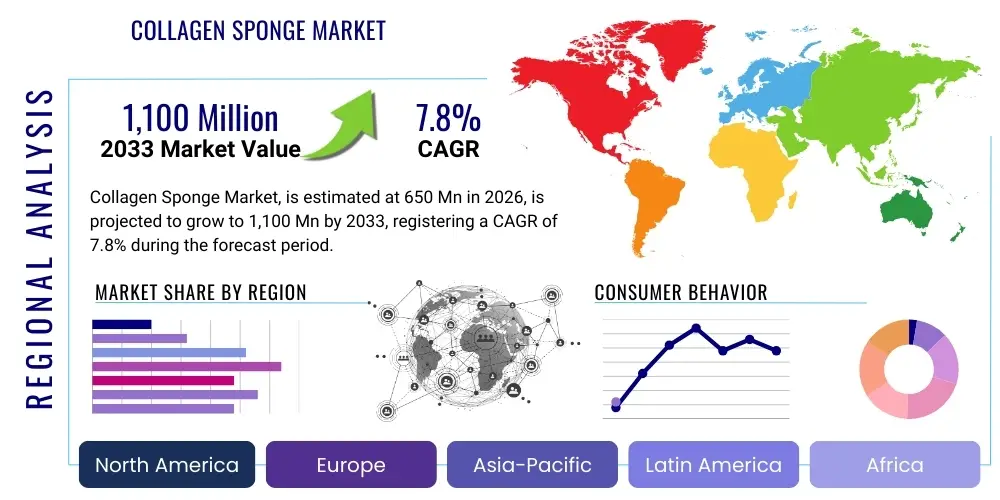

Collagen Sponge Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441285 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Collagen Sponge Market Size

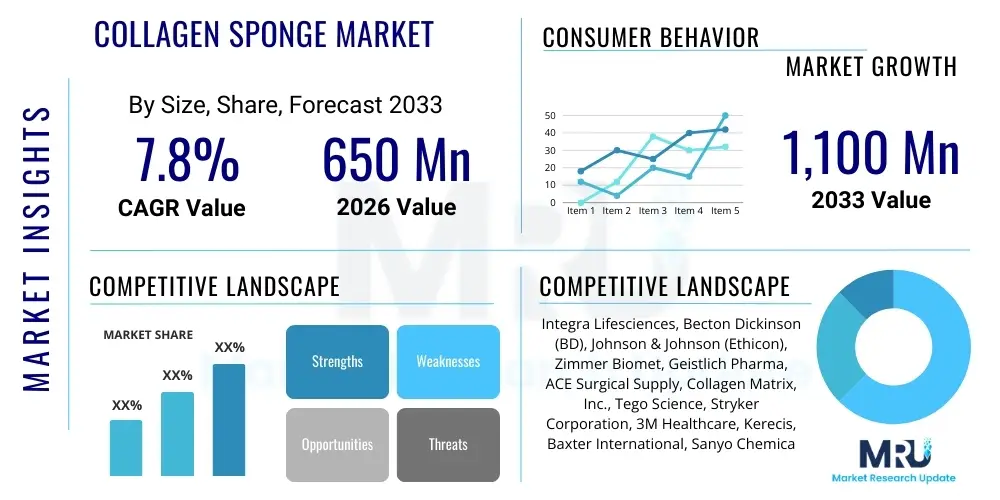

The Collagen Sponge Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,100 Million by the end of the forecast period in 2033.

Collagen Sponge Market introduction

The Collagen Sponge Market encompasses highly sophisticated biomaterial products derived primarily from bovine, porcine, or synthetic collagen, engineered into porous, absorbent matrices designed for applications across advanced wound care, surgical hemostasis, and tissue engineering. These sponges serve as versatile delivery systems for therapeutic agents or as scaffolds to facilitate cellular proliferation and tissue regeneration. The inherent biocompatibility and biodegradability of collagen, a naturally occurring protein essential to structural integrity, make these sponges ideal candidates for in-vivo applications where integration and eventual absorption are crucial outcomes. The market's foundational strength lies in the broad clinical utility of these products, ranging from minor abrasions and chronic diabetic ulcers to complex surgical sites in dentistry, orthopedics, and neurosurgery, thereby ensuring a consistently high demand profile in modern healthcare systems globally.

Collagen sponges possess unique physiochemical properties, including high surface area and porosity, which allow them to effectively absorb exudate while providing a moist environment crucial for accelerated healing. Furthermore, the hemostatic capability of collagen, owing to its interaction with platelets and coagulation factors, positions collagen sponges as primary tools for controlling bleeding in operative fields, particularly in highly vascularized areas. Key applications driving market expansion include dental surgery (alveolar ridge preservation, guided tissue regeneration), orthopedic procedures (bone graft substitutes), and advanced chronic wound management, where traditional dressings often fail to stimulate effective closure. The continuous refinement in manufacturing techniques, such as freeze-drying and cross-linking methods, enhances the mechanical strength and degradation profile of these products, optimizing their performance for specific clinical indications and extending their shelf life, which further solidifies their adoption rate among specialists.

The principal driving factors fueling the robust growth of the Collagen Sponge Market involve the increasing global burden of chronic diseases such as diabetes, leading to a surge in hard-to-heal wounds, and the demographic shift towards an aging population requiring more frequent surgical and reconstructive interventions. Additionally, the growing awareness among healthcare providers regarding the superior efficacy of advanced biological dressings compared to conventional methods is accelerating market penetration. Regulatory streamlining in key geographical regions for medical devices utilizing established biomaterials also plays a supportive role, enabling faster market entry for innovative product variants. Conversely, the market must navigate challenges related to raw material sourcing consistency, maintaining stringent sterilization standards, and managing the potential for immunological reactions, though continuous R&D efforts are mitigating these restraints by developing highly purified and recombinant collagen sources, ensuring sustainable market progression.

Collagen Sponge Market Executive Summary

The Collagen Sponge Market is characterized by vigorous innovation focused on material science and therapeutic augmentation, translating into significant business trends centered around strategic partnerships and targeted acquisitions aimed at consolidating specialized technology. Leading industry players are heavily investing in integrating antimicrobial agents, growth factors, and active pharmaceutical ingredients (APIs) directly within the collagen matrix to create next-generation sponges that offer combined therapeutic functions, moving beyond simple hemostasis and scaffolding. The prevailing business model emphasizes securing long-term supply agreements with major hospital networks and specialized surgical centers, particularly in high-volume surgical disciplines like cardiac and spinal procedures. Furthermore, the market exhibits a distinct trend toward customization, where manufacturers are developing sponges tailored in shape, size, and porosity to meet the specific anatomical and clinical requirements of complex surgical procedures, enhancing procedural efficiency and patient outcomes, thus providing a competitive advantage to firms possessing flexible manufacturing capabilities.

Regional trends reveal that North America and Europe maintain dominance, driven by well-established reimbursement policies, high healthcare expenditure, and the rapid adoption of sophisticated surgical techniques requiring advanced biomaterials. However, the Asia Pacific (APAC) region is demonstrating the most accelerated growth trajectory, primarily due to the expanding medical tourism sector, improving healthcare infrastructure investments in emerging economies like China and India, and the rising prevalence of surgical procedures necessitating quality wound and surgical care products. Regulatory harmonization efforts within regional blocs, such as the European Union’s Medical Device Regulation (MDR), are shaping market entry strategies, demanding higher levels of clinical evidence, which disproportionately affects smaller enterprises but simultaneously raises the quality bar for all market participants. This regional dynamic necessitates tailored marketing and distribution strategies, acknowledging the varied regulatory and procurement processes inherent across diverse healthcare systems.

Segmentation trends indicate that the Type I Collagen segment, primarily sourced from bovine tendons, continues to hold the largest market share due to its established safety profile, abundance, and cost-effectiveness in large-scale production, making it a staple in general surgical applications. However, the Synthetic and Recombinant Collagen segments are projected to experience superior growth rates, spurred by efforts to minimize zoonotic risk and achieve superior consistency and purity, which is critical for highly sensitive applications like neurosurgery and ocular reconstruction. Application-wise, the Dental segment, particularly restorative and implantology procedures, is consistently driving high revenue volumes, while the Chronic Wound Care segment is forecast to be the fastest-growing area, propelled by the increasing global geriatric population and the associated rise in complex chronic wounds that necessitate advanced biological interventions to achieve healing and prevent limb amputation. This shift underscores a market moving from commodity products to high-value, niche therapeutic platforms, requiring specialized sales forces and clinical support.

AI Impact Analysis on Collagen Sponge Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Collagen Sponge Market predominantly center on how AI can optimize the material science, enhance clinical deployment, and streamline the complex regulatory pathway associated with advanced biomaterials. Specific concerns frequently raised include the potential for AI-driven predictive modeling to forecast the long-term degradation kinetics and tissue integration properties of new collagen formulations, thereby reducing expensive and lengthy in-vivo trials. Users are also keenly interested in the application of Machine Learning (ML) algorithms for quality control during the manufacturing process, specifically in image analysis of sponge microstructure (porosity, fiber alignment) to ensure batch-to-batch consistency—a significant challenge in natural biomaterial processing. Furthermore, clinical practitioners seek AI tools to assist in selecting the optimal type and size of collagen sponge based on a patient’s unique wound characteristics, co-morbidities, and healing trajectory, moving towards precision wound management.

AI's influence is beginning to manifest significantly in the R&D phase, where algorithms are employed to analyze vast datasets pertaining to protein structure, cell-material interactions, and biomechanical performance. By leveraging sophisticated neural networks, researchers can rapidly screen potential cross-linking agents, purification methods, and additive concentrations to design sponges with optimized characteristics, such as enhanced resilience to enzymatic degradation or controlled release profiles for embedded therapeutic compounds. This computational approach drastically accelerates the preclinical development timeline, reducing the reliance on traditional, labor-intensive experimental methods. The ability of AI to simulate complex biological environments and predict the efficacy of novel scaffolds before physical manufacturing represents a transformative shift, allowing companies to allocate resources more efficiently towards promising innovations that address unmet clinical needs in fields like orthopedic regeneration and complex tissue repair, areas where scaffold performance is paramount.

In the post-market surveillance and clinical adoption phases, AI-powered tools are contributing to enhanced patient outcomes through intelligent monitoring and decision support systems. These systems utilize data captured from electronic health records, imaging diagnostics, and even wearable sensors to provide real-time feedback on wound healing status following the application of a collagen sponge. For example, ML models trained on thousands of wound photographs and corresponding healing rates can alert clinicians to potential complications, such as infection or inadequate cellular ingrowth, earlier than conventional monitoring methods. This capability improves the clinical utility of the collagen sponges by ensuring timely intervention and adjustment of the care protocol, maximizing the therapeutic value of the product. The increasing regulatory expectation for real-world evidence (RWE) also positions AI/ML analysis platforms as indispensable tools for manufacturers seeking continuous clinical validation and robust justification for their product claims.

- AI optimizes collagen purification processes, ensuring consistent batch quality and minimizing antigenic properties.

- Machine Learning algorithms predict optimal sponge porosity and mechanical properties based on target tissue type and application.

- Predictive modeling accelerates R&D by simulating scaffold degradation kinetics and tissue integration in various physiological conditions.

- AI-driven image analysis enhances quality control during manufacturing, verifying microstructural integrity.

- Clinical decision support systems use patient data to recommend the most effective collagen sponge size and formulation for precision wound care.

DRO & Impact Forces Of Collagen Sponge Market

The dynamics of the Collagen Sponge Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the impact forces determining its growth trajectory and competitive intensity. The primary Drivers revolve around the escalating global prevalence of chronic wounds, particularly diabetic foot ulcers and venous leg ulcers, which necessitate sophisticated biological solutions for effective management and accelerated healing, often minimizing hospitalization time. The increasing volume of complex surgical procedures across orthopedics, neurology, and cardiovascular domains, where effective intraoperative hemostasis and tissue support are non-negotiable requirements, further cements demand. This demand is intrinsically linked to technological advancements in material science, which have led to the introduction of enhanced, cross-linked sponges offering superior mechanical integrity and prolonged functional life within the patient's body, addressing specific clinical longevity requirements.

Conversely, significant Restraints challenge the market's smooth expansion. Chief among these is the regulatory stringency, particularly concerning products derived from animal sources, which require rigorous testing to ensure the absence of infectious agents (e.g., TSE/BSE risk) and to demonstrate consistent purity levels, increasing the time and cost associated with market entry. Price sensitivity in emerging markets and high treatment costs associated with advanced biological dressings in general healthcare systems pose another hurdle, sometimes favoring cheaper, traditional alternatives despite lower efficacy. Furthermore, the variability in raw material sourcing—the primary source of medical-grade collagen—can lead to supply chain vulnerabilities and fluctuations in manufacturing costs, demanding robust quality assurance frameworks and diversified sourcing strategies to mitigate these operational risks effectively and maintain continuous supply.

Opportunities for profound market growth exist primarily in the development and commercialization of bio-active collagen sponges loaded with novel therapeutic payloads, such as antimicrobial peptides (AMPs), growth factors (e.g., PDGF, VEGF), or anti-inflammatory drugs, transforming the sponge from a passive scaffold into an active therapeutic agent. Significant untapped potential lies in expanding applications into areas like cosmetic surgery, regenerative aesthetics, and drug delivery platforms where the biodegradable nature of collagen offers distinct advantages over synthetic polymers. The development of fully synthetic or recombinant human collagen sponges presents a major opportunity to overcome safety concerns and supply chain variability associated with animal-derived sources, enabling superior standardization and potentially accessing patient populations sensitive to bovine or porcine materials, thereby broadening clinical applicability and increasing physician confidence in long-term safety profiles.

Segmentation Analysis

The Collagen Sponge Market is comprehensively segmented based on Type, Application, Source, and End-User, allowing for granular analysis of market dynamics and targeted strategic planning. The Type segmentation distinguishes between sponges made from Type I, Type II, and Type III collagen, reflecting differences in structural function and optimal biological application (e.g., Type I for skin and bone, Type II for cartilage). The Source classification is crucial, differentiating between Bovine, Porcine, Avian, Marine, and Recombinant/Synthetic origins, each carrying distinct implications regarding cost, availability, regulatory oversight, and potential immunogenicity. Application segmentation highlights the primary clinical utilities, ranging from acute trauma care and dental surgery to specialized use in neurosurgery and orthopedics, where performance specifications are highly demanding and distinct.

The significance of segmentation lies in understanding the shift in market preference toward high-purity, application-specific products. For instance, in dental bone regeneration, cross-linked, high-density porcine collagen sponges are highly favored for their handling characteristics and barrier function, contrasting sharply with the requirement for softer, more pliable bovine collagen sponges used in severe burn or chronic wound management. This heterogeneity drives specialized product development. End-User analysis, distinguishing between Hospitals, Ambulatory Surgical Centers (ASCs), and Specialized Clinics (like dental and dermatology), provides insight into procurement patterns and volume potential, indicating that while hospitals account for the highest volume due to complex procedures, ASCs are gaining prominence due to increasing procedural migration driven by cost efficiencies and patient preference.

Analyzing these segments allows stakeholders to pinpoint areas of greatest revenue potential and competitive vulnerability. The fastest-growing segment, often the Chronic Wound Care application, requires products optimized for extended wear and infection control, contrasting with the surgical segment, which prioritizes rapid hemostasis and controlled degradation. Furthermore, the rise of recombinant collagen, despite higher initial costs, signals a long-term trend toward premium, standardized products that mitigate the biological variability inherent in natural sources, addressing the increasing demand from regulatory bodies and discerning clinicians for highly predictable and consistent biomaterials across complex clinical scenarios.

- By Type:

- Type I Collagen Sponges

- Type II Collagen Sponges

- Type III Collagen Sponges

- By Source:

- Bovine

- Porcine

- Marine

- Recombinant/Synthetic

- By Application:

- Dental Surgery (Guided Bone Regeneration, Ridge Preservation)

- Chronic Wound Management (Diabetic Ulcers, Pressure Ulcers)

- Surgical Hemostasis (Neurosurgery, Cardiovascular, Orthopedic)

- Drug Delivery and Tissue Engineering

- Burn Treatment

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics (Dental, Dermatology)

Value Chain Analysis For Collagen Sponge Market

The value chain for the Collagen Sponge Market begins with the highly specialized Upstream Analysis, which focuses predominantly on the sourcing, collection, and initial processing of high-purity, medical-grade raw collagen, predominantly derived from bovine or porcine tendons and hides, requiring meticulous selection to ensure minimal disease risk (e.g., TSE/BSE certification). Key activities here include rendering, purification, and solubilization of the collagen, a critical phase that dictates the final material's biocompatibility and structural integrity. Due to the biological nature of the raw material, stringent quality control protocols and traceability systems are absolutely essential at this stage to comply with international regulatory standards (e.g., ISO 22442). Investment in advanced purification technologies, such as enzymatic or acid-solubilization methods combined with filtration, is necessary to produce the refined collagen matrix suitable for pharmaceutical and medical device manufacturing, thereby forming the fundamental cost structure of the final product.

The Midstream phase involves the sophisticated manufacturing process, including the formation of the sponge structure through techniques such as freeze-drying (lyophilization) or solvent casting, followed by cross-linking treatments (e.g., using glutaraldehyde or dehydrothermal treatments) to control the degradation rate and enhance mechanical strength, tailoring the product for specific clinical applications. Crucial activities include precise pore size control, sterilization (typically gamma irradiation or E-beam), and meticulous packaging within sterile environments, adhering to GMP (Good Manufacturing Practice) standards. Manufacturing economies of scale are challenging due to the specialized nature of the processing equipment and the necessity of handling biological materials, meaning only a few large players possess the required sophisticated infrastructure for high-volume, high-quality production across diverse product lines, often necessitating vertical integration for better cost control and quality assurance.

The Downstream Analysis involves distribution channels and market access strategies. The distribution channel is typically bifurcated into Direct and Indirect sales models. Direct sales are common for high-value, specialized products targeting large hospitals and teaching institutions, leveraging specialized sales teams with deep clinical knowledge to educate surgeons on proper usage and technical benefits, enhancing product uptake. Indirect channels utilize established medical device distributors, particularly for general wound care products and accessing fragmented markets like smaller clinics or ASCs, ensuring broad geographic reach and inventory management efficiency. Given the product's medical device classification, regulatory clearance for distribution is mandatory in every target jurisdiction. Successful market penetration relies heavily on securing favorable reimbursement status, especially in mature markets like the US and Europe, as effective clinical documentation and robust post-market surveillance are prerequisites for sustained commercial success and competitive advantage against both biological and synthetic alternatives.

Collagen Sponge Market Potential Customers

The primary End-Users and Buyers of Collagen Sponge products span a wide spectrum of healthcare providers who require advanced biomaterials for surgical intervention, regenerative medicine, and chronic wound management. These customers fundamentally seek products that offer predictable clinical outcomes, ease of use during complex procedures, and superior biocompatibility compared to traditional dressings or synthetic equivalents. Hospitals represent the largest volume purchaser, driven by their engagement in high-acuity surgeries, including orthopedics (spinal fusion, joint reconstruction), general surgery (abdominal and trauma cases requiring hemostasis), and specialty surgery (neurosurgery and cardiac procedures), where minimizing blood loss and supporting tissue healing are critically important operational metrics. Procurement in these institutions often involves complex tenders and value analysis committees, requiring manufacturers to demonstrate clinical superiority, cost-effectiveness, and reliable supply chains to secure long-term contracts.

Ambulatory Surgical Centers (ASCs) constitute a rapidly expanding customer segment, particularly for specialized, minimally invasive procedures, including many dental, ophthalmic, and minor orthopedic interventions. ASCs prioritize products that facilitate quicker recovery times, reduce procedural complexity, and offer efficient inventory management solutions. Collagen sponges used in ASCs are typically standardized, easily handled products for guided bone regeneration in dental implantology or for small-scale reconstructive procedures. The decision-makers here often include managing physicians or purchasing consortia who are highly attuned to product pricing and ease of integration into established clinical workflows. The shift of procedures from inpatient hospital settings to outpatient ASCs represents a significant growth opportunity, prompting manufacturers to package products in formats optimized for outpatient surgical efficiency and immediate use.

Specialized clinics, such as those focusing on dentistry (periodontists and oral surgeons), chronic wound care centers, and aesthetic/plastic surgery practices, form the third crucial customer cluster. Dental specialists are heavy consumers of collagen sponges for post-extraction socket preservation and periodontal defect repair, relying on specific product characteristics like membrane-like integrity and effective barrier function. Wound care clinics utilize these products for the management of non-healing, complex wounds where the biological scaffolding properties of collagen are essential to promote granulation tissue formation and subsequent epithelialization. These end-users typically value high-quality clinical data, product innovation (e.g., sponges incorporating antibiotics or silver), and targeted technical support from the manufacturer, demonstrating a willingness to pay a premium for specialized, high-performance wound matrices that demonstrably accelerate healing and reduce patient morbidity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,100 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Integra Lifesciences, Becton Dickinson (BD), Johnson & Johnson (Ethicon), Zimmer Biomet, Geistlich Pharma, ACE Surgical Supply, Collagen Matrix, Inc., Tego Science, Stryker Corporation, 3M Healthcare, Kerecis, Baxter International, Sanyo Chemical Industries, Inc., Advanced Medical Solutions Group plc, Ossur, Coloplast, Medtronic, Cologenesis Healthcare Pvt. Ltd., Orthogen, and Miltenyi Biotec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Collagen Sponge Market Key Technology Landscape

The technological landscape of the Collagen Sponge Market is defined by continuous innovation focused on optimizing the biomaterial's structure, performance, and biological functionality through advanced manufacturing and modification techniques. A critical technology is lyophilization (freeze-drying), which is instrumental in controlling the porosity and internal structure of the sponge, ensuring optimal cell infiltration and nutrient exchange essential for effective tissue regeneration. Coupled with this are sophisticated cross-linking technologies—both chemical (using agents like EDC/NHS or glutaraldehyde) and physical (dehydrothermal treatment)—which are essential for tuning the degradation rate of the collagen matrix to match the specific pace of tissue repair required by the application, ensuring the scaffold persists long enough to facilitate healing but degrades fully once its function is served, preventing adverse foreign body reactions.

Furthermore, the market is characterized by advancements in combining collagen matrices with other bioactive components through proprietary coating or incorporation techniques. This includes the integration of micro- and nano-sized carriers loaded with antibiotics, pain management agents, or growth factors (like FGF or BMPs) into the sponge structure, creating a controlled release system that delivers therapeutic agents directly to the surgical or wound site over a sustained period. This transition towards 'smart scaffolds' represents a major technological leap, transforming simple mechanical supports into dynamic therapeutic delivery platforms that significantly improve infection prevention, reduce pain, and accelerate the natural healing cascade. Manufacturing precision is achieved through techniques like electrospinning or 3D bioprinting, particularly in the R&D stage, enabling the creation of highly complex, multi-layered scaffolds that mimic the hierarchical structure of native human tissue more accurately than traditional sponge formats.

Another pivotal area of technological advancement is the shift towards Recombinant Collagen Production. Traditional animal-derived collagen faces regulatory and ethical hurdles, alongside inherent batch variability. Companies are increasingly investing in technologies utilizing yeast, bacteria, or plant systems (e.g., tobacco plants) to produce recombinant human collagen (RHC). RHC offers superior purity, eliminates the risk of zoonotic disease transmission, and allows for precise control over the collagen sequence structure, enabling the development of truly standardized and biologically potent biomaterials. This technology, although currently more expensive, represents the future of high-end surgical and regenerative medicine applications, ensuring consistent clinical performance and overcoming major supply chain dependencies on animal sourcing, promising to revolutionize the production standards and regulatory compliance within the advanced biomaterials sector, setting a new benchmark for biocompatibility and functional reliability.

Regional Highlights

- North America (USA and Canada): North America maintains its leading position in the Collagen Sponge Market, largely attributable to the high prevalence of chronic diseases like diabetes, leading to a massive patient pool requiring advanced wound care solutions. The US healthcare system benefits from robust reimbursement policies for advanced biological dressings and surgical biomaterials, which encourages the rapid adoption of high-cost, high-efficacy collagen sponges. Moreover, the presence of major global market players, coupled with substantial governmental and private investment in R&D for regenerative medicine and tissue engineering, provides a fertile ground for market innovation and swift commercialization. The stringent yet clear regulatory pathways established by the FDA, while demanding, also instill high confidence among practitioners regarding product quality and safety, further driving clinical acceptance, particularly in specialized surgical fields like dental implantology and complex orthopedic reconstructions where product performance dictates outcome.

- Europe (Germany, UK, France, Italy, Spain): The European market is characterized by strong demand driven by an aging population and sophisticated healthcare systems, particularly in Western European economies like Germany and the UK. The market growth is underpinned by excellent clinical acceptance of bovine and porcine derived collagen products, which have been used reliably for decades in both aesthetic and functional surgical applications. The recent implementation of the Medical Device Regulation (MDR) has mandated more rigorous clinical data requirements, which has slightly slowed the entry of new products but has concurrently solidified the position of established manufacturers who can demonstrate long-term safety and efficacy. High per capita healthcare expenditure and strong public health funding for specialized wound centers ensure a steady, high-volume demand for premium collagen products, especially those integrated with antimicrobial features for infection control in hospital settings.

- Asia Pacific (APAC) (China, Japan, India, South Korea): The APAC region is forecast to exhibit the fastest growth over the projection period. This explosive expansion is powered by rapid improvements in healthcare infrastructure, substantial increases in public and private healthcare spending, and a growing medical tourism industry that demands world-class surgical and regenerative products. Countries like China and India are experiencing a massive rise in the surgical procedure volume across all specialties due to large populations and increasing disposable incomes allowing access to specialized care. While Japan and South Korea lead in adopting cutting-edge technologies like marine-derived collagen and recombinant products, emerging markets are focused on increasing access to cost-effective, high-quality porcine and bovine sponges. Regulatory divergence across countries in APAC remains a significant complexity, requiring manufacturers to tailor product specifications and clinical documentation based on local requirements, though regional harmonization efforts are underway.

- Latin America (LATAM) (Brazil, Mexico, Argentina): The LATAM market presents considerable opportunities, albeit with high volatility and varied market maturity across countries. Brazil and Mexico are the dominant players, driven by significant surgical volumes and burgeoning private healthcare sectors. Demand for collagen sponges is focused primarily on essential surgical hemostasis and basic wound care, reflecting a greater emphasis on cost-efficiency. Market penetration is challenging due to economic instabilities, currency fluctuations impacting import costs, and complex local registration processes. However, increasing awareness among specialists regarding the long-term benefits of advanced wound dressings, coupled with international training initiatives, is gradually driving a shift toward higher-value products, requiring companies to establish localized distribution networks and production facilities to stabilize pricing.

- Middle East and Africa (MEA) (UAE, Saudi Arabia, South Africa): The MEA market is marked by high growth in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to massive government investment in building state-of-the-art medical cities and specialized trauma centers, attracting high-caliber medical professionals. These markets favor premium, imported products and maintain high standards for safety and quality. Collagen sponge demand in these wealthy nations mirrors Western adoption trends, focusing on complex cardiac, neurological, and orthopedic surgeries. Conversely, in the African continent, market adoption remains limited by infrastructure constraints and affordability issues, primarily focusing on essential wound care in major urban hospitals. The future growth here relies heavily on standardization of healthcare quality and addressing the widespread need for affordable infection control and surgical products in public health systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Collagen Sponge Market.- Integra Lifesciences

- Becton Dickinson (BD)

- Johnson & Johnson (Ethicon)

- Zimmer Biomet

- Geistlich Pharma

- ACE Surgical Supply

- Collagen Matrix, Inc.

- Tego Science

- Stryker Corporation

- 3M Healthcare

- Kerecis

- Baxter International

- Sanyo Chemical Industries, Inc.

- Advanced Medical Solutions Group plc

- Ossur

- Coloplast

- Medtronic

- Cologenesis Healthcare Pvt. Ltd.

- Orthogen

- Miltenyi Biotec

Frequently Asked Questions

Analyze common user questions about the Collagen Sponge market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a collagen sponge in surgical applications?

Collagen sponges primarily function as hemostatic agents, rapidly controlling bleeding in surgical sites by activating platelets and facilitating the coagulation cascade. They also serve as biocompatible scaffolds that promote tissue regeneration and wound healing by providing a structure for cell migration and growth, particularly in dental and orthopedic procedures.

What are the key differences between bovine and recombinant collagen sponges?

Bovine collagen, while widely used and cost-effective, is animal-derived, carrying a theoretical risk of pathogen transmission and batch variability. Recombinant collagen (often human-sequence), produced via genetic engineering, eliminates these risks, offering superior purity, higher consistency, and better standardization, though typically at a higher manufacturing cost.

How is the degradation rate of a collagen sponge controlled?

The degradation rate is controlled during manufacturing through physical or chemical cross-linking methods. Cross-linking increases the number of chemical bonds within the collagen matrix, making the sponge more resistant to enzymatic breakdown by the body, allowing manufacturers to tune the functional longevity of the scaffold to match the patient's specific healing requirements.

Which application segment holds the greatest potential for market growth?

The Chronic Wound Management segment is projected to experience the fastest market growth. This is driven by the global rise in lifestyle diseases, particularly diabetes, which results in a high incidence of non-healing chronic ulcers requiring advanced biological dressings, such as collagen sponges enhanced with growth factors or antimicrobial agents, for effective intervention.

Do regulatory hurdles impact the market entry of new collagen sponge products?

Yes, regulatory hurdles significantly impact market entry, especially for products utilizing animal sources or novel biological additives. Regulations require extensive pre-clinical testing for biocompatibility, sterility, and long-term efficacy, increasing the time and financial investment necessary to secure market approval, particularly under stringent frameworks like the EU MDR and FDA requirements for high-risk medical devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager