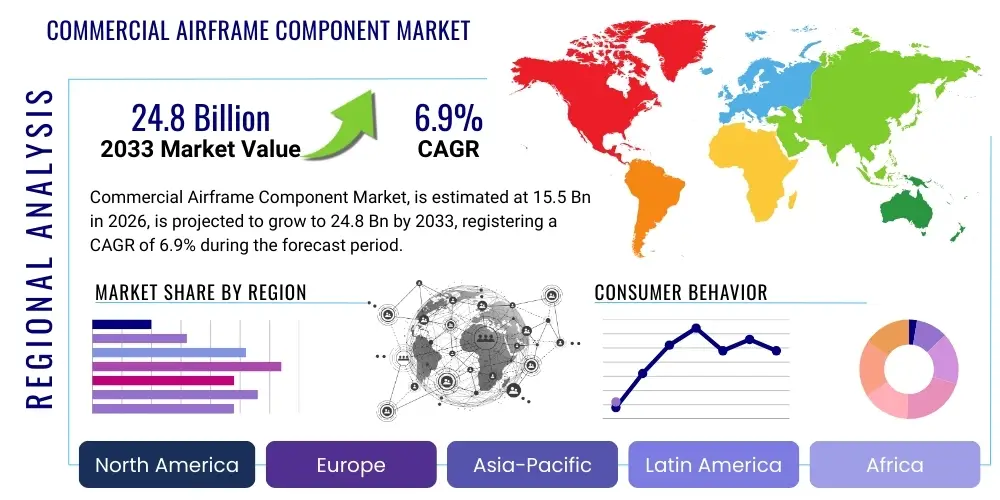

Commercial Airframe Component Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443147 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Commercial Airframe Component Market Size

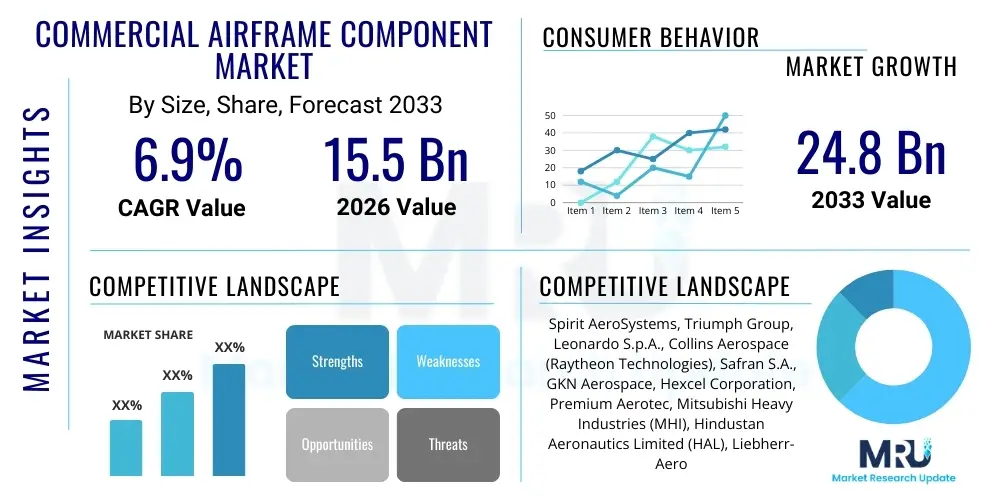

The Commercial Airframe Component Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 24.8 Billion by the end of the forecast period in 2033. This sustained growth is primarily attributed to the robust recovery of commercial air travel globally, coupled with massive order backlogs for new-generation, fuel-efficient aircraft, necessitating consistent production and supply chain scaling for structural airframe elements.

Commercial Airframe Component Market introduction

The Commercial Airframe Component Market encompasses the design, manufacturing, and supply of structural elements crucial for the integrity and functionality of commercial aircraft, including fuselage sections, wing assemblies, empennage (tail sections), landing gear systems, and control surfaces. These components are vital for ensuring aerodynamic efficiency, structural safety, and operational performance across narrow-body, wide-body, and regional jet platforms. The primary applications span original equipment manufacturing (OEM) for new aircraft production and the robust Maintenance, Repair, and Overhaul (MRO) sector, driven by aging fleet requirements and mandated structural integrity checks.

The fundamental benefits derived from high-quality airframe components include enhanced aircraft fuel efficiency through the incorporation of lightweight, advanced composite materials like Carbon Fiber Reinforced Polymers (CFRP), improved fatigue life, and superior corrosion resistance compared to traditional metallic structures. Furthermore, modern component design focuses heavily on modularity and ease of maintenance, reducing aircraft turnaround times and operational costs for airlines. Key driving factors propelling this market include global airline fleet modernization initiatives, particularly in high-growth regions like Asia Pacific, the increasing demand for high-load, high-strength titanium alloys, and the continuous technological advancements in aerospace manufacturing processes, such as additive manufacturing and advanced robotics.

The market environment is characterized by stringent regulatory requirements, extremely long product life cycles (often exceeding 30 years), and a highly concentrated supply chain dominated by Tier 1 suppliers specializing in specific structural segments. The shift toward single-aisle aircraft, which form the backbone of global commercial fleets, strongly influences the demand profile for components such as wing boxes and fuselage panels. As manufacturers strive to reduce weight and complexity, the integration of smart components equipped with sensors for real-time structural health monitoring (SHM) is emerging as a significant trend, transforming component design from passive structure into active systems.

Commercial Airframe Component Market Executive Summary

The Commercial Airframe Component Market is poised for substantial expansion, underpinned by cyclical peaks in new aircraft deliveries and strategic investments in MRO infrastructure. Current business trends indicate a strong prioritization among OEMs and Tier 1 suppliers toward vertical integration and resilience building within the supply chain, largely as a response to post-pandemic disruptions and geopolitical instability affecting raw material access. Furthermore, there is a pronounced push towards sustainable manufacturing practices, focusing on reducing waste and improving energy efficiency in component production, aligning with broader industry goals for achieving net-zero carbon emissions in aviation operations.

Regionally, the Asia Pacific (APAC) market is expected to exhibit the highest growth rate, fueled by substantial passenger traffic expansion, the establishment of major airline hubs in China and India, and corresponding massive infrastructure investment in local MRO facilities capable of handling complex airframe maintenance. North America and Europe, while mature, remain dominant centers for high-value component manufacturing, innovation in materials technology, and intellectual property development, driven by the presence of key industry giants like Boeing, Airbus, and leading Tier 1 suppliers. Latin America and the Middle East continue to offer lucrative opportunities, primarily through fleet expansion and modernization programs requiring steady component replacements and upgrades.

Segmentation trends highlight the increasing dominance of advanced composite materials over traditional aluminum alloys, especially in newly designed wide-body platforms where weight reduction is paramount for long-haul efficiency. By component type, the fuselage and wing structure segments retain the largest market share due to their sheer size and structural criticality, but the market for specialized components like landing gear systems and auxiliary power unit (APU) enclosures is also expanding rapidly, driven by the need for enhanced durability and shock absorption capabilities. The end-user segment is increasingly favoring long-term component supply agreements (CSAs) between airlines and MRO providers, ensuring predictable component lifecycle management and operational reliability.

AI Impact Analysis on Commercial Airframe Component Market

User queries regarding AI's influence in the Commercial Airframe Component Market primarily revolve around how machine learning can enhance production quality control, optimize complex supply chain logistics for critical structural parts, and revolutionize aircraft structural health monitoring (SHM). Key concerns focus on the reliability and certification of AI-driven inspection systems, the need for skilled labor to manage and interpret vast datasets generated by intelligent components, and the potential impact of autonomous systems on traditional manufacturing jobs. Users expect AI to reduce defects in highly intricate composite layups, predict component failure with greater accuracy than current probabilistic models, and automate the identification of geometric deviations during assembly, ultimately accelerating the time-to-market for complex components.

The integration of Artificial Intelligence is moving the component manufacturing paradigm toward predictive maintenance and smart factory concepts. In manufacturing, AI algorithms analyze real-time data from industrial IoT sensors on machinery, allowing for dynamic adjustment of parameters (temperature, pressure, speed) during the molding and machining of composite and metallic parts, drastically reducing material waste and improving first-pass yield rates. This application of AI minimizes tolerance stack-up issues, which are historically challenging in large-scale airframe assembly, thereby ensuring components meet the extremely rigorous standards required for flight safety and structural integrity.

Furthermore, AI significantly impacts the operational lifespan and MRO phase of airframe components. By leveraging deep learning models trained on decades of flight data, maintenance logs, and sensor inputs, AI systems can accurately forecast the remaining useful life (RUL) of high-stress components like wing spars and landing gear axles. This shift from calendar-based or flight-cycle-based maintenance schedules to true condition-based monitoring reduces unnecessary component replacements, lowers MRO costs for airlines, and maximizes aircraft availability, representing a fundamental efficiency gain across the entire aviation value chain.

- AI-driven predictive maintenance (PDM) for component lifecycle management.

- Optimization of complex airframe component supply chain logistics using machine learning.

- Automated visual inspection and non-destructive testing (NDT) using computer vision.

- Generative design and topology optimization for lightweight structural components.

- Real-time structural health monitoring (SHM) anomaly detection in composite structures.

- Enhanced quality control in additive manufacturing processes for metallic components.

DRO & Impact Forces Of Commercial Airframe Component Market

The dynamics of the Commercial Airframe Component Market are shaped by a complex interplay of systemic drivers, inherent structural restraints, emerging technological opportunities, and macro-level impact forces. A primary driver is the unprecedented backlog of new aircraft orders, particularly from Airbus and Boeing, which necessitate high-volume component production over the next decade. Complementing this is the cyclical demand generated by the global MRO sector, fueled by the imperative to refurbish and maintain an aging global fleet, especially for popular models like the Boeing 737NG and Airbus A320ceo family. These factors collectively push manufacturers to invest heavily in advanced production capabilities and supply chain scaling.

However, significant restraints temper this expansion. The aviation sector faces persistent supply chain volatility, particularly regarding critical aerospace-grade raw materials such as titanium, high-performance aluminum alloys, and carbon fiber precursors, leading to extended lead times and fluctuating component costs. Additionally, the lengthy and highly rigorous regulatory certification process (FAA, EASA) for new materials or component designs poses a substantial barrier to entry and slows down the integration of innovative technologies like advanced additive manufacturing. The scarcity of specialized labor skilled in handling advanced composites and precision machining further constraints rapid capacity expansion.

Opportunities for growth are concentrated in the areas of material science and manufacturing technology. The continuous development of thermoplastic composites and advanced metal matrix composites offers the potential for components that are lighter, stronger, and more recyclable, addressing industry sustainability goals. Moreover, the integration of 3D printing (Additive Manufacturing) for tooling, prototyping, and eventually, certified end-use parts (especially non-structural or internal engine components) presents a key opportunity to reduce waste and complexity in the manufacturing process. Impact forces, such as global economic trends, geopolitical stability (affecting air traffic and defense spending), and fuel price fluctuations, exert substantial influence by determining airline profitability and, consequently, their capital expenditure on new aircraft and component maintenance.

Segmentation Analysis

The Commercial Airframe Component Market is meticulously segmented based on key structural criteria, including the type of material used, the specific component's function, the aircraft platform it serves, and the end-user market. This segmentation is crucial for understanding demand patterns, technological maturity, and competitive dynamics across different market niches. The diversity in component requirements, ranging from high-stress metallic landing gear structures to large-area composite wing skins, mandates distinct supply chain and manufacturing expertise for each segment. Analysts rely on these detailed segmentations to predict shifts in material preference, such as the accelerating adoption of composite structures in single-aisle jets, previously dominated by aluminum alloys.

By defining the market along these specific parameters, stakeholders can pinpoint high-growth areas. For example, the wide-body platform segment, while smaller in volume than narrow-body, commands higher component average selling prices (ASPs) due to the size, complexity, and advanced material requirements of parts like center wing boxes and large fuselage barrels. Similarly, the end-user segmentation between OEM and MRO dictates whether the demand is driven by new delivery schedules (OEM) or the operational lifespan and maintenance cycles of existing aircraft (MRO). The ongoing trend toward fleet renewal ensures sustained demand across both segments, though MRO component demand is often more resilient to short-term economic downturns.

- By Material:

- Aluminum Alloys

- Titanium Alloys

- Steel Alloys

- Composite Materials (CFRP, GFRP)

- Specialty Materials

- By Component Type:

- Fuselage Structure Components (Panels, Frames, Bulkheads)

- Wing Structure Components (Spars, Ribs, Winglets, Control Surfaces)

- Empennage Components (Horizontal and Vertical Stabilizers)

- Landing Gear Systems and Components

- Doors and Access Panels

- Pylons and Nacelles

- By Aircraft Platform:

- Narrow-body Aircraft (e.g., A320 Family, B737 Family)

- Wide-body Aircraft (e.g., B787, A350, B777, A380)

- Regional Jets

- General Aviation

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Maintenance, Repair, and Overhaul (MRO) Providers

Value Chain Analysis For Commercial Airframe Component Market

The value chain for commercial airframe components is characterized by a multi-tiered, complex structure that begins with the extraction and processing of raw materials and culminates in the final integration into the aircraft by the OEM. The upstream segment involves the production of critical aerospace-grade materials, specifically the suppliers of high-purity aluminum ingots, titanium sponge, specialized steel alloys, and high-tensile carbon fiber and resin systems. Control over these specialized raw materials is often highly concentrated and subject to global trade dynamics, making upstream supply resilience a key strategic concern for all subsequent tiers in the chain.

The midstream comprises Tier 1 suppliers (System Integrators) and Tier 2/3 component manufacturers. Tier 1 companies, such as Spirit AeroSystems or Leonardo, often take responsibility for designing, manufacturing, and delivering major structural sub-assemblies (e.g., fuselage sections or wing boxes) directly to OEMs. Tier 2 and Tier 3 suppliers specialize in specific processes, such as precision machining, forging, casting, and advanced composite layup, providing detailed parts and smaller assemblies to the Tier 1 integrators. This part of the chain requires intensive capital expenditure in specialized machinery, stringent quality assurance protocols, and strict adherence to aerospace manufacturing standards.

The downstream activities involve the OEM assembly process, where components are integrated into the final aircraft structure, followed by distribution and after-market support. Direct distribution channels are prevalent, involving long-term contracts between Tier 1 suppliers and OEMs (Airbus/Boeing). Indirect channels are dominated by MRO providers and part distributors who supply replacement components to airlines globally. The aftermarket (MRO) is a highly profitable segment, emphasizing inventory management, fast logistics, and certified repair capabilities to ensure rapid return-to-service for grounded aircraft. Digitalization, particularly through secure blockchain applications, is increasingly being explored to enhance traceability and authenticity verification throughout this extensive supply chain.

Commercial Airframe Component Market Potential Customers

The primary customers in the Commercial Airframe Component Market fall into two distinct but interconnected categories: the Original Equipment Manufacturers (OEMs) who drive new component demand, and the Maintenance, Repair, and Overhaul (MRO) facilities, including airlines themselves, which drive aftermarket and replacement component demand. OEMs such as Boeing, Airbus, Embraer, and COMAC represent the largest volume purchasers, requiring consistently high volumes of precision-engineered components for their production lines. Their purchasing decisions are driven by production rate forecasts, cost-efficiency, weight reduction targets, and the ability of suppliers to meet stringent quality and delivery schedules for multi-year contracts.

The MRO segment encompasses specialized third-party MRO providers (e.g., Lufthansa Technik, SIA Engineering), independent component repair shops, and the internal maintenance divisions of major global airlines (e.g., Delta TechOps, Air France Industries KLM Engineering & Maintenance). These customers purchase replacement components, structural repair kits, and modification components. Their purchasing rationale is centered on reliability, certified component lifecycles, and competitive pricing for parts that must comply with original design specifications (PMA or OEM parts). The demand from MRO providers is generally steadier than OEM demand, acting as a stabilizing factor in the overall market cycle.

A third category of potential buyers includes component distributors and lessors. Component distributors serve as intermediaries, stocking authorized parts and providing logistical support to smaller airlines or MROs globally, ensuring rapid access to critical spares. Aircraft lessors, who own a significant portion of the global fleet, also influence component demand by stipulating maintenance contracts and ensuring their leased aircraft comply with high maintenance standards, often requiring certified OEM or authorized parts replacement upon lease return.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 24.8 Billion |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spirit AeroSystems, Triumph Group, Leonardo S.p.A., Collins Aerospace (Raytheon Technologies), Safran S.A., GKN Aerospace, Hexcel Corporation, Premium Aerotec, Mitsubishi Heavy Industries (MHI), Hindustan Aeronautics Limited (HAL), Liebherr-Aerospace, Kawasaki Heavy Industries, Aernnova Aerospace S.A., FACC AG, UTC Aerospace Systems, Senior plc, Norsk Titanium AS, Constellium SE, Alcoa Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Airframe Component Market Key Technology Landscape

The technology landscape governing the Commercial Airframe Component Market is currently undergoing a rapid transformation, moving away from traditional subtractive manufacturing towards integrated, digitalized production systems focused on reducing weight, improving strength-to-weight ratios, and enhancing component durability. A primary technological focus is on advanced material processing, particularly the refinement of Automated Fiber Placement (AFP) and Automated Tape Laying (ATL) technologies for large-scale composite structures (wings, fuselage sections). These technologies allow for precise, repeatable layup of carbon fiber reinforced plastics (CFRP), minimizing manual labor and ensuring structural consistency critical for airworthiness certification.

Another pivotal technological advancement is the integration of Additive Manufacturing (AM), or 3D printing, for both metallic and polymer components. While not yet widespread for primary load-bearing structures, AM is rapidly maturing for applications in complex internal components, non-critical brackets, tooling, and specialized replacement parts in the MRO segment. Specifically, techniques like Electron Beam Melting (EBM) and Laser Powder Bed Fusion (LPBF) are used with aerospace alloys (e.g., Titanium, Nickel-based superalloys) to produce near-net-shape components, significantly reducing material waste and lead times compared to traditional forging and machining processes. The ability of AM to create topology-optimized designs contributes directly to the overall goal of aircraft weight reduction.

Furthermore, the market is adopting Industry 4.0 principles, integrating sensors (Industrial IoT) and robotics throughout the production line. Advanced robotics are crucial for high-precision operations such as drilling thousands of fastener holes on wing and fuselage assemblies, minimizing human error and improving geometric accuracy. Automated Non-Destructive Testing (NDT) systems, utilizing advanced ultrasound and phased array inspection techniques combined with AI image analysis, are becoming standard for detecting microscopic flaws in composite and metallic structures. This digital thread approach, linking design (CAD/PLM) to manufacturing (MES) and final quality control, ensures comprehensive traceability and streamlined certification processes, which are vital for maintaining competitive advantage in this capital-intensive sector.

Regional Highlights

- North America: North America, particularly the United States, remains a dominant force in the global airframe component market, serving as the primary hub for advanced research, material development, and manufacturing of high-value components. The region benefits significantly from the strong presence of major OEMs (Boeing) and leading Tier 1 suppliers (Spirit AeroSystems, Collins Aerospace), driving immense demand for complex structural assemblies, particularly for wide-body platforms like the 787 and 777X programs. Robust defense spending also spurs innovation that frequently translates into commercial aviation applications, especially in composite and titanium processing.

- Europe: Europe holds a comparable position to North America, anchored by the operational scale of Airbus and its extensive supply chain network across countries like Germany, France, Spain, and the UK. The European market leads in the technological adoption of advanced composite structures (A350 component production) and sustainable aviation initiatives. Significant MRO activity and the development of next-generation aircraft propulsion systems further solidify Europe's role, with a strong focus on regulatory harmonization (EASA) and supply chain resilience within the Eurozone.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive growth in air passenger traffic, massive fleet expansion among carriers in China, India, and Southeast Asia, and strategic government investments in indigenous aerospace manufacturing capabilities (e.g., China’s COMAC programs). While currently a major consumer and MRO center, APAC is rapidly evolving into a significant manufacturing base for components, leveraging lower operational costs and increasing technological transfer to localize production and service critical fleet maintenance demands.

- Middle East and Africa (MEA): The MEA region is characterized by substantial demand derived from large-scale airline fleet modernization programs (e.g., Emirates, Qatar Airways), particularly for wide-body components necessary for long-haul routes. The region is increasingly investing in establishing world-class MRO hubs to service global fleets passing through major transit points, creating a strong market for structural component repair and replacement services, often procured through international suppliers and distributor networks.

- Latin America: Latin America represents a growing market, driven largely by the expansion of low-cost carriers (LCCs) and regional jet operators, which necessitates steady component supply for narrow-body aircraft. Brazil, home to Embraer, maintains a domestic manufacturing base for regional jet components, but the wider regional market relies heavily on imports from North America and Europe for advanced materials and high-value structural parts required for MRO activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Airframe Component Market.- Spirit AeroSystems

- Triumph Group

- Leonardo S.p.A.

- Collins Aerospace (Raytheon Technologies)

- Safran S.A.

- GKN Aerospace

- Hexcel Corporation

- Premium Aerotec

- Mitsubishi Heavy Industries (MHI)

- Hindustan Aeronautics Limited (HAL)

- Liebherr-Aerospace

- Kawasaki Heavy Industries

- Aernnova Aerospace S.A.

- FACC AG

- Senior plc

- Norsk Titanium AS

- Constellium SE

- Alcoa Corporation

- Parker Hannifin Corporation

- Viking Aerospace

Frequently Asked Questions

Analyze common user questions about the Commercial Airframe Component market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Commercial Airframe Component Market?

The market is primarily driven by the large, ongoing backlog of new commercial aircraft orders globally, requiring sustained high-volume component manufacturing, and robust demand from the Maintenance, Repair, and Overhaul (MRO) sector due to aging aircraft fleets and mandatory structural inspections.

How are advanced composite materials impacting airframe component manufacturing?

Advanced composite materials, such as Carbon Fiber Reinforced Polymers (CFRP), are crucial for reducing aircraft weight, improving fuel efficiency, and enhancing corrosion resistance. Their adoption necessitates significant investment in Automated Fiber Placement (AFP) and specialized manufacturing technologies to maintain structural integrity and airworthiness standards.

Which geographical region exhibits the fastest growth potential for airframe components?

The Asia Pacific (APAC) region is projected to register the fastest market growth. This expansion is fueled by unprecedented air passenger traffic increases, substantial fleet expansion, and increasing government initiatives focused on developing domestic aerospace and MRO capabilities, particularly in China and India.

What is the role of Additive Manufacturing (3D printing) in this market?

Additive Manufacturing is transforming the market by enabling the production of highly complex, topology-optimized components and specialized tooling with less material waste. While used initially for prototypes and non-critical parts, AM is rapidly moving toward certified end-use components, offering significant benefits in lead time reduction and supply chain flexibility, especially within the MRO segment.

What are the main segments of the Commercial Airframe Component Market?

The market is segmented by Material (Aluminum, Titanium, Composites), Component Type (Fuselage, Wings, Empennage, Landing Gear), Aircraft Platform (Narrow-body, Wide-body, Regional Jets), and End-User (OEM and MRO providers).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager