Coated Groundwood Paper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443532 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Coated Groundwood Paper Market Size

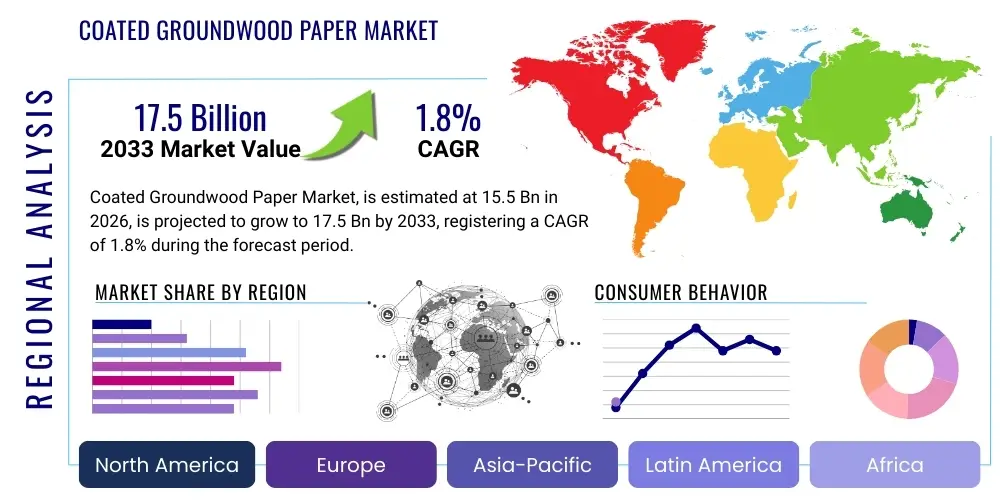

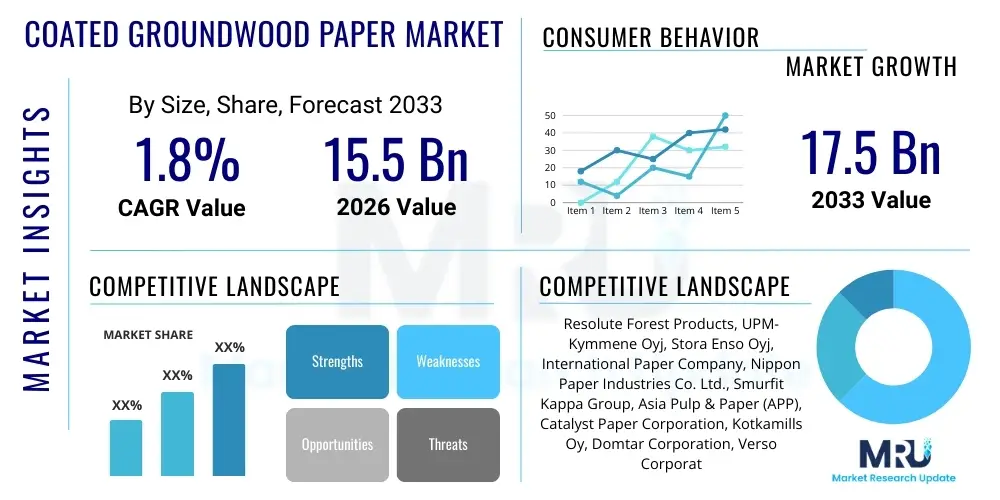

The Coated Groundwood Paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 1.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 17.5 Billion by the end of the forecast period in 2033.

Coated Groundwood Paper Market introduction

The Coated Groundwood Paper market encompasses paper products that utilize mechanical pulp (groundwood) combined with chemical pulp, followed by the application of a surface coating typically composed of pigments and binders. This specific type of paper is highly valued in the printing industry due to its superior opacity, smoothness, brightness, and excellent printability, particularly for high-speed web offset and rotogravure printing processes. Groundwood pulp provides high bulk and stiffness at lower cost compared to purely chemical pulp, making Coated Groundwood Paper a cost-effective solution for publications requiring high volume and color fidelity, such as magazines, catalogs, inserts, and promotional flyers. Market dynamics are heavily influenced by the consumption habits of the retail and publishing sectors, though structural decline in traditional print media necessitates strategic shifts toward niche high-value applications and sustainable production methods.

Coated Groundwood Paper is categorized into various grades, primarily differentiated by basis weight, brightness, and the amount of mechanical versus chemical fiber content, often designated as LWC (Lightweight Coated) or MFC (Machine Finished Coated). These grades directly impact their suitability for specific applications. LWC paper, for instance, is the cornerstone for high-volume magazines and advertising inserts due to its lightweight nature, which minimizes postage costs while maintaining excellent graphic reproduction quality. The manufacturing process involves sophisticated coating technologies, often utilizing clay, calcium carbonate, or titanium dioxide, which fills the surface pores of the base paper and provides the necessary gloss and ink holdout required for sharp, vibrant imagery. Demand stability in this sector is highly dependent on advertising expenditure cycles and the structural health of the print retail environment.

The principal applications driving the continued albeit modest growth in specific segments include retail circulars, mass-market catalogs, and sophisticated direct mail campaigns where tactile interaction remains crucial for consumer engagement. While digital media adoption has constrained overall volume growth, Coated Groundwood Paper continues to offer distinct benefits, such as high fidelity color consistency across large print runs, and the ability to convey a sense of quality and permanence often leveraged in premium brand marketing. Major driving factors include the relative affordability compared to Coated Freesheet papers, advancements in printing technology enabling higher quality on lighter stocks, and the growing consumer preference for sustainably sourced paper products, pressuring manufacturers to enhance fiber sourcing and recycling infrastructure.

Coated Groundwood Paper Market Executive Summary

The Coated Groundwood Paper market is navigating a complex landscape characterized by structural decline in legacy publishing sectors offset by stabilization in advertising-driven segments like retail inserts and catalogs. Business trends indicate a continued consolidation among major producers globally, driven by the necessity to optimize capacity utilization and achieve economies of scale amidst fluctuating raw material costs, particularly pulp and energy. Strategic investments are increasingly focused on process efficiency, minimizing environmental impact, and developing specialized, high-opacity grades that compete effectively with digital marketing channels by offering superior visual and tactile appeal. The market exhibits significant overcapacity in certain regions, leading to competitive pricing pressure, thus rewarding companies with diversified product portfolios and robust supply chain management.

Regionally, the market presents a dichotomy. Mature markets in North America and Europe are experiencing sustained volume contraction, forcing producers to rationalize operations and focus on high-margin, specialized coated grades for commercial printing and specific packaging applications. Conversely, the Asia Pacific (APAC) region, driven by countries such as China and India, demonstrates relative resilience due to expanding consumer bases, growing retail sectors, and increasing literacy rates, although the adoption rate of digital media is rapidly accelerating there as well. These regional shifts dictate investment decisions, with capital expenditure largely targeting operational efficiencies in the West and targeted capacity expansions or modernizations in select high-growth Asian markets.

Segmentation trends highlight a crucial pivot towards sustainable and certified paper products, with buyers increasingly demanding Forest Stewardship Council (FSC) or Programme for the Endorsement of Forest Certification (PEFC) certified papers. By product type, Lightweight Coated (LWC) paper remains the dominant segment due to its suitability for high-volume advertising media. By application, the retail segment (catalogs and circulars) is the primary revenue driver, offering more stability than traditional magazine or newspaper inserts, which have been severely impacted by digital migration. Success in the forecast period hinges on manufacturers’ ability to innovate within the coating chemistry and fiber preparation processes to deliver papers that offer premium aesthetics at groundwood-competitive price points.

AI Impact Analysis on Coated Groundwood Paper Market

User queries regarding AI's impact on the Coated Groundwood Paper market typically revolve around two primary concerns: the role of AI in accelerating the shift towards digital advertising, and the potential for AI optimization within the paper manufacturing and supply chain processes. Users are concerned that AI-driven hyper-personalization and highly efficient targeted advertising platforms will further diminish the relevance and volume requirements for printed media, particularly catalogs and direct mail. Conversely, there is significant interest in how AI can be leveraged to enhance operational efficiency, specifically in predictive maintenance of complex paper machines, optimizing pulp blending ratios for consistency, and improving logistics to minimize inventory costs and waste. The key themes emerging are efficiency gains versus structural demand risk.

The structural risk posed by AI is principally centered on its ability to enhance the effectiveness of digital alternatives. AI algorithms are increasingly sophisticated at determining consumer intent and optimizing advertising spend across digital channels, which directly competes with the traditional large-volume print advertising that Coated Groundwood Paper serves. As marketers gain greater real-time return on investment (ROI) metrics from digital campaigns, the allocation of budgets away from print becomes a predictable outcome. This demands that print advertisers leverage print's unique characteristics—tactility, permanence, and high-quality reproduction—in highly specific, niche applications that complement, rather than directly compete with, digital outreach, such as high-end brand books or limited-run, personalized direct mail pieces.

Operationally, AI offers substantial opportunities for market participants to mitigate the rising costs and complex production environment. Machine learning models can analyze vast datasets from sensors across the production line—from pulping consistency to coating application speed and drying temperature—to predict quality deviations before they occur. This predictive capability translates directly into reduced waste, lower energy consumption, and increased uptime, crucial financial levers in a mature, price-sensitive market. Furthermore, AI-driven demand forecasting can significantly improve inventory management and optimize global logistics, ensuring the right grades of paper are delivered efficiently, thereby enhancing competitiveness against cheaper, lower-quality alternatives.

- AI accelerates digital marketing efficacy, potentially reducing bulk print volume demand.

- Predictive maintenance driven by AI optimizes paper machine uptime and reduces operational costs.

- AI-enhanced coating and quality control systems ensure superior product consistency and lower defect rates.

- Improved supply chain logistics and inventory forecasting through machine learning minimizes working capital requirements.

- AI assists in developing highly personalized print runs (programmatic print), creating high-value, niche applications.

DRO & Impact Forces Of Coated Groundwood Paper Market

The Coated Groundwood Paper market is fundamentally shaped by a delicate balance of inherent advantages, structural constraints, and emerging opportunities. Driving factors (D) primarily center on the cost-effectiveness of groundwood fiber, which makes it an indispensable medium for price-sensitive, high-volume advertising materials like retail circulars and mass-market catalogs. The superior surface qualities imparted by the coating process—including brightness, smoothness, and ink holdout—ensure that brand messaging maintains visual integrity, a critical need for advertisers. Restraints (R), however, are potent, dominated by the pervasive substitution threat posed by digital media across virtually all publishing and advertising formats, leading to secular volume decline. Furthermore, volatile raw material costs (pulp, chemicals, energy) and increasing environmental regulatory pressures pose constant operational challenges, squeezing already thin profit margins for manufacturers.

Opportunities (O) for market participants lie in strategic diversification towards specialized, high-performance coated grades that serve resilient niches. This includes ultra-lightweight high-opacity grades that minimize postage costs and sustainable products manufactured using circular economy principles, such as high recycled content papers or those with advanced renewable fiber sourcing. Furthermore, optimizing the use of Coated Groundwood Paper in hybrid advertising campaigns, where print serves as a high-impact, tactile complement to digital outreach, provides a crucial avenue for sustained demand. The Impact Forces (IF) are currently favoring substitution and regulatory constraints over innate demand drivers. The high fixed cost structure of integrated paper mills means that operational efficiencies (IF) are paramount, making technology adoption for energy and process optimization a critical competitive necessity. The pervasive environmental consciousness (IF) among corporate buyers and consumers mandates continuous improvement in sustainable forestry and manufacturing practices.

The combined effect of these forces suggests a highly competitive, mature market where volume growth is difficult to achieve, necessitating aggressive cost management and strategic innovation. Companies must not only defend their core high-volume printing segments but also actively seek out and develop new applications, potentially bridging into specialized flexible packaging or label stock where the groundwood component offers cost advantages. Addressing the environmental restraint by achieving carbon neutrality or significantly increasing the use of sustainable energy sources will be crucial for maintaining corporate social license to operate, especially in heavily regulated European and North American markets. Therefore, while demand forces are weak, technological and regulatory impact forces are strong and shape the investment landscape significantly.

Segmentation Analysis

The Coated Groundwood Paper market is structurally segmented primarily based on the grade of paper, which reflects its intended end-use application, its weight, and its processing characteristics. The core distinction lies between Lightweight Coated (LWC), Mediumweight Coated (MWC), and other specialized coated mechanical papers. These physical attributes directly translate into functional suitability, dictating whether the paper is optimized for low-cost, high-volume direct mail, glossy magazine covers, or highly detailed, high-resolution commercial printing. Furthermore, the market is segmented by the application, clearly distinguishing between highly impacted sectors like magazines and newspapers versus more resilient sectors like retail catalogs and advertising inserts. Geographical segmentation remains essential, reflecting diverse consumption patterns, differing levels of digital media penetration, and varying capacities for paper production globally, particularly between established Western markets and rapidly developing Asian economies.

The segmentation by coating method—blade coating, roll coating, or air knife coating—also reveals technological trends. Blade coating is dominant for high-volume, high-quality production, ensuring uniform smoothness required for demanding graphic applications. In terms of end-users, publishers, retailers, and commercial printers constitute the major consumers, with retail remaining the most stable segment due to the continued reliance on printed circulars for immediate sales promotion. Detailed analysis of these segments is vital for producers to accurately forecast demand shifts and allocate resources effectively, ensuring production aligns with the most economically viable and structurally stable pockets of demand, especially in a market characterized by general secular decline.

- By Product Type:

- Lightweight Coated (LWC) Paper

- Mediumweight Coated (MWC) Paper

- Machine Finished Coated (MFC) Paper

- Supercalendered Coated Paper

- By Coating Type:

- Blade Coated

- Roll Coated

- Air Knife Coated

- By Application:

- Magazines and Periodicals

- Retail Catalogs and Circulars

- Advertising Inserts and Flyers

- Commercial Printing (Brochures, Annual Reports)

- Direct Mail

- By Geography:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Coated Groundwood Paper Market

The Value Chain for Coated Groundwood Paper is a complex, capital-intensive process that spans resource extraction to end-user consumption. Upstream analysis focuses on the sourcing of primary raw materials: wood pulp (both mechanical groundwood pulp and supplementary chemical pulp), coating pigments (predominantly kaolin clay and calcium carbonate), and various binders and chemicals. The cost and quality of wood fiber, often supplied by integrated forest management operations or external suppliers, dictates the base paper properties and cost competitiveness. Volatility in energy costs is a major factor upstream, as mechanical pulping is highly energy-intensive. Efficiency in this stage is critical, often involving advanced grinding or thermomechanical processes to maximize yield while maintaining fiber quality suitable for high-speed printing.

The midstream segment involves the integrated paper manufacturing process, including pulping, paper forming, drying, and the critical coating application. This stage demands continuous technological optimization to minimize waste and ensure product consistency. Distribution channels (downstream) are typically multifaceted, involving direct sales from mill to large publishers or converters, as well as indirect sales through a network of merchant distributors and paper wholesalers. Merchants play a vital role in providing inventory management, cut-size services, and localized delivery to smaller commercial printers. The choice between direct and indirect distribution depends heavily on the volume requirements and geographic spread of the end-user base; large integrated publishers often negotiate long-term direct contracts, while smaller printing operations rely on the flexibility and accessibility provided by merchants.

Effective value chain management in this market hinges on mitigating supply chain risks associated with raw material price fluctuations and optimizing logistical pathways to counterbalance the relatively low value-per-ton nature of the product. The trend toward digitalization in logistics and inventory tracking is improving efficiency in the distribution segment. Furthermore, sustainability requirements influence the value chain deeply, requiring verifiable sourcing and production transparency, impacting everything from forest harvesting practices upstream to recycling infrastructure management downstream. Companies that successfully integrate sustainable practices and leverage advanced logistics technologies gain a significant competitive edge.

Coated Groundwood Paper Market Potential Customers

Potential customers and primary buyers of Coated Groundwood Paper are organizations with high-volume printing requirements where cost-efficiency must be balanced with adequate print quality for graphic reproduction. The largest and most consistent segment of end-users are major retail chains and hypermarkets. These entities utilize massive volumes of Coated Groundwood Paper for printing weekly or seasonal promotional circulars, flyers, and regional advertising inserts. The high speed and cost-effectiveness of groundwood-based paper make it ideally suited for these time-sensitive, high-frequency campaigns, where postage weight and material cost directly impact overall marketing budget efficiency. These retailers prioritize LWC grades that offer minimum weight combined with maximum opacity and good runnability on web presses.

Another significant customer segment includes magazine and periodical publishers, particularly those focusing on mass-market, lower-cost publications like entertainment guides, television listings, and certain trade journals. While this segment faces structural contraction due to digital substitution, they remain critical consumers of LWC and MWC papers for both the interior pages and potentially the covers of their publications. These publishers require excellent color reproduction and high surface smoothness to ensure compelling visual appeal that meets advertiser expectations. The third key segment comprises large commercial printing houses and direct mail companies that handle outsourcing jobs for diverse clients, ranging from corporate communications (brochures, lightweight annual reports) to sophisticated targeted direct marketing campaigns. These printers demand reliable supply and consistent paper properties to ensure high throughput and minimize press downtime.

Finally, niche, emerging applications include lightweight packaging liners and specialized promotional materials where the tactile quality and print brilliance of coated paper are leveraged to elevate brand perception without incurring the high costs associated with premium freesheet stocks. These end-users demand customized coatings or specific caliper specifications. Understanding the purchasing power and procurement cycles of these diverse customer groups—retailers operating on seasonal cycles, and publishers with fixed annual contracts—is paramount for suppliers to align their production capacity and inventory strategies accurately, ensuring stability in a challenging market environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 17.5 Billion |

| Growth Rate | 1.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Resolute Forest Products, UPM-Kymmene Oyj, Stora Enso Oyj, International Paper Company, Nippon Paper Industries Co. Ltd., Smurfit Kappa Group, Asia Pulp & Paper (APP), Catalyst Paper Corporation, Kotkamills Oy, Domtar Corporation, Verso Corporation, Svenska Cellulosa Aktiebolaget (SCA), Sylvamo Corporation, Kruger Inc., Hansol Paper Co., Ltd., The Navigator Company, SA, Sappi Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coated Groundwood Paper Market Key Technology Landscape

The technological landscape of the Coated Groundwood Paper market is defined by continuous process refinements aimed at enhancing efficiency, reducing costs, and improving the functional properties of the final product, particularly opacity and print surface quality. A major focus is on fiber processing technology, moving towards refined mechanical pulping techniques such as Thermo-Mechanical Pulping (TMP) and Chemi-Thermo Mechanical Pulping (CTMP). These advancements allow manufacturers to achieve higher strength and smoother base sheets with maximized fiber yield from wood resources, reducing the reliance on more expensive chemical pulps. Furthermore, sophisticated online monitoring and control systems, often integrated with AI and machine learning, are now standard in modern mills to ensure consistent weight, moisture, and caliper profiles across extremely high-speed production lines, minimizing breaks and costly waste.

Coating technology constitutes the second critical pillar of innovation. While high-speed blade coating remains the dominant method for producing LWC grades, technological evolution centers on advanced coating formulations. This includes the use of engineered mineral pigments, such as high-brightness calcium carbonates or structured kaolins, coupled with synthetic binders and optical brighteners (OBAs), to achieve superior gloss and print fidelity with minimal coating weight. The trend is toward thinner coatings that maintain performance, directly contributing to overall weight reduction—a crucial factor for postal cost savings in advertising media. Furthermore, advancements in drying technology, incorporating infrared and high-velocity air drying systems, allow for faster machine speeds while preventing curl and maintaining paper stability.

The third area of technological focus is sustainable manufacturing and water management. Modern mills are implementing closed-loop water systems and advanced effluent treatment plants to meet stringent environmental regulations, particularly in Europe. Bioenergy generation, utilizing by-products of the pulping process like bark and sludge, is becoming increasingly prevalent to reduce reliance on fossil fuels, directly addressing the high energy consumption characteristic of groundwood papermaking. Process digitization, encompassing digital twin technology for entire mill operations, allows for precise predictive modeling of production outcomes and raw material consumption, ensuring that manufacturers can operate at peak efficiency even with lower overall market volumes, maximizing profitability in a mature industry.

Regional Highlights

Regional dynamics within the Coated Groundwood Paper market are highly segmented, reflecting divergent trends in digital adoption, regulatory environments, and economic development. North America, historically a major consumer and producer, is characterized by market contraction driven by the pronounced decline in magazine circulation and the migration of advertising spending online. Producers in this region are aggressively consolidating capacity, focusing intensely on LWC grades for resilient segments like direct mail and specialized retail inserts, and converting some former printing paper machines to production of containerboard or packaging materials to adapt to shifting market demands. Sustainability certifications (e.g., SFI, FSC) are prerequisites for doing business with major retailers and publishers, driving continuous improvement in responsible sourcing and mill efficiency.

Europe represents another mature market facing similar structural challenges, exacerbated by some of the world's most stringent environmental regulations. The high cost of energy and labor places continuous pressure on European producers, forcing them to lead in technological adoption, particularly concerning bioenergy integration and high-yield pulping processes. Demand stability in Europe is partly maintained by a strong tradition of magazine culture in countries like Germany and France, and the persistent use of high-quality catalogs. However, overall consumption volumes are expected to continue declining gradually throughout the forecast period, making export markets increasingly vital for regional mills to maintain capacity utilization.

Asia Pacific (APAC) stands out as the area with the most stable, and in certain regions, slightly growing demand, particularly in developing economies like India and Southeast Asia. While China, the region’s largest market, is rapidly digitizing, the sheer scale of its consumer base and the ongoing expansion of its modern retail sector sustain high demand for printed advertising materials. The APAC region benefits from lower operating costs in some areas, but is also rapidly adopting higher quality standards and Western-style environmental controls. Local manufacturers are increasingly competing on quality and sustainability, not just price. Latin America and the Middle East & Africa (MEA) remain smaller markets, often characterized by reliance on imports or limited local, small-scale production, where demand is highly correlated with cyclical GDP growth and major global sporting or political events that boost advertising spending.

- North America: Defined by capacity rationalization, focus on high-opacity LWC grades for direct mail, and significant market conversion efforts towards packaging.

- Europe: Characterized by high environmental compliance standards, technological leadership in energy efficiency, and moderate, structurally stable demand in niche magazine and catalog segments.

- Asia Pacific (APAC): Exhibits the greatest potential stability, driven by retail growth in populous countries, high demand for commodity printing papers, and increasing investment in local, quality-focused manufacturing.

- Latin America (LATAM): Market volatility tied closely to macroeconomic conditions; relies on imports for specialized coated grades; focus on regional commercial printing.

- Middle East and Africa (MEA): Small but growing market primarily served by imports; demand driven by education and retail sector expansion in oil-rich nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coated Groundwood Paper Market.- Resolute Forest Products

- UPM-Kymmene Oyj

- Stora Enso Oyj

- International Paper Company

- Nippon Paper Industries Co. Ltd.

- Smurfit Kappa Group

- Asia Pulp & Paper (APP)

- Catalyst Paper Corporation (now owned by Paper Excellence)

- Kotkamills Oy

- Domtar Corporation (now part of Paper Excellence)

- Verso Corporation (now part of Billerud)

- Svenska Cellulosa Aktiebolaget (SCA)

- Sylvamo Corporation

- Kruger Inc.

- Hansol Paper Co., Ltd.

- The Navigator Company, SA

- Sappi Ltd.

- Glatfelter Corporation

- Sun Paper Group

- Metsa Group

Frequently Asked Questions

Analyze common user questions about the Coated Groundwood Paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor restraining growth in the Coated Groundwood Paper Market?

The primary restraining factor is the ongoing and accelerating substitution of printed media by digital advertising and publishing platforms, which reduces the overall volume demand for high-speed printing papers globally.

How is Coated Groundwood Paper differentiated from Coated Freesheet Paper?

Coated Groundwood Paper uses a significant portion of mechanical (groundwood) pulp, making it bulkier, more opaque, and typically less expensive. Coated Freesheet Paper uses exclusively chemical pulp, resulting in superior permanence, higher brightness, and better archival properties, but at a higher cost.

Which geographical region shows the most resilience in demand for this paper type?

The Asia Pacific (APAC) region, particularly driven by large consumer markets in China and India, exhibits the greatest resilience and stable demand due to expanding retail sectors and relatively lower digital penetration in specific consumer segments compared to Western markets.

What technological advancements are crucial for manufacturers in this market?

Crucial advancements include AI-driven process optimization for predictive maintenance and quality control, innovations in lighter-weight coating formulations, and investments in bioenergy and closed-loop systems to manage high energy costs and environmental compliance efficiently.

What is the main application driving demand for Lightweight Coated (LWC) grades?

The main application driving demand for LWC grades is the printing of high-volume retail circulars, catalogs, and promotional inserts, where the cost-effectiveness and reduced postal weight are critical economic advantages for major retailers.

The Coated Groundwood Paper market operates within a dynamic environment where survival and profitability depend on rigorous cost management, technical excellence in specialized product manufacturing, and strategic focus on market niches that resist digital disruption. The shift towards sustainable sourcing and environmentally responsible production processes is not merely a regulatory compliance issue but a fundamental requirement for maintaining market access, especially in highly developed economies. Despite the modest projected growth rate, the market continues to provide essential materials for the retail advertising sector, which utilizes printed media for direct, high-impact consumer engagement. Future success will be contingent upon the industry's ability to innovate lightweight, high-opacity papers that offer premium print aesthetics while remaining fundamentally cost-competitive against digital alternatives and premium paper grades.

The sustained competitive pressure necessitates that key players continually invest in optimizing the complex manufacturing value chain, from efficient fiber procurement—increasing the utilization of recycled fibers or sustainably certified virgin pulp—to optimizing distribution channels to minimize time-to-market and inventory holding costs. Furthermore, geopolitical stability and trade policies significantly influence the global flow of paper products, adding another layer of complexity to logistical planning for multinational corporations operating integrated supply networks. The capacity rationalization observed over the past decade in North America and Europe is expected to continue, leading to a leaner, more technologically sophisticated, and geographically consolidated global industry structure. This consolidation is aimed at ensuring that remaining production capacity aligns more closely with structurally adjusted, albeit lower, market demand volumes, thereby improving utilization rates and securing long-term operational viability for the surviving entities.

In summary, while the market faces headwinds from media convergence, the necessity of tactile, physical promotional materials for specific high-value campaigns ensures a baseline level of demand. Producers who successfully pivot towards high-value applications, such as specialized digital printing coated grades or hybrid paper-based interactive media, will be best positioned for sustained profitability. The 1.8% CAGR reflects a cautious stabilization, acknowledging that operational excellence and targeted innovation are necessary to capture value in a market where volume growth is limited. This requires deep understanding of end-user needs, focusing not just on the paper itself, but on the holistic efficiency of the printed media supply chain, including collaboration with commercial printers and advertisers to maximize the effectiveness of print campaigns in an increasingly digital world.

The economic viability of Coated Groundwood Paper production relies significantly on the minimization of input variability, a challenge where sensor technology and real-time data analytics are playing an increasing role. Maintaining consistency in the fiber mixture—balancing the cost benefit of mechanical pulp with the strength and quality provided by chemical pulp—is crucial for paper machine runnability at speeds exceeding 1,500 meters per minute. Furthermore, the selection and application of coating agents must be precise. The shift towards light calcium carbonate (LCC) and precipitated calcium carbonate (PCC) as primary pigments offers environmental and brightness advantages, but requires stringent control over particle size and shape distribution to ensure flawless surface uniformity necessary for high-definition color printing. Failure to maintain these standards results in press breaks and significant financial penalties in a fiercely competitive environment.

Beyond the core manufacturing process, market differentiation is increasingly achieved through supply chain integrity and transparency. Customers, particularly major brand owners and retailers, demand detailed traceability of paper products to ensure compliance with global anti-deforestation and ethical sourcing mandates. This has catalyzed investment in digital tracking systems that monitor fiber origin from the forest stand through to the final roll of paper. Moreover, the industry is witnessing a trend towards "smart paper" initiatives, although predominantly focused on packaging, which involve incorporating digital tracking or interactive elements into the printed product. While not yet mainstream for Coated Groundwood grades, these technological intersections hint at future opportunities for specialized advertising media that combines the physical presence of print with immediate digital interactivity, potentially revitalizing niche market segments.

Regulatory constraints continue to be a dominant external force, particularly regarding air and water emissions from integrated pulp and paper mills. Compliance costs are substantial, often necessitating significant capital expenditure for modernizing aging infrastructure, especially in Western Europe and North America. However, these regulations also inadvertently foster innovation, as mills are forced to develop more efficient processes, such as anaerobic effluent treatment systems that produce biogas, which can then be used as a renewable energy source for the mill itself. This cyclical optimization—turning environmental challenges into operational efficiencies—is vital for sustained profitability. The Coated Groundwood Paper market, therefore, exemplifies a mature manufacturing sector where incremental technological advancements and rigorous operational discipline dictate success over the long term, positioning it as a highly specialized commodity reliant on mass-scale efficiency.

The role of coating preparation kitchens in the midstream value chain cannot be overstated. These facilities manage the mixing, storage, and application of complex coating slurries that determine the final paper quality. Modern coating kitchens utilize advanced rheological monitoring equipment to ensure the coating viscosity and solids content are perfectly suited to the application method and the high speed of the paper machine. Small variations in these parameters can lead to streak formation, blistering, or inadequate gloss, necessitating complex reprocessing or rejection of entire rolls. Furthermore, research into novel coating materials, including bio-based polymers and nano-pigments, aims to reduce the overall environmental footprint of the coating while enhancing barrier properties or reducing drying energy requirements, directly addressing both cost and sustainability pressures.

The commercial printing segment, a key downstream customer, is also undergoing rapid technological shifts that influence the Coated Groundwood market. The increasing adoption of high-speed inkjet and advanced digital printing technologies demands coated papers with unique surface chemistries that promote rapid ink drying and excellent dot gain control, properties that traditional offset-optimized coated papers may not possess. Manufacturers are thus compelled to develop specialized "digital-ready" coated mechanical grades, bridging the gap between traditional offset performance and the emerging needs of the digital commercial print sector. This dual optimization—maintaining performance on traditional web offset presses while ensuring compatibility with high-speed digital presses—represents a significant technological challenge and investment area for leading paper producers.

Finally, the interplay between timber procurement and carbon sequestration credits is becoming a financial lever in the Coated Groundwood market, particularly for integrated producers with forestland assets. Sustainable forest management not only assures a reliable, certified raw material supply but also allows companies to participate in emerging carbon markets. The certification systems, such as FSC and PEFC, are evolving to include stricter requirements for climate change mitigation and biodiversity protection, further integrating sustainability into the core financial structure of the paper industry. This integration of environmental stewardship and financial planning underscores the complexity of modern market operations, requiring sophisticated data analysis and long-term capital allocation strategies to navigate the mature phase of the Coated Groundwood paper lifecycle effectively.

The market faces significant challenges in capacity management, particularly in regions where closure announcements are frequent due to unprofitability. When a mill shuts down, the subsequent regional supply tightening can lead to temporary price increases, but often results in the acceleration of the substitution to digital media or to alternative packaging materials. Manufacturers who successfully convert underutilized paper machines from graphic grades to high-demand packaging grades (like linerboard or fluting) are showing high strategic foresight, effectively pivoting capital assets toward structurally growing sectors while maintaining some flexibility to re-enter graphic grades if specific demand spikes occur. This concept of asset flexibility and machine conversion capability is rapidly becoming a key competitive differentiator in the wider pulp and paper industry, including the Coated Groundwood sector.

The demand for Light Weight Coated (LWC) paper remains highly cyclical, closely tracking global advertising expenditures. Economic downturns lead to immediate, deep cuts in retail circular printing, severely impacting LWC producers. Conversely, periods of strong economic growth often result in short-term surges in paper demand, potentially leading to capacity shortages and upward pressure on prices. Due to the high capital investment required for new capacity expansion, producers are extremely cautious about adding new greenfield capacity. Instead, they focus on brownfield improvements—upgrading existing machines to increase speed, efficiency, and flexibility. This cautious approach to capacity ensures a tighter market balance, preventing severe oversupply which historically characterized this sector, thereby supporting the forecast’s modest but stable growth projection anchored in price stability rather than volume increase.

In terms of specific chemical inputs, the market is continually evaluating alternatives to traditional synthetic binders (like styrene-butadiene latexes) due to cost and environmental concerns. Research into starch-based and other bio-based binders aims to reduce reliance on petrochemical derivatives while maintaining necessary coating strength and water resistance. Successful adoption of these sustainable chemistries will not only reduce operational costs but also enhance the environmental profile of the final paper product, resonating strongly with environmentally conscious corporate buyers, particularly those involved in global retail operations. This continuous pursuit of marginal gain through input optimization defines the ongoing competitive battleground within the coating preparation segment of the market.

Furthermore, the competitive dynamic is heavily influenced by energy prices, particularly for European producers who rely heavily on natural gas for drying and process heat. Volatility in global energy markets can disproportionately impact the profitability of Coated Groundwood mills compared to those utilizing extensive biomass or hydroelectric power. This necessitates that producers engage in long-term energy hedging and invest in on-site renewable energy generation, such as biomass boilers and solar arrays, as a foundational strategy for mitigating external financial risks. The ability to control internal energy costs is paramount to sustaining competitive pricing against global rivals, particularly those in regions with lower or subsidized energy prices.

Finally, the application of Coated Groundwood Paper in the emerging field of "programmatic print" is a niche opportunity that deserves increased focus. This involves linking highly segmented digital consumer data with automated, high-speed digital printing capabilities to produce customized, small-run physical mailings. While this volume remains small compared to mass-market circulars, it represents a high-value application where the print material (often an LWC or MWC grade) acts as a highly effective, tactile conversion tool. Paper producers who develop grades specifically optimized for these precise, data-driven print methods stand to capture premium pricing, moving the product from a low-margin commodity to a high-value marketing asset.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager