Cold Spray System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442066 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Cold Spray System Market Size

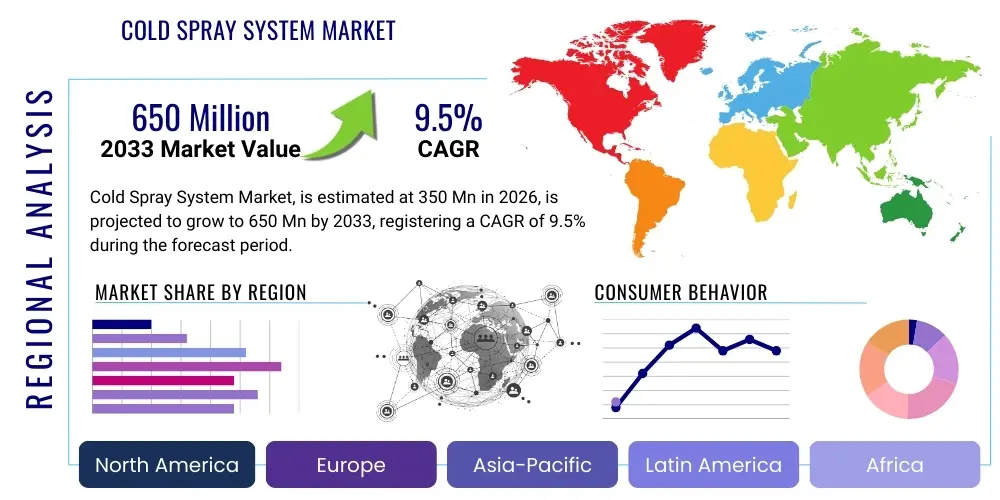

The Cold Spray System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 350 million in 2026 and is projected to reach USD 650 million by the end of the forecast period in 2033.

Cold Spray System Market introduction

The Cold Spray System Market is defined by the proliferation of advanced, solid-state material deposition technology primarily employed for repair, restoration, and fabrication processes across highly demanding industrial sectors, including aerospace, defense, energy, and automotive. This distinct coating technique accelerates micron-sized metallic or composite powders to supersonic speeds using pressurized gas (typically nitrogen or helium). The impact kinetic energy causes severe plastic deformation upon collision with the substrate, forming a dense, metallurgical bond without necessitating the melting of the feedstock material. This solid-state mechanism is the core differentiator, preventing the thermal degradation, oxidation, and material phase changes common in traditional thermal spray processes, thereby producing coatings with superior microstructural integrity, high density, and minimal residual stress. The resulting enhanced material properties enable cold spray systems to extend the functional lifespan of critical components, significantly reducing replacement costs and operational downtime, particularly for high-value assets in sectors governed by strict safety and performance regulations.

The key products within this market are categorized primarily by operating pressure: High-Pressure Cold Spray (HPCS) systems, which typically use high-cost gases like helium to achieve higher particle velocities and superior coating quality for structural applications; and Low-Pressure Cold Spray (LPCS) systems, which offer greater cost-efficiency and portability suitable for corrosion protection and less structurally demanding surface engineering tasks. Major applications span critical component dimensional restoration—such as repairing turbine blades and landing gear—as well as comprehensive corrosion and erosion protection for pipelines and marine structures. Furthermore, cold spray is increasingly vital in the production of functional coatings for electronic components and thermal management solutions. Benefits driving rapid market adoption include superior coating purity, the ability to deposit heat-sensitive materials (e.g., nanostructured or amorphous alloys), and the environmental advantage derived from eliminating toxic plating chemicals, aligning with global sustainability mandates and industrial best practices.

Driving factors sustaining market expansion are multifaceted, including the global push for lightweighting in transportation sectors, the strategic imperative of military and commercial entities to maximize the service life of aging fleets through sophisticated Maintenance, Repair, and and Overhaul (MRO) techniques, and the increasing integration of cold spray into modern hybrid additive manufacturing (AM) workflows. The technology offers a uniquely efficient method for depositing specific materials locally onto complex geometries fabricated by other AM techniques or traditional machining, creating novel component architectures. Continuous technological advancements focusing on reducing the dependency on expensive gases and developing automated, robot-integrated spray cells are further accelerating commercial viability. As process standardization matures and the cost-effectiveness of cold spray repair is demonstrated across various regulated industries, its market footprint is expected to expand considerably into general manufacturing and non-traditional coating applications globally.

Cold Spray System Market Executive Summary

The Cold Spray System Market’s operational landscape is undergoing transformation driven by key business trends centered on technological integration and supply chain optimization. A primary business trend involves the shift toward automated and robotic cold spray application cells, moving the technology from a specialized lab process to a high-throughput, repeatable manufacturing solution integrated into factory automation lines. Strategic alliances between equipment manufacturers and robotic suppliers (e.g., FANUC, KUKA) are becoming commonplace to deliver turnkey hybrid manufacturing systems. Furthermore, there is heightened business activity focused on expanding the certified material feedstock library, partnering with powder producers to qualify new alloys and composites specifically engineered for superior cold spray characteristics, thereby diversifying application scope beyond traditional metals and alloys. The service component, including proprietary software for process monitoring and optimization, is emerging as a crucial competitive differentiator, providing value-added solutions that enhance operational efficiency and coating quality consistency for end-users.

From a regional perspective, North America and Europe retain foundational dominance, capitalizing on mature defense spending and well-established, highly regulated aerospace industries that prioritize certified, reliable MRO solutions. North America, supported by significant government investment and academic research, leads in pioneering structural repair protocols and integrating cold spray into military logistics and supply chains. Europe’s market growth is strongly influenced by its robust automotive sector and the necessity of adhering to strict environmental legislation, particularly the phase-out of hexavalent chromium, which favors the adoption of non-toxic cold spray alternatives. Crucially, the Asia Pacific (APAC) region stands out for its aggressive growth trajectory, fueled by rapid industrialization, massive investments in infrastructure (rail, power generation), and a burgeoning indigenous aerospace industry, particularly in countries like China and India, where the need for localized repair capabilities and manufacturing efficiency improvement is acute.

Segmentation trends reveal HPCS continuing to dominate the market value due to its indispensable role in critical applications requiring high density, low porosity coatings, particularly in turbine and structural aerospace component repair. Conversely, LPCS is rapidly gaining volumetric share, driven by its lower operational costs and suitability for large-area applications such as anti-corrosion and general surface enhancement in the marine and heavy machinery sectors. The application segment focused on Maintenance, Repair, and Overhaul (MRO) remains the largest revenue generator, underpinned by the substantial economic benefits of component restoration over replacement. However, the fastest growth is anticipated in the Additive Manufacturing (AM)/Hybrid segment, as industries realize the potential of cold spray to combine superior material deposition rates with CNC precision. In materials, the demand for complex intermetallic and composite powders is rising sharply, driven by advanced research into thermal management and wear resistance coatings, suggesting a market pivot towards highly functional, specialized applications.

AI Impact Analysis on Cold Spray System Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) into the Cold Spray System Market predominantly revolve around optimizing complex process parameter settings and automating real-time quality control mechanisms. Users frequently question how AI and Machine Learning (ML) can navigate the multi-dimensional parameter space—including gas temperature, particle velocity, stand-off distance, and powder morphology—to achieve optimal coating properties for novel materials or substrates, aiming to reduce the extensive trial-and-error phases currently dominating R&D. The demand is high for predictive maintenance solutions that utilize AI to analyze sensor data from gas heaters, powder feeders, and robots, forecasting system failures or deviations before they impact production quality. Furthermore, users seek AI-driven vision systems capable of analyzing the spray plume geometry and particle impact dynamics in real-time, providing immediate feedback for self-correction and ensuring the rigorous quality assurance needed for critical aerospace and medical applications, thereby elevating process repeatability and decreasing reliance on post-deposition inspection.

- AI algorithms utilized for intelligent process control, predicting and setting optimal spray parameters based on desired coating performance metrics (hardness, porosity, adhesion).

- Integration of Machine Learning models to rapidly analyze vast datasets of material properties and processing conditions, accelerating the qualification of new feedstock powders for cold spray applications.

- Development of AI-powered vision systems for real-time monitoring of particle velocity and distribution, enabling autonomous detection and correction of process anomalies or defects.

- Implementation of predictive maintenance strategies across cold spray equipment, optimizing operational uptime by forecasting wear on nozzles, heaters, and powder feeders.

- Enhanced simulation fidelity using AI to rapidly solve complex Computational Fluid Dynamics (CFD) models, optimizing nozzle design and gas dynamics for improved deposition efficiency.

- Data standardization and sharing (GEO-focused) enabled by AI, allowing for global benchmarking of cold spray repair procedures and establishing consistent certification pathways across diverse manufacturing facilities.

- Autonomous robotic path planning driven by AI, compensating for substrate geometry variations and ensuring uniform coating thickness over complex surfaces without manual reprogramming.

DRO & Impact Forces Of Cold Spray System Market

The operational framework of the Cold Spray System Market is significantly shaped by distinct Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces. A major Driver (D) is the escalating need for component life extension and cost-effective repair, particularly evident in the highly capital-intensive aerospace and energy sectors where replacement costs are exorbitant. The superior material integrity and low-heat input of cold spray allow for the repair of fatigue-sensitive components previously deemed unrepairable, generating significant economic value. Furthermore, the global regulatory push, exemplified by the phasing out of hazardous substances like hexavalent chromium plating due to environmental concerns (R), mandates the adoption of compliant, solid-state alternatives such providing a strong, non-cyclical driver for cold spray adoption in North America and Europe. This regulatory pressure forces industries to invest in new, compliant coating technologies, where cold spray offers a technically superior and environmentally responsible solution for high-performance applications such as corrosion and wear protection, solidifying its place as a necessary modern technology.

Key Restraints (R) challenging market growth include the substantial initial capital outlay required for HPCS systems, particularly the auxiliary equipment such as high-capacity gas compressors and heaters, which serves as a major barrier to entry for smaller enterprises and research institutions. Furthermore, the high recurring operational expense associated with specific process gases, especially the cost and often unstable supply of high-purity helium necessary for optimal performance with lighter powders, limits system deployment in regions facing high utility costs or supply volatility. Another critical restraint is the relative immaturity of universal industry standards, certification procedures, and design data for cold spray deposits compared to long-established repair methods like welding or thermal spray. This lack of broad standardization necessitates costly and time-consuming application-specific qualification processes (e.g., MIL-STD, specific OEM qualifications), slowing down broad commercial adoption and uptake in highly regulated industries, requiring system manufacturers to invest heavily in providing certification support services to their clients to mitigate this restraint.

The most compelling Opportunities (O) reside in the seamless integration of cold spray into the rapidly expanding Hybrid Additive Manufacturing (AM) segment, combining the advantages of high-rate metal deposition with high-precision subtractive manufacturing techniques. This synergy enables the production of functionally graded materials, repair of complex geometries, and localized application of superior surface properties, unlocking new applications in critical structural component fabrication. The increasing miniaturization and portability of LPCS systems also create opportunities for on-site, rapid field repair and maintenance in remote or difficult-to-access environments, such as offshore platforms, large industrial machinery in mining, and infrastructural pipelines, tapping into the decentralized MRO market. The ongoing research into less expensive, higher-performance powder formulations and the continuous technological refinement of nitrogen-based HPCS systems offer substantial opportunities to reduce operational costs and enhance system accessibility, ultimately accelerating global market penetration beyond the current specialized niches and making the technology a mainstream manufacturing tool.

Segmentation Analysis

The Cold Spray System Market segmentation provides a strategic framework for understanding diverse market drivers and end-user needs, categorized primarily across technology type, component structure, material feedstock, application domain, and primary end-use industry. The technological split between High-Pressure Cold Spray (HPCS) and Low-Pressure Cold Spray (LPCS) is pivotal, defining performance limits and initial investment requirements, with HPCS capturing high-value, performance-critical applications. Analysis of the component segment highlights that while equipment sales constitute a significant upfront investment, the recurring revenue generated by consumables (powders, process gases) and specialized services (MRO, training) represents a stable and growing revenue stream. Furthermore, the segmentation by material type emphasizes the market's technological evolution, moving beyond basic metals to complex, engineered composites necessary for advanced functional coatings and specialized repair tasks, driving innovation across the supply chain. This comprehensive segmentation allows market participants to tailor their offerings to specific industry requirements, ensuring targeted growth and resource allocation.

- By Technology:

- High-Pressure Cold Spray (HPCS)

- Low-Pressure Cold Spray (LPCS)

- By Component:

- Cold Spray Equipment (Hardware: gun, powder feeder, gas heater, control units)

- Consumables (Metal Powders, Process Gases like Nitrogen/Helium)

- Services (MRO Support, Training, Process Qualification)

- By Material Type:

- Pure Metals (Aluminum, Copper, Titanium, Zinc)

- Alloys (Nickel-based, Steel, Titanium Alloys)

- Composite Materials and Carbides (Metal Matrix Composites, Polymers/Metals)

- By Application:

- Repair and Restoration (Dimensional Restoration, Corrosion Pitting Repair)

- Corrosion and Wear Protection

- Additive Manufacturing and Cladding

- Functional Coatings (Electrical Conductivity, Thermal Management)

- By End-Use Industry:

- Aerospace and Defense (MRO, Structural Repair)

- Oil and Gas (Pipeline and Equipment Protection)

- Automotive and Transportation (Engine Components, Lightweighting)

- Energy/Power Generation (Turbine Repair)

- Mining and Heavy Machinery

- Electronics and Semiconductor

Value Chain Analysis For Cold Spray System Market

The Cold Spray System Value Chain begins with the Upstream activities centered on the procurement and development of highly specialized consumables. This segment is dominated by advanced gas producers and sophisticated metal powder manufacturers. For powder feedstock, strict requirements exist regarding particle size distribution, sphericity, purity, and flowability, demanding specialized atomization techniques (e.g., gas atomization, plasma spheroidization). Consistency in powder quality is paramount as it directly influences deposition efficiency and coating quality. Similarly, the reliable supply of high-purity process gases, particularly helium and nitrogen, forms a critical upstream bottleneck, heavily impacting the operational costs of end-users. Competitive strategies in this phase focus on material innovation, developing proprietary alloy formulations optimized for cold spray, and securing long-term gas supply contracts to stabilize input costs for system manufacturers.

The midstream sector is where the core value creation occurs, involving the design, manufacturing, and integration of the complex Cold Spray systems. System manufacturers source highly specialized components such as high-pressure heaters, precision powder feeders, and optimized nozzles, integrating them with control software and often robotic systems. Technological expertise in aerodynamics, high-pressure fluid dynamics, and thermodynamics is essential here. The distribution channel in the midstream is bifurcated: high-value HPCS systems for aerospace and military are typically sold via Direct sales channels, ensuring close collaboration for installation, customization, and certification support. Conversely, LPCS systems and generic consumables may utilize Indirect distribution through regional specialized dealers and integrators who provide local maintenance and rapid supply chain support, widening the geographical reach and supporting smaller market participants.

The Downstream segment consists of the industrial End-Users, including major OEMs, MRO service providers, and governmental defense facilities, where the cold spray technology is finally applied. The highest value is extracted in this phase through the successful, certified application of coatings that either restore expensive components (reducing component replacement costs) or enhance manufacturing capability (creating new functional parts). Downstream success relies on comprehensive training and process certification, making Services a highly valued component of the overall offering. Feedback loops from these end-users back to system and material manufacturers are vital for continuous product improvement and defining industry standards. The high barrier to entry for complex cold spray operation means that third-party MRO service centers, often equipped with automated systems, are increasingly providing cold spray services to smaller companies that cannot afford the initial capital investment, thereby democratizing access to the technology.

Cold Spray System Market Potential Customers

The key potential customers for Cold Spray Systems are organizations facing critical challenges related to component wear, fatigue, corrosion, and the imperative to maximize operational readiness while minimizing life cycle costs. The Aerospace and Defense sectors represent the highest-value customer segment. Military maintenance depots and commercial airline MRO operations purchase systems to repair high-value, complex components such as turbine engine casings, airframe structures, and landing gear, where cold spray is certified to meet stringent safety standards for dimensional restoration and fatigue life enhancement. These buyers require turnkey solutions that include certification documentation, robust training programs, and highly reliable, automated systems capable of operating under strict quality control mandates. For these customers, the return on investment (ROI) is measured not only in material savings but critically in reduced aircraft downtime and mission readiness, justifying the significant capital investment required for HPCS technology.

Another rapidly expanding customer base is found in the Heavy Industry and Energy sectors, including Oil & Gas operators and Power Generation firms. Customers in the oil and gas industry utilize cold spray for preventing erosion and corrosion in drilling tools, risers, and pipelines, seeking robust field-deployable or fixed systems to extend asset life in harsh operating environments. Power generation companies, particularly those managing large gas and steam turbines, are major buyers for applying specific wear-resistant or thermal barrier coatings, often using cold spray to repair rotor tips and stator elements subjected to extreme thermal and mechanical stresses. These customers value the ability of cold spray to apply repair materials without inducing harmful heat stress, which is essential for maintaining the structural integrity of high-speed rotating machinery. Their purchasing decisions prioritize system reliability, ease of integration into existing MRO workshops, and strong post-sales application support.

Emerging potential customers are concentrated within the Advanced Manufacturing and Electronics sectors. Automotive OEMs are increasingly investing in cold spray, particularly LPCS systems, for applying conductive coatings, functionalizing lightweight aluminum parts, and enhancing components critical for electric vehicle battery cooling and power electronics. Medical device manufacturers represent a niche but high-growth customer segment, utilizing cold spray to deposit biocompatible metals like titanium onto implants, where the non-thermal nature ensures coating purity and superior adhesion essential for regulatory approval. These advanced customers often purchase systems for R&D purposes initially, focusing on the technology's capability to deposit novel material combinations (composites, nano-powders) that cannot be achieved by conventional methods, driving the market toward hybrid manufacturing solutions and specialized functional coatings requiring exceptionally high precision and repeatability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 million |

| Market Forecast in 2033 | USD 650 million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oerlikon Metco, Praxair Surface Technologies (Linde), VRC Metal Systems, Plasma Giken Co., Ltd., CenterLine (TSS) Ltd., Impact Innovations GmbH, Kinetics Spraying, Inc., Inovati, Curtiss-Wright Corporation, Powder Alloy Corporation, Kuka AG, Sulzer Ltd., ASB Industries, Sciaky Inc., Progressive Surface, Inc., Flame Spray Technologies, Titomic Ltd., Tecnar Automation Ltd., General Turbine Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cold Spray System Market Key Technology Landscape

The technological evolution of the Cold Spray System Market is concentrated on enhancing the core physics of the process, particularly focusing on the efficiency of particle acceleration and deposition. Critical advancements are centered around Gas Heating Systems, with manufacturers developing robust, high-power electric and inductive heaters capable of achieving exceptionally high temperatures (>1000°C) with highly precise control. This thermal management is essential as higher gas temperatures increase the speed of sound, allowing for greater particle velocities crucial for successful bonding of high-strength alloys (e.g., steel and titanium) using less expensive gases like nitrogen. Simultaneously, extensive R&D is devoted to optimizing Nozzle Geometries, leveraging advanced Computational Fluid Dynamics (CFD) simulations to design convergent-divergent nozzles that maximize kinetic energy transfer to the particles, minimize turbulence, and create a highly uniform spray plume, thereby boosting deposition efficiency and minimizing material waste, a key cost consideration for end-users operating high-value powder feedstocks.

System integration with advanced automation and robotics marks another fundamental shift in the technology landscape. Modern Cold Spray systems are increasingly being deployed as fully automated cells, integrated with 6-axis articulated robots (e.g., KUKA, FANUC) and closed-loop control systems. This integration ensures highly repeatable coating paths and precise stand-off distance control, eliminating variability associated with manual application and making the technology viable for high-volume, certified manufacturing environments. This move towards automation is foundational to the development of Hybrid Manufacturing Systems, where cold spray heads are mounted alongside traditional CNC cutting tools, allowing for the sequential deposition and finishing of parts within a single machining platform. These hybrid systems offer unprecedented flexibility in creating multi-material components and complex functional coatings with micron-level geometric accuracy, pushing the boundaries of what is manufacturable in demanding sectors like defense and medical devices.

Furthermore, the focus on In-Situ Monitoring and Diagnostic Technologies is paramount for ensuring process repeatability and quality assurance, particularly essential for applications requiring strict certification. Key technologies deployed include high-speed imaging, laser velocimetry, and infrared thermography, which measure crucial process variables such as particle speed, spray pattern stability, and substrate temperature in real-time. This real-time feedback loop allows for instantaneous adjustments to gas parameters and powder feed rates, minimizing defects and enabling detailed process traceability, addressing one of the industry's major restraints regarding standardization. Simultaneously, technological advancements are yielding smaller, more robust, and highly portable Cold Spray systems, optimized for operation outside of controlled factory environments. These low-pressure, portable solutions utilize compressed air or basic nitrogen sources, significantly broadening the market scope to include field maintenance operations in remote locations such as maritime repair, bridge infrastructure maintenance, and on-site repair in the mining industry, showcasing a vital trend towards greater accessibility and reduced logistical complexity.

Regional Highlights

- North America: This region is characterized by high adoption rates, driven by the massive budgets and strategic importance of the U.S. Department of Defense (DoD) in leveraging cold spray for critical MRO activities involving aircraft, naval vessels, and ground vehicles. North America leads in establishing qualified process standards (e.g., specific MIL-STDs) and is the primary hub for high-end HPCS research and commercialization, focusing on advanced materials for high-temperature and structural applications. The presence of major aerospace OEMs and dedicated research universities ensures continuous innovation and technological certification leadership.

- Europe: The European market demonstrates steady growth, highly influenced by the necessity of replacing hazardous coatings due to strict EU directives like REACH, providing a strong regulatory impetus for non-toxic alternatives. Key countries like Germany, the UK, and France are leaders in both system manufacturing and industrial application, particularly within the advanced automotive, marine, and power generation industries. European research focuses strongly on process optimization for sustainability and the integration of cold spray into existing European manufacturing automation infrastructure.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by the accelerating industrial modernization and infrastructure investment across China, India, and South Korea. Rapid expansion in the domestic defense and commercial aerospace sectors is increasing the localized demand for advanced MRO capabilities. Furthermore, the burgeoning automotive and electronics industries utilize LPCS for high-volume applications and functional coatings, making APAC a key driver for cost-effective, high-throughput system innovation and consumption of commodity cold spray powders.

- Latin America: Market penetration in Latin America is still developing, highly concentrated in resource-rich economies such as Brazil and Mexico. The primary demand stems from the necessity to maintain and repair heavy machinery in the mining sector and critical infrastructure in the oil and gas industry, where components face extreme erosion and corrosion. Growth is constrained by investment capital and the availability of local technical expertise and specialized process gases, though the need for advanced MRO solutions remains high, providing a mid-to-long-term growth opportunity.

- Middle East & Africa (MEA): Demand in the MEA region is intrinsically linked to the longevity of its expansive oil and gas processing infrastructure. Cold spray is recognized as a vital tool for preventive maintenance and rapid repair of refinery components, pipelines, and offshore platforms subjected to severe operational conditions. Defense spending and the establishment of new MRO hubs in the Gulf Cooperation Council (GCC) countries also contribute significantly to the market, requiring certified HPCS systems for maintaining modern aviation and naval fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold Spray System Market.- Oerlikon Metco

- Praxair Surface Technologies (Linde)

- VRC Metal Systems

- Plasma Giken Co., Ltd.

- CenterLine (TSS) Ltd.

- Impact Innovations GmbH

- Kinetics Spraying, Inc.

- Inovati

- Curtiss-Wright Corporation

- Powder Alloy Corporation

- Kuka AG (System Integrator)

- Sulzer Ltd.

- ASB Industries

- Sciaky Inc.

- Progressive Surface, Inc.

- Flame Spray Technologies

- Titomic Ltd.

- Tecnar Automation Ltd.

- General Turbine Systems

- H.C. Starck Solutions

Frequently Asked Questions

Analyze common user questions about the Cold Spray System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental advantage of cold spray over traditional thermal spray methods?

Cold spray utilizes kinetic energy rather than thermal energy for deposition, operating below the melting point of the material. This solid-state process prevents material oxidation, retains the feedstock’s microstructure, and minimizes thermal damage to the substrate, yielding coatings with superior density, low porosity, and excellent bond strength, which is vital for structural applications.

Which industries are driving the highest demand for High-Pressure Cold Spray (HPCS) systems?

The Aerospace and Defense sectors are the primary drivers for HPCS due to the critical nature of their components, requiring structural-quality repairs (e.g., turbine repair, dimensional restoration of landing gear). The Energy (power generation) and Oil & Gas sectors also heavily rely on HPCS for specialized wear and erosion control coatings.

How is the market addressing the high operational cost associated with utilizing helium gas?

Manufacturers are heavily investing in proprietary nozzle designs and advanced gas preheating technologies to maximize particle acceleration using less expensive process gases, primarily high-pressure nitrogen. This innovation aims to achieve HPCS-like performance metrics for common metals while reducing operational expenses and dependence on helium supply volatility.

What role does cold spray play in the evolving landscape of Additive Manufacturing (AM)?

Cold spray is pivotal in Hybrid Additive Manufacturing (AM), where it is integrated with CNC machining. It is used for rapid material build-up, creating functionally graded materials, and repairing high-value AM components by locally adding material without compromising the part's thermal or structural integrity. It is considered a crucial tool for both fabrication and restoration.

Are there widely accepted industry standards and certifications available for cold spray repair?

While a single universal standard does not yet exist, major industry bodies, particularly within the military and aerospace (e.g., FAA, specific OEM specifications), are developing and certifying application-specific cold spray procedures. This movement toward qualified procedures for specific material/geometry combinations is accelerating, fostering trust and wider industrial adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager