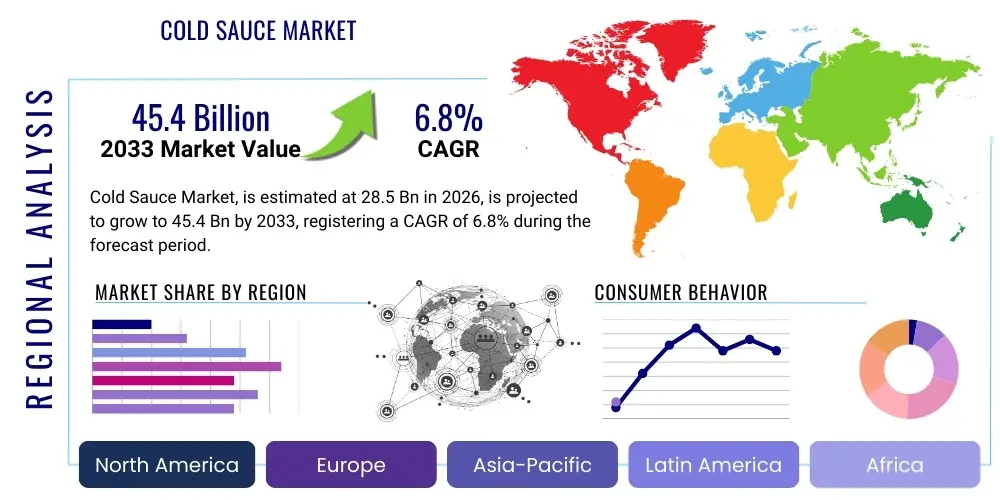

Cold Sauce Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441970 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Cold Sauce Market Size

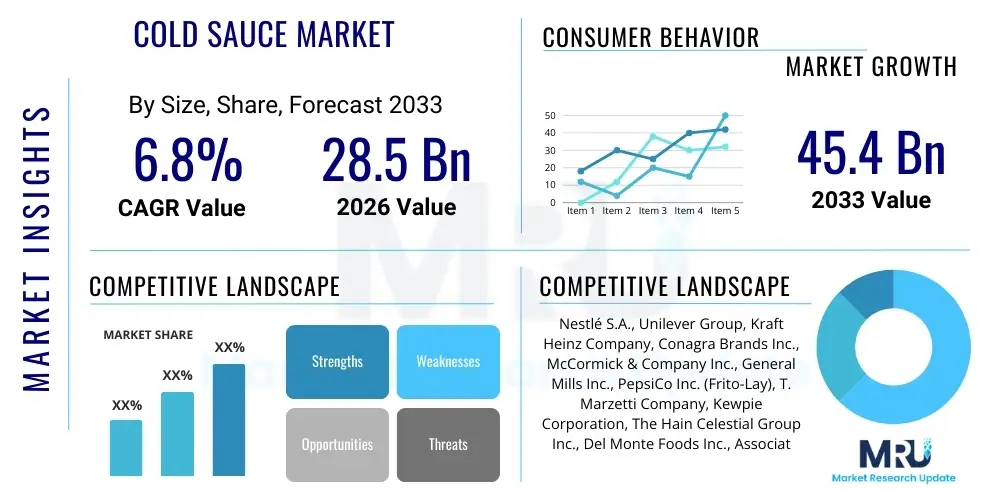

The Cold Sauce Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 45.4 Billion by the end of the forecast period in 2033.

Cold Sauce Market introduction

The Cold Sauce Market encompasses a broad category of ready-to-use condiments and dressings that are typically stored and served refrigerated or at ambient temperatures but are not thermally processed after preparation, such as mayonnaise, ketchup, mustard, salad dressings, and various dipping sauces. These products are crucial components in both commercial foodservice (HORECA) and household consumption, primarily serving to enhance flavor, texture, and moisture content of meals. The increasing global appetite for diversified cuisines and the growing consumer demand for convenient, ready-to-eat food solutions are the fundamental driving forces propelling market expansion across all major economies.

Product descriptions within this market vary widely, ranging from classic staples like standardized mayonnaise and simple vinaigrettes to complex, globally-inspired sauces like sriracha aioli, chimichurri, and premium truffle dips. Major applications span use in sandwiches, burgers, salads, meat and vegetable marinades, and as standalone dipping accompaniments for snacks. The primary benefits derived by consumers include culinary convenience, significant time savings during meal preparation, and the ability to instantly replicate restaurant-quality flavors at home. Furthermore, ongoing innovation in formulation, focusing on natural ingredients and reduced sodium/sugar content, is expanding the market appeal to health-conscious demographics.

Key driving factors accelerating the growth of the Cold Sauce Market include the rapid urbanization and associated changes in dietary habits, characterized by a preference for quick service restaurants (QSRs) and packaged foods. The expansion of e-commerce platforms and sophisticated cold chain logistics have also made niche and international sauce varieties more accessible to the mass market. Furthermore, significant marketing efforts by major manufacturers, coupled with product differentiation based on ethnic flavors and functional attributes (e.g., vegan, gluten-free, organic), continue to stimulate consumer trial and repeat purchases, thereby ensuring sustained market growth throughout the forecast period.

Cold Sauce Market Executive Summary

The Cold Sauce Market is currently undergoing a robust transformation driven by several key business, regional, and segment trends. Business trends highlight a strong industry shift toward premiumization and 'clean label' products, where transparency regarding ingredient sourcing and processing methods is prioritized by both manufacturers and consumers. Major corporations are actively investing in sustainable packaging solutions and plant-based alternatives to traditional egg-based sauces, thereby mitigating supply chain risks associated with raw material volatility and addressing ethical consumer demands. Furthermore, strategic mergers and acquisitions are commonplace, aimed at acquiring specialized flavor profiles or entering high-growth niche categories, such as gourmet dips and ethnic sauces, solidifying the market’s competitive landscape.

Regionally, North America and Europe maintain dominant market shares due to high per capita consumption of processed foods and established foodservice industries. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by increasing disposable incomes, Westernization of diets, and the proliferation of QSR chains in countries like China, India, and Southeast Asian nations. This rapid growth in APAC presents significant opportunities for international cold sauce manufacturers seeking market penetration. Conversely, regulatory hurdles concerning food safety standards and labeling requirements, particularly in developed markets, necessitate adaptive strategies and significant compliance investments from key market players.

Segment trends reveal that the vegan and plant-based segment is experiencing exponential growth, particularly for mayonnaise and creamy dressings, reflecting consumer shifts toward flexitarian or purely plant-based diets. The distribution channel landscape is evolving, with modern trade (supermarkets and hypermarkets) remaining the primary point of sale, although online retail channels are rapidly gaining traction due to convenience and broader product availability. Flavor innovation remains paramount; consumers are increasingly seeking bold, authentic, and globally inspired tastes, leading to a surge in demand for sauces incorporating ingredients like fermented chili, exotic fruits, and highly aromatic herbs, challenging the dominance of traditional ketchup and standard mustard varieties.

AI Impact Analysis on Cold Sauce Market

User inquiries regarding AI in the Cold Sauce Market often center on its ability to revolutionize product development, enhance supply chain efficiency, and personalize consumer engagement. Key themes frequently analyzed include: "How can AI predict future flavor trends?", "What role does machine learning play in optimizing cold chain logistics for perishable sauces?", and "Can AI enhance quality control and food safety protocols faster than traditional methods?". The consensus expectation is that AI will move beyond simple data analytics to become a core operational tool, enabling precision manufacturing, reducing waste, and offering deeply personalized sauce recommendations based on purchasing history and dietary preferences, thereby driving niche market growth and operational excellence.

AI's influence is particularly pronounced in Research and Development (R&D). Machine learning algorithms are being deployed to analyze vast datasets of consumer preferences, social media trends, and regional culinary traditions to predict novel, high-potential flavor combinations years in advance. This capability drastically shortens the product lifecycle and reduces the financial risk associated with launching new products. Furthermore, in manufacturing, predictive maintenance powered by AI minimizes downtime on high-speed bottling lines, while computer vision systems monitor packaging integrity and label placement with unmatched accuracy, ensuring compliance and maximizing operational throughput.

In the supply chain, AI optimizes cold chain integrity, which is critical for maintaining the stability and safety of temperature-sensitive cold sauces. AI systems predict demand fluctuations with higher fidelity than traditional forecasting models, allowing companies to manage inventory levels more effectively, minimize stockouts, and reduce spoilage. By analyzing real-time data from refrigerated transportation units (reefers), AI can proactively flag potential temperature deviations, thereby ensuring product quality from the factory gate to the consumer’s refrigerator, ultimately strengthening brand trust and enhancing logistical resilience against market volatility.

- AI-driven Predictive Flavor Modeling: Identifying high-growth, novel flavor combinations based on consumer data analytics.

- Optimized Cold Chain Logistics: Utilizing machine learning for dynamic route planning, temperature monitoring, and inventory forecasting to minimize spoilage of perishable goods.

- Quality Control Automation: Deployment of computer vision systems for high-speed inspection of packaging, fill levels, and tamper seals.

- Personalized Consumer Marketing: Tailoring sauce recommendations and promotional offers based on individual purchasing behavior and dietary needs.

- Supply Chain Resilience: Predictive analytics to anticipate and mitigate disruptions related to raw material shortages or extreme weather events.

DRO & Impact Forces Of Cold Sauce Market

The Cold Sauce Market dynamics are defined by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the pervasive consumer demand for convenience food solutions, where ready-to-use sauces dramatically reduce meal preparation time, aligning perfectly with modern, busy lifestyles. Concurrently, the increasing globalization of culinary tastes is a major accelerating force; consumers are actively seeking authentic and innovative ethnic sauces, encouraging manufacturers to diversify their portfolios beyond standard offerings. These drivers collectively amplify the market's growth trajectory, especially in urbanized areas with high concentrations of QSRs and prepared meal kits that heavily rely on specialized cold sauces.

Conversely, significant restraints challenge market expansion, primarily stemming from growing health consciousness among global consumers. The high caloric content, excessive sodium, and added sugars frequently found in traditional cold sauces are increasingly scrutinized, leading to regulatory pressures and consumer avoidance. This restraint is forcing companies to invest heavily in reformulation, seeking healthier alternatives without compromising taste. Furthermore, raw material volatility, particularly the price fluctuation of key ingredients such as edible oils, eggs, and specialized spices, poses an ongoing operational challenge, compressing profit margins and necessitating sophisticated risk management strategies within procurement departments.

Despite these restraints, substantial opportunities exist, particularly through product innovation focusing on functional and natural ingredients. The development of cold sauces infused with probiotics, immune-boosting elements, or certified organic components appeals directly to the wellness trend. Moreover, geographic expansion into rapidly developing economies in APAC and MEA, where per capita consumption is currently low but rapidly rising, offers lucrative growth prospects. Impact forces such as rapid regulatory changes concerning clean label requirements and increased scrutiny of plastic packaging further necessitate agile corporate responses, driving innovation in sustainable sourcing and biodegradable packaging materials to maintain market relevance and competitive advantage.

Segmentation Analysis

The Cold Sauce Market segmentation provides a granular view of consumption patterns, product preferences, and distribution channel effectiveness, which is crucial for targeted marketing and strategic resource allocation. The market is primarily segmented by Product Type (e.g., Ketchup, Mayonnaise, Mustard, Salad Dressings), Application (Foodservice vs. Retail/Household), Distribution Channel (Modern Trade, Convenience Stores, Online), and Ingredient Type (Conventional vs. Organic/Vegan). Analyzing these segments reveals shifting consumer loyalties, with rapid growth observed in specialized segments like organic and plant-based sauces, contrasting with the slower, yet stable, growth of traditional, high-volume segments like ketchup.

The Retail/Household application segment holds the largest volume share, driven by daily consumption and bulk purchases, but the Foodservice segment (HORECA) often commands higher value due to customized bulk orders and specialized formulations required by chefs. Ingredient-based segmentation clearly shows the impact of health trends; while conventional sauces still dominate in volume, the organic and natural ingredient segment is significantly outpacing others in terms of growth rate, especially in North American and Western European markets where consumers are willing to pay a premium for perceived quality and sustainability. Understanding the nuances within these segments allows manufacturers to tailor their product launches and packaging formats effectively.

- Product Type:

- Ketchup

- Mayonnaise and Aioli

- Mustard (Yellow, Dijon, Spicy)

- Salad Dressings (Vinaigrettes, Creamy)

- Dipping Sauces (BBQ, Hot Sauce, Sweet Chili, Specialty Dips)

- Spreads and Marinades

- Distribution Channel:

- Modern Trade (Supermarkets and Hypermarkets)

- Convenience Stores

- Specialty Stores

- Online Retail (E-commerce)

- Others (Wholesalers, Farmers Markets)

- Application:

- Foodservice (HORECA, QSRs, Institutional Catering)

- Retail/Household

- Ingredient Type:

- Conventional

- Organic

- Plant-Based/Vegan

- Gluten-Free

- Low Sodium/Low Sugar

Value Chain Analysis For Cold Sauce Market

The value chain of the Cold Sauce Market is characterized by a high degree of integration between raw material sourcing and the final distribution network, which is often cold chain dependent. Upstream analysis focuses on the procurement of primary agricultural commodities, including high-quality edible oils (e.g., soybean, sunflower, canola), eggs or plant-based alternatives, tomatoes, vinegar, and various spices and flavorings. Fluctuations in the global price and quality of these agricultural inputs directly impact manufacturing costs and, consequently, the final product pricing. Strategic sourcing and long-term contracts with regional farmers or major commodity brokers are critical upstream activities to ensure supply stability and ingredient quality, especially for organic and specialty sauce lines.

The midstream operation involves sophisticated processing and manufacturing, including blending, emulsification, pasteurization (where applicable for stability), and high-speed bottling or sachet packaging. Operational efficiency at this stage, particularly minimizing waste and optimizing energy usage, is paramount for cost leadership. Quality control is rigorous, ensuring microbiological safety and maintaining the desired flavor profile and texture stability over the product's shelf life. Downstream distribution is crucial for cold sauces, involving both direct sales to large Foodservice clients and indirect sales through extensive retail networks, necessitating robust cold chain logistics for perishable products like fresh mayonnaise or certain creamy dressings.

Distribution channels are multifaceted. Direct channels typically involve bulk sales to major Quick Service Restaurants (QSRs) or industrial food manufacturers who incorporate the sauces into their finished products. Indirect channels leverage wholesalers, distributors, and finally, the retail sector (supermarkets, convenience stores). E-commerce has introduced a highly efficient, though logistically complex, indirect channel, demanding specialized last-mile delivery solutions to maintain product integrity. Success in the downstream market hinges on effective channel management, strong promotional partnerships with retailers, and ensuring optimal shelf visibility to capture immediate consumer attention in highly competitive retail environments.

Cold Sauce Market Potential Customers

The primary customer base for the Cold Sauce Market is extensive and segmented into industrial, commercial, and individual consumers. Industrial customers include large-scale food processors and ready-meal manufacturers who purchase bulk quantities of sauces as essential ingredients for products like frozen dinners, pre-packaged sandwiches, and deli items. Their purchasing decisions are driven primarily by consistency, price competitiveness, and technical specifications, such as stability under varying processing conditions. Securing long-term contracts with these manufacturers represents a stable and high-volume revenue stream for sauce producers.

The commercial segment, primarily encompassing the Foodservice sector (Hotels, Restaurants, Cafes, and institutional catering), represents a high-value customer group that demands customized flavors, versatile packaging (e.g., large dispensers, single-serve packets), and reliable supply. QSR chains, in particular, rely heavily on cold sauces to maintain brand consistency across numerous outlets, driving demand for tailored formulations and stringent quality control. The preference in this segment is increasingly shifting towards premium, globally inspired dips and dressings that allow establishments to differentiate their menus and cater to sophisticated palates.

The largest customer base by volume is the household or individual consumer, accessed predominantly through retail channels. These end-users are highly sensitive to brand reputation, flavor innovation, and price points. Their purchasing behavior is heavily influenced by convenience, health trends (driving demand for low-fat, organic, and plant-based options), and family size (influencing the choice between large bottles and smaller, specialized jars). Effective marketing targeting this segment emphasizes meal versatility, quick usage ideas, and emotional connections related to flavor and family dining experiences, ensuring sustained market penetration within the domestic environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 45.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Unilever Group, Kraft Heinz Company, Conagra Brands Inc., McCormick & Company Inc., General Mills Inc., PepsiCo Inc. (Frito-Lay), T. Marzetti Company, Kewpie Corporation, The Hain Celestial Group Inc., Del Monte Foods Inc., Associated British Foods plc, Goya Foods Inc., Dr. Oetker, Stokes Sauces, Walkerswood Caribbean Foods, Veeba Food Services, Nando’s Group Holdings, Solina Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cold Sauce Market Key Technology Landscape

Technological advancements in the Cold Sauce Market are primarily focused on enhancing product stability, extending shelf life without compromising nutritional integrity, and improving the efficiency of high-volume manufacturing. Aseptic processing and Ultra-High Temperature (UHT) techniques, traditionally applied to beverages, are being adapted for certain non-egg-based sauces to achieve commercial sterility while minimizing the thermal impact on flavor and color. For more delicate emulsions like premium mayonnaise, High-Pressure Processing (HPP) is emerging as a critical non-thermal preservation technique. HPP significantly extends shelf life by inactivating pathogens and spoilage microorganisms through extreme pressure, allowing manufacturers to meet 'natural' and 'clean label' demands by reducing or eliminating chemical preservatives.

Beyond preservation, advanced emulsification technologies are key to developing low-fat or plant-based creamy sauces that mimic the texture and mouthfeel of traditional, high-fat products. Manufacturers are utilizing specialized homogenizers and colloid mills to create stable oil-in-water or water-in-oil emulsions using novel stabilizers like hydrocolloids and starch derivatives. Furthermore, automation and robotics are transforming the packaging stage. High-speed multi-head fillers and sophisticated check-weighing systems ensure precise dosing and minimal product giveaway, which is essential for maintaining profitability in a high-volume, low-margin industry. The integration of IoT sensors throughout the manufacturing line provides real-time data for proactive quality assurance.

The digital technology landscape is equally vital, particularly concerning flavor creation and intellectual property protection. Advanced chromatographic techniques (e.g., Gas Chromatography-Mass Spectrometry) coupled with sensory analysis panels are used to deconstruct and replicate complex ethnic and proprietary flavor profiles. This flavor mapping technology enables rapid iteration and scale-up of new products. Traceability technologies, including blockchain integration, are also gaining traction, offering end-to-end transparency from raw ingredient sourcing to consumer purchase. This addresses increasing consumer demand for accountability regarding ingredient origin, sustainability claims, and ethical sourcing, bolstering regulatory compliance and brand trust across global supply chains.

Regional Highlights

North America maintains its position as a dominant market region, characterized by high consumer awareness, strong consumption of fast food and processed meals, and the presence of major global sauce manufacturers. The U.S. market, in particular, drives innovation through consumer demand for specialized sauces, ranging from gourmet, small-batch artisanal dips to healthy, functional dressings. Regulatory standards are mature and strictly enforced, influencing trends toward lower sodium and organic certifications. The robust foodservice sector, including thousands of QSR outlets and full-service restaurants, ensures consistent, high-volume demand for both standard and customized cold sauce products.

Europe represents a mature yet dynamic market. Western European countries like Germany, France, and the UK exhibit high per capita consumption, with a strong emphasis on quality, sustainability, and regional specialties. Clean label demands are extremely influential here, pressuring manufacturers to minimize artificial additives and prioritize local sourcing. Eastern Europe, while less saturated, presents significant opportunities as organized retail penetration increases. The European market is also a hotbed for plant-based innovation, leading the global trend in vegan mayonnaise and dairy-free dressings, often driven by health trends and stringent environmental consciousness.

The Asia Pacific (APAC) region is the fastest-growing market globally, driven by urbanization, rising middle-class disposable incomes, and the rapid expansion of Western fast-food chains. Countries such as China, India, and Southeast Asian nations are experiencing massive market expansion, though local flavor preferences remain highly distinct, necessitating regional customization. Manufacturers face challenges related to establishing reliable cold chain infrastructure, but the sheer size of the potential consumer base makes this region highly attractive for aggressive market entry and capacity expansion strategies.

- North America: Dominant market share due to high consumer spending, strong QSR culture, and advanced logistics; focus on high-end gourmet and functional sauces.

- Europe: Mature market with stringent clean label standards; high growth in vegan/plant-based segments and localized specialty products (e.g., specific regional mustards).

- Asia Pacific (APAC): Fastest-growing region driven by rapid urbanization and Western dietary adoption; significant opportunity in countries like China and India; emphasis on adapting sauces to local savory and spicy flavor profiles.

- Latin America (LATAM): Moderate growth fueled by expanding foodservice sectors in Brazil and Mexico; local production often prioritized; price sensitivity is a key purchasing factor.

- Middle East and Africa (MEA): Emerging market with increasing demand, particularly in the GCC countries due to high expatriate population and modern retail expansion; strong preference for rich, savory flavors and large package sizes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold Sauce Market.- Nestlé S.A.

- Unilever Group

- The Kraft Heinz Company

- McCormick & Company Inc.

- Conagra Brands Inc.

- General Mills Inc.

- PepsiCo Inc. (Frito-Lay)

- Kewpie Corporation

- T. Marzetti Company

- The Hain Celestial Group Inc.

- Del Monte Foods Inc.

- Associated British Foods plc

- Goya Foods Inc.

- Dr. Oetker

- Stokes Sauces

- Walkerswood Caribbean Foods

- Veeba Food Services

- Nando’s Group Holdings

- Solina Group

- Reckitt Benckiser Group plc (French’s)

Frequently Asked Questions

Analyze common user questions about the Cold Sauce market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for plant-based cold sauces?

The primary driver is the global shift toward flexitarian and vegan diets, coupled with increasing consumer awareness regarding health, ethical sourcing, and environmental sustainability. Plant-based mayonnaise and dips offer functional benefits without compromising texture, appealing strongly to health-conscious younger demographics.

Which geographical region shows the most significant growth potential for cold sauces?

The Asia Pacific (APAC) region, specifically emerging economies such as India and China, demonstrates the highest growth potential. This is attributed to rapid urbanization, increasing disposable incomes, and the significant expansion of organized retail and Western foodservice chains, driving consumption of ready-to-use condiments.

How do 'clean label' trends affect cold sauce manufacturing?

Clean label requirements mandate manufacturers to use fewer artificial ingredients, preservatives, and colorings. This necessitates investment in non-thermal preservation techniques like High-Pressure Processing (HPP) and the substitution of chemical additives with natural stabilizers and flavor extracts, raising production costs but increasing market trust.

What are the key challenges related to the cold sauce supply chain?

Key challenges include managing the high volatility of raw material prices (especially oils and eggs), maintaining strict temperature controls across the entire cold chain for perishable products to prevent spoilage, and adapting logistics to meet the varied demands of both bulk foodservice and individual retail packaging formats.

What is the most popular type of cold sauce globally?

Ketchup and mayonnaise remain the most popular and highest-volume cold sauce categories globally, driven by their versatility and ubiquitous use in Western diets and the foodservice sector. However, the fastest-growing categories are specialized dipping sauces and ethnic flavor profiles, reflecting culinary exploration trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager