Commercial Biotechnology Separation Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443338 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Commercial Biotechnology Separation Systems Market Size

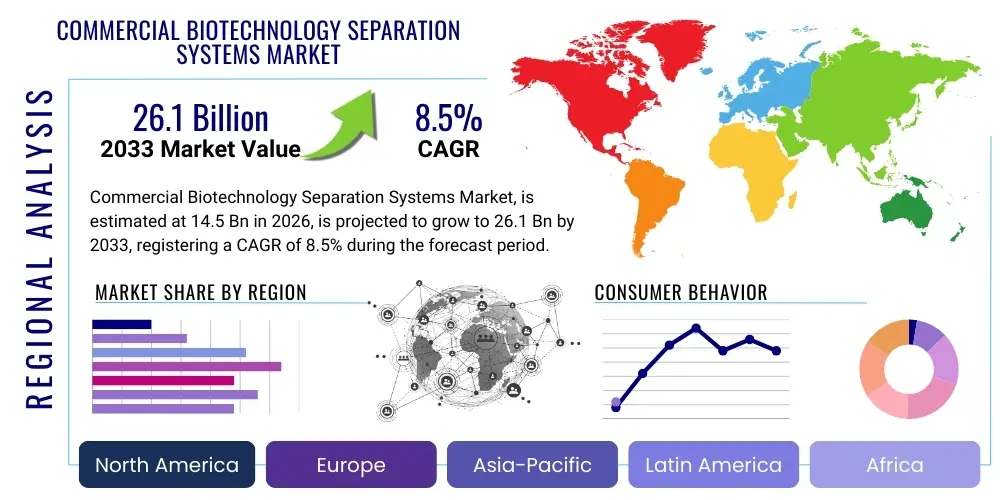

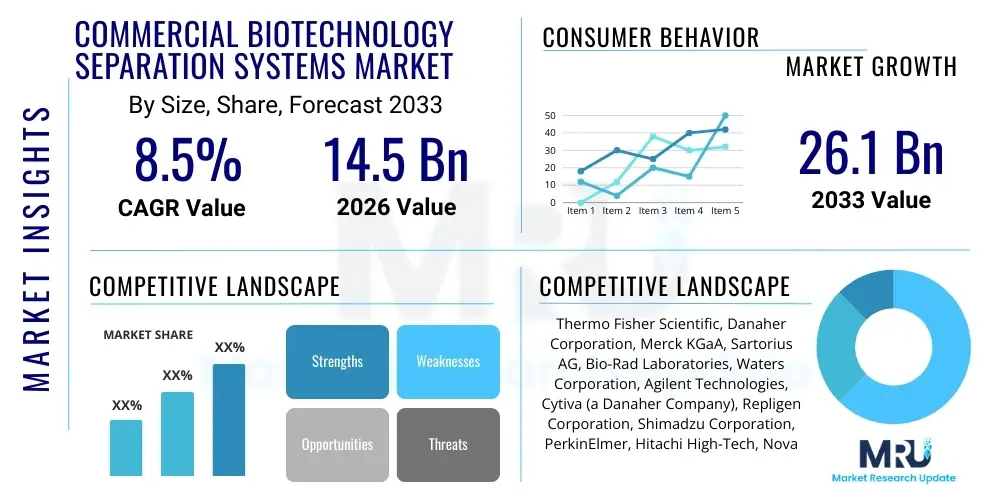

The Commercial Biotechnology Separation Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $26.1 Billion by the end of the forecast period in 2033.

Commercial Biotechnology Separation Systems Market introduction

The Commercial Biotechnology Separation Systems Market encompasses the highly specialized equipment, instruments, and consumables used for isolating, purifying, and analyzing target molecules—such as proteins, nucleic acids, and small molecules—from complex biological matrices. These systems are foundational to modern biomanufacturing, drug discovery, and diagnostics, playing a critical role in ensuring the purity and potency of biopharmaceutical products. Key product categories include chromatography systems (HPLC, FPLC), membrane filtration devices (ultrafiltration, microfiltration), centrifugation equipment, and electrophoresis apparatus. The inherent complexity of biological feedstocks necessitates robust and scalable separation technologies capable of achieving high resolution and throughput while maintaining strict regulatory compliance, particularly Good Manufacturing Practices (GMP).

The primary applications driving this market are centered around the burgeoning biopharmaceutical sector, notably in the production of monoclonal antibodies (mAbs), recombinant proteins, vaccines, and cell and gene therapies. Efficient separation is paramount in downstream processing (DSP), which often accounts for a significant portion of the overall production cost in biologics manufacturing. These systems offer benefits such as enhanced product yield, superior purity profiles required for clinical safety, reduced batch variability, and faster time-to-market through optimized process development. The core function is the successful transition from crude cell culture supernatant or lysate to a final, highly purified therapeutic product suitable for human use.

Driving factors propelling market expansion include the sustained global rise in chronic diseases necessitating advanced biologic treatments, substantial governmental and private investment in biotechnology and genomics research, and the increasing adoption of continuous bioprocessing methodologies which demand specialized high-throughput separation solutions. Furthermore, advancements in analytical science, particularly the integration of automation and process analytical technology (PAT) into separation workflows, are enhancing efficiency and control, making modern systems indispensable for next-generation therapeutic development and commercialization. The focus on developing biosimilars and biobetters also mandates precise and reproducible separation capabilities, thereby reinforcing market growth.

Commercial Biotechnology Separation Systems Market Executive Summary

The Commercial Biotechnology Separation Systems Market demonstrates robust growth driven primarily by the global demand for advanced biopharmaceuticals, particularly cell and gene therapies, and monoclonal antibodies. Business trends indicate a shift towards intensified and continuous chromatography systems, which offer operational efficiencies and smaller footprints compared to traditional batch processing. Strategic mergers, acquisitions, and collaborations focused on integrating novel membrane technologies and advanced column resins are reshaping the competitive landscape, aiming to provide end-to-end purification solutions. Furthermore, the market is characterized by significant R&D spending focused on developing single-use separation technologies that mitigate cross-contamination risks and reduce cleaning validation costs in GMP environments.

Regionally, North America maintains its dominance due to a strong presence of major biopharmaceutical companies, favorable regulatory frameworks, and extensive academic research infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by expanding domestic biotech sectors in China and India, increasing healthcare expenditure, and governmental initiatives promoting localized biomanufacturing capacity. Europe remains a critical market, leveraging its strong history in pharmaceutical innovation and a high concentration of Contract Manufacturing Organizations (CMOs) that rely heavily on sophisticated separation platforms for client projects.

Segment trends highlight the overwhelming dominance of the chromatography segment, particularly high-performance liquid chromatography (HPLC) and affinity chromatography, due to their unmatched resolution capabilities required for complex biopharmaceuticals. Within products, consumables (such as chromatography columns, resins, and specialized filters) hold the largest market share due to their recurrent purchase cycle, driven by increased bioproduction volumes globally. The application segment sees the Biopharmaceuticals category leading, while the rapid emergence of gene therapy applications is creating specialized demand for scalable viral vector purification systems, thus stimulating innovation in ultracentrifugation and specialized membrane separation tools.

AI Impact Analysis on Commercial Biotechnology Separation Systems Market

Common user questions regarding AI's impact on commercial separation systems frequently revolve around predictive maintenance capabilities, optimization of chromatography parameters, and the potential for autonomous process control in biomanufacturing. Users are keen to understand how AI algorithms can leverage large datasets generated during purification runs (e.g., pressure, flow rate, UV absorbance) to dynamically adjust parameters, predict resin lifespan, and ensure consistent product quality across different batches. Key themes include concerns about data security, the required integration level with existing legacy systems, and the ability of machine learning (ML) models to handle the inherent variability of biological feedstocks. Expectations are high regarding AI’s potential to dramatically shorten development timelines and reduce the cost of goods sold (COGS) through intelligent process modeling and real-time decision-making, ultimately moving separation processes closer to true self-optimization.

- AI-driven real-time process optimization (RPO) leading to enhanced yield and purity.

- Predictive maintenance and fault detection in complex separation hardware, minimizing downtime.

- Automated classification and analysis of spectroscopic data (e.g., Raman, NIR) coupled with separation output for quality control.

- Machine learning models accelerating the selection of optimal chromatography resins and operating conditions.

- Enhanced process development efficiency through in silico modeling and simulation of separation train performance.

- Integration of AI with Process Analytical Technology (PAT) to enable autonomous control loops in continuous processing.

- Optimization of buffer preparation and consumption, minimizing waste and material costs.

DRO & Impact Forces Of Commercial Biotechnology Separation Systems Market

The Commercial Biotechnology Separation Systems Market is significantly influenced by a dynamic interplay of factors. Key drivers include the exponential growth in the monoclonal antibody (mAb) and biosimilar pipelines, which necessitates high-capacity, high-resolution purification platforms. Opportunities emerge from the pivot towards continuous bioprocessing, demanding specialized single-use separation modules and integrated downstream solutions. Restraints primarily involve the substantial capital investment required for installing GMP-compliant separation infrastructure and the ongoing challenge of high costs associated with premium chromatography resins and specialized filtration media. These forces collectively shape investment priorities and technological development trajectories within the bioprocessing industry, pushing manufacturers toward efficiency and scalability.

Drivers: The escalating prevalence of chronic and complex diseases, such as cancer and autoimmune disorders, continuously fuels demand for sophisticated biologic drugs, directly impacting the need for advanced purification methods. Furthermore, significant governmental funding across major economies dedicated to life science research, combined with a robust pipeline of novel therapeutic modalities (e.g., viral vectors for gene therapy, exosomes), requires innovative separation solutions capable of handling these highly sensitive and complex molecules. The standardization and maturation of quality control regulations, particularly GMP requirements enforced by global agencies like the FDA and EMA, mandate the use of highly reproducible and validated separation systems, assuring sustained market stability and growth.

Restraints: A primary constraint is the extremely high cost associated with both the initial procurement of sophisticated separation equipment and the recurrent expenditure on specialized consumables, particularly high-end chromatography resins and filters. This cost barrier can slow adoption, especially among smaller biotech startups and academic institutions in developing regions. Additionally, the technical complexity involved in scaling up separation processes from laboratory scale to commercial manufacturing, often requiring extensive validation and optimization expertise, presents a significant bottleneck. Regulatory hurdles related to the adoption and validation of novel separation technologies, especially in continuous manufacturing contexts, further complicate market entry and expansion.

Opportunities: The ongoing paradigm shift toward single-use (disposable) separation systems presents a lucrative opportunity, reducing facility preparation time, cleaning validation burdens, and risk of cross-contamination, which is highly appealing to CMOs and biopharma manufacturers. The increasing focus on personalized medicine and diagnostics requires highly sensitive and high-throughput micro-scale separation systems for sample preparation and analysis. Moreover, the emergence of advanced purification techniques, such as membrane chromatography and magnetic separation, offers alternative, potentially more cost-effective solutions for specific purification steps, challenging traditional column chromatography and opening new market niches. The integration of advanced data analytics and AI into process control provides a pathway for significant performance optimization.

Segmentation Analysis

The Commercial Biotechnology Separation Systems Market is comprehensively segmented based on the specific technologies employed, the product type (systems versus recurring consumables), the scale of operation, and the end-user application domain. This segmentation is crucial as different bioprocesses and target molecules require distinct separation strategies; for instance, monoclonal antibodies heavily rely on affinity chromatography, while viral vectors often necessitate ultracentrifugation and specialized tangential flow filtration (TFF). The fastest growing segment is currently driven by the increasing application in cell and gene therapy manufacturing, which requires tailored, highly efficient, and closed separation systems to ensure sterility and handle smaller batch sizes typical of personalized medicine.

- By Technology:

- Chromatography Systems (Affinity, Ion Exchange, Size Exclusion, Hydrophobic Interaction, Mixed-Mode)

- Filtration Systems (Microfiltration, Ultrafiltration, Nanofiltration, Tangential Flow Filtration (TFF))

- Centrifugation (Preparative Ultracentrifugation, Continuous Flow Centrifuges)

- Electrophoresis (Gel Electrophoresis, Capillary Electrophoresis)

- Extraction and Precipitation

- By Product:

- Systems/Instruments (Chromatography Skids, Filtration Systems, Centrifuges)

- Consumables (Chromatography Resins, Columns, Filter Cartridges, Membranes, Electrophoresis Gels)

- By Scale of Operation:

- Analytical/Laboratory Scale

- Preparative Scale

- Process/Manufacturing Scale

- By Application:

- Biopharmaceuticals (Monoclonal Antibodies, Recombinant Proteins, Vaccines, Insulin)

- Diagnostics and Clinical Research

- Academic and Government Research

- Food and Beverage Testing

- By End User:

- Pharmaceutical & Biotechnology Companies

- Contract Manufacturing Organizations (CMOs) & Contract Research Organizations (CROs)

- Academic and Research Institutes

Value Chain Analysis For Commercial Biotechnology Separation Systems Market

The value chain for commercial biotechnology separation systems is intricate, beginning with specialized raw material suppliers and progressing through technology developers, system manufacturers, distribution channels, and culminating in end-user biomanufacturing facilities. Upstream analysis focuses heavily on the sourcing of highly specialized components, particularly porous materials necessary for chromatography resins (e.g., polymers like agarose or silica) and high-quality membranes for filtration units. Manufacturers in the middle tier focus on engineering robustness, scalability, and regulatory compliance (e.g., FDA validation) into the core instrumentation, converting these specialized materials into integrated, automated separation platforms. Innovation at this stage, particularly around fluid dynamics and column packing efficiency, is critical for competitive advantage.

The distribution channel involves a mix of direct sales forces employed by major manufacturers (e.g., Thermo Fisher, Danaher) to handle high-value system sales, supported by specialized technical support and field service engineering teams. Indirect distribution involves authorized regional distributors and third-party logistics providers who facilitate the movement of high-volume, recurring consumables like filters and resins to global end-users, ensuring just-in-time inventory management, which is critical in biomanufacturing. Strategic importance lies in maintaining robust global supply chains, especially given the strict quality requirements for GMP-grade consumables, which are often single-sourced.

Downstream analysis highlights the end-users, primarily large pharmaceutical companies and CMOs, whose purchasing decisions are dictated by performance metrics (resolution, throughput, recovery rate) and total cost of ownership (TCO), including both initial capital expenditure and ongoing consumable costs. Market success hinges on providing integrated solutions that seamlessly fit into the end-users’ existing downstream processing train and meet stringent regulatory expectations for product quality and batch consistency. Customer support, rapid response to technical issues, and comprehensive validation documentation form essential components of the downstream value proposition, driving long-term customer loyalty and repeat consumable purchases.

Commercial Biotechnology Separation Systems Market Potential Customers

The primary customers for commercial biotechnology separation systems are organizations involved in the industrial production or rigorous analysis of biological molecules. Biopharmaceutical companies form the largest customer base, relying on these systems for the production scale purification of blockbuster drugs like monoclonal antibodies and insulin, where separation efficiency directly impacts profitability and regulatory approval. These users demand high-throughput, validated systems that can operate reliably under GMP conditions and handle large volumes of feed material.

A rapidly expanding customer segment includes Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). As biopharma companies increasingly outsource production, CMOs require flexible, multi-purpose separation platforms capable of handling diverse client molecules, from vaccines to complex recombinant proteins, often prioritizing single-use technology for rapid changeover between client projects. Research institutes and academic laboratories also constitute a steady customer stream, focusing primarily on analytical and preparative scale systems for early-stage drug discovery, protein characterization, and basic life science studies, valuing high-resolution and ease of use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $26.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, Sartorius AG, Bio-Rad Laboratories, Waters Corporation, Agilent Technologies, Cytiva (a Danaher Company), Repligen Corporation, Shimadzu Corporation, PerkinElmer, Hitachi High-Tech, Novasep (a Sartorius Company), Tosoh Bioscience, Sepax Technologies, GEA Group, 3M Purification, Pall Corporation, Bio-Works Technologies, BIA Separations. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Biotechnology Separation Systems Market Key Technology Landscape

The technology landscape of commercial bioseparation is defined by continuous evolution aimed at increasing purity, scalability, and speed while reducing production costs. Chromatography remains the cornerstone technology, but significant innovation is occurring within resin chemistry, focusing on developing multimodal or mixed-mode ligands that offer high binding capacities and selectivity, particularly advantageous for challenging purification steps where traditional single-mode resins fall short. Furthermore, the trend toward continuous chromatography, utilizing systems like simulated moving bed (SMB) or multi-column chromatography, is gaining traction. These systems maximize resin utilization and system throughput, critical for efficiently meeting the massive demand for certain blockbuster biologics. Manufacturers are heavily investing in robust automation capabilities within these chromatography skids to ensure process stability and minimal operator intervention.

Membrane separation technologies, specifically ultrafiltration and tangential flow filtration (TFF), are undergoing rapid advancement, largely driven by the demand for single-use assemblies and improved flux rates. These technologies are crucial for concentration, buffer exchange, and removal of viral contaminants (nanofiltration). The adoption of fiber-based membranes and disposable capsules is revolutionizing upstream and downstream integration by simplifying cleaning validation and reducing facility footprint. The development of advanced depth filtration media is also key for efficient clarification stages, preceding high-cost chromatography steps, ensuring optimal protection of expensive resins and maximizing overall process yield.

Beyond traditional methods, newer separation techniques are gaining commercial relevance, especially in the niche, high-growth area of cell and gene therapy (CGT). This includes high-speed, scalable ultracentrifugation for viral vector harvesting and purification, and the emerging field of magnetic separation technology, offering gentle, high-yield alternatives for cell sorting and bead-based purification. The overall technological direction is moving toward interconnected, integrated separation platforms managed by sophisticated digital control systems that leverage Process Analytical Technology (PAT) sensors for in-line monitoring of critical quality attributes (CQAs), enabling proactive process adjustments and adherence to Quality by Design (QbD) principles.

Regional Highlights

Market dynamics vary significantly across key geographical regions, reflecting differences in biomanufacturing capacity, regulatory environment, and investment levels in life sciences.

- North America (U.S. and Canada): Dominates the global market share due to the highest concentration of established biopharma companies, substantial R&D expenditure, and early adoption of advanced separation technologies (e.g., continuous chromatography). The U.S. remains the innovation hub, supported by favorable intellectual property laws and a mature regulatory framework conducive to the production of novel biologics and therapeutics.

- Europe (Germany, U.K., France): Represents a mature and highly competitive market, characterized by strong academic research linkages and a large number of Contract Manufacturing Organizations (CMOs). Germany, in particular, is a leader in advanced bioprocessing equipment manufacturing, and widespread adoption of single-use separation technology is prevalent across the continent.

- Asia Pacific (APAC) (China, Japan, India, South Korea): Projected to be the fastest-growing region. This acceleration is driven by significant state-backed investment in biomanufacturing capacity expansion in China and India, the rising demand for affordable biosimilars, and the increasing localization of pharmaceutical production processes. Japan and South Korea are technological leaders, particularly in diagnostics and specialized protein purification.

- Latin America (LATAM): Exhibits nascent but steady growth, focusing primarily on local vaccine production and generic drug manufacturing. Market expansion is dependent on improving regulatory harmonization and increased foreign direct investment into regional biomanufacturing infrastructure.

- Middle East and Africa (MEA): Currently holds the smallest market share but shows potential due to growing healthcare modernization efforts and increasing establishment of localized pharmaceutical production centers, often relying on imported, validated separation systems from global leaders to meet quality standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Biotechnology Separation Systems Market.- Thermo Fisher Scientific

- Danaher Corporation

- Merck KGaA

- Sartorius AG

- Bio-Rad Laboratories

- Waters Corporation

- Agilent Technologies

- Cytiva (a Danaher Company)

- Repligen Corporation

- Shimadzu Corporation

- PerkinElmer

- Hitachi High-Tech

- Novasep (a Sartorius Company)

- Tosoh Bioscience

- Pall Corporation (a Danaher Company)

- 3M Purification

- GEA Group

- BIA Separations (part of Sartorius)

- Sepax Technologies

- Bio-Works Technologies

Frequently Asked Questions

Analyze common user questions about the Commercial Biotechnology Separation Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Commercial Biotechnology Separation Systems Market?

The primary driver is the explosive growth and increasing maturity of the global biopharmaceutical pipeline, particularly the high demand for complex large-molecule therapeutics such as monoclonal antibodies (mAbs), cell therapies, and gene therapies, all of which require highly specialized and scalable purification technologies for commercial production.

Which separation technology holds the largest market share and why?

Chromatography systems, specifically liquid chromatography (LC), hold the largest market share due to their unparalleled resolution and selectivity, which are essential for purifying highly sensitive biological molecules to the stringent purity standards required for clinical use and regulatory compliance in downstream bioprocessing.

How is the market influenced by the trend towards continuous bioprocessing?

The shift toward continuous bioprocessing necessitates the development and adoption of specialized, highly efficient separation systems like multi-column chromatography and continuous tangential flow filtration (TFF). This trend drives market innovation toward smaller footprint, higher throughput, and integrated single-use solutions, promising significant reductions in manufacturing variability and cost.

What are the main advantages of adopting single-use (disposable) separation systems?

Single-use systems significantly reduce the risk of cross-contamination between batches, eliminate the need for extensive cleaning validation procedures, lower utility consumption (like water for injection), and enable faster facility turnaround times, making them highly attractive to CMOs and biomanufacturers focusing on operational flexibility.

Which geographical region is projected to experience the fastest market growth through 2033?

The Asia Pacific (APAC) region, spearheaded by strong government support and rapid infrastructure development in biomanufacturing across China and India, is projected to register the fastest compound annual growth rate (CAGR), driven by increasing domestic and export-focused production of biosimilars and generics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager