regions lacking sophisticated cold chain logistics. Partnerships with global health organizations and local manufacturing alliances are also critical strategies for mitigating access barriers in developing economies. The future market is therefore characterized not just by the factor molecule itself, but by the comprehensive package of safety data, delivery convenience, patient support, and global accessibility. Managing the threat of generic or biosimilar entrants, particularly for standard half-life FVIII products, requires continuous fortification of patent portfolios and focusing R&D expenditure on patent-protected, high-value EHL and novel factor variants, thereby maintaining high gross margins and technological superiority in the specialized hematology field.

The regulatory environment remains a dominant influence, requiring strict adherence to pharmacovigilance and stringent requirements for product traceability, especially for plasma-derived therapies. Manufacturers must demonstrate impeccable compliance across all jurisdictions, which necessitates significant investment in global quality management systems. Furthermore, the increasing acceptance of non-factor treatments, while competitive, opens avenues for synergistic portfolio development where companies may offer a mix of traditional factors, EHLs, and novel subcutaneous therapies to cover the entire spectrum of patient needs, including those with inhibitors. This multifaceted approach ensures resilience against single-therapy disruption. The overall market health is strongly correlated with public health funding and the success of international efforts to standardize hemophilia care globally, making macroeconomic stability and advocacy a silent but powerful driver of market expansion over the forecast period.

Specifically addressing the technology surrounding recombinant factor production, the shift from conventional mammalian cell systems to optimized systems capable of producing humanized factors, sometimes incorporating structural elements to resist degradation or enhance affinity to Von Willebrand Factor (VWF), is a continuous technological driver. The ongoing quest to develop factors with super-extended half-lives, potentially enabling once-monthly dosing, showcases the limits of current protein engineering techniques. This pursuit requires advanced bioconjugation chemistry and deep molecular understanding of factor catabolism. Success in this area would dramatically reshape patient lifestyle and further solidify the dominance of recombinant EHL products over plasma-derived counterparts, which inherently face limitations in achieving such extreme half-life extensions due to plasma sourcing constraints and manufacturing complexities.

Furthermore, the manufacturing complexity associated with Prothrombin Complex Concentrates (PCCs) and Factor VIIa (FVIIa) is increasing due to their critical role in emergency settings for acquired bleeding disorders and for treating inhibitor patients. Technology here focuses on ensuring rapid reconstitution, stability at higher concentrations, and batch-to-batch consistency—essential features when treating life-threatening hemorrhages. The need for rapid availability and deployment means distribution systems for these specific factor types must be even more streamlined and robust, emphasizing the logistical superiority of manufacturers who can reliably supply these acute care necessities on a global scale. The integration of quality by design (QbD) principles in manufacturing workflows is becoming mandatory to manage the inherent variability in biological source materials and complex purification processes, ensuring consistent product quality and regulatory compliance internationally.

The digital health component is not merely limited to patient monitoring but extends deeply into the clinical management of hemophilia. Telemedicine platforms integrated with dosing calculation software based on individual patient pharmacokinetics (PK) profiles are evolving rapidly. These technologies utilize AI algorithms trained on population PK data to predict individual factor clearance rates, allowing hematologists to prescribe highly personalized, data-driven prophylactic regimens. This optimization minimizes factor usage waste while maximizing clinical protection, a critical value proposition for high-cost therapeutics. The ability to offer this level of personalized medicine through digital tools is increasingly serving as a competitive differentiator, especially in established markets where patients expect cutting-edge, convenient care management solutions alongside their factor concentrate supply.

Finally, the long-term market structure depends heavily on the successful management of biosafety and immunogenicity risks. For new factor variants, robust preclinical and clinical data demonstrating low inhibitor incidence is non-negotiable. Technology focuses on designing factors that are less immunogenic, potentially through altering non-essential protein domains or optimizing protein folding during production. Regulatory bodies are demanding increasingly sophisticated monitoring systems to track inhibitor development across diverse patient populations post-launch. This necessity reinforces the moat around established, proven factor concentrates, making new market entry difficult and costly, thereby consolidating market power among incumbents with decades of safety and efficacy data.

The financial viability of the Coagulation Factor Concentrates market is directly linked to intellectual property management, ensuring that the proprietary technologies used for EHL extensions and novel factor design remain protected against generic competition for extended periods. Successful companies actively manage large patent landscapes, creating interlocking protections around the molecule, the process, and the delivery system. Pricing strategies must be carefully calibrated to balance access goals in developing nations—often facilitated through humanitarian aid or tiered pricing—with maintaining premium profitability in highly subsidized markets. The balance between profitability and global accessibility is a continuous ethical and strategic challenge defining corporate market positioning and public perception.

The increasing prevalence of aging populations globally means that hemophilia patients are living longer, often developing age-related comorbidities that complicate their coagulation management. This demographic shift necessitates the development of factor concentrates that are compatible with polypharmacy and tailored for older patients, potentially requiring lower-volume injections or enhanced stability features. This trend drives technology innovation toward higher concentration formulations that minimize fluid load, addressing a subtle but growing clinical need within the market. Furthermore, the rise in acquired hemophilia, an autoimmune condition, represents another key growth driver for acute factor usage (often FVIIa or PCCs), requiring robust factor supplies tailored for rapid, emergency intervention across general hospital settings, expanding the customer base beyond traditional HTCs.

Market sustainability is also intrinsically tied to environmental and ethical sourcing practices. For plasma-derived products, ethical sourcing of human plasma, ensuring non-coercive donation and compensating donors appropriately (where permissible), is crucial for maintaining public trust and regulatory approval. For recombinant manufacturers, reducing the carbon footprint associated with large-scale bioreactor operations and minimizing chemical waste from complex purification processes are becoming key corporate social responsibility (CSR) initiatives that influence procurement decisions by major healthcare systems, adding a non-financial factor to competitive positioning in the highly scrutinized biotechnology sector.

Finally, the investment ecosystem reflects confidence in specialized hematology, with significant venture capital and pharmaceutical M&A activity targeting innovative platforms, particularly those focused on gene therapy manufacturing and delivery systems. This influx of capital accelerates the competitive race to find a durable cure, but simultaneously pressures existing concentrate manufacturers to rapidly adapt by offering superior, safer, and more convenient replacement options. The market is evolving from a product market into a comprehensive solution market, where factor concentrates are packaged with diagnostic, monitoring, and educational services, ensuring holistic patient management and securing long-term payer allegiance.

The strategic challenge for market leaders is balancing short-term revenue from established factor concentrate lines with the long-term imperative to invest heavily in curative or disruptive technologies. This necessitates a dual-track strategy: maximizing the lifecycle value of current EHL products through global market penetration and advanced formulation, while concurrently positioning the company to benefit from the eventual shift toward gene therapy, either through internal development, strategic acquisition, or partnerships. Failure to embrace this technological duality risks obsolescence in a market defined by rapid innovation aimed at reducing lifelong dependency on replacement therapy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager