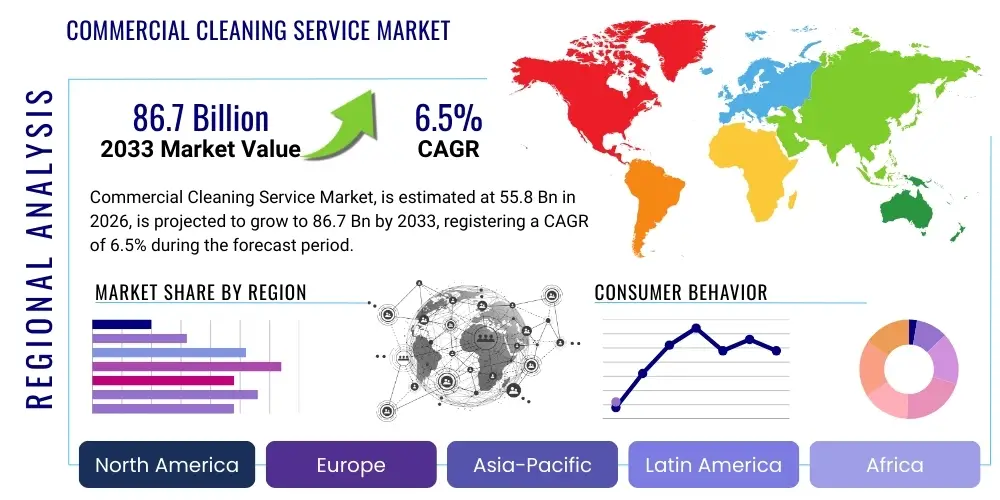

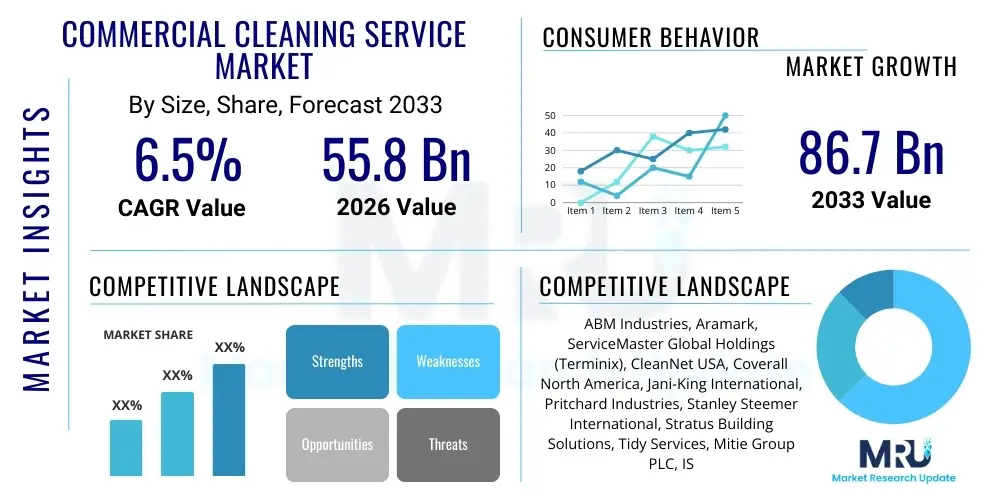

Commercial Cleaning Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441558 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Commercial Cleaning Service Market Size

The Commercial Cleaning Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $55.8 Billion in 2026 and is projected to reach $86.7 Billion by the end of the forecast period in 2033.

Commercial Cleaning Service Market introduction

The Commercial Cleaning Service Market encompasses a wide range of professional services dedicated to maintaining the cleanliness, sanitation, and hygienic conditions of commercial, institutional, and industrial facilities. These services are vital for ensuring compliance with health regulations, enhancing the aesthetic appeal of workspaces, and contributing significantly to the health and productivity of employees and occupants. The scope of services typically ranges from routine janitorial tasks such as trash removal, vacuuming, and dusting, to specialized services including deep disinfection, high-level window cleaning, and comprehensive floor care. The increasing urbanization and expansion of the corporate sector, coupled with heightened awareness regarding indoor air quality and infection control, are consistently fueling the demand for reliable and high-quality commercial cleaning solutions across diverse verticals globally.

The product, fundamentally a service offering, is characterized by customized service contracts tailored to the specific needs of end-users, such as commercial office buildings, healthcare systems, educational facilities, and retail environments. Major applications include daily maintenance cleaning for continuity of operations, periodic deep cleaning to preserve assets, and emergency response cleaning (e.g., post-construction cleanup or pandemic-related sanitation). The shift toward sustainable cleaning practices, utilizing green certified products and water-efficient equipment, is also reshaping service delivery. These professional services offer substantial benefits, including cost efficiency compared to in-house cleaning teams, access to industrial-grade equipment and specialized training, and mitigation of liability risks associated with workplace cleanliness and safety standards.

The primary driving factors sustaining market expansion include stringent regulatory mandates regarding public health and safety, particularly within the food service and healthcare sectors. Additionally, the increasing complexity of modern building designs and the proliferation of sensitive technical equipment necessitate professional expertise for maintenance. Post-pandemic hygiene standards have permanently elevated expectations for disinfection protocols, making outsourced cleaning services indispensable. Furthermore, outsourcing trends allow core businesses to focus on primary competencies, thereby increasing reliance on third-party cleaning providers to manage facility upkeep effectively and efficiently.

Commercial Cleaning Service Market Executive Summary

The global Commercial Cleaning Service Market is characterized by robust growth driven primarily by escalating corporate real estate development and non-negotiable compliance requirements across regulated industries such as healthcare and manufacturing. Current business trends indicate a significant consolidation among large international players aiming for standardized, large-scale service delivery, while regional niche players capitalize on specialized offerings like green cleaning or specific industrial certifications. The market is witnessing accelerated technological adoption, particularly concerning smart cleaning solutions, including robotic floor scrubbers and IoT-enabled monitoring systems that track cleanliness metrics and optimize resource deployment, thereby improving efficiency and service quality and addressing persistent labor challenges through automation integration.

Regionally, North America remains the dominant revenue contributor, largely due to high commercial activity, stringent occupational safety regulations, and a culture of outsourcing non-core functions. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by rapid urbanization, massive infrastructure projects, and the expansion of multinational corporate headquarters in countries like China, India, and Southeast Asia. Europe maintains a mature market characterized by strong emphasis on environmental, social, and governance (ESG) factors, leading to high adoption rates of sustainable cleaning products and practices, whereas Latin America and MEA present emerging opportunities driven by increased foreign investment in commercial and hospitality infrastructure, gradually shifting demand from informal to professional service providers.

Segment trends reveal that the healthcare end-user segment maintains critical importance, demanding specialized biohazard cleaning and terminal disinfection services that command premium pricing, driving high revenue contribution. Concurrently, the floor care and vacuuming service type segments constitute the largest volume of routine tasks, anchoring daily operations. A key structural shift is observed in the operating model, where outsourced contracts are increasingly preferred over in-house teams across medium and large enterprises seeking operational flexibility and guaranteed standards of service. The implementation of standardized service level agreements (SLAs) and performance metrics, often facilitated by mobile management applications, is becoming a prerequisite for securing high-value, long-term commercial contracts.

AI Impact Analysis on Commercial Cleaning Service Market

Common user questions regarding AI's impact on the Commercial Cleaning Service Market revolve around efficiency gains, job displacement, data privacy of monitoring systems, and the integration costs of new technologies. Users are keenly interested in whether AI-driven solutions can genuinely reduce operational expenditures while simultaneously enhancing cleaning quality metrics. Key themes emerging from these inquiries include the potential for predictive maintenance and cleaning scheduling based on real-time occupancy data, the reliability of autonomous cleaning robots (ACRs) in complex environments, and how AI can aid in compliance reporting, particularly concerning stringent post-COVID sanitation standards. There is a general expectation that AI will transition cleaning from a reactive service to a proactive, data-informed operational necessity, shifting the workforce focus from manual labor to supervision and technical maintenance of advanced systems.

AI’s initial influence is primarily visible in optimization and automation. Predictive cleaning protocols, powered by machine learning algorithms analyzing foot traffic and air quality sensor data, allow cleaning resources to be deployed precisely when and where they are needed, rather than following rigid, time-based schedules. This precision minimizes wasteful resource use and ensures higher satisfaction in high-traffic areas. Furthermore, the integration of visual AI allows autonomous cleaning equipment to navigate complex floor plans, avoid obstacles more effectively, and identify areas requiring intensive cleaning based on visual confirmation of debris or spills, thereby enhancing the efficacy of robotic fleet operations in large commercial settings such as airports and hospitals.

Looking forward, the transformative effect of AI extends into workforce management and quality control. AI tools are being developed to analyze employee performance, optimize shift scheduling based on task complexity and facility size, and provide real-time feedback mechanisms to cleaning personnel via mobile applications. This move towards 'smart cleaning' ensures compliance documentation is automatically generated and auditable, significantly reducing administrative overhead. However, the market must address concerns related to the initial capital investment required for these sophisticated technologies and the necessary upskilling of the existing labor force to manage, program, and maintain these AI-driven systems effectively.

- AI-Powered Predictive Scheduling: Optimizing cleaning routes and frequency based on real-time occupancy, foot traffic, and particulate sensor data, minimizing unnecessary cleaning cycles.

- Autonomous Cleaning Robotics (ACRs): Integration of machine learning for improved navigation, obstacle avoidance, and pattern recognition in complex commercial spaces.

- Visual Data Analytics: Utilizing AI to analyze camera feeds and sensor input to identify areas needing immediate attention (spills, high contamination zones) for dynamic task assignment.

- Inventory and Resource Management: AI algorithms forecasting consumables usage (detergents, paper products) to automate ordering and prevent stock-outs, ensuring operational continuity.

- Automated Compliance Reporting: Generating verifiable, time-stamped reports on disinfection activities and operational metrics, crucial for regulated environments like healthcare and food processing.

- Workforce Optimization: Using AI to manage employee schedules, training needs, and productivity tracking for enhanced operational efficiency and labor cost reduction.

DRO & Impact Forces Of Commercial Cleaning Service Market

The market dynamics of the Commercial Cleaning Service sector are shaped by powerful Drivers (D) promoting growth, inherent Restraints (R) limiting potential, and strategic Opportunities (O) for expansion, all culminating in measurable Impact Forces. A primary driver is the accelerating trend of corporate outsourcing, where businesses increasingly divest non-core operations like facility management to focus on primary profit generation, ensuring professional, specialized upkeep without internal resource strain. This is strongly coupled with regulatory compulsion, particularly heightened public health standards globally, demanding verifiable and consistent professional sanitation protocols, which only specialized service providers can reliably offer and document. These drivers generate a high positive impact force, sustaining steady contract volume and pricing power, especially for certified providers.

Conversely, significant restraints hinder optimal market growth. The sector remains critically dependent on a stable labor supply, and high employee turnover rates combined with the increasing difficulty in finding reliable, trained staff present a persistent challenge to service consistency and scaling operations. Furthermore, intense price competition, especially in routine janitorial contracts, limits profit margins and restricts investment in advanced, non-essential technologies, forcing many providers to compete solely on cost. The inherent high operating costs associated with specialized equipment, insurance, and compliance training also pose a barrier to entry for smaller firms and compress margins across the board, generating a moderate negative impact force that limits margin expansion.

The primary opportunities lie in technological innovation and diversification into high-value niche sectors. The integration of IoT, AI, and robotic solutions offers a pathway to mitigate labor challenges and enhance service quality verification, representing a crucial opportunity for efficiency gains and premium service differentiation. Specialized cleaning sectors, particularly infection control in acute care facilities and certified cleanroom maintenance in industrial environments, offer higher margins and less price sensitivity than general office cleaning, allowing for targeted strategic growth. Finally, the growing corporate commitment to sustainability presents an opportunity for providers specializing in "green cleaning" products and practices, allowing them to secure contracts with ESG-focused large corporations. These strategic opportunities create a strong future growth impact force, favoring tech-enabled, specialized providers.

Segmentation Analysis

The Commercial Cleaning Service Market is extensively segmented based on the type of service provided, the end-user industry requiring the service, the operational location, and the organizational model adopted for service delivery. This detailed segmentation is critical as it reflects the distinct needs and regulatory requirements of various client sectors, directly influencing pricing structures, equipment specialization, and required certifications. Analyzing these segments helps service providers tailor their offerings, optimize resource allocation, and identify high-growth or underserved market niches, ranging from standardized office maintenance to highly specialized industrial decontamination procedures requiring expert training and specialized chemicals.

The segmentation by Service Type highlights the complexity of offerings, moving beyond basic janitorial tasks to include detailed sanitation, floor restoration, and waste handling services. The End-User segmentation reveals the varying market elasticity and regulatory strictness—for example, healthcare demands high stringency and specialized expertise, contrasting with retail, which often prioritizes aesthetic presentation and flexible scheduling. Understanding the intersectionality of these segments, such as providing specialized floor care (Service Type) in educational institutions (End-User), allows firms to develop targeted value propositions and secure long-term, high-value contractual relationships across the diverse commercial landscape.

- By Service Type:

- Floor Care (Sweeping, Mopping, Buffing, Stripping, Waxing)

- Carpet Cleaning and Upholstery Cleaning

- Window and Exterior Cleaning

- General Janitorial Services (Dusting, Vacuuming, Waste Removal)

- Disinfection and Sanitation Services (Infection Control)

- Specialized Cleaning (e.g., HVAC duct cleaning, High-level facility cleaning)

- Restroom Cleaning and Supplies

- By End-User:

- Commercial Office Buildings and Corporate Spaces

- Healthcare Facilities (Hospitals, Clinics, Assisted Living)

- Educational Institutions (Schools, Universities, Daycares)

- Retail and Hospitality (Malls, Stores, Hotels, Restaurants)

- Industrial and Manufacturing Facilities

- Government and Institutional Buildings

- Transportation Hubs (Airports, Train Stations)

- By Operating Model:

- In-house Cleaning Operations

- Outsourced/Contracted Cleaning Services

- By Frequency:

- Daily/Routine Cleaning

- Weekly/Periodic Cleaning

- Annual/Deep Cleaning

Value Chain Analysis For Commercial Cleaning Service Market

The value chain for the Commercial Cleaning Service Market begins with upstream activities focused on securing the necessary inputs for service delivery. This includes the procurement of highly specialized cleaning chemicals, industrial-grade equipment (such as extractors, scrubbers, and vacuum systems), protective safety gear, and, critically, labor resources. Key upstream suppliers include manufacturers of sustainable cleaning formulations, specialized robotics and IoT providers, and human resource/training agencies. Optimized supply chain management at this stage, focusing on bulk purchasing of eco-friendly and high-performance consumables, is essential for maintaining competitive pricing and high-quality service standards while ensuring compliance with environmental regulations prevalent in major markets.

The central phase of the value chain involves the operational delivery of the cleaning service, encompassing activities such as client assessment, contract negotiation, scheduling, actual execution of tasks, and quality control monitoring. This phase is heavily labor-intensive and relies on efficient workforce management, sophisticated training protocols, and adherence to client-specific Service Level Agreements (SLAs). Technology plays an increasingly important role here, with mobile applications and GPS tracking systems optimizing route planning and allowing for real-time verification of service completion. The ability to customize service packages, particularly for complex environments like cleanrooms or surgical theatres, adds substantial value and dictates profitability margins within the mid-stream operations.

Downstream activities involve the distribution of the service and subsequent client relationship management. Since the product is intangible, distribution primarily occurs through direct client contracts secured via competitive bidding, tenders, or established long-term relationships. Direct channels, involving sales teams negotiating customized contracts with facility managers or procurement departments, dominate the high-value commercial segment. Indirect distribution occasionally occurs through integration with broader Facility Management (FM) companies, where the cleaning service is bundled with security, maintenance, and catering services. Post-service value is derived from continuous client feedback loops, performance audits, and contract renewal rates, emphasizing transparency and proven compliance history as crucial elements for sustained market share and long-term viability in this service sector.

Commercial Cleaning Service Market Potential Customers

The potential customer base for the Commercial Cleaning Service Market is exceptionally broad, spanning nearly every sector of the developed and developing economy that operates out of commercial or institutional real estate. Primary end-users or buyers of these services are facility managers, administrative officers, procurement departments, and chief operating officers responsible for maintaining operational readiness and aesthetic standards of their organizations' physical assets. The demand is intrinsically linked to factors like employee density, public interaction levels, and regulatory compliance needs within a given facility, meaning high-traffic and regulated environments represent the most consistent and valuable clientele.

Specific high-value segments include Healthcare Facilities, where stringent infection control standards necessitate specialized cleaning contracts (terminal cleaning, operating theatre sanitation), making them non-negotiable budget items. Corporate and Commercial Office Buildings are high-volume customers requiring regular janitorial services to support employee well-being and corporate image, often prioritizing reliability and flexibility. Educational and Government Institutions represent stable, large-scale contracts typically secured through competitive public tenders, valuing long-term cost predictability and demonstrable safety compliance standards for public access areas.

Moreover, the growth in specialized industrial and retail sectors offers targeted opportunities. Industrial facilities, including manufacturing plants and warehouses, require specialized maintenance for machinery and high-ceiling structures, often involving hazardous material handling or complex floor treatments. Retail and Hospitality sectors, such as hotels, malls, and restaurants, prioritize immaculate presentation and rapid response cleaning, driving demand for flexible, high-frequency services tailored to visitor throughput and specific brand standards, representing vital potential customers seeking a direct link between cleanliness and consumer experience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.8 Billion |

| Market Forecast in 2033 | $86.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABM Industries, Aramark, ServiceMaster Global Holdings (Terminix), CleanNet USA, Coverall North America, Jani-King International, Pritchard Industries, Stanley Steemer International, Stratus Building Solutions, Tidy Services, Mitie Group PLC, ISS A/S, Compass Group PLC, Daiseki Co., Ltd., OCS Group, Sodexo, Dussmann Group, Vanguard Resources, Tork. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Cleaning Service Market Key Technology Landscape

The Commercial Cleaning Service Market is undergoing a rapid technological transformation, moving away from purely manual methods toward data-driven and automated service delivery, crucial for addressing labor shortages and enhancing verifiable quality standards. The key technologies employed today center around automation, Internet of Things (IoT) integration, and advanced chemical formulations. Autonomous Cleaning Robots (ACRs), including floor scrubbers, sweepers, and specialized disinfection units (e.g., UV-C robots), are becoming standard in large, open-plan environments like malls, hospitals, and airports, providing consistent coverage and allowing human staff to focus on complex, high-touch point areas. These robots utilize sophisticated sensors, LiDAR, and computer vision systems to map environments and optimize cleaning paths, significantly boosting labor efficiency.

IoT platforms and sensor technology are fundamental to modern facility maintenance management. Sensors measuring air quality, surface particulate matter, and foot traffic patterns provide real-time data inputs that feed into building management systems and cleaning scheduling software. This integration enables 'cleaning on demand'—a major shift from scheduled cleaning—where services are dispatched only when threshold levels of dirt or occupancy are met. Furthermore, mobile applications and cloud-based reporting tools are crucial for connecting cleaning staff, supervisors, and clients. These applications allow for digital checklists, incident reporting, before-and-after photo documentation, and proof of presence (via geofencing), ensuring transparent service delivery and simplifying the audit process for compliance purposes.

Beyond hardware and software, the evolution of cleaning chemicals constitutes a significant technological advancement. There is a strong market shift towards biotechnological solutions, such as enzyme-based and probiotic cleaners, which offer superior long-term efficacy and are environmentally benign, addressing the growing demand for green cleaning services and ESG compliance. Electrostatic spray technology is also a key innovation, particularly for disinfection and sanitation, allowing charged disinfectant droplets to wrap around surfaces, ensuring comprehensive coverage and minimizing chemical waste. The convergence of these technological pillars—robotics for labor efficiency, IoT for data-driven precision, and advanced chemistry for sustainability—is fundamentally redefining competitive capability in the commercial cleaning sector, making technological investment a crucial strategic imperative for future market leadership and efficiency maximization.

Regional Highlights

Regional dynamics heavily influence the Commercial Cleaning Service Market, reflecting varying levels of commercialization, regulatory stringency, and technological adoption rates across the globe. North America, driven by the United States and Canada, represents the largest market share primarily due to the vast stock of commercial real estate, high corporate emphasis on outsourcing non-core functions, and strict regulations governing workplace cleanliness and sanitation standards. The region is characterized by early adoption of robotics and green cleaning solutions, alongside a highly mature competitive landscape dominated by large, national service providers who leverage advanced technology to counteract high labor costs.

Europe stands as the second-largest market, distinguished by its strong focus on environmental and social sustainability. European contracts often prioritize providers demonstrating verifiable use of certified eco-friendly products and robust labor practices. Countries like Germany and the UK exhibit high penetration rates for sophisticated facility management contracts that integrate cleaning with other services (e.g., security, catering), often demanding high-quality service verified by stringent European Union standards. The Nordic countries are particularly advanced in adopting digital cleaning solutions and sustainable chemicals, setting a benchmark for the rest of the continent in efficiency and environmental responsibility.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by unprecedented infrastructure development, rapid urbanization, and the establishment of numerous multinational offices, particularly in major economic hubs like Shanghai, Mumbai, and Sydney. While pricing remains highly competitive, the demand for professional, standardized cleaning services is rising dramatically, driven by global corporate standards. This region sees a high potential for growth in outsourced contracts, moving away from fragmented, informal service providers towards large, international firms capable of delivering consistent quality across diverse and expansive geographic footprints. Regulatory oversight is tightening, pushing demand towards professional, certified providers capable of meeting escalating public health requirements.

- North America: Market leader defined by high outsourcing penetration, early adoption of robotics and IoT, and stringent occupational safety standards, particularly driving specialized cleaning in healthcare and tech industries.

- Europe: Characterized by a strong mandate for sustainability, green cleaning certifications, and integrated facility management solutions, with a mature market focused on quality and compliance adherence (e.g., EU regulations).

- Asia Pacific (APAC): Highest growth potential due to rapid commercial infrastructure expansion, increasing urbanization, and rising corporate demand for standardized, professional cleaning services across major emerging economies.

- Latin America: Emerging market characterized by fragmented competition and growing formalization. Opportunities exist in large urban centers (e.g., São Paulo, Mexico City) driven by foreign investment in retail and hospitality sectors.

- Middle East and Africa (MEA): Growth concentrated in GCC nations due to massive hospitality, governmental, and commercial development projects (e.g., UAE, Saudi Arabia). Focus remains on large-scale, high-visibility contracts often requiring specialized equipment for extreme climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Cleaning Service Market.- ABM Industries

- Aramark

- ServiceMaster Global Holdings (Terminix)

- CleanNet USA

- Coverall North America

- Jani-King International

- Pritchard Industries

- Stanley Steemer International

- Stratus Building Solutions

- Tidy Services

- Mitie Group PLC

- ISS A/S

- Compass Group PLC

- Daiseki Co., Ltd.

- OCS Group

- Sodexo

- Dussmann Group

- Vanguard Resources

- Tork (Essity)

- Cintas Corporation

Frequently Asked Questions

Analyze common user questions about the Commercial Cleaning Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Commercial Cleaning Service Market?

Market growth is primarily driven by increasing corporate reliance on outsourcing non-core functions, stringent post-pandemic public health and safety regulations, and the continual expansion of commercial and institutional infrastructure globally, necessitating professional upkeep.

How is technology impacting commercial cleaning operations?

Technology impacts the sector through the adoption of Autonomous Cleaning Robots (ACRs), IoT sensors for real-time occupancy and dirt monitoring, and AI-powered scheduling, which collectively enhance efficiency, reduce labor dependency, and provide auditable quality control metrics.

Which end-user segment offers the highest growth potential?

The Healthcare Facilities segment consistently offers high-value contracts and growth potential due to the non-negotiable need for specialized disinfection, infection control protocols, and terminal cleaning, demanding premium, certified service providers.

What are the key restraints affecting market profitability?

Key restraints include the sector's persistent challenge of high labor turnover and scarcity, intense price competition driving down routine contract margins, and the significant initial capital investment required for adopting advanced, specialized cleaning equipment and training.

Is green cleaning a dominant trend in the commercial market?

Yes, green cleaning, utilizing eco-friendly chemicals and sustainable practices, is a significant trend, especially in North America and Europe, driven by corporate ESG initiatives, regulatory pressures, and consumer demand for environmentally responsible facility management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager