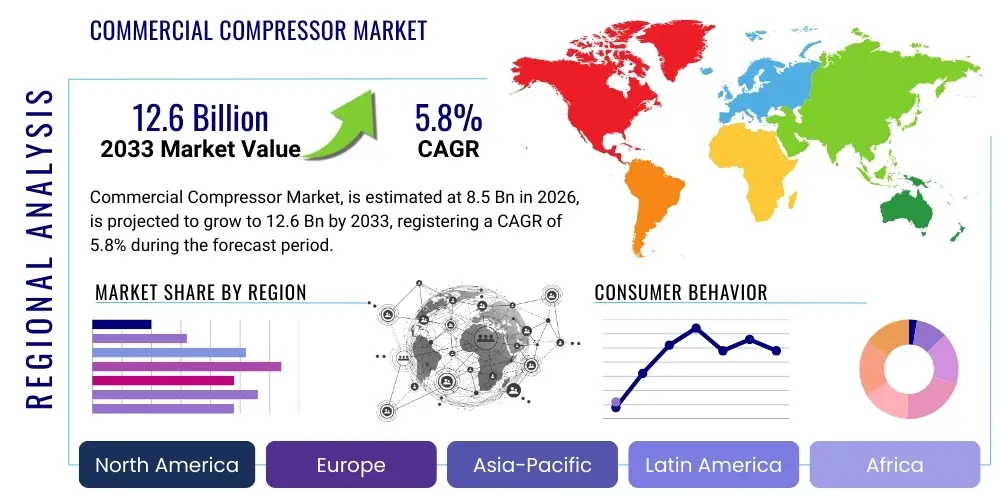

Commercial Compressor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443165 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Commercial Compressor Market Size

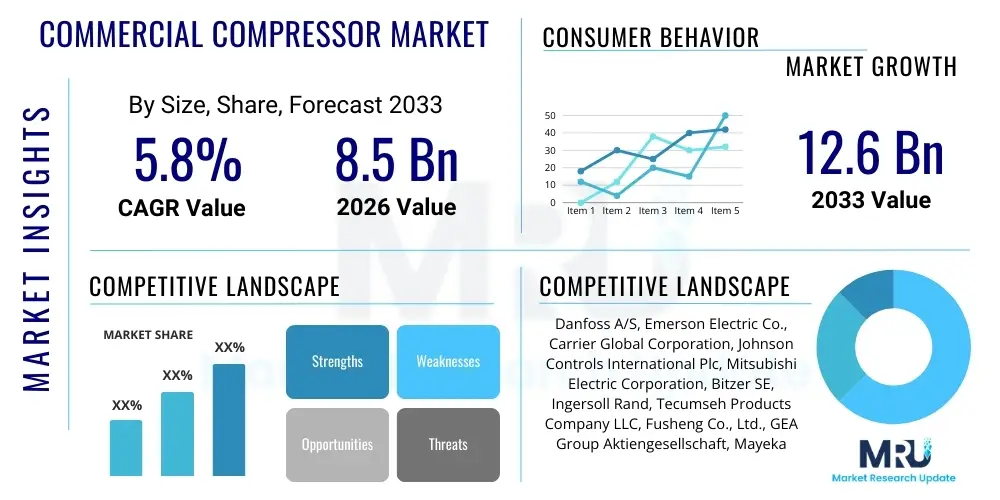

The Commercial Compressor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Commercial Compressor Market introduction

The Commercial Compressor Market encompasses the manufacturing, distribution, and utilization of various compressor types—including reciprocating, rotary (screw and scroll), and centrifugal—specifically designed for non-residential applications such as Heating, Ventilation, Air Conditioning, and Refrigeration (HVAC-R) systems, process cooling, and industrial air supply. These compressors are essential mechanical components responsible for increasing the pressure and reducing the volume of refrigerants or air, enabling critical climate control and preservation functionalities across diverse commercial settings. Key applications span supermarkets, cold storage facilities, data centers, hospitals, and office buildings, where reliable temperature management is paramount for operational efficiency, human comfort, and product integrity. The inherent design focus for commercial compressors revolves around robust performance, maximized energy efficiency, lower noise levels, and compliance with stringent environmental regulations regarding refrigerants, such as the phase-down of hydrofluorocarbons (HFCs) under global agreements, driving innovation toward natural refrigerants and variable speed technologies.

Product descriptions for commercial compressors emphasize specialized engineering to handle high-duty cycles and fluctuating loads typical of commercial operations. Scroll compressors are gaining significant traction due to their compact size, lower vibration, and superior energy efficiency, making them ideal for smaller and medium-sized HVAC units. Conversely, screw compressors dominate large-scale refrigeration and industrial air applications where high volumetric flow rates and sustained high performance are necessary, often incorporating sophisticated oil injection systems for cooling and sealing. The major applications of these products are inextricably linked to urbanization and infrastructural development, particularly in emerging economies, where the demand for modern, climate-controlled commercial spaces—including logistical hubs and large retail chains—is accelerating rapidly, creating a sustained requirement for new installations and robust replacement cycles of older, less efficient units.

The primary benefits driving market expansion include enhanced energy conservation capabilities mandated by global standards, leading to reduced operational costs for end-users, and improved system reliability that minimizes downtime. Regulatory pressures, particularly those focused on reducing the global warming potential (GWP) of refrigerants, act as a powerful driving factor, compelling manufacturers to invest heavily in research and development of compressors compatible with environmentally friendly alternatives like R-290 (propane), R-600a (isobutane), and R-744 (CO2). Furthermore, the integration of smart technology, such as variable frequency drives (VFDs) and IoT-enabled monitoring systems, allows compressors to operate precisely according to load demands, optimizing performance and extending component lifespan, thereby bolstering the overall market growth trajectory. This confluence of regulatory push, technological advancement, and foundational economic demand reinforces the market’s positive outlook through the forecast period.

Commercial Compressor Market Executive Summary

The Commercial Compressor Market is experiencing a pivotal shift driven by sustainability mandates and technological integration, positioning energy efficiency as the paramount consideration for business trends. Manufacturers are rapidly transitioning production lines to focus exclusively on highly efficient inverter-driven and variable speed compressors, moving away from fixed-speed legacy models. This trend is closely aligned with global governmental incentives and building codes that reward or require low-carbon operational footprints in new commercial constructions and retrofitting projects. Furthermore, a critical business trend involves the consolidation and integration within the supply chain, as major players acquire specialized component manufacturers or software developers to enhance their offerings in integrated HVAC-R solutions, thus providing end-users with seamless, optimized systems rather than standalone compressor units. The competitive landscape is increasingly defined not just by raw capacity but by the embedded intelligence and predictive maintenance capabilities offered within the compressor package, making digitalization a crucial differentiator.

Regionally, the market exhibits divergent growth patterns shaped by climate and regulatory adherence. Asia Pacific (APAC) stands out as the highest growth region, fueled by rapid urbanization, significant investments in cold chain logistics, and expanding commercial real estate development in countries like China, India, and Southeast Asian nations. This demand is often directed toward robust and cost-effective compressor solutions. Conversely, established markets in North America and Europe are characterized by slow volume growth but high-value sales, mandated by strict environmental regulations (such as the EU F-Gas Regulation and the US AIM Act). These regions lead in the adoption of natural refrigerant compressors and sophisticated, high-SEER (Seasonal Energy Efficiency Ratio) systems, often requiring complex integration into smart building management platforms. The Middle East and Africa (MEA) presents a growing opportunity, particularly for high-capacity cooling solutions necessary for extreme arid climates, although market penetration is sensitive to geopolitical stability and energy subsidy policies.

Segment trends emphasize the dominance of the scroll and screw compressor types, reflecting their adaptability across various commercial scales. The scroll segment is forecast to maintain robust growth, primarily supported by its application in light commercial air conditioning and heat pump systems which are becoming ubiquitous in smaller office buildings and retail environments. Meanwhile, the screw segment retains its leadership in large industrial refrigeration and chillers, benefiting from expansion in the refrigerated transport and cold storage sectors. A significant segment trend is the rising commercial viability of compressors designed explicitly for R-744 (CO2) systems, particularly in supermarket refrigeration, driven by their superior thermodynamic properties and zero-ODP/low-GWP profile. This specialization within the refrigerant type segment indicates a future where compressor technology will be hyper-optimized for specific, environmentally defined refrigerants, rather than offering broad compatibility, compelling specialized manufacturing investment.

AI Impact Analysis on Commercial Compressor Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Commercial Compressor Market primarily center on three core themes: predictive maintenance effectiveness, optimization of energy consumption, and the automation of diagnostics and system calibration. Users are seeking clarity on how AI algorithms can move beyond simple threshold alarms to provide genuine foresight into mechanical failures, particularly relating to valve wear, lubrication efficacy, and motor health, which traditionally require manual inspection or reactive interventions. There is significant anticipation that AI will substantially reduce operational expenditure (OPEX) by minimizing unscheduled downtime, thereby improving the total cost of ownership (TCO) of commercial HVAC-R installations. Concerns often revolve around the security and standardization of data collection from heterogeneous compressor fleets and the expertise required to interpret complex AI-generated insights, prompting demand for user-friendly interfaces and clear return-on-investment models for AI integration services.

The integration of AI directly impacts the design and deployment of commercial compressors, shifting the value proposition from hardware reliability alone to integrated smart system performance. AI models utilizing machine learning are trained on vast datasets of vibration, temperature, pressure, and current consumption patterns to establish 'normal' operating profiles for specific compressor models under varied load conditions. This capability allows commercial building operators to implement condition-based monitoring, triggering maintenance alerts weeks or months before catastrophic failure, enabling strategic parts replacement and scheduling services during low-demand periods. For example, AI can detect subtle anomalies in motor current signature analysis (MCSA) that indicate incipient winding faults or rotor bar breakage long before conventional overload protection systems would activate, thus preserving the core asset and ensuring continuous operational readiness, which is crucial for sensitive environments like data centers and healthcare facilities.

Furthermore, AI is fundamentally changing the way compressors are controlled in real-time within complex HVAC-R networks. Advanced AI-driven control systems can dynamically adjust compressor speed, staging, and refrigerant flow based not just on current internal system parameters but also on external variables such as localized weather forecasts, predicted occupancy levels, and historical energy price fluctuations. This level of optimization maximizes the compressor’s coefficient of performance (COP) throughout its operational envelope, ensuring that the system operates at the highest possible efficiency point. The influence extends to manufacturing processes as well, where AI-powered quality control systems utilize vision analysis and acoustic monitoring during assembly to detect minute manufacturing defects that could compromise long-term reliability, resulting in higher quality components and further cementing AI's role as a transformative technology across the entire compressor lifecycle.

- Predictive maintenance based on vibration, pressure, and thermal pattern analysis using Machine Learning (ML).

- Real-time optimization of Variable Frequency Drive (VFD) settings for maximum energy efficiency (COP).

- Automated fault detection and root cause analysis, significantly reducing diagnostic time.

- Enhanced system calibration and commissioning through automated digital twins and simulation tools.

- Improved supply chain forecasting for spare parts inventory management.

- AI-driven optimization of multi-compressor rack configurations in large refrigeration systems.

DRO & Impact Forces Of Commercial Compressor Market

The dynamics of the Commercial Compressor Market are dictated by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form potent Impact Forces shaping strategic decisions across the value chain. A primary Driver is the rigorous enforcement of energy efficiency standards globally, such as SEER and EER ratings, which necessitate the continuous adoption of advanced compressor technologies like variable speed drives and inverter controls to meet escalating performance benchmarks. Simultaneously, the global mandate to phase down high Global Warming Potential (GWP) refrigerants, exemplified by the Kigali Amendment and regional F-Gas regulations, acts as a powerful catalyst, forcing manufacturers to redesign compressors for compatibility with low-GWP alternatives (R-290, R-744, and HFOs). These legislative pressures, combined with the underlying growth in urbanization and the expansion of the cold chain infrastructure worldwide, particularly in fast-developing markets, ensure a sustained demand cycle for advanced, sustainable cooling solutions.

However, the market faces considerable Restraints that moderate this growth. The significant upfront cost associated with high-efficiency and natural refrigerant-based compressors remains a deterrent for smaller commercial enterprises and retrofitting projects in price-sensitive regions. These advanced systems often require specialized installation and maintenance expertise, creating a skills gap in the service sector that hampers rapid widespread adoption. Furthermore, volatility in raw material costs, particularly copper, steel, and electronic components essential for VFDs and integrated controls, introduces cost pressure and supply chain instability. The complexity associated with transitioning refrigerant types also poses a restraint; specifically, the increased safety requirements for flammable refrigerants (like R-290) and the high operating pressures required for CO2 (R-744) systems demand comprehensive redesigns and rigorous component testing, slowing down the pace of market change in certain sub-segments.

The key Opportunity lies in the burgeoning demand for centralized heating and cooling systems integrated with heat recovery features, particularly in Europe and North America, driven by decarbonization goals in the building sector. Compressors capable of efficient heat pump operation represent a massive untapped market. Another significant opportunity is the rapid expansion of data center infrastructure globally, which requires ultra-reliable, high-capacity cooling solutions to manage extremely high heat loads, favoring high-efficiency screw and centrifugal compressors. Impact forces are strong and predominantly positive, compelling innovation toward digitalization and service integration. The necessity to meet environmental regulations acts as the strongest long-term impact force, fundamentally reshaping product portfolios toward sustainable, smart, and highly efficient models, ensuring that manufacturers prioritize R&D investment into natural refrigerant platforms and embedded IoT capabilities for optimized performance.

Segmentation Analysis

The Commercial Compressor Market is intricately segmented across various dimensions, including product type, operational mechanism, application, and end-user vertical. This stratification allows for detailed market understanding, reflecting the distinct requirements of different commercial cooling and air compression tasks. Product segmentation highlights the performance differences and cost structures inherent in reciprocating, rotary (screw and scroll), and centrifugal technologies, directly correlating specific compressor types to optimal commercial uses, ranging from small retail chillers to massive industrial refrigeration racks. Application segmentation is critical, separating commercial refrigeration needs (e.g., cold storage, food retail) from commercial air conditioning (e.g., office buildings, hospitals) and general industrial air compression, each demanding unique flow rates, pressure capabilities, and efficiency profiles, thereby influencing manufacturing focus and distribution strategies across the globe.

- By Product Type:

- Reciprocating Compressors

- Rotary Compressors (Screw, Scroll, Rotary Vane)

- Centrifugal Compressors

- By Technology:

- Inverter/Variable Speed Drive (VSD) Compressors

- Fixed Speed Compressors

- By Refrigerant Type:

- HFC-based Compressors

- Natural Refrigerant Compressors (R-744, R-290, Ammonia)

- HFO-based Compressors

- By Application:

- Commercial Refrigeration (Cold Storage, Supermarkets, Freezers)

- Commercial Air Conditioning (Chillers, VRF/VRV Systems, Unitary AC)

- Industrial Air Compression (Pneumatic Tools, Process Air)

- By End-User:

- Food & Beverage Retail (Supermarkets, Convenience Stores)

- Healthcare (Hospitals, Pharmaceuticals)

- Data Centers & IT Infrastructure

- Hospitality & Real Estate

- Logistics & Transportation (Refrigerated Transport)

- By Tonnage/Capacity:

- Small Capacity (Below 10 Ton)

- Medium Capacity (10 to 50 Ton)

- High Capacity (Above 50 Ton)

Value Chain Analysis For Commercial Compressor Market

The Commercial Compressor Market value chain begins with intensive Upstream Analysis, which focuses primarily on the procurement of critical raw materials and specialized components. This stage involves securing consistent supplies of high-grade metals (steel, copper, aluminum) for casings, rotors, and motor windings, alongside sophisticated electronic components like microprocessors, sensors, and variable frequency drives (VFDs) which are often sourced from highly concentrated, specialized global suppliers. Maintaining stable relationships with these upstream providers is crucial, as material price volatility and geopolitical factors influencing electronics supply chains directly impact manufacturing costs and lead times. Furthermore, specialized manufacturing inputs such as sealants, high-performance lubricants, and proprietary refrigerants (or natural refrigerant handling components) require stringent quality control and strategic sourcing to ensure product reliability and compliance with exacting performance standards necessary for commercial-grade equipment.

The midstream segment of the value chain is characterized by complex and capital-intensive manufacturing processes, including precision machining, motor assembly, winding, and rigorous quality testing, culminating in the integration of the core compressor unit into system racks or standalone equipment. Distribution channels are varied and tailored to the compressor’s intended application. Direct channels are predominantly used for large, custom-engineered screw and centrifugal compressors sold to Original Equipment Manufacturers (OEMs) of large chillers or industrial process systems, where close technical collaboration is essential for integration and performance optimization. Indirect channels, which rely heavily on specialized distributors, wholesalers, and Value-Added Resellers (VARs), dominate the high-volume scroll and reciprocating segments, serving the replacement market, light commercial AC unit manufacturers, and local HVAC contractors who require immediate availability and technical support for installation and service.

The Downstream analysis focuses on installation, maintenance, and the relationship with the final End-User/Buyer. Post-sale activities, including commissioning, regular maintenance contracts, and spare parts supply, are increasingly critical revenue streams and major points of differentiation for leading manufacturers. The transition to smart, IoT-enabled compressors is bolstering the importance of the service segment, as data analytics and predictive maintenance tools enhance long-term customer relationships and increase the value captured throughout the compressor lifecycle. Effective distribution channels must manage inventory efficiently and ensure that highly trained service technicians are available to handle the technical complexities of high-pressure CO2 systems or complex inverter-driven units, ensuring reliable operation and minimizing downtime for critical commercial applications like cold storage and data centers.

Commercial Compressor Market Potential Customers

Potential customers for commercial compressors span a broad spectrum of commercial and industrial sectors, primarily defined by their critical need for controlled climate, precision cooling, or reliable compressed air supply. The largest segment of buyers comprises Original Equipment Manufacturers (OEMs) specializing in HVAC-R equipment, such as chiller manufacturers, producers of Variable Refrigerant Flow (VRF) systems, and commercial refrigeration rack builders. These OEMs act as strategic bulk buyers, integrating the compressors as the core functional component into their finished products which are then sold to the final end-users. Their procurement decisions are heavily influenced by the compressor’s energy efficiency ratings, compatibility with new refrigerants, long-term reliability metrics, and the supplier's capacity for just-in-time delivery and technical co-development to meet evolving regulatory and market demands.

The secondary major category includes large-scale End-Users who procure equipment directly or via specialized contractors, specifically enterprises where environmental stability is non-negotiable. This category includes the sprawling Food & Beverage Retail sector, such as supermarket chains and hypermarkets, which require advanced, often centralized, refrigeration systems (increasingly utilizing transcritical CO2 compressors) for perishable goods preservation. Equally critical are Data Centers and IT Infrastructure providers, who demand robust, highly redundant cooling systems (utilizing centrifugal or high-capacity screw compressors) to manage immense heat loads and ensure 24/7 server uptime, making reliability and energy consumption the primary purchase drivers. The healthcare sector, encompassing hospitals and pharmaceutical warehouses, represents another key buyer group requiring precision cooling for drug storage and sensitive medical environments, often prioritizing specialized scroll and small reciprocating units for precision tasks.

Furthermore, the market includes customers in the hospitality, commercial real estate, and industrial logistics sectors. Commercial property developers and facility managers purchase compressors integrated into centralized air conditioning systems for large office buildings, hotels, and shopping malls, driven by the need for tenant comfort and compliance with building energy codes. The logistics segment, particularly refrigerated transport (reefers) and cold storage warehousing, requires highly reliable mobile and fixed compressor units capable of maintaining tight temperature tolerances under variable external conditions. In essence, the potential customer base is defined by any commercial operation seeking to optimize energy consumption while maintaining strict control over environmental conditions, positioning the compressor as a foundational component in their capital expenditure planning, necessitating a focus on total cost of ownership rather than initial purchase price.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danfoss A/S, Emerson Electric Co., Carrier Global Corporation, Johnson Controls International Plc, Mitsubishi Electric Corporation, Bitzer SE, Ingersoll Rand, Tecumseh Products Company LLC, Fusheng Co., Ltd., GEA Group Aktiengesellschaft, Mayekawa Mfg. Co., Ltd., Hanbell Precise Machinery Co., Ltd., Dorin S.p.A., Frascold S.p.A., Kaeser Kompressoren SE, Hitachi Ltd., Shanghai Highly (Group) Co., Ltd., GREE Electric Appliances, Inc., Nidec Global Appliance, Carlyle Compressor. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Compressor Market Key Technology Landscape

The technological landscape of the Commercial Compressor Market is rapidly evolving, driven primarily by demands for higher energy efficiency, environmental compliance, and enhanced operational intelligence. The most influential technology is the widespread adoption of Variable Speed Drives (VSDs) and inverter technology across all compressor types—scroll, screw, and reciprocating. VSDs allow the compressor motor speed to modulate continuously, precisely matching the cooling or compression requirement of the commercial load. This variable operation dramatically reduces power consumption compared to traditional fixed-speed compressors, which cycle on and off inefficiently. The implementation of VSDs requires sophisticated power electronics and advanced control algorithms to manage motor dynamics and harmonic distortion, ensuring that the compressor can maintain peak performance and reliability across a wide range of operating conditions, making this integration a cornerstone of modern commercial HVAC-R design.

Another dominant technological shift involves the design and engineering necessary to accommodate Natural Refrigerants, specifically Carbon Dioxide (R-744) and Propane (R-290). R-744 systems, particularly Transcritical CO2 compressors, operate at significantly higher pressures than conventional HFC systems (often exceeding 120 bar), requiring specialized, high-strength materials, complex sealing technologies, and robust safety mechanisms, including gas coolers and pressure regulators. Simultaneously, R-290 systems require compressors optimized for slightly higher displacement and integrated systems for mitigating flammability risks, often necessitating hermetically sealed motor assemblies and specialized sensor arrays. This focus on natural refrigerants pushes the boundaries of mechanical and material science, requiring manufacturers to develop entirely new compressor architectures that are fundamentally different from legacy models, thereby creating steep barriers to entry for manufacturers not investing heavily in these specialized components and testing capabilities.

The increasing digitalization, driven by the Internet of Things (IoT) and edge computing, forms the third pillar of technological advancement. Modern commercial compressors are often equipped with embedded sensors that monitor parameters such as vibration, bearing temperature, oil pressure, and motor current in real-time. This data is processed locally (at the edge) or transmitted to cloud platforms for AI-driven predictive maintenance and fleet management. The integration of advanced communication protocols allows compressors to interface seamlessly with Building Management Systems (BMS) and energy optimization software, enabling remote diagnostics, fine-tuning, and proactive intervention. This technology shift transforms the compressor from a purely mechanical device into an intelligent, networked component, optimizing system performance across an entire commercial facility and providing valuable operational insights to facility managers, significantly improving the total cost of ownership and asset longevity through continuous, intelligent self-management and diagnostics.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of volume growth in the commercial compressor market, primarily driven by massive infrastructure spending, rapid urbanization, and the expanding need for cold chain logistics, particularly in food processing and distribution across China, India, and Southeast Asia. The region exhibits high demand for both energy-efficient scroll compressors for new construction and robust screw compressors for industrial applications. Regulatory shifts towards stricter energy standards (e.g., in China and India) are accelerating the transition from fixed-speed units to VSD technology, offering substantial growth potential for high-efficiency components.

- North America: This mature market is characterized by high-value sales, replacement cycles focused on efficiency upgrades, and stringent environmental compliance under the AIM Act, pushing the rapid adoption of low-GWP refrigerants (HFOs and R-744). The demand is highly concentrated in specialized sectors like data centers and precision manufacturing, prioritizing reliability, redundancy, and integration into sophisticated smart building systems. Innovation in centrifugal compressors for large chiller applications remains a key feature of the North American market.

- Europe: Europe is the global leader in the transition to natural refrigerants, particularly R-744 (CO2) systems, largely mandated by the F-Gas regulation. The market demand centers heavily on advanced transcritical compressors for supermarket refrigeration and highly efficient heat pump compressors for commercial buildings undergoing decarbonization retrofits. Germany, France, and the Nordics show strong adoption rates for sustainable and integrated heating and cooling solutions, favoring manufacturers with comprehensive natural refrigerant portfolios.

- Latin America (LATAM): Growth in LATAM is variable but significant, particularly in Mexico and Brazil, driven by industrialization and modernization of the retail sector. The market is moderately price-sensitive, balancing cost considerations with a gradual adoption of higher efficiency standards. Demand primarily focuses on reliable, mid-range scroll and reciprocating compressors, though there is increasing governmental interest in sustainable refrigeration for food safety and storage.

- Middle East and Africa (MEA): MEA presents specialized demand for high-capacity, robust cooling solutions necessary to combat extreme climate conditions, driving the need for large-tonnage screw and centrifugal chillers. Market penetration is closely tied to large-scale commercial development projects (e.g., in the UAE and Saudi Arabia). Energy subsidies and the long-term shift toward sustainable construction practices are key factors influencing long-term compressor technology adoption in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Compressor Market.- Danfoss A/S

- Emerson Electric Co.

- Carrier Global Corporation

- Johnson Controls International Plc

- Mitsubishi Electric Corporation

- Bitzer SE

- Ingersoll Rand

- Tecumseh Products Company LLC

- Fusheng Co., Ltd.

- GEA Group Aktiengesellschaft

- Mayekawa Mfg. Co., Ltd.

- Hanbell Precise Machinery Co., Ltd.

- Dorin S.p.A.

- Frascold S.p.A.

- Kaeser Kompressoren SE

- Hitachi Ltd.

- Shanghai Highly (Group) Co., Ltd.

- GREE Electric Appliances, Inc.

- Nidec Global Appliance

- Carlyle Compressor

Frequently Asked Questions

Analyze common user questions about the Commercial Compressor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Commercial Compressor Market?

The market is primarily driven by rigorous global mandates for energy efficiency (like SEER and EER standards), mandatory phasing down of high-GWP refrigerants, and the rapid expansion of the cold chain and data center infrastructure worldwide. Technological advancements, particularly in Variable Speed Drives (VSDs), also catalyze sustained growth by improving operational performance.

How is the phase-out of HFC refrigerants impacting compressor technology and adoption?

The HFC phase-out is forcing a fundamental shift towards compressors optimized for low-GWP natural refrigerants like R-744 (CO2), R-290 (propane), and R-600a. This requires specialized, high-pressure design components, increased safety systems, and significant R&D investment, leading to higher adoption rates of transcritical CO2 compressors, especially in supermarket refrigeration.

Which type of compressor technology is dominating the market in terms of energy efficiency?

Variable Speed Drive (VSD) technology, applied across scroll and screw compressors, is dominating the high-efficiency segment. VSD compressors adjust output precisely to load requirements, substantially reducing electricity consumption and offering superior Seasonal Energy Efficiency Ratios (SEER) compared to traditional fixed-speed models.

What is the role of AI and IoT in the commercial compressor lifecycle?

AI and IoT enable real-time condition monitoring, predictive maintenance, and optimized operational control. Embedded sensors gather performance data, which AI algorithms analyze to anticipate mechanical failures, reduce unplanned downtime, and dynamically adjust compressor settings to maximize energy performance (COP) within commercial HVAC-R systems.

Which geographic region presents the greatest market opportunity for commercial compressors?

Asia Pacific (APAC) represents the greatest market opportunity due to accelerated urbanization, massive governmental investments in infrastructure, and the expansion of commercial real estate and food cold chain networks, particularly in populous economies like China and India, creating robust demand for new compressor installations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager