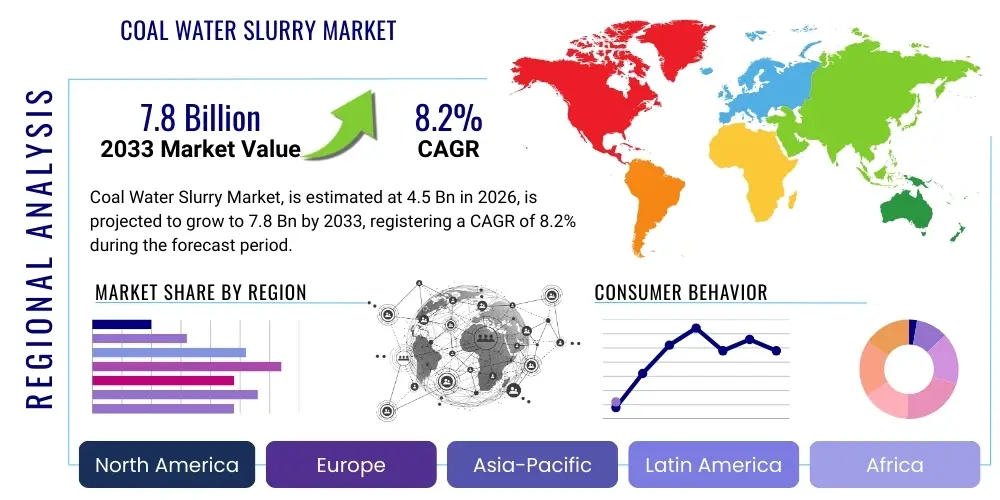

Coal Water Slurry Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442590 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Coal Water Slurry Market Size

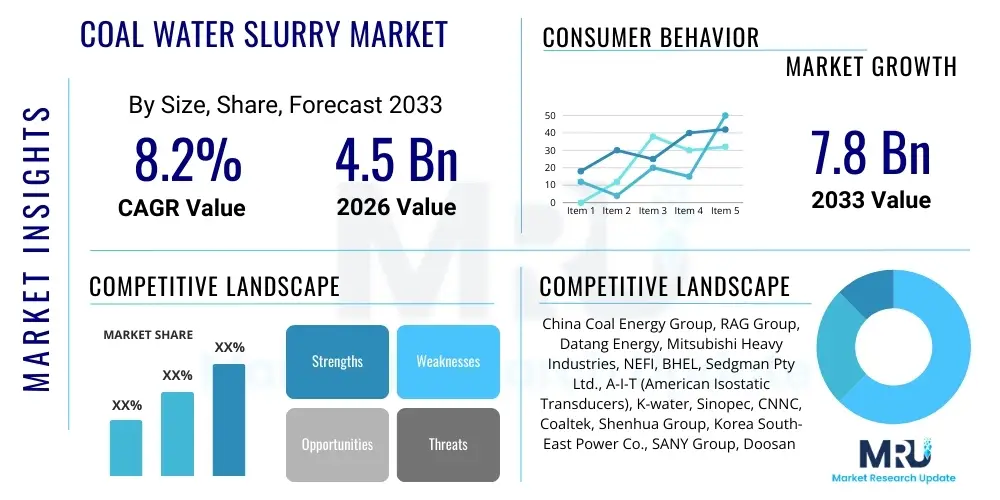

The Coal Water Slurry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.8 Billion by the end of the forecast period in 2033.

Coal Water Slurry Market introduction

The Coal Water Slurry (CWS) market encompasses the production, distribution, and utilization of a suspension fuel composed primarily of finely pulverized coal particles dispersed stably in water, often incorporating chemical additives to maintain fluidity and stability. This advanced fuel technology serves as a viable alternative to heavy fuel oil and raw pulverized coal, offering significant environmental and logistical advantages, particularly in industrial and utility-scale applications. The fundamental product offers energy density comparable to low-grade oils while utilizing abundant and domestically sourced coal, crucial for energy security in nations highly reliant on coal resources for their industrial base and power generation capacity. The introduction of CWS marked a pivotal shift toward cleaner and more efficient coal utilization methods, addressing some of the inherent challenges associated with traditional solid fuel handling and combustion.

Major applications of Coal Water Slurry are predominantly found in the power generation sector, where it is utilized in boiler systems originally designed for oil combustion, enabling a straightforward fuel switch without intensive infrastructure overhauls. Beyond power plants, CWS is increasingly adopted by heavy industries such as cement manufacturing, metallurgical processing, and chemical production, which require stable, high-intensity heat sources. The immediate benefits derived from CWS adoption include enhanced handling safety, reduction in particulate matter emissions compared to dry pulverized coal, and improved combustion efficiency due to the fine particle size and precise control over fuel injection. This technology facilitates compliance with tightening environmental regulations while maintaining fuel cost competitiveness, making it highly attractive in regions prioritizing both industrial output and environmental stewardship.

The driving factors behind the sustained growth of the CWS market are multi-faceted, centered around the necessity for enhanced energy efficiency and the global push for reduced emissions from coal combustion. Specifically, the volatility and rising cost of petroleum-based heavy fuels incentivize the adoption of cheaper, more predictable coal-based alternatives. Furthermore, continuous technological advancements in CWS formulation, specifically related to stability enhancement and ash management, are expanding its applicability to a broader range of industrial operations. Supportive governmental policies, particularly in Asia Pacific economies, focusing on "clean coal" technologies and energy independence, further stimulate investment in CWS production facilities and utilization infrastructure, solidifying its role as a key component in the transitionary energy mix.

- Product Description: Stable colloidal suspension of fine coal particles in water with stabilizing additives.

- Major Applications: Utility power generation, industrial boilers, cement kilns, metallurgical furnaces.

- Key Benefits: Improved handling safety (liquid fuel characteristics), reduced particulate emissions, lower operational costs compared to heavy fuel oil.

- Driving Factors: High cost of heavy fuel oil, stringent air quality regulations, focus on national energy security, and advancements in slurry preparation technology.

Coal Water Slurry Market Executive Summary

The global Coal Water Slurry (CWS) market is currently experiencing robust growth, primarily driven by compelling business trends focusing on optimizing operational expenditure and achieving cleaner combustion processes within traditional heavy industries. A core business trend involves the retrofitting of existing oil-fired facilities, particularly in the utility and cement sectors, to utilize CWS, thereby extending the economic life of these assets while immediately realizing fuel cost savings. Furthermore, there is a pronounced investment shift toward developing specialized, high-concentration CWS formulations tailored for specific industrial applications, maximizing energy density and combustion efficiency, which represents a crucial business differentiator among leading providers. Strategic partnerships between coal suppliers, chemical additive manufacturers, and engineering firms are also increasing, forming comprehensive value chains that streamline production and distribution logistics globally.

Regionally, the market trajectory is overwhelmingly dominated by the Asia Pacific (APAC) area, spearheaded by China and India, which possess vast coal reserves and massive, rapidly expanding industrial and energy infrastructure requiring immediate, cost-effective fuel alternatives. These regional trends are characterized by substantial governmental support for domestic coal utilization through cleaner technologies like CWS, positioning APAC as both the largest producer and consumer. Europe, while shifting toward renewable energy, maintains niche demand for CWS in specialized industrial pockets where high thermal output is necessary, and logistical infrastructure supports its use. North America exhibits moderate growth, focused primarily on technological innovation in CWS stability and environmental performance, rather than volume consumption, driving specialized exports and licensing agreements.

Segment trends reveal that the Power Generation application segment continues to hold the largest market share, serving as the foundational consumer base due to the high volume requirement for utility-scale boilers. However, the Industrial Boilers segment, encompassing various manufacturing processes, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), reflecting widespread adoption as small to mid-sized industrial players seek efficiency gains and fuel diversification. Segmentation by Type emphasizes the increasing demand for High Concentration Coal Water Slurry (HCCWS), which minimizes water content and maximizes calorific value, thereby reducing transportation costs and improving combustion performance. This technological preference is reshaping the competitive landscape, favoring manufacturers capable of producing highly optimized, stable slurries reliably.

AI Impact Analysis on Coal Water Slurry Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Coal Water Slurry market commonly center on questions of operational efficiency, quality control, and environmental mitigation. Key concerns frequently revolve around how AI can optimize the slurry formulation process to ensure consistent stability and maximum energy output, given the inherent variability in raw coal feedstock. Users also express strong interest in AI’s ability to predict and prevent equipment failures in complex CWS preparation plants and boiler systems, seeking significant reductions in downtime. Furthermore, there is a distinct theme focusing on AI-driven combustion optimization, where advanced algorithms can dynamically adjust air-to-fuel ratios and nozzle pressures in real-time to minimize NOx and SOx emissions while maximizing thermal output, transforming CWS from a traditional fuel source into a highly controlled energy system. The overwhelming expectation is that AI integration will fundamentally enhance the reliability, cost-effectiveness, and environmental compliance of CWS utilization across the entire value chain.

- Enhanced Process Optimization: AI algorithms predict optimal mixing ratios of coal, water, and additives, maximizing slurry stability and concentration based on real-time feedstock analysis.

- Predictive Maintenance: AI monitors vibrational data, temperature profiles, and flow rates in preparation plants and pipelines to forecast equipment failures in pumps, mixers, and injectors, reducing unplanned downtime significantly.

- Combustion Efficiency: Machine Learning (ML) models dynamically adjust boiler parameters (e.g., air flow, secondary injection) during operation to maintain peak thermal efficiency and minimize pollutant formation, crucial for AEO compliance.

- Supply Chain Management: AI optimizes raw coal sourcing and CWS logistics, forecasting demand fluctuations and improving inventory management for highly volatile industrial consumer bases.

- Quality Control Automation: Computer vision systems and sensor data analyzed by AI ensure the consistent particle size distribution of pulverized coal, which is critical for CWS stability and atomizer performance.

DRO & Impact Forces Of Coal Water Slurry Market

The dynamics of the Coal Water Slurry (CWS) market are dictated by a powerful combination of drivers, restraints, and opportunities that collectively shape the adoption curve and investment decisions globally. A primary driver is the pervasive need for cost-effective fuel diversification, particularly in countries heavily reliant on energy imports, where CWS leverages domestic coal reserves to enhance energy independence and mitigate exposure to volatile international oil markets. This economic imperative is strongly supported by technological advancements that have significantly improved the stability, handling, and combustion characteristics of CWS, moving it beyond a niche alternative into a mainstream industrial fuel. Simultaneously, the impact force of regulatory pressure, demanding cleaner combustion technologies, compels industries to adopt CWS as a bridging solution that immediately improves emission profiles compared to burning raw coal or heavy fuel oil, satisfying initial environmental compliance requirements without requiring full transition to non-fossil fuels.

However, significant restraints impede the rapid expansion of the CWS market, primarily centered around high initial capital expenditure (CAPEX) required for setting up specialized slurry preparation plants and retrofitting existing boiler infrastructure. The required investments in homogenization, pumping systems, and specialized atomizers create a substantial entry barrier, particularly for smaller industrial consumers. Furthermore, the inherent technical challenge of managing high-ash content in certain coal types, which can compromise slurry stability and lead to burner fouling, remains a critical restraint that demands continuous R&D investment. The long-term global impact force of decarbonization policies, aiming for net-zero emissions, presents a fundamental existential threat, positioning CWS as a transition fuel that eventually must be phased out, potentially deterring large-scale, decades-long infrastructure investments in CWS production.

Despite these challenges, substantial market opportunities exist, particularly within the rapidly industrializing economies of Asia and Africa, where massive energy demand growth cannot be met solely by renewables in the near to medium term. The opportunity lies in positioning CWS as the cleanest, most efficient way to utilize domestic coal reserves, capitalizing on the vast installed base of coal-fired power and cement plants. Furthermore, market expansion is achievable through novel applications, such as using CWS as a feedstock for Integrated Gasification Combined Cycle (IGCC) systems, enhancing overall system efficiency and reducing environmental output further. The cumulative impact forces of economic necessity, regulatory mandates for pollution control, and targeted innovation in additive chemistry and ash handling technology are expected to maintain the market's positive trajectory throughout the forecast period, balancing the inherent constraints imposed by global climate goals.

Segmentation Analysis

The Coal Water Slurry (CWS) market is segmented based on the composition characteristics of the slurry (Type), the specific industrial application where the fuel is consumed (Application), and the concentration level (End-Use Industry), which collectively define the market structure and competitive dynamics. Understanding these segments is crucial as the performance requirements and pricing mechanisms vary significantly across different formulations. For instance, high-concentration slurries, while challenging to produce, command a premium due to their superior energy density and reduced transport costs, making them preferred in remote power generation facilities. Conversely, slurries designed for industrial boilers prioritize stability under varying operating conditions, often accepting slightly lower concentrations for logistical simplicity and cost control. This granular segmentation allows market players to specialize in offerings that meet the specific technical and economic needs of diverse end-user profiles, from centralized power plants to decentralized industrial heat applications.

- By Type:

- Standard Concentration Coal Water Slurry (SCCWS)

- Medium Concentration Coal Water Slurry (MCCWS)

- High Concentration Coal Water Slurry (HCCWS)

- By Application:

- Power Generation (Utility Boilers)

- Industrial Boilers and Furnaces

- Cement Manufacturing

- Metallurgical Applications (e.g., Iron and Steel)

- Chemical Processing

- By End-Use Industry:

- Energy & Power Sector

- Chemical & Materials Industry

- Construction & Cement Industry

- Manufacturing Sector

Value Chain Analysis For Coal Water Slurry Market

The Coal Water Slurry value chain commences with the upstream extraction and preparation of raw coal, a phase critical for determining the final quality and stability of the resulting slurry. Upstream activities involve extensive coal mining operations, followed by sorting, crushing, and meticulous beneficiation processes to reduce ash and sulfur content, which are detrimental to CWS performance. The quality of raw coal feedstock directly impacts the required complexity of the subsequent slurry preparation phase. Key players in this stage are large-scale coal producers and specialized coal washing and processing companies, focusing on consistent supply volumes and stringent quality control standards necessary for producing stable, high-concentration CWS formulations tailored to specific customer specifications regarding viscosity and calorific value.

The midstream phase centers on the actual slurry manufacturing process, where pulverized coal is mixed with water and chemical additives (stabilizers, dispersants) under precise conditions to create the final CWS product. This stage is technologically intensive, involving proprietary mixing and grinding technologies crucial for achieving colloidal stability and uniform particle size distribution. Following production, the logistics and distribution channels become paramount. CWS is transported as a liquid, utilizing direct pipelines, rail tankers, or specialized road tankers, requiring robust infrastructure and adherence to strict safety protocols. Direct channels involve dedicated pipelines from the preparation plant to a captive power plant, ensuring continuous, reliable supply, while indirect channels utilize third-party logistics providers to deliver CWS to distributed industrial customers.

Downstream analysis focuses on the end-use and consumption of CWS, primarily within utility power generation, cement manufacturing, and industrial boiler operations. Success at this stage relies heavily on customer conversion, often involving the complex retrofitting of oil-fired or traditional coal-fired facilities to handle CWS combustion efficiently. Key downstream activities include specialized burner installation, atomization equipment maintenance, and ash handling system integration. The stability and predictability of CWS supply are major factors influencing downstream decision-making, as end-users require guaranteed fuel characteristics to maintain consistent operational output and environmental compliance. Effective collaboration between CWS producers and combustion equipment manufacturers is vital for optimizing downstream utilization performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | China Coal Energy Group, RAG Group, Datang Energy, Mitsubishi Heavy Industries, NEFI, BHEL, Sedgman Pty Ltd., A-I-T (American Isostatic Transducers), K-water, Sinopec, CNNC, Coaltek, Shenhua Group, Korea South-East Power Co., SANY Group, Doosan Heavy Industries, Powerchina, Foster Wheeler. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coal Water Slurry Market Potential Customers

The primary potential customers for Coal Water Slurry are large-scale energy producers and heavy industrial conglomerates whose operational continuity relies on high-volume, continuous heat and power generation. Utility companies operating existing coal or oil-fired power plants represent the largest consumer base, especially those seeking cost-effective fuel switching solutions without massive reinvestment in new combustion infrastructure. These customers are driven by regulatory demands for reduced emissions, specifically sulfur dioxide (SOx) and particulate matter, and the economic necessity of securing long-term, stable fuel supply, making CWS an attractive interim solution that bridges the gap between traditional fossil fuels and renewable energy sources. Furthermore, state-owned energy enterprises in coal-rich nations are key strategic customers, often mandated by government policy to prioritize domestic fuel sources like CWS to enhance national energy security.

Secondary but rapidly growing customer segments include the Cement and Construction industries. Cement production is highly energy-intensive, requiring sustained high temperatures, and CWS provides a stable and often cheaper alternative to traditional fuels such as pulverized coal or petcoke. These customers evaluate CWS based on its impact on clinker quality, burner efficiency, and overall fuel cost reduction, placing emphasis on formulations with controlled ash chemistry to avoid deleterious effects on their processes. The inherent logistical benefits of handling CWS as a liquid, minimizing dust and storage issues typical of dry coal, further enhance its appeal to industrial end-users constrained by space or stringent dust control regulations in urban or semi-urban operating environments.

Another crucial customer group is the chemical and materials processing sector, particularly manufacturers utilizing industrial boilers for steam generation or direct heating processes. These customers require highly consistent fuel quality to prevent operational disruptions and maintain product quality. For these specialized industrial applications, the potential customer base is highly technical, focusing on the homogeneity and viscosity stability of the slurry under varying load conditions. Successful penetration into this segment relies on CWS providers offering tailored solutions, often incorporating advanced additives and supply chain predictability, ensuring that the CWS acts as a reliable, drop-in replacement for conventional heavy fuel oil, minimizing the transition risk for high-value manufacturing processes.

Coal Water Slurry Market Key Technology Landscape

The technological landscape of the Coal Water Slurry market is characterized by continuous innovation across three main areas: preparation, stabilization, and combustion. In the preparation phase, key technological advancements focus on ultra-fine grinding techniques, such as stirred media milling, which ensure the coal particles are reduced to sub-micron sizes (typically 10-50 micrometers). This ultra-fine grinding is crucial for achieving high coal loading (up to 70% by weight) while maintaining low viscosity, a property essential for efficient pumping and atomization. Modern preparation plants incorporate advanced classification and dewatering technologies, often utilizing froth flotation or selective agglomeration, to enhance the purity of the coal concentrate prior to mixing, thereby ensuring the final slurry delivers superior calorific value and minimized ash content, which is a major technological differentiator in the highly concentrated CWS segment.

Stability technology constitutes another vital pillar of the market, driven by the need to prevent coal sedimentation during long-distance transport and prolonged storage. The current landscape involves sophisticated surfactant and polymer chemistry, where proprietary chemical additives are used as dispersants and stabilizers. Research and development efforts are focused on creating environmentally friendly additives that are effective across a wide range of coal types (bituminous, sub-bituminous, lignite) and varying water chemistries. The development of electro-rheological fluids and smart additive systems allows for dynamic adjustment of the slurry's rheological properties, preventing pipeline plugging and ensuring optimal flow characteristics from the storage tank to the burner tip, often monitored and controlled using real-time sensor data and control systems.

The combustion technology aspect involves specialized boiler and burner designs optimized for CWS utilization. Crucial innovations include the design of highly efficient CWS atomizers, which use either mechanical, steam, or air assistance to break the slurry into fine droplets necessary for rapid and complete combustion, mitigating the cooling effect of the water content. Advanced burner designs incorporate features that manage flame stability and temperature profiles to minimize the formation of nitrogen oxides (NOx), a key environmental concern. The trend toward adopting CWS for retrofitted oil boilers necessitates tailored combustion systems that can seamlessly integrate into existing infrastructure, often incorporating advanced flue gas treatment systems designed to manage the specific ash characteristics resulting from CWS firing, ensuring high energy conversion efficiency while meeting stringent emission targets.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed epicenter of the Coal Water Slurry market, accounting for the dominant share of consumption and production. This supremacy is directly attributed to the massive industrial footprint of countries like China and India, which possess vast, domestically available coal reserves and simultaneously face immense pressure to modernize their power infrastructure for improved efficiency and reduced local pollution. Government initiatives in these nations heavily promote "clean coal" technologies, positioning CWS as a mature, proven technology that allows utilities and cement producers to comply with local environmental regulations without sacrificing the critical volume of energy required for economic growth. The high density of heavy industrial clusters, combined with the continuous operation of coal-fired assets, ensures a stable and continuously growing demand base for CWS formulations optimized for regional coal types and transportation networks.

North America and Europe, while possessing smaller CWS markets overall compared to APAC, are crucial hubs for technological innovation and niche industrial application. In Europe, consumption is focused less on utility-scale power generation and more on specialized high-temperature processes in industries such as metallurgy and chemical manufacturing, where CWS provides specific logistical and environmental benefits over alternative heavy fuels. The focus here is heavily skewed toward high-quality, ultra-low emission CWS products. North America’s market growth is driven primarily by patented technology development, particularly in areas like advanced additives and rheology control, often leading to export revenues and licensing agreements rather than domestic volume sales. The stringent environmental standards in these regions compel CWS providers to continuously refine their formulations and combustion efficiency technologies.

The Latin America and Middle East & Africa (MEA) regions represent significant growth opportunities for the CWS market. Latin American countries, particularly those with strong industrial sectors and domestic coal supplies, are beginning to evaluate CWS as a means to reduce reliance on volatile oil imports for industrial steam and power generation. In the MEA region, the market is emerging, driven by industrialization and infrastructure projects, particularly in countries seeking to diversify their energy mix away from natural gas for basic industrial heat, where CWS offers an economically viable, mid-term solution. These regions are characterized by less mature logistics infrastructure, meaning CWS solutions must be highly stable and flexible for multi-modal transport, positioning turnkey CWS plant solutions as a high-potential offering.

- Asia Pacific (APAC): Market leader by volume; driven by China and India’s energy security needs, rapid industrialization, and governmental support for clean coal technologies.

- Europe: Niche high-value market focused on specialized industrial applications (cement, metals) and high-quality, environmentally compliant CWS formulations.

- North America: Primarily a technology exporter and R&D center; moderate domestic consumption focused on innovation in stabilization and combustion efficiency.

- Latin America & MEA: Emerging markets with high potential; adoption driven by industrial fuel diversification and infrastructure development, seeking alternatives to volatile oil imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coal Water Slurry Market.- China Coal Energy Group

- RAG Group

- Datang Energy Generation Co., Ltd.

- Mitsubishi Heavy Industries, Ltd. (MHI)

- NEFI (National Energy Technology Laboratory)

- Bharat Heavy Electricals Limited (BHEL)

- Sedgman Pty Ltd.

- A-I-T (American Isostatic Transducers)

- Korea Water Resources Corporation (K-water)

- Sinopec (China Petroleum & Chemical Corporation)

- CNNC (China National Nuclear Corporation)

- Coaltek Ltd.

- Shenhua Group (China Energy Investment)

- Korea South-East Power Co., Ltd.

- SANY Group Co., Ltd.

- Doosan Heavy Industries & Construction Co., Ltd.

- Powerchina Resources Ltd.

- Foster Wheeler AG (now part of Amec Foster Wheeler)

Frequently Asked Questions

Analyze common user questions about the Coal Water Slurry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary environmental advantages of using Coal Water Slurry (CWS) over pulverized coal?

CWS offers key environmental benefits, primarily reduced particulate matter (dust) emissions due to its liquid form, improving handling safety. Furthermore, sulfur and ash can be partially removed during CWS preparation, leading to lower SOx emissions compared to direct raw coal combustion, particularly when coupled with modern boiler technology.

How does the High Concentration Coal Water Slurry (HCCWS) segment differ technologically from standard CWS?

HCCWS typically contains 65–75% coal solids, significantly reducing the water content compared to standard CWS (45–55%). This requires sophisticated chemical additives and ultra-fine grinding technology to maintain stability and flow characteristics, resulting in higher energy density and substantial logistical cost savings.

Which geographical region dominates the consumption of Coal Water Slurry, and why?

The Asia Pacific (APAC) region, led by China and India, dominates CWS consumption. This dominance is driven by the necessity for cleaner utilization of vast domestic coal reserves, high industrial energy demand, and government policies supporting cost-effective, transitionary fuel technologies for existing power and cement infrastructure.

What are the main technical hurdles to adopting Coal Water Slurry in existing power plants?

The main hurdles include the high initial capital investment required for retrofitting existing facilities with specialized atomizers and CWS burners, the need for robust slurry storage and pipeline infrastructure, and managing the potential for burner erosion and ash fouling specific to CWS combustion residues.

Is Coal Water Slurry considered a long-term energy solution, given global decarbonization goals?

CWS is generally viewed as a critical transition fuel. While it significantly improves the efficiency and reduces the immediate environmental impact of coal utilization, it remains a fossil fuel. Its long-term viability depends on integration with carbon capture technologies or its use in high-efficiency systems like IGCC, where its liquid properties facilitate enhanced processing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager