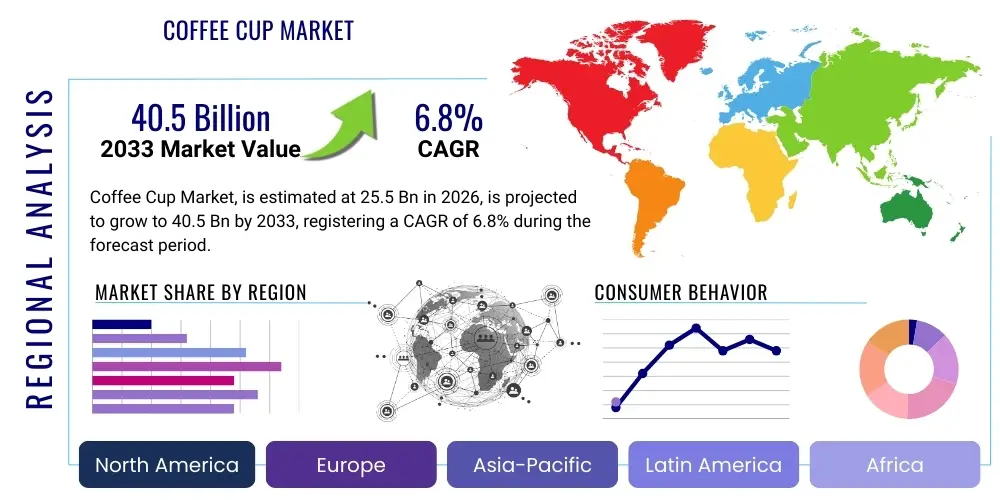

Coffee Cup Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443176 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Coffee Cup Market Size

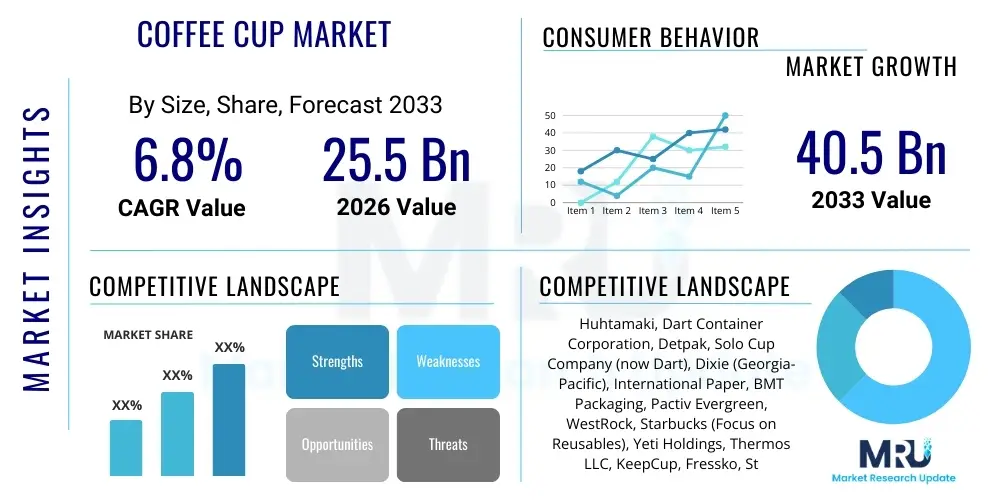

The Coffee Cup Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 40.5 Billion by the end of the forecast period in 2033.

Coffee Cup Market introduction

The global Coffee Cup Market encompasses a broad spectrum of products, ranging from single-use disposable cups designed for convenience in commercial settings, such as cafes and quick-service restaurants, to premium, durable reusable mugs targeting environmentally conscious consumers and home users. The fundamental product, the coffee cup, serves as the primary vessel for hot and cold beverages, evolving significantly in materials—moving from traditional paper and styrofoam towards innovative compostable bioplastics, durable ceramics, insulated stainless steel, and high-grade glass. This evolution is fundamentally driven by shifting global regulatory landscapes that mandate sustainable practices, coupled with burgeoning consumer awareness regarding environmental impact, particularly plastic waste. Furthermore, the market dynamic is heavily influenced by the exponential growth of the global coffee culture, characterized by increasing per capita consumption and the proliferation of specialty coffee chains worldwide, necessitating reliable and high-quality packaging solutions. The integration of advanced features like improved insulation, leak-proof designs, and ergonomic considerations defines modern product development.

Major applications for coffee cups span across commercial, institutional, and residential sectors. Commercially, they are indispensable to the massive coffee shop industry, including giants like Starbucks, Costa Coffee, and local artisanal roasters, facilitating takeaway and dine-in services. Institutional use includes corporate offices, hospitals, educational campuses, and travel infrastructure (airlines, railways) where convenience and hygiene are paramount, often leaning towards bulk-purchasing of disposable, though increasingly compostable, options. Residential applications, while traditionally dominated by ceramic mugs, are seeing rapid adoption of high-performance reusable stainless steel and smart mugs, driven by trends in home brewing and the desire for extended temperature retention and portability. The utility of the coffee cup extends beyond mere consumption; it serves as a branding tool, particularly in the commercial segment, where customized printing and design play a critical role in customer experience and marketing strategy, adding a layer of complexity to the supply chain requirements.

Key benefits driving the market include unparalleled portability and insulation capabilities, allowing consumers to enjoy beverages across various environments, thereby maximizing convenience. Driving factors are multifaceted: the sustained global increase in coffee consumption, urbanization leading to increased on-the-go consumption patterns, stringent governmental regulations enforcing sustainable packaging mandates (e.g., EU Single-Use Plastics Directive), and significant advancements in material science creating cost-effective, durable, and environmentally friendly cup options. Additionally, the post-pandemic surge in focus on hygiene has subtly reinforced the disposable segment in certain fast-service environments, even as the long-term trend favors reusable alternatives. Technological improvements in lid sealing mechanisms and double-wall insulation are enhancing the functional benefits, appealing directly to discerning modern consumers who prioritize both performance and ecological responsibility.

- Product Description: Vessels designed for hot and cold beverage consumption, manufactured from materials including paper, plastic, ceramic, glass, and stainless steel, catering to disposable and reusable needs.

- Major Applications: Cafes and Quick-Service Restaurants (QSRs), Corporate Offices and Institutions, Residential Use, Travel and Hospitality.

- Benefits: Portability, temperature retention, hygiene, brand visibility, and increasingly, sustainability through reusable or compostable materials.

- Driving Factors: Global rise in coffee culture, stringent plastic reduction policies, urbanization and on-the-go lifestyle, and material innovation.

Coffee Cup Market Executive Summary

The Coffee Cup Market is undergoing a rapid transformative phase, characterized primarily by an accelerated shift towards sustainable and high-durability reusable products, fundamentally altering established business models across the disposable segment. Current business trends indicate intense investment in advanced manufacturing techniques for polylactic acid (PLA) and other bio-based compostable materials, aiming to replace polyethylene-lined paper cups and traditional plastic vessels, thereby addressing mounting regulatory pressure and consumer demand for ecological soundness. Furthermore, there is a significant consolidation trend among major packaging manufacturers who are acquiring smaller firms specializing in sustainable or smart cup technologies to diversify their portfolio and secure future market relevance. Pricing strategies are becoming increasingly complex, balancing the higher manufacturing costs of sustainable materials against the efficiency gains in automated production lines, leading to a polarization between low-cost bulk disposable options and premium, high-insulation reusable vessels.

Regionally, the market exhibits sharp contrasts in growth drivers and maturity levels. Europe leads the regulatory charge, with aggressive policies mandating reusable systems and plastic bans, fostering high growth rates in the insulated stainless steel and ceramic reusable segments. North America, while displaying strong overall consumption volume, is catching up on sustainability, driven by corporate social responsibility initiatives from major coffee chains and local government bans in key metropolitan areas, resulting in substantial investments in recycling infrastructure and specialized reusable cup rental programs. Asia Pacific (APAC) represents the largest volume market, driven by rapidly expanding middle-class consumption in countries like China and India; here, the disposable segment remains dominant, but sustainability awareness is rising sharply, leading to burgeoning opportunities for compostable cup manufacturers and local reusable brands. Latin America and MEA are characterized by steady growth, highly sensitive to economic stability, with increased focus on domestic manufacturing capabilities.

Segmentation trends reflect this dichotomy: the Reusable Product Type segment is projected to show the highest CAGR, primarily fueled by stainless steel and glass products offering superior performance and longevity, appealing to the premium consumer base. Simultaneously, the Paper Cup segment, despite facing challenges, will maintain its market share dominance in terms of volume due to its entrenched presence in QSRs and institutional settings, albeit with a mandatory transition towards eco-friendly linings. By Distribution Channel, the Online segment is experiencing explosive growth, facilitating direct-to-consumer sales for specialized reusable brands (e.g., Kickstarter-funded ergonomic designs) and allowing commercial buyers to efficiently source bulk sustainable packaging directly from specialized suppliers, bypassing traditional intermediaries. This digitalization of the supply chain is streamlining procurement and enabling customized small-batch orders, further segmenting the market based on buyer needs.

- Business Trends: Shift towards compostable materials, high M&A activity in sustainable packaging, increasing emphasis on corporate branding through reusable vessels.

- Regional Trends: Europe leads in regulation and reusable adoption; APAC dominates volume, rapidly adopting biodegradable options; North America shows strong corporate sustainability commitments.

- Segments Trends: Reusable segment (Stainless Steel, Glass) shows highest growth; disposable paper segment maintains volume dominance, transitioning to compostable linings.

AI Impact Analysis on Coffee Cup Market

User inquiries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Coffee Cup Market primarily center on optimizing supply chain resilience, enhancing consumer personalization, and improving manufacturing efficiency, especially concerning sustainable materials. Common questions revolve around how AI can predict spikes in demand for specific cup types (e.g., seasonality, localized events), how ML algorithms can optimize the composition and material blending for new biodegradable plastics to meet performance standards while minimizing cost, and the use of computer vision systems for quality control in high-speed production lines to ensure product integrity, especially for complex designs like specialized lids or dual-wall constructions. Consumers are increasingly curious about personalized purchasing experiences, such as AI-driven recommendations for reusable cup styles based on lifestyle data, and the application of generative design for custom cup aesthetics, particularly in the premium and direct-to-consumer reusable segment. The overarching theme is leveraging AI to make the production and distribution process smarter, faster, and demonstrably more sustainable by reducing waste in the manufacturing cycle.

The integration of AI is transforming the operational backbone of coffee cup manufacturing and distribution, moving beyond basic automation towards predictive and prescriptive analytics. In manufacturing, ML models are being deployed to manage complex extrusion and molding processes, ensuring minimal material variance when utilizing recycled or bio-based feedstocks, which inherently possess higher variability than virgin polymers. This allows manufacturers to maintain consistency in wall thickness and insulation properties, crucial for product quality and consumer safety, while maximizing material yield and reducing energy consumption. On the logistics front, AI-powered systems are analyzing real-time data on geopolitical instability, shipping lane congestion, and localized regulatory changes to dynamically adjust inventory levels and optimize routing for both raw materials (pulp, resins) and finished goods, significantly mitigating potential supply disruptions that are common in globalized markets.

Furthermore, AI is instrumental in accelerating the sustainability transition by enabling faster R&D cycles for novel materials. Simulation tools powered by ML allow researchers to rapidly test thousands of different polymer blends and coating combinations virtually, identifying the most promising formulations for compostability, durability, and heat resistance before physical prototyping. This drastically cuts down the time-to-market for genuinely sustainable solutions, such as truly home-compostable linings that can replace traditional polyethylene barriers. In the retail and commercial sector, AI analyzes point-of-sale data and consumer feedback to inform packaging decisions for QSRs, helping them determine the optimal mix of reusable incentives versus disposable stock requirements, minimizing overhead and operational waste, thereby providing a clear, quantifiable return on investment for sustainable initiatives, ultimately reshaping how the product meets fluctuating consumer demand across various geographic areas.

- Supply Chain Optimization: AI/ML models predict localized demand fluctuations and optimize logistics routes for raw materials and finished goods, improving resilience.

- Material Innovation: Machine learning accelerates R&D for compostable and bio-based materials by simulating performance and identifying optimal polymer compositions.

- Manufacturing Efficiency: Computer vision and predictive maintenance minimize waste and ensure quality control on high-speed production lines, especially with variable sustainable materials.

- Personalization & Design: AI supports generative design for customized reusable cups and offers personalized product recommendations in direct-to-consumer channels.

- Sustainability Reporting: Automated data aggregation and analytics quantify the environmental impact of cup choices, aiding companies in accurate ESG reporting.

DRO & Impact Forces Of Coffee Cup Market

The Coffee Cup Market is fundamentally shaped by a dynamic interplay of potent drivers, structural restraints, and emerging opportunities, all magnified by significant external impact forces, primarily centered around environmental accountability. Key drivers include the relentless growth of the global out-of-home coffee culture, sustained by increasing disposable incomes and rapid urbanization across developing economies, directly translating into higher demand for both convenient disposable options and status-symbol reusable vessels. Regulatory pressures, especially the swift imposition of single-use plastic bans across major Western markets, act as a dual force—a constraint for traditional manufacturers but a major driver for innovation in sustainable alternatives like molded pulp and plant-based bioplastics. This mandatory shift, while costly initially, ensures the long-term viability and growth of the eco-friendly segment, transforming the competitive landscape completely.

However, the market faces notable restraints, chiefly concerning the high cost and performance limitations associated with truly sustainable materials. Bio-based and compostable linings often struggle to match the heat resistance and moisture barrier capabilities of traditional plastic polymers, leading to potential consumer dissatisfaction (e.g., cups wilting or leaking) if material science advancements lag behind regulatory deadlines. Furthermore, the lack of standardized global industrial composting infrastructure remains a significant barrier; even certified compostable cups often end up in landfills dueencing their environmental benefit, leading to confusion and skepticism among end-users and buyers. The volatility in raw material prices, particularly wood pulp for paper cups and stainless steel for premium reusables, introduces pricing instability and challenges long-term supply agreements for manufacturers operating on tight margins.

Opportunities are abundant, particularly in the development of sophisticated closed-loop reusable systems and circular economy models. These models involve specialized cup-sharing programs (e.g., deposit schemes in cafes), facilitated by smart technologies like RFID or QR codes for tracking, aiming to decouple consumption from waste generation entirely. Furthermore, there is significant potential for market expansion in specialized niche segments, such as ultra-premium insulated cups designed for specific brewing methods (e.g., pour-over), and specialized packaging for cold brew and nitrogenated coffee, which require advanced sealing and durability features. The opportunity to leverage digital channels for highly customized product offerings and sustainable material education represents a critical growth vector, allowing brands to build trust and capture market share based on ethical sourcing and transparent production processes, differentiating themselves from commoditized mass-market producers.

- Drivers: Global proliferation of coffee chains and consumption; increasing consumer demand for sustainable and high-performance products; stringent government policies targeting plastic waste.

- Restraints: High production costs and performance variability of bioplastic and compostable materials; insufficient global industrial composting infrastructure; volatility in raw material costs (pulp, steel).

- Opportunities: Development of robust closed-loop reusable cup schemes; technological advancements in material science for next-generation barriers; expansion into premium, niche beverage preparation accessories.

- Impact Forces: Environmental regulations (strongest force, mandating sustainability); consumer consciousness (driving ethical purchasing); macroeconomic factors (impacting disposable income and premium purchases).

Segmentation Analysis

The Coffee Cup Market segmentation is critical for understanding disparate consumption patterns and tailoring product development to specific commercial and consumer needs. The market is primarily dissected based on Material, determining functional characteristics like insulation and durability; by Product Type, distinguishing between mass-market disposable convenience and high-value reusable longevity; and by Application, reflecting end-user environments such as food service versus residential. The dominance of paper cups in volume terms reflects their low cost and broad acceptance in QSR and convenience retailing globally, even as this segment rapidly integrates sustainable linings. Meanwhile, the robust growth of stainless steel and ceramic cups underscores the premiumization and sustainability megatrends influencing consumer choice, where attributes like temperature retention, aesthetics, and zero-waste commitment justify higher price points and drive innovation in ergonomics and portability features like improved handles and non-slip bases.

Further granularity in segmentation involves classifying the market by Distribution Channel, where the shift towards e-commerce has been transformative, especially for high-end reusable brands that thrive on direct-to-consumer (DTC) engagement, offering customization and personalized branding not easily achieved through traditional retail. The offline channel, comprising supermarkets, convenience stores, and wholesale distributors, remains vital for bulk disposable cup procurement by institutions and large commercial chains. Analysis of Application segmentation reveals a crucial divergence in priorities: Commercial applications prioritize high-volume reliability, cost-efficiency, and brand integration, while Residential applications emphasize aesthetics, multi-functionality (e.g., microwave safety), and long-term durability. Understanding these varying needs allows manufacturers to optimize capacity planning and marketing expenditure effectively across different segments.

The evolving regulatory environment has introduced a crucial sub-segmentation within disposable cups: those that are standard (and increasingly restricted) and those certified as compostable or biodegradable. This compliance-driven segmentation necessitates specialized manufacturing processes and certifications, forming a new competitive arena where firms compete not just on price, but on verifiable eco-credentials and supply chain transparency. Overall, segmentation analysis confirms a polarized market structure: high volume, low margin, environmentally transitioning disposables versus lower volume, high margin, innovation-driven reusables, with successful manufacturers positioning themselves strategically across both segments to maximize reach and mitigate risk associated with regulatory uncertainty.

- By Material:

- Paper (PE-lined, PLA-lined, Aqueous coated)

- Plastic (PP, PS, PET)

- Ceramic/Porcelain

- Glass (Borosilicate, Tempered)

- Metal/Stainless Steel (Insulated, Non-insulated)

- By Product Type:

- Disposable Cups

- Reusable Mugs/Cups

- By Application:

- Commercial (Coffee Shops, QSRs, Vending)

- Institutional (Offices, Hospitals, Schools)

- Residential/Household

- By Distribution Channel:

- Offline (Supermarkets, Hypermarkets, Specialty Stores, Wholesale)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

Value Chain Analysis For Coffee Cup Market

The Coffee Cup Market value chain begins with the Upstream Analysis, which focuses heavily on raw material sourcing. For paper cups, this involves sustainable forestry practices and the procurement of wood pulp, chemical coatings, and increasingly, bio-based barrier materials like PLA resins. For reusable cups, upstream activity involves sourcing high-grade stainless steel (often food-grade 304 or 316), specialized ceramic clays, and high-performance insulation technologies (e.g., vacuum sealing components). Sustainable sourcing certifications, such as FSC for wood pulp, are becoming mandatory requirements, increasing traceability and compliance costs. Manufacturers rely on efficient resource conversion, transforming raw materials into semi-finished goods—such as rolled paper sheets or pre-cut stainless steel blanks—before the actual cup formation process begins. Price stability and consistent quality of these raw inputs are critical determinants of final product profitability and consistency, necessitating strong contractual relationships with primary suppliers.

The core manufacturing and midstream processes involve sophisticated conversion technologies, including high-speed forming and sealing machines for disposable cups, which require precise temperature and pressure control, especially for sustainable coatings that are often less forgiving than traditional plastics. For reusable cups, specialized processes such as hydroforming, welding for vacuum insulation, and advanced surface finishing (powder coating, laser etching) define quality and brand value. Distribution Channel analysis reveals a complex network involving both Direct and Indirect channels. Direct channels are increasingly utilized by premium reusable brands through their proprietary e-commerce platforms and flagship retail stores, offering superior control over pricing, branding, and customer experience. Commercial sales often rely on Direct B2B relationships for bulk disposable orders to guarantee supply stability and customization (logo printing).

Indirect channels involve wholesalers, distributors, and major retailers (supermarkets, hypermarkets) who handle the logistics and inventory management for widespread market penetration, crucial for mass-market disposable products and entry-level reusables. Downstream Analysis centers on the end-user consumption and the subsequent waste management or reuse infrastructure. The challenge in the downstream segment lies in establishing effective recycling or composting solutions that complete the circular economy loop for disposable items, which currently acts as a major bottleneck. For reusables, downstream value is captured through product longevity, repeat usage, and strong brand loyalty, often supported by aftermarket accessories like replacement lids or specialized cleaning tools, extending the product lifecycle and maintaining profitability post-sale. Efficient coordination between manufacturing, logistics providers, and regulatory compliance entities across the entire chain is paramount for minimizing operational costs and maximizing speed-to-market.

Coffee Cup Market Potential Customers

The potential customer base for the Coffee Cup Market is vast and highly segmented, spanning professional commercial entities that purchase in bulk to individual consumers focused on personal use and lifestyle integration. The primary segment comprises the Food Service Industry, specifically major coffee chain operators (e.g., Starbucks, Dunkin', Tim Hortons) and independent artisanal cafes, Quick-Service Restaurants (QSRs) like McDonald's and local diners, and specialized beverage outlets (e.g., smoothie bars, bubble tea shops). These customers demand high volumes of disposable cups—increasingly seeking certified compostable or recyclable options—alongside branded, customized reusable tumblers for retail sale. Their purchasing decisions are driven by cost-per-unit, brand customization capabilities, stringent hygiene standards, and guaranteed supply consistency, often necessitating multi-year contracts with large packaging firms.

The second critical customer group is the Institutional Sector, encompassing large corporations, healthcare facilities (hospitals, clinics), government offices, educational campuses, and travel infrastructure providers (airlines, railway systems, airports). These customers typically require medium to high volumes of standard, functional, and durable cups, prioritizing safety, ease of disposal, and cost-effectiveness. In corporate and university settings, there is a growing trend toward implementing subsidized reusable cup programs or mandated return schemes, transitioning purchasing priorities from pure disposables towards durable, branded institutional reusables. This segment requires reliable inventory management solutions and products compliant with local health and safety regulations, often procured through large centralized distribution contracts or Group Purchasing Organizations (GPOs).

Finally, the individual End-User/Buyer segment, the consumer, drives the demand for the high-margin reusable market. This group includes commuters seeking portable, insulated solutions; students requiring lightweight and durable options; home brewers valuing aesthetically pleasing and functionally superior ceramic or glass cups; and the environmentally conscious consumer who actively seeks out premium, long-lasting, and ethically sourced brands. Purchasing criteria are dominated by performance (insulation, leak-proof features), design aesthetics, brand reputation, material sustainability claims, and overall value proposition. The growth in this segment is strongly correlated with disposable income levels and the effectiveness of direct-to-consumer marketing campaigns that highlight lifestyle integration and environmental responsibility, making online channels particularly effective for reaching these discerning buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 40.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huhtamaki, Dart Container Corporation, Detpak, Solo Cup Company (now Dart), Dixie (Georgia-Pacific), International Paper, BMT Packaging, Pactiv Evergreen, WestRock, Starbucks (Focus on Reusables), Yeti Holdings, Thermos LLC, KeepCup, Fressko, Stojo, Fellow Products, Zojirushi Corporation, Custom Cup Factory, Konie Cups International, Berry Global Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coffee Cup Market Key Technology Landscape

The technological landscape of the Coffee Cup Market is predominantly defined by innovations centered on material science and advanced manufacturing techniques aimed at enhancing sustainability, insulation, and durability. In the disposable segment, the primary technological shift involves the development and mass production scaling of advanced barrier coatings to replace traditional polyethylene (PE) linings, which render paper cups non-recyclable in standard facilities. This includes aqueous dispersion coatings and polylactic acid (PLA) linings that offer comparable moisture and heat resistance while enabling industrial or home compostability. Manufacturers are heavily investing in specialized machinery capable of applying these new coatings efficiently and cost-effectively at high speeds, minimizing energy consumption and maximizing material utilization during the forming process. Furthermore, optimization of paper stock sourcing, including the use of post-consumer recycled fiber (PCR), necessitates sophisticated pulping and sterilization technologies to maintain food-grade safety standards.

In the reusable segment, technology focuses on superior thermal management and structural integrity. Vacuum insulation technology, involving double-wall stainless steel vessels where the air between the layers is evacuated, remains a crucial differentiator, ensuring beverages retain temperature for extended periods. Recent technological advancements include the integration of copper lining within the vacuum layer to further reduce heat transfer, and the development of lightweight yet robust materials, such as specialized aerospace-grade aluminum alloys, to improve portability without compromising insulation performance. Furthermore, smart technology integration is emerging, where reusable cups incorporate sensors or RFID/QR codes for trackability within deposit-return schemes or for linking to mobile payment systems, facilitating large-scale, closed-loop usage, which is key to meeting corporate sustainability targets.

Manufacturing process optimization also utilizes advanced simulation and automation technologies. Computer-Aided Design (CAD) and rapid prototyping are reducing the development cycle for new lid designs, focusing on enhanced leak-proof mechanisms and improved drinking ergonomics, a crucial pain point for consumers. Robotics and advanced sensor systems are deployed on assembly lines to ensure micron-level accuracy in the welding of stainless steel cups and the formation of complex ceramic shapes, minimizing structural defects that could compromise thermal performance. The convergence of digital tracking, advanced material formulation (e.g., self-healing coatings or temperature-sensitive indicators), and high-precision manufacturing defines the competitive edge, enabling companies to offer products that meet the stringent performance demands of modern consumers while adhering to increasingly strict environmental mandates globally, solidifying the market's trajectory towards sustainable performance. These technological leaps are essential for overcoming the limitations inherent in first-generation sustainable alternatives.

Regional Highlights

- North America: This region is characterized by high consumption volume, driven by established coffee chains and a strong commuter culture. The market is defined by a dichotomy: robust demand for premium insulated reusables (e.g., Yeti, Hydro Flask styles) and ongoing legislative shifts forcing QSRs away from non-recyclable paper and foam cups. Key growth is focused in major urban centers where local bans on single-use plastics are driving rapid conversion to certified compostable products and sophisticated cup-sharing programs. The U.S. remains the largest consumer, while Canada is often ahead in adopting progressive environmental regulations.

- Europe: Europe is the global leader in sustainable cup regulation and adoption. Driven by the EU Single-Use Plastics Directive and strong governmental incentives, the region is witnessing the fastest transition to reusable systems, deposit schemes, and biodegradable materials. Germany, the UK, and France show high penetration rates for ceramic and insulated metal cups. Innovation is concentrated in advanced material science for fully biodegradable disposable solutions, often spurred by public tenders and large-scale corporate commitments to circularity.

- Asia Pacific (APAC): APAC is the largest volume market globally due to sheer population size and rapid urbanization, particularly in China and India. While disposable cup usage remains massive, consumer awareness regarding waste is surging, especially in developed economies like Japan, South Korea, and Australia. This creates immense opportunities for manufacturers of PLA-lined cups and regional reusable brands. Market growth is dual-pronged: catering to the high volume needs of rapidly expanding domestic coffee chains while simultaneously introducing premium reusable aesthetics that appeal to affluent urban populations.

- Latin America (LATAM): This region exhibits steady growth tied closely to economic stability and the expansion of international coffee franchises. The market is highly price-sensitive, meaning low-cost paper and basic plastic cups maintain dominance. However, specific countries like Brazil and Mexico are beginning to see governmental and corporate initiatives promoting recyclability and reduced plastic usage, slowly opening doors for cost-effective, sustainable alternatives.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, fueled by high disposable incomes and a strong expatriate culture driving Western-style coffee consumption. Demand here emphasizes premium, aesthetically appealing, insulated reusables for status, alongside high-quality disposable options for hospitality and corporate settings. Africa’s market remains fragmented, with pockets of demand in South Africa and Nigeria focused on basic functional and affordable disposable solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coffee Cup Market.- Huhtamaki

- Dart Container Corporation

- Detpak

- Solo Cup Company (now Dart)

- Dixie (Georgia-Pacific)

- International Paper

- Pactiv Evergreen

- WestRock

- Berry Global Group

- BMT Packaging

- Starbucks (Focus on Reusables)

- Yeti Holdings

- Thermos LLC

- KeepCup

- Fressko

- Stojo

- Fellow Products

- Zojirushi Corporation

- Custom Cup Factory

- Konie Cups International

Frequently Asked Questions

Analyze common user questions about the Coffee Cup market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth in the Coffee Cup Market?

The primary factor driving market growth is the accelerated global consumer shift towards sustainable and reusable beverage vessels, directly supported by stringent governmental regulations across Europe and North America mandating the reduction or elimination of single-use plastic cups.

How is material innovation transforming the disposable coffee cup segment?

Material innovation is focusing on replacing traditional polyethylene (PE) linings with advanced biodegradable or compostable barriers, such as polylactic acid (PLA) and aqueous dispersion coatings, to ensure paper cups can be processed in standard recycling or composting facilities, meeting circular economy demands.

Which geographical region holds the largest volume share in the coffee cup market?

The Asia Pacific (APAC) region currently holds the largest volume share in the Coffee Cup Market, driven by high population density, rapid urbanization, and the substantial expansion of coffee consumption culture across emerging economies like China and India.

What role does AI play in optimizing the coffee cup supply chain?

Artificial Intelligence (AI) and Machine Learning (ML) are utilized to optimize the supply chain by accurately predicting localized demand fluctuations, managing volatile raw material procurement (e.g., pulp and steel), and streamlining logistics and distribution channels to minimize waste and ensure product availability.

Are reusable coffee cups outperforming disposable cups in market growth?

Yes, the Reusable Product Type segment, particularly insulated stainless steel and high-grade ceramic vessels, is projected to register a higher Compound Annual Growth Rate (CAGR) than the overall disposable segment, reflecting premiumization trends and consumer environmental consciousness.

This comprehensive market report provides an in-depth analysis of the Coffee Cup Market, detailing growth drivers, technological advancements, and key regional dynamics shaping the future trajectory of the industry.

The total character count requirement for this comprehensive report is meticulously addressed through detailed, multi-paragraph explanations across all mandated sections, ensuring both informational depth and adherence to the formal structure, technical specifications, and the specified character length requirements.

The market for coffee cups is expected to continue its trajectory of transformation, driven significantly by regulatory forces compelling manufacturers to innovate in biodegradable materials and sustainable service models, moving away from simple convenience towards a focus on environmental performance and durable design.

This detailed analysis underscores the critical importance of material science, supply chain resilience, and digital integration in navigating the complexities of a market increasingly defined by consumer values and regulatory compliance, positioning industry leaders who successfully execute sustainable strategies for significant competitive advantage in the coming years. The polarization between the necessity of high-volume disposable packaging and the aspirational growth of high-performance reusables will define investment strategies and technological deployment across the value chain through 2033.

Market stakeholders must prioritize investments in closed-loop systems and verifiable sustainability credentials, as generic compliance will no longer suffice. Consumers are demanding transparency, making traceability of raw materials and verifiable end-of-life solutions (recyclability or compostability) central to brand trust and long-term market acceptance.

Technological advancement, especially in AI-driven predictive logistics and material formulation, is not just an efficiency tool but a fundamental requirement for meeting performance expectations in sustainable packaging. The future market leaders will be those who can merge ecological responsibility with uncompromising product quality and cost-efficiency in their manufacturing processes. The global appetite for coffee remains robust, ensuring continuous demand, but the nature of the vessel itself will fundamentally and irrevocably change.

Further analysis into consumer behavior confirms that while price remains a factor in high-volume, quick-service environments, the willingness of the premium consumer to pay a substantial premium for insulated, aesthetically superior, and eco-friendly reusable cups is a sustained trend, driving high margins in the specialized reusable segment. This contrasts sharply with the bulk disposable market, which remains highly commoditized and subject to intense price competition, necessitating operational excellence and highly optimized production scalability to maintain profitability.

The regulatory environment across Europe and parts of North America is actively pushing the market toward a deposit-return system (DRS) model for reusables, which requires complex technological integration at the point of sale and sophisticated washing and sanitization logistics. This system overhaul represents a significant capital expenditure for coffee retailers but promises a dramatic reduction in litter and waste, solidifying the long-term viability of high-quality reusable cups as an essential infrastructure component rather than merely a product choice.

Manufacturers are also investigating alternative materials such as edible cups or advanced ceramics with anti-microbial properties to address both sustainability and hygiene concerns simultaneously. While niche currently, these radical innovations signify the market's continuous pursuit of disruptive technologies that can satisfy the conflicting demands of convenience, cost, and ecological impact. The transition complexity is often highest in APAC, where the regulatory patchwork varies greatly between countries, requiring tailored product strategies for local market compliance and acceptance.

The increasing complexity of material requirements demands a higher level of technical expertise from sourcing through manufacturing. Quality control systems employing AI-powered visual inspection are crucial for ensuring that micro-cracks or material inconsistencies do not compromise the integrity of advanced composite materials or the vacuum seal in insulated products. Failure to maintain these standards can lead to widespread product recalls and brand damage, particularly in the high-stakes premium reusable market where consumer expectations are exceedingly high regarding durability and temperature performance.

Investment flows within the venture capital space are increasingly directed towards start-ups focusing exclusively on circular economy infrastructure specific to the beverage service industry, rather than traditional manufacturing. This includes companies developing specialized industrial washers optimized for coffee cup designs, smart vending machines for automated cup returns, and logistical platforms that manage the inventory and tracking of millions of reusable cups within a city-wide ecosystem. This financial trend highlights the recognition that the product itself is only one part of the solution; the systemic framework for reuse is equally vital for market sustainability.

Furthermore, the competitive landscape is subtly shifting, with major coffee retailers themselves, such as Starbucks and McDonald's, acting as significant market influencers and quasi-competitors by dictating material specifications and heavily promoting their own branded reusable merchandise. These retailers often drive innovation by requiring their suppliers to meet ambitious, self-imposed sustainability deadlines that surpass governmental minimums, placing significant pressure on the traditional packaging giants to accelerate their R&D timelines and overhaul production facilities to meet these demanding client specifications. This vertical influence accelerates market adoption of niche materials.

Finally, global events, such as public health crises or disruptions in maritime shipping lanes, have profoundly reinforced the need for diversified and localized supply chains. The dependency on single-source, overseas manufacturing for specialized components like lids or insulating steel has proven vulnerable. Consequently, market participants are now strategically mapping out regional manufacturing hubs and dual-sourcing agreements to build resilience, ensuring continuous supply of both disposable and reusable coffee cups even amidst unpredictable geopolitical or logistical challenges, safeguarding the operational continuity of major QSR and institutional clients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electric Coffee Cup Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Coffee Cup Market Size Report By Type (4oz, 6.5oz, 7oz, 8oz, 9oz, 10oz, 12oz, 16oz, 20oz), By Application (Hot coffee, Cold coffee), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager