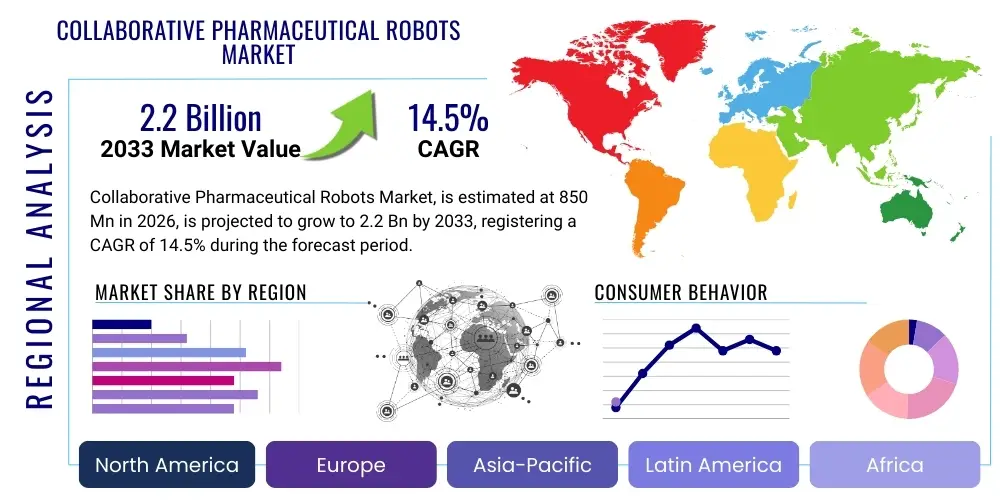

Collaborative Pharmaceutical Robots Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441578 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Collaborative Pharmaceutical Robots Market Size

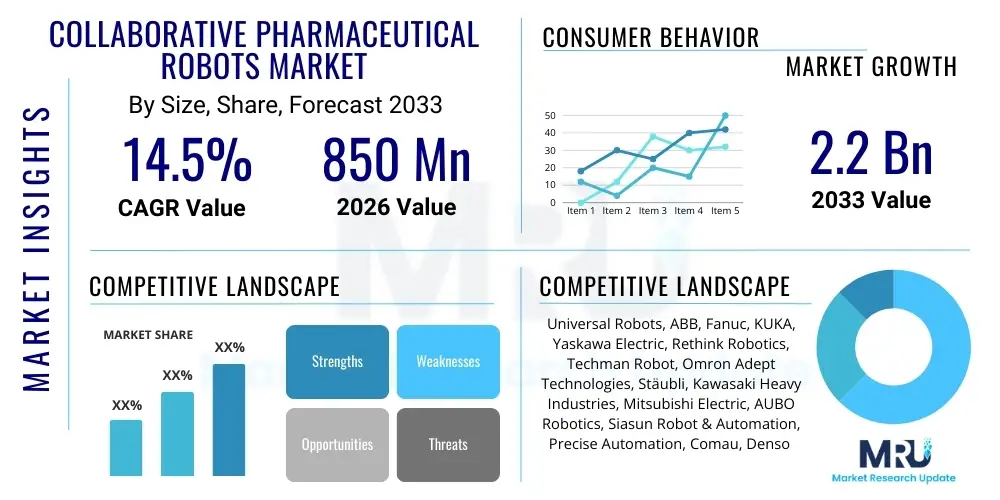

The Collaborative Pharmaceutical Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033.

Collaborative Pharmaceutical Robots Market introduction

Collaborative pharmaceutical robots, often termed cobots, are advanced robotic systems designed to work safely and interactively alongside human operators in pharmaceutical and biotechnology manufacturing and research environments. These systems are inherently safe due to integrated sensors, force limitations, and advanced control algorithms, allowing them to operate without traditional safety caging. The integration of cobots addresses critical needs within the highly regulated pharmaceutical sector, primarily enhancing efficiency, ensuring precision in delicate tasks, and supporting scalability in production while maintaining stringent quality control standards mandated by regulatory bodies like the FDA and EMA.

The core product offering includes highly flexible, multi-axis robotic arms equipped with specialized end-effectors, vision systems, and proprietary software interfaces tailored for pharmaceutical workflows. Major applications span high-throughput screening, quality inspection, automated packaging (blister packs and vials), precise liquid handling, pill sorting, and laboratory automation. These robots excel in repetitive tasks that demand high accuracy and repeatability, minimizing the risk of human error and contamination, which are paramount concerns in sterile drug production and complex biological assays.

The primary benefit driving adoption is the rapid return on investment (ROI) achieved through increased throughput, reduced operational costs, and improved workplace safety. Collaborative robots provide flexibility in production layout, enabling quick repurposing for different batch sizes or drug formats, critical in personalized medicine and rapid vaccine development. Key driving factors include the pharmaceutical industry's continuous push towards automation to meet rising global drug demand, the necessity for enhanced compliance with GxP standards, and the increasing shortage of skilled labor willing to perform repetitive or hazardous tasks in sterile environments.

Collaborative Pharmaceutical Robots Market Executive Summary

The Collaborative Pharmaceutical Robots Market is characterized by robust growth, primarily fueled by the accelerating adoption of Industry 4.0 principles within drug manufacturing and research. Current business trends indicate a strong focus on developing cobots with higher payload capacities and integrated AI-driven vision systems capable of complex decision-making, such as identifying defective products or adjusting dispensing volumes in real-time. Strategic partnerships between established automation providers and specialized pharmaceutical technology integrators are defining the competitive landscape, aiming to deliver tailored, validated solutions that simplify regulatory approval processes for end-users. Furthermore, the shift towards modular, scalable production units necessitates the flexibility and small footprint that collaborative robots uniquely offer.

Regionally, North America maintains market leadership due to substantial R&D investment, a high concentration of major pharmaceutical and biotech firms, and early adoption of advanced manufacturing technologies. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, driven by government initiatives promoting pharmaceutical manufacturing self-sufficiency (e.g., India and China), expanding domestic drug production, and significant foreign direct investment into modern manufacturing facilities. Europe remains a critical market, spurred by stringent quality requirements and a necessity for automation to offset high labor costs, particularly in countries like Germany and Switzerland.

Segment trends reveal that the Application segment for Laboratory Automation and Inspection is expanding rapidly, reflecting the critical need for speed and accuracy in drug discovery and quality control (QC). In terms of Payload Capacity, medium-payload cobots (5 kg to 10 kg) are experiencing substantial demand as they strike an optimal balance between handling common pharmaceutical components (like vials, trays, and pre-filled syringes) and maintaining safety protocols. End-user analysis highlights pharmaceutical manufacturing companies as the primary revenue generator, while Contract Manufacturing Organizations (CMOs) represent a high-growth segment, leveraging cobots to efficiently manage diverse client projects and optimize batch changeovers.

AI Impact Analysis on Collaborative Pharmaceutical Robots Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Collaborative Pharmaceutical Robots Market frequently center on themes of enhanced precision, predictive maintenance, and autonomous decision- making in sterile environments. Common concerns revolve around the validation of AI algorithms in regulated settings, data security, and the complexity of integrating advanced machine learning models into existing robotic infrastructure. Users expect AI to transcend basic automation, enabling cobots to learn optimal handling strategies for sensitive biological materials, predict equipment failures before they occur, and dynamically adjust processes based on real-time sensor data, thereby significantly increasing yield and reducing waste while ensuring continuous compliance.

The integration of AI, particularly Machine Vision and Deep Learning, is transforming collaborative robotics from simple pick-and-place tools into intelligent, adaptive co-workers. AI algorithms enhance robotic perception, allowing cobots to accurately identify subtle visual defects during inspection (e.g., micro-cracks in vials or incorrect label placement) that might be missed by traditional vision systems or human eyes. This capability drastically improves Quality Assurance (QA) processes. Furthermore, AI optimizes motion planning and trajectory execution, enabling the robot to perform highly intricate movements, such as micro-dosing or cell culture manipulation, with unparalleled smoothness and precision, minimizing shear stress on delicate samples.

Crucially, AI facilitates true collaborative interaction and safety. Predictive analytics and reinforcement learning are used to model human behavior patterns in shared workspaces. This allows the cobot to anticipate human movements and adjust its speed or path proactively, ensuring safety without constant stops. In laboratory settings, AI drives autonomous experimental design (Automated Scientific Discovery), where the robot executes complex sequences, analyzes results (via integrated data platforms), and automatically modifies subsequent steps, accelerating drug discovery cycles and reducing the dependency on constant human supervision for routine optimization tasks.

- AI-driven Machine Vision enhances defect detection sensitivity in packaging and inspection processes.

- Predictive maintenance algorithms minimize unplanned downtime by forecasting cobot component failure.

- Reinforcement learning optimizes collaborative safety protocols, allowing smoother human-robot interaction.

- AI enables autonomous laboratory workflows (self-optimizing high-throughput screening).

- Deep Learning algorithms refine handling techniques for sensitive biologics, reducing sample damage.

- Natural Language Processing (NLP) integration simplifies programming and human-robot instruction exchange.

- Real-time process adjustment based on data analytics ensures dynamic compliance and quality control.

DRO & Impact Forces Of Collaborative Pharmaceutical Robots Market

The Collaborative Pharmaceutical Robots Market is propelled by strong drivers, principally the increasing demand for high-quality, standardized production runs, offset by significant restraints related to validation complexities and high initial capital expenditure. Opportunities lie primarily in expanding applications into biopharma and personalized medicine, where flexibility and precision are paramount. The overarching impact forces include regulatory pressures demanding consistency (driving automation adoption) and rapid technological advancements in sensor and AI integration (enhancing cobot functionality and safety), collectively fostering a highly dynamic and expanding market environment.

Key drivers include the global mandate for pharmaceutical manufacturers to reduce operational expenditures (OPEX) while maintaining rigorous quality standards (cGMP compliance). Cobots offer a unique solution by automating labor-intensive tasks like sterile filling and final packaging, minimizing contamination risk and significantly improving batch consistency—a crucial factor in regulatory audits. Furthermore, the rising adoption of robotics in downstream processing, especially in secondary packaging and serialization, is driven by global anti-counterfeiting measures and track-and-trace requirements, where cobots provide the necessary flexibility and precision to handle diverse serialization data formats rapidly and reliably.

However, the market faces restraints, chiefly the lengthy and rigorous validation processes required for any new equipment introduction into a GxP environment. Integrating automation hardware and software must be meticulously documented and validated according to strict regulatory guidelines, often delaying deployment and increasing project costs. The high initial capital outlay for specialized, pharmaceutical-grade cobots, coupled with the need for specialized training for technical staff, presents a significant barrier to entry, particularly for smaller Contract Research Organizations (CROs) or academic labs. Opportunities arise from the unmet need in small-batch and personalized medicine production, where traditional rigid automation is uneconomical; cobots, with their modularity, are perfectly suited to handle diverse, low-volume production runs efficiently. Additionally, the development of standardized, pre-validated software modules for common pharmaceutical tasks will accelerate deployment and reduce the validation burden.

Impact forces are strongly positive. The rapidly decreasing cost of sensor technology and advanced materials (enabling easier cleaning and sterilization) enhances the feasibility of cobots in sterile environments. The increasing availability of robotics-as-a-service (RaaS) models is lowering the financial barrier to entry, transforming high capital expenditure into manageable operational expenses. Regulatory bodies are also increasingly publishing guidance that supports the adoption of smart manufacturing technologies, provided they meet validation requirements, signaling a shift that encourages the use of advanced automation tools to improve overall product quality and safety profiles across the industry.

Segmentation Analysis

The Collaborative Pharmaceutical Robots Market segmentation provides a granular view of market dynamics based on hardware capabilities, functional applications, and specific end-user environments. Analyzing these segments is essential for understanding where investment and growth are concentrated. The market is primarily categorized by Payload Capacity, which dictates the robot's physical handling capability; by Application, reflecting the specific task performed within the pharmaceutical workflow; and by End-User, identifying the types of organizations driving demand for these automated solutions.

The Payload Capacity segment (Low, Medium, High) determines the suitability of the cobot for different manufacturing scales and object sizes. Low payload cobots (typically under 5 kg) are favored in laboratory automation for handling microplates and small instruments, demanding maximum dexterity. Medium payload robots (5 kg to 10 kg) dominate packaging and assembly lines, handling vials, syringes, and small components. High payload cobots (over 10 kg) are crucial in logistics, palletizing, and moving larger batches. Meanwhile, the Application segmentation demonstrates a strong shift towards areas requiring high precision and compliance, such as sterile filling and inspection, moving beyond basic packaging tasks.

The End-User segment reveals that Pharmaceutical and Biopharmaceutical Companies are the largest consumers, implementing cobots across their entire operational footprint from research to final distribution. Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) are the fastest-growing sub-segment, as they leverage cobot flexibility to rapidly switch between client projects and achieve optimal operational efficiency in highly competitive outsourcing scenarios. Academic and Research Laboratories, while smaller consumers, are crucial for driving innovation in specialized applications like genomics and proteomics research.

- By Payload Capacity:

- Low Payload (Up to 5 kg)

- Medium Payload (5 kg to 10 kg)

- High Payload (Above 10 kg)

- By Application:

- Pick and Place and Material Handling

- Packaging and Palletizing (Primary, Secondary, Final)

- Assembly (e.g., pen injectors, medical devices)

- Inspection and Quality Control (Vision Systems)

- Laboratory Automation (High-Throughput Screening, Liquid Handling)

- Sterile Filling and Aseptic Processing

- By End-User:

- Pharmaceutical and Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Research Laboratories and Institutes

- By Component:

- Hardware (Robotic Arm, Controllers, End Effectors)

- Software and Services

Value Chain Analysis For Collaborative Pharmaceutical Robots Market

The value chain for Collaborative Pharmaceutical Robots starts with upstream raw material suppliers and component manufacturers (e.g., specialized motor producers, sensor and vision system developers). This is followed by the core robot manufacturers who design and assemble the fundamental robotic platform (the arm and controller). These foundational elements are then customized and integrated by specialized system integrators, who focus heavily on creating pharmaceutical-specific end-effectors, sterile enclosures, and GxP-compliant software interfaces. This integration step is crucial as it tailors the general-purpose cobot for highly specific and regulated tasks, such as handling cytotoxic drugs or performing precise liquid transfers in cleanrooms.

The distribution channel involves both direct and indirect routes. Major robot manufacturers often use a direct sales model for large pharmaceutical clients, providing custom consultation, installation, and long-term service contracts. However, the indirect channel, dominated by specialized system integrators and distributors, is vital for reaching small to medium-sized enterprises (SMEs) and specialized research laboratories. These integrators possess deep domain expertise, offering necessary validation services and localized technical support, which are critical requirements in this highly regulated industry. Downstream activities involve comprehensive training, maintenance, calibration, and ongoing software updates to ensure the robot systems maintain peak performance and compliance throughout their operational lifecycle.

The value generated within this chain heavily relies on compliance assurance and technical support. Differentiation occurs at the integration level, where providers who can demonstrate rapid validation and seamless integration with existing Pharmaceutical Manufacturing Execution Systems (MES) gain a competitive edge. Transparency in the supply chain regarding component sourcing and materials (especially for parts exposed to sanitization agents) is increasingly important. Ultimately, the successful delivery of value is measured not just by the robot's functionality but by its ability to reliably contribute to compliant, high-quality pharmaceutical production outcomes, making the after-sales service and validation documentation paramount.

Collaborative Pharmaceutical Robots Market Potential Customers

Potential customers for Collaborative Pharmaceutical Robots are organizations involved in the discovery, development, testing, and manufacturing of pharmaceuticals, biologics, and medical devices where high precision, sterility, and regulatory compliance are non-negotiable requirements. The primary end-users are large multinational pharmaceutical corporations, such as Pfizer, Novartis, and Johnson & Johnson, who seek to automate large-scale manufacturing processes, including high-volume sterile filling, packaging, and complex logistical tasks within their global supply chains. These large entities demand robust, scalable solutions with comprehensive validation packages and global service networks.

A rapidly expanding customer base includes Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs). CMOs, handling diverse product portfolios for multiple clients, prioritize the flexibility and ease of reprogramming offered by cobots to minimize changeover time between batches, maximizing facility utilization. CROs utilize these robots heavily in their laboratory environments for high-throughput screening, sample preparation, and compound management, where cobots significantly reduce variability and increase the speed of preclinical testing. These organizations seek systems that are easy to deploy, scalable, and adaptable to shifting research protocols.

Further potential customers include specialized biotechnology companies focusing on advanced therapies like cell and gene therapy (CGT). In CGT manufacturing, the extreme sensitivity of the biological product and the need for closed, aseptic processing environments make collaborative robots indispensable tools for ensuring product integrity and compliance with complex handling procedures. Additionally, academic research institutes and large hospital pharmacies (for compounding sterile preparations) represent niche but growing customer segments, valuing the precision, small footprint, and safety features of cobots for specialized or hazardous tasks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Universal Robots, ABB, Fanuc, KUKA, Yaskawa Electric, Rethink Robotics, Techman Robot, Omron Adept Technologies, Stäubli, Kawasaki Heavy Industries, Mitsubishi Electric, AUBO Robotics, Siasun Robot & Automation, Precise Automation, Comau, Denso Wave, EPSON Robots, Hanwha Precision Machinery, Franka Emika. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Collaborative Pharmaceutical Robots Market Key Technology Landscape

The technological landscape of the Collaborative Pharmaceutical Robots market is rapidly advancing, focusing primarily on integration capabilities, enhanced safety features, and specialized material science. The core technology centers around high-resolution force and torque sensors integrated into every joint, enabling the cobot to detect unexpected contact and stop immediately, which is fundamental to collaboration and inherently safe operation within proximity to humans. Advanced motion control systems utilize sophisticated algorithms to ensure smooth, repeatable trajectories necessary for sensitive tasks like micro-dosing or cell culture manipulation, minimizing sample perturbation.

Vision systems represent a critical technological differentiator, moving beyond simple 2D cameras to incorporate 3D vision and hyperspectral imaging, particularly in quality control and inspection applications. These advanced vision systems, powered by AI and machine learning, allow cobots to interpret complex visual data, recognize subtle variations in products (e.g., liquid levels, particle contamination), and adapt their actions accordingly. Furthermore, the specialized materials used in cobot construction—such as stainless steel or FDA-approved coatings—are essential for meeting stringent cleanroom standards (ISO Class 5/7) and resisting harsh chemical sterilization agents (Vaporized Hydrogen Peroxide – VHP), ensuring compatibility with aseptic environments.

The evolution towards seamless integration is driven by standardized communication protocols (like OPC UA or proprietary APIs) that allow cobots to interface effortlessly with Laboratory Information Management Systems (LIMS), Manufacturing Execution Systems (MES), and enterprise resource planning (ERP) software. This interconnectivity is vital for data integrity and GxP documentation, enabling full audit trails and real-time performance monitoring. The rise of intuitive, graphical user interfaces and 'no-code' programming environments is lowering the skill barrier for deployment, allowing pharmaceutical technicians, rather than only specialized robotics engineers, to rapidly teach and reconfigure the robots for new tasks.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share due to its established biopharmaceutical ecosystem, significant expenditure on R&D, and the presence of numerous global drug manufacturers. The region is characterized by high labor costs, which strongly incentivize automation adoption. Furthermore, clear regulatory pathways for advanced manufacturing technologies encourage the rapid deployment of collaborative robots in both large-scale production and cutting-edge biotech research facilities. Early adoption of AI integration and specialized applications, particularly in gene and cell therapy manufacturing, solidify North America's leadership position.

- Europe: Europe represents a mature market with robust growth driven by high manufacturing standards, stringent quality control requirements (EU GMP), and a strong push towards sustainable and efficient manufacturing processes. Countries such as Germany, Switzerland, and Ireland are key hubs, focusing on precision engineering and pharmaceutical manufacturing excellence. European companies often emphasize the collaborative aspect, seeking cobots to augment existing workforces rather than purely replace them, leading to specialized solutions focused on ergonomics and human-robot interaction safety.

- Asia Pacific (APAC): The APAC region is anticipated to exhibit the highest CAGR during the forecast period. This accelerated growth is primarily attributed to massive investments in expanding domestic pharmaceutical manufacturing capabilities in countries like China, India, and South Korea, aiming for self-sufficiency and global export competitiveness. Lower initial automation penetration combined with government support (e.g., "Made in China 2025") and the rapid construction of new, state-of-the-art facilities creates substantial demand for flexible, scalable automation solutions like cobots. The focus here is on high-volume packaging and quality inspection efficiencies.

- Latin America (LATAM): The LATAM market is in an emerging phase, with growth concentrated in major economies such as Brazil and Mexico. Adoption is currently driven by international pharmaceutical companies establishing or modernizing local production sites to meet regional demand and adhere to international GxP standards. Challenges include fluctuating economic conditions and complexity in importing high-tech equipment, but the opportunity remains substantial for basic automation in packaging and materials handling.

- Middle East and Africa (MEA): The MEA market is developing, characterized by targeted automation investments focused on building local drug production capacity, particularly in the UAE and Saudi Arabia. Market uptake is slower but steady, supported by government initiatives to diversify economies away from oil and establish regional healthcare hubs. Demand is typically project-based, centered around new facility construction that incorporates modular, efficient automation from the ground up.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Collaborative Pharmaceutical Robots Market.- Universal Robots

- ABB

- Fanuc Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Rethink Robotics GmbH (acquired by HAHN Group)

- Techman Robot (Quanta Storage Inc.)

- Omron Adept Technologies

- Stäubli International AG

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- AUBO Robotics

- Siasun Robot & Automation Co., Ltd.

- Precise Automation, LLC

- Comau S.p.A.

- Denso Wave Incorporated

- EPSON Robots

- Hanwha Precision Machinery Co., Ltd.

- Franka Emika GmbH

Frequently Asked Questions

Analyze common user questions about the Collaborative Pharmaceutical Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between traditional industrial robots and collaborative pharmaceutical robots?

The primary distinction lies in safety and proximity; collaborative robots (cobots) are designed with inherent safety features (force/torque limitation, rounded edges, safety sensors) allowing them to work alongside humans without safety caging, unlike traditional industrial robots which require restricted operational zones. Cobots also offer superior flexibility for small-batch, high-mix environments typical in pharmaceutical R&D.

How do collaborative robots ensure compliance with GxP and regulatory standards in sterile environments?

Cobots ensure GxP compliance through specialized, sanitary designs (smooth surfaces, stainless steel, resistance to VHP sterilization), integration with validated data systems for audit trails, and consistent, repeatable execution of tasks that minimizes human error and contamination risks, particularly important in Grade A/B cleanrooms for aseptic filling.

What are the largest growth opportunities for cobots in the pharmaceutical market?

The largest growth opportunities are concentrated in laboratory automation (high-throughput screening and complex liquid handling) and in advanced therapeutic manufacturing, specifically cell and gene therapy (CGT), where the need for precise, closed-system, and highly flexible automation solutions is paramount due to the high value and sensitivity of the biological products.

What is the typical Return on Investment (ROI) timeline for implementing a collaborative robot in a pharma setting?

The ROI timeline varies based on application, but significant efficiency gains in highly repetitive tasks, reduced contamination events, and lower operating expenses often lead to payback periods typically ranging from 12 to 24 months, especially when utilized for 24/7 operations in packaging or sterile quality inspection.

What role does AI play in improving the functionality of collaborative pharmaceutical robots?

AI significantly improves cobot functionality by enhancing vision systems for quality control (defect detection), optimizing motion paths for precision tasks (reducing handling time and improving smoothness), and enabling proactive maintenance scheduling, transitioning cobots from automated tools into adaptive, intelligent systems capable of self-optimization in dynamic production environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager