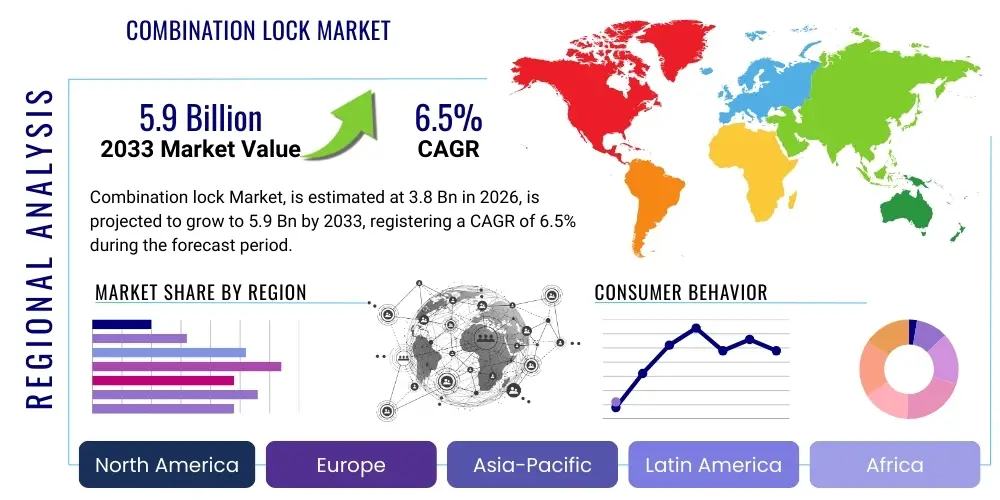

Combination lock Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442954 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Combination lock Market Size

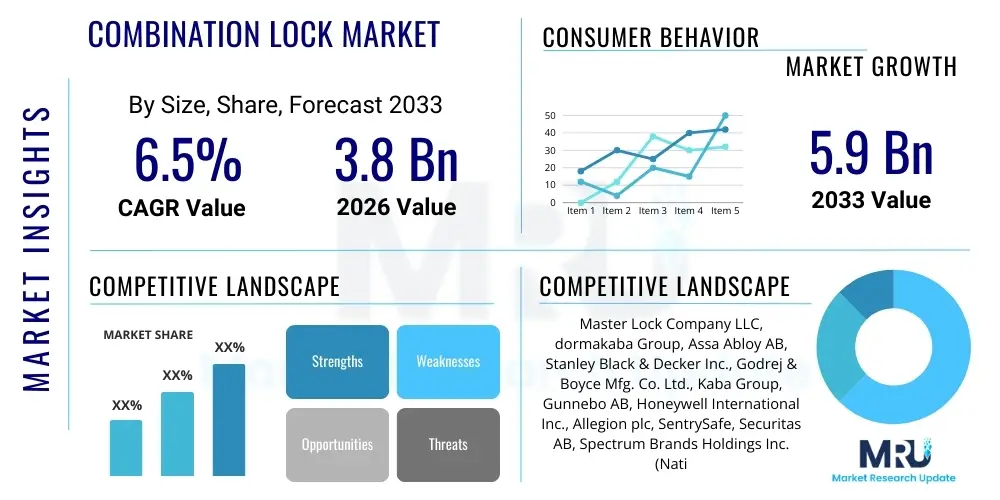

The Combination lock Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Combination lock Market introduction

The Combination lock Market encompasses a diverse range of mechanical and electronic security devices designed to secure property through a predetermined sequence of characters or movements, rather than requiring a traditional key. These locks are fundamental components in the security architecture across various sectors, offering enhanced convenience and reduced risk of key loss compared to conventional locking mechanisms. Key product segments include robust mechanical dial locks, modern push-button mechanisms, sophisticated electronic combination locks (often utilizing secure digital keypads and encrypted communication), and cutting-edge biometric-enabled combination systems. Each product variant is strategically positioned to cater to specific security needs, ranging from low-security luggage protection to high-security vault access, adapting seamlessly to diverse technological preferences and operational environments. The core value proposition of combination locks lies in their inherent shareability of the code and the ability for authorized users to quickly and securely change the code sequence without requiring physical re-keying or specialized tools, which is highly advantageous in dynamic, multi-user environments such as academic institutions, fitness centers, and large corporate facilities requiring flexible access management solutions.

Major applications of combination locks span consumer, commercial, institutional, and industrial domains. In the consumer sector, there is pervasive utilization for securing personal items, including travel luggage mandated by TSA standards, bicycles secured in public spaces, highly organized toolboxes, and residential floor safes for valuable documents. Commercially, these systems are indispensable for securing employee lockers in large organizations, retail display cases containing high-value merchandise, and secure cabinet enclosures housing IT infrastructure or sensitive documents. Industrial applications are often highly specialized, involving securing critical utility infrastructure, monitored storage of hazardous materials, and large-scale high-security vaults in logistics and financial centers, where the detailed, unalterable audit trails provided by advanced electronic combination locks are paramount for regulatory compliance and operational security oversight. The inherent benefits of these security systems—including high degrees of tamper resistance, centralized ease of code management, reduced operational costs associated with traditional key duplication, and exceptional durability—have collectively driven their consistent and accelerating adoption globally, integrating them firmly into modern security frameworks.

Driving factors contributing significantly to the combination lock market expansion include the sustained global increase in urbanization and continuous infrastructural development, necessitating superior and reliable access control systems across newly constructed commercial complexes, residential towers, and public transportation hubs. The consistently growing global awareness regarding the necessity for proactive personal and corporate asset protection, coupled with empirical data demonstrating a rising incidence of organized theft and opportunistic vandalism, necessitates the deployment of robust, failsafe security solutions like advanced combination locks. Technological advancements, particularly the successful integration of wireless connectivity protocols (such as Bluetooth, NFC, and Wi-Fi 6) and substantial improvements in the power efficiency and battery life of electronic variants, are making these locks vastly more appealing and functionally versatile. Moreover, increasingly stringent regulatory compliance requirements across sensitive industries, particularly those mandating detailed, traceable access control logs for auditing purposes (e.g., pharmaceutical storage, data centers), significantly accelerate the market shift towards high-specification electronic and smart combination locking mechanisms that can reliably meet complex legislative requirements.

Combination lock Market Executive Summary

The global Combination lock Market is currently positioned for substantial and sustained growth, fundamentally driven by the pervasive, non-negotiable requirement for keyless and traceable security across virtually all industrial and consumer landscapes. Current business trends clearly indicate a strategic pivot across the manufacturing sector towards developing and promoting electronic and smart combination locks. These products offer superior functional advantages, including granular control over access permissions, real-time remote monitoring capabilities, the ability to issue time-limited temporary access codes, and seamless integration with broader smart home or sophisticated building management systems (BMS). While traditional mechanical locks retain a foundational market share, particularly in highly cost-sensitive or extreme-environment applications, their dominance is rapidly being eroded by digital alternatives which provide highly valued supplementary features such as comprehensive audit trails and proactive diagnostic capabilities. Market-leading companies are strategically focusing their R&D investments on product miniaturization, substantially improving the structural and digital tamper resistance of keypads and electronic interfaces, and developing highly intuitive user-friendly software interfaces to capture and consolidate larger shares of the competitive global market. Furthermore, the exploration and successful implementation of recurring revenue streams, such as subscription-based models for advanced software features like remote monitoring and cloud-based access logging in smart locks, represents a critical emerging trend that is fundamentally transforming industry revenue dynamics.

From a regional perspective, North America and Europe continue to function as mature, highly competitive markets, characterized by exceedingly high prevailing security standards, substantial disposable income, and the rapid, widespread adoption of sophisticated electronic combination locks within large commercial, governmental, and institutional settings. These regions prioritize advanced technological features such as robust multi-factor biometric authentication, secure cloud data storage, and the requirement for seamless, standardized integration into existing corporate IT and security infrastructure. Conversely, the Asia Pacific (APAC) region is decisively poised for the highest proportional Compound Annual Growth Rate (CAGR), a trajectory fueled robustly by unprecedented rates of infrastructural expansion, significantly increasing levels of regional disposable incomes, and the widespread establishment of new commercial facilities, sprawling manufacturing plants, and expanded educational institutions that require reliable and highly scalable security solutions. Latin America and the Middle East & Africa (MEA) are characterized as actively developing markets, where the immediate demand is predominantly focused on procuring durable, highly cost-effective mechanical and foundational electronic locks, although interest and pilot programs for premium smart solutions are demonstrably accelerating, particularly within established large urban centers and high-end commercial developments.

Specific segment trends within the market highlight the current dominance of the residential and general commercial applications segments, with growth especially concentrated in products designed for luggage security, high-end residential safe locks, and large-scale institutional locker security management systems. Analyzing the market by mechanism type reveals that electronic combination locks are rapidly gaining significant traction and unit market share over purely mechanical variants, primarily due to their intrinsic flexibility, superior key management capabilities, and comprehensive integration potential, especially in high-traffic and regulatory-sensitive commercial environments. A deeper analysis of the industry segmentation confirms a robust, accelerating demand from the crucial retail, healthcare, and education sectors, all of which require high-volume, easily manageable access control mechanisms for protecting personal belongings, sensitive patient records, or valuable institutional equipment. Moreover, the industry-wide increase in standardization of connectivity protocols (e.g., Matter, Thread, Zigbee) is efficiently lowering the technical barriers to entry for new, innovative smart lock manufacturers, consequently intensifying market competition, fostering rapid innovation, and driving down the average unit cost for feature-rich advanced products, which directly benefits the global base of end-users.

AI Impact Analysis on Combination lock Market

User queries regarding the long-term impact of Artificial Intelligence (AI) on the Combination lock Market predominantly center on three core areas: advanced predictive maintenance capabilities, the substantial enhancement of biometric accuracy, and the implementation of proactive, anomaly-based threat detection systems. Users are deeply interested in understanding how sophisticated AI algorithms can ingest and analyze continuous usage patterns, environmental factors, and system diagnostic data to accurately predict potential mechanical wear-out or electronic failures in locks well before they materialize, thereby allowing for planned, preventive maintenance, minimizing costly security downtime, and significantly reducing overall operational expenditures. Another key area of concern and expectation involves the integration of AI to drastically refine and improve the accuracy and robustness of facial or fingerprint recognition technology currently used in high-end biometric combination locks. This refinement aims to virtually eliminate false positives and false negatives, ensuring highly reliable authentication while simultaneously enhancing authentication speed, which is critical in fast-paced commercial entry points. Furthermore, users frequently question AI's capacity to analyze atypical access attempts, monitor environmental sensor data, or detect subtle physical signatures characteristic of forced entry in real-time. This ability to move security posture from purely reactive logging to proactive, predictive defense represents a significant shift. This collective interest summarizes a powerful market expectation that AI will fundamentally transition combination locks from static, passive security devices into dynamic, self-learning components of an integrated, highly intelligent security ecosystem.

The successful integration of machine learning (ML) models allows the most advanced electronic combination locks to continuously learn and meticulously recognize authorized user behaviors, meticulously tracking metrics such as typical time-of-day access, the geographical location of authorized entry attempts, and even the established standard velocity of code entry on a keypad. Any significant or statistically unusual deviation from these carefully learned behavioral norms—for example, a correct code being entered at an atypical hour or under significant duress, or a failed biometric scan that is statistically improbable—can instantly trigger an enhanced security alert status. This intelligent flagging system allows security personnel to investigate potential breaches even when the technical criteria (entering the correct code) have been met by an unauthorized or compromised individual, such as under coercion. This added layer of behavioral biometrics provides a substantial, nuanced depth of security far beyond simple numerical code validation. Moreover, AI is being deployed to optimize the energy consumption profile in highly complex electronic locks by intelligently managing the activation cycles of sensors, modulating wireless communication protocols, and scheduling firmware checks based strictly on historical usage data. This critical optimization significantly extends the essential battery life, minimizing the need for manual maintenance and substantially reducing the operational footprint in large-scale commercial and institutional deployments.

For combination lock manufacturers and system integrators, AI contributes fundamentally to improved quality control processes, accelerated failure analysis, and design optimization cycles. Machine learning algorithms can efficiently analyze massive datasets derived from accelerated stress tests, simulated environmental failures, and real-world field failure reports to rapidly pinpoint specific structural weaknesses, endemic mechanical component failures, or critical firmware vulnerabilities. This data-driven insight leads directly to the creation of demonstrably more robust, longer-lasting, and cyber-resilient product designs. Furthermore, within the complex supply chain, AI-driven advanced demand forecasting ensures highly optimized material procurement and efficient production schedules for the specialized microcontrollers, sensors, and cryptographic chips utilized in high-volume smart combination locks, leading to better inventory management and reduced lead times. Ultimately, AI fundamentally transforms combination locks into highly adaptable, continuously improving security platforms capable of proactive self-diagnosis, dynamic threat pattern recognition, and effective mitigation, decisively addressing the modern, critical necessity for highly responsive, intelligent security measures across all sectors.

- AI-driven Predictive Maintenance: Analyzing usage cycles, environmental stress, and component telemetry to accurately forecast mechanical or electronic failure before it occurs.

- Enhanced Biometric Authentication: Utilizing deep learning and neural networks for near-perfect facial, fingerprint, or iris recognition, virtually eliminating authentication errors.

- Behavioral Pattern Recognition: Creating baseline user profiles to identify anomalous access attempts based on learned habits, serving as a layer of active intrusion detection.

- Optimized Energy Management: Machine learning algorithms dynamically regulating sensor activity and communication for optimal power usage, substantially extending battery service life.

- Real-Time Multi-Sensor Threat Detection: Analyzing fused sensor data (vibration, noise, temperature) using AI to instantly differentiate legitimate usage from sophisticated forced entry or tampering attempts.

DRO & Impact Forces Of Combination lock Market

The Combination lock Market is strategically defined and influenced by a powerful combination of accelerating drivers (D), significant structural restraints (R), and compelling market opportunities (O), all operating under the influence of major impact forces. Key drivers fueling this market expansion include the sustained global escalation in demand for highly reliable, keyless access control systems across expansive commercial and municipal infrastructures. Simultaneously, the rapid, high-density expansion of the global hospitality sector (hotels, short-term rentals) and the education sector (universities, K-12 schools), where efficient, high-volume locker management is an absolute operational necessity, acts as a primary demand aggregator. The rapid technological progression towards highly sophisticated electronic locks that offer seamless integration with the Internet of Things (IoT) and smart building ecosystems is perhaps the most fundamental and forceful driver, rendering purely mechanical security systems increasingly obsolete or relegated to niche applications. These commercial drivers are inextricably linked to rising global economic activity, increasing global standards of living, and an elevated societal valuation of both personal and corporate asset protection, which firmly establishes high-quality security hardware as a non-negotiable, fundamental component of all modern architectural and building management specifications.

Despite this robust growth environment, the market faces notable structural restraints that moderate its pace. The most pervasive challenge is the relatively high initial capital outlay required for advanced electronic and particularly biometric combination locks, a cost which often represents a significant barrier compared to the negligible cost of traditional, standard keyed locks. This high initial investment can significantly hinder the necessary broad-scale adoption, especially within highly price-sensitive developing regions or when scaling solutions for smaller residential renovation projects. Furthermore, a substantial restraint involves increasing consumer and corporate apprehension concerning the digital security vulnerabilities inherent in smart locks, specifically the risks associated with hacking, Denial-of-Service attacks, or firmware exploitation. This digital apprehension creates genuine consumer skepticism regarding data privacy (especially concerning biometric data, which falls under stringent regulations like GDPR) and overall long-term system reliability. The critical operational necessity for periodic, professional battery replacement and the potential for complete electronic failure in the event of poor maintenance or unforeseen power surge also represent crucial operational limitations that purely mechanical systems inherently circumvent, demanding that manufacturers invest heavily in redundant power solutions, robust tamper detection, and advanced, layered encryption to actively mitigate these prevalent concerns.

The strategic opportunities for robust market expansion are vast and highly technology-dependent, primarily centering on the expansive and largely untapped potential within the rapidly maturing Internet of Things (IoT) security landscape. A major opportunity involves the industry-wide push for the development of standardized, vendor-agnostic, and interoperable smart lock platforms. Successful standardization efforts will dramatically lower integration complexity, opening the door to massive, large-scale combination lock installations in next-generation smart cities and fully automated commercial and industrial facilities. Niche market specialization, such as developing ultra-high-security combination locks specifically engineered for central bank vaults, high-value art storage, or highly specialized tamper-proof systems for regulated pharmaceutical and narcotics storage, also presents crucial high-margin growth avenues. Moreover, the increasing global demand for retrofitting and modernizing existing, legacy infrastructure with advanced smart access control systems offers substantial immediate, short-term sales cycles. These complex market dynamics are actively shaped by macro-level impact forces, including the mandate for compliance with stringent international security certification standards (such. UL fire ratings, CEN mechanical classifications) and the stability of the global macroeconomic environment, which directly governs the annual capital expenditure budgets allocated for essential security infrastructure.

Segmentation Analysis

The Combination lock Market is characterized by a high degree of fragmentation and complexity, which necessitates a meticulous and detailed segmentation across various critical parameters including mechanism type, end-use application, specific end-user industry, and prevailing distribution channel structure to accurately assess market dynamics and effectively tailor products to highly specific consumer needs. This granular segmentation approach is strategically vital, as it empowers manufacturers to precisely configure product attributes—such as the required level of mechanical ruggedness, specific connectivity capabilities (e.g., offline codes vs. real-time Wi-Fi), and the inherent complexity of the user interface—to align perfectly with the unique operational and security requirements of highly divergent sectors, ranging from low-security education locker systems to highly regulated defense contractors. The primary market differentiation between the purely mechanical and advanced electronic segments is particularly critical; this split fundamentally reflects the consumer preference bifurcation between prioritizing absolute mechanical durability and operational simplicity versus the critical need for advanced digital functionality, remote management, and comprehensive, reliable auditability features. Furthermore, geopolitical segmentation provides crucial regional insight into highly localized spending patterns, preferred security standards, and the specific regulatory environments that decisively influence combination lock adoption rates.

Detailed segmentation by Mechanism Type bifurcates the market into traditional Mechanical Combination Locks, which offer maximum reliability and fail-safe operation without any power dependency, and Electronic Combination Locks, which are highly technologically advanced and incorporate features like secure digital keypads, responsive touchscreens, or high-accuracy biometric scanners. Application segmentation thoroughly covers major end-uses, including high-security Safes and Vaults (e.g., bank use), general-purpose Luggage and Briefcases (e.g., TSA locks), mass-market Lockers and Cabinets (e.g., gym use), and Architectural Hardware (e.g., main building access doors). The End-User analysis carefully distinguishes between high-volume Residential consumers, diverse Commercial enterprises (e.g., expansive Retail outlets, modern Office Spaces, Hospitality chains), large-scale Institutional buyers (e.g., Educational campuses, Healthcare facilities, various Government bodies), and specialized Industrial facilities, each segment having dramatically different volume requirements and specific security grade expectations. Strategically understanding and targeting these segments is paramount for effective market penetration, allowing firms to capitalize on specific technological advantages—such as low-power, high-security Bluetooth modules specifically designed for consumer luggage locks or robust, high-availability audit trail features mandated for industrial critical infrastructure.

- By Mechanism Type:

- Mechanical Combination Locks (Dial, Push-Button)

- Electronic Combination Locks (Digital Keypad, Touchscreen Interface, Advanced Biometric Integration)

- By Application:

- Safes and Vaults (High-Security)

- Lockers and Cabinets (Institutional, Commercial)

- Luggage and Briefcases (Travel Security)

- Doors and Access Control Systems (Architectural Hardware)

- By End-User:

- Residential (Home Safes, Gates)

- Commercial (Retail, Office Spaces, Hospitality, Data Centers)

- Institutional (Education, Healthcare, Government, Military)

- Industrial (Manufacturing, Utilities, Logistics)

- By Distribution Channel:

- Offline (Specialty Locksmiths, Mass Hardware Stores, Direct Sales)

- Online (E-commerce Platforms, Manufacturer Websites)

Value Chain Analysis For Combination lock Market

The Value Chain for the Combination lock Market initiates in the upstream segment with the essential activities of raw material procurement and complex component manufacturing. This involves securing consistent supplies of high-grade, durable materials such as specialized hardened steel, resilient zinc alloys, and precision-machined brass for all mechanical components, alongside sourcing cutting-edge specialized electronics, including secure microcontrollers, high-definition optical/capacitive sensors, and reliable communication chips (e.g., 5G-ready, encrypted modules) for all digital variants. Key raw material and specialized component suppliers, predominantly concentrated within established industrial regions like China, South Korea, and Taiwan, exert significant leverage over component costs, supply volume, and critical lead times. The manufacturing phase requires sophisticated processes, including high-precision CNC machining, metal stamping, complex alloy casting, and an increasingly intricate final assembly process necessary for electronic combination systems, often mandating the use of specialized cleanroom environments and highly calibrated testing equipment for sensitive biometric or high-security, tamper-evident components. The relentless pursuit of efficiency and quality control in this upstream segment directly determines the final product performance, inherent security level, and overall manufacturing cost, making the strategic management of international supplier relationships absolutely critical for achieving optimal market margins.

Downstream activities are focused intensely on efficient logistics, multi-channel distribution, and specialized installation/aftermarket services. The resulting distribution channel structure is highly diversified: it relies on strategic direct sales models aimed at large institutional clients (such as major hotel chains or governmental agencies purchasing centralized lock management systems) and expansive indirect channels utilizing large, globally integrated hardware retail chains, major e-commerce platforms (like Amazon or Alibaba), and networks of specialized security distributors who also provide essential supplementary services, including certified professional installation, system integration, and critical maintenance contracts. The inherent and increasing complexity of advanced electronic locks mandates the involvement of skilled, manufacturer-certified installation technicians, effectively adding significant value and specialized knowledge further down the value chain. Strategic marketing and sales campaigns are crucial for market differentiation, focusing heavily on highlighting internationally recognized security certifications (e.g., CEN Grade 6, UL 768 classifications) and showcasing advanced technological features (such as flawless smartphone application integration, patented anti-tamper mechanisms, and seamless cloud connectivity) to establish a competitive advantage in a highly saturated marketplace. These marketing efforts must strategically target professional locksmiths, security consultants, and system integrators who frequently act as influential gatekeepers and trusted advisors for large-scale security purchases.

The direct distribution model often proves highly beneficial by eliminating intermediate margin layers, typically favoring large-volume manufacturers selling foundational mechanical locks or highly specialized, customized high-end vault locks directly to major security infrastructure developers and dedicated construction firms. Conversely, the indirect distribution model, which maximizes leverage of global mass-market retail channels and vast e-commerce platforms, remains dominant in the high-volume residential and standardized commercial segments, ensuring rapid, broad geographical reach and maximum consumer visibility. The accelerating global adoption of online sales channels enables specialized, innovative manufacturers to effectively reach international markets with minimal physical infrastructure investment. Crucially, the overall efficiency and robustness of the distribution network, combined with prompt, high-quality customer service, technical training, and reliable ongoing firmware support for highly complex electronic products, collectively dictate market responsiveness, brand loyalty, and overall customer life-cycle satisfaction. This comprehensive structure completes the value cycle, extending from the initial complex sourcing of raw materials through to sustained, post-installation end-user engagement and technical support.

Combination lock Market Potential Customers

Potential customers for combination locks are highly heterogeneous and geographically distributed, spanning virtually every sector of the global economy that mandates secure, reliable, and keyless access control for either tangible assets or personal property. The largest foundational volume segment comprises institutional buyers, prominently including large educational facilities (extensive K-12 school districts, multi-campus universities) and public/private health systems (hospitals, clinics, research laboratories). These institutions require massive quantities of durable, easily resettable, and centrally managed combination locks for securing student, patient, or employee storage lockers, often integrated with central administrative software for simplified access management and auditing. Commercial enterprises constitute the second largest customer base, critically encompassing high-traffic fitness centers, extensive corporate office complexes, retail stores requiring highly secure and visibly controlled display cases for premium goods, and major transportation hubs (e.g., international airports, large train stations) that necessitate high-security luggage and short-term storage locker solutions.

Industrial customers form a critical high-value, high-specification segment of the market, typically demanding robust, heavy-duty electronic combination locks that incorporate advanced audit trail features and resistance to extreme environmental conditions. These clients utilize combination locks to secure vital operational equipment, complex utility panels, sensitive server racks within data centers, restricted inventory storage areas, and specialized containment units. Within the enormous residential sector, end-users purchase combination locks primarily for the enhanced convenience and security they offer when securing personal, smaller residential safes, exterior utility gates, secure storage sheds, and travel luggage, largely driven by the elimination of traditional key management hassle and associated risks of key loss or unauthorized duplication. Furthermore, Original Equipment Manufacturers (OEMs) who specialize in producing safes, fireproof filing cabinets, high-end furniture, and travel luggage are highly significant customers, as they purchase and integrate combination locking mechanisms directly into their final product offerings during the manufacturing assembly phase, often requiring customized specifications.

The continuous, rapid market shift towards digital and integrated smart security solutions has fundamentally expanded the potential customer profile to include technology-savvy consumers, specialized property management firms, and advanced smart building developers who increasingly prioritize seamless digital connectivity, remote monitoring, and centralized network management capabilities. These high-tech customers demand combination locks that are fully certified to integrate seamlessly with standard smart home platforms like Amazon Alexa, Google Home, or specialized professional Building Management Systems (BMS). At the absolute apex of security demand are Financial Institutions (e.g., commercial banks, credit unions, governmental treasuries), which require highly certified, specialized, often redundant mechanical and electronic combination locks for securing vaults, safety deposit boxes, and currency processing areas. For this segment, absolute reliability, uncompromising physical security, and strict compliance with global insurance and regulatory standards are non-negotiable purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Master Lock Company LLC, dormakaba Group, Assa Abloy AB, Stanley Black & Decker Inc., Godrej & Boyce Mfg. Co. Ltd., Kaba Group, Gunnebo AB, Honeywell International Inc., Allegion plc, SentrySafe, Securitas AB, Spectrum Brands Holdings Inc. (National Hardware), Salvagnini, Cannon Safe, Fortis Security, Lowe & Fletcher, Alpha Guardian, Liberty Safe, CCL Security Products, Sargent and Greenleaf. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Combination lock Market Key Technology Landscape

The technology landscape of the Combination lock Market is dynamically evolving, primarily propelled by the strategic convergence of time-tested mechanical durability principles with cutting-edge digital connectivity and processing power. The foundational technology involves highly sophisticated internal gear mechanisms, meticulously calibrated tumblers, and extremely high-precision tolerances in the core mechanical dial systems, which are essential for ensuring maximum resistance against physical tampering and manipulation (picking, drilling) and guaranteeing flawlessly smooth, reliable operation under harsh conditions. However, the leading frontier of innovation is firmly situated within electronic combination locks, which leverage advanced cryptographic key management protocols, specialized, unalterable secure element chips (hardware security modules), and robust, energy-efficient wireless communication modules (including Bluetooth Low Energy 5.0, standardized Z-Wave, and mesh-networking Zigbee) to seamlessly facilitate secure remote access, efficient system interaction with central smart hubs, and robust data transmission. A paramount technological trend involves the radical miniaturization of these complex electronic components, which is enabling successful integration into significantly smaller form factors, such as high-security travel luggage and minimalist bike locks, without any measurable compromise on the critical security or feature set.

Biometric technology adoption, specifically high-resolution fingerprint and 3D facial recognition, is rapidly gaining significant traction in high-security, premium-tier combination locks. This technology leverages advanced capacitive and optical sensor arrays combined with sophisticated machine learning-driven matching algorithms to offer instantaneous, personalized, and highly secure keyless access, thereby definitively addressing the pervasive operational problem of "forgotten combinations" that is inherent in traditional numeric systems. Furthermore, critical advancements in integrated power management solutions are central to market viability; state-of-the-art electronic locks now utilize ultra-low-power consumption microcontrollers and utilize specialized, high-density battery chemistries to ensure exceptional operational longevity. Manufacturers often guarantee multi-year service life without the need for manual battery replacement, which represents a crucial and non-negotiable requirement for large-scale commercial and institutional installations aiming to minimize disruptive, costly maintenance burdens. Continuous technological investment focuses intensely on developing robust anti-tamper, anti-bypass, and anti-picking technologies, which includes the advanced fusion and integration of various internal sensors (accelerometers, vibration sensors, thermal sensors) designed to instantaneously detect any non-standard physical manipulation attempts.

A transformational technological shift centers around the widespread adoption of secure, scalable cloud-based access management platforms. These powerful platforms afford system administrators the critical capability to remotely and simultaneously manage hundreds or even thousands of installed combination locks, enabling the instantaneous granting or revocation of temporary access codes, and the automated generation of detailed, legally compliant audit trails—all managed securely in real-time. This level of centralized, granular control and oversight is absolutely vital for meeting the complex operational requirements of large institutional clients (e.g., government buildings) and major global commercial end-users. The implementation of Firmware Over-The-Air (FOTA) update capabilities is another technological necessity, ensuring that electronic locks can be continuously and remotely patched against newly discovered digital and zero-day vulnerabilities, which is essential for maintaining product security resilience and compliance throughout the lock's operational lifespan. Finally, the strategic integration of Near Field Communication (NFC) and advanced Radio Frequency Identification (RFID) technology further expands the access options, permitting alternative entry methods via specialized smart cards, key fobs, or enabled smartphones, offering end-users a sophisticated, layered choice in access control methodologies beyond the constraints of traditional numerical code entry.

Regional Highlights

The Combination lock Market demonstrates distinct, regionally specific consumption patterns, security priorities, and market growth trajectories across the major global geographical regions. These regional nuances are substantially influenced by local economic development metrics, specific prevailing security regulations, and the regional rate of adoption of advanced digital technologies. North America maintains its position as a mature, technologically saturated market, distinguished by exceptionally high consumer awareness regarding physical and digital personal security, alongside the early, enthusiastic adoption of premium, feature-rich electronic and interconnected smart combination locks. This region’s market strength is bolstered by consistent, robust commercial infrastructure development and high corporate capital expenditure dedicated to integrated access control systems, particularly prevalent within the financial, institutional, and high-end retail sectors. The persistent, high demand for internationally recognized UL-certified high-security safe locks underscores the region’s stringent regulatory environment and the powerful influence of insurance liability requirements, collectively driving continuous innovation in advanced tamper-proof and fire-resistant locking technology.

Europe, structurally, closely mirrors the technological maturity of North America, with key economic powerhouses such as Germany, the United Kingdom, and France spearheading the widespread adoption of highly advanced electronic security solutions that strictly comply with comprehensive European Union security directives and established CEN (European Committee for Standardization) standards. The market growth in this region is significantly driven by the massive retrofit sector, focusing on the systematic upgrading of existing, often historical infrastructure with state-of-the-art smart access solutions. There is also pronounced, specialized demand stemming from the hospitality sector (for guest room and staff lockers) and the high-volume education sector, which requires interconnected and centrally managed locker systems. Furthermore, European market selection criteria often place a high premium on product sustainability, material sourcing ethics, and certified energy efficiency, favoring electronic locks that demonstrate ultra-low power consumption and adhere to certified eco-friendly or circular economy manufacturing processes.

The Asia Pacific (APAC) region is decisively recognized as the fastest-growing market globally, its expansion vigorously fueled by unprecedented rates of rapid urbanization, massive governmental investment in critical infrastructure projects (including ambitious smart city initiatives and expansive commercial complexes), and continuously rising consumer purchasing power across rapidly developing economies such as the People’s Republic of China, India, and the rapidly growing economies of Southeast Asia. While the massive volume market across APAC currently retains a strong preference for highly cost-effective and durable mechanical locks, the accelerating commercial and industrial demand for sophisticated, network-enabled electronic combination locks is surging dramatically, driven by the need for advanced access control in newly constructed corporate headquarters and modern manufacturing facilities. This region is simultaneously a primary global manufacturing hub, leading to both immense internal consumption and large-scale export production, which fundamentally influences global supply chain dynamics and combination lock pricing trends. Latin America and the Middle East & Africa (MEA) are dynamic emerging markets, where significant combination lock market growth is heavily concentrated in major, rapidly expanding metropolitan areas. This growth is often driven by a necessity for demonstrably enhanced security due to high regional crime rates, alongside increasing foreign direct investment into commercial real estate, large-scale infrastructure, and luxury hospitality projects, particularly visible in the GCC countries.

- North America: High technological adoption; strong regulatory compliance driving demand for certified high-security products; significant expenditure on commercial and institutional access control integration.

- Europe: Growth driven by infrastructure modernization (retrofitting); stringent adherence to CEN security standards; emphasis on energy efficiency and sustainable manufacturing practices in product selection.

- Asia Pacific (APAC): Highest projected CAGR; fueled by rapid large-scale urbanization and infrastructural investment; bifurcated market balancing high-volume mechanical demand with surging electronic lock adoption in commercial sectors.

- Latin America: Emerging but accelerating market; growth tied directly to new commercial construction and residential demand for improved basic security solutions; price sensitivity remains a key factor.

- Middle East & Africa (MEA): Growth driven by massive tourism sector expansion, luxury commercial development, and heightened regional security needs, with focus concentrated in major economic hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Combination lock Market.- Master Lock Company LLC

- dormakaba Group

- Assa Abloy AB

- Stanley Black & Decker Inc.

- Godrej & Boyce Mfg. Co. Ltd.

- Kaba Group

- Gunnebo AB

- Honeywell International Inc.

- Allegion plc

- SentrySafe

- Securitas AB

- Spectrum Brands Holdings Inc. (National Hardware)

- Salvagnini

- Cannon Safe

- Fortis Security

- Lowe & Fletcher

- Alpha Guardian

- Liberty Safe

- CCL Security Products

- Sargent and Greenleaf

Frequently Asked Questions

Analyze common user questions about the Combination lock market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from mechanical to electronic combination locks?

The shift is primarily driven by the critical need for enhanced digital functionality, including flexible remote access management, the capability for real-time audit trail generation, and seamless integration into large-scale smart building ecosystems. Electronic locks inherently offer superior operational flexibility and heightened user convenience over traditional, geographically constrained mechanical systems.

How reliable are biometric combination locks in commercial settings?

Biometric combination locks are considered highly reliable in demanding commercial and institutional settings, leveraging state-of-the-art sensor technology and advanced ML algorithms to substantially minimize false readings. Their core benefit is providing near-instantaneous access and completely eliminating the need to memorize or insecurely transmit codes, thereby drastically enhancing overall security protocols in high-traffic entry environments.

What is the projected Compound Annual Growth Rate (CAGR) for the Combination lock Market?

The global Combination lock Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period spanning 2026 to 2033, a growth trajectory largely sustained by continuous technological breakthroughs, global urbanization trends, and increasing mandatory security expenditure.

Which geographical region holds the largest potential for combination lock market growth?

The Asia Pacific (APAC) region is strategically forecasted to exhibit the highest rate of market growth, a trend vigorously fueled by unprecedented rates of commercial and residential infrastructural development, rapid urbanization across key economies, and significant increasing investment in large-scale institutional facilities requiring highly scalable and integrated security solutions.

Are electronic combination locks vulnerable to hacking, and how is this addressed?

While electronic locks possess inherent digital attack vectors, leading manufacturers proactively mitigate this risk through mandatory robust security measures. These include military-grade end-to-end encryption for all data transmission, the utilization of dedicated secure element hardware chips, mandatory periodic remote firmware updates (FOTA), and sophisticated physical anti-tamper design to secure internal electronic components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager