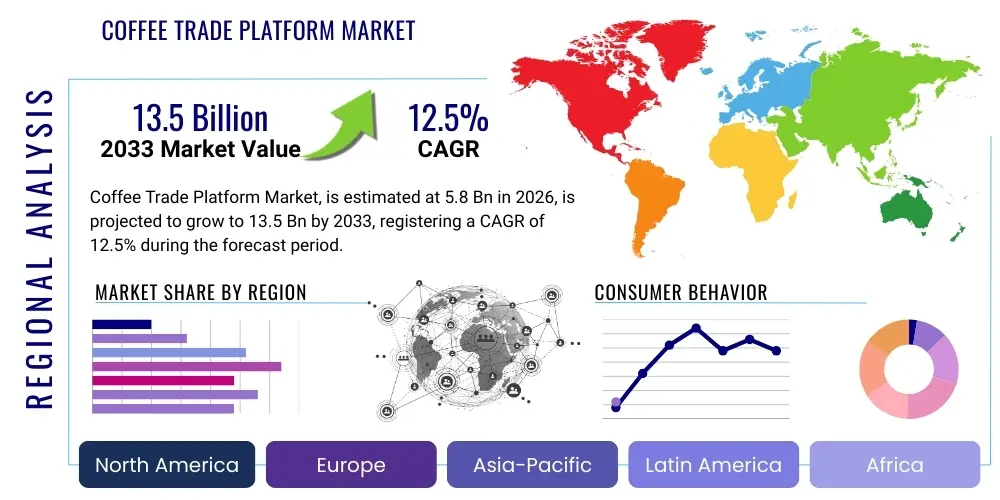

Coffee Trade Platform Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442466 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Coffee Trade Platform Market Size

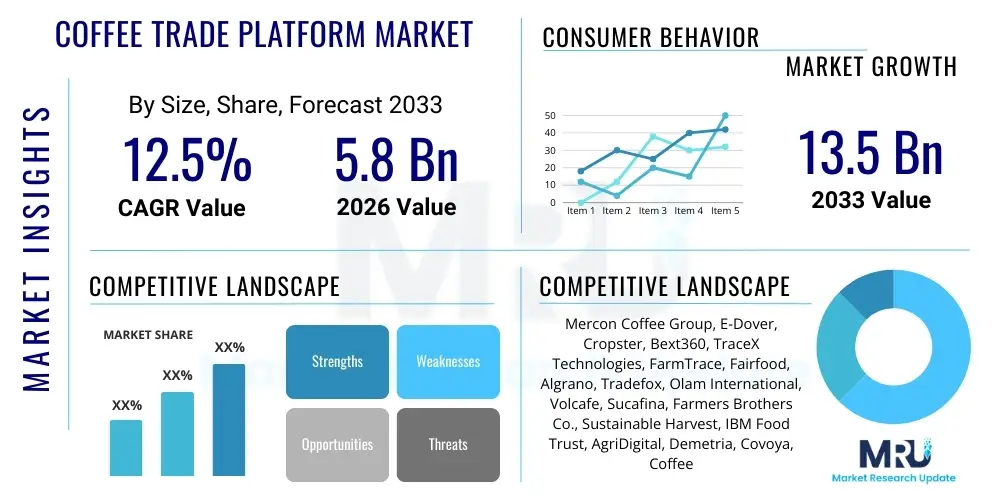

The Coffee Trade Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $13.5 Billion by the end of the forecast period in 2033.

Coffee Trade Platform Market introduction

The Coffee Trade Platform Market encompasses digital solutions and online marketplaces designed to facilitate transactions, logistics, and information exchange between coffee producers (farmers, cooperatives), buyers (roasters, importers), and related service providers globally. These platforms streamline the traditional, often opaque, coffee supply chain by offering features such as digitized contract management, quality verification tools, price discovery mechanisms, and integrated logistics tracking. The primary goal is to enhance efficiency, reduce transaction costs, and provide greater transparency regarding pricing, origin, and sustainability certifications, catering to the increasing consumer demand for ethically sourced and traceable coffee products.

Major applications of these platforms include direct trade facilitation, future contract trading, real-time market data dissemination, and financing solutions tailored for the coffee sector. These systems often integrate advanced technologies like blockchain for immutable traceability and AI for predictive pricing and demand forecasting. The fundamental benefit provided is the democratization of market access, allowing smallholder farmers to bypass multiple intermediaries and secure better prices, while buyers gain verifiable supply chain data and reliable sourcing opportunities, directly supporting the global movement toward sustainable and responsible coffee consumption.

Driving factors for this market include the global proliferation of internet connectivity in producing regions, increased regulatory scrutiny regarding supply chain labor practices and environmental impact, and the critical need for risk mitigation against price volatility inherent in commodity markets. Furthermore, the push for digitalization accelerated by global events has made platform adoption a necessity for maintaining competitive edge and operational resilience across all tiers of the coffee supply ecosystem, from farm gate to consumer cup.

Coffee Trade Platform Market Executive Summary

The Coffee Trade Platform Market is currently characterized by rapid technological integration, driven primarily by the pursuit of end-to-end supply chain transparency and efficiency improvements. Business trends indicate a strong move toward specialized niche platforms focusing on high-value segments, such as specialty coffee and fair-trade certified beans, leveraging blockchain technology to authenticate origin and quality claims. Key players are increasingly forming strategic partnerships with logistics providers and financial institutions to offer bundled services, addressing working capital requirements and streamlining complex cross-border shipping, thereby solidifying platform utility as a comprehensive trade ecosystem rather than just a transaction interface.

Regionally, Asia Pacific (APAC) and Latin America are poised for significant growth, primarily due to the concentration of coffee production (Latin America) and burgeoning consumer markets coupled with technological readiness (APAC). Latin American growth is fueled by the imperative for farmers to maximize earnings through direct trade models facilitated by these platforms. North America and Europe remain mature but highly valuable markets, focusing on adopting highly sophisticated platforms that integrate complex sustainability reporting and carbon footprint tracking tools to meet stringent consumer and regulatory demands. Middle East and Africa (MEA) are emerging regions, where adoption is accelerating due to governmental initiatives promoting digitalization in agriculture.

Segmentation trends reveal robust growth in subscription-based platform models, favored by large-scale roasters seeking consistent, reliable data access and premium features like automated compliance checks. Furthermore, platforms categorized by bean type (e.g., Arabica vs. Robusta) are witnessing segmentation based on the sophistication of required quality grading and certification integration. The market for integrated trade finance solutions offered through these platforms is also emerging as a critical segment, addressing the liquidity challenges commonly faced by coffee producers and exporters, and driving overall platform stickiness.

AI Impact Analysis on Coffee Trade Platform Market

User queries regarding AI's influence in the Coffee Trade Platform Market primarily revolve around its ability to stabilize volatile commodity prices, enhance supply chain integrity through predictive quality assurance, and automate complex contractual negotiations. Common concerns include the potential for AI algorithms to introduce bias in pricing, the reliability of quality grading without human intervention, and the necessity of data standardization across diverse global farms to feed these models effectively. Users highly anticipate AI's role in fraud detection, optimizing logistics routes, and providing actionable insights into climate change impacts on crop yields, which directly influences future trading strategies and inventory management.

AI is fundamentally transforming coffee trade by moving market decision-making from reactive to predictive. By analyzing vast datasets—including historical price movements, weather patterns, shipping delays, geopolitical factors, and quality reports—AI algorithms can generate highly accurate forecasts for price volatility and supply availability. This capability is crucial for roasters managing long-term sourcing contracts and for producers seeking the optimal time to sell their harvest. The deployment of machine learning in quality control, utilizing image recognition and spectral analysis of coffee beans, standardizes grading processes, reducing disputes and accelerating transaction closures.

Furthermore, AI-powered predictive maintenance and yield forecasting tools are increasingly integrated into platforms, providing crucial resilience insights at the farm level. For buyers, AI facilitates smart contract execution based on verified conditions (e.g., successful quality check, arrival at port), minimizing manual oversight and enhancing trust within the digital ecosystem. The integration of Natural Language Processing (NLP) is also improving the global accessibility of these platforms by automating translation and simplifying the legal complexity of international trade documents.

- Automated Price Discovery and Hedging: AI models analyze market forces to suggest optimal trade prices and inform hedging strategies, mitigating price risk.

- Predictive Quality Assurance: Machine learning algorithms analyze visual and sensory data to predict coffee quality score before physical inspection, enhancing sourcing efficiency.

- Optimized Logistics and Inventory Management: AI calculates the most cost-effective and fastest shipping routes, minimizing spoilage and optimizing warehouse placement.

- Fraud Detection and Traceability: Algorithms monitor blockchain entries and transaction patterns to identify and flag suspicious activity, reinforcing supply chain integrity.

- Personalized Market Matching: AI connects specific buyers with producers whose bean profiles, sustainability credentials, and production volumes perfectly align with requirements.

- Climate Resilience Modeling: Predictive analytics forecasts the impact of climate variations on crop yields, informing forward contracts and risk assessment.

DRO & Impact Forces Of Coffee Trade Platform Market

The Coffee Trade Platform Market is powerfully shaped by the synergistic impact of digitalization and the global shift towards sustainability. Key drivers include the overwhelming need for greater price transparency, allowing small producers to capture a larger share of the value chain, and the increasing maturity of blockchain technology, which provides the necessary trust layer for digital trade documentation. Restraints primarily involve the significant digital divide in many coffee-producing nations, characterized by limited internet infrastructure and low digital literacy among smallholder farmers, hindering widespread platform adoption. Opportunities are vast, centered on integrating trade finance and insurance products directly into the platforms, and expanding into vertical integration services like precision agriculture consulting.

Impact forces currently prioritize market decentralization and the ethical sourcing mandate. The push for decentralization challenges traditional commodity brokers, driving intense competition among platform providers to offer superior, direct-to-producer models. Meanwhile, consumer and regulatory pressure demanding verifiable ethical and sustainable sourcing acts as a major catalyst. Platforms that can credibly track metrics such as carbon emissions, labor conditions, and fair wages using digital ledgers gain a substantial competitive advantage, making sustainability reporting a non-negotiable feature.

The market faces significant internal friction concerning standardization; specifically, the lack of universally accepted digital grading protocols for green coffee beans slows cross-platform interoperability. However, this restraint concurrently fuels an opportunity for platform providers capable of establishing industry-leading standardization tools. Overall, the market dynamics reflect a rapid transition from legacy, manual brokerage systems to agile, data-driven digital ecosystems, where successful platforms will be those that effectively balance advanced technology with inclusive access for global participants.

Segmentation Analysis

The Coffee Trade Platform Market is segmented across multiple dimensions to reflect the diverse needs of its global participants, including platform type, transaction model, end-user categorization, and the technological architecture deployed. Understanding these segments is crucial for market participants looking to tailor their offerings or strategically target high-growth areas. The market exhibits strong differentiation between transactional platforms primarily focused on bulk commodity trading and informational platforms that emphasize data aggregation, compliance reporting, and specialized supply chain intelligence for high-end specialty coffee. Growth is particularly robust in segments that directly address transparency and financing gaps faced by producers.

- By Platform Type:

- B2B Trade Marketplaces (Producer-to-Roaster)

- Data and Analytics Platforms (Market intelligence, pricing feeds)

- Integrated Supply Chain Management Platforms (Logistics, Documentation)

- By Transaction Model:

- Spot Trading

- Forward and Futures Contracts

- Direct Trade/Auction Models

- By Deployment Model:

- Cloud-Based

- On-Premise

- By Technology Integration:

- Blockchain-Enabled Platforms

- AI/ML Driven Platforms (Forecasting, Grading)

- Standard Digital Platforms

- By End-User:

- Smallholder Farmers and Cooperatives

- Large Scale Coffee Estates

- Coffee Roasters (Small Batch & Industrial)

- Importers and Exporters

- Retail Coffee Chains

Value Chain Analysis For Coffee Trade Platform Market

The Value Chain for the Coffee Trade Platform Market fundamentally disrupts the traditional coffee supply chain by shifting transaction control and information flow. Upstream analysis focuses on content creation—the gathering, verification, and digitization of raw data points from the farm level, including yield metrics, quality assessments, and sustainability certifications. These platforms utilize IoT sensors and mobile apps to capture this data, ensuring immutability, often via blockchain integration. The efficiency of upstream data aggregation directly dictates the platform's value proposition for downstream buyers who rely on accurate and verifiable source information to meet regulatory and consumer demands for traceability.

Downstream analysis centers on the utilization and monetization of this digitized information by buyers and logistics providers. Platforms act as high-efficiency distribution channels, matching supply to demand based on highly granular criteria (e.g., specific varietal, elevation, fermentation process). Direct channels, facilitated by the platforms, enable roasters to establish long-term relationships with specific farms, bypassing traditional intermediaries like commodity houses. Indirect channels involve platforms providing aggregated, anonymized data to financial services and logistics companies to facilitate trade finance, insurance, and optimized freight booking, further embedding the platform into the trade ecosystem.

The distribution structure is predominantly digital and direct. Platforms leverage centralized cloud infrastructure (e.g., AWS, Azure) to deliver Software as a Service (SaaS) models globally. Revenue generation stems from transaction fees, premium subscription services for advanced analytics, and integrated service charges (e.g., trade finance facilitation). The key challenge in the value chain remains bridging the technological gap between high-tech platform interfaces and low-tech farm operations, requiring significant investment in localized training and accessible digital tools to ensure comprehensive participation across the entire supply chain.

Coffee Trade Platform Market Potential Customers

Potential customers for Coffee Trade Platforms span the entire spectrum of the global coffee industry, from the smallest producers to the largest multinational coffee chains. The primary end-users are coffee roasters, ranging from artisan specialty roasters seeking unique, traceable microlots to industrial roasters requiring large volumes of standardized commodity coffee. These buyers use platforms to secure consistent supply, manage procurement risk, and access verifiable data on sustainability and origin, which is crucial for their branding and compliance requirements. Their need for streamlined procurement and quality assurance drives platform feature development.

Another major customer segment comprises coffee exporters and importers, who utilize these platforms to increase their operational efficiency in documentation and cross-border logistics. They leverage integrated tools for digital contract signing, customs clearance documentation, and real-time shipment tracking, replacing manual paperwork and significantly reducing processing times and errors. For these entities, the platform serves as a critical infrastructure layer that enhances their ability to service diverse clients across multiple geographic jurisdictions quickly and compliantly.

Crucially, smallholder farmers and farmer cooperatives constitute a growing base of potential customers, particularly in emerging markets. While often facing barriers to entry (digital literacy, connectivity), the platforms offer them the unprecedented opportunity for direct market access, leading to higher price realization and immediate feedback on quality requirements. Platforms designed with mobile-first interfaces and localized language support are essential for onboarding this segment, transforming them from passive suppliers in an opaque market to active, informed participants in global trade.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $13.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mercon Coffee Group, E-Dover, Cropster, Bext360, TraceX Technologies, FarmTrace, Fairfood, Algrano, Tradefox, Olam International, Volcafe, Sucafina, Farmers Brothers Co., Sustainable Harvest, IBM Food Trust, AgriDigital, Demetria, Covoya, Coffee Chain, Raiz |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coffee Trade Platform Market Key Technology Landscape

The technological core of the Coffee Trade Platform Market is centered on three critical areas: distributed ledger technology (Blockchain), advanced predictive analytics (AI/Machine Learning), and Internet of Things (IoT) integration. Blockchain is fundamental for establishing trust by providing an immutable ledger for every transaction, quality check, and certification event, addressing the industry’s historical challenge of provenance and fraud. Leading platforms utilize enterprise blockchain solutions (like Hyperledger Fabric or customized Ethereum implementations) to ensure that the journey from farm to cup is transparent and verifiable, offering unprecedented depth in traceability data to consumers and regulators alike.

AI and Machine Learning capabilities are increasingly embedded to optimize market functions. These technologies power predictive pricing models that forecast future market volatility based on macroeconomic indicators and crop performance data. Furthermore, ML is used in automated quality grading, where algorithms analyze high-resolution images of green beans to assess defects and assign a standardized quality score, reducing human subjectivity and speeding up the sourcing process. This analytical layer transforms raw trade data into actionable commercial intelligence, enhancing profitability for all participants.

Finally, IoT sensors and mobile connectivity play a pivotal role in feeding accurate, real-time data into these digital platforms from the point of origin. Devices deployed on farms monitor soil conditions, climate metrics, and yield health, providing data critical for implementing precision agriculture techniques. Mobile applications designed for producers facilitate easy input of harvest data and access to market prices, ensuring that even remote coffee growers can seamlessly interact with the high-tech trading ecosystem. The convergence of these technologies defines the competitive edge of modern coffee trade platforms.

Regional Highlights

- Latin America: This region is dominant due to being the largest global producer of Arabica coffee. Market relevance is driven by the strong adoption of direct trade platforms, aimed at improving farmer income and providing international buyers with certified specialty coffee from countries like Colombia, Brazil, and Guatemala. Government support for agricultural technology and the presence of numerous cooperatives accelerate platform integration.

- North America: Characterized by high consumer demand for specialty, ethically sourced coffee and sophisticated infrastructure. North America is a major market for platform providers focusing on advanced features such as complex carbon footprint tracking, automated compliance reporting, and sophisticated trade financing tools tailored for large roasters and retail chains.

- Europe: A highly mature market with stringent sustainability and import regulations (e.g., EU Deforestation Regulation). European adoption is focused on platforms that offer robust traceability and verifiable supply chain reporting. Innovation here is concentrated on integrating platforms with regulatory databases and supporting complex multi-country logistics within the EU zone.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate, driven by both major coffee producers (Vietnam, Indonesia) and burgeoning consumer markets (China, India). The digitalization push across agricultural sectors, combined with improving internet penetration, makes APAC a critical investment area for platforms looking to streamline high-volume commodity trading and logistics management.

- Middle East and Africa (MEA): Emerging market, crucial due to the presence of significant origin countries (Ethiopia, Kenya, Uganda). Adoption is accelerating as platforms provide essential access to international markets, offering transparency that helps combat corruption and price manipulation, thus boosting farmer profitability in traditionally challenging trading environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coffee Trade Platform Market.- Mercon Coffee Group

- E-Dover

- Cropster

- Bext360

- TraceX Technologies

- FarmTrace

- Fairfood

- Algrano

- Tradefox

- Olam International

- Volcafe

- Sucafina

- Farmers Brothers Co.

- Sustainable Harvest

- IBM Food Trust

- AgriDigital

- Demetria

- Covoya

- Coffee Chain

- Raiz

Frequently Asked Questions

Analyze common user questions about the Coffee Trade Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.How do Coffee Trade Platforms ensure price transparency for smallholder farmers?

Coffee Trade Platforms ensure price transparency by providing direct digital connections between farmers and buyers, eliminating multi-layered intermediaries. They utilize real-time market data feeds, often combined with blockchain-verified quality scores, to establish fair pricing benchmarks, allowing producers to negotiate based on verifiable, current market value rather than fixed, opaque broker pricing. This direct visibility ensures farmers retain a greater percentage of the final price.

What role does blockchain play in verifying the sustainability of traded coffee?

Blockchain provides an immutable ledger for tracking sustainability claims. Every certification, quality assurance check, fair wage payment record, and environmental compliance milestone associated with a coffee lot is digitally recorded and timestamped. This secure, verifiable digital trail ensures that sustainability claims—such as organic status or fair trade compliance—are authenticated and cannot be altered, building crucial trust for roasters and consumers.

Are these platforms primarily used for commodity coffee or specialty coffee trading?

While platforms accommodate both, there is significant and growing platform development dedicated specifically to specialty coffee. Specialty coffee, due to its high value and emphasis on unique provenance and processing methods, heavily benefits from the granular traceability and digital quality grading tools offered by these platforms. Commodity trading uses platforms primarily for streamlined logistics and spot market price discovery.

What are the main technical barriers to adopting Coffee Trade Platforms in developing regions?

The main technical barriers include the digital divide—limited internet and cellular connectivity in remote farming areas—and low digital literacy among aging farmer populations. Platforms must overcome these by developing robust offline capabilities, utilizing SMS integration, and investing in user interfaces that are accessible via basic mobile devices and require minimal technical expertise for data input and transaction execution.

How do AI tools impact the risk management processes on trade platforms?

AI significantly enhances risk management by leveraging machine learning algorithms to predict risks associated with price volatility, logistical delays, and crop failure due to climate events. AI provides early warnings and automated recommendations for hedging future contracts or adjusting supply chain routes, transforming reactive risk mitigation into proactive, data-driven financial and operational resilience for roasters and investors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager