Commercial Aero Turbofan Engine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442102 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Commercial Aero Turbofan Engine Market Size

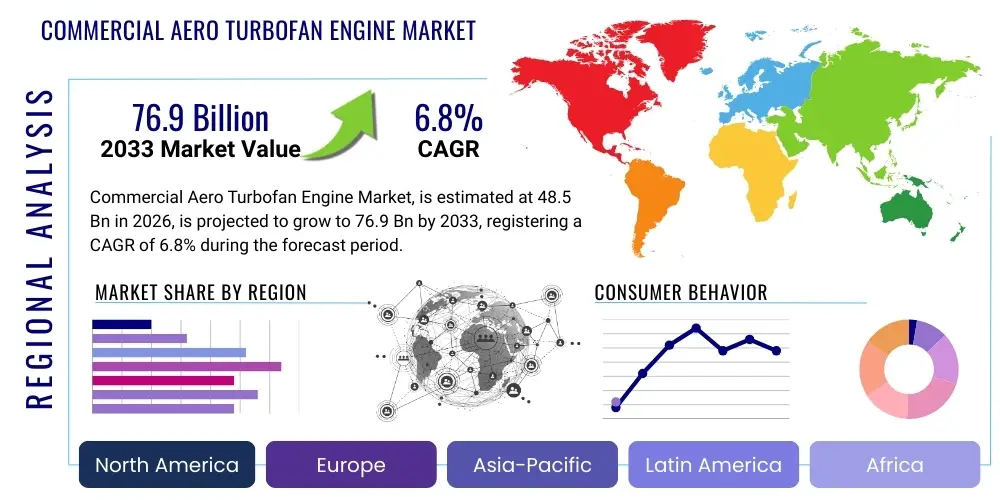

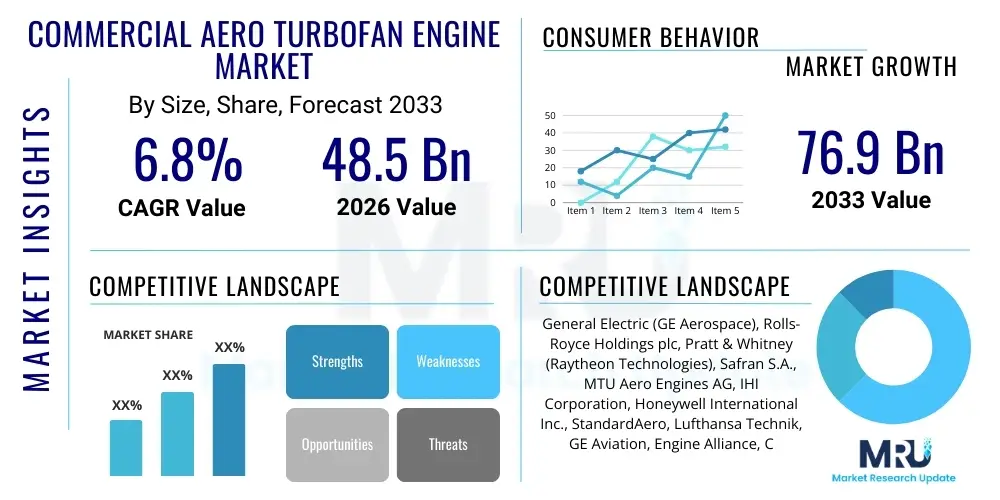

The Commercial Aero Turbofan Engine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 48.5 billion in 2026 and is projected to reach USD 76.9 billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the sustained increase in global air traffic, necessitating larger fleets and replacements for aging aircraft, coupled with the critical industry focus on achieving enhanced fuel efficiency and reduced carbon emissions through advanced engine designs. The continuous demand for narrow-body and wide-body aircraft, particularly in emerging economies, provides a foundational catalyst for engine production and aftermarket services growth.

Commercial Aero Turbofan Engine Market introduction

The Commercial Aero Turbofan Engine Market encompasses the design, manufacturing, overhaul, and service of gas turbine engines utilized primarily in civilian passenger and cargo aircraft. Turbofan engines are characterized by a large fan at the front, which bypasses a significant amount of air around the core, generating most of the thrust and dramatically increasing fuel efficiency compared to turbojets. Key applications span across short-haul narrow-body jets, which dominate the fleet size globally, to long-haul wide-body airliners and large dedicated freighter aircraft.

Major applications include new engine installations for aircraft manufacturers (OEM market) and the extensive Maintenance, Repair, and Overhaul (MRO) sector, which provides aftermarket services crucial for the operational lifespan of these complex machines. Benefits derived from modern turbofan technology include substantial reductions in fuel consumption, lower noise footprints, extended time on wing (TOW), and superior operational reliability, which directly impacts airline profitability and adherence to increasingly strict environmental regulations. Product innovation is heavily focused on materials science, thermal management, and electronic engine control systems (FADEC).

Driving factors propelling market expansion include the globalization of travel and trade, leading to consistent year-over-year increases in Revenue Passenger Kilometers (RPK) and Freight Tonne Kilometers (FTK). Furthermore, technological advancements, such as the adoption of Geared Turbofan (GTF) architectures and Ultra-High Bypass Ratio (UHBR) designs, are essential for meeting the industry's ambitious sustainability targets, particularly those set by international bodies like the International Civil Aviation Organization (ICAO). The replacement cycle of older, less efficient engine models further solidifies market momentum throughout the forecast period.

Commercial Aero Turbofan Engine Market Executive Summary

The Commercial Aero Turbofan Engine Market exhibits resilient business trends characterized by intense competition among a few dominant original equipment manufacturers (OEMs) and a growing emphasis on long-term service agreements (LTSAs) which ensure stable aftermarket revenue streams. Key business trends include the vertical integration of engine OEMs into MRO services and the strategic consolidation of supply chains to manage volatility in raw material costs, particularly specialized alloys. Technological innovation centers on sustainability, driving significant R&D investment into engine designs compatible with Sustainable Aviation Fuels (SAF) and exploring future hybrid-electric propulsion systems for smaller commercial aircraft. The increasing backlog of aircraft orders from major airframe manufacturers (Airbus and Boeing) guarantees substantial engine demand through the next decade.

Regionally, the Asia Pacific (APAC) continues to be the primary engine of growth, driven by burgeoning middle classes, extensive infrastructure development in countries like China and India, and the establishment of new low-cost carriers (LCCs) demanding highly reliable and fuel-efficient narrow-body engines. North America and Europe, while mature markets, emphasize fleet modernization and MRO capabilities, focusing on the sophisticated overhaul of existing high-value assets and accelerating the adoption of engines meeting the latest Stage 5 noise standards. The Middle East and Africa (MEA) contribute significantly through their hub carriers, which operate large fleets of wide-body aircraft, demanding high-thrust engines and specialized maintenance solutions.

Segment trends reveal that the narrow-body aircraft segment, primarily utilizing engines with lower thrust ratings (under 50,000 lbs), holds the largest volume share, reflecting its ubiquity in regional and short-to-medium haul routes. Conversely, the wide-body and regional jet segments drive value, given the complexity and higher pricing of high-thrust engines (over 70,000 lbs). The MRO segment is expanding rapidly, often surpassing the growth rate of the new engine OEM segment, indicating the long operational lifespan and maintenance intensity of commercial turbofans. The aftermarket sector is further specialized by component type, with high-pressure turbine and combustor sections demanding the most intensive service and component replacement expenditure.

AI Impact Analysis on Commercial Aero Turbofan Engine Market

User inquiries regarding AI's influence in the turbofan engine market predominantly center on how artificial intelligence can enhance engine performance, predict maintenance failures, and optimize manufacturing processes. Key themes include the implementation of predictive maintenance (CBM) to reduce unplanned downtime, the use of machine learning algorithms to analyze vast datasets generated by Engine Health Monitoring (EHM) systems, and the potential for AI-driven design optimization to accelerate the development of next-generation, highly efficient engines. Users are concerned about data security, the reliability of AI predictions in safety-critical systems, and the need for standardized regulatory frameworks to govern autonomous decision-making in engine diagnostics and operational control. Expectations are high regarding significant reductions in operating costs (Direct Operating Costs or DOC) and improved engine Time on Wing (TOW) through intelligent maintenance scheduling and fault isolation.

The application of AI is moving beyond simple data logging, transitioning into complex prognostic models that integrate flight parameters, environmental conditions, and historical component performance data to provide highly accurate remaining useful life (RUL) estimations for critical rotating and non-rotating parts. This shift is revolutionizing the MRO sector, enabling airlines and MRO providers to move from time-based or cycle-based maintenance schedules to true on-condition maintenance, substantially minimizing unnecessary shop visits and inventory holding costs. Furthermore, in the realm of advanced manufacturing, AI is being utilized for quality control during the production of intricate components via additive manufacturing, ensuring structural integrity and adherence to stringent aerospace standards, thereby streamlining the production pipeline.

AI also plays a pivotal role in optimizing engine performance in real-time during flight. Advanced algorithms can dynamically adjust engine control parameters (via FADEC systems) to account for atmospheric variations, aircraft weight, and flight path, ensuring optimal thrust settings and fuel burn throughout the mission profile. This granular level of optimization contributes directly to the industry's fuel efficiency goals. The integration of digital twins—virtual replicas of physical engines—powered by AI, allows engineers to simulate component wear and failure scenarios under various operational stresses, offering invaluable insights for design improvements and proactive maintenance intervention strategies, fundamentally changing the engine lifecycle management paradigm.

- Enhanced Predictive Maintenance: AI analyzes EHM data to forecast component failure, optimizing repair scheduling and reducing AOG (Aircraft on Ground) time.

- Optimized Manufacturing: Machine learning algorithms improve quality control in additive manufacturing (3D printing) of complex engine components.

- Real-Time Performance Tuning: AI-driven FADEC adjustments maximize fuel efficiency and minimize emissions during flight operations.

- Accelerated Design Cycles: Generative AI assists engineers in exploring new material combinations and aerodynamic structures for next-generation engines.

- Supply Chain Resilience: Predictive analytics anticipate component demand fluctuations, ensuring optimal inventory levels for MRO activities.

DRO & Impact Forces Of Commercial Aero Turbofan Engine Market

The market is defined by several powerful dynamics, encompassing robust Drivers, critical Restraints, and significant Opportunities, which collectively exert substantial Impact Forces on industry growth and strategic direction. Primary drivers include the global expansion of air travel and fleet modernization mandates, especially the transition toward narrow-body aircraft requiring high-efficiency turbofans. Restraints center on the immense capital expenditure required for engine development, the stringent regulatory certification processes, and the volatile costs associated with specialized raw materials, such as titanium and nickel-based superalloys. Opportunities arise from the burgeoning demand for sustainable aviation solutions, prompting investment in new propulsion technologies, hybrid-electric integration, and the exponential growth expected in the high-value MRO sector, particularly in APAC and the Middle East.

Key drivers are centered around improving operational economics and environmental compliance. The necessity for airlines to minimize Direct Operating Costs (DOC) strongly favors newer engine models that offer double-digit percentage improvements in fuel burn compared to their predecessors. This economic imperative drives the replacement market, even for relatively young aircraft fleets. Furthermore, rising geopolitical pressures and international commitments regarding carbon neutrality necessitate engines capable of high blending ratios of SAF, pushing OEMs to redesign combustion chambers and fuel systems. The expansion of Low-Cost Carriers (LCCs) worldwide, reliant on maximizing utilization rates of homogeneous fleets, creates a consistent, high-volume demand base for reliable and easily maintainable turbofans.

Restraints are often systemic and structural within the aerospace industry. The typical 5-7 year development cycle for a new engine platform, requiring investments often exceeding $5 billion, creates substantial barriers to entry for new competitors. Additionally, the limited number of qualified suppliers for critical, high-tolerance components, coupled with stringent quality assurance requirements, limits production scalability. The most significant impact forces acting on the market are technological disruption (e.g., the potential scaling of hydrogen or electric propulsion for regional aircraft) and cyclical economic vulnerability, as commercial aviation remains highly sensitive to global recessions, pandemics, and sustained volatility in crude oil prices, which directly affect airline procurement decisions and MRO budgets. Nevertheless, the long-term, non-discretionary nature of engine maintenance ensures a resilient aftermarket segment, stabilizing overall market revenue.

Segmentation Analysis

The Commercial Aero Turbofan Engine Market is systematically segmented across critical dimensions including Aircraft Type, Thrust Rating, Component Type, and End-User, providing a comprehensive framework for market assessment and strategic planning. Segmentation by Aircraft Type allows for the differentiation of engine requirements based on mission profile, with narrow-body engines dominating unit sales and wide-body engines driving revenue due to their high complexity and cost. Thrust Rating segmentation directly correlates to aircraft size and operational distance, separating the market into low, medium, and high-thrust categories, crucial for understanding OEM focus areas. Component segmentation highlights the aftermarket intensity, identifying high-wear components like compressor and turbine blades as key revenue streams within MRO activities.

The end-user segmentation clearly delineates the Original Equipment Manufacturer (OEM) market, focused on new engine delivery to aircraft builders (e.g., Airbus and Boeing), from the aftermarket segment, which caters to airlines, independent MRO providers, and third-party lessors. The aftermarket segment is further segmented into line maintenance, heavy maintenance, and component repair, representing distinct service requirements and revenue pools. Analyzing these segments is essential for stakeholders to tailor business strategies, from targeted product development focusing on next-generation efficiency enhancements to optimizing global supply chain logistics for MRO parts delivery, ensuring minimal turnaround time (TAT) for aircraft maintenance procedures globally. This granular segmentation facilitates accurate forecasting of both initial procurement capital expenditure and long-term operational expense trends.

- By Aircraft Type:

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Jet Aircraft

- By Thrust Rating:

- Below 30,000 lbs

- 30,000 lbs to 50,000 lbs

- 50,000 lbs to 80,000 lbs

- Above 80,000 lbs

- By Component:

- Fan Blades and Housings

- Compressor Modules

- Combustor Sections

- Turbine Modules (High and Low Pressure)

- Accessory Gearbox and Nacelles

- By End-User (Market Type):

- Original Equipment Manufacturer (OEM)

- Aftermarket (Maintenance, Repair, and Overhaul - MRO)

Value Chain Analysis For Commercial Aero Turbofan Engine Market

The value chain for commercial aero turbofan engines is complex, highly specialized, and deeply integrated, commencing with upstream activities focused on the procurement of highly engineered raw materials, primarily specialized nickel and titanium alloys, from a limited pool of certified metal producers. Upstream analysis involves intense R&D focusing on material science to withstand extreme temperatures and pressures inherent in modern engine operation, demanding significant investment in certified forging and casting processes. These materials are then processed by Tier 2 and Tier 3 suppliers into highly complex components (blades, vanes, disks), which are delivered to the engine OEMs (Tier 1 integrators) for final assembly and rigorous testing, culminating in engine certification.

Downstream analysis focuses heavily on the distribution and end-use phases. Distribution channels are predominantly direct, involving engines delivered straight from the OEM to airframe manufacturers (Airbus, Boeing) as part of a pre-negotiated program (e.g., the Airbus A320neo program requiring GTF or LEAP engines). After the aircraft enters service, the downstream value shifts dramatically to the aftermarket. Direct channels involve long-term service agreements (LTSAs) where the engine OEM (e.g., General Electric, Rolls-Royce, Pratt & Whitney) provides MRO services directly to the airline customer, often retaining ownership of the engine data and maintenance records. Indirect channels involve authorized third-party MRO facilities and independent component repair shops that service specific parts or modules under licensing agreements.

The robust aftermarket segment forms the most profitable part of the engine lifecycle, often generating 60-70% of the total program revenue over 30 years. The effectiveness of the value chain is determined by the speed and reliability of the MRO supply chain—specifically, the Turnaround Time (TAT) for engine repair. Optimized logistics for spare parts and specialized repair tooling are critical competitive differentiators. Due to the high intellectual property associated with engine design, OEMs maintain tight control over component certification and repair procedures, influencing pricing power across the entire value chain. Strategic partnerships between OEMs and component specialists are increasingly utilized to optimize costs and enhance global service reach.

Commercial Aero Turbofan Engine Market Potential Customers

Potential customers for the Commercial Aero Turbofan Engine Market are predominantly large commercial airlines, regional carriers, dedicated cargo operators, and aircraft leasing companies, all serving as the end-users or direct buyers of the product and associated services. Major global network carriers (e.g., United, Lufthansa, Emirates) represent high-value customers, requiring high-thrust, reliable engines for their wide-body fleets and comprehensive LTSAs to manage their vast operational scale. Regional jet operators and Low-Cost Carriers (LCCs) are high-volume customers, primarily purchasing engines for narrow-body aircraft, where efficiency and low maintenance costs are paramount for their business model sustainability and growth. The decision-making process for these buyers is heavily influenced by factors such as fuel efficiency guarantees, predicted maintenance intervals, and the engine OEM's global MRO network accessibility.

Another crucial segment of potential customers includes aircraft leasing companies (e.g., AerCap, GECAS, SMBC Aviation Capital). These entities often purchase engines directly or acquire them bundled with airframes from OEMs. They require engines with excellent residual value retention and transferable maintenance contracts, as they manage the asset risk and operational life for numerous airline lessees globally. These leasing firms often prioritize engine commonality across their portfolio to simplify maintenance documentation and maximize asset liquidity. The final major customer group is the government sector, specifically military transport units and specialized government agencies that operate commercial derivatives of airliners (e.g., tankers, VIP transport), purchasing engines through highly specific defense procurement contracts requiring tailored specifications and long-term logistical support guarantees.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 48.5 billion |

| Market Forecast in 2033 | USD 76.9 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric (GE Aerospace), Rolls-Royce Holdings plc, Pratt & Whitney (Raytheon Technologies), Safran S.A., MTU Aero Engines AG, IHI Corporation, Honeywell International Inc., StandardAero, Lufthansa Technik, GE Aviation, Engine Alliance, China Aero Engine Corporation (AECC), Russian Engines (UEC), Triumph Group, Chromalloy Gas Turbine LLC, Barnes Group Inc., HEICO Corporation, Woodward Inc., Wencor Group, HAECO Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Aero Turbofan Engine Market Key Technology Landscape

The technology landscape for commercial aero turbofan engines is currently dominated by radical innovations aimed at maximizing the bypass ratio, increasing core temperature tolerance, and incorporating intelligent monitoring systems. Geared Turbofan (GTF) technology, pioneered by Pratt & Whitney, represents a critical shift, utilizing a reduction gearbox that allows the fan and the low-pressure compressor/turbine to spin at different, optimized speeds, dramatically increasing propulsive efficiency and reducing noise. Furthermore, the LEAP engine family (CFM International - a joint venture of GE and Safran) utilizes advanced materials, including Ceramic Matrix Composites (CMCs) in the hot section, enabling higher operating temperatures and reducing component weight and the need for cooling air, thereby enhancing overall engine thermal efficiency.

Another area of immense technological focus is the adoption of Additive Manufacturing (AM), or 3D printing. OEMs are leveraging AM to produce complex internal geometries, such as fuel nozzles and certain structural casings, which are impossible or impractical to create using traditional casting or machining methods. AM allows for weight reduction, fewer assembly parts, and rapid prototyping, significantly shortening the development timeline for new engine components. Simultaneously, research into Open Rotor or Ultra-High Bypass Ratio (UHBR) designs is accelerating. These concepts aim to further increase the bypass ratio beyond current limits, potentially offering breakthrough levels of fuel efficiency, although they present significant integration and noise abatement challenges that require specialized airframe designs and certification.

Digitalization and the integration of advanced sensors form the backbone of modern engine management. Full Authority Digital Engine Control (FADEC) systems are evolving to incorporate predictive diagnostics and prognostics, gathering terabytes of data per flight cycle. The development of advanced thermal coatings and specialized alloys that can withstand higher combustion temperatures without requiring excessive cooling air is fundamental to achieving ambitious efficiency targets. The ongoing shift towards sustainability is also driving R&D into hydrogen combustion and hybrid-electric architectures, particularly for smaller regional turbofans, anticipating a long-term transition away from conventional jet fuel dependence, positioning these technologies as crucial future growth vectors within the commercial market.

Regional Highlights

The market dynamics for commercial aero turbofan engines vary significantly across global regions, dictated by fleet age, regulatory environments, economic growth, and the concentration of MRO capabilities. Understanding these regional nuances is vital for strategic market entry and investment decisions, particularly concerning aftermarket service deployment.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, primarily driven by massive expansion in air traffic, the emergence of numerous LCCs, and robust economic activity in Southeast Asia, China, and India. This region exhibits the highest demand for new narrow-body aircraft and the corresponding LEAP and GTF engines. The key focus here is on establishing adequate MRO infrastructure to service the rapidly expanding fleet, often through joint ventures with established Western OEMs. China, specifically, represents a critical area, with its domestic engine programs (e.g., CJ-1000A) aiming for self-sufficiency, influencing long-term import strategies.

- North America: This region is characterized by a mature market with a high volume of MRO activity and significant technological leadership. Demand is largely driven by fleet renewal programs (replacing aging Boeing 737 and Airbus A320 models with MAX and neo variants) and a strong emphasis on engines that offer operational reliability and low maintenance costs due to high labor rates. North America houses the headquarters and core manufacturing facilities of dominant engine OEMs (GE, Pratt & Whitney), establishing it as the center for high-value MRO and engine component intellectual property.

- Europe: Europe is defined by stringent environmental regulations (e.g., noise restrictions and emission goals) and a strong focus on advanced, sustainable technology. The region is a vital hub for major OEMs (Rolls-Royce, Safran, MTU) and major MRO providers (Lufthansa Technik). Demand is steady, focused on adopting next-generation engines that comply with the highest environmental standards and supporting the vast European MRO network. The development of technologies compatible with Sustainable Aviation Fuels (SAF) is a key strategic priority within European research consortia and government-funded projects.

- Middle East and Africa (MEA): The MEA region is crucial for the high-thrust engine segment, driven by major hub carriers (Emirates, Qatar Airways, Etihad) operating extensive wide-body fleets for long-haul international routes. Demand is concentrated on reliable, high-power engines and comprehensive MRO solutions, often secured through performance-based logistics contracts. High temperatures and sand ingestion pose unique operational challenges, driving demand for specialized maintenance procedures and robust air filtration technologies, making this a high-value aftermarket service market.

- Latin America: This region presents a growing yet volatile market, characterized by the expansion of LCCs and reliance on narrow-body aircraft. Growth is sensitive to economic stability and currency fluctuations. The primary focus is on cost-effective MRO solutions and securing competitive financing for engine acquisition. Fleet modernization efforts are ongoing, but adoption rates can be slower than in APAC or North America due to capital constraints, leading to a prolonged reliance on older engine models that require specialized repair and refurbishment services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Aero Turbofan Engine Market.- General Electric (GE Aerospace)

- Rolls-Royce Holdings plc

- Pratt & Whitney (Raytheon Technologies)

- CFM International (Joint venture between GE and Safran)

- Engine Alliance (Joint venture between GE and Pratt & Whitney)

- Safran S.A.

- MTU Aero Engines AG

- IHI Corporation

- Honeywell International Inc.

- StandardAero

- Lufthansa Technik

- China Aero Engine Corporation (AECC)

- SIA Engineering Company

- Chromalloy Gas Turbine LLC

- Triumph Group

- Barnes Group Inc.

- HEICO Corporation

- Woodward Inc.

- Wencor Group

- Aerojet Rocketdyne (L3 Harris)

Frequently Asked Questions

Analyze common user questions about the Commercial Aero Turbofan Engine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for new commercial turbofan engines?

The central driver for new commercial turbofan engine demand is the urgent requirement for enhanced fuel efficiency and lower operational costs mandated by airlines, coupled with regulatory pressure to reduce carbon emissions and noise pollution. Newer generation engines, such as the LEAP and GTF families, offer double-digit percentage improvements in fuel burn over legacy models, making fleet modernization economically compelling and necessary for environmental compliance. Furthermore, the sustained, long-term growth in global Revenue Passenger Kilometers (RPK) necessitates continuous expansion and replacement of the global commercial aircraft fleet.

How is the aerospace industry addressing the environmental impact of turbofan engine operations?

The industry is addressing environmental impact through two main strategies: technological innovation in engine design and operational changes. Design innovation focuses on Ultra-High Bypass Ratio (UHBR) architectures, advanced materials like Ceramic Matrix Composites (CMCs) for hotter, more efficient combustion, and improved thermal management systems. Operationally, the shift involves certifying engines to run on 100% Sustainable Aviation Fuels (SAF), which dramatically reduce lifecycle carbon footprint. Additionally, AI-powered systems optimize flight paths and thrust settings in real-time to minimize fuel burn and emissions during every flight phase, actively working towards industry-wide net-zero targets.

What are the largest revenue segments within the Commercial Aero Turbofan Engine Market?

While the initial sale of new engines (OEM segment) provides large, cyclical revenue streams, the Maintenance, Repair, and Overhaul (MRO) aftermarket segment consistently generates the largest long-term revenue and profit margin over the engine’s typical 30-year operational lifespan. Within MRO, the high-value components requiring frequent replacement or sophisticated repair—specifically the hot section components like the high-pressure turbine blades, combustor liners, and compressor modules—represent the most significant expenditure for airlines, thus forming the core revenue stream for engine OEMs and specialized third-party MRO providers.

What role do long-term service agreements (LTSAs) play in the turbofan market structure?

Long-Term Service Agreements (LTSAs), often structured as 'Power by the Hour' contracts, are crucial to the current turbofan market. These contracts transfer the financial risk and operational burden of maintenance from the airline to the engine OEM. LTSAs provide OEMs with highly predictable, recurring revenue streams and crucial proprietary data on engine health and performance. For airlines, they offer predictable maintenance costs (a fixed fee per flight hour), ensuring operational efficiency and fleet readiness, and strengthening the OEM's control over the high-value spare parts and repair component of the aftermarket, effectively locking in long-term customer relationships.

Which regional market is exhibiting the highest growth rate for turbofan engine adoption, and why?

The Asia Pacific (APAC) region consistently exhibits the highest growth rate for new turbofan engine adoption, primarily driven by demographic and economic factors. Rapid urbanization, the expansion of middle-class populations, and corresponding growth in disposable income fuel an exponential increase in regional and international air travel demand. This demand translates directly into massive aircraft orders from airlines across China, India, and Southeast Asia, requiring significant numbers of new, fuel-efficient narrow-body turbofans to support fleet expansion and the development of extensive low-cost carrier networks throughout the continent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager