Commercial And Military Flight Simulation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442494 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Commercial And Military Flight Simulation Market Size

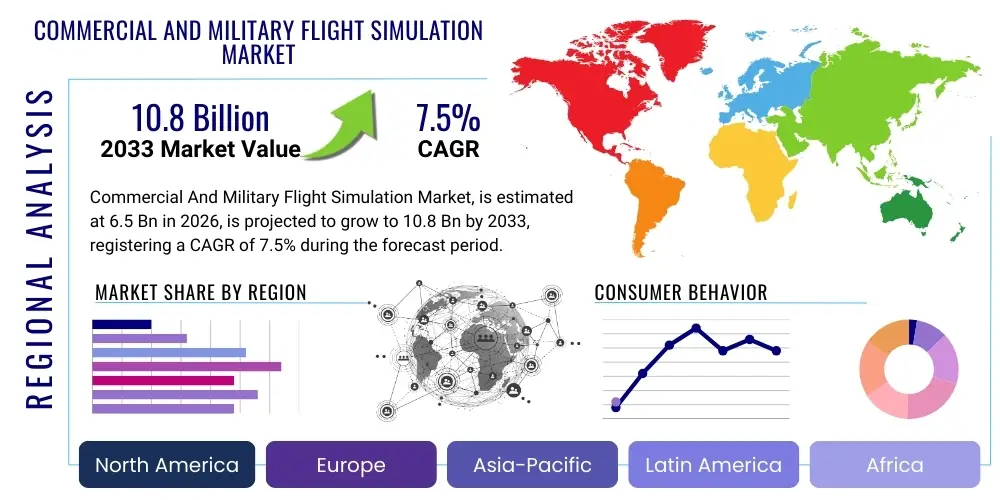

The Commercial And Military Flight Simulation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $6.5 Billion USD in 2026 and is projected to reach $10.8 Billion USD by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for highly realistic, cost-effective pilot training solutions across both civil aviation and global defense sectors. Regulatory mandates, particularly those demanding high-fidelity Level D Full Flight Simulators (FFS) for commercial pilot certification, coupled with massive fleet modernization programs undertaken by various air forces worldwide, are pivotal contributors to this robust market trajectory. Furthermore, the integration of advanced motion cueing systems, complex visual databases, and network-centric simulation capabilities significantly enhances the utility and investment return of modern simulation devices, solidifying their role as indispensable assets in aviation safety and mission preparedness.

Commercial And Military Flight Simulation Market introduction

The Commercial and Military Flight Simulation Market encompasses the design, manufacture, and servicing of high-fidelity training devices, simulators, and related support systems utilized by commercial airlines, civil flight schools, and global defense organizations for pilot training, mission rehearsal, and engineering development. These sophisticated systems range from basic flight training devices (FTDs) to highly complex Level D Full Flight Simulators (FFS) for commercial aircraft, and highly specialized Mission Rehearsal Trainers (MRT) and Joint Terminal Attack Controller (JTAC) simulators for military applications. The core product description revolves around delivering a controlled, risk-free environment that accurately replicates the physical sensation, visual environment, and operational dynamics of real aircraft, thereby optimizing training effectiveness and significantly reducing the cost associated with actual flight hours. Crucially, flight simulation minimizes fuel consumption, reduces maintenance wear on aircraft, and allows for the safe practice of high-risk emergency procedures that are impossible or unsafe to perform in live aircraft.

Major applications for flight simulation systems include initial pilot qualification, recurrent training, transition training for new aircraft types, and advanced scenario-based mission training for military forces. The inherent benefits derived from utilizing simulation technology are manifold, primarily centering on enhanced safety standards, substantial operational cost savings, and accelerated training timelines necessary to meet the increasing demand for skilled aircrews globally. Driving factors for market growth are strongly linked to the rapid expansion of global air traffic, necessitating the production of thousands of new pilots, and the continuous technological evolution mandated by modern military doctrine, which emphasizes network-enabled warfare and realistic joint force training exercises. Furthermore, the mandatory requirements set forth by international regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) for simulator-based training reinforce market stability and consistent demand.

The convergence of commercial and military requirements often involves shared technological platforms, especially in areas like visual systems, motion base technology, and instructor operator stations (IOS). However, the military segment requires distinct customization for combat scenarios, weapon system integration, and secure networking capabilities essential for distributed mission operations (DMO). This dual-market focus creates unique opportunities for key industry players who can leverage economies of scale in component manufacturing while providing specialized software and operational readiness solutions tailored to the stringent security and performance standards of defense clients. The perpetual need for platform updates corresponding to new aircraft deliveries—be it Airbus A320neo, Boeing 787, or F-35 fighter jets—ensures a perpetual refresh cycle within the market, sustaining long-term investment in simulation infrastructure.

Commercial And Military Flight Simulation Market Executive Summary

The Commercial And Military Flight Simulation Market is currently defined by significant technological maturation and strategic consolidation among leading industry players, reflecting robust business trends focused on service provisioning and integrated training solutions rather than solely hardware sales. A primary business trend involves the shift towards long-term, comprehensive service contracts, where manufacturers not only sell the simulator hardware but also manage its maintenance, upgrade cycles, and often the full operations of the training center itself, guaranteeing uptime and compliance. Furthermore, the modular design and interoperability of modern simulation systems are becoming critical competitive differentiators, allowing customers to easily adapt systems to evolving regulatory standards or new aircraft variants. The high barriers to entry, driven by complexity, capital requirements, and stringent certification standards (such as Level D), maintain the market structure as moderately concentrated, dominated by a few global technology leaders continually investing in advanced computing and visual processing capabilities.

Regional trends indicate North America and Europe retain market dominance due to early adoption, established aviation infrastructure, and massive defense spending, particularly in the United States, which operates the largest fleet of training devices globally. However, the Asia Pacific (APAC) region is experiencing the highest growth acceleration, fueled by unprecedented growth in commercial air travel, large-scale procurement of new generation aircraft (particularly in China and India), and aggressive expansion of national carrier training academies. This shift necessitates localized manufacturing and service hubs in APAC. Concurrently, military modernization efforts in the Middle East and specific Latin American countries are driving high-value, albeit sporadic, procurement cycles for advanced military mission simulators, demanding systems that support joint, multi-domain operations and utilize secure, proprietary data links for realistic mission replication.

Segment trends highlight the dominance of the Full Flight Simulator (FFS) segment in terms of revenue contribution within the commercial sector, given their critical role in regulatory compliance and pilot certification. Within the military domain, high-fidelity Tactical Aircraft Simulators and Rotorcraft Simulators remain the largest investment areas, increasingly focusing on networked distributed mission operations (DMO) capabilities. Component-wise, the software and visual systems segments are exhibiting higher growth rates than traditional hardware components, reflecting the shift toward superior graphical fidelity, complex physics modeling, and synthetic environments generated by advanced computational fluid dynamics (CFD) integration. This technological focus ensures that simulators can effectively train pilots for extremely niche, non-standard flight regimes and emerging threats, making software intellectual property a core value driver across the entire flight simulation ecosystem.

AI Impact Analysis on Commercial And Military Flight Simulation Market

User queries regarding the integration of Artificial Intelligence (AI) in the flight simulation market frequently revolve around key themes such as the automation of instructor functions, the personalization of training pathways, and the enhancement of synthetic environment realism. Users are keen to understand how AI-driven Instructor Operating Stations (IOS) can move beyond manual scenario execution to proactively analyze pilot performance in real-time, diagnose deficiencies, and adjust simulation parameters dynamically to optimize the learning experience—a concept known as ‘adaptive learning.’ A significant concern is the balance between automation efficiency and maintaining the critical human interaction required for effective mentorship and complex decision-making training. Expectations are high regarding AI’s potential to generate vastly more realistic and complex adversarial and environmental behaviors in military simulators, leading to truly emergent training scenarios that better prepare personnel for unpredictable real-world situations, thus fundamentally shifting the paradigm from pre-programmed scenarios to highly dynamic, personalized synthetic training environments.

The application of Machine Learning (ML) and Deep Learning (DL) is set to revolutionize data analytics within flight training, transforming raw simulation hours into actionable insights on pilot proficiency and organizational risk. AI algorithms are increasingly being deployed to analyze vast datasets captured during simulation sessions, identifying subtle trends in operational errors or decision-making patterns that human instructors might miss. This predictive maintenance capability extends not only to assessing pilot performance but also to forecasting the maintenance needs of the simulation hardware itself, optimizing the service lifecycle and maximizing simulator availability for commercial airlines. Furthermore, Generative AI is being explored for the automatic creation of intricate, globally-scaled visual databases and terrain modeling, reducing the previously immense manual labor involved in updating environments to reflect current geopolitical or infrastructural changes, dramatically speeding up deployment of mission-specific training scenarios.

In the military sector, AI is pivotal in developing sophisticated Computer Generated Forces (CGF) and constructive simulation environments. These AI-driven entities act as highly realistic, autonomous opponents or wingmen, capable of exhibiting complex tactical behavior and realistic response to pilot input, far surpassing the capabilities of scripted entities. This enables military trainees to practice complex, multi-ship tactics against thinking adversaries, crucial for modern air combat and electronic warfare scenarios. The implementation of AI-enhanced debriefing systems provides instantaneous, objective feedback based on performance metrics, shortening the feedback loop and ensuring immediate reinforcement of best practices. Consequently, AI is not merely an incremental improvement but a foundational shift enabling Hyper-Realistic Training (HRT) that addresses the shortcomings of conventional, static simulation systems.

- AI enables Adaptive Learning Systems (ALS) for personalized pilot training pathways.

- Predictive analytics driven by ML optimizes simulator maintenance schedules and availability.

- Generative AI accelerates the creation and updating of high-fidelity visual and terrain databases.

- AI enhances Computer Generated Forces (CGF) realism for dynamic military mission rehearsal.

- Real-time performance assessment by AI instructors augments human oversight and objective debriefing.

- Integration of DL algorithms improves flight dynamics modeling accuracy for niche operational envelopes.

- AI facilitates automated scenario generation based on evolving threat assessments and historical incident data.

DRO & Impact Forces Of Commercial And Military Flight Simulation Market

The Commercial And Military Flight Simulation Market is propelled by compelling Drivers (D), constrained by notable Restraints (R), and offers significant Opportunities (O), all shaped by potent Impact Forces. Key drivers include stringent regulatory requirements imposed by aviation authorities globally, mandating the use of advanced simulators for pilot qualification and recurrent training, ensuring minimum safety standards are maintained across the industry. Furthermore, the persistent and acute global pilot shortage, exacerbated by high retirement rates and accelerating air travel demand, necessitates highly efficient, throughput-optimized training solutions that only advanced simulation can provide. The military sector contributes heavily to demand through continuous modernization cycles, replacing aging trainers, and the requirement for increasingly complex, multi-domain training environments that mimic integrated warfare scenarios, making live training financially and strategically prohibitive. The high cost savings associated with substituting actual flight hours with simulation hours remains the foundational economic driver across both segments.

Conversely, the market faces significant Restraints. The most prominent constraint is the extremely high initial capital expenditure required for acquiring certified Level D Full Flight Simulators (FFS) or sophisticated military training systems, often costing tens of millions of dollars per unit, which restricts access for smaller airlines or private training organizations. Technological obsolescence also poses a restraint; rapid advancements in computing power and visual display technology mean that high-cost simulators must undergo frequent, expensive upgrades to maintain fidelity and regulatory compliance, leading to high lifecycle costs. Furthermore, the complex process of regulatory certification (e.g., FAA Level D, EASA FFS Level D) is time-consuming and resource-intensive, often delaying the deployment of new training technologies and systems into active service. Export control regulations and strict security requirements for military simulation software and hardware further complicate international market penetration and transfer of technology.

Significant Opportunities exist in the rapid penetration of Virtual Reality (VR) and Augmented Reality (AR) technologies into lower-level training devices (FTDs and basic trainers), offering cost-effective, highly portable solutions that democratize access to quality training environments outside of centralized training centers. The expansion of Simulation as a Service (SaaS) and Managed Services models presents a commercial opportunity for manufacturers to generate predictable, recurring revenue streams by operating training centers for third parties. In the military domain, the opportunity lies in developing highly secure, interoperable Distributed Mission Operations (DMO) networks, allowing geographically dispersed units (air, naval, ground forces) to train simultaneously in a shared, massive synthetic environment, thereby enhancing joint force readiness. The impact forces shaping this market are primarily technological (advances in computing power enabling higher fidelity) and economic (the continuous pressure on airlines to reduce operational costs), ensuring that efficiency, realism, and throughput remain the core determinants of investment decisions.

Segmentation Analysis

The Commercial And Military Flight Simulation Market is comprehensively segmented based on several critical dimensions, including platform type, component technology, application, and end-user. This segmentation allows for precise analysis of investment patterns and technological specialization within the market. Key segments reflect the distinct requirements of civil aviation versus defense, distinguishing between high-capital, high-fidelity systems required for pilot certification and modular, network-centric systems necessary for military mission readiness. The market analysis heavily scrutinizes the differences in procurement strategies and lifecycle support demands between the two major end-user groups, highlighting areas of technological synergy and specialization. Component segmentation further dissects the market value, identifying high-growth areas like advanced visual systems and complex software modeling.

- By Platform:

- Commercial Aircraft Simulators (Fixed-Wing, Rotorcraft)

- Military Aircraft Simulators (Fighter Jets, Transport Aircraft, Helicopters, Unmanned Aerial Systems/UAS)

- By Component:

- Hardware (Visual Systems, Motion Systems, Cockpit Modules, Instructor Operator Stations)

- Software (Flight Dynamics Models, Aerodynamics, System Simulation, Visual Databases)

- Services (Maintenance, Training Center Operations, Upgrades & Modification)

- By Application:

- Training (Initial, Recurrent, Transition)

- Research & Development (Engineering, Prototyping)

- Mission Rehearsal & Analysis

- By Type (Fidelity Level):

- Full Flight Simulators (FFS - Level D, C, B, A)

- Flight Training Devices (FTD - Level 7 to 1)

- Basic Training Devices (BTT/APT)

Value Chain Analysis For Commercial And Military Flight Simulation Market

The Value Chain for the Commercial And Military Flight Simulation Market begins with Upstream Analysis, which focuses on the suppliers of critical high-technology components. This involves specialized industries providing high-resolution visual display systems (e.g., projectors, domes, display processors), advanced motion systems (hydraulic or electric actuators), and sophisticated computing hardware necessary for real-time processing and physics modeling. Key upstream suppliers include major semiconductor firms, specialized software developers for graphic rendering engines, and aerospace component manufacturers providing replicas of aircraft cockpit controls and avionics. Supplier power is moderate; while there are numerous hardware component providers, the suppliers of highly specialized, proprietary flight modeling software and certified motion platforms hold greater leverage due to the niche expertise and intellectual property involved. Consistency in sourcing certified components is vital, as any disruption can severely impact the simulator's ability to achieve regulatory compliance and certification.

The core segment of the value chain involves the design, integration, and manufacturing process, dominated by Tier 1 simulation providers who act as systems integrators. This middle stage involves integrating thousands of components, developing proprietary flight models based on real aircraft data, and achieving stringent regulatory sign-off (e.g., Level D certification). Distribution channels for this market are predominantly Direct and relationship-based. Due to the high value, complexity, and bespoke nature of flight simulators, sales involve extensive negotiation, technical vetting, and long-term support contracts directly between the manufacturer and the airline, military organization, or dedicated training academy. Indirect distribution through third-party distributors is extremely rare, limited mostly to small-scale training devices or specific regional service contracts, ensuring quality control and intellectual property protection remain centralized with the OEM.

Downstream Analysis focuses on the deployment, operation, and lifecycle support phases. Once delivered, the simulator often becomes the center of a long-term service contract, where the manufacturer provides continuous maintenance, software updates, and hardware modifications necessary to match aircraft updates and maintain certification currency. Potential customers are heavily reliant on the OEM for specialized parts and intellectual property updates. A crucial downstream development is the rise of Simulator as a Service (SaaS) models, where the manufacturer operates the training center and sells training time slots rather than the unit itself, integrating the service provision directly into the core value offering. This shifts the downstream focus from merely maintenance to maximizing operational availability (uptime), which becomes a critical performance metric and competitive factor in the mature phase of the value chain.

Commercial And Military Flight Simulation Market Potential Customers

The primary end-users or buyers of Commercial And Military Flight Simulation products are broadly categorized into three distinct, high-value groups: major commercial airlines and air cargo operators, specialized independent flight training organizations (FTOs), and global defense ministries or military branches. Commercial airlines, such as Delta, Lufthansa, and Emirates, represent the largest segment of FFS buyers, requiring high-fidelity systems to maintain the certification standards for their fleet, ranging from wide-body jets to regional aircraft. These customers prioritize regulatory compliance, operational efficiency, and the ability to train hundreds of pilots annually, making throughput and reliability paramount. FTOs, including specialized academies like CAE Oxford Aviation Academy or FlightSafety International, serve as third-party training providers, purchasing simulators to offer standardized training services to multiple airlines or individuals, focusing on maximizing utilization rates and offering diverse platform training capabilities.

The defense sector constitutes the other major buying group, including branches such as the US Air Force, Royal Air Force, and various international army and navy aviation units. Military buyers acquire simulation systems not just for basic flying proficiency but critically for advanced mission rehearsal, system integration training, and complex tactical development, often involving classified technology and secure networking capabilities. Procurement is driven by long-term defense budgets, fleet retirement schedules, and the strategic mandate to reduce costly live flight hours while increasing exposure to high-threat scenarios safely. These customers demand highly customizable systems that integrate proprietary weapon system simulations and support distributed mission operations (DMO) across multiple secure locations, making data security and system fidelity in combat environments key purchasing criteria.

A smaller, yet growing, segment of potential customers includes specialized aerospace manufacturers (e.g., Boeing, Airbus, Lockheed Martin) and research institutions. These entities utilize high-fidelity simulation for engineering development, assessing new aircraft designs, evaluating human-machine interfaces (HMI), and testing performance envelopes before physical prototypes are built. For these R&D customers, the primary purchasing drivers are the simulator’s ability to accurately model physics and integrate early design data, rather than regulatory certification for pilot training. Furthermore, government air traffic control (ATC) agencies and civil regulatory bodies occasionally purchase specific simulation trainers for specialized research into human factors and air space management, rounding out the diverse but highly specialized customer base of the flight simulation market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $6.5 Billion USD |

| Market Forecast in 2033 | $10.8 Billion USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CAE Inc., L3Harris Technologies, Textron Inc. (TRU Simulation + Training), Boeing Global Services (formerly Rockwell Collins/B/E Aerospace), Thales Group, FlightSafety International (a Berkshire Hathaway company), Airbus Group SE (Airbus Defence and Space), Kongsberg Digital, Indra Sistemas S.A., Rheinmetall AG, BAE Systems, Raytheon Technologies (Pratt & Whitney Canada Training), Saab AB, Fidelity Technologies Corporation, HAVELSAN, AXIS Flight Training Systems GmbH, Sim-Tech Simulation GmbH, Frasca International, Inc., Maxon Industries, Collins Aerospace (a Raytheon subsidiary). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial And Military Flight Simulation Market Key Technology Landscape

The technological landscape of the Commercial And Military Flight Simulation market is undergoing a rapid evolution, primarily driven by advancements in computing power and sensory replication. A core technology remains the Full Motion Base System, where the shift from older, maintenance-intensive hydraulic systems to advanced, energy-efficient electric motion platforms (e.g., 6-DOF hexapod actuators) is now the industry standard, offering superior acceleration and fidelity while reducing operational noise and complexity. Crucially, the accuracy of Flight Dynamic Models (FDM) and physics-based modeling software is continuously improving, utilizing computational fluid dynamics (CFD) and data obtained from actual flight testing to replicate extreme flight characteristics, stall conditions, and new avionics integrations with unparalleled precision, which is mandatory for maintaining high-level (Level D) certification that allows zero actual flight hours for type rating.

Visual systems represent another high-impact area, moving rapidly towards ultra-high-resolution LED and laser projection systems integrated into dome or spherical display architectures, offering fields of view exceeding 200 degrees horizontally. Furthermore, significant investment is being channeled into procedural training and low-to-mid-fidelity devices through the integration of Virtual Reality (VR) and Augmented Reality (AR). VR headsets, coupled with haptic feedback systems, provide highly immersive and portable alternatives for pre-flight checklist training, maintenance training, and initial cockpit familiarization (FTDs Level 1-3), significantly lowering the training cost floor. This technology democratizes access to simulation and is particularly impactful for military ground crews and specialized mission support personnel who require immediate, mobile training solutions.

Network connectivity and cybersecurity are defining factors, especially in the military segment. The adoption of open architectures and standardized protocols facilitates the connection of diverse simulators into secure Distributed Mission Operations (DMO) networks, enabling large-scale, geographically dispersed joint exercises. Cloud computing technology is also beginning to impact the delivery model, particularly in software updates, visual database hosting, and simulation management systems, offering scalable resources and centralized data management. This move towards cloud-based simulation infrastructure promises faster deployment, easier updates, and better utilization of geographically spread assets. Maintaining strict cyber defenses is paramount for military systems dealing with classified scenarios, driving continuous investment in proprietary, secure communication links and robust hardware-in-the-loop (HIL) testing methodologies to ensure operational realism and data integrity.

Regional Highlights

- North America: This region dominates the global market, primarily due to the massive scale of the U.S. military’s procurement of advanced training systems and the presence of major simulation OEMs like CAE, L3Harris, and FlightSafety International. The U.S. commercial aviation sector, governed by the FAA, maintains some of the strictest FFS requirements, driving consistent demand for Level D certified units and periodic modernization upgrades. Investment is heavily directed towards networked DMO capabilities for platforms like the F-35 and C-17, alongside significant expenditure on pilot training infrastructure to address domestic pilot recruitment challenges.

- Europe: Europe represents a mature market characterized by stringent EASA regulations that enforce high simulation standards. Growth is steady, driven by major European flag carriers (e.g., Air France-KLM, Lufthansa) expanding their fleets and updating their training academies. The region is home to major players like Thales and Indra. Military spending is focused on multinational programs, such as the European Defence Fund initiatives, concentrating on synthetic training environments for fighter jets (e.g., Eurofighter Typhoon) and enhancing collaboration across NATO allies through interoperable simulation systems.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region globally, driven by explosive commercial air travel growth in China, India, and Southeast Asia. The region requires thousands of new pilots, necessitating rapid investment in new training centers and the localized acquisition of FFS units. Governments are actively supporting domestic aviation training initiatives to reduce reliance on Western training facilities. Military growth is spurred by territorial disputes and defense modernization, leading to high-value contracts for tactical and naval aviation simulators, particularly in Japan, South Korea, and Australia, demanding systems compatible with U.S.-sourced military hardware.

- Latin America: This region exhibits moderate but localized growth, driven primarily by fleet modernization projects within major carriers in Brazil and Mexico, and sporadic military procurements for helicopter and transport aircraft simulators. Economic volatility sometimes restrains large-scale, continuous investment, leading to a higher preference for outsourced training or utilizing simulators as part of leaseback agreements rather than outright purchases, focusing investment on low-to-mid fidelity devices to manage costs.

- Middle East and Africa (MEA): Growth in the MEA region is strongly tied to sovereign wealth investment in national carriers (e.g., Emirates, Qatar Airways, Etihad) and large defense spending. The region is characterized by high-value, bespoke defense simulation contracts focused on sophisticated rotary-wing and high-performance jet trainers, often procured from U.S. and European suppliers. African demand, while smaller, is concentrated in governmental pilot training academies seeking affordable, high-fidelity FTDs to build domestic aviation capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial And Military Flight Simulation Market.- CAE Inc.

- L3Harris Technologies

- Textron Inc. (TRU Simulation + Training)

- Boeing Global Services

- Thales Group

- FlightSafety International (a Berkshire Hathaway company)

- Airbus Group SE (Airbus Defence and Space)

- Kongsberg Digital

- Indra Sistemas S.A.

- Rheinmetall AG

- BAE Systems

- Raytheon Technologies (Collins Aerospace)

- Saab AB

- Fidelity Technologies Corporation

- HAVELSAN

- AXIS Flight Training Systems GmbH

- Sim-Tech Simulation GmbH

- Frasca International, Inc.

- Maxon Industries

- Adacel Technologies Limited

Frequently Asked Questions

Analyze common user questions about the Commercial And Military Flight Simulation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Commercial Flight Simulators (FFS)?

The primary factor driving demand is the stringent regulatory requirement by global bodies like the FAA and EASA, which mandate the use of Level D Full Flight Simulators for initial pilot type rating and recurrent training. This regulatory necessity ensures safety standards and allows for zero-flight-time training.

How is Artificial Intelligence (AI) transforming military flight simulation?

AI is transforming military simulation by enabling Adaptive Learning Systems (ALS) and sophisticated Computer Generated Forces (CGF). This allows for dynamic, highly realistic adversarial behavior and customized training scenarios, crucial for high-fidelity mission rehearsal and distributed operations (DMO).

What is the difference between a Full Flight Simulator (FFS) and a Flight Training Device (FTD)?

An FFS is a high-fidelity system that replicates the cockpit environment, motion, and visuals completely, typically certified to Level D, substituting actual flight time for pilot certification. FTDs (Level 1-7) are lower-fidelity, non-motion-based or limited-motion trainers used primarily for procedural tasks, familiarization, and basic systems training, offering a more cost-effective training hour.

Which geographical region exhibits the highest growth potential in this market?

The Asia Pacific (APAC) region exhibits the highest growth potential, primarily fueled by the rapid expansion of commercial air travel, massive fleet procurement cycles in countries like China and India, and the subsequent urgent need to train a vast number of new commercial pilots.

What major restraints hinder the broader adoption of advanced flight simulation technology?

The most significant restraints are the extremely high initial capital expenditure (CapEx) required for certified Level D units and the substantial ongoing lifecycle costs associated with hardware maintenance, frequent regulatory-mandated software updates, and the complex, time-consuming certification process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager