Commercial Aircraft Wings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441385 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Commercial Aircraft Wings Market Size

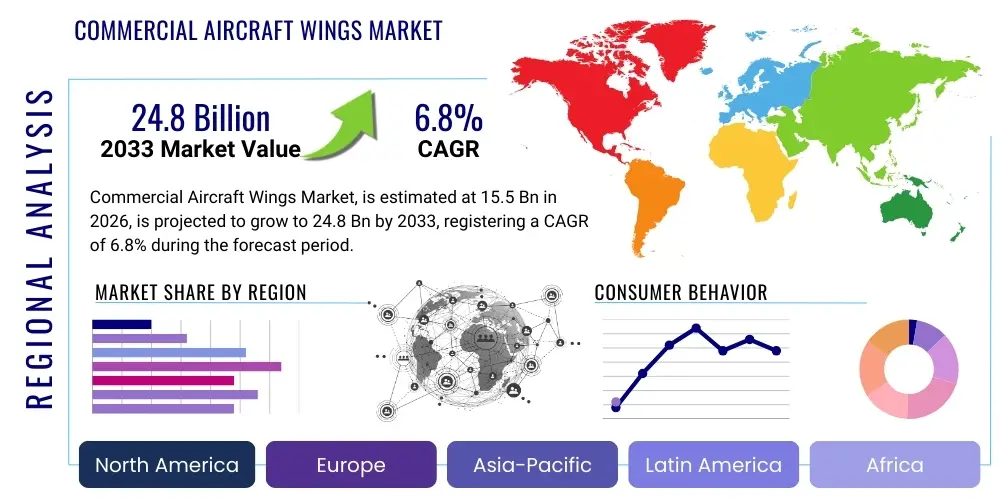

The Commercial Aircraft Wings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 24.8 Billion by the end of the forecast period in 2033.

Commercial Aircraft Wings Market introduction

The Commercial Aircraft Wings Market encompasses the design, manufacturing, assembly, and maintenance of wing structures for passenger, cargo, and regional jets. These complex structures are fundamental to generating lift, managing drag, storing fuel, and housing control surfaces and landing gear components. Modern wing construction emphasizes advanced materials, predominantly carbon fiber reinforced polymers (CFRP) and specialized aluminum alloys, crucial for optimizing weight reduction and enhancing fuel efficiency. The escalating demand for new generation, fuel-efficient aircraft, driven by global air traffic growth and stringent environmental regulations, forms the bedrock of this market's expansion. Furthermore, significant investments in digital manufacturing technologies, such as advanced robotics and automated assembly lines, are defining the competitive landscape, pushing manufacturers toward unprecedented levels of precision and production efficiency.

Product descriptions within this market span several critical components, including the main wing box, winglets, flaps, ailerons, and spoilers. The primary application of these wings is in the assembly of new commercial aircraft across various platforms, including narrow-body, wide-body, and regional aircraft categories. Narrow-body aircraft, dominating the current order books, represent the largest segment due to their high utilization rate in short- and medium-haul routes. The adoption of new wing designs, such as the laminar flow wings or high aspect ratio wings, is accelerating, offering substantial aerodynamic benefits. These innovations directly contribute to the central market benefits: reduced operational costs for airlines, lower carbon emissions, and enhanced structural integrity capable of enduring millions of flight cycles under severe environmental conditions.

The primary driving factors sustaining the commercial aircraft wings sector include the long-term upward trajectory of global air passenger volumes, particularly in the Asia-Pacific region, necessitating massive fleet renewals and expansion programs. Furthermore, the imperative for noise reduction and compliance with ICAO’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) mandates the continuous development of lighter, more aerodynamically sophisticated wings. Geopolitical stability and long-term oil price volatility also push Original Equipment Manufacturers (OEMs) and their suppliers to prioritize lightweight design and advanced manufacturing techniques, suchifying the entire supply chain. The consistent backlogs reported by major aircraft manufacturers, extending well into the next decade, provide robust visibility and stability for the wings manufacturing segment.

Commercial Aircraft Wings Market Executive Summary

The Commercial Aircraft Wings Market executive summary reveals a strategic pivot toward composite material integration and digitalization across the manufacturing lifecycle, significantly impacting long-term business trends. The market dynamics are currently characterized by intense competition among tier-one suppliers vying for crucial contracts on next-generation platforms, emphasizing scalability and risk-sharing partnerships with OEMs. Business trends indicate a concentrated effort to diversify supply chains beyond traditional geographical hubs, mitigating risks associated with trade disputes and localized production disruptions. Furthermore, the growing aftermarket segment, driven by scheduled structural checks, modification programs, and maintenance of aging fleets, is presenting substantial revenue streams, especially for specialized MRO providers focusing on composite repair technologies and structural health monitoring systems.

Regionally, the market exhibits heterogeneity in growth drivers and demand profiles. The Asia-Pacific region is projected to experience the fastest growth due to massive investment in new airport infrastructure, rising middle-class disposable income, and the aggressive expansion plans of low-cost carriers (LCCs). North America and Europe, while representing mature aviation markets, maintain their significance through high-value technological innovation, particularly in advanced materials research and development of future fighter platforms, alongside the robust demand for fleet replacement. Regional trends also highlight the strategic importance of manufacturing hubs in Brazil and China, which are actively cultivating indigenous aerospace industries, increasingly posing competition to established Western suppliers, thereby altering global manufacturing footprints and influencing localized content requirements.

Segmentation trends underscore the dominance of the narrow-body segment by aircraft type, commanding the largest market share due to unparalleled global unit demand. Material segmentation is shifting dramatically towards Carbon Fiber Reinforced Plastics (CFRPs), surpassing traditional aluminum alloys in new large commercial aircraft programs due to superior strength-to-weight ratios. The manufacturing process segment is witnessing rapid adoption of automated fiber placement (AFP) and automated tape laying (ATL) systems, which streamline the composite lay-up process and significantly reduce cycle times. These segment shifts reflect a macro-level focus on minimizing weight and maximizing fuel economy, positioning advanced composite wings as the primary growth vector for the forecast period, driving targeted investments in capacity expansion and robotic automation within supplier facilities.

AI Impact Analysis on Commercial Aircraft Wings Market

User inquiries regarding the application of Artificial Intelligence (AI) in the Commercial Aircraft Wings Market often center on its potential to revolutionize design optimization, predictive maintenance, and quality control during manufacturing. Key themes include how AI algorithms can rapidly iterate through thousands of complex aerodynamic designs inaccessible to traditional simulation methods, leading to unprecedented fuel efficiency gains. Concerns frequently revolve around data security, the high initial investment required for sophisticated sensor deployment on factory floors, and the workforce adaptation necessary to manage AI-driven systems. Users are keenly interested in how machine learning can forecast component failure with high accuracy, thus optimizing maintenance schedules and reducing costly Aircraft On Ground (AOG) time, ultimately expecting AI to lead to a significant reduction in waste, improved structural integrity monitoring, and expedited certification processes for novel wing designs.

- Enhanced Generative Design: AI algorithms optimize wing topology for superior lift-to-drag ratios and reduced material consumption.

- Predictive Maintenance (Pdm): Machine learning models analyze real-time flight data (stress, vibration, temperature) to predict structural fatigue and necessary wing repairs.

- Automated Quality Inspection: Computer vision and AI-powered robotics perform high-speed, non-destructive testing (NDT) of composite panels for micro-defects during production.

- Optimized Manufacturing Scheduling: AI manages complex supply chain logistics, minimizing bottlenecks in large-scale composite component production and assembly.

- Material Performance Prediction: AI models accelerate the development and certification process for new composite materials by simulating long-term degradation and stress resistance.

- Real-time Aerodynamic Load Adjustment: Future AI integration allows wings to dynamically adjust control surfaces based on instantaneous atmospheric conditions for optimal efficiency.

DRO & Impact Forces Of Commercial Aircraft Wings Market

The Commercial Aircraft Wings Market is primarily driven by the consistent growth in global air travel, massive fleet modernization requirements by major airlines, and relentless pressure to reduce operational costs through fuel efficiency improvements. Restraints primarily revolve around the stringent regulatory approval cycles, the high upfront capital expenditure required for advanced composite manufacturing facilities, and the inherent volatility of the aerospace supply chain, which can be susceptible to program delays or raw material price fluctuations. Opportunities lie prominently in the development of disruptive technologies, particularly in additive manufacturing (3D printing) of complex metallic components for internal wing structures and the utilization of sustainable aviation fuels (SAFs), which necessitate lighter, structurally sounder wings to maximize payload capacity. These factors collectively create significant impact forces, where technological superiority and robust quality control determine market leadership and financial viability.

Key drivers include the substantial order backlog for narrow-body aircraft families (e.g., Airbus A320neo and Boeing 737 MAX), which mandates sustained high-rate production of wing sets over the next 10-15 years. The accelerating retirement of older, less efficient aircraft, spurred by global net-zero carbon pledges, further fuels the demand for new wings designed using advanced aerodynamic principles. However, the market faces significant restraints, including the complexity and cost of repairing composite structures in the aftermarket, requiring specialized training and equipment, which limits MRO competitiveness. Furthermore, geopolitical tensions and trade protectionism can disrupt international aerospace collaboration agreements, affecting long-term stability and technology transfer across borders, thereby slowing the adoption of cutting-edge wing technologies.

Opportunities for growth are concentrated in the burgeoning regional jet segment, particularly in developing economies, demanding optimized smaller wings for short-haul operations. There is also a substantial opportunity in developing multifunctional wing structures that integrate sensor networks for real-time monitoring of structural health and performance, transitioning the industry toward truly smart wings. The five impact forces (Porter's Five Forces analysis context) reveal high bargaining power of buyers (major OEMs like Airbus and Boeing) due to the limited number of customers, balanced by high barriers to entry for new suppliers due to steep certification requirements and significant sunk costs. Supplier bargaining power is moderate but increasing, especially for specialized composite material producers, making innovation and strategic sourcing critical determinants of profitability.

Segmentation Analysis

The Commercial Aircraft Wings Market is comprehensively segmented based on crucial criteria including aircraft type, material composition, and the manufacturing process employed, reflecting the diverse technological pathways and demand profiles within the aviation industry. This multi-dimensional segmentation allows for granular analysis of market trends, revealing that while narrow-body platforms continue to dominate volume demand, wide-body aircraft often represent higher average revenue per unit due to their complex structure and larger size. The transition from monolithic metallic wings to composite wings represents the most pivotal segmentation shift, dictating long-term investment strategies in plant machinery and workforce skills. Understanding these segments is vital for suppliers to align their production capabilities with OEM requirements and emerging technological standards.

- By Aircraft Type:

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Aircraft

- Military Transport and Tanker Aircraft (Commercial Derivative)

- By Material:

- Aluminum Alloys (e.g., 7000 Series)

- Carbon Fiber Reinforced Polymer (CFRP)

- Hybrid Materials

- Others (e.g., Titanium Alloys)

- By Component:

- Main Wing Box (Primary Structure)

- Control Surfaces (Flaps, Ailerons, Spoilers)

- Winglets and Sharklets

- Engine Mounts/Pylons (integrated structures)

- By Manufacturing Process:

- Automated Fiber Placement (AFP)

- Resin Transfer Molding (RTM)

- Additive Manufacturing (AM) for brackets and ribs

- Traditional Machining and Assembly

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Maintenance, Repair, and Overhaul (MRO) Providers

- Airlines and Operators

Value Chain Analysis For Commercial Aircraft Wings Market

The value chain for commercial aircraft wings is inherently complex and capital-intensive, starting with the upstream supply of specialized raw materials, primarily aerospace-grade carbon fiber and advanced metallic billets. Upstream analysis focuses on chemical companies and material specialists who provide high-modulus, high-strength carbon fiber prepregs or specific aluminum and titanium alloys compliant with rigorous aviation standards. This stage is characterized by high material costs, stringent quality control, and long qualification processes, making supplier relationships critical for ensuring material consistency and mitigating supply risk. Consolidation in the material supply segment is common, granting substantial bargaining power to key providers of proprietary composite systems or advanced lightweight metals necessary for next-generation wing structures.

The midstream segment involves Tier 1 suppliers and major OEMs responsible for detailed design, complex component fabrication (e.g., composite lay-up, curing in massive autoclaves, high-precision machining of spars and ribs), and final structural assembly. The distribution channel is predominantly direct, as wing sets are massive, highly engineered sub-assemblies delivered directly from the Tier 1 facility (e.g., Spirit AeroSystems, GKN Aerospace) or the OEM's subsidiary to the final aircraft assembly line. Indirect distribution plays a limited role but includes specialized logistics providers managing the complex, often oversized transportation of finished wing structures, ensuring zero-damage delivery across international borders. The midstream is characterized by intense automation, high capital investment in tooling and robotics, and significant program risk management.

Downstream analysis focuses on the end-users: the aircraft OEMs, who integrate the wings into the final aircraft structure, and the Maintenance, Repair, and Overhaul (MRO) sector. Aftermarket services constitute a crucial segment of the downstream value chain, involving structural health monitoring, mandated periodic inspections, and repair/replacement of components throughout the aircraft’s 30-year operational life. Specialized MRO providers focusing on advanced composite repair techniques are gaining prominence, as wing structures increasingly utilize complex, non-metallic materials. The integrity and lifespan of the wing are directly tied to MRO efficiency, thus creating a stable, long-term revenue stream distinct from the cyclical new aircraft delivery market.

Commercial Aircraft Wings Market Potential Customers

The core potential customers and end-users of commercial aircraft wings are the major global Original Equipment Manufacturers (OEMs) of commercial aircraft, notably Airbus, Boeing, Embraer, and COMAC. These entities represent the primary purchasers of new wing assemblies, either fabricated in-house or sourced from Tier 1 risk-sharing partners who design and produce the wings as significant subsections of the aircraft program. Their demand profiles are dictated by their long-term order backlogs, production ramp-up schedules, and requirements for meeting stringent performance and weight targets. For suppliers, securing a contract with an OEM is a multi-decade commitment, demanding substantial financial backing, proven technical expertise, and impeccable quality assurance, making OEMs the most critical customer segment in terms of volume and strategic importance.

The second major category of buyers includes global airlines and dedicated aircraft operators (both cargo and passenger), who become customers indirectly upon aircraft acquisition and directly through the need for Maintenance, Repair, and Overhaul (MRO) services throughout the operational life of their fleet. Airlines necessitate continuous access to certified wing parts, repairs, and structural modifications (e.g., winglet retrofits) to ensure airworthiness and minimize aircraft downtime. Their purchasing decisions in the aftermarket are heavily influenced by regulatory compliance, cost optimization, and the reliability of service providers. The transition to advanced composite wings, which require highly specialized repair skills, is driving airlines to seek out MRO facilities with certifications and experience in these novel materials, thereby redefining the customer profile in the services segment.

A specialized subset of customers includes independent MRO providers and major defense/government entities operating commercial derivative aircraft (e.g., tanker or transport versions based on Boeing 767 or Airbus A330 platforms). Independent MROs act as intermediaries, procuring spare wing components and repair kits from certified suppliers or OEMs to service the global fleet. Furthermore, leasing companies, which own large portions of the global fleet, indirectly influence demand by dictating maintenance standards and requiring extensive documentation regarding wing integrity during aircraft transitions. These customers prioritize long-term cost of ownership, maintainability, and availability of structural spares, focusing the supply chain on longevity and ease of inspection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 24.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Airbus SE, The Boeing Company, Spirit AeroSystems Holdings Inc., GKN Aerospace (Melrose Industries PLC), Leonardo S p A, Mitsubishi Heavy Industries Ltd, Fuji Heavy Industries Ltd, Kawasaki Heavy Industries Ltd, Korea Aerospace Industries Ltd (KAI), Safran SA, United Technologies Corporation (Raytheon Technologies), Triumph Group Inc., Aernnova Aerospace SA, Israel Aerospace Industries (IAI), Bombardier Inc., Commercial Aircraft Corporation of China Ltd (COMAC), Turkish Aerospace Industries (TAI), Hellenic Aerospace Industry, Hindustan Aeronautics Limited (HAL), Liebherr-Aerospace. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Aircraft Wings Market Key Technology Landscape

The technological landscape of commercial aircraft wings is rapidly evolving, driven primarily by the shift towards ultra-lightweight and structurally resilient materials, led by Carbon Fiber Reinforced Polymers (CFRPs). Modern wing designs utilize these advanced composites not just for skins but increasingly for internal structures like spars and ribs, necessitating sophisticated manufacturing processes such as Automated Fiber Placement (AFP) and Automated Tape Laying (ATL). These robotic systems ensure precise material deposition, minimizing void content and maximizing structural integrity, which is crucial for achieving high aspect ratios required for improved aerodynamic efficiency. Furthermore, the integration of advanced non-destructive testing (NDT) techniques, including phased array ultrasonic testing (PAUT) and thermography, is becoming standard practice to maintain zero-defect standards in large composite primary structures, directly impacting the safety and certification process.

Another pivotal technological advancement involves the increasing adoption of Additive Manufacturing (AM) or 3D printing for producing complex metallic components used within the wing structure, such as brackets, hinges, and smaller assemblies. While large primary structures are still fabricated through traditional means, AM allows for radical optimization of internal geometries, leading to parts that are significantly lighter than their traditionally machined counterparts while maintaining or exceeding strength requirements. This shift reduces the buy-to-fly ratio and decreases logistical complexity. Moreover, advancements in bonding and joining technologies, moving away from heavy fasteners towards specialized adhesive systems for primary structures, are crucial for composite integration, enabling smoother aerodynamic surfaces and lighter assemblies, demanding precise environmental controls and robotic application processes.

Digitalization and the concept of the "smart wing" represent the frontier of this technological landscape. This involves embedding arrays of fiber optic sensors (FOS) and micro-electromechanical systems (MEMS) throughout the wing structure during layup (Structural Health Monitoring or SHM). These sensors continuously monitor stress, temperature, strain, and fatigue in real-time during flight, feeding data into predictive maintenance systems. This digital integration allows for condition-based maintenance rather than fixed scheduled maintenance, reducing operational costs and potentially extending the life of the wing. Furthermore, advanced computational fluid dynamics (CFD) and AI-driven generative design tools are optimizing aerodynamic shapes to exploit laminar flow principles more effectively, pushing the boundaries of what is possible in fuel economy and performance metrics for future aircraft programs.

Regional Highlights

- North America: This region maintains a strong market presence driven by the colossal manufacturing footprint of The Boeing Company and key Tier 1 suppliers like Spirit AeroSystems and Triumph Group. North America leads in R&D, particularly concerning advanced metallic materials, high-speed automated manufacturing, and military derivative wings. The region’s aftermarket MRO sector is highly advanced, specializing in complex repairs for both legacy aluminum and modern composite wings, supported by extensive military and commercial fleet operations, ensuring sustained demand for technological innovation and capacity.

- Europe: Europe is a dominant hub, anchored by Airbus SE and significant Tier 1 partners such as GKN Aerospace, Leonardo, and Safran. The European market is characterized by a high degree of international collaboration and a leading role in sustainable aviation initiatives, driving investment in ultra-efficient wing designs like high aspect ratio wings and laminar flow technology. Strict environmental mandates accelerate the transition toward 100% composite primary structures, positioning countries like the UK, France, and Germany as key centers for composite fabrication and wing assembly expertise.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by unprecedented growth in air passenger traffic, particularly in China and India, and the subsequent aggressive fleet expansion of airlines. China, driven by COMAC's C919 program, is rapidly developing indigenous wing manufacturing capabilities, emphasizing self-sufficiency and high-rate local production. The sheer scale of new aircraft deliveries required to meet regional demand ensures that APAC becomes a crucial market for both wing manufacturing capacity investment and subsequent MRO services over the forecast period.

- Latin America: While smaller than other regions, Latin America plays a strategic role primarily due to Embraer, a significant regional jet manufacturer. The market here focuses on optimized wing designs for regional and specialized short-haul aircraft. Market growth is stable, often linked to inter-regional trade and tourism, but is susceptible to regional economic volatility. Suppliers targeting this area must meet specific requirements related to ruggedized designs suitable for challenging operational environments.

- Middle East and Africa (MEA): Demand in the MEA region is heavily concentrated in the Middle East, driven by the expansion of major international carriers (Emirates, Qatar Airways, Etihad) operating large wide-body fleets. This results in significant demand for large, complex wide-body wing sets. Africa's market is primarily focused on MRO services for aging fleets and infrastructure improvements, necessitating robust supply chains for maintenance and structural part replacements, often relying on global MRO service providers due to limited local high-tech repair capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Aircraft Wings Market.- Airbus SE

- The Boeing Company

- Spirit AeroSystems Holdings Inc.

- GKN Aerospace (Melrose Industries PLC)

- Leonardo S p A

- Mitsubishi Heavy Industries Ltd

- Fuji Heavy Industries Ltd

- Kawasaki Heavy Industries Ltd

- Safran SA

- United Technologies Corporation (Raytheon Technologies)

- Triumph Group Inc.

- Aernnova Aerospace SA

- Israel Aerospace Industries (IAI)

- Bombardier Inc.

- Commercial Aircraft Corporation of China Ltd (COMAC)

- Turkish Aerospace Industries (TAI)

- Hellenic Aerospace Industry

- Hindustan Aeronautics Limited (HAL)

- Liebherr-Aerospace

- Korea Aerospace Industries Ltd (KAI)

Frequently Asked Questions

Analyze common user questions about the Commercial Aircraft Wings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary materials used in manufacturing modern commercial aircraft wings?

The primary materials are advanced Carbon Fiber Reinforced Polymers (CFRPs), which offer superior strength-to-weight ratios for new generation aircraft, and high-performance aluminum alloys (like 7000 series) still heavily used in traditional structures and some narrow-body wing components. Titanium is used selectively for high-stress fittings.

How is the adoption of composites impacting the commercial wing MRO segment?

The increasing adoption of composites is significantly elevating the complexity and cost of Maintenance, Repair, and Overhaul (MRO). Composite wing repair requires specialized facilities, highly trained technicians, and unique bonding/curing processes, necessitating strategic investments by MRO providers in specialized composite repair technologies.

Which aircraft segment drives the highest volume demand for new wing sets?

The narrow-body aircraft segment (e.g., Airbus A320 family and Boeing 737 family) drives the highest volume demand globally. These high-rate production programs are the backbone of the commercial wing market due to their massive order backlogs and frequent use in short- and medium-haul routes worldwide.

What is the role of Additive Manufacturing (AM) in commercial aircraft wing production?

Additive Manufacturing (3D printing) is predominantly used to produce complex, lightweight metallic components within the wing, such as brackets, ribs, and non-structural parts. AM enables significant weight reduction and geometric optimization, enhancing overall fuel efficiency, though it is not yet used for primary load-bearing structures.

What are the key technological advancements expected in future wing designs?

Future wing designs are expected to incorporate active flutter suppression systems, laminar flow control technologies to reduce drag, embedded Structural Health Monitoring (SHM) sensors for predictive maintenance, and highly flexible, high aspect ratio wing geometries optimized through AI-driven generative design methods to maximize aerodynamic performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager