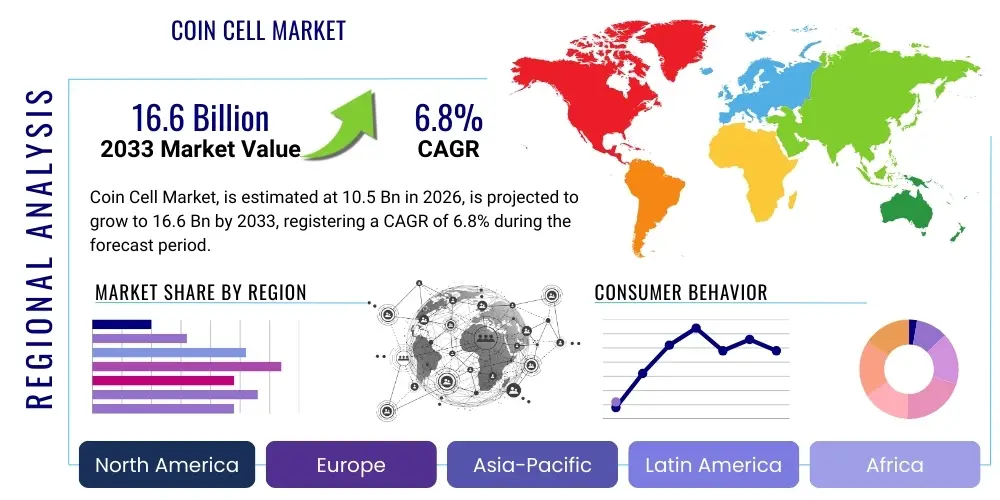

Coin Cell Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442397 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Coin Cell Market Size

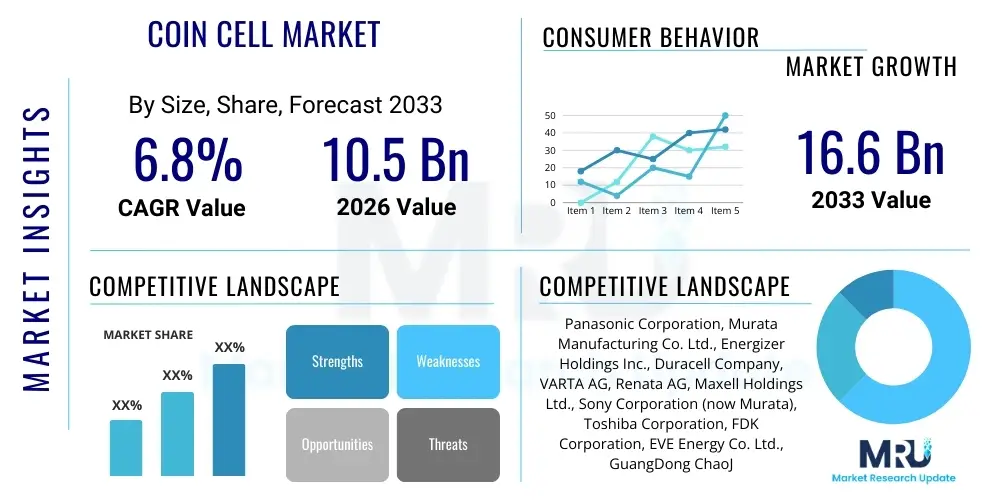

The Coin Cell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 16.6 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the pervasive proliferation of miniaturized electronic devices, particularly within the burgeoning Internet of Things (IoT) ecosystem, coupled with sustained demand from the medical and automotive sectors for reliable, compact power sources. The relentless pursuit of high energy density and extended battery life across various consumer and industrial applications solidifies the market's robust future valuation.

Coin Cell Market introduction

The Coin Cell Market encompasses the production and distribution of small, single-cell batteries, typically lithium or alkaline-based, characterized by their diameter-to-height ratio resembling a coin. These batteries are essential components for devices requiring long-term, low-power operation in a confined space. Their primary appeal lies in their compact form factor, high reliability, and extended shelf life, making them indispensable power sources for a vast array of electronic products. The increasing sophistication of portable electronics, wearable technology, and smart home devices directly correlates with the rising demand for efficient and miniaturized power solutions, with coin cells occupying a critical niche in this landscape. Moreover, advancements in material science are continually enhancing the energy density and safety profile of these cells, ensuring their continued relevance despite the competitive pressures from other portable power technologies.

The core product in this market includes various chemical compositions, such as Lithium Manganese Dioxide (Li-MnO2), Zinc-Air, and Alkaline types, each tailored for specific performance requirements regarding voltage stability, temperature tolerance, and discharge characteristics. Li-MnO2 cells, due to their higher voltage (typically 3V) and superior energy density, dominate applications requiring robust performance over an extended period, such as remote car keys, medical implants, and high-end calculators. Conversely, standard Alkaline coin cells remain popular for cost-sensitive and intermittent-use applications, like basic toys and watches. The continuous miniaturization trend in electronics necessitates corresponding innovation in coin cell technology, pushing manufacturers to develop thinner, lighter, and more powerful cells without compromising safety standards or environmental compatibility. Specialized coin cells are also being developed to meet the demanding operational parameters of industrial sensing equipment and harsh environment monitoring systems.

Major applications of coin cells span across multiple high-growth industries. In the consumer electronics segment, they are the standard power source for CMOS memory backup in computers, keyless entry systems, electronic thermometers, and various smart wearables, including fitness trackers and smart rings. The medical industry represents a significant growth vector, utilizing coin cells for hearing aids, continuous glucose monitoring (CGM) patches, and patient-worn diagnostic devices, where absolute reliability and compact size are paramount safety requirements. Furthermore, the automotive sector integrates these cells into tire pressure monitoring systems (TPMS) and sophisticated remote controllers. Driving factors fueling this market expansion include the exponential growth of IoT deployments globally, stringent regulatory requirements for medical device reliability, and the consumer demand for longer battery life in miniaturized personal devices. However, environmental concerns regarding battery disposal and the inherent limitations in energy density compared to prismatic cells remain persistent challenges that the industry must address through enhanced recycling programs and new material formulations.

Coin Cell Market Executive Summary

The global Coin Cell Market demonstrates robust growth underpinned by significant shifts in consumer electronics manufacturing and healthcare technology integration. Business trends are characterized by intense competition among Asia Pacific-based manufacturers who benefit from large-scale production capabilities and efficient supply chains. Strategic alliances and mergers focusing on intellectual property related to enhanced cathode and anode materials are becoming increasingly common, aimed at overcoming existing energy density constraints. Key market players are heavily investing in lithium-ion and advanced solid-state chemistries suitable for coin cell formats, recognizing the immediate need for higher power output in next-generation medical sensors and active RFID tags. Furthermore, the trend toward sustainable manufacturing practices, including the use of recycled materials and designing cells for easier disassembly, is beginning to influence corporate strategies, driven by evolving European and North American environmental regulations regarding battery life cycle management and traceability.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in both consumption and production, primarily due to the region housing the world’s largest manufacturing hubs for consumer electronics and automotive components, notably in China, Japan, and South Korea. North America and Europe, while lagging in manufacturing volume, exhibit superior growth rates in the application segment, particularly in high-value niches such as medical devices and advanced industrial IoT sensors where premium pricing for reliability is accepted. The demand in these Western markets is heavily tilted towards Lithium-based cells (CR series) due to their demanding performance requirements, whereas developing regions may still rely significantly on lower-cost Alkaline coin cells (LR series) for simpler consumer applications. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, driven by increasing disposable incomes and expanding access to consumer electronics, though infrastructure challenges related to supply chain stability and recycling remain pertinent.

Segment trends confirm that the Lithium chemistry type maintains its dominant market share, driven by its superior performance characteristics suitable for sophisticated, high-drain applications. Within the application segmentation, the medical sector is poised to exhibit the fastest Compound Annual Growth Rate (CAGR), reflecting the rapid deployment of connected health devices and miniaturized diagnostic tools, which require extremely reliable, long-lasting power in minimal volume. Geographically, the market is witnessing diversification in capacity types, with larger diameter cells (e.g., CR2450) gaining traction in smart home devices requiring substantial reserve power, while ultra-small cells (e.g., CR1025) are increasingly adopted in micro-wearables and specialized sensors. The aftermarket segment for replacement batteries, driven by the five to ten-year replacement cycle of devices like car remote keys and security system components, provides a stable, predictable revenue stream for distributors and retailers globally, complementing the more volatile OEM market linked to new product launches.

AI Impact Analysis on Coin Cell Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Coin Cell Market center around optimizing battery lifespan, predicting failure rates, and tailoring energy consumption profiles in smart devices. Users frequently ask if AI can significantly extend the operational life of coin cells without physical intervention, or how AI-driven power management strategies affect the choice of battery chemistry. The primary themes emerging from this analysis are focused on efficiency gains through intelligent load management and predictive maintenance, rather than direct manufacturing disruption. Users recognize that AI cannot physically alter the cell's chemical limits but anticipate that software optimization powered by AI will drastically reduce parasitic power drain and enhance device autonomy, thereby indirectly boosting the perceived value and performance of the installed coin cell.

AI's influence is largely focused on the application layer, dramatically changing the energy demand profile imposed on the coin cell. In devices powered by coin cells—such as IoT sensors, smart door locks, and medical monitors—AI algorithms analyze usage patterns, environmental factors, and connectivity status to implement highly granular, predictive sleep modes and power throttling. For instance, an AI-enabled security sensor can learn the typical movement patterns in a home and adjust its sensor activation sensitivity and data transmission frequency, optimizing battery consumption during periods of anticipated low activity. This intelligent management minimizes unnecessary energy use during standby states, which traditionally consumes a significant portion of a coin cell’s lifespan, extending device replacement intervals and improving overall customer satisfaction with the battery performance.

Furthermore, AI is increasingly being integrated into the manufacturing and quality control phases of coin cell production. Machine learning models analyze massive datasets derived from internal resistance testing, chemical composition metrics, and production environment variables to identify subtle defects invisible to traditional inspection methods. This predictive quality assurance significantly reduces the variability in cell performance, ensuring that manufactured batches meet stringent longevity and reliability specifications, which is particularly crucial for applications like implanted medical devices. The utilization of AI in simulating discharge curves under diverse load conditions also accelerates R&D cycles, allowing manufacturers to rapidly optimize new material combinations for specific high-drain or low-temperature applications, thereby speeding up market deployment of improved cell technology.

- AI-driven Predictive Maintenance: Enables optimization of power transmission and data handling protocols in IoT devices to maximize coin cell longevity.

- Manufacturing Quality Control: Machine learning algorithms analyze production data to predict and mitigate subtle electrochemical defects, improving batch consistency and reliability.

- Intelligent Load Shifting: AI systems dynamically adjust device operational states (sleep cycles, transmission power) based on real-time needs and usage context, conserving stored energy.

- Enhanced R&D Simulation: AI models accelerate the testing of novel electrode materials and electrolyte compositions, reducing the time required to commercialize high-performance coin cell variants.

- Inventory and Supply Chain Optimization: Predictive analytics forecasts demand fluctuations based on electronics manufacturing cycles, ensuring timely supply of specialized coin cells globally.

DRO & Impact Forces Of Coin Cell Market

The dynamics of the Coin Cell Market are shaped by powerful Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate strategic decisions and market trajectory. Primary drivers include the massive, ongoing proliferation of the Internet of Things (IoT), requiring billions of small, reliable power sources for sensors and communication modules, coupled with sustained growth in the healthcare sector’s reliance on wearable and disposable medical devices. These drivers emphasize the need for energy density and miniaturization. Restraints primarily involve the inherent limitations of coin cell chemistry in delivering high pulsed current required by advanced wireless protocols (like certain 5G modules), along with escalating environmental concerns and regulatory pressures regarding the responsible disposal and recycling of lithium and mercury-containing cells. The ongoing competitive threat posed by micro-batteries and supercapacitors in specific niche applications also acts as a restraint.

Opportunities in the market center around technological advancements and untapped regional potential. The development of solid-state coin cells represents a major opportunity, promising enhanced safety, higher energy density, and faster charging capabilities, although full commercialization remains challenging. Furthermore, the rising demand for sophisticated, low-power wide-area network (LPWAN) enabled devices in industrial settings presents a vast opportunity for specialized, long-life coin cells. The strategic imperative for market players is to leverage these opportunities by focusing research and development on material innovation, specifically exploring zinc-air and other non-lithium chemistries that offer superior environmental profiles and energy storage capabilities suitable for extreme low-drain applications. The emerging markets in Southeast Asia and Latin America also provide substantial opportunities for establishing new manufacturing and distribution networks, capitalizing on rapid urbanization and increasing consumer adoption of smart technologies.

The collective Impact Forces pressure manufacturers to innovate rapidly while maintaining cost competitiveness. The pervasive force of global digitalization and miniaturization ensures continued, high-volume demand, but this is tempered by intense price sensitivity, especially in the high-volume consumer electronics segment. Environmental regulations act as a critical impact force, shifting investment toward sustainable material sourcing and circular economy models for battery disposal, forcing traditional manufacturers to overhaul their production processes. The convergence of medical and IoT technologies is creating an urgent need for certified, high-reliability cells, which influences pricing power and market access. Successfully navigating these forces requires a dual strategy: optimizing cost for standard Alkaline cells while simultaneously investing heavily in advanced, high-margin lithium and solid-state coin cells optimized for mission-critical applications that prioritize reliability over unit cost.

Segmentation Analysis

The Coin Cell Market is analyzed through several key segmentation dimensions including Type, Chemistry, Capacity, and End-Use Application. This segmentation provides a granular view of market dynamics, revealing specific high-growth areas and identifying technological preferences within different consumer and industrial landscapes. The segmentation by Type primarily differentiates between standard single-use batteries and rechargeable variants, although single-use disposable cells currently dominate due to the nature of their typical low-power applications (e.g., CMOS backup, basic watches). However, rechargeable micro-batteries, often implemented in a coin cell form factor, are gaining traction in premium wearables and persistent IoT devices where replacement is inconvenient or impossible.

The segmentation by Chemistry is the most crucial differentiator, primarily separating Lithium, Alkaline, Silver Oxide, and Zinc-Air technologies. Lithium chemistry, specifically Lithium Manganese Dioxide (Li-MnO2), accounts for the largest market share due to its excellent shelf life, high energy density, and stable output voltage (3V). Alkaline cells (LR series) remain relevant due to their low cost and wide availability, while Silver Oxide cells are favored in precision applications like high-end watches where stable voltage output over the entire discharge cycle is critical. Zinc-Air batteries are emerging rapidly in the hearing aid market because of their superior energy density per unit volume, which is essential for these compact, power-hungry medical devices. Capacity segmentation (e.g., CR2032, CR2450) directly relates to device size and required energy storage, with the CR2032 segment being the universal standard and largest revenue generator.

End-Use Application segmentation clearly illustrates the demand drivers, dividing the market into Consumer Electronics (the largest segment), Medical Devices (the fastest growing), Automotive, Industrial IoT, and Others (including toys and specialized security tags). The growth within the medical segment is driven by the proliferation of highly sophisticated patient monitoring systems and minimally invasive diagnostic tools, all of which rely heavily on specialized, highly reliable coin cells. Analyzing these segmentations allows stakeholders to tailor their product offerings, focusing R&D efforts on chemistries and capacities that align with the specific performance demands of target industries, such as developing specialized wide-temperature-range coin cells for industrial monitoring equipment deployed in harsh environments.

- By Chemistry:

- Lithium Manganese Dioxide (Li-MnO2)

- Alkaline

- Silver Oxide

- Zinc-Air

- Others (e.g., Lithium Carbon Fluoride)

- By Type:

- Primary (Non-Rechargeable)

- Secondary (Rechargeable Micro-Batteries in Coin Form)

- By Capacity/Size Standard:

- CR2032

- CR2025

- CR2450

- CR1632

- Others (e.g., CR1220, CR1025)

- By End-Use Application:

- Consumer Electronics (Watches, Calculators, CMOS Backup)

- Medical Devices (Hearing Aids, CGM Devices, Thermometers)

- Automotive (Key Fobs, TPMS)

- Industrial & Commercial (IoT Sensors, RFID Tags, Security Systems)

Value Chain Analysis For Coin Cell Market

The Value Chain for the Coin Cell Market begins with upstream activities focused on raw material procurement, encompassing the highly specialized extraction and processing of lithium carbonate, manganese dioxide, zinc, silver, and high-purity electrolytes and separator materials. Suppliers in this upstream segment are crucial, as material quality directly determines the coin cell's energy density, longevity, and safety profile. Due to the geopolitical concentration of lithium reserves and specialized cathode material manufacturing, managing supply chain resilience and cost volatility at this stage is a primary strategic concern for major battery producers. Technological innovation at the material science level, focusing on novel solid electrolytes and environmentally friendly compositions, forms the foundation of competitive advantage within the value chain.

Midstream activities involve the highly automated manufacturing, assembly, and quality control of the coin cells. This phase includes electrode coating, cell assembly (stacking or winding), electrolyte filling, sealing, and extensive performance testing (e.g., capacity, internal resistance, discharge curves). Efficiency and scale are paramount here, driven largely by Asian manufacturers who leverage advanced automation to achieve high throughput and low unit costs. Distribution channels then move the finished goods downstream. Direct distribution often involves large contracts supplying Original Equipment Manufacturers (OEMs) in the electronics and medical industries, where stringent quality and just-in-time delivery are essential requirements. Indirect distribution involves wholesalers, specialized battery distributors, and retail channels to serve the vast aftermarket replacement demand, necessitating effective inventory management and point-of-sale marketing.

Downstream activities center on integration into end-user devices and the eventual consumer use and disposal. OEMs integrate coin cells into products ranging from car remotes to sophisticated monitoring patches. The final stage, the end-of-life management, is rapidly growing in importance due to regulatory pressure, particularly in Europe. The efficient collection, sorting, and recycling of used coin cells—especially those containing lithium or mercury (though mercury use is heavily restricted now)—are becoming necessary components of the value chain. Companies that successfully implement comprehensive product stewardship programs, facilitating easy and compliant recycling, enhance their brand reputation and meet increasing corporate sustainability mandates, thereby completing a critical loop in the modern circular economy model for coin cells.

Coin Cell Market Potential Customers

The primary customers for the Coin Cell Market are broadly categorized into three major segments: Original Equipment Manufacturers (OEMs) across various high-technology sectors, specialized institutional buyers (e.g., military, large hospitals), and the vast global retail aftermarket. OEMs represent the most significant volume segment, as coin cells are integrated components in millions of new products annually. These customers, including manufacturers of smart watches, medical diagnostic equipment (such as CGM systems), security tags, and automotive electronics suppliers, require high-volume contracts, strict adherence to quality specifications, and specific form factors (e.g., thickness and diameter) that match their product designs. Building long-term relationships and achieving certification with these OEMs requires manufacturers to demonstrate consistent quality control, reliable supply chain management, and often, customized cell design capabilities tailored for specific thermal or power profile requirements.

Specialized institutional customers, particularly in the healthcare and industrial sectors, represent a high-value customer base that prioritizes performance and reliability over marginal cost savings. Hospitals and clinics purchasing power sources for hearing aids, implantable medical devices, and high-precision monitoring equipment demand FDA or equivalent regulatory compliance, sterility, and guaranteed operational longevity, making Silver Oxide and high-grade Lithium cells essential purchases. Similarly, industrial buyers utilizing IoT sensors for structural health monitoring or asset tracking in harsh environments require specialized coin cells capable of wide-temperature range operation and high vibration resistance. These institutional relationships are characterized by rigorous qualification processes and long procurement cycles, but they result in stable, high-margin revenue streams for specialized coin cell manufacturers who can meet these demanding standards.

The aftermarket and retail customers constitute the third major segment, driven by replacement demand for batteries in everyday consumer devices. This segment includes general consumers purchasing batteries through supermarkets, online retailers, hardware stores, and specialized electronics shops. Key factors influencing purchasing decisions in this segment are brand trust, price, and accessibility. While individual purchase volumes are small, the sheer frequency and global scale of replacements for items like car keys, remote controls, and basic watches make this a consistently profitable channel. Manufacturers must maintain strong retail visibility, effective packaging, and robust distribution networks to capitalize on this expansive, recurring revenue opportunity, often relying on global brands like Energizer, Duracell, and Renata to distribute their white-label or branded products effectively to the end-consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 16.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Panasonic Corporation, Murata Manufacturing Co. Ltd., Energizer Holdings Inc., Duracell Company, VARTA AG, Renata AG, Maxell Holdings Ltd., Sony Corporation (now Murata), Toshiba Corporation, FDK Corporation, EVE Energy Co. Ltd., GuangDong ChaoJing Electronics Co. Ltd., GP Batteries International Ltd., Huizhou Huiderui Battery Technology Co. Ltd., ZeniPower (Zhuhai) Battery Co. Ltd., Rayovac (Spectrum Brands), KTS Corporation, ZPower, Moli Energy Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coin Cell Market Key Technology Landscape

The Coin Cell Market’s technology landscape is defined by continuous incremental improvements in electrochemical efficiency and breakthroughs in advanced material science designed to overcome volumetric energy density limits. The dominant technology remains Lithium Manganese Dioxide (Li-MnO2) due to its mature supply chain and established reliability; however, intense research is focused on enhancing cathode active materials and optimizing electrolyte formulations to safely increase the capacity retention under varying temperatures. A crucial technological focus is on developing high-temperature stable cells (e.g., for automotive or industrial oven monitoring) and wide-temperature range cells (for outdoor IoT deployment), requiring specialized sealing technologies and robust internal construction to prevent leakage and thermal degradation.

A significant technological shift involves the transition toward solid-state coin cell batteries. Traditional coin cells use liquid or gel electrolytes, which pose leakage risks and inherent safety limitations. Solid-state technology replaces these liquids with a solid electrolyte, promising higher energy density, superior safety characteristics (non-flammable), and a significantly longer cycle life for rechargeable variants. While still in the early commercialization phase for miniaturized formats, solid-state coin cells are anticipated to revolutionize the market for high-performance medical implants and high-reliability industrial sensors, justifying their higher initial production costs. Manufacturers are exploring various solid electrolyte materials, including polymer, glass, and ceramic types, each offering different trade-offs in conductivity and mechanical flexibility.

Furthermore, Zinc-Air battery technology is gaining prominence, particularly driven by its superior energy density per volume compared to lithium coin cells, which is highly advantageous for hearing aids and small medical patches. Unlike traditional sealed coin cells, Zinc-Air cells utilize oxygen from the surrounding air as the cathode reactant, drastically reducing the size and weight of internal components. Technological advancements here focus on improving the air electrode structure and electrolyte longevity to mitigate drying out (dehydration) and manage the challenges associated with high humidity environments, ensuring that the cell maintains its performance over the required operational lifespan. Other technologies include thin-film and printed batteries, which, although not strictly coin cells, compete for the same miniaturized application space, prompting coin cell manufacturers to explore ultra-thin formats (e.g., thickness less than 1.6 mm) to maintain competitive relevance in the ultra-portable device market.

Regional Highlights

The global Coin Cell Market exhibits significant regional disparities in terms of production capacity, technological adoption, and demand structure. These regional dynamics reflect varied regulatory environments, differences in consumer electronics manufacturing centralization, and specific healthcare infrastructure needs.

- Asia Pacific (APAC): APAC is the largest market both in terms of revenue and volume, primarily driven by China, South Korea, and Japan. This region dominates the manufacturing of consumer electronics (including key fobs, smart wearables, and computing peripherals), serving as the global production hub. The demand is massive and often price-sensitive, leading to high-volume production of both standard Lithium (CR series) and Alkaline (LR series) cells. Japan remains a leader in high-quality, specialized cell manufacturing, particularly for the medical sector, while China aggressively expands its market share through sheer scale and cost efficiency.

- North America: North America represents a technologically advanced and high-value market. Demand is strong in the medical device sector (e.g., continuous glucose monitors, advanced hearing aids) and high-end automotive applications. This region prioritizes performance, reliability, and regulatory compliance (FDA standards), favoring premium Lithium and Silver Oxide chemistries. Growth is supported by substantial R&D investment in new battery chemistries and advanced smart home technologies that require reliable, long-life coin cells.

- Europe: Europe is characterized by stringent environmental regulations, particularly concerning battery disposal (e.g., the EU Battery Directive). This regulatory environment drives demand for non-toxic and easily recyclable chemistries, including advanced Zinc-Air technology. Key markets like Germany and Switzerland are hubs for high-precision manufacturing and medical technology, necessitating ultra-reliable coin cells. The European market focuses heavily on ensuring traceability and ethical sourcing of raw materials used in cell production.

- Latin America (LATAM): LATAM is an emerging market experiencing moderate growth, driven by increasing consumer adoption of basic electronics and expanding automotive markets. The region primarily relies on imported coin cells. Market penetration is accelerating due to rising disposable incomes, leading to higher demand for standard consumer-grade coin cells, focusing mainly on the replacement market for watches and basic security devices.

- Middle East and Africa (MEA): Growth in MEA is highly uneven, with concentrated demand in the wealthy Gulf Cooperation Council (GCC) nations due to high import volumes of premium consumer and medical electronics. Infrastructure development and increasing digitalization are slowly boosting demand for IoT-related applications and associated coin cells, though supply chain logistics and standardization remain challenging across the broader African continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coin Cell Market.- Panasonic Corporation

- Murata Manufacturing Co. Ltd.

- Energizer Holdings Inc.

- Duracell Company

- VARTA AG

- Renata AG

- Maxell Holdings Ltd.

- Toshiba Corporation

- FDK Corporation

- EVE Energy Co. Ltd.

- GuangDong ChaoJing Electronics Co. Ltd.

- GP Batteries International Ltd.

- Huizhou Huiderui Battery Technology Co. Ltd.

- ZeniPower (Zhuhai) Battery Co. Ltd.

- Rayovac (Spectrum Brands)

- KTS Corporation

- Tadiran Batteries GmbH

- Great Power Energy Co. Ltd.

- Power-Sonic Corporation

- Excell Battery Co.

Frequently Asked Questions

Analyze common user questions about the Coin Cell market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Coin Cell Market?

The primary driver is the explosive growth and mass adoption of miniaturized electronic devices and the Internet of Things (IoT), requiring compact, reliable, and long-lasting power sources for sensors, wearable technologies, and keyless entry systems globally.

Which coin cell chemistry offers the highest energy density for long-term applications?

Lithium Manganese Dioxide (Li-MnO2) coin cells, such as the widely used CR series, generally offer the best combination of high energy density, stable 3V output, and long shelf life, making them preferred for sophisticated medical and security devices.

How is the medical device sector influencing coin cell technology?

The medical sector drives demand for extremely high-reliability, non-toxic batteries, spurring significant investment in specialized chemistries like Silver Oxide (for stable voltage in hearing aids) and advanced, leakage-proof Lithium cells essential for implantable and patient-worn monitoring devices.

What are the main environmental concerns associated with coin cell usage?

Key concerns revolve around the proper disposal and recycling of cells containing materials such as lithium and, historically, mercury (now largely restricted). Regulations are pushing manufacturers to develop more sustainable material compositions and robust take-back recycling programs to mitigate environmental impact.

Are rechargeable coin cells becoming a significant part of the market?

Rechargeable coin cell formats (often micro-lithium-ion batteries) are growing significantly in high-end, closed-system devices like premium smart wearables and persistent IoT trackers where battery replacement is difficult, prioritizing cycle life over the single-use capacity of traditional primary cells.

The strategic dynamics across the global coin cell market are highly intertwined with advancements in related semiconductor and connectivity technologies. As device manufacturers continue to prioritize ultra-low power consumption in microcontrollers and specialized RF chips, the demands on coin cell performance shift from requiring higher instantaneous power (which is typically addressed by larger prismatic batteries) to maximizing volumetric energy density and maintaining exceptionally low self-discharge rates over many years. This technological imperative compels coin cell producers to innovate constantly in sealing methods and electrolyte stabilization, ensuring that the stored energy remains viable even after five to ten years of shelf life or intermittent device usage. The medical segment, in particular, places extraordinary pressure on manufacturers for zero-defect reliability, leading to stringent auditing processes and specialized manufacturing lines, which further bifurcates the market into high-volume consumer goods cells and highly specialized, premium-priced medical-grade cells. This stratification is crucial for analyzing competitor positioning and pricing strategies globally. Furthermore, the advent of solid-state battery technology, even in the coin cell format, promises to disrupt the existing reliance on liquid electrolytes. While costs remain high, the inherent safety advantages (non-flammable) and projected improvements in energy density and cycle stability will unlock new applications in high-temperature industrial monitoring and long-duration active RFID tags, fundamentally changing the performance ceiling currently imposed by conventional Lithium Manganese Dioxide technology. The overall market is transitioning from a commodity-driven segment to one increasingly defined by specialized material science and sophisticated power management integration, making robust R&D investment a prerequisite for sustained leadership.

In terms of regional market evolution, Asia Pacific's dominance is shifting subtly. While its manufacturing capacity remains unparalleled, regulatory pressures in Europe and North America related to sustainability (e.g., carbon footprint traceability, ethical sourcing) are beginning to influence material selection and supply chain establishment even in APAC-based facilities producing for export. European manufacturers, despite lower absolute output volume, retain significant influence in high-margin sectors such as military specifications and aerospace components, where legacy suppliers benefit from long-standing trust and certification requirements. The rapid digitalization occurring in emerging economies, notably India and Southeast Asia, ensures that regional demand will continue to support high-volume manufacturing close to these rapidly expanding end-user bases. However, addressing the disposal challenges in these rapidly growing consumer markets remains an unsolved operational and environmental hurdle. Strategic expansion into these areas requires not only setting up manufacturing or distribution channels but also establishing necessary infrastructure for responsible battery end-of-life management, which is a major long-term investment that determines sustainable market access and regulatory compliance. The intense competitive landscape necessitates continuous cost optimization through automation and leveraging economies of scale, especially as the price erosion for standard cells continues to challenge profit margins across all geographic regions.

Finally, the interplay between component manufacturing and finished product development dictates market opportunities. Coin cell manufacturers are increasingly collaborating directly with semiconductor designers and original equipment manufacturers (OEMs) at the early design stage to co-optimize the battery's characteristics with the device's power requirements. This shift from a standardized component approach to a custom-engineered power solution model is crucial for maximizing battery life in power-sensitive applications like sophisticated health monitoring patches or advanced car key fobs that incorporate secure short-range communications. This close collaboration reduces waste, accelerates product qualification, and ensures the coin cell performs optimally under the specific duty cycle of the end device. Looking forward, the integration of advanced battery management systems (BMS) directly into the electronic circuitry of devices, capable of AI-driven predictive performance optimization, will continue to increase the operational efficiency of coin cells. This technological convergence ensures that the coin cell market, despite its seemingly mature product category, remains a dynamic and vital component of the global electronics ecosystem, essential for facilitating the ongoing trend toward pervasive, ubiquitous computing and sensing across all major industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager