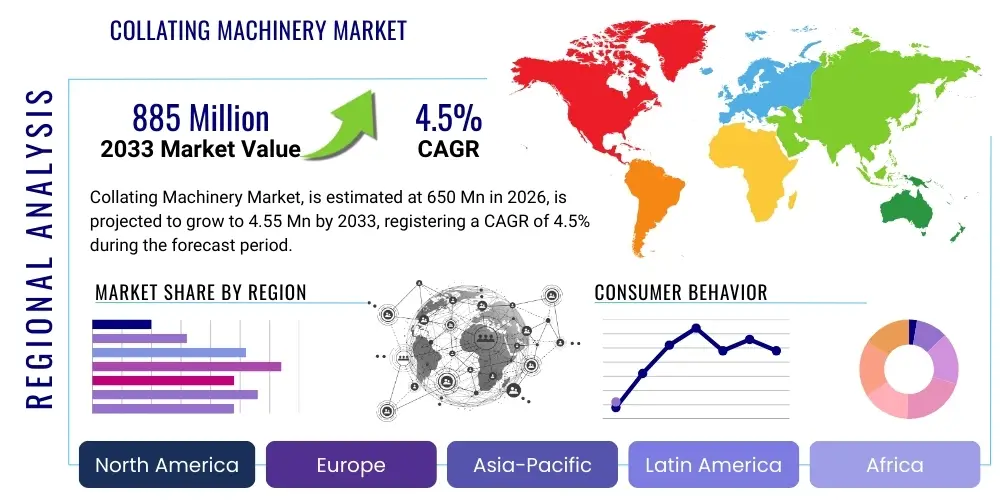

Collating Machinery Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441183 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Collating Machinery Market Size

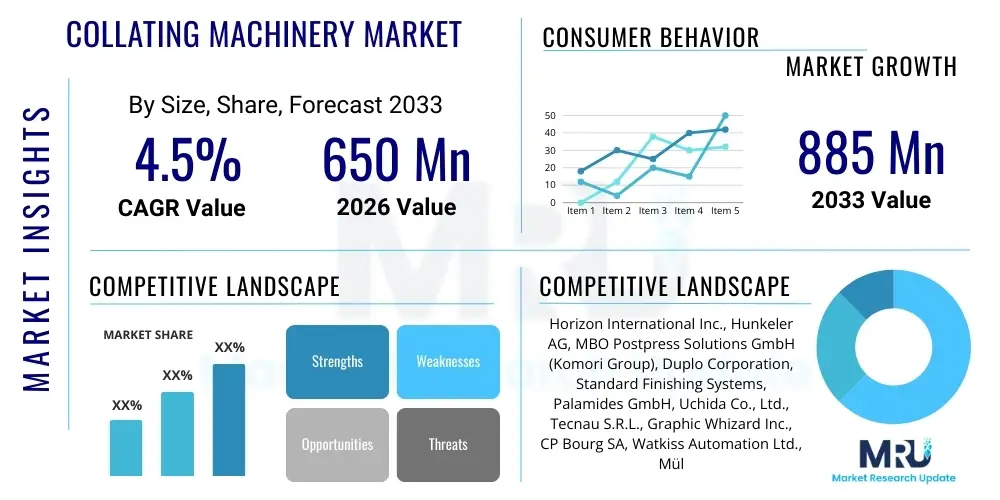

The Collating Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 885 Million by the end of the forecast period in 2033.

Collating Machinery Market introduction

Collating machinery encompasses automated systems designed to gather sheets, signatures, or products in a predefined sequence. This equipment is essential in post-press processes within the printing, publishing, and packaging industries, ensuring that booklets, magazines, catalogs, and personalized document sets are assembled accurately and efficiently. The core function of these machines is to manage high-speed sorting and sequencing tasks, reducing manual labor, minimizing errors, and drastically improving production throughput. Modern collators integrate sophisticated sensor technology and computerized controls to handle varying paper weights, sizes, and substrates with precision.

The product range within this market includes friction collators, suction-feed collators, and tower collators, catering to different operational scales and material requirements. Major applications span commercial printing houses, in-house corporate printing departments, direct mail operations, secure document processing (e.g., ballot counting, financial statement assembly), and specialized packaging for pharmaceuticals and consumer goods where strict sequential order is critical. The primary benefits derived from adopting advanced collating machinery include significant labor cost reduction, enhanced quality control through automated verification systems, and the flexibility to manage complex job requirements, such as inserting variable data pages or mixed media.

Driving factors propelling market expansion are fundamentally linked to global trends in personalized content production and the resurgence of targeted direct mail campaigns, especially in developed economies. Furthermore, the persistent demand for efficiency and high operational speed in continuous manufacturing environments, coupled with the necessity for integration with upstream printing presses and downstream binding equipment, solidifies the machinery's importance. Regulatory demands for traceability and accuracy in sectors like pharmaceuticals also necessitate the high reliability offered by modern automated collating solutions.

Collating Machinery Market Executive Summary

The global Collating Machinery Market is experiencing steady growth, driven primarily by the escalating demand for high-speed automated finishing solutions in the commercial printing and packaging sectors. Key business trends indicate a strong move towards modular collating systems that offer enhanced flexibility, allowing manufacturers to quickly reconfigure machinery to handle diverse job sizes, material types, and output formats. Investment in advanced sensor technology, particularly optical inspection and misfeed detection systems, is paramount among leading vendors, ensuring flawless assembly and minimizing waste, which directly impacts the profitability of printing operations. Furthermore, consolidation among mid-tier printing service providers is driving demand for highly efficient, centralized collating equipment capable of handling massive volumes derived from merged operations.

Regional trends reveal that Asia Pacific (APAC) is emerging as the fastest-growing market, fueled by explosive growth in e-commerce, which mandates high volumes of marketing inserts, fulfillment documents, and specialized secondary packaging. Developing economies within APAC, notably China and India, are seeing massive investment in modern printing and packaging infrastructure, replacing outdated manual or semi-automated processes with fully integrated collating lines. North America and Europe, while mature, maintain strong market shares driven by the necessity for highly precise, specialized collating equipment required for secure printing (passports, financial reports) and complex pharmaceutical instructions, where compliance standards are stringent. The focus in these regions is heavily skewed towards digital integration and achieving industry 4.0 standards.

Segmentation trends highlight that the suction-feed collator segment, valued for its ability to handle delicate and heavily coated papers, remains dominant, though friction-feed systems are gaining traction for high-volume, standard stock applications. By application, commercial printing holds the largest market share due to the sheer volume of output, but the secure document and financial services sector is demonstrating the highest growth trajectory, reflecting increasing global requirements for secure and verified assembly processes. Manufacturers are also observing a segment shift towards integrated solutions that combine collating with stitching, folding, and trimming capabilities into single, continuous production lines, optimizing floor space and operational complexity for end-users.

AI Impact Analysis on Collating Machinery Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the collating machinery domain frequently center on how these technologies can enhance operational predictive maintenance, optimize job changeover times, and improve quality control beyond traditional sensor mechanisms. Users are specifically concerned about AI’s ability to predict component failure based on vibration and temperature data, thereby maximizing uptime and reducing unplanned halts. Additionally, there is significant interest in using machine learning algorithms to analyze historical production data, automatically adjusting feeder speeds, vacuum intensity, and pressure settings based on the specific material characteristics (weight, texture, humidity) of the input stock, moving toward truly autonomous operation. The overarching theme is the expectation that AI integration will transform collators from high-speed mechanical devices into intelligent, self-optimizing finishing hubs capable of near-zero defects and minimal human intervention.

- AI-driven Predictive Maintenance: Utilizing machine learning models to analyze real-time operational parameters (e.g., motor strain, thermal signatures) to forecast equipment failure, dramatically increasing Mean Time Between Failures (MTBF).

- Automated Setup and Job Optimization: Employing algorithms to recognize material types and job specifications (e.g., number of sheets, sequence complexity) and automatically configure machine settings, reducing setup time by up to 40%.

- Enhanced Quality Control (QC): Implementing AI-powered vision systems that go beyond simple misfeed detection, analyzing print registration, color consistency, and assembly accuracy across multiple pages simultaneously, minimizing quality escapes.

- Anomaly Detection in Feed Systems: Machine learning identifying subtle deviations in material handling that precede jams or misfeeds, allowing for instantaneous micro-adjustments to feeder mechanics.

- Energy Consumption Optimization: AI analyzing production schedules and loads to intelligently manage power consumption of motors and vacuum pumps, contributing to greener manufacturing practices.

- Integration with ERP/MES Systems: Facilitating seamless data flow between the collating machine and Enterprise Resource Planning (ERP) or Manufacturing Execution Systems (MES) for accurate real-time inventory and throughput tracking.

DRO & Impact Forces Of Collating Machinery Market

The trajectory of the Collating Machinery Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively generating the market's impact forces. Key drivers include the global expansion of the publishing and commercial printing industries, particularly in emerging markets, coupled with persistent inflationary pressure requiring increased operational efficiency and automation across high-volume production facilities. The necessity for advanced traceability in regulated industries, such as pharmaceuticals (patient information leaflets) and government documents, further accelerates the demand for highly reliable, automated collating solutions. However, market growth is moderated by several critical restraints, primarily the substantial initial capital expenditure required for sophisticated, high-speed collating lines, making adoption challenging for smaller print service providers. Furthermore, the global trend towards digitalization and electronic document delivery acts as a persistent headwind, reducing the overall print volume demand in sectors like financial reporting and certain governmental communications.

Opportunities for market expansion are centered around technological innovation and geographic penetration. The development of modular, multi-format collating systems that can efficiently handle both paper and non-paper substrates (e.g., plastic cards, small packaging inserts) presents a lucrative avenue for vendors. Specifically, the integration of advanced sensors and software for personalized printing requires collators to manage variable input sets, driving the development of highly adaptable machinery. Moreover, the increasing adoption of sustainable practices encourages manufacturers to invest in machinery designed for reduced energy consumption and minimal material waste, aligning with corporate social responsibility goals and offering a competitive edge. The expansion of e-commerce packaging, requiring collating for promotional inserts and instruction manuals, also opens new market niches.

The collective impact forces resulting from these DRO elements indicate a market trending towards specialization and high technological integration. The driving forces of automation necessity and quality control excellence currently outweigh the restraints imposed by high investment cost and digitalization, especially in niche sectors where physical documents remain mandatory. Consequently, the market is characterized by intense competition focused on engineering reliability, speed, and software integration capabilities. The strongest impact force is the necessity for high-throughput automation; manufacturers who can deliver machines that significantly reduce labor dependency and maximize uptime will dominate future market share. This high-reliability mandate forces continuous R&D investment, ensuring that collating machinery evolves rapidly to meet the demands of Industry 4.0 printing environments.

Segmentation Analysis

The Collating Machinery Market is segmented based on critical operational and structural characteristics, allowing for targeted analysis of adoption trends across various end-user industries. Primary segmentation includes Type (based on feeding mechanism), Automation Level, and Application. The structure reflects the diversity of post-press requirements, ranging from small, low-volume jobs handled by friction-feed desktop collators to massive, integrated high-speed systems utilized in major commercial printing plants. Understanding these segments is vital as technological advancements, particularly in automated setup and real-time monitoring, differentially affect adoption rates and pricing structures across the market.

- By Type:

- Friction-Feed Collators

- Suction-Feed Collators

- Vertical (Tower) Collators

- Horizontal Collators

- By Automation Level:

- Automatic

- Semi-Automatic

- By Speed/Capacity:

- Low-Speed (up to 1,500 sets/hour)

- Medium-Speed (1,500 - 5,000 sets/hour)

- High-Speed (above 5,000 sets/hour)

- By Application:

- Commercial Printing and Publishing

- Direct Mail and Fulfillment

- Packaging and Converting

- Secure Document Assembly (e.g., Financial Reports, Government Documents)

- Pharmaceutical Packaging (Instruction Leaflets)

- By End-Use Industry:

- Printing Houses

- Book Binding Companies

- Corporate In-house Print Shops

- Mailing and Logistics Centers

Value Chain Analysis For Collating Machinery Market

The value chain for the Collating Machinery Market begins with upstream activities involving the sourcing of high-precision mechanical components, advanced electronics, and control systems. Key components include specialized feeders, motors, sensors (optical and ultrasonic), programmable logic controllers (PLCs), and durable materials like reinforced steel and aluminum alloys necessary for high-speed operation and longevity. Manufacturers often rely on specialized suppliers for proprietary software and vision inspection systems, which are increasingly critical for quality assurance and Industry 4.0 integration. The competitive advantage at this stage hinges on securing reliable, high-quality component supplies and maintaining strict quality control over complex mechanical assemblies.

The core manufacturing stage involves the design, assembly, testing, and integration of the machinery. This stage requires significant intellectual capital, particularly in developing patented feeding mechanisms and optimizing machine layouts for speed and maintainability. Post-manufacturing, the distribution channel plays a vital role. Collating machinery is typically distributed through a combination of direct sales teams for large, complex installations involving customization, and authorized indirect distributors or agents who handle sales, installation, and essential maintenance services in local or regional markets. Due to the high-value and technical complexity of the equipment, strong aftermarket support, including spare parts availability and technical training, is integral to the distributor's function.

Downstream activities focus on the end-users—the commercial printers, publishers, and packaging companies—who utilize the machinery to assemble final products. The efficiency and reliability of the collator directly affect the profitability of the end-user's operation. Post-sales service, including periodic maintenance, software updates, and technical troubleshooting, significantly influences customer satisfaction and repeat purchases. The movement towards leasing and service contracts (Machine as a Service) also transforms the downstream relationship, shifting the focus from a single capital purchase to a long-term operational partnership. The effectiveness of the overall value chain relies heavily on seamless communication and technical expertise across all stages, ensuring that specialized machinery meets diverse industrial demands.

Collating Machinery Market Potential Customers

Potential customers for collating machinery are predominantly institutions involved in large-scale, sequential document or product assembly, where accuracy and speed are paramount. The largest segment of end-users consists of major commercial printing houses that require equipment capable of handling millions of signatures annually for books, magazines, and catalogs. These customers prioritize high-speed, fully automated collators with integrated binding and trimming capabilities to support continuous production lines. Another critical customer segment includes specialized direct mail and fulfillment houses, which need highly flexible collators capable of managing personalized, variable-data print runs and inserting mixed media (e.g., plastic cards, product samples) accurately into envelopes or packages.

Beyond traditional printing, key buyers include companies operating in regulated sectors. Pharmaceutical companies and contract packers require collating machinery specifically designed for assembling patient information leaflets (PILs) with extreme accuracy and verification systems to meet stringent regulatory compliance standards. Similarly, financial institutions and governmental agencies (e.g., election commissions, tax authorities) represent a vital customer base, needing machinery for secure document preparation, such as assembling ballot packets, annual reports, or confidential financial statements, where chain of custody and sequence integrity are non-negotiable. Finally, corporate in-house print shops, particularly those within large educational or multinational organizations, purchase smaller to medium-capacity collators to handle internal document production, training manuals, and departmental reports.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 885 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Horizon International Inc., Hunkeler AG, MBO Postpress Solutions GmbH (Komori Group), Duplo Corporation, Standard Finishing Systems, Palamides GmbH, Uchida Co., Ltd., Tecnau S.R.L., Graphic Whizard Inc., CP Bourg SA, Watkiss Automation Ltd., Müller Martini AG, Sitma Machinery SpA, Rima System, Meccanotecnica Group, Shanghai Purlux Machinery Co., Ltd., Hang Ming Printing Machinery Co., Ltd., Wenzhou Lixin Printing Machinery Co., Ltd., Shanghai Dragon Printing Machinery Co., Ltd., JMD Machine Tools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Collating Machinery Market Key Technology Landscape

The technological landscape of the Collating Machinery Market is defined by a shift towards digital integration, enhanced sensor capabilities, and modular design principles aimed at maximizing operational flexibility and precision. Modern collators are moving far beyond simple mechanical gathering; they incorporate sophisticated electronic controls centered around advanced Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs). These systems enable quick job setup, real-time diagnostics, and seamless communication with other finishing equipment (binders, stitchers). Key innovations focus on the feeding mechanism itself, particularly the use of high-friction or advanced suction technology combined with air separation systems to reliably handle challenging substrates, including extremely thin papers common in pharmaceutical leaflets or thick card stock used in packaging inserts.

Vision inspection technology represents a fundamental technological pillar in modern collating. High-resolution cameras and optical sensors are integrated into the feed lines to perform complex checks, including sequence verification, print registration confirmation, and barcode/QR code reading for variable data matching. This technology is crucial in high-security applications, guaranteeing that no miscollated or misprinted sets leave the machine. Furthermore, the drive toward automation necessitates sophisticated robotics for stacking and unloading finished sets, minimizing physical handling and further speeding up the entire post-press workflow. These robotic interfaces are increasingly powered by proprietary software that learns optimal gripping and stacking patterns based on material properties.

Connectivity and data utilization are increasingly paramount, aligning collating machinery with Industry 4.0 standards. Equipment is now often equipped with IoT sensors that stream operational data (e.g., speed, temperature, error rates) to cloud-based platforms. This data supports predictive maintenance models, allowing service providers to anticipate and address potential mechanical issues before they result in costly downtime. Moreover, the integration with Manufacturing Execution Systems (MES) allows printers to track job progress, material consumption, and efficiency metrics in real-time, facilitating better inventory management and production scheduling. The focus on modularity allows users to scale capacity or integrate new functions (e.g., perforating, folding) without replacing the entire core machine structure, ensuring longevity and adaptability in a rapidly changing printing environment.

Regional Highlights

The Collating Machinery Market exhibits distinct growth dynamics across major global regions, reflecting variations in printing industry maturity, technological adoption, and regulatory landscapes. North America and Europe currently represent the largest revenue generators, primarily driven by the existence of large, established printing and publishing houses and stringent regulatory demands for high-quality, verifiable document assembly, particularly in the financial, pharmaceutical, and government sectors. These regions prioritize sophisticated, high-speed automated systems with advanced digital integration capabilities, focusing on efficiency and labor reduction. The replacement cycle for older, less automated machinery in these mature markets is a persistent driver of sales.

- North America: Market dominance characterized by high investment in state-of-the-art automation and advanced digital workflow integration. Strong demand stems from the direct mail and secure printing segments, where variable data integrity and production speed are essential. Major growth is spurred by the shift to integrated finishing lines that combine collating, stitching, and trimming in one continuous process.

- Europe: A mature market with a high concentration of specialized printing services and luxury packaging operations. Emphasis is placed on precision, quality output, and sustainability features, driving demand for technologically advanced collators that minimize waste and energy consumption. German and Italian manufacturers lead innovation in modular and highly configurable systems.

- Asia Pacific (APAC): The fastest-growing region globally, fueled by rapid industrialization, massive expansion of the e-commerce sector, and increasing literacy rates driving publishing demand. Countries like China, India, and Southeast Asian nations are rapidly investing in new printing infrastructure, often skipping semi-automatic stages and adopting fully automated, medium-to-high speed collating lines immediately. Price sensitivity remains a factor, but demand for high-volume capacity is explosive.

- Latin America (LATAM): Growth is moderate but steady, concentrated primarily in Brazil and Mexico, driven by local commercial printing and educational publishing needs. Market adoption often leans toward cost-effective, durable, semi-automatic or medium-speed automatic collators.

- Middle East and Africa (MEA): Represents the smallest, but potentially high-growth region, particularly in the UAE and Saudi Arabia due to infrastructure projects and governmental printing requirements. The market heavily relies on imported machinery, focusing on robust equipment capable of handling diverse environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Collating Machinery Market.- Horizon International Inc.

- Hunkeler AG

- MBO Postpress Solutions GmbH (Komori Group)

- Duplo Corporation

- Standard Finishing Systems

- Palamides GmbH

- Uchida Co., Ltd.

- Tecnau S.R.L.

- Graphic Whizard Inc.

- CP Bourg SA

- Watkiss Automation Ltd.

- Müller Martini AG

- Sitma Machinery SpA

- Rima System

- Meccanotecnica Group

- Shanghai Purlux Machinery Co., Ltd.

- Hang Ming Printing Machinery Co., Ltd.

- Wenzhou Lixin Printing Machinery Co., Ltd.

- Shanghai Dragon Printing Machinery Co., Ltd.

- JMD Machine Tools

Frequently Asked Questions

Analyze common user questions about the Collating Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Collating Machinery Market?

The Collating Machinery Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period from 2026 to 2033, driven by increasing automation needs in the printing and packaging sectors.

Which type of collating machinery is preferred for handling delicate or coated paper stocks?

Suction-Feed Collators are generally preferred for delicate or heavily coated paper stocks, as they utilize vacuum pressure to lift and transport individual sheets, minimizing friction and reducing the risk of marking or damage compared to traditional friction-feed systems.

How is AI impacting the operational efficiency of collating equipment?

AI integration enhances operational efficiency primarily through predictive maintenance, reducing unplanned downtime by forecasting component failures. It also optimizes job changeover times by automatically adjusting machine settings based on material analysis and historical job data, leading to superior accuracy and speed.

Which geographical region is showing the fastest growth in the collating machinery market?

The Asia Pacific (APAC) region is demonstrating the fastest growth in the collating machinery market, attributed to massive investments in new printing infrastructure, rapid expansion of e-commerce packaging requirements, and increasing demand for high-volume publishing solutions in countries like China and India.

What are the key differences between automatic and semi-automatic collators?

Automatic collators perform the entire assembly, inspection, and often stacking process without constant manual input, handling high throughput rates suitable for commercial printers. Semi-automatic collators require manual loading of sections and may need operator intervention for stacking or basic quality checks, typically utilized by smaller print shops or for lower-volume specialty jobs.

What primary restraint challenges the market growth for collating machinery?

The primary restraint challenging the market growth is the high initial capital investment required for purchasing advanced, high-speed automated collating lines, which can pose a significant financial barrier, particularly for small to medium-sized print service providers globally.

How do collating machines contribute to security in document assembly?

Collating machines contribute to security by ensuring precise sequential integrity and using integrated optical verification systems to match variable data (like barcodes or serial numbers) across multiple pages of a set, which is crucial for secure documents such as financial statements or official government papers.

What emerging technology is critical for quality control in the modern collating process?

Advanced vision inspection technology, utilizing high-resolution cameras and sophisticated image processing software, is critical. This technology enables real-time checking of print registration, sequence verification, and detection of subtle print defects or misfeeds at maximum operational speeds.

Who are the primary end-users of high-speed collating machinery?

The primary end-users of high-speed collating machinery are large commercial printing and publishing houses, direct mail fulfillment centers, and pharmaceutical manufacturers, all requiring consistent, high-volume production with stringent quality control standards.

What role does modular design play in the collating machinery market?

Modular design allows end-users to easily expand the machine’s capabilities or integrate additional finishing modules (like stitchers, folders, or trimmers) later, offering flexibility, scalability, and maximizing the longevity and utility of the initial equipment investment.

What is the estimated market size of the collating machinery market in 2033?

The market size for collating machinery is projected to reach USD 885 Million by the end of the forecast period in 2033, reflecting steady growth across global industrial printing and packaging applications.

How does the demand from the e-commerce sector influence this market?

The e-commerce sector drives demand by requiring high volumes of personalized marketing inserts, return instructions, and fulfillment documents that need rapid, accurate assembly and collating before being packaged for shipment.

What is a Vertical (Tower) Collator primarily used for?

Vertical or Tower Collators are space-saving machines typically used for smaller footprints, designed to handle lighter stocks and smaller jobs, often utilized in corporate or educational in-house print shops needing vertical arrangement for easier access and loading.

What are the key components sourced in the upstream value chain for collating machinery?

Key upstream components include specialized feeder mechanisms, high-precision motors, advanced optical and ultrasonic sensors, complex Programmable Logic Controllers (PLCs), and proprietary control software for machine operation and diagnostics.

Why is predictive maintenance crucial for modern collating equipment?

Predictive maintenance, often powered by IoT and AI, is crucial because unexpected downtime in high-speed collating lines results in severe production losses; forecasting failures allows for scheduled maintenance, significantly maximizing overall equipment effectiveness (OEE).

What distinguishes high-speed collators in terms of capacity?

High-speed collators are generally defined as systems capable of assembling output exceeding 5,000 sets per hour, designed for 24/7 continuous operation in large commercial printing environments.

Which application segment holds the largest share in the market?

The Commercial Printing and Publishing application segment holds the largest market share due to the persistent volume demand for producing magazines, books, catalogs, and general printed marketing materials globally.

How do collators align with Industry 4.0 principles?

Collators align with Industry 4.0 through connectivity via IoT sensors, integration with MES/ERP systems for real-time data exchange, and the implementation of AI for self-optimization, enabling smart factory operations and complete digital workflow management.

What impact does digital document adoption have on the market?

Digital document adoption acts as a restraint by reducing the overall volume of some traditional printed materials, such as bank statements and certain catalogs, forcing collating machinery manufacturers to focus on specialized, high-value print niches like personalized direct mail and secure documents.

What is the primary function of a collating machine?

The primary function of a collating machine is the automated and highly accurate gathering and sequencing of multiple sheets, signatures, or products into a predefined order, essential for the final assembly of finished printed materials.

Why are pharmaceutical companies major potential customers for specialized collators?

Pharmaceutical companies are major customers because regulatory requirements mandate extreme accuracy and traceability in the assembly of patient information leaflets (PILs) and instructions, necessitating highly reliable, verified collating equipment to avoid serious compliance issues.

What is the significance of the shift towards leasing models in this market?

The shift towards leasing and service contracts (Machine as a Service) lowers the barrier of entry for smaller companies by reducing the high initial capital expenditure, transforming the transaction into an operational expense and establishing long-term customer relationships.

How do manufacturers ensure the handling of diverse paper weights and sizes?

Manufacturers ensure diverse material handling through highly customizable feeding systems, often combining suction technology with air separation and pressure adjustments, controlled electronically to optimize gripping and separation based on the specific substrate characteristics.

Which factor is the most powerful driver for automation adoption in this sector?

The most powerful driver for automation adoption is the necessity to reduce labor costs and mitigate the pervasive challenge of skilled labor shortages, while simultaneously meeting market demands for extremely high throughput and uncompromising quality control.

How does the distribution channel structure typically function for collating machinery?

The distribution channel utilizes both direct sales teams for customized large installations and a network of authorized regional distributors and agents who handle localized sales, installation, training, and crucial after-sales support due to the technical nature of the equipment.

What are the key technological advancements concerning sensor technology in collators?

Key sensor advancements include high-speed optical sensors for double-sheet detection, ultrasonic sensors for material thickness verification, and sophisticated camera systems for barcode and sequence verification, ensuring zero-error production at high speeds.

What is the impact of environmental concerns on collating machinery design?

Environmental concerns drive manufacturers to design machinery with optimized power management systems, reduced material waste features (minimized misfeeds), and the use of sustainable or recyclable components, aligning with growing industry focus on green manufacturing.

How do collating machines integrate with downstream binding equipment?

Collating machines integrate seamlessly with downstream equipment (like stitchers or perfect binders) through sophisticated conveyance systems and synchronized electronic controls, creating continuous, inline finishing workflows that maximize speed and minimize intermediate handling.

Where does the majority of innovation in modular systems originate?

The majority of innovation in modular and highly flexible collating systems originates from established machinery manufacturers in Europe, particularly Germany and Italy, and major Japanese post-press technology firms, who lead in precision engineering and integration software.

What is the projected value of the market in 2026?

The Collating Machinery Market is estimated to be valued at USD 650 Million in the base year of 2026, marking the beginning of the defined forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager